First Public Hearing on 2015 County Budget

September 5, 2014

The first Public Hearing on the 2015 County Budget is Monday evening, September 8th, at 6:00PM at 301 N Olive, WPB, 6th floor.

Unchanged from June, the county proposes to keep the county-wide tax rate at last year’s 4.7815 despite a 7% increase in valuations, which will result in a tax increase of about $44M over the 2014 adopted tax. This follows a $23M increase last year.

These additional funds will mostly go to the Sheriff (67%), and BCC operations (driven by salary increases).

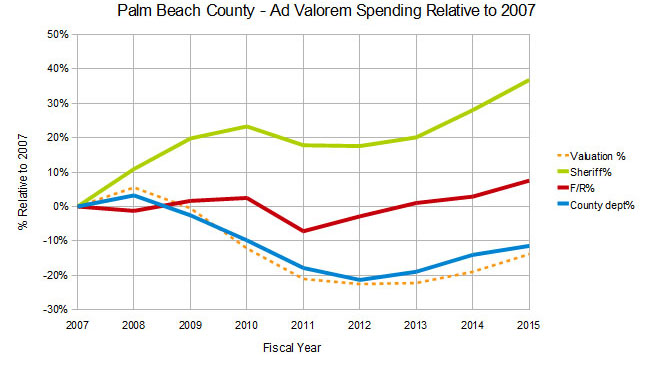

Note the growth in the Sheriff’s budget relative to other county departments. Those departments under control of the Administrator have tracked the valuation changes while the Sheriff showed no such restraint.

When the real estate bubble was expanding prior to 2007, the county budget grew by leaps and bounds, because a flat or mildly decreasing millage was easier to execute than raising it during the downturn. We are about to experience something similar. Back to back increases of $23M and now $44M is our warning. If not opposed now, the county spending will climb unrestrained. Some Commissioners (Burdick, Abrams, Valeche) see this. Others (Taylor, Vana) have embraced it. Returning even a small portion of the 2015 windfall to the taxpayer would set a precedent for the future.

The county is not alone in claiming all the valuation increase for more spending – most of the municipalities are following suit.

If you have a homestead exemption, it may appear that the tax increase on your TRIM notice is smaller than the 7% that the budget would project. This is because valuation increases in a single year are capped at the inflation rate (1.5% this year). Rest assured that your taxes will climb every year hence until you are “caught up”, even if valuations fall. This year, the difference is made up with higher taxes on commercial property and residences without the homestead exemption, for which the cap is 10%.

If you find all this troubling, let the Commissioners know you care about the growth in the county tax burden and spending. Attend the meeting on Monday if you can, or send them an email to BCC-AllCommissioners@pbcgov.org.

Let them know that we don’t want to return to the spending excesses of the last real estate bubble. A decrease of millage this year, sharing the windfall with the taxpayers, would be a tangible signal of responsible governance.

For some details of the 2015 budget, see: “2015 Budget – Flat Millage, what’s not to like? PLENTY!“