2024 Budget Raises $100M in New Property Taxes

At the first public hearing on the 2024 PBC County budget on 9/7, the Board of County Commissioners (BCC) followed through with their intention to reduce the millage by about 5% from 4.715 to 4.500. As in July, the vote was unanimous.

A reduction in the millage of that much was a bit of a surprise in June as staff had recommended keeping it flat, and the change reduces the original county-wide ad-valorem tax proposal by $62M. Kudos to Commissioner Marino for suggesting the change and getting the rest of the board to follow her lead.

That said, the county-wide property tax burden is still going up by 8.5% since taxable valuations have climbed almost 15% since last year. That is an increase of $102M. Where is the new money going you ask? Much of it goes to a 6% across the board increase for every employee. This is on top of 3% a year, every year for the last nine (34% from 2014).

Some other increases:

- $54M more for the Sheriff – this is a 7.5% increase, yet the PBSO share of the total budget has declined to 59.5% from a peak of 66.4% in 2020

- $105M increase in reserves. The $1.6B in reserves are now 32% of budgeted expenditures, up from 28% one year ago.

- $29M increase in BCC operations net of revenues

- $85M in capital projects

- $12M increase for the Supervisor of elections, now at $34M (55% increase). Next year is a Presidential election year, but the budget in 2020 was only $16M so it is more than doubled. At the hearing, the majority of speakers addressed this line item and there appears to be an upswell of angst about the conduct of elections in Palm Beach County. This budget increase does not help that much.

The Fire / Rescue budget (separate taxing district, paid only if your town does not have its own F/R) has increased over 10% to $529M.

Total staffing is increasing by 66 to 12,369.

The final public hearing will be held on September 26th at 5:05pm.

2023 County Budget – 13% Tax Increase in Spite of Small Millage Drop

The final proposed county budget for FY 2023 will be voted on at the September 20th BCC Public Hearing at 5:05PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

In the summer workshops, the BCC voted to reduce the millage by about 1.6% to 4.7150. This is the first millage change since 2012 when it was increased during the depths of the real estate valuation slump. Even with this minor reduction, the tax burden is up 13.4%. This is so much over the rollback rate that it will take a super majority of the Commission to enact.

It is a budget unlike the last few years in that it is presented in a time of uncontrolled inflation. When prices for everything are rising at an average 8.6% rate, governments just like people must find a way to increase their revenue or cut their spending. Having the power to tax of course, means governments can do just fine while the rest of us suffer.

With close to flat millage (with rising valuations), 6% salary increases for staff across the board and a tax increase over the previous year of about 13.4%, the county’s budget proposal doesn’t appear to subscribe to the “cut the spending” response to inflation.

Total County-wide tax is up $141M to $1.2B, on top of the penny sales tax (infrastructure surcharge) of another $94M (estimated). After many years of small budget increases, the BCC ad-valorem funded departments are going to town. Inside the overall 13% increase, the Sheriff is only asking for 5.5%, while the rest of the departments’ growth is an astounding 27%!

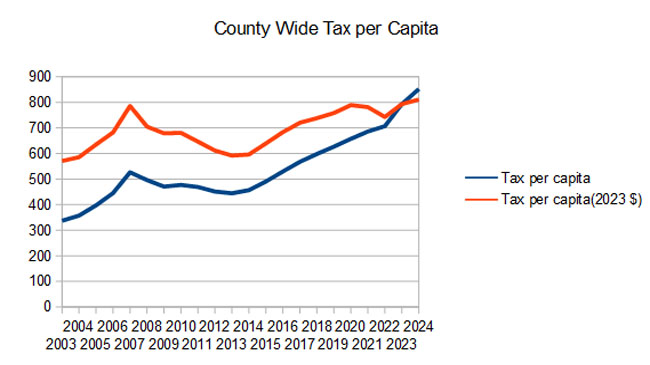

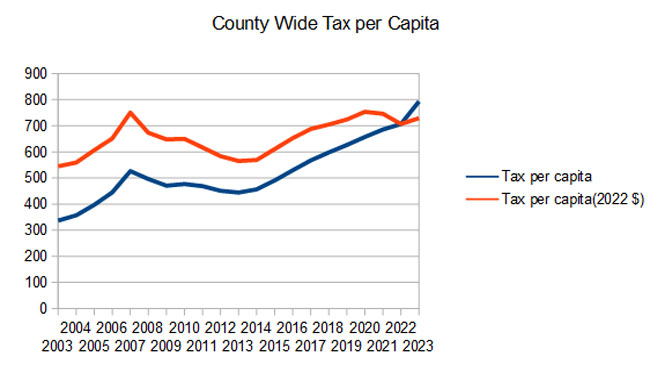

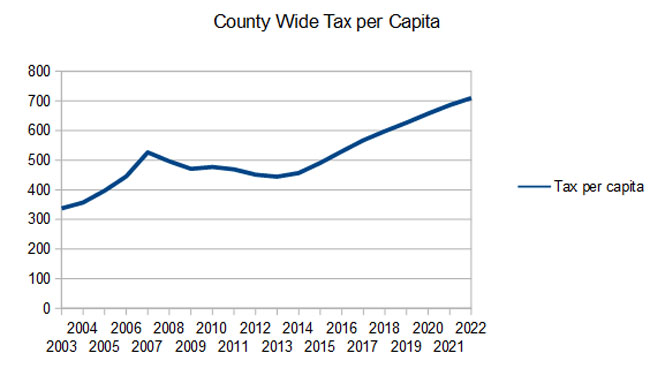

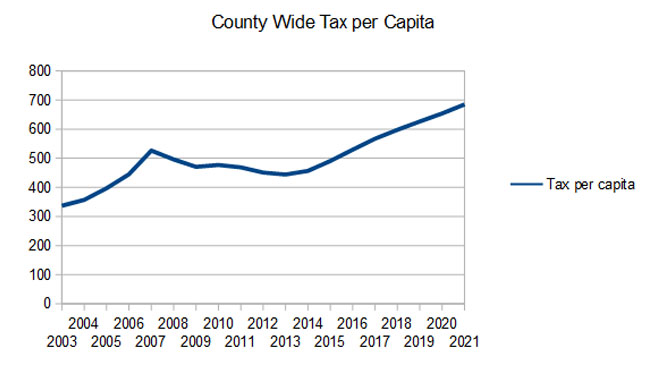

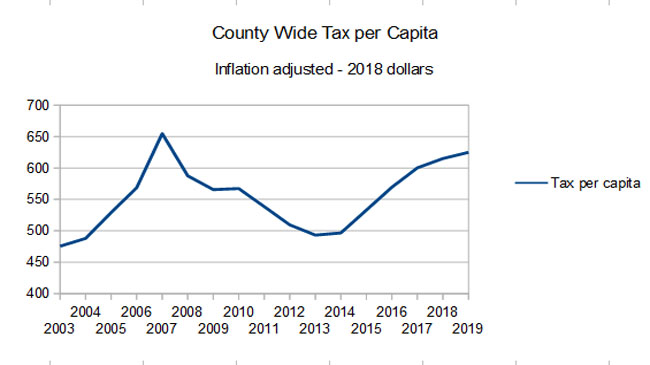

To be fair, with the Federal Reserve printing money to accommodate the Biden Administration’s excessive spending (the $2 Trillion “rescue plan” went right into the M2 money supply), it is prudent for the county to expect much higher costs going forward and padding the budget a little. I expect we will see that on the municipal level as well during the summer. If you look at the “County Wide Tax Per Capita” chart below, when shown in 2022 dollars taxation in flattening out.

For some perspective, during the last 11 years of flat millage (2012-2023), the ad-valorem tax per capita in Palm Beach County rose from $451 to $793, a 73% increase during a time of a 41% change in the consumer price index (much of that in the last year).

Here are some items in the budget of note:

- $3.4M is allocated for “Compensation Study Phase III”, the third and final installment “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” Since this year’s 6% increase comes on top of 3% a year for the last 8 (30% in total), we wonder if the study will find that county staffers are overpaid. No, I didn’t think so.

- As mentioned, after eight years of 3% cost of living (COLA) increases across the board, adding an ongoing $7.3M per year, this year’s 6% makes it 34% over the 9 years – a period when inflation was about 19%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $188K

- Sheriff (including part time crossing guards, etc.): $168K

- Information Technology: $124K

- Office of Management and Budget: $120K

- Parks and Recreation: $94K

- Palm Tran: $98K

- Engineering and Public Works: $87K

- The budget for the Supervisor of Elections is growing about 9% to $21.8M on top of 28% last year.. This includes a net gain of 5 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $255 billion, up about 15% over a year ago.

- With slightly smaller millage (4.7150), this valuation will generate more than $1.2 Billion in ad-valorem taxes, up $141M (13.3%) over last year.

- There will be 97 new BCC funded positions, 16 of them ad-valorem funded.

- General Fund reserves are being increased to $262M, 14% of general fund revenues (was $189M, so up 39% over last year)

- The Sheriff will see a $38M ad-valorem increase (5.5%). This includes money for 16 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $8.1M and $44.2M respectively.

2022 Budget Workshop on Tuesday, June 15

The proposed county budget for FY 2022 will be presented at the June 15 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year of about 4.8%.

Total County-wide tax is up $49M to $1.05B, on top of the penny sales tax (infrastructure surcharge) of another $80M (estimated).

For some perspective, during the last 10 years of flat millage (2012-2022), the ad-valorem tax per capita in Palm Beach County rose from $451 to $710, a 57% increase during a time of a 25% change in the consumer price index (much of that in the last few months).

Some items in the budget that should raise a few eyebrows:

- $3.2M is allocated for “Compensation Study Phase II”. The fall budget workshop estimated an additional $10M would be needed to fully complete phase II. Although not described in the package, we believe this is a continuation from the study by Evergreen Solutions back in 2018 and 19, whose purpose was: “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” See: Evergreen Study

- This is the eighth year of a 3% cost of living (COLA) increase across the board, adding an ongoing $7.3M per year. This amounts to 27% over the 8 years – a period when inflation was about 16%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $177K

- Sheriff (including part time crossing guards, etc.): $145K

- Information Technology: $117K

- Office of Management and Budget: $113K

- Parks and Recreation: $89K

- Palm Tran: $92K

- Engineering and Public Works: $82K

- The budget for the Supervisor of Elections is growing 28% to $19.9M. This includes a net gain of 4 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $221 billion, up about 4.9% over a year ago.

- With flat millage (4.7815), this valuation will generate more than $1 Billion in ad-valorem taxes, up $49M (4.8%) over last year.

- There will be 83 new BCC funded positions, 8 of them ad-valorem funded.

- General Fund reserves are being increased to $194M, 11.6% of general fund revenues (was $176M, so up 12% over last year)

- The Sheriff will see a $33M ad-valorem increase (5.1%). This includes money for 35 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $2.1M and $11.4M respectively.

2021 Budget Workshop on June 16

The proposed county budget for FY 2021 will be presented at the June 16 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year about 5.8%.

Total County-wide tax is up $54.7M to $1.0B, on top of the penny sales tax (infrastructure surcharge) of another $84M (estimated).

For some perspective, during the last 9 years of flat millage (2012-2021), the ad-valorem tax per capita in Palm Beach County rose from $451 to $685, a 52% increase during a time of a 12% change in the consumer price index.

Some items of interest:

- Valuations are estimated at about $210 billion, up about 4.9% over a year ago.

- With flat millage (4.7815), this valuation will generate more than $1 Billion in ad-valorem taxes for the first time, up $54.7M (5.1%) over last year.

- There will be 146 new BCC funded positions, 26 of them ad-valorem funded.

- General Fund reserves are being increased to $177M, 11.2% of general fund revenues (was $154M, so up 15% over last year)

- A 3% COLA for all BCC employees will cost $7.0M. This is the seventh year in a row – a 22% across-the-board raise over 7 years. During the same period, inflation was about 7.4%.

- The Sheriff will see a $21.7M ad-valorem increase, which is a net $31.8M (+5.1%) considering carry-forwards and increased revenue. This includes money for 27 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $3.1M and $16.3M respectively.

- Palm Tran is seeing a big boost of $14.1M (11%), 4.8M of that from ad-valorem.

The BCC priorities were funded, with $3.4M for business incentives, $89.2M for infrastructure (including Palm Tran vehicles), $17.6M for Housing/Homelessness (including “non-congregate” shelters), and $2.5M for substance use and behavior disorders.

2020 Budget Workshop on June 10

The proposed county budget for FY 2020 will be presented at the June 10 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year about 5.5%.

Total County-wide tax is up $49.1M to $947M, on top of the penny sales tax (infrastructure surcharge) of another $73M.

For some perspective, during the time of flat millage (2012-2020), the ad-valorem tax per capita in Palm Beach County rose from $505 to $652, a 29% increase during a time of 10% inflation.

Some items of interest:

- Valuations are estimated at about $198 billion, up about 5.3% over a year ago.

- With flat millage (4.7815), this valuation will generate $947 Million in ad-valorem taxes, up $49.1M (5.5%) over last year.

- There will be 170 new BCC funded positions, 32 of them ad-valorem funded.

- General Fund reserves are being increased to $154M, 10.4% of general fund revenues (was $131M, so up 18% over last year)

- A 3% COLA for all BCC employees will cost $6.7M. This is the sixth year in a row – a 19% across-the-board raise over 6 years. During the same period, inflation was just shy of 10%.

- The Sheriff will see a $38.2M ad-valorem increase, which is a net $47.7M (+4.7%) considering carry-forwards and increased revenue. This includes money for 10 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $3.0M and $14.8M respectively.

- Palm Tran is seeing a big boost of $15M (11%), 9.9M of that from ad-valorem.

The BCC priorities were funded, with $52M for Housing/Homelessness, and $2.6M for substance use and behavior disorders.

Last year the supervisor of elections, which has had a flat budget in the $10M range over the 5 years saw a 142% increase to $22M. This was for equipment upgrades getting ready for the 2020 election, and this year’s budget has been decreased by about $4M to $17M – still high by historical standards.

Trends in the County Budget

The first public hearing on the FY2019 county budget is scheduled for Tuesday, September 4 at 6PM.

As laid out in June, the county intends to keep the millage flat at 4.7815. With the updated valuations at around $188B, up 6% over last year’s $176.8B, that will give them another 6.2% to allocate to new spending and to reserves.

301 N. Olive Street, 6th floor.

Links:

The increased tax collections for 2019 will go primarily to salary and benefit increases (another 3% COLA across the board – for the fifth year in a row), a $31M increase for the Sheriff, 81 new positions being created, and the addition of about $20M to reserves. The reserve funding will bring the total unrestricted reserves up to about 9.2% of the gross General Fund budget.

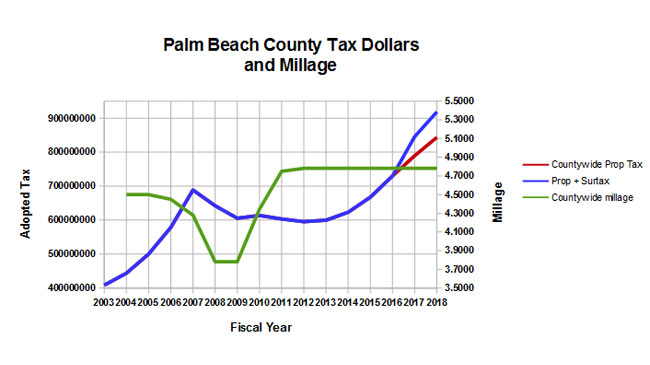

As this is the seventh year of flat millage, it should be noted that the county-wide taxes collected in those years (FY2012-2019) increased from $595M to $898M, a 51% increase due solely to increased property valuations. That is an average of 7% per year.

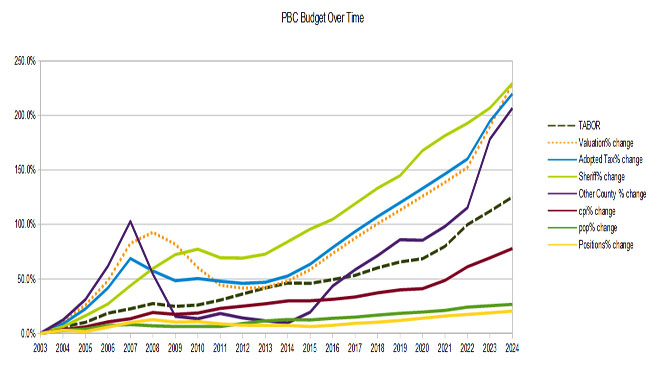

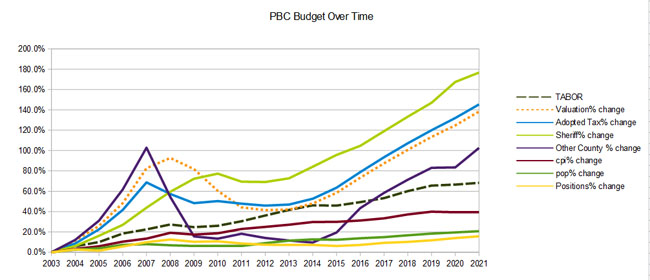

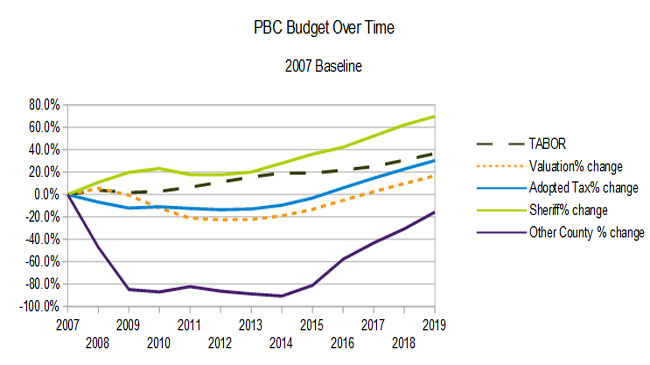

The county implies in their budget package that the increases have been less than TABOR (population growth and inflation), but is that really true? It all depends on the base year you pick.

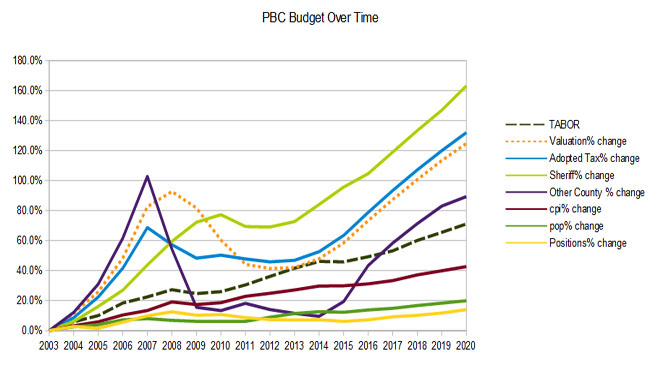

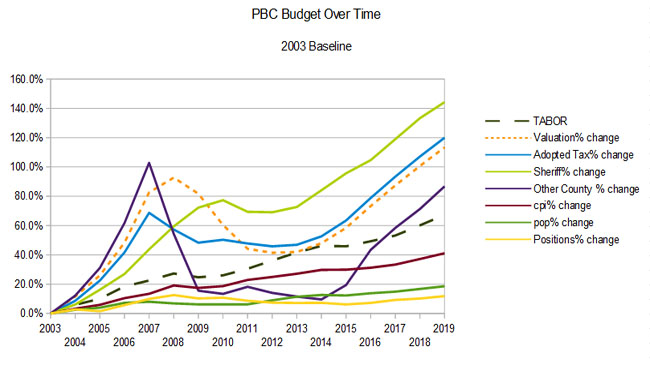

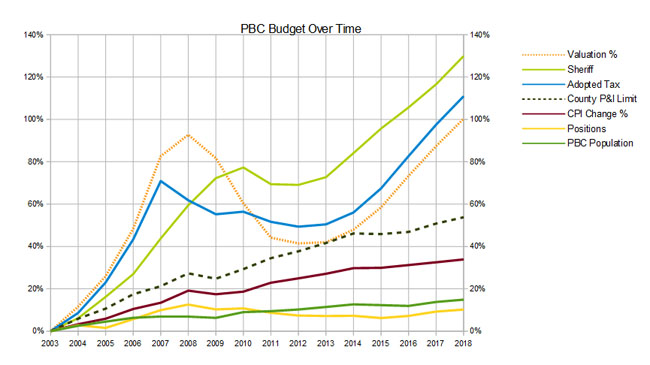

We at TAB have been following the trends in the county budget using data starting in 2003 – a 16 year stretch to the current 2019 Fiscal year.

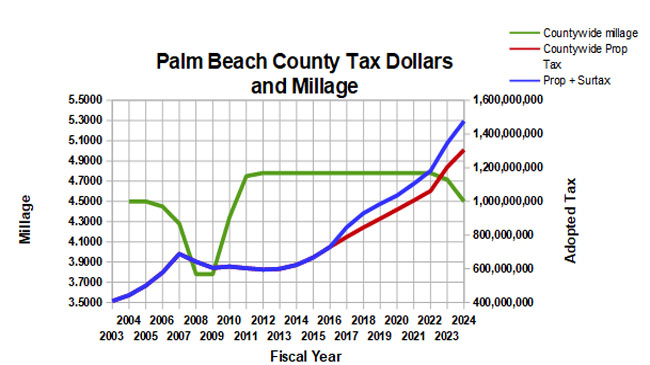

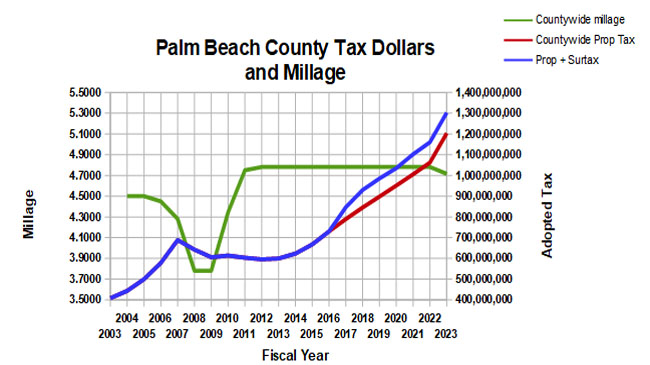

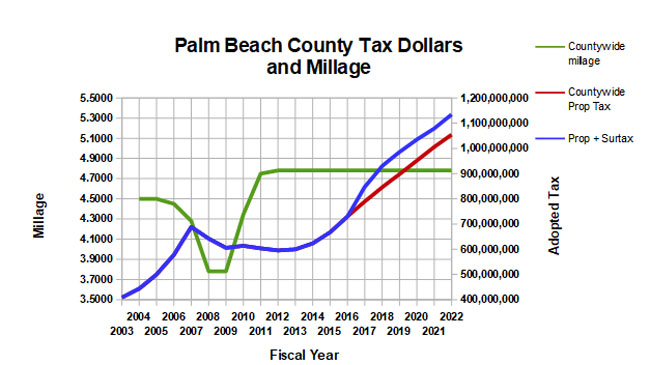

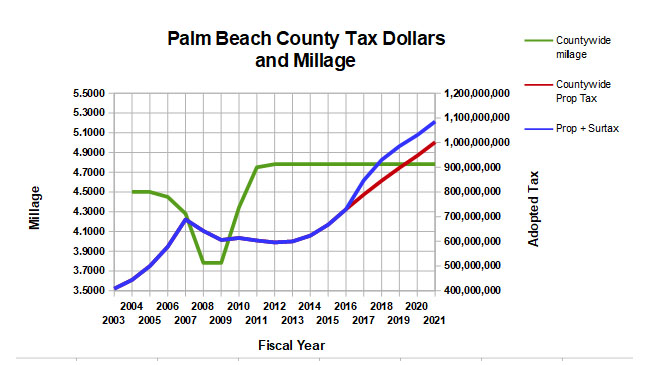

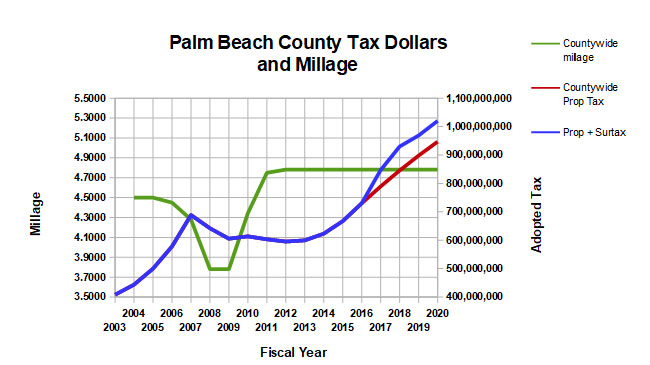

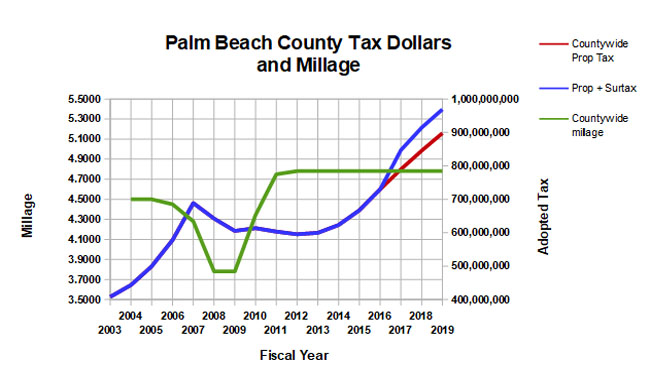

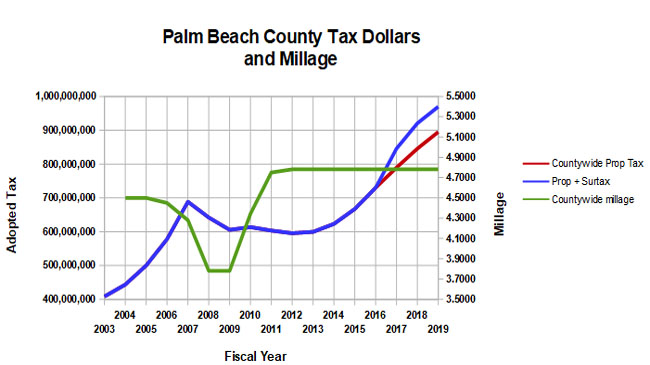

As the following chart 1 indicates, county tax collections significantly declined in 2008 and 2009, and did not really start to recover until 2013. This was due to a number of factors – real estate prices collapsed leading to the financial collapse of 2008, but a major effect on local governments was the legislative changes that made “save our homes” portable, an increase in the homestead exemption and the addition of more classes of property subject to caps.

Chart 1 – 2003 Base

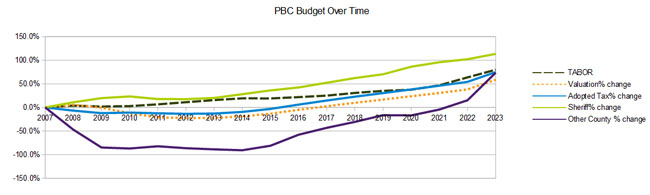

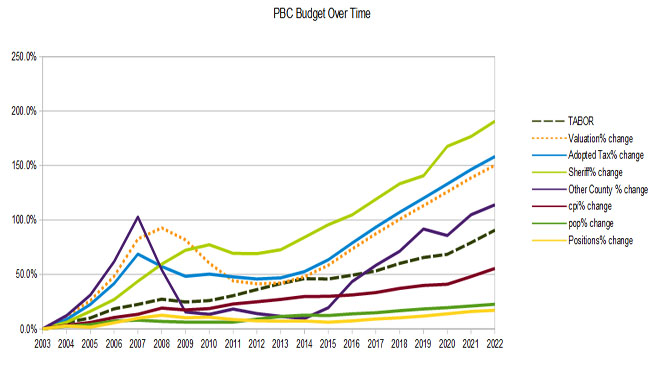

Following the peak of 2007 (prior to which county taxes were expanding at an unsustainable rate), county-wide ad-valorem taxes, excluding the Sheriff, fell 43% in two years – a decline of $150M. This was accompanied by a drastic reduction in capital spending, and a gradual decline in staffing. As of today, we still have not exceeded the 2007 peak of non-Sheriff taxation. (The total ad-valorem tax level passed the peak last year). Referring to chart 2, you will see that until recently, although the Sheriff has always exceeded TABOR by a large margin, other county spending did not.

So, in order to make the current level of taxation not look so bad, the county uses the peak year 2007 as its baseline for comparisons. In the second chart below, you will see that using a 2007 base keeps total ad-valorem spending under the TABOR line, even when including the Sheriff’s budget, which now accounts for 64% of the total, down from a peak of about 70% in 2014.

Chart 2 – 2007 Base

On a per-capita basis (inflation adjusted), the county taxes have increased from $475 to $625 since 2003 (in 2018 dollars). Since 2007 they have actually fallen from $655 to $625. (See chart 3).

Chart 3 – Per Capita Taxes

Chart 4 shows the millage and ad-valorem taxes over time. We also show the effect of the revenue from the sales tax surcharge passed by referendum. The 2019 surcharge will amount to about $71M.

Chart 4 – Millage and Taxation

2019 Budget Season Kicks off with June 12 Workshop

The proposed county budget for FY 2019 will be presented at the June 12 BCC workshop at 6:00PM.

Usually, the powerpoint presentation for the meeting is available along with the budget package a week before the meeting, but this year it is not, so we will have to wait for additional details.

301 N. Olive Street, 6th floor.

Links:

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year just shy of 6%.

Some items of interest:

- Valuations are estimated at about $187B, up about 5.7% over a year ago.

- With flat millage (4.7815), this valuation will generate $894.8M in ad-valorem taxes, up $49.2M (5.8%) over last year.

- There will be 81 new BCC funded positions.

- General Fund reserves are being increased to $128M, 9.2% of general fund revenues (was $107M, so up 19% over last year)

- A 3% COLA for all BCC employees will cost $6.5M. This is the fifth year in a row – a 16% across-the-board raise over 5 years.

- The Sheriff will see a $31M increase, which is a net $25.8M (+4.7%) considering carry-forwards and increased revenue.

- The Inspector General will see an increase of 4 positions next year, with 6 more over the following two years. The IG is funded now about 2/3 by the county – municipalities and others kick in about $1M.

- Library and Fire/Rescue will also see flat millage, yielding increases of $2.7M and $13.4M respectively.

Two fairly unusual things jumped out at us from the department level detail, that are not explained in the meeting package or anywhere on the county website. A call to the Budget Office cleared them up:

The supervisor of elections, which has had a flat budget in the $10M range over the last 5 years is jumping up to $22M – a $142% increase. There is not any noticeable increase is staff, so we assumed it must be for equipment or other needs. Robyn Lawrence, Assistant Budget Director explained that the $12M is for scanners, modems and other equipment upgrades.

Likewise, an unexplained change is occurring in the Tax Collector’s budget – a $5.5M decrease from $14.5M down to $9M. This reflects money allocated for a facility being recast as capital spending.

New Budget up 6.9% with Flat Millage

On Tuesday evening 6/13 at 6:00PM, the County Commission will hold the first budget workshop for the 2018 fiscal year.

Links:

There are no surprises. As they have done for the last 5 years, the county staff proposes to take full advantage of another rise in property values by continuing the 4.7815 millage rate and reaping a tax increase of $54M, up 6.9% over last year, for a total ad-valorem tax levy of $844M.

There is no discussion of reducing millage in recognition of the $75M windfall from the sales tax surcharge. When property tax is combined with the yearly surcharge revenue, the total take of $919M is up 53% over the last 5 years.

This is the fifth year in a row of a 3% across the board pay increase for all employees, representing a raise of 16% since 2013. The Sheriff, as usual, gets a 5% increase and at $542M, now represents about half of the total countywide net spending from property taxes.

The graph below shows the trend in ad-valorem taxes and millage since 2003, with the sales tax surcharge added to put it in perspective.

The next graph shows the budget over time compared to the valuation curve and the “TABOR” line. The orange dotted line is valuation which has just doubled since 2003 and is at a new peak for the first time following the 2008 “crash”. Note that the Sheriff’s budget has shown little restraint and has only declined once in 15 years – it is now up about 130% since 2003.

The “TABOR” line (green dotted “County P&I limit”) reflects the combination of inflation and population growth over time and is a model for what responsible budget growth would look like. TABOR would suggest a growth in taxes of about 54% for the period. Although not shown on this graph, if the Sheriff’s budget is subtracted from the total, the budget for the rest of the county departments has not exceeded the TABOR line, clearly indicating where the problem lies.

For more information, see the Budget Presentation and the Budget Package.