$725M County Budget Proposal Largest in History

The county budget proposal, to be discussed in the first budget workshop on Tuesday, June 9 at 6pm, proposes flat millage at 4.7815 producing $57.5M in new taxes on rising valuations.

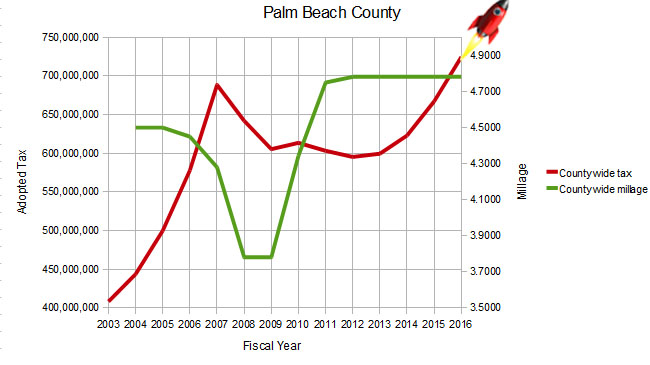

With property values having returned to 89% of the peak seen in 2007, this budget is actually $36M higher than the record set that year, making it the highest dollar value budget in the history of the county.

Coming on top of a $44M tax increase last year, during a time of negligible inflation and little population growth, the county is intent on taking a larger and larger share of taxpayer wealth. Many of the municipalities have already started talking about decreasing their millage – why not the county?

As usual, the Sheriff is claiming a big slice of this largesse, but the county-wide departments are also upping their spending. There is an across the board 3% “cost of living” increase on top of a similar 3% last year. Hiring is being turned on again with 66 new positions to fill. And $19M is targeted for capital projects.

Since the proposed millage is the same as last year, and there is a slight decline in the debt service, this budget will be presented as if it contains a slight tax rate decrease in aggregate. Don’t be fooled – at $725M, the proposed countywide taxes collected is both the largest total amount in history, as well as the largest dollar increase since 2007 at the peak of the bubble.

So what does this mean to the property owner?

Thanks to “Save our Homes”, the most that the taxable value of a homestead property can increase in a single year is 3% or the inflation rate, whichever is lower. This year the state has set the rate to 0.8%. With flat millage then, the homesteader’s tax bill increase is limited to less than 1% and much will be made of the fact that this is only a few dollars at most.

2015 Tax x 39% = homestead share

$667M x .39 = $260M

Allowable increase = 0.8% x $260M = $2.08M

Remainder ($57.5M – $2.08M = $55.4M)

to be paid by non-homesteader

who paid

$667M x 61% = $407M for 2015

and will pay

$407M + $55M = $462M for 2016

or + 13.6%

But what of the non-homesteader?

There are approximately 630K taxable properties in the county, of which 298K are homesteaded (47%), and last year these paid about 39% of the taxes. Using these figures we can calculate that the homesteader’s share of the $57.5M tax increase is about $2M or about $7 per parcel on average (see box). The remaining $55M will be paid by the non-homestead properties (both residential and commercial) and they will see an increase of about 13% over last year, or about $167 per parcel. Since some non-homestead properties are capped at 10%, those not so fortunate will pay even more.

From a historical perspective, the millage has been unchanged since 2012, when the county property valuation was about $125B. As it now sits at $152B, the county has been able to increase its “take” from the $595M in 2012 to this proposal’s $725M, up $130M, without having to increase the tax rate. How much different it was in the years leading up to the bubble bursting after 2007. For the years 2006, 2007 and 2008, as valuations climbed, a different set of Commissioners actually DECREASED the millage rate. Even though tax amounts continued to climb, their action resulted in lower taxes than flat millage would have produced.

It is clearly time to start decreasing the millage rate, even a small amount. Maybe this Commission should study the actions of their predecessors.