Final Budget Hearing on 9/22

On Monday, September 22, the final county budget hearing will take place at 6pm at the Government Center at 301 N. Olive.

We still believe the Sheriff’s increase is much too large, but the show of support he mustered at the September 8 meeting has precluded any substantive discussion of the issue before the Commission.

And although Commissioner Abrams suggested they discuss a modest reduction in millage (and the size of the $44M tax increase) at the upcoming meeting, we do not sense the rest of them want to go there.

We therefore expect the proposed budget (4.7815 millage, $667M proposed tax) will be adopted.

For some thoughts on the growth in the Sheriff’s budget and the Commission’s inability to deal with it, see: On Oversight, Checks and Balances, and the County Budget

On Oversight, Checks and Balances, and the County Budget

Our system of government imposes an arrangement of checks and balances, so no person or group can acquire unchecked power.

When it comes to the county budget, Florida statutes clearly designate the legislative body – the county commission, to have the authority and responsibility to set priorities for spending and taxation. The administrator and his staff prepare a detailed budget, following whatever guidelines they have been given, and the commission meets in the sunshine for two workshops and two public hearings to discuss and adopt a budget before the fiscal year begins on October 1.

WIth $4B at stake, a bureaucracy exceeding 11,000 people, and limited time available, the commissioners themselves cannot physically evaluate every line item in this very complex budget, so they focus on insuring adequate funding for their own public policy priorities while much of the budget travels on automatic. Lower level line items like specific road projects, nature centers, or other items with a constituency, only get discusssed if the staff recommends a substantial change to the item.

What does get discussed every year is the Sheriff’s budget, since it is the major consumer of tax dollars, and outside the control of county staff.

Most everyone will agree that the function of PBSO – law enforcement, the county jails and courtroom protection, is necessary and should be adequately funded. The agency should have modern equipment suitable to the mission, and deputies and staff should be adequately compensated in line with peer agencies around the state and in the rest of the country, and it is the Sheriff’s responsibility to request a budget that delivers what he needs.

But what if his request is excessive?

In the county departments, managers submit budget requests that are a mixture of needs and wish list items. It is the nature of organizations to want to grow. The Administrator and his staff must adjust the requests of his departments in creating the overall budget, so that spending growth (if any) fits within the revenue expectations of the organization as a whole. If the priorities are not in line with the Commission’s expectations, they are free to make adjustments as a part of the process. Not all wish list items are funded. Although the other Constitutional Officers have a similar autonomy to the Sheriff, they usually “play nice” with staff and their budgets are rarely controversial. They are also relatively small.

The Sheriff’s budget is different. It is very large and complex, and very little detail is available to staff or Commissioners, and certainly not the public without a chapter 119 (open Records) request. The attitude is one of arrogance – “this is what I need and I am not willing to discuss it further.” Since the PBSO request must fit within the overall county budget, big increases there crowd out other county spending and severely limit the ability of staff or Commission to be fiscally responsible. Since they are charged with approving the budget, the public typically blames them for the excessive tax increases that result.

This year, many of the Commissioners told us privately that they agreed the Sheriff’s budget is out of control. They know they are responsible for approving his spending, but see no effective way to challenge him. This has been true for many years, as Commissioners have come and gone. While it is true that they have the statutory authority to reduce his spending (subject to appeal to the Florida Cabinet), they do not feel they have the political basis to do so.

This year, only Vice Mayor Paulette Burdick and Mayor Priscilla Taylor have publically questioned the Sheriff’s spending. This takes courage and we appreciate what they have said and done.

As for the others, they are hostage to an impressive political machine that can bring enormous pressure on wavering commissioners from the districts where the Sheriff provides most of the law enforcement. Just witness the array of speakers at the September 8 hearing – HOA Presidents, concerned citizens, even PBSO employees – all came out to speak the Sheriff’s praises and remind the Commissioners what the price of resistance would be. One particular Commissioner went so far as to admit that without the support of the Sheriff, their re-election would be in doubt.

There are about 1.3 million citizens of Palm Beach County. Almost 900,000 are voters. Yet only a small number of people follow what happens at the county, and fewer still participate in the process. We believe that most of the county residents would be surprised at the size and growth rate of the Sheriff’s budget, but they are not organized, and lack the time and assistance to provide sufficient cover to those commissioners who would act if they could. By carefully limiting the size of his increases, the Sheriff assures that we never reach that tipping point that would so outrage the citizens that they would spontaneously rise in opposition.

Some Commissioners have suggested that next year can be different, but we doubt it. As long as the status quo goes unchallenged, or the funding mechanism for the Sheriff’s office is modified through statute or charter, the Sheriff will continue to claim whatever portion of the county budget he desires.

First Public Hearing on 2015 County Budget

The first Public Hearing on the 2015 County Budget is Monday evening, September 8th, at 6:00PM at 301 N Olive, WPB, 6th floor.

Unchanged from June, the county proposes to keep the county-wide tax rate at last year’s 4.7815 despite a 7% increase in valuations, which will result in a tax increase of about $44M over the 2014 adopted tax. This follows a $23M increase last year.

These additional funds will mostly go to the Sheriff (67%), and BCC operations (driven by salary increases).

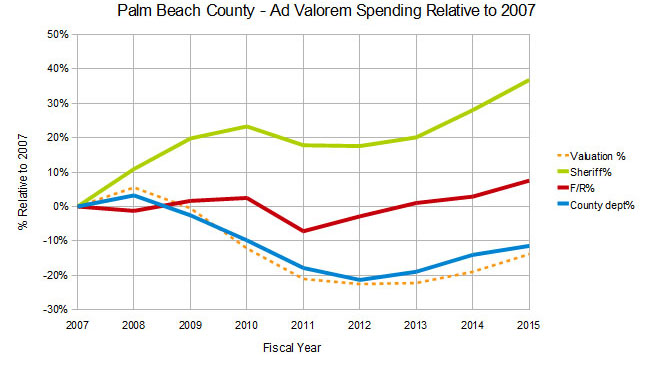

Note the growth in the Sheriff’s budget relative to other county departments. Those departments under control of the Administrator have tracked the valuation changes while the Sheriff showed no such restraint.

When the real estate bubble was expanding prior to 2007, the county budget grew by leaps and bounds, because a flat or mildly decreasing millage was easier to execute than raising it during the downturn. We are about to experience something similar. Back to back increases of $23M and now $44M is our warning. If not opposed now, the county spending will climb unrestrained. Some Commissioners (Burdick, Abrams, Valeche) see this. Others (Taylor, Vana) have embraced it. Returning even a small portion of the 2015 windfall to the taxpayer would set a precedent for the future.

The county is not alone in claiming all the valuation increase for more spending – most of the municipalities are following suit.

If you have a homestead exemption, it may appear that the tax increase on your TRIM notice is smaller than the 7% that the budget would project. This is because valuation increases in a single year are capped at the inflation rate (1.5% this year). Rest assured that your taxes will climb every year hence until you are “caught up”, even if valuations fall. This year, the difference is made up with higher taxes on commercial property and residences without the homestead exemption, for which the cap is 10%.

If you find all this troubling, let the Commissioners know you care about the growth in the county tax burden and spending. Attend the meeting on Monday if you can, or send them an email to BCC-AllCommissioners@pbcgov.org.

Let them know that we don’t want to return to the spending excesses of the last real estate bubble. A decrease of millage this year, sharing the windfall with the taxpayers, would be a tangible signal of responsible governance.

For some details of the 2015 budget, see: “2015 Budget – Flat Millage, what’s not to like? PLENTY!“