2024 Budget Raises $100M in New Property Taxes

At the first public hearing on the 2024 PBC County budget on 9/7, the Board of County Commissioners (BCC) followed through with their intention to reduce the millage by about 5% from 4.715 to 4.500. As in July, the vote was unanimous.

A reduction in the millage of that much was a bit of a surprise in June as staff had recommended keeping it flat, and the change reduces the original county-wide ad-valorem tax proposal by $62M. Kudos to Commissioner Marino for suggesting the change and getting the rest of the board to follow her lead.

That said, the county-wide property tax burden is still going up by 8.5% since taxable valuations have climbed almost 15% since last year. That is an increase of $102M. Where is the new money going you ask? Much of it goes to a 6% across the board increase for every employee. This is on top of 3% a year, every year for the last nine (34% from 2014).

Some other increases:

- $54M more for the Sheriff – this is a 7.5% increase, yet the PBSO share of the total budget has declined to 59.5% from a peak of 66.4% in 2020

- $105M increase in reserves. The $1.6B in reserves are now 32% of budgeted expenditures, up from 28% one year ago.

- $29M increase in BCC operations net of revenues

- $85M in capital projects

- $12M increase for the Supervisor of elections, now at $34M (55% increase). Next year is a Presidential election year, but the budget in 2020 was only $16M so it is more than doubled. At the hearing, the majority of speakers addressed this line item and there appears to be an upswell of angst about the conduct of elections in Palm Beach County. This budget increase does not help that much.

The Fire / Rescue budget (separate taxing district, paid only if your town does not have its own F/R) has increased over 10% to $529M.

Total staffing is increasing by 66 to 12,369.

The final public hearing will be held on September 26th at 5:05pm.

2021 Budget Workshop on June 16

The proposed county budget for FY 2021 will be presented at the June 16 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year about 5.8%.

Total County-wide tax is up $54.7M to $1.0B, on top of the penny sales tax (infrastructure surcharge) of another $84M (estimated).

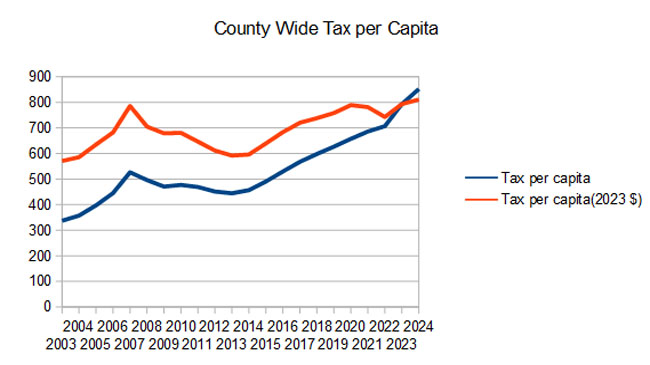

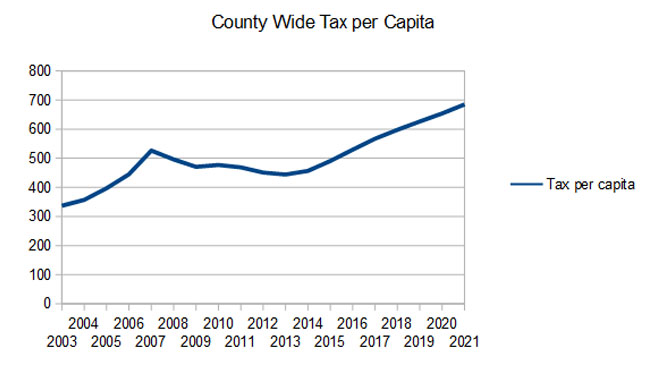

For some perspective, during the last 9 years of flat millage (2012-2021), the ad-valorem tax per capita in Palm Beach County rose from $451 to $685, a 52% increase during a time of a 12% change in the consumer price index.

Some items of interest:

- Valuations are estimated at about $210 billion, up about 4.9% over a year ago.

- With flat millage (4.7815), this valuation will generate more than $1 Billion in ad-valorem taxes for the first time, up $54.7M (5.1%) over last year.

- There will be 146 new BCC funded positions, 26 of them ad-valorem funded.

- General Fund reserves are being increased to $177M, 11.2% of general fund revenues (was $154M, so up 15% over last year)

- A 3% COLA for all BCC employees will cost $7.0M. This is the seventh year in a row – a 22% across-the-board raise over 7 years. During the same period, inflation was about 7.4%.

- The Sheriff will see a $21.7M ad-valorem increase, which is a net $31.8M (+5.1%) considering carry-forwards and increased revenue. This includes money for 27 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $3.1M and $16.3M respectively.

- Palm Tran is seeing a big boost of $14.1M (11%), 4.8M of that from ad-valorem.

The BCC priorities were funded, with $3.4M for business incentives, $89.2M for infrastructure (including Palm Tran vehicles), $17.6M for Housing/Homelessness (including “non-congregate” shelters), and $2.5M for substance use and behavior disorders.

First of two Public Hearings on 2018 Budget on Tuesday 9/5

On Tuesday evening 9/5 at 6:00PM, the County Commission will hold the first of the two required public hearings on the budget for the 2018 fiscal year.

Links:

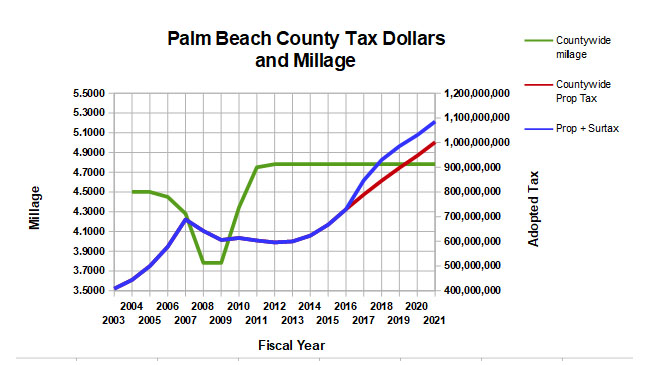

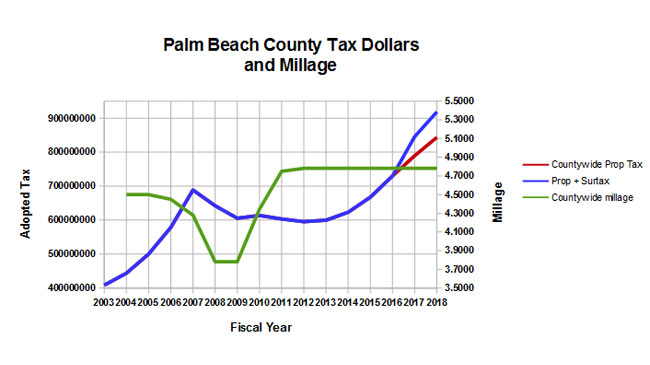

There are no surprises, as the budget presented in the June and July workshops is essentially the same. At the July meeting, the maximum millage was set at 4.7815, unchanged since 2011. The county staff again proposes to take full advantage of another rise in property values by continuing the 4.7815 millage rate and reaping a tax increase of $56M, up 7.1% over last year, for a total ad-valorem tax levy of $846M. (NOTE: For comparison, we use the stated spending levels in the adopted budget from the previous year, not rollback. General fund ad-valorem taxes in the last budget year were $789.6M, hence the current budget is up 7.1%.)

There is no discussion of reducing millage in recognition of the $75M windfall from the sales tax surcharge. When property tax is combined with the yearly surcharge revenue, the total take of $921M is up 54% over the last 5 years.

This is the fifth year in a row of a 3% across the board pay increase for all employees, representing a raise of 16% since 2013. The Sheriff, as usual, gets a 5% increase and at $542M, now represents about 53% of the total countywide net ad-valorem spending (exclusive of the dependent districts – Fire/Rescue and Library).

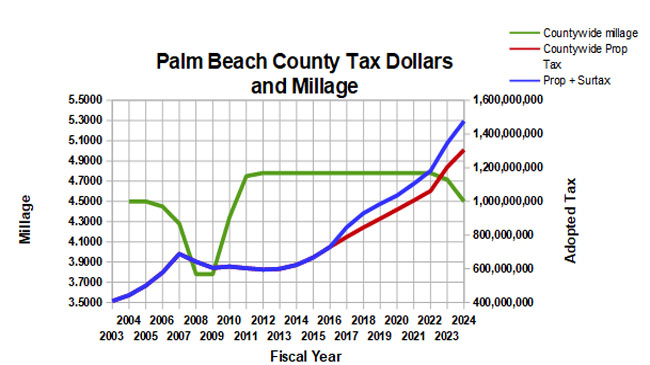

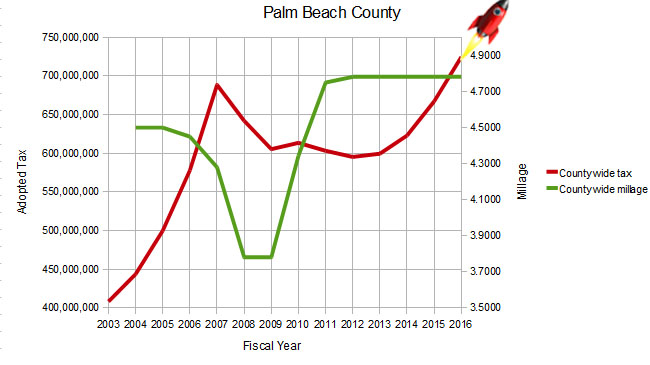

The graph below shows the trend in ad-valorem taxes and millage since 2003, with the sales tax surcharge added to put it in perspective.

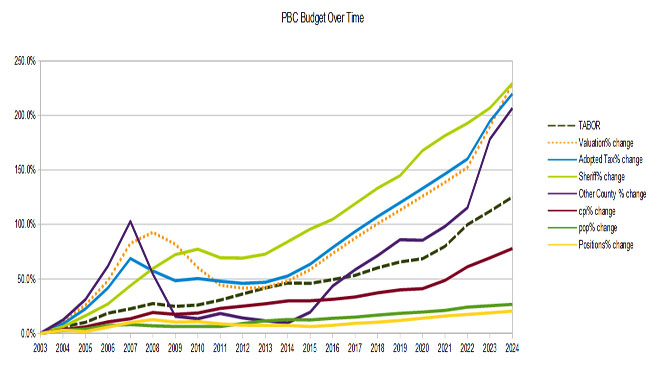

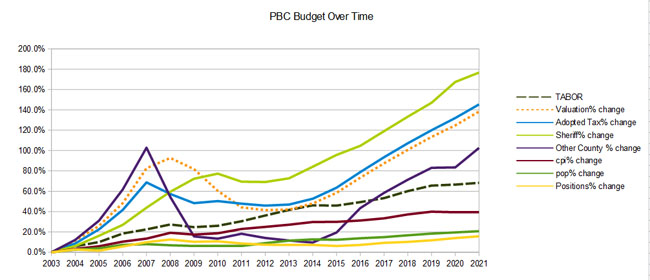

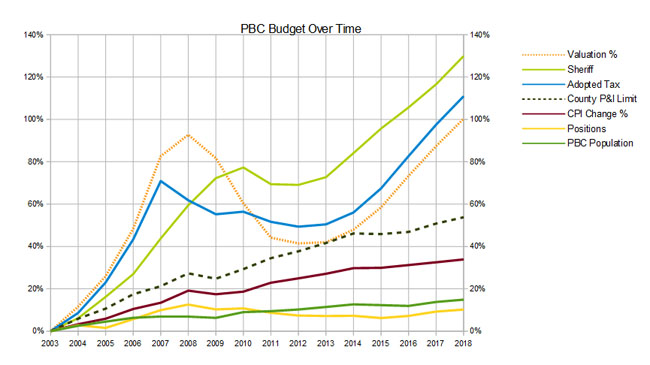

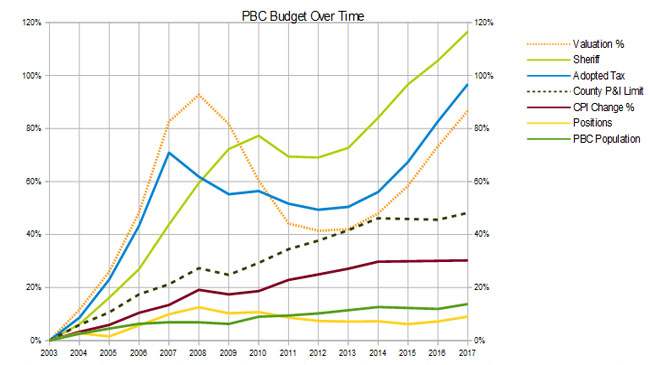

The next graph shows the budget over time compared to the valuation curve and the “TABOR” line. The orange dotted line is valuation which has just doubled since 2003 and is at a new peak for the first time following the 2008 “crash”. Note that the Sheriff’s budget has shown little restraint and has only declined once in 15 years – it is now up about 130% since 2003.

The “TABOR” line (green dotted “County P&I limit”) reflects the combination of inflation and population growth over time and is a model for what responsible budget growth would look like. TABOR would suggest a growth in taxes of about 54% for the period. Although not shown on this graph, if the Sheriff’s budget is subtracted from the total, the budget for the rest of the county departments has not exceeded the TABOR line, clearly indicating where the problem lies.

For more information, see the First Public Hearing Package.

Final County Budget Hearing This Evening 9/19

At the first September budget hearing, the Commission unanimously adopted the 4.7815 millage – unchanged for 6 years, and tonight they will make it official.

When this tax rate was first set for the 2012 fiscal year, the countywide ad valorem tax was $595M against a valuation of $124.6B. This year, property valuations have greatly recovered and now total $165.1B. At that level, this millage will generate $790M – up 33% in 6 years, 8.2% in this year alone.

OVer those 6 years, there has only been about 4% inflation and population has grown about 3%. The average household income throughout Palm Beach County grew about 6%.

The government did much better. County employees saw across the board raises of 3% for 4 years in a row (12.6%), and taxes went up 33%.

Remember this growth in taxes – far in excess of inflation and population growth, as you consider whether a 7% sales tax makes sense. If passed, the tax will provide another $70M per year to the county government – larger than the $60M increase in this year’s ad-valorem.

Public Hearing Tuesday on 2017 County Budget

Links:

On Tuesday 9/6 at 6:00 PM, the County Commission will most likely vote to leave the millage unchanged for a sixth year in a row, accepting the tax windfall from rising valuations.

The numbers are slightly higher than the June package as the valuations have been adjusted up slightly to $165.1B – 97% of the all time peak that occurred in 2008. This year’s tax take of $790M is up 8.2% over last year and up 33% in the 5 years since 2012.

Highlights of the budget include:

- a 3% across-the-board salary increase for all employees (on top of 3% in each of the last 3 years). Note that this 12.5% increase for county employees came during the 4 year period when the county average household income only went up about 4%.

- 62 new positions. County staffing has grown by 286 in the last 4 years to a total of 11,202.

- A $28M increase for the Sheriff. The Sheriff now accounts for about 48% of the general fund total appropriation budget.

- A 4.7% decrease in the budget for Engineering and Public Works.

Note that there is nothing in the budget for revenue and appropriations associated with infrastructure projects that would be funded by the proposed 1 cent sales tax surcharge. If the tax were to pass, the county would receive about $70M per year – about $10M more than the amount of the increase in this year’s property tax. When added together, the total tax increase would be 18% in 2017.

Sales Tax Referendum Gathering Steam

The county commission will vote Tuesday whether to ask the voters to raise the county sales tax from 6% to 7%. (Agenda Item 5B1)

After aborted attempts in 2012 and 2014, when a majority of the board thought the proposal was “half baked” and the need not urgent enough to convince the voters to cough up several billion over ten years, this time no one will say that the proposal hasn’t been finely tuned.

To her credit, County Administrator Verdenia Baker has put enormous energy and thought into lining up partners and getting potential opponents on board. She has made countless trips to the District, the League of Cities, business groups, city and town governments, and even homeowners associations to solicit ideas and sell the concept.

The School District has bought in, voting to partner up and accept just 48% of the take – less than they would have received with a go-it-alone half cent increase “for the children”.

The cities have also rallied to grab a piece of the potential windfall, producing a detailed wish list of projects to absorb their 18.5% – many of which would never have been conceived under their own municipal budgets.

And the master stroke was to bring in the Cultural Council as the tip of the spear. Acting in a capacity that can be looked at as “fee for service”, the Cultural Council is the hired gun whose “One County, One Plan, One Penny” campaign is already cranking up. The School District and the County Government are prohibited by law from engaging in political campaigning to pass a measure favorable to them, but the Public/Private Cultural Council is under no such restraint. Their 4.5% of the proceeds (about $122M over 10 years) is payment rendered to convince the public that this tax increase is to their benefit.

If it passes, the county will receive 28.5% of the proceeds, and although it is an “infrastructure surtax”, intended for maintenance of roads, bridges and facilities, much of the money is earmarked for new capital projects. It even contains a $27M “Economic Development Fund” for unspecified projects “to attract, retain, and expand businesses to improve the local economy.”

We think this a bad direction for the county, but there is enough muscle behind the proposal, that keeping it off the ballot would seem unlikely at this point. Only one Commissioner has signaled his opposition (Hal Valeche, to his credit), and the usual folks who oppose tax increases – such as the Economic Council, the Palm Beach Post editorial board, even some TAB partners, are either supporting the proposal or remaining neutral.

If you would like to go on record as opposing this referendum, send an email to the BCC or speak at the meeting on Tuesday.

Here are some things to keep in mind:

- It is a net tax increase of $220M per year – there is no talk of reducing ad-valorem taxes

- It is not subject to the scrutiny applied to items in the annual ad-valorem budget

- It creates an incentive to make purchases outside the county (both Broward and Martin are at 6%)

- It is regressive

- It is not an “infrastructure maintenance” tax, but includes many new capital projects

Sales Tax Proposal Sent Back for More Info

During a long meeting that stretched from before lunch until 5pm, the Board of County Commissioners yesterday deferred action on staff’s sales tax proposal, sending it back for more information.

Commissioners Valeche, Burdick and Abrams all wanted to see things slow down while the proposal is fleshed out. They did not want to see ballot language as of yet, rather the next session should discuss the unknowns of the proposal, including:

– What is the project list from the cities and School District?

– How would funds be distributed among cities, Cultural Council, county, schools?

– What it looks like without the Cultural Council projects included?

– What does the Hospitality Industry think of it?

While no one wanted to shut it down, they are clearly not ready to move on it. Some concerns expressed were that the proposal had expanded way beyond the original infrastructure funding, encompassing new construction projects, equipment for the Sheriff, and other items. Commissioner Abrams worried that the “Christmas tree” could tip over from all the ornaments.

Regarding the proposals from the Cultural Council – illustrated by a procession of over 10 museum directors, zookeepers, theater managers and the like, some of the projects go way beyond what you would expect from public funding, including architectural enhancements to the exterior of existing buildings to make them more trendy.

We will wait and see. We have listed objections to the plan as it is currently known. We expect that the devil is in the details though, specifically:

– Will the cities give up some of their share to fund CC projects?

– What will each of the 39 municipalities do with their share? Will any reduce their ad-valorem?

– What effect will this have on the county Ad-valorem budget process this year?

Regarding the Fire/Rescue sales tax proposal, there were too many questions about the enabling statute to move forward at this time. In particular:

– It is unclear what happens if sales tax revenue exceeds needs – can the surplus be spent on non fire/rescue projects by the county or cities? – It needs a statute change or AG opinion.

– What would be the process for collecting and distributing the cash, and how could ad-valorem be adjusted after trim notices are sent – Tax Collector Anne Gannon came and listed some of her process issues with it.

– What does Fire/Rescue administration (ie. Fire Chief Collins) think of the proposal. (The proposal is being brought forward by the IAFF union, not Fire/Rescue management).

We will keep you posted.

Some of the organizations with whom we have spoken, are also in a “wait and see” mode. Many believe there are real infrastructure needs, but many of the add-on projects give them pause.

For the Post story on the meeting, see: Action on Sales Tax Issue Delayed.

Final Hearing on FY2016 Budget, 9/21

Next Monday, the Commission will take their final vote to set the county-wide millage rate at 4.7815, unchanged since 2012.

Out of the $63M tax increase, the $775K that they did not commit to new spending will be rolled into reserves, ready for use to increase the BDB subsidy and other priorities that didn’t make the budget proposal.

This is how the budget compares to last year:

| 2015 | 2016 | Change | |

|---|---|---|---|

| County-wide | $667.3M | 729.9M | + 9.4% |

| Library | $41.5M | 45.0M | + 8.4% |

| County Fire Rescue | $196.6M | 214.8M | + 9.3% |

| Jupiter Fire Rescue | $17.6M | 17.7M | + 0.6% |

Keep these large increases in mind as you contemplate the coming push for raising the sales tax to pay for “infrastucture” projects that should have been addressed in the normal budget process.

Public Hearing on the Budget – What to expect

On Tuesday, September 8 at 6 PM, the county commission will meet to consider the 2016 budget in the first of two meetings to set the millage rate. See: 1st Public Hearing Package

In the June workshop, before the county valuations were adjusted upward slightly, flat millage projections yielded $724.8M in property taxes – an 8.6% increase over last years budget. With the new valuations, the yield became $729.9M or a 9.4% increase.

All of this $62.6M windfall has been allocated to new spending, including large increases for the Sheriff, another 3% across the board pay increase for all county employees, new hiring, some capital projects and increases to reserves.

What is not being addressed in this budget is infrastructure – roads, bridges, parks, etc., which both staff and commissioners have been saying is an urgent need. Why? Because they plan to hit you with a sales tax increase and/or higher debt loads for that.

A sales tax increase would have to be passed by referendum and is not guaranteed, but staff and commissioners appear eager to make the attempt, even Hal Valeche, who laughably calls himself a “tax cutter”. To my knowledge, there have been no county tax cuts since he has been on the dais.

Funding critical infrastructure “off budget” is devious. One of the most important functions of local government is to build and maintain public roads and spaces. When these projects are funded as they should be, through a public budget process that allows for public input and discussion, commissioners are forced to make tradeoffs and set priorities. Because of the “Save our Homes” statute that limits homestead tax increases to the inflation rate (0.8% this year), there is a limit to the amount they can gouge the non-homestead propery owners. If they can get an “infrastructure sales tax” passed, it would generate an enormous amount of new revenue – just .5% would exceed $100M / year, and none of it would have to be justified through the budget process.

So what to expect?

The additional $5M that would be generated from the higher valuations (determined since June), could be used to reduce the millage and “give a little back to the taxpayer”. Do not expect that from this Commission. In the July workshop it was mostly allocated to other spending, including a mid-year pay increase for the tax collector’s office. With a little less than $1M unallocated going into the September hearing, likely recipients will be the Business Development Board (which has requested another $500K), and additional hiring in other areas.

The maximum millage rate set in July at 4.7815, unchanged since 2012, will very likely become the adopted rate after the two September hearings, and you can expect a push in the 4th quarter for the sales tax referendum to go on the November 2016 ballot, and/or a very sizable bond issue for “infrastructure”.

Since for homestead property owners, the 0.8% limit makes their tax increase minimal, there is not likely to be much public opposition in these meetings, and TAB does not plan to oppose the increase. The sales tax though is another matter, and now is not too early to consider what can be done to defeat such a move.

Maximum Millage to be set Tuesday, 7/21

The county commission will act to set the maximum millage for fiscal year 2016 on Tuesday, 7/21, as part of a regular agenda. Staff recommends holding the county-wide millage flat at 4.7815.

Since the June budget workshop, where the flat millage would have generated $724.8M in taxes on $151.6B in valuation, the property values have been adjusted upward to $152.7B. With flat millage, that will provide another $5.1M in taxes, or $729.9M.

Compared to last year’s adopted tax of $667M, this represents a 9% tax increase, and the largest proposed tax in county history.

The $5.1M windfall since June could have been used to reduce the tax rate, but only Commissioners Steven Abrams and Paulette Burdick have even suggested that as a course of action. Other Commissioners scoffed as they have plans for that money.

Most disappointing was Commissioner Hal Valeche. A founding member of TAB (see: BCC 7/20/10), his interest in restraining the growth in the budget seems to have vanished, showing that once elected to office, one’s priorities change. Commissioner Valeche favors taking all the windfall and (since all is never enough) later floating a bond issue for “infrastructure” spending. Quoted in the Palm Beach Post as the countywide spending soars above $1B, he remarked: “Government has to eventually spend some money on some basic things. This isn’t fluff.”

It should be noted that the area of “infrastructure” – roads and bridges, where it has been repeatedly claimed that more money is needed, saw no significant increase in the budget. The Engineering and Public Works department actually saw a decrease of $1.2M. Remember this when later in the year there is a discussion of the bonds and/or raising the sales tax to pay for basic maintenance of roads, bridges and parks.

As previously noted, the taxable value increase on homestead property is limited this year by the Save Our Homes statute to about 0.8%, so this increase will be mostly borne by non-homesteaders – businesses and second home properties. As a result, homestead owners may feel they have no dog in this fight, but they are wrong. As we saw throughout the downturn, Save Our Homes just delays the tax hikes. Eventually, taxable valuations will catch up – even if market values decline.

The agenda item on 7/21 is not expected to generate much discussion – they will set the maximum millage and go on. In the September public hearings (9/8 and 9/21) though, the Commission will have the opportunity to adopt a lower number – but don’t hold your breath.