2024 Budget Raises $100M in New Property Taxes

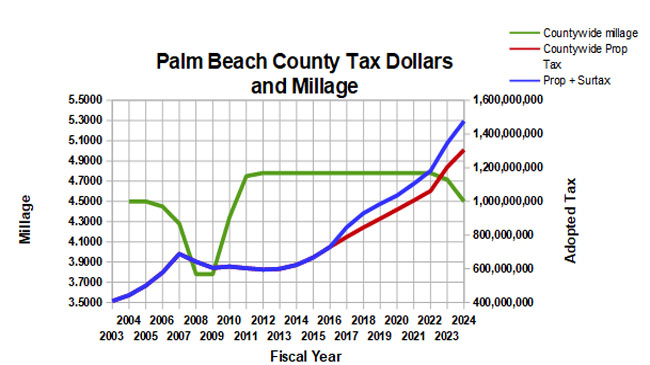

At the first public hearing on the 2024 PBC County budget on 9/7, the Board of County Commissioners (BCC) followed through with their intention to reduce the millage by about 5% from 4.715 to 4.500. As in July, the vote was unanimous.

A reduction in the millage of that much was a bit of a surprise in June as staff had recommended keeping it flat, and the change reduces the original county-wide ad-valorem tax proposal by $62M. Kudos to Commissioner Marino for suggesting the change and getting the rest of the board to follow her lead.

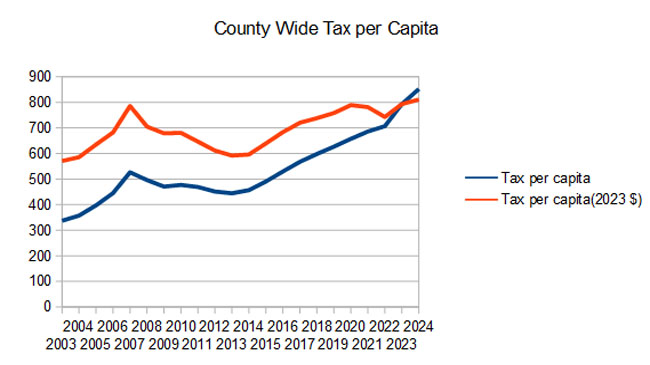

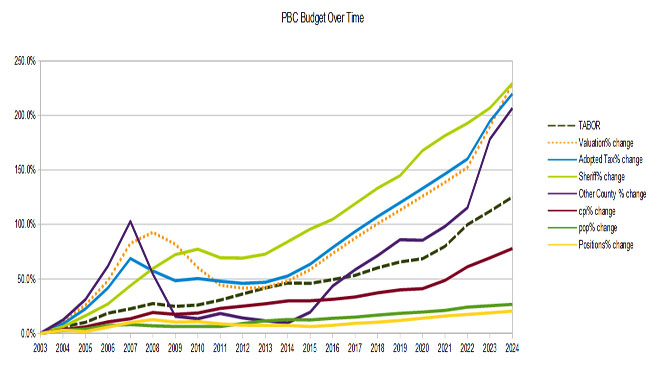

That said, the county-wide property tax burden is still going up by 8.5% since taxable valuations have climbed almost 15% since last year. That is an increase of $102M. Where is the new money going you ask? Much of it goes to a 6% across the board increase for every employee. This is on top of 3% a year, every year for the last nine (34% from 2014).

Some other increases:

- $54M more for the Sheriff – this is a 7.5% increase, yet the PBSO share of the total budget has declined to 59.5% from a peak of 66.4% in 2020

- $105M increase in reserves. The $1.6B in reserves are now 32% of budgeted expenditures, up from 28% one year ago.

- $29M increase in BCC operations net of revenues

- $85M in capital projects

- $12M increase for the Supervisor of elections, now at $34M (55% increase). Next year is a Presidential election year, but the budget in 2020 was only $16M so it is more than doubled. At the hearing, the majority of speakers addressed this line item and there appears to be an upswell of angst about the conduct of elections in Palm Beach County. This budget increase does not help that much.

The Fire / Rescue budget (separate taxing district, paid only if your town does not have its own F/R) has increased over 10% to $529M.

Total staffing is increasing by 66 to 12,369.

The final public hearing will be held on September 26th at 5:05pm.

2023 County Budget – 13% Tax Increase in Spite of Small Millage Drop

The final proposed county budget for FY 2023 will be voted on at the September 20th BCC Public Hearing at 5:05PM. The final budget hearing for the 2023 budget will be held on Tuesday, September 20th at 5:05PM in the BCC chambers, 301 N. Olive Street, 6th floor. Links: June 14 Budget Presentation June 14 Budget Package September 20th Budget Package Watch the meeting on Channel 20. In the summer workshops, the BCC voted to reduce the millage by about... [Read More...]

2022 Budget Workshop on Tuesday, June 15

The proposed county budget for FY 2022 will be presented at the June 15 BCC workshop at 6:00PM. The first budget workshop for the 2022 budget will be held on Tuesday, June 15 at 6PM in the BCC chambers, 301 N. Olive Street, 6th floor. Links: June 15 Budget Presentation June 15 Budget Package Watch the meeting on Channel 20. It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board... [Read More...]

2021 Budget Workshop on June 16

The proposed county budget for FY 2021 will be presented at the June 16 BCC workshop at 6:00PM. The first budget workshop for the 2021 budget will be held on Tuesday, June 16 at 6PM in the BCC chambers, 301 N. Olive Street, 6th floor. Links: June 16 Budget Package It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year about 5.8%. Total... [Read More...]

2020 Budget Workshop on June 10

The proposed county budget for FY 2020 will be presented at the June 10 BCC workshop at 6:00PM. The first budget workshop for the 2020 budget will be held on Monday, June 10 at 6PM in the BCC chambers, 301 N. Olive Street, 6th floor. Links: Budget Package It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year about 5.5%. Total County-wide... [Read More...]

Trends in the County Budget

The first public hearing on the FY2019 county budget is scheduled for Tuesday, September 4 at 6PM. As laid out in June, the county intends to keep the millage flat at 4.7815. With the updated valuations at around $188B, up 6% over last year’s $176.8B, that will give them another 6.2% to allocate to new spending and to reserves. The first public hearing for the FY2019 budget will be held on Tuesday, September 4 at 6PM in the BCC chambers,... [Read More...]

2019 Budget Season Kicks off with June 12 Workshop

The proposed county budget for FY 2019 will be presented at the June 12 BCC workshop at 6:00PM. Usually, the powerpoint presentation for the meeting is available along with the budget package a week before the meeting, but this year it is not, so we will have to wait for additional details. The first budget workshop for the 2019 budget will be held on Tuesday, June 12 at 6PM in the BCC chambers, 301 N. Olive Street, 6th floor. Links: Budget Package It... [Read More...]

First of two Public Hearings on 2018 Budget on Tuesday 9/5

On Tuesday evening 9/5 at 6:00PM, the County Commission will hold the first of the two required public hearings on the budget for the 2018 fiscal year. The meeting will be held on Tuesday, September 5 at 6PM in the BCC chambers, 301 N. Olive Street, 6th floor. Links: Public Hearing Package There are no surprises, as the budget presented in the June and July workshops is essentially the same. At the July meeting, the maximum millage was set at... [Read More...]

New Budget up 6.9% with Flat Millage

On Tuesday evening 6/13 at 6:00PM, the County Commission will hold the first budget workshop for the 2018 fiscal year. The meeting will be held on Tuesday, June 13 at 6PM in the BCC chambers, 301 N. Olive Street, 6th floor. Links: Presentation Budget Package There are no surprises. As they have done for the last 5 years, the county staff proposes to take full advantage of another rise in property values by continuing the 4.7815 millage rate... [Read More...]

Final County Budget Hearing This Evening 9/19

At the first September budget hearing, the Commission unanimously adopted the 4.7815 millage – unchanged for 6 years, and tonight they will make it official. When this tax rate was first set for the 2012 fiscal year, the countywide ad valorem tax was $595M against a valuation of $124.6B. This year, property valuations have greatly recovered and now total $165.1B. At that level, this millage will generate $790M – up 33% in 6 years, 8.2%... [Read More...]