New Budget up 6.9% with Flat Millage

On Tuesday evening 6/13 at 6:00PM, the County Commission will hold the first budget workshop for the 2018 fiscal year.

Links:

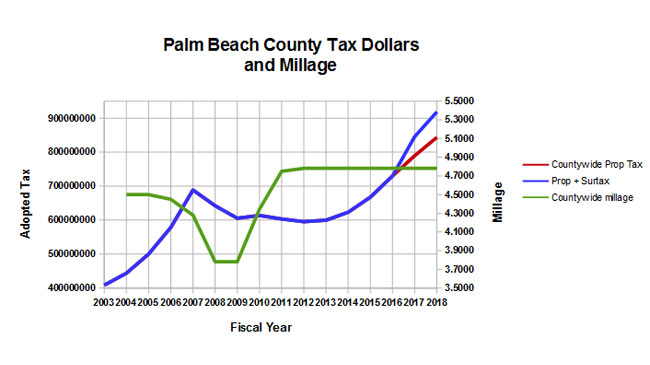

There are no surprises. As they have done for the last 5 years, the county staff proposes to take full advantage of another rise in property values by continuing the 4.7815 millage rate and reaping a tax increase of $54M, up 6.9% over last year, for a total ad-valorem tax levy of $844M.

There is no discussion of reducing millage in recognition of the $75M windfall from the sales tax surcharge. When property tax is combined with the yearly surcharge revenue, the total take of $919M is up 53% over the last 5 years.

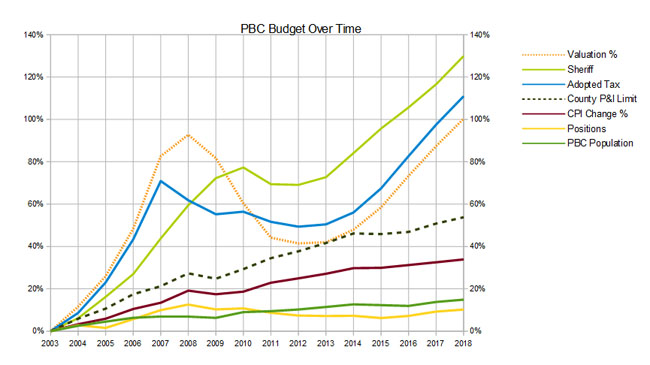

This is the fifth year in a row of a 3% across the board pay increase for all employees, representing a raise of 16% since 2013. The Sheriff, as usual, gets a 5% increase and at $542M, now represents about half of the total countywide net spending from property taxes.

The graph below shows the trend in ad-valorem taxes and millage since 2003, with the sales tax surcharge added to put it in perspective.

The next graph shows the budget over time compared to the valuation curve and the “TABOR” line. The orange dotted line is valuation which has just doubled since 2003 and is at a new peak for the first time following the 2008 “crash”. Note that the Sheriff’s budget has shown little restraint and has only declined once in 15 years – it is now up about 130% since 2003.

The “TABOR” line (green dotted “County P&I limit”) reflects the combination of inflation and population growth over time and is a model for what responsible budget growth would look like. TABOR would suggest a growth in taxes of about 54% for the period. Although not shown on this graph, if the Sheriff’s budget is subtracted from the total, the budget for the rest of the county departments has not exceeded the TABOR line, clearly indicating where the problem lies.

For more information, see the Budget Presentation and the Budget Package.