Tax Rate Proposal Still Too High

The current proposed millage on the table for the 2012 budget is $4.79 per thousand dollars of valuation, up 0.8% from the $4.75 of last year. With declining valuations, that millage would collect $596M in taxes, $7M or about 1% less than last year. An “alternative” offered by Bob Weisman differs by about $700K – hardly worth mentioning.

At the September 13 preliminary hearing, commissioners Abrams, Burdick and Marcus voted against the rate increase and were in favor of further reductions in the Sheriff’s budget. At $467M, it is down slightly from last year, but not as much as the estimated $19M he is saving from pension reform which requires contributions from employees for the first time. The other four commissioners (Aaronson, Santamaria, Taylor, Vana) declined to challenge the Sheriff in any way, and thus there were not enough votes to even discuss this prospect.

There are three major components to the county budget – county departments, Fire/Rescue, and the Sheriff’s Office.

In the last 9 years, the county departments grew fat on the rising real estate bubble, but have cut their tax requirements significantly since the peak in 2007 and are now only about 3% over what they were in 2003.

Fire Rescue grew and stayed high (up 70% since 2003) but this year they are not increasing the tax rate and have reduced spending by about $4M. They are also negotiating in good faith with the IAFF to avoid across the board raises in the next contract and reduce starting salaries 22%.

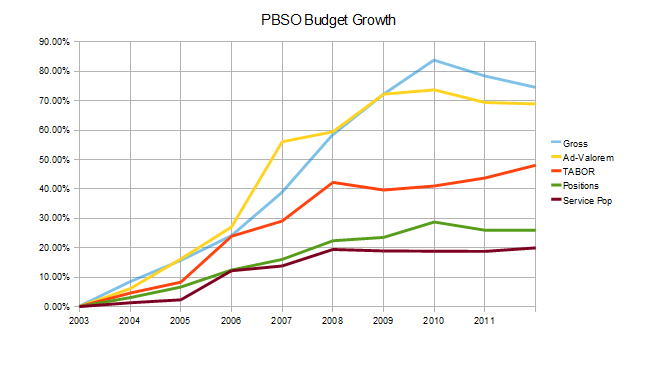

PBSO on the other hand, at almost $400M, is almost twice the county department’s ad-valorem requirement, up from close to parity a decade ago. (See graph below) There is very little the commissioners have been able to do about this balloon in public safety spending. At the first hint of cuts, the Sheriff threatens neighborhood groups with reductions in patrols or the closing of a substation and they bring enormous political pressure on the individual commissioners. As an independently elected constitutional officer, the Sheriff has autonomy in how he spends his budget, but the county commissioners are empowered to set his bottom line. Typically, no commissioners have seriously challenged the Sheriff, but this year we see a change. Newly elected commissioner Paulette Burdick does not seem to be afraid to ask the right questions and suggest that the Sheriff share the cuts with the county. Neither does commissioner Abrams. Commissioner Marcus, not too much of a PBSO critic in the past, has joined the other two in challenging the PBSO budget this year, to her credit. What is the matter with the other four? If there ever was an economy that called for across the board cuts, including in PBSO, this is it.

We call on Commissioners Aaronson, Santamaria, Taylor and Vana to think about the Taxpayer this year and show a little spine.

Only $5M in additional cuts are needed to avoid a rate increase. Cut the $5M from the Sheriff’s budget (1.25%) and you will be done. PBSO has become unaffordable at the current level.

We stand by the TAB Proposal for 2012:

- Don’t increase the tax rates

- Take the remaining cuts from the Sheriff

- Sell off unused property

- Use reserves where necessary

This is a great summary and breakdown of the budgets. Thanks!