County Proposes No Change to Millage, $23M Tax Increase

The July budget line item is included in the next scheduled BCC Meeting on Tuesday, July 16, which starts at 9:30am. It is item 5G-1 on the agenda and will likely be the last item of the morning session.

The first county budget proposal for fiscal year 2014, presented at the June 11 meeting, called for a millage increase to 4.8164 (up from the current 4.7815) and $25M in new ad valorem tax revenue – mostly to fund new spending proposed by the Sheriff.

While not definitive, the drift from the dais was that they would like to see flat millage (Abrams, Burdick, Valeche) and more spending on priorities like road repair and less of an increase to PBSO. Some commissioners, particularly Shelley Vana, didn’t want to be “penny wise and pound foolish” and thought that flat millage should “no longer be the holy grail”.

So we were pleasantly surprised to see that the July Budget Package is introduced under separate cover by Administrator Bob Weisman with

down to the current year 4.7815.

During the month interim, Mr. Weisman and staff were able to achieve this by:

- Seeing an additional $2.6M from increased property valuations

- Allocating an additional $2M from the proceeds of the $26M Mecca Farms sale into 2014

- Gaining $859,000 in concessions from the Sheriff – which is half of the remaining shortfall with flat millage.

He was also able to increase funding for some priorities, including:

- $1.6M for neighborhood road repaving

- $270K for the Palm Beach sand transfer plant

- $100K in additional funds for the Business Development Board

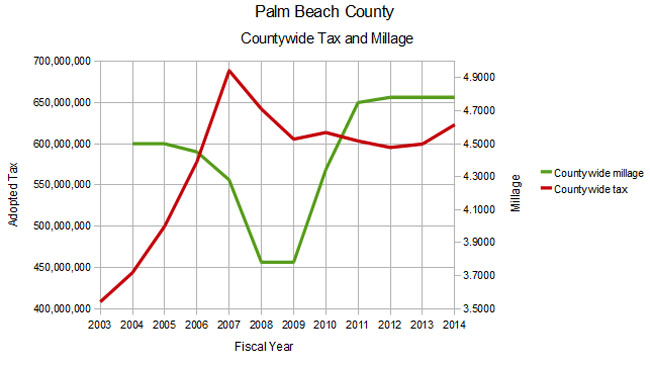

With the new assumptions, the flat millage proposal will generate a countywide tax of $623M, up $23M from the 2013 fiscal year, slightly less than the June proposal. As seen in the chart, this is a visible uptick from previous years, and is the highest tax collected since 2008, when the millage was at a low point of 3.7811.

Assuming that the valuation increase this year is a start of a trend, flat millage will no longer be acceptable going forward and we will be expecting substantial reductions. That said, the current proposal of flat millage appears to be a genuine attempt to satisfy the pent up spending demand, particularly for salary increases for county staff while not overly gouging the taxpayer. Historically, overall county spending is approaching a “TABOR” (population and inflation) projection from a 2003 baseline. (See Determining County Budget Growth – Why the Baseline Year Matters )

Assuming the BCC accepts the flat millage proposal, we do not expect to be calling for any taxpayer actions during this budget cycle.

Thank you for doing such a great job. It still makes me mad the Sheriff’s department gets away with so much. Having the same amount of population does not justify his increases.