Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

This is the second in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

A recent article in the Sun-Sentinel found Orlando to be tops in the US for meetings July 2011-June 2012. “After Orlando, the company found the next most popular cities for meetings and events are in order: Washington DC, Las Vegas, Miami, Chicago, San Diego, Phoenix, Atlanta, Dallas and New Orleans.” “Miami is No. 4, Fort Lauderdale No. 30 and Boca Raton No. 43”.

So – let’s look at how some cities’ convention centers or HQ hotels are faring by looking at some recent 2010-2012 headlines…

Miami: Voters on Tuesday supported a Miami Beach bed tax increase to fund convention center improvements. But if and when a tax increase happens depends on city commissioners and a public corruption investigation. – August 2012

“The commission voted in December to bid out a $1 billion convention center district project that aims to have developers renovate the convention center, build an adjacent hotel and redesign and lease the surrounding publicly owned acres into an iconic complex. That project, however, remains in the early stages due largely to a public corruption investigation into whether the city’s then-purchasing director tainted the bidding process.”

Washington D.C: The sorry saga of the D.C. convention center hotel – Feb 2010

“I understand there may be reasons to subsidize a convention center hotel that agrees to set aside 80 percent of its rooms during peak season for low-margin convention business. But if the hotel really requires this much of a subsidy, then it raises a serious question about the economics of a project that, at best, is expected to increase convention spending in the city by $100 million a year. Right now, it looks as though the benefit of all those subsidies will be fully captured by convention attendees, the convention hotel’s developers and perhaps the owners of the city’s other hotels. If all goes well, the taxpayers will get their money back, but not much more.”

Ft. Lauderdale: Fort Lauderdale to take $13 million hit as it loses its biggest convention – July 2012

“Leaders at the Greater Fort Lauderdale Convention and Visitors Bureau said it’s unlikely that a single convention can replace the business lost from ARVO. So the bureau is working to bring in several smaller events that might fill as many rooms as ARVO: about 24,000 room nights a year.

But competition for groups is stiff because big convention center destinations such as Orlando and Las Vegas no longer wait for mega-events. They go after smaller conventions that pieced together can fill up their space — events that would more typically go to smaller venues.

“Fort Lauderdale competes with everyone in the United States, just as we do, as it relates to small and medium shows,” said Gary Sain, president of Visit Orlando.”

Daytona Beach, FL: If We Build More Will They Come? – June 2012

Raleigh, NC: Raleigh Convention Center: Throwing Good Money after Bad – February 2012

Boston, MA: Panel Proposes Convention Center Hotel – March 2011

Pittsburgh, PA: New Convention Center Hotel is Stalled – March 2012

Salt Lake City, UT: Salt Lake City officials Balk at subsidy for Megahotel – August 2011

Portland, OR: Oregon Convention Center Hotel Gets Another Chance at Life – August 2012

Virginia Beach, VA: Virginia Beach convention center hotel deal killed – February, 2012

There are many more articles for many more cities – but each story just confirms the speciousness of the arguments and the lack of metrics or proof of economic impact.

A County Funded Hotel – Who Wins?

Today the County Commission voted 6-1 to allocate $57M ($27M direct subsidy plus $20M loan guarantee plus $10M cost of the land) toward a 400 room hotel next to the Convention Center. The county would actually own both the land and the building.

Who are the winners and losers in this “public / private partnership”?

First, let’s stipulate that the convention center needs a “headquarters hotel” to make it viable for more than the occasional home show or local meeting. It really wasn’t necessary for the hordes of dark suited businessmen to assure the commissioners of that fact, or that a viable convention center would be good for businesses in the vicinity. Even the Scuba Association and Lion Country Safari came to make that point. People who spend time at conventions can vouch for the fact that needing a 10 minute shuttle ride to and from an event is not conducive to networking or making the most of the convention experience.

Second, lets also stipulate that some amount of public money or other incentive is probably necessary to launch the project, given that nothing is happening without it.

Third, lets acknowledge the fact (that Commissioners Aaronson and Santamaria have done in some detail) that as a business deal, the current proposal is a perfectly awful investment that no sane person would make willingly. On a monetary basis, the county will not see returns for a long time (if ever), and neither the county nor the city of West Palm Beach stand to receive ad-valorem tax revenue on the hotel property.

The winners in this deal are the developer and operator, who have much of their risk assumed by the taxpayers, the businesses in the immediate vicinity that will see increased revenues from conventions (Kravis Center, City Place, Clematis Street, perhaps the Palm Beach restaurants), and the Town of West Palm Beach which would experience growth and an increased tax base from rising valuations associated with new business (even if they get no taxes from the hotel itself). The county commission is also a winner in a moral sense as there would be vindication for hatching a white elephant if it can be made successful,

The losers are the taxpayers who assume the risk of failure (what if they don’t come?), and default on the development loan, and the several million dollars a year of general fund interest payments on the bonds. Bed tax revenue, which can be expected to increase, is restricted in use and cannot offset the drain on the general fund.

Some specific problems we have with the funding plan:

1. Regarding the $20M loan guarantee, think Solyndra. It is similar in two ways – taxpayers take the fall on failure, and the deal pays the taxpayers last as the county sees no revenue until the operator has recouped 10% of their investment or $7M. Solyndra was heralded as a great investment – until it wasn’t.

2. The benefits accrue in geographic proximity to the hotel and flow mostly to West Palm Beach. Yet the citizens of Boca Raton, Jupiter, Wellington and others are asked to pay for it through their property taxes.

3. The existing hotels in the area have large meeting rooms and can support “small” conventions, perhaps to the 500-600 range. The Convention Center is designed to handle up to 6000 according to its website. It is difficult to see how a 400 room headquarters hotel would be make a dent in meeting a need of that size. At some point we expect we will be asked for more money because “the center needs a BIGGER hotel to make it viable”, and the developer does not have the business plan to expand.

4. The data presented to support the project assumptions seem optimistic. The 75% occupancy, the percentage of public investment in convention center projects, the estimates of convention business, the effect on the surrounding area – none of this feels right. Is convention activity nationwide growing? Some studies suggest not. If not, are we poaching from Fort Lauderdale? From Boca Raton? Only public/private projects were included in the averages for amount of public investment for convention center projects. Are there some success stories without public investment? If so where and why? Since the county taxpayers are shouldering the lion’s share of the risk, have the risks been understated? We will be examining these “projections” in a future article.

Today it was wishful thinkers 6, taxpayers 1. Thank you Commissioner Abrams for not drinking the kool-aid.

Commissioners Cap Millage at Last Year’s Levels

The 2:15pm time-certain item 5A3 to set maximum millage for 2013 didn’t get going until well past 3:30 – but it was short and to the point.

County Administrator Weisman made it clear that the only topic that had to be discussed was the setting of maximum millage for the September hearings. No details of the budget need be addressed until then. He confirmed to Commissioner Aaronson that the current millage was 4.7815. Aaronson then made a motion to keep the maximum millage at 4.7815 and Commission Taylor seconded it.

Two members of the public spoke. Stella Jordan of the Town of South Palm Beach and a member of their town council, told the Commission that they were fortunate that valuations went up. She cautioned, however, that spending would be going up with this flat millage and that she would expect next year that millage be reduced. Alex Larson said she was glad that the Commissioners were not going to raise the millage rate. But she said was that what their constituents really needed from the Commission and the School Board and all the governments was to lower tax rates.

Back to the Board – Commissioner Burdick questioned the amount actually available for additional spending – which after some clarification, was $800K. Kudos to Mrs. Burdick for suggesting that perhaps in September the Commission could establish a precedent for taking half of any overage and using it to rollback rates for the taxpayer. There will be pressures on the Commission to spend to the limit. We hope that they decide, instead, to give some, if not all, back to the tax-payers.

County Commission District 1 Candidate Forum

Candidate Forum

Join us for an evening of in-depth discussion of county issues with the three Republican candidates competing to replace term-limited commmissioner Karen Marcus.

Moderated by Tom Boyhan, WJTW FM100.3

June 18, 2012

6:00pm Meet and Greet, 7:00 Program

Abacoa Golf Club

105 Barbados Drive, Jupiter, Florida 33458

Food and Drink Available

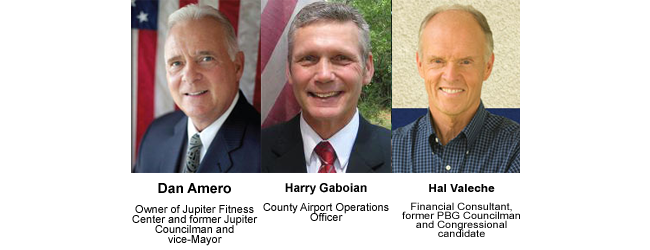

The candidates are:

This event is jointly sponsored by:

Palm Beach County Taxpayer Action Board

Palm Beach County Tea Party

Palm Beach Republican Club

Republican Club of the Northern Palm Beaches

Republican Club of the Palm Beaches

Singer Island Civic Association

South Florida 912

This forum has been organized to feature the district one candidates appearing on the August ballot. Gardens Mayor David Levy, also a candidate for the position, is unopposed on the Democrat ticket and will face the eventual winner of this August contest in November.

BCC to Discuss $29M in Spending Reductions

At the Tuesday, May 15 Commission Meeting, agenda items 5a2 and 5a3 deal with an “efficiency audit” performed by consultants Gerstle, Rosen & Goldenberg at the request of county administration.

The audit found areas of significant savings, both in county operations and in the constitutional offices (except the Sheriff who evidently refused to answer any of their questions), estimated in the range of $29M. They looked in four areas: operating efficiencies, outsourcing, staff reductions, and additional sources of revenue. (It appears that only the outsourcing will be discussed in 5a2, and 5a3 addresses efficiencies regarding the constitutional offices).

These savings involve the elimination of 921 positions, mostly through outsourcing, and the bulk of the savings comes from reduction in benefit obligations.

With the county facing a potential $15M shortfall in the 2013 budget to be discussed at the first workshop on June 12, searching for areas to reduce spending is sorely needed and this study is an excellent move in that direction. Staff should be commended for both commissioning the study and for bringing it to the board for direction.

We are not overly optimistic that this initiative will be warmly embraced however. Already, the counter-arguments have begun. Chairman Vana says “My goal was never to try to get rid of a million people”. OFMB Director Bloesser warns that “it was unlikely that many of the findings could be put into effect before the budget year begins on Oct. 1”. Clerk Bock says that the proposed savings in her office are “incorrect and irresponsible”.

Nevertheless, this is the kind of direction that TAB has been calling for for several years, and we ask partners and supporters of TAB to attend the Tuesday session in support of the consultants proposals, or communicate your views to your commissioner.

The full content of the report can be found in the attachment for item 5a2 and the initial reactions are captured in the Palm Beach Post: Consultant: Palm Beach County can save $32M with 1,000 job cuts, add $3M with rate hike.

A Look at the Candidates for County Office at the Voters Coalition

“Half Baked” Tax Proposal put back in the oven for another year

“Half baked” – that is how Commissioner Steve Abrams described Bob Weisman’s proposal to put a $100M, half percent sales tax surcharge on the November ballot.

We agree. Even Commissioner Taylor, who seems to believe our money belongs to her (“We’re not exercising our RIGHT” to raise these taxes) thought the proposal needed a little more development.

Normally, county staff does a good job on budget proposals. We don’t always agree with their priorities, but they do offer justifications and complete analysis. This proposal seemed to drop out of thin air a week ago and postulated $100M more in revenues for unspecified “transportation” projects with no sunset. A vague suggestion of possible offsets to property taxes was contained in the agenda item, but there was no Powerpoint presentation, no forward projections, no discussion of the trends in existing transportation funding like the gas tax.

The commmissioners, to their credit, recognized the difficulty in selling such an open ended proposal and all wanted to table the issue until the staff could come back with a more thought-out package. Those that were OK with raising the sales tax (Taylor, Vana, Aaronson), wanted staff to return in a month so there would still be time to put it on the November ballot. Those not so keen on the idea (Burdick, Abrams, Marcus), preferred to table it until next year or indefinitely. Karen Marcus suggested that when the TriRail expansion occurs, we may need the money more than we do now. (Ouch !).

It is clear that if the proposal were to come back in a month, a lot of time and resources would have to be spent by TAB and others in order to develop counter arguments. With the budget workshops coming up in June, that would be a considerable distraction. It was starting to look at one point that we would have another 4-3 vote in that direction, but Commissioner Santamaria joined with the taxpayer-friendly commissioners to table the issue until next year.

Thank you to all who came to the meeting and spoke against the proposal, including Alex Larson, Pat Cooper, Fred and Iris Scheibl, Janet Campbell, Nancy Hogan, and Rick Roth.

TAB Note: The discussion of transportation funding has shined a light on the budget dynamics of Palm Tran, which we were astounded to learn is more than 90% subsidized. Since only a small part is ad-valorem funded, TAB has not paid it much mind in the past, but now it will get some scrutiny for sure.

TAB Opposes Sales Tax Increase

Staff requests direction on implementation of a “Charter County and Regional Transportation Tax”

On Tuesday, May 1st, the Palm Beach County Commission will be considering a $100 Million, 1/2% increase (raising existing 6% to 6.5%) in the sales tax to fund transportation related spending. The Administrator is requesting board feedback on putting this proposed tax on the November ballot, and the Commission must give approval prior to the August 10th ballot language deadline. A good description can be found in Jennifer Sorentrue’s article Palm Beach County voters may be asked to increase sales tax by half-cent for roads, transportation.

The agenda item is 4A2 – and it falls early in the morning’s schedule – after special presentations and the Consent Agenda, and an item related to the Supervisor of Elections. The agenda can be found here and the agenda item background here.

The County Administrator’s rationale is as follows:

- The tax will generate over $100 million annually

- It will partially shift transportation funding to ‘tourists’

- State Statute allows for the tax and PBC is one of the few of the 67 counties that don’t charge this sales tax.

Why now? Is it because our economy languishes and home values aren’t increasing significantly so there are revenue pressures? Is it because the price of gas has become so high that we – tourist and resident alike, are driving less or boating less? Is it because the administration doesn’t want to have to account for how they spend – when they have no productivity and performance benchmarks nor measurements against those benchmarks?

TAB has issues with this proposed sales tax increase:

- This is a tax increase. It affects most purchases and services. And unlike the fire/rescue sales surtax proposed to the Commission in 2010, it makes no claims that it will be revenue neutral nor is it accompanied by any decrease in ad valorem

- This tax would be permanent. Unlike the recently expired school sales tax, this tax is not for a specific set of projects nor does it have an end date.

- This will be a revenue windfall for the county. We remain in an economy close to recession. Inflation is already here in our fuel and food prices, and will continue to increase.

- There is no accountability. The spending isn’t subject to any board, nor does the county have any performance or productivity benchmarks.

Background:

Residents, business owners and tourists alike pay ad valorem taxes. The resident or business owner pays it directly. The ‘tourist’ pays it indirectly. Residents, businesses and tourists pay for fuel. The Palm Beach County Revenue Manual lists several taxes that are geared towards transportation already:

- Local option gas tax: 6 cents on every gallon of gas for exactly the same purpose as this proposed except debt service

- The ‘ninth’ cent tax, 1 cent tax on every gallon of gas that lists all the same purpose

- County Gas Tax: 1 cent on every gallon of gas to be used on transportation related areas

In addition – Palm Tran already has fees, and builders have ‘road’ impact fees.

At the April 27, 2012 Commissioners’ workshop on the Internal Audit Department, the Commissioners, whether rhetorically or not, questioned the lack of any kind of productivity or performance measurements in the county. Asking the voters’ to hand over more of their hard-earned money to an open-ended, unspecific, windfall tax is unconscionable.

Voters are unlikely to approve the proposed ballot amendment. Please tell your commissioners to reject this request by the County Administration and not put it on the ballot in November.

BCC Briefs for April 17, 2012

The following was provided by Quianna Gray, Secretary to Shelley Vana:

At the April 17, 2012, Board of County Commissioners meeting, the board took the following action:

Wage theft – discussed a proposed county ordinance establishing a procedure for victims of wage theft to recover back wages. Staff was directed to take 90 days to work on the ordinance language with the Legal Aid Society, business leaders, and members of a workers advocacy group.

Congress Avenue – conceptually approved alignment 2a for the extension of Congress Avenue from Park Lane to Alternate A1A. This allows for the design and right of way acquisition process to begin.

Island Way – discussed a proposed alignment for Jupiter Park Drive/Western Corridor, to be known as Island Way, and agreed to postpone selection to the May 15 board meeting to give staff an opportunity to meet with affected residents.

Water mains – adopted resolutions confirming special assessments for property owners on Raulerson Drive in Greenacres and East Secretariat Drive in Loxahatchee for installation of potable water mains.

Vehicles for hire – approved on preliminary reading and to advertise for public hearing on May 15 a series of amendments to the Palm Beach County Vehicle for Hire Ordinance. Staff was directed to return in six months with specific standards mirroring those in effect at Palm Beach International Airport.

Legislative update – heard a presentation by state Rep. Mark Pafford on the county’s 2012 legislative agenda priorities and appropriations.

Legislative Affairs – received a final report on the 2012 Florida Legislative Session from Legislative Affairs Director Todd Bonlarron.

Housing – approved up to $10 million in Housing Finance Authority multifamily housing revenue bonds for Village at the Park, a 152-unit multifamily rental housing facility in Delray Beach to be rented to qualified individuals; also approved up to $8.4 million in Housing Finance Authority multifamily housing revenue refunding debt obligations for Pinnacle Palms Apartments, a 152-unit facility for the elderly in West Palm Beach. No county funds or its taxing power, faith or credit are involved.

Historic property – adopted a resolution granting a county tax exemption for a historic property known as the Bath and Tennis Club, located at 1170 South Ocean Blvd., in the town of Palm Beach.

Land use – declined to consider at a future meeting whether to require a super-majority vote (five votes) on proposed land-use changes for Peanut Island, environmentally sensitive lands owned by the county, and publicly owned land in the Agricultural Reserve.