Final Hearing on FY2016 Budget, 9/21

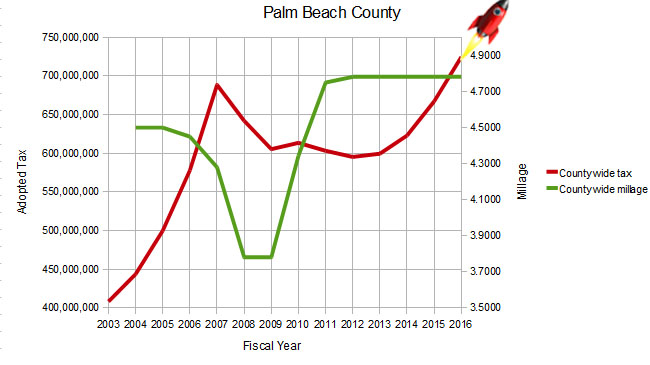

Next Monday, the Commission will take their final vote to set the county-wide millage rate at 4.7815, unchanged since 2012.

Out of the $63M tax increase, the $775K that they did not commit to new spending will be rolled into reserves, ready for use to increase the BDB subsidy and other priorities that didn’t make the budget proposal.

This is how the budget compares to last year:

| 2015 | 2016 | Change | |

|---|---|---|---|

| County-wide | $667.3M | 729.9M | + 9.4% |

| Library | $41.5M | 45.0M | + 8.4% |

| County Fire Rescue | $196.6M | 214.8M | + 9.3% |

| Jupiter Fire Rescue | $17.6M | 17.7M | + 0.6% |

Keep these large increases in mind as you contemplate the coming push for raising the sales tax to pay for “infrastucture” projects that should have been addressed in the normal budget process.

Public Hearing on the Budget – What to expect

On Tuesday, September 8 at 6 PM, the county commission will meet to consider the 2016 budget in the first of two meetings to set the millage rate. See: 1st Public Hearing Package

In the June workshop, before the county valuations were adjusted upward slightly, flat millage projections yielded $724.8M in property taxes – an 8.6% increase over last years budget. With the new valuations, the yield became $729.9M or a 9.4% increase.

All of this $62.6M windfall has been allocated to new spending, including large increases for the Sheriff, another 3% across the board pay increase for all county employees, new hiring, some capital projects and increases to reserves.

What is not being addressed in this budget is infrastructure – roads, bridges, parks, etc., which both staff and commissioners have been saying is an urgent need. Why? Because they plan to hit you with a sales tax increase and/or higher debt loads for that.

A sales tax increase would have to be passed by referendum and is not guaranteed, but staff and commissioners appear eager to make the attempt, even Hal Valeche, who laughably calls himself a “tax cutter”. To my knowledge, there have been no county tax cuts since he has been on the dais.

Funding critical infrastructure “off budget” is devious. One of the most important functions of local government is to build and maintain public roads and spaces. When these projects are funded as they should be, through a public budget process that allows for public input and discussion, commissioners are forced to make tradeoffs and set priorities. Because of the “Save our Homes” statute that limits homestead tax increases to the inflation rate (0.8% this year), there is a limit to the amount they can gouge the non-homestead propery owners. If they can get an “infrastructure sales tax” passed, it would generate an enormous amount of new revenue – just .5% would exceed $100M / year, and none of it would have to be justified through the budget process.

So what to expect?

The additional $5M that would be generated from the higher valuations (determined since June), could be used to reduce the millage and “give a little back to the taxpayer”. Do not expect that from this Commission. In the July workshop it was mostly allocated to other spending, including a mid-year pay increase for the tax collector’s office. With a little less than $1M unallocated going into the September hearing, likely recipients will be the Business Development Board (which has requested another $500K), and additional hiring in other areas.

The maximum millage rate set in July at 4.7815, unchanged since 2012, will very likely become the adopted rate after the two September hearings, and you can expect a push in the 4th quarter for the sales tax referendum to go on the November 2016 ballot, and/or a very sizable bond issue for “infrastructure”.

Since for homestead property owners, the 0.8% limit makes their tax increase minimal, there is not likely to be much public opposition in these meetings, and TAB does not plan to oppose the increase. The sales tax though is another matter, and now is not too early to consider what can be done to defeat such a move.