What’s Going On with Convention Centers and HQ Hotels? Part 1 of 3

This is the first in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

PBCTAB is late to the game as we first heard about the Convention Center HQ Hotel a year ago, and then had short notice prior to the July 24th, 2012 Workshop where it was decided to proceed with a County subsidized Convention Center HQ Hotel.

While conventional (sic) wisdom says that of course one should have a HQ hotel next to a convention center (A County Funded Hotel – Who Wins?), does the supposed induced demand in conventions due to the proposed HQ hotel justify the spending of taxpayer dollars? West Palm Beach and Palm Beach County are not alone. There are many cities considering, in process or completing HQ hotels. All of these use the same arguments and analyses.

The myriad cities all:

- are told by X, Y, Z trade show associations that they were not picked because of lack of HQ hotel (or their HQ hotel was not adequately sized) and are presented with videos by those associations describing how they would have picked that city otherwise

- use the same 1-3 consultants to justify their proposal to use public funds

- say that they have unique and desirable features that will bring the conventioneer to their city

- estimate a large increase in attendance based upon the addition of the HQ hotel or addition and an associated increase in employment and associated economic impact by those direct jobs and indirect spending by the visitors

- do not put measurements in place to assure that the projections are met

- do not achieve the desired outcome

- then have to ‘update’ their convention center, their HQ Hotel, their ‘City Place’ equivalent or add an arena.

We sent the Commissioners an article entitled “The Convention Center Shell Game” from 2004. But has anything changed since then? Steve Malanga, author of the quoted piece, writes this in a January 2012 piece:

“The convention business has been waning for years. Back in 2007, before the current economic slowdown, a report from Destination Marketing Association International was already calling it a “buyer’s market.” It has only worsened since. In 2010, conventions and meetings drew just 86 million attendees, down from 126 million ten years earlier. Meantime, available convention space has steadily increased to 70 million square feet, up from 40 million 20 years ago.”

Several of the Commissioners have quoted from Governing magazine in the past. The following quotation is from an article from the magazine, entitled “Needed: Better Benchmarks for Convention Investments” in July 2011. The emphasis is ours.

“The national supply of convention exhibit space has increased by more than 70 percent over the last 20 years, but the past decade hasn’t been kind. According to the now-defunct industry publication Tradeshow Week, attendance at conventions, trade and consumer shows decreased from 126 million in 2000 to 86 million in 2010.

Even such industry leaders as Las Vegas, Orlando, Atlanta and Chicago saw business decline after completing expansions in recent years, according to Prof. Heywood Sanders, who tracks the convention industry. Some opened their expanded facilities during a recession, but all saw business drop.

With hotels–particularly the large, moderately priced kind convention planners favor–proving increasingly difficult to finance, many industry insiders are blaming the downturn on a shortage of rooms proximate to convention centers. The response has been a spate of publicly owned or subsidized hotel development.

But that hasn’t cured what ails the industry. Convention hotels in Baltimore, Austin and Phoenix are doing poorly, and St. Louis’ convention headquarters hotel is in foreclosure.

Nonetheless, a 1,167-room headquarters hotel just opened in Washington, D.C., and Philadelphia recently unveiled a $787 million convention-center expansion. Convention and/or hotel expansions are also underway in Dallas, Detroit, Indianapolis, Nashville and Orlando.”

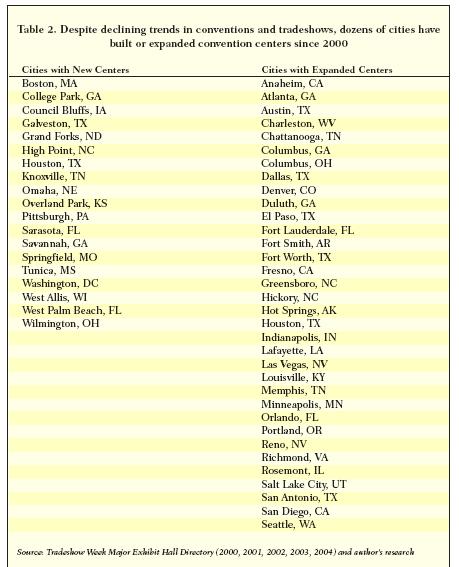

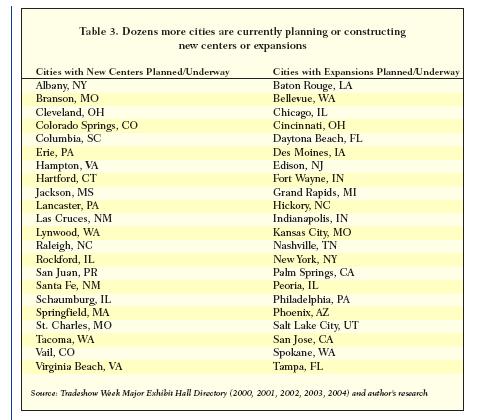

Dr. Heywood Sanders, Professor at University of Texas, San Antonio, wrote a research brief published by the Brookings Institution in 2005, entitled Space Available: The Realities of Convention Centers as Economic Development Strategy. Sanders’ expertise is in Public Policy and he is sought by citizens from cities across the country to testify to the folly of their government’s proposed expenditures. While the professor may have his detractors (primarily cities forging ahead with plans and those consultants used to justify those plans) – the following two charts from his 2005 study show the sheer number of convention center upgrades in the works during the last 10 years:

and

Meanwhile – the studies used by our own Palm Beach County administration shows a chart, Figure 5, of similarly sized, publicly subsidized hotels with the dates they were due to open.

Source: Public Participation in Hotel Development Prepared by HVS Convention, Sport& Entertainment Facilities Consulting, November 3, 2011.

These above are only a list of similarly sized hotels and do not represent all of the additional room nights being added throughout the country. The leading convention centers areas, such as Orlando, and Las Vegas are dealing with the economic realities by packing in multiple simultaneous events into their huge centers – thus taking demand from the second and third tier markets.

This mature and declining industry cannot possibly absorb all of the additional space nor achieve the positive economic impacts and occupancy projections made to the cities by consultants and by the cities to justify expenditure of public monies.

Our next article will examine recent developments related to publicly subsidized Convention Centers and HQ Hotels around the country.

- Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

This is the second in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

A recent article in the Sun-Sentinel found Orlando to be tops in the US for meetings July 2011-June 2012. “After Orlando, the company found the next most popular cities for meetings and events are in order: Washington DC, Las Vegas, Miami, Chicago, San Diego, Phoenix, Atlanta, Dallas and New Orleans.” “Miami is No. 4, Fort Lauderdale No. 30 and Boca Raton No. 43”.

So – let’s look at how some cities’ convention centers or HQ hotels are faring by looking at some recent 2010-2012 headlines…

Miami: Voters on Tuesday supported a Miami Beach bed tax increase to fund convention center improvements. But if and when a tax increase happens depends on city commissioners and a public corruption investigation. – August 2012

“The commission voted in December to bid out a $1 billion convention center district project that aims to have developers renovate the convention center, build an adjacent hotel and redesign and lease the surrounding publicly owned acres into an iconic complex. That project, however, remains in the early stages due largely to a public corruption investigation into whether the city’s then-purchasing director tainted the bidding process.”

Washington D.C: The sorry saga of the D.C. convention center hotel – Feb 2010

“I understand there may be reasons to subsidize a convention center hotel that agrees to set aside 80 percent of its rooms during peak season for low-margin convention business. But if the hotel really requires this much of a subsidy, then it raises a serious question about the economics of a project that, at best, is expected to increase convention spending in the city by $100 million a year. Right now, it looks as though the benefit of all those subsidies will be fully captured by convention attendees, the convention hotel’s developers and perhaps the owners of the city’s other hotels. If all goes well, the taxpayers will get their money back, but not much more.”

Ft. Lauderdale: Fort Lauderdale to take $13 million hit as it loses its biggest convention – July 2012

“Leaders at the Greater Fort Lauderdale Convention and Visitors Bureau said it’s unlikely that a single convention can replace the business lost from ARVO. So the bureau is working to bring in several smaller events that might fill as many rooms as ARVO: about 24,000 room nights a year.

But competition for groups is stiff because big convention center destinations such as Orlando and Las Vegas no longer wait for mega-events. They go after smaller conventions that pieced together can fill up their space — events that would more typically go to smaller venues.

“Fort Lauderdale competes with everyone in the United States, just as we do, as it relates to small and medium shows,” said Gary Sain, president of Visit Orlando.”

Daytona Beach, FL: If We Build More Will They Come? – June 2012

Raleigh, NC: Raleigh Convention Center: Throwing Good Money after Bad – February 2012

Boston, MA: Panel Proposes Convention Center Hotel – March 2011

Pittsburgh, PA: New Convention Center Hotel is Stalled – March 2012

Salt Lake City, UT: Salt Lake City officials Balk at subsidy for Megahotel – August 2011

Portland, OR: Oregon Convention Center Hotel Gets Another Chance at Life – August 2012

Virginia Beach, VA: Virginia Beach convention center hotel deal killed – February, 2012

There are many more articles for many more cities – but each story just confirms the speciousness of the arguments and the lack of metrics or proof of economic impact.

Some Background to the Mecca Farms Proposal

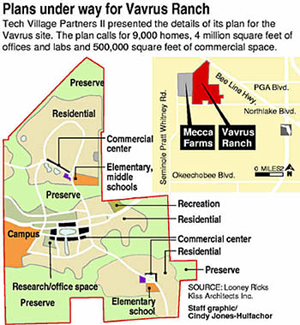

As the BCC considers the possible sale of the Mecca Farms property to the South Florida Water Management District, it is useful to consider the history of this site, and its relationship to the Vavrus Ranch which is just now being considered for development. (See: Blockbuster deal for Vavrus Ranch in the works)

The 1919 acre Mecca Farms, initially the preferred site for the Scripps Biotech industrial park, was to be accompanied by a residential development on the adjacent Vavrus ranch, presumably a “science ghetto” where the Scripps employees and their families would buy houses. Pushed by then Governor Jeb Bush and Commissioner Mary McCarty, the Business Development Board signed options for both parcels in 2003, prior to a final decision by Scripps. Scripps ultimately moved to their current Abacoa location when environmental lawsuits became a significant obstacle and a judge reversed the Corps of Engineers approval of the project.

According to Randy Schultz in the Post on May 25 (The best deal they’ll get):

Source:Sun Sentinel, 2/2005

As reported in the South Florida Business Journal in February of 2005, a division of Lennar held a joint option with Centex to buy Vavrus and planned 9-10,000 homes. The option was held by EDRI (Economic Development Research Institute), a nonprofit established by the BDB, who later transferred it to Lennar/Centex for $1.5M up front plus $51M on closing.

As reported in the Boca News on 8/3/2004, Mecca Farms itself was purchased by the county after a hastily convened meeting of four of the seven Commissioners voted 3-1 to proceed. Voting yes were Burt Aaronson, Karen Marcus and Mary McCarty, with Addie Greene voting no. The reason for the haste was that then Clerk Dorothy Wilkin was holding $1.4M of funds intended to clear the citrus trees off the site and the commissioners wanted to proceed.

Development got started early too, with Catalfumo Construction hired to build the roads on the site, and AKA services to build a 9 mile water pipe extension along SR7, 40th Street, 140th Street North and Grapeview Blvd. In total, the county spent $40M on planning and site prep and $51M for the pipeline, in addition to the $60M for the land.

The 2009 Grand Jury Report on public corruption in the county had this to say:

“The county eventually purchased the 2,000 acre Mecca Farms grove site for approximately $60 million dollars. Palm Beach County paid $30,000 per acre for land that credible evidence indicated was worth a maximum $10,000 to $15,000 per acre. With improvements to the site and area, the county expended approximately $100 million dollars to acquire and improve the Mecca site. Ultimately, Mecca Farms was never approved for development and the Scripps project was sited and built near Abacoa in Jupiter. Palm Beach County now owns and maintains at taxpayer’s expense the 2,000 acres of unimproved and undeveloped property known as the Mecca site.”

“The Mecca site transaction and other transactions lend credence to the perception of cronyism, unfair access and corruption of the land acquisition process. The Grand Jury repeatedly heard testimony of intense political pressure put on local government in land deals. Witnesses referred to the political atmosphere surrounding land deals as being a feeding frenzy.”

“The Grand Jury finds that a glaring deficiency in how land deals are handled by Palm Beach County is the overvaluation of property for purchase and undervaluation of property for sale or trade. A number of witnesses testified that when the county buys property, it overpays, and when the county sells property, it sells too cheaply. The Grand Jury examined a number of documents, received testimony and reviewed reports that support this buy high and sell low charge.”

The current offer for Mecca is $30M in cash plus about 1700 acres of land puported to be worth $25M. Mecca is appraised in the PAPA database at about $50M. The $30M cash is not sufficient to pay off the remaining $45M in debt incurred in the Mecca purchase (with $6.5M / year in debt service), nor will it recoup the $91M investment in infrastructure.

Vavrus is carried on the PAPA books as owned by WIFL, LLC. It is split into 11 parcels with a total 2011 appraisal of $68.5M and a taxable value of less than $1M.

With a Vavrus development now being considered, it would be helpful to know if the pipeline costs can be recovered by supplying the new development, and what affect (if any) a large development next to Mecca would have on its appraisal, and intended use by SFWMD for water storage.

The then ill-advised purchase of Mecca was rushed into without due diligence. Let’s not make the same mistake on its sale. In particular, let not a future grand jury say “..when the county buys property, it overpays, and when the county sells property, it sells too cheaply”.