2015 Budget - Flat Millage, what's not to like? PLENTY!

June 5, 2014

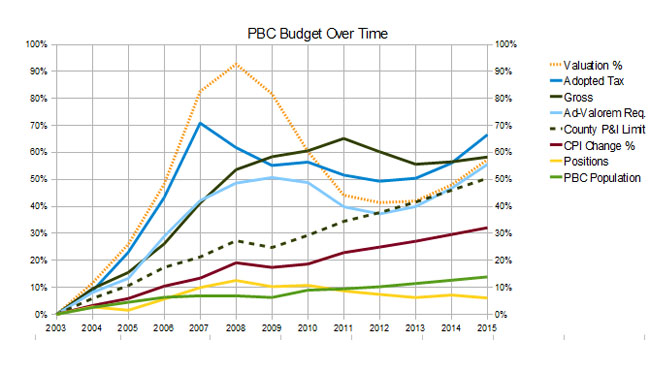

The Palm Beach County budget proposal, published this week, is quite remarkable. Not since the bubble years, when inflated valuations drove out of control spending, has there been a budget proposal of this size. Rising valuations should allow a modest return to the taxpayer through lowering the millage. This proposal, while holding millage flat, clearly notes that there are areas whose levels of funding they think are “unacceptably low”.

By almost any measure – the tax amount, ad-valorem equivalent spending, population and inflation (TABOR), the county apparently believes we have returned to the good old days.

While valuations have improved by over 6% this year, at $138.6B we are only at 82% of the peak year of 2008. Yet this year’s budget proposes to spend more than the all time record (on an ad-valorem equivalent basis) that occured in 2009, and collect within 2% of the record tax dollars levied in 2007.

When taking population and inflation into account, this year’s tax increase is more than DOUBLE the 3% that would be expected under TABOR.

What is driving this inflated budget? It is not hiring, as the overall staffing levels have declined slightly. It is not really the FRS contribution rate (less than 7% of the increase), or Palm Tran Connection changes (about 10%). A lot of it is pay increases for employees (3% across the board, on top of step and longevity raises in PBSO) which account for about $21M or half of the increase.

The big gorilla in the room of course is the Sheriff’s budget (as it usually is).

Sheriff Bradshaw seeks to spend $531M next year, supported by $467M from ad-valorem taxes. (The county budget proposal contains $5M less than this but the Sheriff has not agreed to the reduction). This is up from $499M (+6.4%) and $434M (+7.6%) last year. Since 82% of the Sheriff’s budget is personal service costs (salary and benefits), and staff growth is minimal (30 out of almost 4000), we can conclude that most of this increase is headed into the pockets of employees, as they will receive the same 3% that all county employees are scheduled to receive, plus contracted step and longevity raises.

Since 2003, PBSO spending has almost doubled (97%) while other county departments have only increased by a third – well within inflation and population measures. As measured by spending per capita, the Sheriff’s budget has increased by 73% from $195 per county resident in 2003, to $336 today. In 2003, the Sheriff spent 36% of county tax dollars and today that figure has grown to 48%.

Every year, adminstrator Weisman warns the commissioners that this growth of the Sheriff’s budget is unsustainable and at some point will crowd out all other county spending, yet as a group they never do anything about it. Some commissioners have pushed back – particularly Paulette Burdick and sometimes Mayor Taylor and Commissioner Abrams, but there have never been 4 votes to roll back his spending to a sustainable level.

There are a number of reasons for this. A cut to the budget for a constitutional officer (such as the Sheriff) can be appealed to the Governor. If an appeal is brought and the county loses, the budget goes into the next fiscal year with a large hole that needs to come from reserves. While the commission can cut the Sheriff’s appropriation, they are not allowed to say what specific items he should cut. He can therefore use his discretionary power to target areas of maximum political leverage. We have seen for example, how the threat to close the West Boynton substation will turn out COBWRA and others in force to pressure the BCC to restore the funds. We have also seen the PBA fill the commission chambers with red-shirted union members in solidarity with the Sheriff.

Unless there is a concerted effort by the public to raise their voices in opposition to the spending of this leviathan that is PBSO, we can expect no action again this year.

What can you do:

Attend the budget workshop on Tuesday June 10 and / or email, write or call your commissioner. Ask them:

1. Why has county spending returned to levels not seen since the real estate bubble.

2. To reject the Sheriff’s budget as submitted and return a portion of the valuation increase to the taxpayer in the from of a reduction in millage.

3. To consider providing raises to employees based on merit, rather than across-the-board or COLA increases

The bottom line is this – rising property valuations are not correlated with rising incomes among county residents. The growth of government spending should be “reasonable” – perhaps in line with population growth and inflation. There is no justification for a $40M tax increase in a single year.