The TAB Proposal and the County Budget

June 6, 2011

The county has published their initial budget package for the June 13 workshop. It is a flat millage budget, with cuts of $13.6M from county departments and $22M from PBSO over FY2011, and would seem at first reading to be in line with the first two points of the TAB Proposal, “Don’t raise the millage” and “take more of the cuts from the Sheriff”.

Upon further reading, it is clear that many of the cuts are intended to provoke a response from the user community. If you remember the horde of lifeguards and community recipients of FAA (charity) funds that showed up last year to protest, you can expect the same from the proposed $4.8M cut to Parks and Recreation which will close pools and reduce lifeguards, and the $1M cut to the FAA funds. Not to mention who will turn out to protest the $2.4M increase in Palm Tran fares.

In his cover letter, Administrator Weisman says: “I recommend the Board set a millage rate at rollback, which is currently estimated to be 4.922 mills. This would allow the Board to reinstate some of the less desirable budget cuts.”

Rollback represents a 3.6% increase in tax rates. Unless TAB partners and like minded citizens turn out to support the TAB proposal and ask the board to accept the submitted flat millage budget as stated, we can surely expect the special interests to push it to the rollback rate or beyond.

To recap, the TAB proposal is:

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

We also want to see a charter amendment for a county version of “Smart Cap” placed on the 2012 ballot. Detailed arguments for each of these can be found later in this article.

Background

Last year, TAB was formed in July, after the county budget process was well underway.

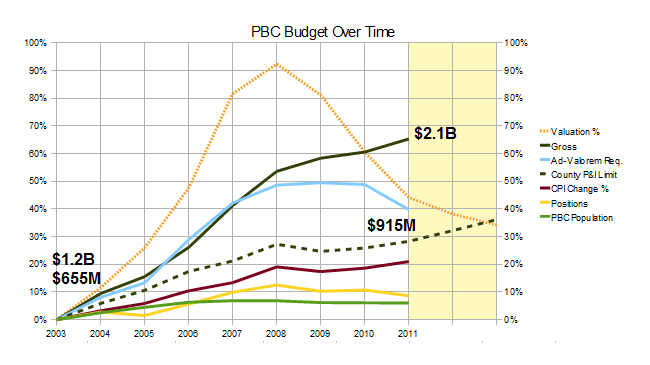

After researching the growth in county spending for the period 2003-2011, we concluded that it had grown 11 times the population growth and 3 times the rate of inflation. For FY2011, the proposed budget raised the millage by more than 9% on top of an increase of more than 15% in the previous year. Although the ad-valorem equivalent (and the total amount of collected taxes) declined in the 2011 fiscal year with the steep decline in property valuations, those with homestead properties saw their taxes go up. Overall spending, propped up by state and federal stimulus funds, continued to increase in 2011. (See chart below).

With the weak economy and double digit unemployment in the county, we thought another tax rate increase was wrong, and argued for keeping the millage flat at 4.344. As part of the proposal, we went through the staff’s “green” and “blue” pages, and made specific spending cut proposals totalling over $50M, argued for deferring raises in Fire/Rescue and PBSO, and listed $100M in capital projects that could have been deferred.

In meetings with the individual commissioners, we made our case and had a productive dialogue, but were not persuasive enough to carry the day against the hordes of special interests (including PBA members supporting the Sheriff’s budget) that flooded the meetings and lobbied the commissioners to keep the taxpayer money flowing. The final budget passed with a 9.3% rate hike on a 4-2 vote, with commissioners Abrams and Santamaria voting against, and the district 2 seat vacant after the resignation of Jeff Koons.

This year we are starting earlier and have focused on educating community groups about the budget history, preparing them to join the discussion armed with the proper facts. The actual budget has just been released to the public and we are just beginning our analysis. These are some aspects of the environment in which it is being created:

- The county administrator submitted a 4.75 flat millage budget as directed by the BCC, yet he is really asking for a rollback rate of 4.922 which would be a 3.6% increase over 2011, “to reinstate some of the less desirable budget cuts.”

- The Sheriff submitted a budget request with spending that is 4% higher than last year, mostly to cover raises under the collective bargaining agreements in place until 9/2012. In the flat millage budget, he is being asked to cut 5% more than he saves with FRS.

- The property appraiser, who had been projecting a 6% decline in valuations this year, has softened his outlook to a 2.3% decline.

- FRS reform, passed by the legislature and signed by the Governor, will result in savings to the county departments, PBSO and Fire/Rescue of $15.4M, $20.6M, and $11.6M respectively (by our calculations). Note: The county shows the PBSO savings to be $18M.

- Adam Playford’s article in the Palm Beach Post on May 21 gives some indication of the direction various players would like to go. Administrator Bob Weisman would like to see rollback millage to prevent any cuts in service. Commissioner Shelly Vana suggests we have not properly determined our priorities. The county is “saddled with debt”. The interest payments take 14% of what the county collects in property taxes according to Budget Director John Wilson. “Some of the county’s current fiscal squeeze is because it didn’t save enough earlier in the decade when tax money was flooding in” (during the boom) according to Clerk and Comptroller Sharon Bock.

The following is an outline of the “TAB Proposal” for 2012:

The 2012 TAB Proposal – preliminary

- Maintain the county-wide millage at 4.75

- County-wide property tax rates have risen 25.6% in the last two years alone

- Although the total taxes collected have declined over the same period, those with homestead properties saw double digit increase in their county taxes

- This year, the reduction in valuations has slowed from an expectation of -6% to a more modest -2.8%, reducing the pressure on the budget and millage rate

- TAB estimates that reforms to the Florida Retirement System (FRS), passed by the Legislature, will result in a $48M savings to the county this year ($20.6M in PBSO, $15.4 in county departments, and $11.6M in Fire/Rescue). This should be used to hold or reduce the millage, not for new spending on programs or salary increases.

- The commissioners directed the County Administrator to submit an initial budget with no change to the millage rate and he did. Bob Weisman’s request for rollback at 4.922 (a 3.6% increase) would seem to exceed his guidance.

- The county is still experiencing double digit unemployment and slow economic growth. This is not the time to be raising taxes.

- We expect the Fire / Rescue and Library MSTUs to also avoid a rate increase, but that has already been included in the submitted budget and so far no one has asked to exceed it.

- Take the majority of cuts from PBSO, not the county departments

- County-wide ad-valorem taxes pay for the county departments and the constitutional officers, including the Sheriff. In the last 8 years, PBSO has grown from 46% of the budget to 59%.

- Most of the growth in the PBSO budget has been in personal services costs (salary and benefits), and PBSO deputies are now compensated more than 30% above the national average for similar positions.

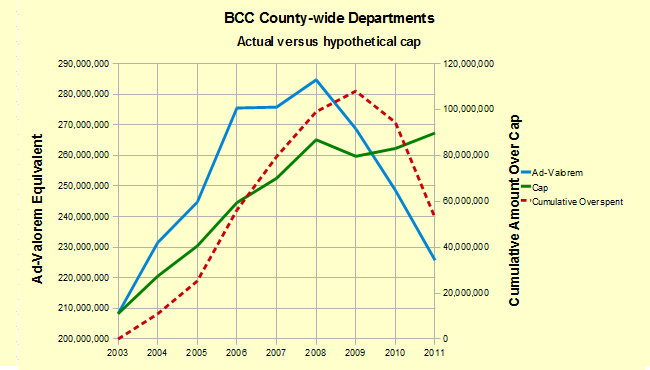

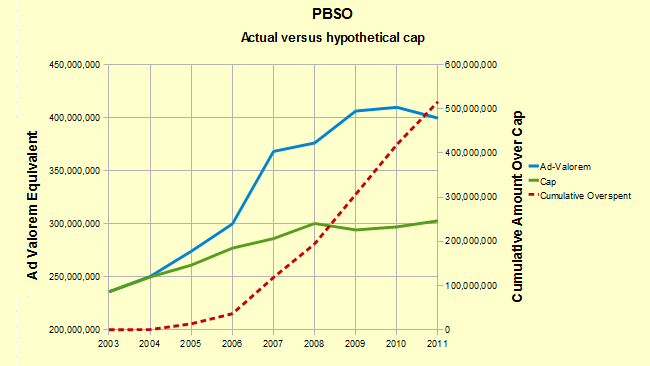

- Measured against a hypothetical population+inflation cap since 2003, county departments are now comfortably under the cap (although they exceeded it in the boom years by a cumulative amount of $50M). PBSO has greatly exceeded the cap in each year, with a cumulative overspending (versus the cap) of $500M in the 8 years. (See charts below)

- The Sheriff provides only the statutory minimum of budget data to the county (and the public) so it is difficult to see where the money is being spent. Through Chapter 119 (open records law) requests, TAB has determined that almost all the spending growth has been in salaries and benefits for employees covered by collective bargaining agreements, not in operating costs.

- The reduction to PBSO from $470M to $448M in the submitted budget would meet our criteria if allowed to stand.

- Take action to reduce the inventory of county property and reduce the debt

- Florida TaxWatch is conducting a study funded by the PBCA and others, that will inventory underutilized land and other property owned by the county, and compare our debt and capital programs to our peer counties. This study can be used as a blueprint for action to reduce the debt (currently $1600 per county resident with interest costs estimated at 14% of taxes collected) and make plans to sell off assets like Mecca Farms.

- The Clerk and Comptroller has identified the debt as being significant already, and it is about to be increased even further with the building of the waste to energy facility by the Solid Waste Authority and the convention center hotel.

- During the boom, windfall tax receipts were used to start projects that committed the county to long term debt that is difficult to justify now that the boom has ended. We need a plan to correct the problems caused by earlier bad decisions.

- TAB has obtained a list of vacant properties owned by the county and has begun comparing the current value of these parcels to what was paid for them. As long as these properties remain on the books it is a double liablility – there is a carrying cost associated with them and they are held off the tax rolls. Many of the over 2400 properties listed in the PAPA database as belonging to the county should be sold, even at a loss.

Separate from the TAB Proposal for the FY2012 budget cycle, but important for long term budget restraint is a charter amendment to bring the state level “Smart Cap” proposal (SJR958) to the county. This will be a separate track, aligned with the charter review process, but if you agree with it, please mention it in the context of the budget discussion.

Adopt a “Smart Cap” charter amendment for county government

- The state-wide “Smart Cap” (SJR958) will be on the ballot in 2012. What is good for the state is good for the county.

- “Smart Cap” limits the revenue that can be collected to last year’s cap plus an adjustment factor that reflects inflation (change in Consumer Price Index) and population growth – an objective measure of “appropriate spending”.

- Although the decline in valuations has currently dampened the large increases in county spending that occurred during the boom, spending has continued to rise, even last year. When “normal” returns to the real estate market, a cap could prevent the out of control spending that occurred during the bubble.

- Unlike Colorado’s Taxpayer Bill of Rights (TABOR), a smart cap is based on last year’s cap, not on last year’s revenue. That prevents the “ratcheting down” of the cap that caused problems in that state during a recession.

- A well designed Smart Cap can provide emergency override (Supermajority BCC vote) and exemptions for unfunded mandates and other areas identified by the League of Cities as as problematic.

This year’s TAB Proposal is really not asking that much. With the smaller decline in valuations and the large savings from FRS reform, there should be very little difficulty in making the modest cuts that will be necessary to avoid an increase in the tax rates.

Growth in ad-valorem equivalents compared to hypothetical “Smart Cap”