Final County Budget Hearing This Evening 9/19

At the first September budget hearing, the Commission unanimously adopted the 4.7815 millage – unchanged for 6 years, and tonight they will make it official.

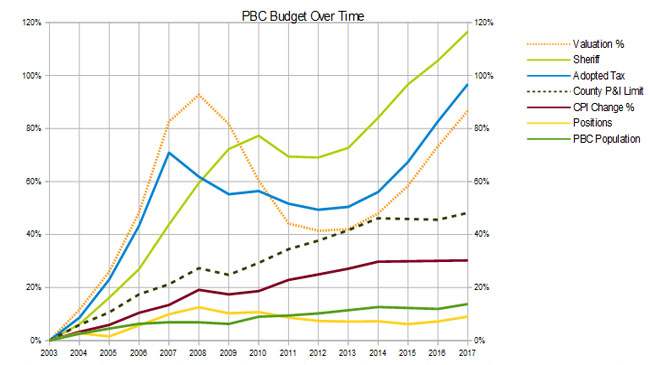

When this tax rate was first set for the 2012 fiscal year, the countywide ad valorem tax was $595M against a valuation of $124.6B. This year, property valuations have greatly recovered and now total $165.1B. At that level, this millage will generate $790M – up 33% in 6 years, 8.2% in this year alone.

OVer those 6 years, there has only been about 4% inflation and population has grown about 3%. The average household income throughout Palm Beach County grew about 6%.

The government did much better. County employees saw across the board raises of 3% for 4 years in a row (12.6%), and taxes went up 33%.

Remember this growth in taxes – far in excess of inflation and population growth, as you consider whether a 7% sales tax makes sense. If passed, the tax will provide another $70M per year to the county government – larger than the $60M increase in this year’s ad-valorem.

Public Hearing Tuesday on 2017 County Budget

Links:

On Tuesday 9/6 at 6:00 PM, the County Commission will most likely vote to leave the millage unchanged for a sixth year in a row, accepting the tax windfall from rising valuations.

The numbers are slightly higher than the June package as the valuations have been adjusted up slightly to $165.1B – 97% of the all time peak that occurred in 2008. This year’s tax take of $790M is up 8.2% over last year and up 33% in the 5 years since 2012.

Highlights of the budget include:

- a 3% across-the-board salary increase for all employees (on top of 3% in each of the last 3 years). Note that this 12.5% increase for county employees came during the 4 year period when the county average household income only went up about 4%.

- 62 new positions. County staffing has grown by 286 in the last 4 years to a total of 11,202.

- A $28M increase for the Sheriff. The Sheriff now accounts for about 48% of the general fund total appropriation budget.

- A 4.7% decrease in the budget for Engineering and Public Works.

Note that there is nothing in the budget for revenue and appropriations associated with infrastructure projects that would be funded by the proposed 1 cent sales tax surcharge. If the tax were to pass, the county would receive about $70M per year – about $10M more than the amount of the increase in this year’s property tax. When added together, the total tax increase would be 18% in 2017.