2023 County Budget – 13% Tax Increase in Spite of Small Millage Drop

Posted by Fred Scheibl on September 19, 2022 · Leave a Comment

The final proposed county budget for FY 2023 will be voted on at the September 20th BCC Public Hearing at 5:05PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

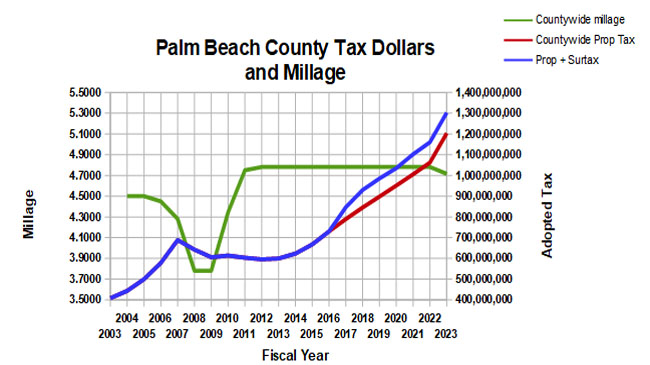

In the summer workshops, the BCC voted to reduce the millage by about 1.6% to 4.7150. This is the first millage change since 2012 when it was increased during the depths of the real estate valuation slump. Even with this minor reduction, the tax burden is up 13.4%. This is so much over the rollback rate that it will take a super majority of the Commission to enact.

It is a budget unlike the last few years in that it is presented in a time of uncontrolled inflation. When prices for everything are rising at an average 8.6% rate, governments just like people must find a way to increase their revenue or cut their spending. Having the power to tax of course, means governments can do just fine while the rest of us suffer.

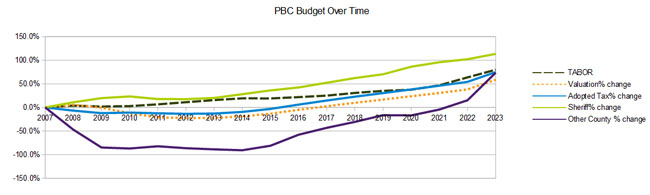

With close to flat millage (with rising valuations), 6% salary increases for staff across the board and a tax increase over the previous year of about 13.4%, the county’s budget proposal doesn’t appear to subscribe to the “cut the spending” response to inflation.

Total County-wide tax is up $141M to $1.2B, on top of the penny sales tax (infrastructure surcharge) of another $94M (estimated). After many years of small budget increases, the BCC ad-valorem funded departments are going to town. Inside the overall 13% increase, the Sheriff is only asking for 5.5%, while the rest of the departments’ growth is an astounding 27%!

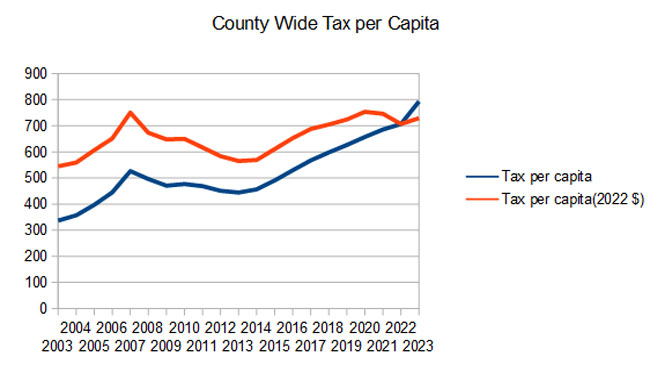

To be fair, with the Federal Reserve printing money to accommodate the Biden Administration’s excessive spending (the $2 Trillion “rescue plan” went right into the M2 money supply), it is prudent for the county to expect much higher costs going forward and padding the budget a little. I expect we will see that on the municipal level as well during the summer. If you look at the “County Wide Tax Per Capita” chart below, when shown in 2022 dollars taxation in flattening out.

For some perspective, during the last 11 years of flat millage (2012-2023), the ad-valorem tax per capita in Palm Beach County rose from $451 to $793, a 73% increase during a time of a 41% change in the consumer price index (much of that in the last year).

Here are some items in the budget of note:

- $3.4M is allocated for “Compensation Study Phase III”, the third and final installment “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” Since this year’s 6% increase comes on top of 3% a year for the last 8 (30% in total), we wonder if the study will find that county staffers are overpaid. No, I didn’t think so.

- As mentioned, after eight years of 3% cost of living (COLA) increases across the board, adding an ongoing $7.3M per year, this year’s 6% makes it 34% over the 9 years – a period when inflation was about 19%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $188K

- Sheriff (including part time crossing guards, etc.): $168K

- Information Technology: $124K

- Office of Management and Budget: $120K

- Parks and Recreation: $94K

- Palm Tran: $98K

- Engineering and Public Works: $87K

- The budget for the Supervisor of Elections is growing about 9% to $21.8M on top of 28% last year.. This includes a net gain of 5 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $255 billion, up about 15% over a year ago.

- With slightly smaller millage (4.7150), this valuation will generate more than $1.2 Billion in ad-valorem taxes, up $141M (13.3%) over last year.

- There will be 97 new BCC funded positions, 16 of them ad-valorem funded.

- General Fund reserves are being increased to $262M, 14% of general fund revenues (was $189M, so up 39% over last year)

- The Sheriff will see a $38M ad-valorem increase (5.5%). This includes money for 16 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $8.1M and $44.2M respectively.