2022 Budget Workshop on Tuesday, June 15

Posted by Fred Scheibl on June 13, 2021 · 1 Comment

The proposed county budget for FY 2022 will be presented at the June 15 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

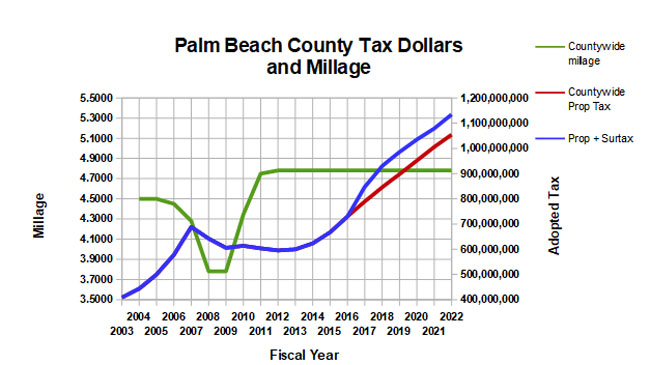

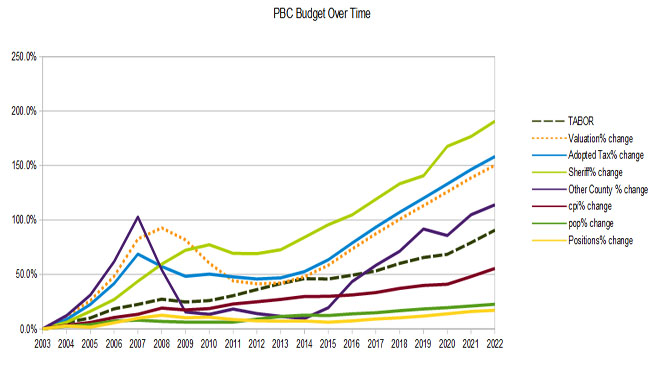

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year of about 4.8%.

Total County-wide tax is up $49M to $1.05B, on top of the penny sales tax (infrastructure surcharge) of another $80M (estimated).

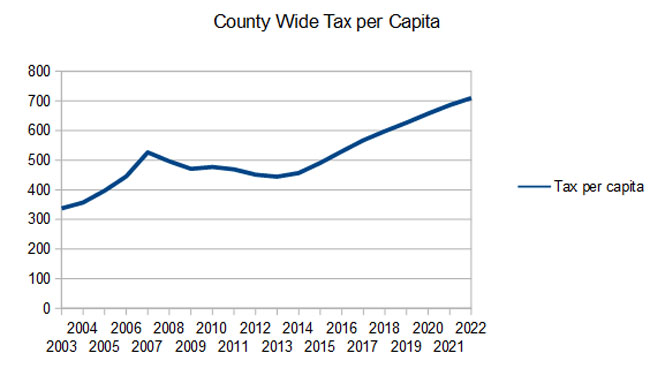

For some perspective, during the last 10 years of flat millage (2012-2022), the ad-valorem tax per capita in Palm Beach County rose from $451 to $710, a 57% increase during a time of a 25% change in the consumer price index (much of that in the last few months).

Some items in the budget that should raise a few eyebrows:

- $3.2M is allocated for “Compensation Study Phase II”. The fall budget workshop estimated an additional $10M would be needed to fully complete phase II. Although not described in the package, we believe this is a continuation from the study by Evergreen Solutions back in 2018 and 19, whose purpose was: “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” See: Evergreen Study

- This is the eighth year of a 3% cost of living (COLA) increase across the board, adding an ongoing $7.3M per year. This amounts to 27% over the 8 years – a period when inflation was about 16%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $177K

- Sheriff (including part time crossing guards, etc.): $145K

- Information Technology: $117K

- Office of Management and Budget: $113K

- Parks and Recreation: $89K

- Palm Tran: $92K

- Engineering and Public Works: $82K

- The budget for the Supervisor of Elections is growing 28% to $19.9M. This includes a net gain of 4 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $221 billion, up about 4.9% over a year ago.

- With flat millage (4.7815), this valuation will generate more than $1 Billion in ad-valorem taxes, up $49M (4.8%) over last year.

- There will be 83 new BCC funded positions, 8 of them ad-valorem funded.

- General Fund reserves are being increased to $194M, 11.6% of general fund revenues (was $176M, so up 12% over last year)

- The Sheriff will see a $33M ad-valorem increase (5.1%). This includes money for 35 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $2.1M and $11.4M respectively.

Why can’t they lower the millage rate based on the “COVID” impact on business and employment? Why does the county wage/salaries need to be raised 3% when no businesses are giving even a 1% raise because the businesses have lost revenue due to COVID?