The 2012 Budget - a Very Preliminary Analysis.

April 22, 2011

Although the first budget workshop is a couple of months away, and the department rollups won’t be done until next month, there are some inferences that can be drawn from the environment in which the budget is being prepared.

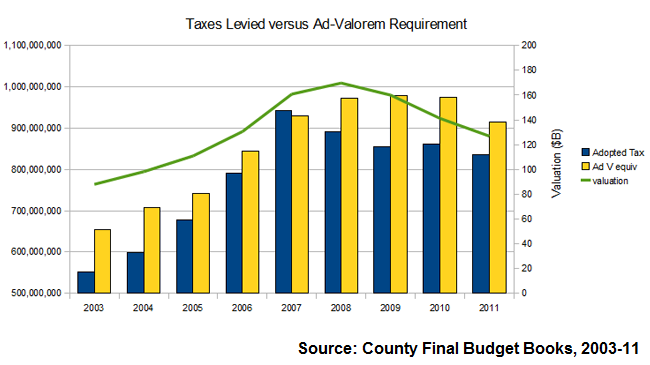

- Property values are expected to decline by 6%, but some new construction will offset that and the county is using a 5% decline as a working number. Since the 2011 valuation was approximately $127B, the 2012 number would then be $120.7B.

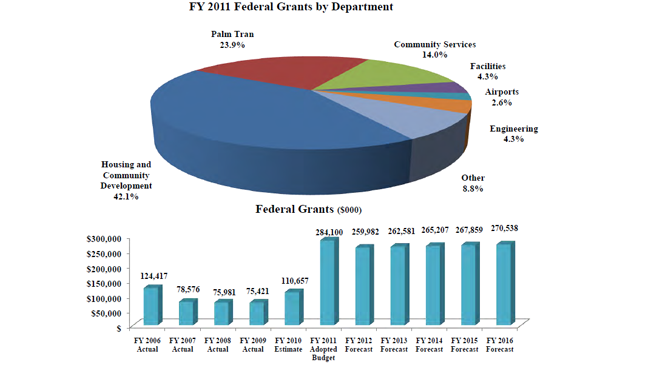

- The record $522M of intergovernmental (federal and state) revenue in the 2011 budget will likely be less this year – grants to local governments are under pressure both in Washington and Tallahassee.

- Expenses are rising in some areas – particularly in personal service costs. Step raises, longevity bonuses and other aspects of the existing collective bargaining contracts will add to the budget this year, even if most staff do not get raises.

- Revenue from non-ad valorem sources (eg. sales, bed, gas taxes) could also decline given the level of economic activity.

County staff expects to see about a $60M shortfall from these factors if the millage is not raised. Currently, county-wide millage is 4.75, yielding $603M, and the Fire/Rescue MSTU millage is 3.4581, yielding $179M. County Administrator Bob Weisman has signaled on several occasions (at the commissioners “off-site” retreat, and again at the 4/12 BCC meeting) that he would like to see rollback millage adopted, which by our calculation would be about 5.00 county-wide, a 5.3% increase. Achieving rollback would require about a $30M cut from the expected rollup. No millage increase, as previously noted, requires $60M in cuts.

At the off-site retreat, a majority of the commissioners requested that the first pass at the budget have no millage increase and directed staff to provide the list of cuts that are necessary to achieve it. TAB has some ideas in this area.

What is “realistic growth” in spending?

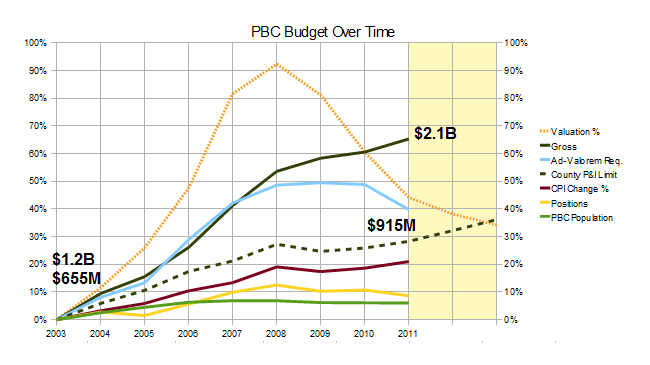

First, it is necessary to say that we believe holding the countywide millage at 4.75 (and the Fire/Rescue MSTU to 3.4581) this year is the proper decision. We have tracked county spending and tax collections from 2003 through the current year, and compared it to changes in county population and inflation – an objective measure of “appropriate” spending growth. During that time, gross spending (appropriations) has grown 11 times the population rate and 3 times the rate of inflation, and it continues to rise – an unsustainable trend. Ad-valorem requirements on the other hand, declined slightly in FY2010 and fell by about 6% in FY2011. This spending increase at a time of decining tax collection was possible because the spending was propped up by large infusions of intergovernmental revenue, including the federal “stimulus” known as the “American Recovery and Reinvestment Act” (ARRA). The $522M infusion in FY2011 compares to $239M in FY2009, a 218% increase in 2 years!

Note that we expect a reduction in intergovermental revenue this year – reflecting new realities in Washington and Tallahassee. County estimates of these amounts are overly optimistic however (see graph below taken from the Final FY2011 County Budget assumptions).

From 2003 to 2011, inflation measured by the consumer price index was about 21%. Population growth was about 6% overall. Combining those numbers would imply that a “realistic growth” figure for the county budget would have been 28.4%, not the 65% that spending grew, or the 40% increase in ad-valorem requirements. These numbers are the combined requirements of the county-wide, fire/rescue, and library taxing units, and aren’t completely fair since Fire/Rescue in particular serves only about 63% of the county and saw its service population grow 26% over the 8 year period. The Sheriff provides primary law enforcement to about 56% of the county, but any variations in PBSO service area is accounted for in the revenue received from those areas, and the entire county foots the bill for the Sheriff’s ad-valorem requirement. We are refining our P&I model and will have a better analysis as the budgets are developed.

It should be noted that for most of the last 8 years, the adopted tax (millage x valuation) was considerably less than ad-valorem requirement (see graph below). This reflects a spending down of reserves. As this is a management action divorced from either spending or taxation, we are using ad-valorem requirements for analysis, except where millage is discussed.

So from where would the $60M in cuts come? Much would come from Tallahassee in the form of FRS reform, courtesy of Governor Scott. Although the legislature has fallen short of where the governor wanted to go, the bills (HB1405 and SB2100) require an average of 3% contribution by participants in the FRS pension system (which includes all county employees). Pension reform is a complex area, and there are many differences in the bills (see Pension Bills Ready for Conference), but each bill contains the 2011 employer contribution as a percent of salary, which allows an estimate of the potential savings to the county. By our calculations, using employee salary data, this reform will save between $23M to $40M for the county ($16M – $30M against county-wide ad-valorem requirements alone). It also will save $28M-$39M for the school system.

| Group | Number of employees | Average Salary | Scott Proposal Savings | SB2100 Savings | HB1405 Savings |

|---|---|---|---|---|---|

| County Staff | 5,731 | $45.9K | $13.2M | $11.9M | $8.5M |

| PBSO (general risk) | 1,808 | $53.0K | $4.8M | $4.4M | $3.1M |

| Fire/Rescue (general risk) | 208 | $85.0K | $0.9M | $0.8M | $0.6M |

| Schools | 20,986 | $41.3K | $43.3M | $39.3M | $27.9M |

| TOTAL (contr.) | 28,733 | $62.2M | $56.4M | $40.1M | |

| Governor 2% accrual | |||||

| PBSO special risk | 2111 | $77.7K | $20.3M | $13.6M | $6.5M |

| F/R special risk | 1303 | $88.6M | 14.3M | $9.6 | $4.6M |

| TOTAL (accr.) | 3414 | $34.6M | $23.2 | $11.1M | |

| TOTAL (both) | 32,147 | $96.8M | $79.6 | $51.2M | |

| Schools Only | 20,986 | $43.3M | $39.3M | $27.9M | |

| County Only | 11,161 | $53.5M | $40.3M | $23.3M | |

| Copyright 2011, Palm Beach County Taxpayer Action Board | |||||

Further cuts could come from the areas identified last year in the “blue pages”. TAB had identified approximately $31M in cuts that could have been taken in these programs. Since PBSO is a larger (and growing larger) part of the county-wide budget, we believe that the Sheriff should match any cuts taken by county staff, perhaps even exceeding them as our preliminary calculations of population and inflation measurements show PBSO has grown much faster than the growth of their service population would require.

As the budget develops, we will be refining the TAB position.