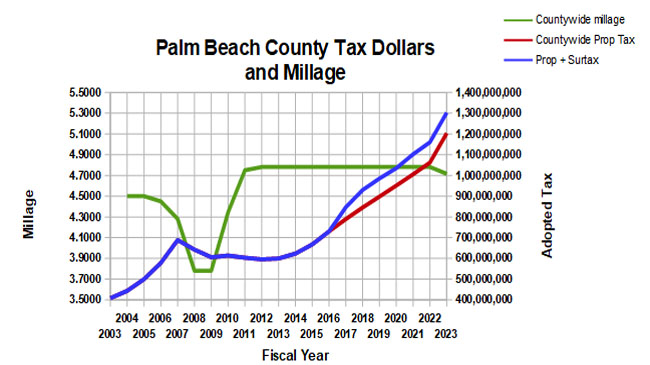

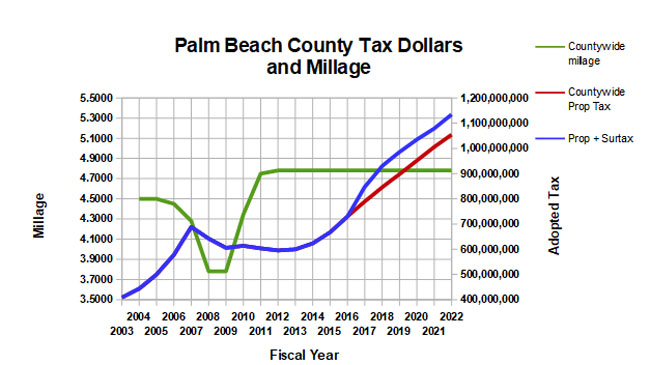

2024 Budget Raises $100M in New Property Taxes

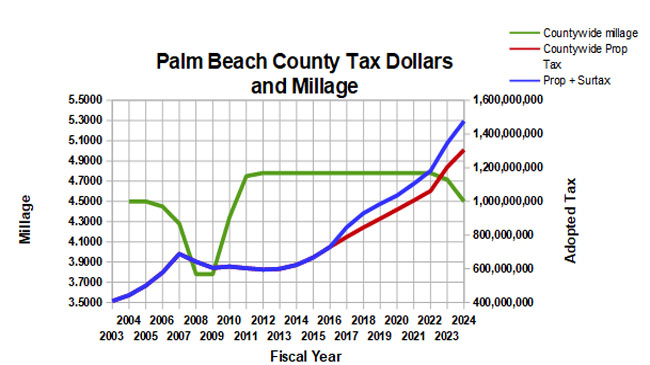

At the first public hearing on the 2024 PBC County budget on 9/7, the Board of County Commissioners (BCC) followed through with their intention to reduce the millage by about 5% from 4.715 to 4.500. As in July, the vote was unanimous.

A reduction in the millage of that much was a bit of a surprise in June as staff had recommended keeping it flat, and the change reduces the original county-wide ad-valorem tax proposal by $62M. Kudos to Commissioner Marino for suggesting the change and getting the rest of the board to follow her lead.

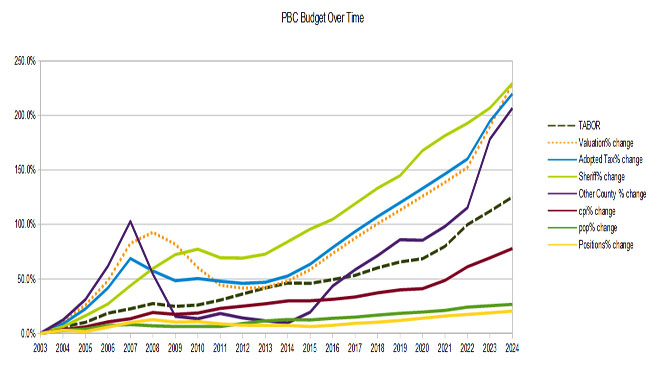

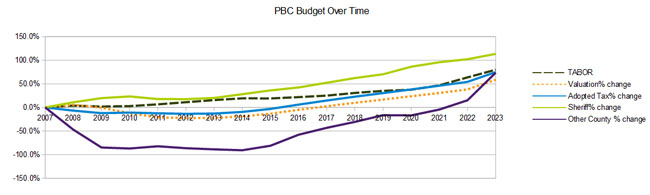

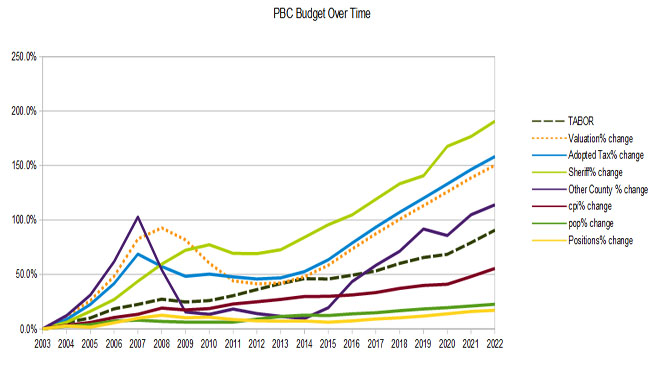

That said, the county-wide property tax burden is still going up by 8.5% since taxable valuations have climbed almost 15% since last year. That is an increase of $102M. Where is the new money going you ask? Much of it goes to a 6% across the board increase for every employee. This is on top of 3% a year, every year for the last nine (34% from 2014).

Some other increases:

- $54M more for the Sheriff – this is a 7.5% increase, yet the PBSO share of the total budget has declined to 59.5% from a peak of 66.4% in 2020

- $105M increase in reserves. The $1.6B in reserves are now 32% of budgeted expenditures, up from 28% one year ago.

- $29M increase in BCC operations net of revenues

- $85M in capital projects

- $12M increase for the Supervisor of elections, now at $34M (55% increase). Next year is a Presidential election year, but the budget in 2020 was only $16M so it is more than doubled. At the hearing, the majority of speakers addressed this line item and there appears to be an upswell of angst about the conduct of elections in Palm Beach County. This budget increase does not help that much.

The Fire / Rescue budget (separate taxing district, paid only if your town does not have its own F/R) has increased over 10% to $529M.

Total staffing is increasing by 66 to 12,369.

The final public hearing will be held on September 26th at 5:05pm.

2023 County Budget – 13% Tax Increase in Spite of Small Millage Drop

The final proposed county budget for FY 2023 will be voted on at the September 20th BCC Public Hearing at 5:05PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

In the summer workshops, the BCC voted to reduce the millage by about 1.6% to 4.7150. This is the first millage change since 2012 when it was increased during the depths of the real estate valuation slump. Even with this minor reduction, the tax burden is up 13.4%. This is so much over the rollback rate that it will take a super majority of the Commission to enact.

It is a budget unlike the last few years in that it is presented in a time of uncontrolled inflation. When prices for everything are rising at an average 8.6% rate, governments just like people must find a way to increase their revenue or cut their spending. Having the power to tax of course, means governments can do just fine while the rest of us suffer.

With close to flat millage (with rising valuations), 6% salary increases for staff across the board and a tax increase over the previous year of about 13.4%, the county’s budget proposal doesn’t appear to subscribe to the “cut the spending” response to inflation.

Total County-wide tax is up $141M to $1.2B, on top of the penny sales tax (infrastructure surcharge) of another $94M (estimated). After many years of small budget increases, the BCC ad-valorem funded departments are going to town. Inside the overall 13% increase, the Sheriff is only asking for 5.5%, while the rest of the departments’ growth is an astounding 27%!

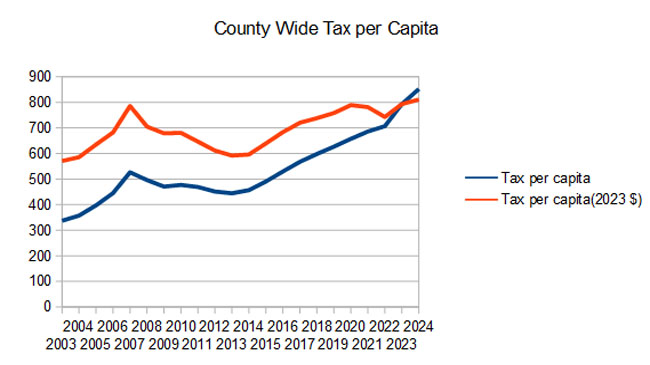

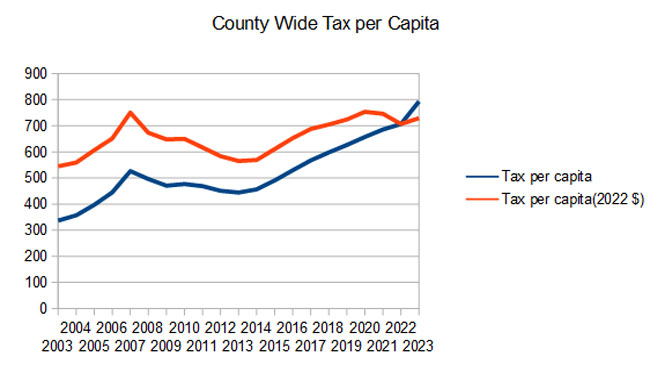

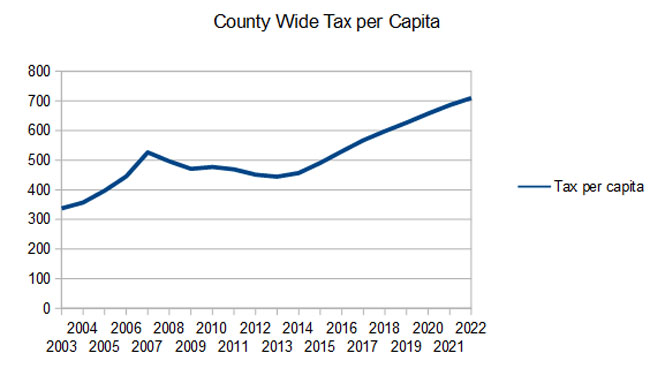

To be fair, with the Federal Reserve printing money to accommodate the Biden Administration’s excessive spending (the $2 Trillion “rescue plan” went right into the M2 money supply), it is prudent for the county to expect much higher costs going forward and padding the budget a little. I expect we will see that on the municipal level as well during the summer. If you look at the “County Wide Tax Per Capita” chart below, when shown in 2022 dollars taxation in flattening out.

For some perspective, during the last 11 years of flat millage (2012-2023), the ad-valorem tax per capita in Palm Beach County rose from $451 to $793, a 73% increase during a time of a 41% change in the consumer price index (much of that in the last year).

Here are some items in the budget of note:

- $3.4M is allocated for “Compensation Study Phase III”, the third and final installment “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” Since this year’s 6% increase comes on top of 3% a year for the last 8 (30% in total), we wonder if the study will find that county staffers are overpaid. No, I didn’t think so.

- As mentioned, after eight years of 3% cost of living (COLA) increases across the board, adding an ongoing $7.3M per year, this year’s 6% makes it 34% over the 9 years – a period when inflation was about 19%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $188K

- Sheriff (including part time crossing guards, etc.): $168K

- Information Technology: $124K

- Office of Management and Budget: $120K

- Parks and Recreation: $94K

- Palm Tran: $98K

- Engineering and Public Works: $87K

- The budget for the Supervisor of Elections is growing about 9% to $21.8M on top of 28% last year.. This includes a net gain of 5 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $255 billion, up about 15% over a year ago.

- With slightly smaller millage (4.7150), this valuation will generate more than $1.2 Billion in ad-valorem taxes, up $141M (13.3%) over last year.

- There will be 97 new BCC funded positions, 16 of them ad-valorem funded.

- General Fund reserves are being increased to $262M, 14% of general fund revenues (was $189M, so up 39% over last year)

- The Sheriff will see a $38M ad-valorem increase (5.5%). This includes money for 16 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $8.1M and $44.2M respectively.

2022 Budget Workshop on Tuesday, June 15

The proposed county budget for FY 2022 will be presented at the June 15 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year of about 4.8%.

Total County-wide tax is up $49M to $1.05B, on top of the penny sales tax (infrastructure surcharge) of another $80M (estimated).

For some perspective, during the last 10 years of flat millage (2012-2022), the ad-valorem tax per capita in Palm Beach County rose from $451 to $710, a 57% increase during a time of a 25% change in the consumer price index (much of that in the last few months).

Some items in the budget that should raise a few eyebrows:

- $3.2M is allocated for “Compensation Study Phase II”. The fall budget workshop estimated an additional $10M would be needed to fully complete phase II. Although not described in the package, we believe this is a continuation from the study by Evergreen Solutions back in 2018 and 19, whose purpose was: “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” See: Evergreen Study

- This is the eighth year of a 3% cost of living (COLA) increase across the board, adding an ongoing $7.3M per year. This amounts to 27% over the 8 years – a period when inflation was about 16%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $177K

- Sheriff (including part time crossing guards, etc.): $145K

- Information Technology: $117K

- Office of Management and Budget: $113K

- Parks and Recreation: $89K

- Palm Tran: $92K

- Engineering and Public Works: $82K

- The budget for the Supervisor of Elections is growing 28% to $19.9M. This includes a net gain of 4 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $221 billion, up about 4.9% over a year ago.

- With flat millage (4.7815), this valuation will generate more than $1 Billion in ad-valorem taxes, up $49M (4.8%) over last year.

- There will be 83 new BCC funded positions, 8 of them ad-valorem funded.

- General Fund reserves are being increased to $194M, 11.6% of general fund revenues (was $176M, so up 12% over last year)

- The Sheriff will see a $33M ad-valorem increase (5.1%). This includes money for 35 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $2.1M and $11.4M respectively.

Proposed sales tax hike raises discourse at Palm Beach political forum

Tab Point of View Presented at PBCA Candidate Event

Sales Tax Increase – Are the intended uses lawful?

As you probably know, the County Commission voted 5-2 to proceed with a 1% sales tax referendum for the November election. Ballot language is expected to be voted on at an upcoming meeting.

Under the terms of the proposal, the $270M annual proceeds are distributed as follows:

| 48.0% | $130M | School District |

|---|---|---|

| 27.5% | $74M | County |

| 18.5% | $50M | Municipalities |

| 4.5% | $12M | Cultural Council Projects |

| 1.5% | $4M | Economic Development |

A sales tax can only be imposed under the rules established by Florida Statutes 212.055 “Discretionary sales surtaxes; legislative intent; authorization and use of proceeds”, which spells out how proceeds may be used.

Specifically, it says in 2(d): “The proceeds …. shall be expended … to finance, plan and construct infrastructure; to acquire land for public recreation, conservation or protection of natural resources ….”

Section 2(d)1 provides a definition of “infrastructure”, which includes construction and improvement of public facilities, acquisition of public safety vehicles and equipment, etc.

Then in 2(d)3, it says “a local government infrastructure surtax … may allocate up to 15 percent of the surtax proceeds for deposit into a trust fund within the county’s accounts created for the purpose of funding economic development projects having a general public purpose of improving local economies, including the funding of operational costs and incentives related to economic development.”

It is probably safe to assume that the school district, county and municipalities can easily identify their intended projects as “infrastructure”. The Cultural Council projects though, as they are privately owned, do not qualify. Therefore, to be able to spend money from the sales tax, the museums, theaters and other entities would have to be considered “economic development” projects.

Are they really? Do they have “a general public purpose of improving local economies”? Is improving the outside appearance of the Norton Museum really in the same category as offering an incentive to a company to move its headquarters to the county?

What about the argument that these projects encourage tourism, and thus bring jobs and economic activity to the county?

On the WPTV show “To the Point” last Sunday, Tourist Development Council Executive Director Glenn Jergensen spoke of the drivers of county tourism – specifically beaches, baseball, and the convention center. He never mentioned theaters, museums or the zoo.

The statute also says that the “economic development” money needs to be put in a trust fund, presumably to be allocated for projects that are prioritized by some process. How can it be lawful to designate a fixed 4.5% of the proceeds to the discretion of the Cultural Council – an unelected board representing private interests?

The Cultural Council itself gets money from the bed tax and provides grants to the museums, theaters and other entities who typically have their own endowments or sources of private funding, and are not totally dependent on public money. Many of the projects intended for sales tax dollars were already in the pipeline and would happen with or without public funds.

It would seem that allocating 4.5% of the proceeds to these cultural projects may violate the letter of FS212.055, making the entire proposal subject to legal challenge. As such, we think the county should seek an opinion from the state Attorney General before proceeding with this ballot initiative.

As the municipalities are in the process of deciding whether to sign an interlocal agreement in support of the package, they too should be concerned. If any of you plan on attending your city or town’s meeting on the subject, consider bringing it up.

Sales Tax Referendum Gathering Steam

The county commission will vote Tuesday whether to ask the voters to raise the county sales tax from 6% to 7%. (Agenda Item 5B1)

After aborted attempts in 2012 and 2014, when a majority of the board thought the proposal was “half baked” and the need not urgent enough to convince the voters to cough up several billion over ten years, this time no one will say that the proposal hasn’t been finely tuned.

To her credit, County Administrator Verdenia Baker has put enormous energy and thought into lining up partners and getting potential opponents on board. She has made countless trips to the District, the League of Cities, business groups, city and town governments, and even homeowners associations to solicit ideas and sell the concept.

The School District has bought in, voting to partner up and accept just 48% of the take – less than they would have received with a go-it-alone half cent increase “for the children”.

The cities have also rallied to grab a piece of the potential windfall, producing a detailed wish list of projects to absorb their 18.5% – many of which would never have been conceived under their own municipal budgets.

And the master stroke was to bring in the Cultural Council as the tip of the spear. Acting in a capacity that can be looked at as “fee for service”, the Cultural Council is the hired gun whose “One County, One Plan, One Penny” campaign is already cranking up. The School District and the County Government are prohibited by law from engaging in political campaigning to pass a measure favorable to them, but the Public/Private Cultural Council is under no such restraint. Their 4.5% of the proceeds (about $122M over 10 years) is payment rendered to convince the public that this tax increase is to their benefit.

If it passes, the county will receive 28.5% of the proceeds, and although it is an “infrastructure surtax”, intended for maintenance of roads, bridges and facilities, much of the money is earmarked for new capital projects. It even contains a $27M “Economic Development Fund” for unspecified projects “to attract, retain, and expand businesses to improve the local economy.”

We think this a bad direction for the county, but there is enough muscle behind the proposal, that keeping it off the ballot would seem unlikely at this point. Only one Commissioner has signaled his opposition (Hal Valeche, to his credit), and the usual folks who oppose tax increases – such as the Economic Council, the Palm Beach Post editorial board, even some TAB partners, are either supporting the proposal or remaining neutral.

If you would like to go on record as opposing this referendum, send an email to the BCC or speak at the meeting on Tuesday.

Here are some things to keep in mind:

- It is a net tax increase of $220M per year – there is no talk of reducing ad-valorem taxes

- It is not subject to the scrutiny applied to items in the annual ad-valorem budget

- It creates an incentive to make purchases outside the county (both Broward and Martin are at 6%)

- It is regressive

- It is not an “infrastructure maintenance” tax, but includes many new capital projects

Sales Tax Proposal Sent Back for More Info

During a long meeting that stretched from before lunch until 5pm, the Board of County Commissioners yesterday deferred action on staff’s sales tax proposal, sending it back for more information.

Commissioners Valeche, Burdick and Abrams all wanted to see things slow down while the proposal is fleshed out. They did not want to see ballot language as of yet, rather the next session should discuss the unknowns of the proposal, including:

– What is the project list from the cities and School District?

– How would funds be distributed among cities, Cultural Council, county, schools?

– What it looks like without the Cultural Council projects included?

– What does the Hospitality Industry think of it?

While no one wanted to shut it down, they are clearly not ready to move on it. Some concerns expressed were that the proposal had expanded way beyond the original infrastructure funding, encompassing new construction projects, equipment for the Sheriff, and other items. Commissioner Abrams worried that the “Christmas tree” could tip over from all the ornaments.

Regarding the proposals from the Cultural Council – illustrated by a procession of over 10 museum directors, zookeepers, theater managers and the like, some of the projects go way beyond what you would expect from public funding, including architectural enhancements to the exterior of existing buildings to make them more trendy.

We will wait and see. We have listed objections to the plan as it is currently known. We expect that the devil is in the details though, specifically:

– Will the cities give up some of their share to fund CC projects?

– What will each of the 39 municipalities do with their share? Will any reduce their ad-valorem?

– What effect will this have on the county Ad-valorem budget process this year?

Regarding the Fire/Rescue sales tax proposal, there were too many questions about the enabling statute to move forward at this time. In particular:

– It is unclear what happens if sales tax revenue exceeds needs – can the surplus be spent on non fire/rescue projects by the county or cities? – It needs a statute change or AG opinion.

– What would be the process for collecting and distributing the cash, and how could ad-valorem be adjusted after trim notices are sent – Tax Collector Anne Gannon came and listed some of her process issues with it.

– What does Fire/Rescue administration (ie. Fire Chief Collins) think of the proposal. (The proposal is being brought forward by the IAFF union, not Fire/Rescue management).

We will keep you posted.

Some of the organizations with whom we have spoken, are also in a “wait and see” mode. Many believe there are real infrastructure needs, but many of the add-on projects give them pause.

For the Post story on the meeting, see: Action on Sales Tax Issue Delayed.

Increasing Sales Taxes a Bad Idea

A little shy of two years ago, the County Commission voted 4-3 to reject a staff proposal for a ballot initiative for a half penny sales tax increase. This was the third sales tax attempt since 2012, and we are about to see the fourth attempt unveiled at the February 9th BCC meeting (Items 5D2, 5D3).

County Administrator Verdenia Baker has been shopping around her proposal for a half cent increase to fund “infrastructure” – roughly defined as roads, bridges, drainage, parks, and other physical items. The increase would last at least 10 years, and bring in more than $110M per year of new revenue for each 1/2 cent increase. The plan was defeated last time around partly because it was perceived as funding a “grab bag” of small unrelated projects, with nothing that would capture the imagination as a critical need. As one of the Commissioners put it – what is the constituency for road striping and drainage ditches?

Complicating matters this year is the “feeding frenzy” that is surrounding the whiff of new revenue. The School System, with infrastructure needs of their own, are also considering a half cent increase, and since “for the children” is more compelling than “for the drainage ditches”, the county would like to combine their request into a full cent that would be split with the District. So far the district isn’t buying it, figuring (rightly) that their chances are better alone. Not to be muscled aside, County Fire/Rescue, which is funded by its own taxing districts (county and Jupiter), has wanted since 2010 to convert some of its revenue flow from property taxes to sales taxes, and would like at least a half cent of their own. The 2010 proposal was turned down by the BCC over the complexity of dividing it up among the county and cities. And outside of the process (but perhaps thinking they can bring marketing skill to the ballot proposal), the PBC Cultural Council would like a piece of the action. The CC is funded today by the “tourist” bed tax on hotel stays and rental cars.

So is this potential 1-1/2 cent increase in the sales tax (to 7.5% if everyone gets theirs) justified?

Please consider:

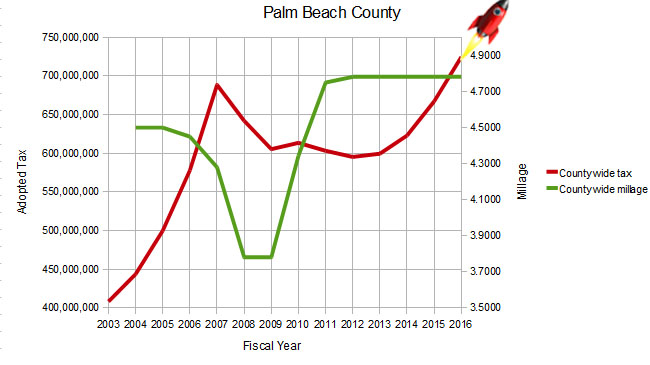

- For the current fiscal year, the county-wide property taxes levied reached an all-time high of $730M, up 9.4% over the previous year, and up 23% in just 4 years, far exceeding inflation and population growth.

- Although the Sheriff’s portion of the budget increased by almost $30M, he deferred some capital spending into the next fiscal year and we expect an even larger increase in the 2017 budget – therefore the county will be considering another big property tax hike as well.

- Maintaining the infrastructure is one of the basic things we expect from government, and it should not need its own special revenue source – it should be given priority in the normal budget process.

- Sales taxes, by their nature generate revenue untied to specific spending needs and outside of the public budgeting process. This leads to a lack of oversight and wasteful spending.

- A portion of sales taxes (40%) by statute must go to the cities. Some cities are actively opposed to a sales tax increase, and others have budgeted responsibly and do not need additional revenue sources. This is a wasteful and inefficient way to generate county level revenue.

- For the county, the designated infrastructure “needs” are still a grab-bag of small unrelated projects, and not a compelling list of urgent priorities justifying up to $2.5B in new taxes over 10 years.

- The schools budget proposed at the state level by the governor will provide significantly more money for the school system next year, easing any need they have for more sales tax revenue.

- While a case could be made to shift some revenue from property to sales tax to capture more from non-residents (there is some of this in the Fire/Rescue proposal), neither the county nor the School District is considering a reduction of ad-valorem taxes.

We think raising the sales tax for any of the stated purposes is a bad idea, and if any of these do get on the November ballot, we think it will very likely be defeated by the already overburdened taxpayers.

If you agree, let the Commissioners know at BCC-AllCommissioners@pbcgov.org or speak at the meeting.

For TAB Articles concerning the various sales tax schemes of the last few years see:

- Mar 12 2014: Dodging a Bullet – No Sales Tax Referendum

- Mar 7, 2014: Another Go at the Sales Tax on Tuesday

- Dec 18, 2013: Dark Cloud of Sales Tax Referendum Hangs over the County

- Dec 11, 2013: Another Attempt to Raise the County Sales Tax

- May 11, 2012: “Half Baked” Tax Proposal put back in the oven for another year

- Apr 27, 2012: TAB Opposes Sales Tax Increase

- Dec 8, 2010: Fire/Rescue Sales Tax Surcharge to Make a Comeback

$725M County Budget Proposal Largest in History

The county budget proposal, to be discussed in the first budget workshop on Tuesday, June 9 at 6pm, proposes flat millage at 4.7815 producing $57.5M in new taxes on rising valuations.

With property values having returned to 89% of the peak seen in 2007, this budget is actually $36M higher than the record set that year, making it the highest dollar value budget in the history of the county.

Coming on top of a $44M tax increase last year, during a time of negligible inflation and little population growth, the county is intent on taking a larger and larger share of taxpayer wealth. Many of the municipalities have already started talking about decreasing their millage – why not the county?

As usual, the Sheriff is claiming a big slice of this largesse, but the county-wide departments are also upping their spending. There is an across the board 3% “cost of living” increase on top of a similar 3% last year. Hiring is being turned on again with 66 new positions to fill. And $19M is targeted for capital projects.

Since the proposed millage is the same as last year, and there is a slight decline in the debt service, this budget will be presented as if it contains a slight tax rate decrease in aggregate. Don’t be fooled – at $725M, the proposed countywide taxes collected is both the largest total amount in history, as well as the largest dollar increase since 2007 at the peak of the bubble.

So what does this mean to the property owner?

Thanks to “Save our Homes”, the most that the taxable value of a homestead property can increase in a single year is 3% or the inflation rate, whichever is lower. This year the state has set the rate to 0.8%. With flat millage then, the homesteader’s tax bill increase is limited to less than 1% and much will be made of the fact that this is only a few dollars at most.

2015 Tax x 39% = homestead share

$667M x .39 = $260M

Allowable increase = 0.8% x $260M = $2.08M

Remainder ($57.5M – $2.08M = $55.4M)

to be paid by non-homesteader

who paid

$667M x 61% = $407M for 2015

and will pay

$407M + $55M = $462M for 2016

or + 13.6%

But what of the non-homesteader?

There are approximately 630K taxable properties in the county, of which 298K are homesteaded (47%), and last year these paid about 39% of the taxes. Using these figures we can calculate that the homesteader’s share of the $57.5M tax increase is about $2M or about $7 per parcel on average (see box). The remaining $55M will be paid by the non-homestead properties (both residential and commercial) and they will see an increase of about 13% over last year, or about $167 per parcel. Since some non-homestead properties are capped at 10%, those not so fortunate will pay even more.

From a historical perspective, the millage has been unchanged since 2012, when the county property valuation was about $125B. As it now sits at $152B, the county has been able to increase its “take” from the $595M in 2012 to this proposal’s $725M, up $130M, without having to increase the tax rate. How much different it was in the years leading up to the bubble bursting after 2007. For the years 2006, 2007 and 2008, as valuations climbed, a different set of Commissioners actually DECREASED the millage rate. Even though tax amounts continued to climb, their action resulted in lower taxes than flat millage would have produced.

It is clearly time to start decreasing the millage rate, even a small amount. Maybe this Commission should study the actions of their predecessors.