Some Background to the Mecca Farms Proposal

August 13, 2012

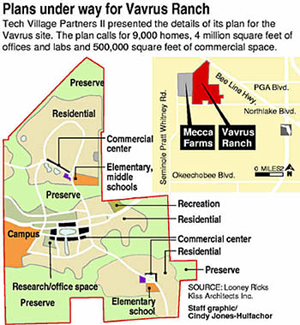

As the BCC considers the possible sale of the Mecca Farms property to the South Florida Water Management District, it is useful to consider the history of this site, and its relationship to the Vavrus Ranch which is just now being considered for development. (See: Blockbuster deal for Vavrus Ranch in the works)

The 1919 acre Mecca Farms, initially the preferred site for the Scripps Biotech industrial park, was to be accompanied by a residential development on the adjacent Vavrus ranch, presumably a “science ghetto” where the Scripps employees and their families would buy houses. Pushed by then Governor Jeb Bush and Commissioner Mary McCarty, the Business Development Board signed options for both parcels in 2003, prior to a final decision by Scripps. Scripps ultimately moved to their current Abacoa location when environmental lawsuits became a significant obstacle and a judge reversed the Corps of Engineers approval of the project.

According to Randy Schultz in the Post on May 25 (The best deal they’ll get):

Source:Sun Sentinel, 2/2005

As reported in the South Florida Business Journal in February of 2005, a division of Lennar held a joint option with Centex to buy Vavrus and planned 9-10,000 homes. The option was held by EDRI (Economic Development Research Institute), a nonprofit established by the BDB, who later transferred it to Lennar/Centex for $1.5M up front plus $51M on closing.

As reported in the Boca News on 8/3/2004, Mecca Farms itself was purchased by the county after a hastily convened meeting of four of the seven Commissioners voted 3-1 to proceed. Voting yes were Burt Aaronson, Karen Marcus and Mary McCarty, with Addie Greene voting no. The reason for the haste was that then Clerk Dorothy Wilkin was holding $1.4M of funds intended to clear the citrus trees off the site and the commissioners wanted to proceed.

Development got started early too, with Catalfumo Construction hired to build the roads on the site, and AKA services to build a 9 mile water pipe extension along SR7, 40th Street, 140th Street North and Grapeview Blvd. In total, the county spent $40M on planning and site prep and $51M for the pipeline, in addition to the $60M for the land.

The 2009 Grand Jury Report on public corruption in the county had this to say:

“The county eventually purchased the 2,000 acre Mecca Farms grove site for approximately $60 million dollars. Palm Beach County paid $30,000 per acre for land that credible evidence indicated was worth a maximum $10,000 to $15,000 per acre. With improvements to the site and area, the county expended approximately $100 million dollars to acquire and improve the Mecca site. Ultimately, Mecca Farms was never approved for development and the Scripps project was sited and built near Abacoa in Jupiter. Palm Beach County now owns and maintains at taxpayer’s expense the 2,000 acres of unimproved and undeveloped property known as the Mecca site.”

“The Mecca site transaction and other transactions lend credence to the perception of cronyism, unfair access and corruption of the land acquisition process. The Grand Jury repeatedly heard testimony of intense political pressure put on local government in land deals. Witnesses referred to the political atmosphere surrounding land deals as being a feeding frenzy.”

“The Grand Jury finds that a glaring deficiency in how land deals are handled by Palm Beach County is the overvaluation of property for purchase and undervaluation of property for sale or trade. A number of witnesses testified that when the county buys property, it overpays, and when the county sells property, it sells too cheaply. The Grand Jury examined a number of documents, received testimony and reviewed reports that support this buy high and sell low charge.”

The current offer for Mecca is $30M in cash plus about 1700 acres of land puported to be worth $25M. Mecca is appraised in the PAPA database at about $50M. The $30M cash is not sufficient to pay off the remaining $45M in debt incurred in the Mecca purchase (with $6.5M / year in debt service), nor will it recoup the $91M investment in infrastructure.

Vavrus is carried on the PAPA books as owned by WIFL, LLC. It is split into 11 parcels with a total 2011 appraisal of $68.5M and a taxable value of less than $1M.

With a Vavrus development now being considered, it would be helpful to know if the pipeline costs can be recovered by supplying the new development, and what affect (if any) a large development next to Mecca would have on its appraisal, and intended use by SFWMD for water storage.

The then ill-advised purchase of Mecca was rushed into without due diligence. Let’s not make the same mistake on its sale. In particular, let not a future grand jury say “..when the county buys property, it overpays, and when the county sells property, it sells too cheaply”.