Yet Another Taxing District?

Palm Beach County property owners are taxed in many ways. We pay separate tax rates for our cities, for our schools, and for the county government. We also pay for the county libraries, the Health Care District, the Children’s Services Council, and a variety of inlet and water management districts. If we live in the unincorporated areas we pay separately for Fire/Rescue.

Now there is a proposal to create yet another tax district – for the Office of Inspector General. Why this and why now?

It is raw politics.

Some Background

The Office of Inspector General was established in 2009 by the County Commission in response to the grand jury report investigating “Corruption County”. With many commissioners and lobbyists serving jail terms for abuse of the public trust, it was a correct response, and much effort went in to making the office “independent”. Hiring was performed by an independent selection board. Removal required the votes of the entire selection board plus 5 of the 7 commissioners. The budget was floored at an amount .25% of the contracts that vendors have with the county, and could not be reduced without 5 votes of the commission.

In 2010, a ballot initiative asked the voters if the IG jurisdiction should be extended to the 38 municipalities, with a proportional increase in funding to come from those entities. 72% of the voters agreed and the result was codified in the county charter after a six month effort by an ordinance drafting committee. The committee was composed of representatives of the county, the League of Cities, and the public, but much of the discussion was contentious. The cities objected mainly on two grounds – that the scope was too broad and that the purview of “waste, fraud, abuse and mismanagement” needed to be narrowly defined to limit what the IG could investigate, and that the funding formula based on a LOGER estimate of contract activity constituted an illegal tax. The ordinance draft did pass by a majority vote.

In 2011, after the IG began her work with the cities, the opposition began. Many cities passed local ordinances adding the definitions that were rejected by the drafting committee. A narrative was established that complying with the IG would be prohibitively expensive to answer their questions and fix any problems found. “The people did not know what they were voting for” became the operative justification for the opposition. Finally, in a major strike, 15 of the 38 municipalities filed a lawsuit claiming that the funding mechanism is illegal under Florida law, and refused to remit their obligated funding. Funds already provided by the municipalities that were not party to the lawsuit were sequestered by the County Clerk. A crisis in funding was at hand.

Recent Developments

On Tuesday, 3/20, a lawsuit “settlement proposal” negotiated by County Attorney staff was brought to the Commissioners. Under its terms, the cities would collect a contract fee of .25% levied by the county on their contracts, to be used for IG oversight of only those contracts. Contracts that predated 6/12 would be excluded, as would a long list of exempted contracts including large ones like FPL, waste collection and all federal grants. The IG office estimated that acceptance of this settlement would gut 60% of their budget, effectively limiting their oversight of the municipalities. After a large number of members of the public came forward urging rejection of the settlement, the commission voted 7-0 to reject it and move on to mediation.

On Monday 3/26, a joint meeting was held in the West Palm Beach City Hall between the County Commission and the representative of the municipal litigants. It was an august collection of the most senior public officials at the local level. While all professed to “support the IG”, and that the lawsuit was “just about the funding”, an objective observer could conclude that an independent Inspector General with free rein to investigate in the cities was not universally embraced.

Commission Chairman Shelley Vana correctly summarized that the intention of the ordinance is to provide for IG independence by having the governing body NOT control the IG budget. Mayor Muoio and the others see that as the crux of the problem – how can you be responsible for a budget if you can’t set the level of spending on a line item. Why, if the economy is bad, we may just decide not to fund the IG at all in a given year! Control of the IG budget is control of the office – just what the ordinance is intended to prevent.

During this meeting, West Palm Beach attorney Glen Torciva suggested an independent taxing district as the way out of the dilemma. Let both the county and the municipalities wash their hands of the funding issue and let the people decide. Of course a new taxing district would have to go on the ballot – perhaps this November. This is perfect for those who believe “the voters didn’t know what they were voting for” in extending the IG to the cities. Instead of asking “.. should we have an IG?” as in the 2010 question, we will ask ” .. should we pay more taxes so we can have an IG?” Maybe then the 72% of the voters who wanted to meddle in the affairs of our elected officials will think twice.

If you have any doubts about the motive here, consider Mr. Torciva’s statement to the Palm Beach Post:

Commissioner Burt Aaronson, a supporter of the concept, added (with a smile):

The creation of the Office of Inspector General and the Ethics Commission has gone a long way to correct our reputation as “Corruption County”. This latest attempt to neuter or eliminate the office proves that we still have a lot of work to do. The roughly $3.5M OIG budget would be equivalent to a 0.03 millage rate on our $120B property valuation – hardly worth the effort it would take to collect it. The current LOGER system is an accurate, reliable way of measuring local economic activity and establishing a fee for IG services. Whether a fee is actually charged to a contract or not, it is a reasonable way to both estimate and bill.

We think the county and cities should find a way to make it work and drop any attempt at forming a new taxing district.

TAB Proposals for Charter Changes

Back in June, the County began public meetings about its ongoing Charter Review. The County Charter is its ‘constitution’ and describes Home Rule. There are 20 Home Rule or Charter Counties in Florida. Palm Beach County does not have a formalized Charter Review process, and this is the first comprehensive review to have taken place.

The Charter and the county’s charter review website can be found here. While there are a few changes that the Commissioners would like, citizens can input their own suggestions via the County Website. Suggestions are limited to 300 words per suggestion. Here is a link to the survey page. You can make as many submissions as you like.

There are many significant proposals that have surfaced, including county-wide commission districts, non-partisan elections, and converting some (or all) constitutional offices into county departments. We do not favor any of these as they appear to risk too many unintended consequences.

Attached are five proposals that we believe would improve county governance. One of these, “Smart Cap”, would have a direct affect on the county budget and we have explored that in depth in “Smart Cap – Good for the State, Good for the County”.

If you agree with any or all of these proposals, you can participate in the process by submitting the text contained within the box yourself using the county tool referenced above. To submit any of the ones listed below, just click on the [COPY] to the right of the suggestion you would like to copy, and then cut/paste from the text that comes up and submit that to the survey link above. All of the descriptions fall within the 300 word limit. Friday, August 26, is the last date on which submissions will be accepted on the county website.

Review all boards and advisory committees every four years

Objective: Formalizes a review process to remove unnecessary, redundant, or obsolete Boards and Advisory Committees.

Precedent and wording from Broward County Section 2.09 F

The County Commission shall adopt procedures to provide for the review of the performance of all Boards, Committees, Authorities and Agencies at least once every four (4) years. As part of its review of the respective Board, Committee, Authority or Agency, the County Commission shall determine, by resolution, that the applicable Board, Committee, Authority, or Agency is needed to serve the public interest, and the cost of its existence to the citizens and taxpayers is justified. The review provision shall not apply to any Board, Committee, Authority, or Agency established by this Charter.

County Version of Smartcap (this is a TAB proposal)

Objective: Limits spending growth to population growth and inflation formula

Reference: State Revenue Limitation (CS/SJR958). The yearly adjustment factor is calculated based on the previous year’s cap, not revenue collected. This avoids the problem encountered by Colorado “TABOR” which caused excessive reductions in spending during an economic downturn.

Precedent: Brevard 2.9.3.1(a): http://www.brevardcounty.us/countycharter/charter-article2.cfm – s29 and City of Jacksonville Sections 14.08/14.09: http://library.municode.com/index.aspx?clientID=12174&stateID=9&statename=Florida

Suggested wording: 1) For each budget year, county revenue collected is limited by the state computed adjustment factor defined in CS/SJR958. 2) Exemptions are allowed for unfunded mandates and certain other classifications of spending. 3) Emergency override is permitted with a super majority vote of the BCC.

Periodic Mandatory Review of the Charter by Independent Commission

Objective: Formalize the review of County Charter, instead of the ad hoc approach being taken during the current county review.

Precedent: 16 of the 20 Home Rule counties have a formal appointed* Charter Review Commission specified in their Charters. Period ranges from every 4 years to every 10 years. Size of Commission ranges from 10-15 individuals, with majority or 2/3 vote required to bring an amendment forward, and most scheduled to coincide with General Elections. *Sarasota County has an elected Charter Review Commission

Recommendation: Modify the charter to require a Formal review, by appointed review commission consisting of citizens, with an odd number of commissioners and majority vote, every 8 years, with results to coincide with a general election.

Debt Policy

Objective: Transparency and Accountability

Precedent: Charlotte County Sec 2.2.J

http://library.municode.com/index.aspx?clientID=10526&stateID=9&statename=Florida

Text from Charlotte County:

The county commission shall adopt and review annually, prior to April first of each year, a debt policy to guide the issuance and management of debt. The debt policy shall be integrated with other financial policies, operating and capital budgets. Adherence to a debt policy helps ensure that debt is issued and managed prudently in order to maintain a sound fiscal position and protect credit quality. Elements to be addressed in the debt policy shall include:

(1)The purposes for which debt may be issued.

(2)Legal debt limitations, or limitations established by policy (maximum amount of debt that should be outstanding at one time).

(3)The types of debt permitted to be issued and criteria for issuance of various types of debt.

(4)Structural features of debt (maturity, debt service structure).

(5)Credit objectives.

(6)Placement methods and procedures.

State of the County Quarterly/Annual Report

Objective: Transparency and Accountability by the administrative branch of the county

Precedent: Broward County 1.04 L: http://library.municode.com/index.aspx?clientID=10288&stateID=9&statename=Florida

Lee County: 2.3.A.1.(a): http://library.municode.com/index.aspx?nomobile=1&clientid=10131

The County Commission shall require and the public is entitled to have access to a Management Report published by the County Administrator, and made public on a quarterly basis, detailing the performance of the County government offices, divisions and departments. The Management Report shall include, but not be limited to, a report on the receipt and expenditure of County funds by each County office, division and department, and a report of the expected and actual performance* of the activities of each County office, division and department.

*Performance shall include measurements (benchmark metrics like head counts against peer counties) in key areas/contingent liabilities for long term union contracts and capital projects/annual market comparison of salaries and benefits (peer counties and private sector), other issues.

District 7 Charter Review – July 29

Reduce Govt Overhead, Not Essential Services: BOC, Constitutional Officers and particularly the Sheriff

Editor’s note: This post was sent as an email to the County Commissioners and Constitutional Officers by Dale Gregory on June 13, 2011.

PALM BEACH TAB PROPOSALS:

I support in concept the proposals of the Palm Beach TAB advocated at the June 13, 2011 Budget Workshop.

REDUCE GOVERNMENT OVERHEAD, NOT ESSENTIAL SERVICES

I am appalled at the County Administrator’s appeal to emotion by proposing to increase Palm Tran rates, reduce life guards, and the like. I pray that you will vote “NO” on any increase in taxes or reduction in essential services! This applies to the Sheriff’s response that he is going to reduce essential staff if the BOC doesn’t approve his budget demands.

In 2010 Martin County implemented a one day per month furlough (unpaid day off) as a means to balance their budget. The County has also reduced staff levels. Has Palm Beach County used this as a tool to balance the budget?

I have volunteered on a number of initiatives in Palm Beach County and learned early on: If the County Administrator doesn’t take a personal interest, forget the initiative no matter how much it may benefit the community.

If the County Administrator could effectively collaborate with the Constitutional Officers we could dramatically improve the efficiency of government operations. Examples include sharing information technology, telecommunication services, purchasing, human resource administration, real estate planning, logistics, and other back office functions.

There are similar collaboration and shared services opportunities between the County, Palm Beach School District, South Florida Water Management District, Children’s Services Council, Palm Beach County Health Care District, Library District, Port of Palm Beach District, municipalities, and nonprofit organizations. Trust me, it works. Take a trip to Martin County to learn more.

Collaboration is happening elsewhere in the United States, and taxpayers are benefiting immensely. Unfortunately Palm Beach County’s reputation of corruption and insider deals impedes such collaboration. County Administrative leadership is not a “poster child” for advocating trust, shared values, and change.

Elected officials need to leave their ego’s at home and start thinking about being better stewards of the combined “spend” of taxpayers – state, county, schools, municipal, and other taxing authorities. This includes Constitutional Officers.

COUNTY ADMINISTRATIVE LEADERSHIP

Most private sector and nonprofit organizations would not tolerate strategies that have been proposed by the County Administrator. The most successful organizations would make changes at the top to transform their culture and develop a winning strategy to achieve organizational objectives. Early 20th century thinking simply doesn’t work in today’s world.

If the Administrator cannot develop a strategy to balance the budget without increasing taxes while maintaining all essential services, the BOC should find someone who will.

SHERIFF:

I recently talked to a Commissioner from another Florida county. I explained how the Palm Beach Sheriff appears to ignore the Palm Beach BOC, operating without sufficient checks and balances. I was told that this would never happen in their county….. that the BOC would force the issue.

You were elected to serve the residents of Palm Beach County. This includes a fiduciary responsibility to manage the use of all of our tax dollars. It is time to put the Sheriff on notice: Cut expenditures and maintain service levels. This includes freezing compensation of all who are not part of collective bargaining agreements. If the Sheriff has the option to appeal his issue on funding to Tallahassee, go for it. It is time to break the mold.

Legislative Update – 5/5/11

As the Legislature winds down the session, there has been much progress on the bills we have been tracking that relate to county budget issues. The following is a status:

Pension Reform

SB2100/HB1405 having emerged from conference on Friday May 6, has been sent to the governor. From the House bill, the plan adopts the 3% employee contribution and retirement eligibility of age 65 / 33 years for general class and age 60 / 30 years for special risk. From the Senate bill it eliminates cost-of-living adjustments for accruals accumulated after July of this year. The DROP program, eliminated in both underlyihg bills, was retained in the compromise, but the interest rate was reduced from 6% to 1.3%. One feature that appears to be new is the redefinition of “average final compensation” from 5 years to 8 years, which will reduce the base upon which a pension amount is calculated. The provision in the House bill to restrict new hires to a defined contribution plan only did not survive.

We estimate the savings for the county to be about $48M in the first year, based on the “employer contribution” section of the bill. See Pension Reform – the Final Bill for the details of the analysis.

Smart Cap

CS/JSR958 State Revenue Limitation, also known as “Smart Cap”, was sent to the Governor on May 4. Placed on the 2012 ballot will be a constitutional amendment that replaces the state’s current cap based on personal income growth, to one based on population and inflation, similar to Colorado’s TABOR. It differs from TABOR in one important respect however – the cap is based on the previous year’s cap, not on revenue. This has the effect of preventing the “ratcheting down” effect that can happen when revenue declines in a recession, and prevents unanticipated or undesired reductions. The cap can decline though, if inflation is negative or population shrinks.

Smart Cap applies only to state revenue, but we think it is time to examine a potential Smart Cap for the county budget – implemented as a charter change and also on the 2012 ballot.

Local Government Accountability

One bill that has been under the radar for most people is CS/SB224 – Local Government Accountability. The bill does several different things, but most notably for Palm Beach County, it will require the Sheriff to disclose more of the PBSO budget to public scrutiny, and give the County Commissioners more authority to obtain line item detail for this and previous budget years. Currently, only a Chapter 119 (open records) request has been able to obtain this level of detail on the Sheriff’s budget. Among other things, the bill says:

“The sheriff shall furnish to the board of county commissioners or the budget commission, if there is a budget commission in the county, all relevant and pertinent information concerning expenditures made in previous fiscal years and to the proposed expenditures which the such board or commission deems necessary, including expenditures at the subobject code level in accordance with the uniform accounting system prescribed by the Department of Financial Services.”

This bill was sent to the Governor on May 4.

Additional Homestead Exemption

HJR381, “Additional Homestead Exemption; Property Value Decline; Reduction for Nonhomestead Assessment Increases; Abrogation of Scheduled Repeal”, was sent to the Governor on May 4. This bill places a constitutional amendment on the 2012 ballot that will have several effects if approved by the voters, including eliminating the unfortunate circumstance that can cause your assessed valuation to increase while your actual market value is decreasing on a homesteaded property. It also caps the increase for non-homestead property to 5%.

Labor and Employment

SB830, “Labor and Employment”, also know as the “Thrasher Bill”, would prohibit state or local governments from deducting from wages, funds for political activity, primarly union dues. It also prohibits labor organizations from collecting dues, assessments, fines or penalties for the purposes of political activity without written authorization from the collectee. This is similar to measures being pursued in other states this year.

This bill was never brought up on the floor before the session ended and therefore died from inaction.

As things change with these bills, we will update this post to reflect the current status.

Smart Cap – Good for the State, Good for the County

The Florida Legislature is moving forward on a constitutional amendment for the 2012 ballot to limit state spending to a “growth factor” tied to inflation and population growth. A previous attempt in 2009 had included county and municpal governments in its scope, but that has been omitted this time.

We think it is still a good idea however, and could be implemented for Palm Beach County as a Charter Amendment. TAB plans to argue both for and against the various proposals coming forward during the charter review process. Since a Smart Cap is not likely to be proposed by the Board themselves, we want to raise this proposal now so it can be discussed and perhaps gather momentum.

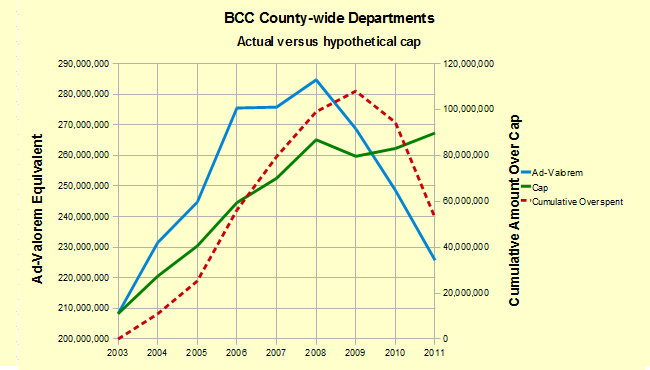

This article examines the effect a smart cap would have had on the county if it were in place since 2003. The conclusions are:

- The FY2011 ad-valorem equivalent for the county-wide departments is 15% less than a cap would have allowed. This is good and reasonable. It was achieved however, by significant reductions over the last three budget cycles, coming off a peak in 2008 that was 7% over cap, and a record of exceeding the cap in all but the last two years.

- It would have greatly restrained the growth in PBSO and Fire/Rescue, as their FY2011 ad-valorem equivalent exceeds what the cap would have allowed by 32% and 19% respectively. Since both of those organization’s budgets are primarily personal service costs, the existence of a cap would have limited the salary and benefit enhancements that were granted in the lucrative collective bargaining agreements that are now such a drag on the county budget.

- If a cap were to be imposed, it could be crafted in such a way that emergency overrides are possible.

- Although we are not enthusiastic about the overuse of federal grants for local projects, a county “Smart Cap” would not interfere with the use of such funds.

- There is precedent – both Duval and Brevard counties (and possibly others) have caps in place today.

For these reasons, we would very much like to see a county version of Smart Cap on the 2012 budget as a result of the Charter Review.

What is Smart Cap?

Senate Joint Resolution 958, introduced by Senator Ellyn Bogdanoff and approved by the Florida Senate on March 15, would place a constitutional amendment on the 2012 ballot to limit the growth in spending at the state level. House Joint Resolution 7221, an identical bill, has passed out of committee and is pending a floor vote.

Unlike a previous attempt at a Florida “Smart Cap” (SJR1906), introduced by now Senate President Mike Haridopolis in 2009 and applying to county and municipal governments as well, the current iteration would apply only to the state budget. It’s provisions (summarized in the staff analysis) are:

- Replaces the existing state revenue limitation based on Florida personal income growth with a new state revenue limitation based on changes in population and inflation

- Requires excess revenues to be deposited into the Budget Stabilization Fund, used to support public education, or returned to the taxpayers

- Adds fines and revenues used to pay debt service on bonds issued after July 1, 2012 to the state revenues subject to the limitation

- Authorizes the Legislature to increase the revenue limitation by a supermajority vote

- Authorizes the Legislature to place a proposed increase before the voters, requiring approval by 60 percent of the voters

It should be noted that the “revenue” that is capped is subject to some exclusions. It does not apply to Medicaid funds, revenue necessary to meet bond requirements, federal grants and some other revenues. The amendment would replace the current cap which is based on personal income. Currently, 32 states have some kind of statutory cap on spending.

Palm Beach County Smart Cap

On the county level, a “Smart Cap” could be instituted through a Charter Change amendment on the 2012 ballot. Would this have much effect on the budget?

TAB has pointed out that the county budget overall has grown “11 times population growth and 3 times the rate of inflation” from $1.2B in 2003 to $2.1B in 2011. This tracks spending growth though, and is partly funded by revenue that under the state rules would be exempt such as federal grants. It also includes “fee for service” revenue that varies with the services requested, and other revenue that is department specific. For simplicity, we have chosen to look at the effects of a “Smart Cap” by analysing the “ad-valorem equivalent” amount at the department level. This number is the difference between the spending proposed by a department (appropriations), and the revenue it receives from specific sources like grants or fees, and is paid for by a combination of ad-valorem taxes and other “ad-valorem equivalent” revenues such as the sales tax.

The revenue cap at the state level is based on a “population and inflation” model, and sets the cap at last year’s revenue limit plus a growth factor. The growth factor is computed by combining inflation represented by the consumer price index (CPI) and the state population as used in other measures. In other states, most notably Colorado’s “TABOR”, the Taxpayer Bill of Rights, the cap was applied to the previous year’s revenue. Since revenue declines during a recession, this caused the cap to “ratchet” down and caused more spending reduction than was anticipated or desired. It was suspended for a period of time by the legislature to allow the economy to equilibrate. The Florida proposal does not have this problem since the growth factor is applied to the previous year’s cap – not the revenue collected (after a multi-year startup phase).

To see the effect had Smart Cap been in effect in 2003, we can compute the growth factor from that year’s budget forward to 2011, and compare it to the actual budget growth that occurred. The results show that while PBSO, Fire/Rescue, and the Supervisor of Elections all grew much faster than a cap would have allowed, the countywide departments are now comfortably 15% under what the cap would require. Bob Weisman has always maintained that his growth was “less than TABOR”, – and it was, if you only look at the endpoints. You just have to separate his budget from the others to see it clearly. The 8 year trend is shown in the following chart. Unfortunately, the overspending in the early years resulted in a cumulative overspend of about $50M.

County-wide Departments ad-valorem equivalent compared to a “smart cap”

The following table illustrates what the FY2011 budget (ad-valorem equivalent) would have been had Smart Cap been in place since 2003. The “Growth Factor” is computed by combining the change in CPI and the change in service population for the period 2003-2011, and is 28.4% countywide. Fire / Rescue has expanded their service area during the period from 641,000 to 807,727 by taking over municipal departments, so their growth factor of 52.5% reflects that change. Likewise, the Library system has grown their population by about 13% during the period, now providing service to 28 of the 38 municipalities for a growth factor of 37.2%.

The Sheriff has also grown the PBSO service area during the period by taking over law enforcement duties in Pahokee, South Bay, Belle Glade, Royal Palm Beach, Wellington, Lake Worth, Mangonia Park and Loxahatchee Groves. We did not adjust the PBSO growth factor however, because unlike Fire/Rescue, they are funded from county-wide ad-valorem taxes and the change in service area is offset by specific contract revenue from the towns and cities that have been absorbed. Corrections, court protection and law enforcement infrastructure (crime lab, SWAT, etc.) are funded by all county taxpayers.

| 2003 Ad-valorem Equivalent | Growth Factor | 2011 Cap | 2011 Ad-valorem Equivalent | Exceeded Cap By | |

|---|---|---|---|---|---|

| County-Wide Departments | $208M | 28.4% | $267M | $226M | -15.4% |

| Fire / Rescue | $113M | 52.5% | $172M | $205M | 19.2% |

| Library System | $26M | 37.2% | $36M | $38M | 6.4% |

| Constitutional Officers | |||||

| Sheriff | $236M | 28.4% | $303M | $400M | 32.0% |

| Clerk * | $31M | 28.4% | $39M | $12M | -69.2% |

| Property Appraiser | $14M | 28.4% | $18M | $18M | 0.0% |

| Supervisor of Elections | $5M | 28.4% | $6M | $11M | 83.3% |

| Tax Collector | $4M | 28.4% | $5M | $4M | -20.0% |

Note: The large reduction in the Clerk’s budget is a result of conversion of some ad-valorem items to a fee basis in 2005.

The eight year growth in spending has shown that portions of the county, including the county-wide departments and the constitutional officers (except the Sheriff and SOE) have been responsible in adjusting their budget appropriate to the size of the county population and consistent with price inflation. It should be noted however, that until the valuations began to decline after 2008 there was not much evidence of restraint.

We will examine the relationship of spending to the cap on a year by year basis in an upcoming article.

PBSO and Fire/Rescue on the other hand have grown way out of proportion, and most of the increase has gone into salaries and benefits for those covered under collective bargaining agreements. It is time to rein this in, and a Smart Cap Charter amendment is a way to do it.

Put Smart Cap on the ballot in 2012 and let the people decide.

Chris Christie on Public Sector Salaries

This man tells it like it is.

TAB Legislative Wish-List – an Update

Since we published our “Legislative Wish List” last month, the outlook for the coming session has come into focus. Two of the 4 items appear to be off the table, while one of them – FRS reform, has been exceeded by the just announced proposal by Governor Scott. Here is an update.

FRS Reform

We support the county’s desire to require employee contributions to FRS, modify the fixed 3% COLA, reduce the DROP program, explore Defined Contribution plans, and tighten the calculation of AFC (Average Final Compensation), but consider their “things to avoid” as too restrictive.

The Governor’s plan on the other hand jumps to a full 5% participant contribution, ends the COLA on accruals after July of this year, drops the DROP altogether, and offers new hires a Defined Contribution plan only. Furthermore, the plan would cut the accrual rate for the “special risk” class from 3% to 2%. He estimates this plan will save the state’s taxpayers about $2.8B over two years. In TAB’s quick calculation, just two of these changes – the special risk accrual rate and the 5% contribution, would save Palm Beach County about $17M per year from Fire/Rescue pension contributions, and about $21M from PBSO.

We therefore much prefer the Governor’s proposal to the county’s agenda and hope that the county Delegation can support it against the significant opposition that is sure to come.

The opposition that will follow this proposal needs to be put in perspective. When the FRS statute was first introduced, the “special risk” class accrual was 2%. Meant to apply to police, corrections officers and firefighters whose physically demanding jobs required them to retire at an earlier age, the differential was to provide them with a roughly equivalent pension at 25 years that a “general class” employee would get at 30 years (approximately 50% of AFC). During 2000, Special Risk Class accrual rates were increased from 2% to 3% for all years between 1978 and 1993 for all members retiring on or after July 1, 2000; the Legislature funded this $696.8 million change from an actuarial surplus in the FRS trust fund over a three-year period.

The following is from 121.0515 FS:

LEGISLATIVE INTENT.—In creating the Special Risk Class of membership within the Florida Retirement System, it is the intent and purpose of the Legislature to recognize that persons employed in certain categories of law enforcement, firefighting, criminal detention, and emergency medical care positions are required as one of the essential functions of their positions to perform work that is physically demanding or arduous, or work that requires extraordinary agility and mental acuity, and that such persons, because of diminishing physical and mental faculties, may find that they are not able, without risk to the health and safety of themselves, the public, or their coworkers, to continue performing such duties and thus enjoy the full career and retirement benefits enjoyed by persons employed in other positions and that, if they find it necessary, due to the physical and mental limitations of their age, to retire at an earlier age and usually with less service, they will suffer an economic deprivation therefrom. Therefore, as a means of recognizing the peculiar and special problems of this class of employees, it is the intent and purpose of the Legislature to establish a class of retirement membership that awards more retirement credit per year of service than that awarded to other employees; however, nothing contained herein shall require ineligibility for special risk membership upon reaching age 55.

We think returning to the original intent of the statute is appropriate.

The following table illustrates the current FRS attributes, the county agenda, and the Governor’s Proposal. An excellent summary can be found in the Sun-Sentinel HERE.

| Current FRS | County Agenda | Rick Scott Proposal | |

|---|---|---|---|

| Accrual Rates | 1.6% general 3% special risk |

No Change | 1.6% general 2% special risk |

| Participant Contributions | None | “Modest Amount”, indexed cap, sliding scale, “offsets” | 5% across the board |

| Defined Contribution Plan | Offered with few takers | Incentives, but not mandatory | Only option for new hires |

| COLA | fixed 3% / year | Indexed to inflation | Eliminated for accruals past July 2011 (protects current retirees and accumulated benefits) |

| DROP Program | Continue working for 5 years while pension accumulates, then lump sum | Wait time lengthened, credit for federal employment | Eliminated after July, 2011 |

Palm Beach County Sheriff Career Service Legislation

The county wants to modify this statute to allow changes to current benefits during collective bargaining. Currently, no existing employer-paid benefits and emoluments to all certified and non-certified employees of the Sheriff with regard to the pay plan, longevity plan, tuition-reimbursement plan, career-path program, health insurance, life insurance, and disability benefits may be reduced except in the case of exigent operation necessity”. We support this change, but have been told by county staff and several commissioners that it is dead in the water. As it is a local bill, unanimous support in the Delegation is needed and the politics are just not there for a measure that would have union opposition.

Neither this item nor the following one were discussed at the recent joint meeting between County Commission and staff and the Legislative Delegation.

Fire/Rescue Sales Tax Surcharge Fix

The county wants to fix 212.055 FS to enable a return of a ballot initiative to raise the sales tax in the county to fund Fire/Rescue. We would prefer to repeal the provision and save us the trouble of a ballot initiative fight. Fire/Rescue should have to justify their budget every year, just like other county departments.

A bill was introduced to limit the use of revenues so collected, but was withdrawn when it was pointed out that amendments could have enabled the tax. As far as we know, no further action is pending and no bill had been introduced by the deadline last Friday by any of the county delegation.

Local Accountablility

HB107, “Local Government Accountability”, was introduced by Representative Jimmie Smith, FH43, Citrus County, and is now in committee, along with the companion Senate Bill SB224. We like it for its provisions on budget detail to be supplied by the Sheriff. The bill does the following:

Revises provisions relating to procedures for declaring special districts inactive; specifies level of detail required for local governmental entity’s proposed budget; revises provisions for local governmental entity’s audit & annual financial reports; requires local governmental entity’s budget to be posted online; revises budgetary guidelines for district school boards.

Effective Date: October 1, 2011

This was brought to our attention by the Clerk’s Office and we believe it deserves support by the local Delegation.

Joint BCC / Legislative Delegation Workshop

This morning (1/28), the Palm Beach County Commission and staff met with 9 of the 18 members of the Palm Beach County Legislative Delegation. Present were Senators Lizbeth Benacquisto (R, FS27) and Maria Sachs (D, FS30), Representative (and delegation chair) Joseph Abruzzo (D, FH85), Steve Perman (D, FH78), Pat Rooney (R, FH83), Lori Berman (D, FH86), Mark Pafford (D, FH88), Jeff Clemens (D, FH89), and Irv Slosberg (D, FH90).

After opening remarks from Chairman Abruzzo and Commission Chair Karen Marcus, PBSC President Dennis Gallon welcomed the groups to his facility, and Legislative Affairs Director Todd Bonlarron began the agenda with a recap of the successful 2010 legislative session and introduced two Powerpoint presentations of particular interest.

In the first, newly appointed Budget Director John Wilson gave a crisp overview of sources of revenue and the property tax supported appropriations. Some of the charts used, as in the past, highlighted the size of the Sheriff’s budget compared to the county departments, and their divergence. PBSO growth in spending has far exceeded county department ad-valorem requirements for the last 3-4 years, and now is almost 70% higher ($394M vs $233M in the 2011 budget).

Another chart showed the trend versus the “TABOR” line, which they show as 28.3% above 2006 levels. (TABOR stands for “Taxpayer Bill of Rights” and refers to a Colorado implementation that constrained the rate of spending growth to population and inflation.) By their measure, PBSO is up 67% over 2003 while county staff has only increased 11%.

(TAB NOTE: Although we do not dispute these numbers, they are a bit misleading and not totally fair to the Sheriff. Since 2003, PBSO has been absorbing new service areas, including the Glades cities, Royal Palm Beach, and Lake Worth. Population growth in the county was about 6%, but the PBSO service area grew by 19% from 2003-2009, requiring a different TABOR baseline. Furthermore, if the 2012 budget comes in with unchanged 4.75 millage, by some measures the county will have converged on the TABOR trend with the Sheriff included. We will be doing an article about this in the near future.)

Regarding TABOR, there was some indication that similar measurements may be discussed in the legislative session. Todd Bonlarron laid down a marker for the county that city and county governments should be exempt from such measurements. Commissioner Marcus pointed out that if we had TABOR here, “we never would have been able to do Scripps.” Given the debt incurred and likely losses surrounding Mecca Farm, maybe that would have been a good thing.

Next up was Assistant County Administrator Brad Merriman who presented a pension overview. Brad is the county’s acknowledged expert on the subject with a background in HR, and gave an excellent summary of the types of pensions, organization and statistics about FRS, and its current status. Hitting on the key aspects of the Defined Benefit plans which the overwhelming majority of employees select, he pointed out the accrual factors (1.6% /year for most, 3.0% for “special risk” classes), and the guaranteed 3% COLA for retirees, then showed an example of a 30 year employee at the “average AFC” of $42K/year receiving a modest retirement income of $19K. While this may be average state-wide, our calculations show higher averages in this county, but still not too excessive. It is the “special risk” categories that are excessive. You can infer this by noting that the pension contribution made for regular employees is mandated at 10.77%, while for special risk it is 23.25%). It was noted by Representative Perman that elected officials also get the same 3%/year as special risk classes. Seems like that is excessive too.

Leading with a comparison to other states’s plans (one of only 5 with no employee contribution, lower accrual but longer AFC calculation, only 40% index COLA), Brad laid out the county recommendations and things to avoid as FRS reform is discussed in Tallahassee. This can be found in depth elsewhere (CLICK HERE) and TAB supports the FRS recommendations for the most part.

Moving along, former Senator Dave Aronberg, now working for the Attorney General, gave an overview of steps being taken to curb the growth of pain clinics, Todd touched briefly on the other items in the county legislative agenda, and the senators and representatives talked about the bills with which they are personally engaged.

It should be noted that two of the areas of particular interest to TAB – namely the “Fire/Rescue Sales Tax Fix” and changes to the “PBSO career service protection act”, were not mentioned at all. It is our understanding that neither area will be pursued in this session. The first would be necessary to enable a sales tax ballot item in 2012 and could presumably be introduced later, so we will continue to scan for that one. The second is a disappointment, as no substantive changes to the PBSO contracts can be made without it, even during collective bargaining sessions for the next contract. We have been told by multiple sources that since it is a local bill requiring unanimous agreement in the delegation, the politics are not there to challenge the unions.

Near the end, Commissioner Aaronson asked that someone in the delegation take on the task to make “31 bullet magazines” illegal. Although there were no takers, Senator Sachs has already introduced a bill that would limit gun rights, and both Commissioners Taylor and Vana want to see guns restricted within the county, particularly in parks and public buildings. If any of you reading this are passionate about second amendment issues, it is time to pay attention.

It should be noted that the delegation is split 10 Democrats to 7 Republicans, as befits the county registration ratios, but the split of the attendees was 7:2 among the state level folks and 5:1 for the commissioners. This is not to imply that there is any partisan clash among the delegation (there doesn’t appear to be), but it makes one wonder how the delegation will succeed in the overwhelmingly Republican legislature.