What's Going On with Convention Centers and HQ Hotels? Part 1 of 3

August 23, 2012

This is the first in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

PBCTAB is late to the game as we first heard about the Convention Center HQ Hotel a year ago, and then had short notice prior to the July 24th, 2012 Workshop where it was decided to proceed with a County subsidized Convention Center HQ Hotel.

While conventional (sic) wisdom says that of course one should have a HQ hotel next to a convention center (A County Funded Hotel – Who Wins?), does the supposed induced demand in conventions due to the proposed HQ hotel justify the spending of taxpayer dollars? West Palm Beach and Palm Beach County are not alone. There are many cities considering, in process or completing HQ hotels. All of these use the same arguments and analyses.

The myriad cities all:

- are told by X, Y, Z trade show associations that they were not picked because of lack of HQ hotel (or their HQ hotel was not adequately sized) and are presented with videos by those associations describing how they would have picked that city otherwise

- use the same 1-3 consultants to justify their proposal to use public funds

- say that they have unique and desirable features that will bring the conventioneer to their city

- estimate a large increase in attendance based upon the addition of the HQ hotel or addition and an associated increase in employment and associated economic impact by those direct jobs and indirect spending by the visitors

- do not put measurements in place to assure that the projections are met

- do not achieve the desired outcome

- then have to ‘update’ their convention center, their HQ Hotel, their ‘City Place’ equivalent or add an arena.

We sent the Commissioners an article entitled “The Convention Center Shell Game” from 2004. But has anything changed since then? Steve Malanga, author of the quoted piece, writes this in a January 2012 piece:

“The convention business has been waning for years. Back in 2007, before the current economic slowdown, a report from Destination Marketing Association International was already calling it a “buyer’s market.” It has only worsened since. In 2010, conventions and meetings drew just 86 million attendees, down from 126 million ten years earlier. Meantime, available convention space has steadily increased to 70 million square feet, up from 40 million 20 years ago.”

Several of the Commissioners have quoted from Governing magazine in the past. The following quotation is from an article from the magazine, entitled “Needed: Better Benchmarks for Convention Investments” in July 2011. The emphasis is ours.

“The national supply of convention exhibit space has increased by more than 70 percent over the last 20 years, but the past decade hasn’t been kind. According to the now-defunct industry publication Tradeshow Week, attendance at conventions, trade and consumer shows decreased from 126 million in 2000 to 86 million in 2010.

Even such industry leaders as Las Vegas, Orlando, Atlanta and Chicago saw business decline after completing expansions in recent years, according to Prof. Heywood Sanders, who tracks the convention industry. Some opened their expanded facilities during a recession, but all saw business drop.

With hotels–particularly the large, moderately priced kind convention planners favor–proving increasingly difficult to finance, many industry insiders are blaming the downturn on a shortage of rooms proximate to convention centers. The response has been a spate of publicly owned or subsidized hotel development.

But that hasn’t cured what ails the industry. Convention hotels in Baltimore, Austin and Phoenix are doing poorly, and St. Louis’ convention headquarters hotel is in foreclosure.

Nonetheless, a 1,167-room headquarters hotel just opened in Washington, D.C., and Philadelphia recently unveiled a $787 million convention-center expansion. Convention and/or hotel expansions are also underway in Dallas, Detroit, Indianapolis, Nashville and Orlando.”

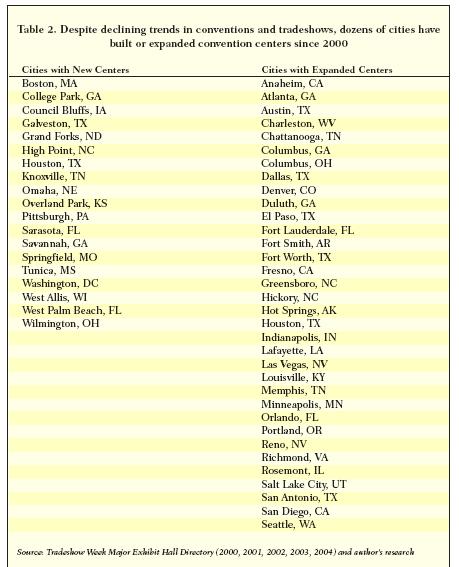

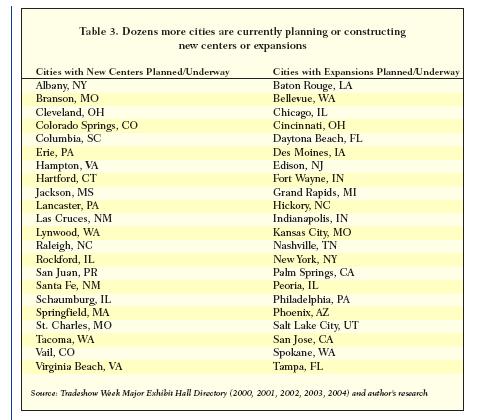

Dr. Heywood Sanders, Professor at University of Texas, San Antonio, wrote a research brief published by the Brookings Institution in 2005, entitled Space Available: The Realities of Convention Centers as Economic Development Strategy. Sanders’ expertise is in Public Policy and he is sought by citizens from cities across the country to testify to the folly of their government’s proposed expenditures. While the professor may have his detractors (primarily cities forging ahead with plans and those consultants used to justify those plans) – the following two charts from his 2005 study show the sheer number of convention center upgrades in the works during the last 10 years:

and

Meanwhile – the studies used by our own Palm Beach County administration shows a chart, Figure 5, of similarly sized, publicly subsidized hotels with the dates they were due to open.

Source: Public Participation in Hotel Development Prepared by HVS Convention, Sport& Entertainment Facilities Consulting, November 3, 2011.

These above are only a list of similarly sized hotels and do not represent all of the additional room nights being added throughout the country. The leading convention centers areas, such as Orlando, and Las Vegas are dealing with the economic realities by packing in multiple simultaneous events into their huge centers – thus taking demand from the second and third tier markets.

This mature and declining industry cannot possibly absorb all of the additional space nor achieve the positive economic impacts and occupancy projections made to the cities by consultants and by the cities to justify expenditure of public monies.

Our next article will examine recent developments related to publicly subsidized Convention Centers and HQ Hotels around the country.