The Story of Spending

The Cost of the Protected Class

Arnold Schwarzenegger writes in the August 27, Wall Street Journal:

“…..At the same time that government-employee costs have been climbing, the private-sector workers whose taxes pay for them have been hurting. Since 2007, one million private jobs have been lost in California. Median incomes of workers in the state’s private sector have stagnated for more than a decade. To make matters worse, the retirement accounts of those workers in California have declined. The average 401(k) is down nationally nearly 20% since 2007. Meanwhile, the defined benefit retirement plans of government employees—for which private-sector workers are on the hook—have risen in value.

Few Californians in the private sector have $1 million in savings, but that’s effectively the retirement account they guarantee to public employees who opt to retire at age 55 and are entitled to a monthly, inflation-protected check of $3,000 for the rest of their lives. ”

“… I am under no illusion about the difficulty of my task. Government-employee unions are the most powerful political forces in our state and largely control Democratic legislators. But for the future of our state, no task is more important.”

Read the whole story HERE

A TAB Look at Fire / Rescue

What do we know about the Fire / Rescue Budget?

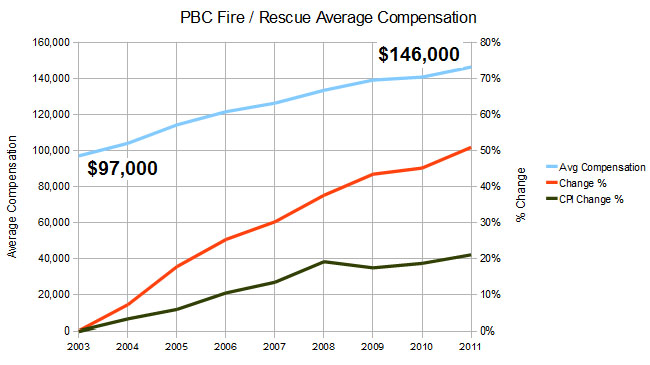

The most important thing to note about Palm Beach County Fire / Rescue is that the average compensation (all employees) is currently $140,000 per year and they are about to get another 4% added to that. This is with other county salaries frozen and private sector county unemployment at 12.1%.

For some perspective, see the Sun Sentinel article “Some government workers get generous raises despite dismal economy”

TAB believes that the raises should be deferred (saving $14M) or other spending reductions be put in place to achieve equivalent savings. Furthermore, the county should perform a comparison with other counties in the state and explain to the citizens why Firefighters in Palm Beach are so expensive.

The current 2011 budget has this line item for Fire / Rescue:

| 2010 | 2011 | Change | % | |

|---|---|---|---|---|

| Revenues | 126,617,751 | 152,101,082 | 25,483,331 | 20.1% |

| Appropriations | 346,986,345 | 360,758,193 | 13,771,848 | 4.0% |

| Countywide | 8,964,411 | 9,423,026 | 458,615 | (5.1%) |

| Net Ad Valorem | 211,404,183 | 199,234,085 | (12,170,098) | (5.8%) |

| Positions | 1542 | 1542 | 0 | (0.0%) |

| In FY 2011, Fire Rescue’s revenue increased by $26.9 million due to a $21.5 million increase in the balance brought forward, an increase in interest income, and an increase in the Main MSTU charges for services (primarily transport revenue). The increase in appropriations is due to to increases in personal services costs (Florida retirement rate, collective bargaining agreement across the board increases and long term disability rates). | ||||

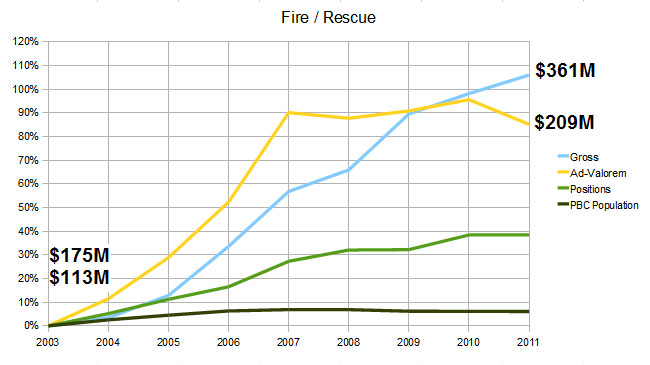

So the budget is being increased by about 4.0% and staffing is unchanged. Is that a good thing or not? To find out, we need to put several things in context. If I go back to previous budgets and plot the “Net Ad Valorem” and staffing from 2003 up to the current year, and place the Palm Beach Population growth line on the same graph it looks like this:

Note that while population stayed relatively flat (we now have only 6% more people in the county than we did in 2003, and it’s been declining since 2007), Fire Rescue staffing went up about 38% and spending went up 106%.

To put that another way, in 2003 there was one Fire Rescue employee for every 1087 residents and Fire Rescue charged an average of $145 per person, while in 2011 it will be one for every 833 residents and cost $281 per person (a 94% increase). Does this make us safer? We’ll look at that question a little later.

2011 Proposed Fire Rescue Budget Cuts

There are none. In fact, the collective bargaining agreement is giving employees an across the board raise of 1% in 4Q10, and 2% next year – with benefits, that is a 4% increase in personal service costs at a time that the rest of the county government is tightening their belts, and civilian unemployment is at 12.2%. Is that prudent?

Project Goals

Palm Beach County Fire & Rescue department is by far one of the most advanced and sophisticated in the Country. The department in it’s current form is not financially sustainable. Small and large changes should be considered to bring this budget back to a realistic working formula. The opportunity to investigate what can be changed is before us right now, for a short window of time. The collective bargaining contract with the Union will be up for renewal in the Spring of 2011. In order for any significant budget and organizational changes to be made, this negotiation must be handled by strong leaders that have the public interest in mind. We intend to . . .

- Search with great scrutiny the collective bargaining contract, review other contracts in Counties that are more fiscally responsible, identify wasteful and excessive items to eliminate. ( Click HERE to view the current contract. )

- Study comparable Fire & Rescue departments in other areas of the Country that are more fiscally responsible to highlight what they are doing differently. Palm Beach County is above the National average. Benefits and pay for the average PBC Fire & Rescue worker is over $140,000 per year.

- Change the new hire policies to reflect the growing need for a more reasonable retirement and benefits package. This should include age of retirement, as well as a change in benefits ( any that can be done on a local level).

- Work on policies that take advantage of the influx of military personnel that will be returning from duty in the near future. These men and women are already well trained in many useful skills and they have VA benefits that could reduce the need for many of their healthcare costs.

- Make proposals in common sense cost cutting areas, such as combining the fleet service with county fleet service, utilizing county communications and dispatch services in a more unified way, eliminating uneccessary vehicles, and replacing 3 full time videographers and photographers with interns from a local film school.

- Explore privatization of services. Provide case studies, and possibly propose a trial area for a test of these services.

- Propose the elimination of Kelly days and review the policy concerning scheduling to reflect the needs of the public, not the needs of Fire & Rescue workers to maintain other jobs.

- Review and eliminate the proposed capital projects that would replace or improve 10 fire stations that are currently not necessary.

- Look into costly and questionable policies concerning lobbying while on duty, including overtime pay in the final retirement formula, accumulating and getting paid for extra sick days, and taking advantage of “double dipping”.

We have a lot of work and research to do in this committee, and we will need to accomplish it before the bargaining agreement begins. Our team is committed to presenting all of our research to the Commissioners and staff and we expect a full review and consideration of all of these suggestions.We will provide the research necessary for this review.

TAB Proposal for Core Services

Proposal for Identifying and Prioritizing Core Services Provided by Palm Beach County

BACKGROUND

Palm Beach County is facing enormous financial pressures causing it to look for ways it can cut its expenditures. Lowering expenditures is necessary in order to avoid increasing, and hopefully decreasing, the rate and amount of taxes levied on taxpayers. Palm Beach County is not alone in facing difficulty in achieving a sustainable budget as counties all over the United States find themselves in similar or worse situations.

A July 16, 2010 Fox Business article described the situation as follows:

“For decades, state and local governments across the U.S. have conceded to the insatiable demands of both their constituents and the public employee unions whose contracts they negotiate and ultimately approve. The result has been unprecedented levels of service delivered through ever-expanding layers of government bureaucracy. Now many of these governments are broke and they find themselves under tremendous pressure to balance their budgets and facing intense heat from their constituents to not raise taxes.”

An elected county official quoted in the Fox Business article noted that his primary obligation as an elected official was to the taxpayers and rate payers of the county. His primary obligation is not to county employees, despite his close relationship with many of them. This is a philosophy that TAB suggests should also apply to Palm Beach County Commissioners when they are making budgetary decisions, as difficult as these decisions may be when they affect county employees.

The article goes on to note another commentary on the new focus of government in view of the economic situation faced by counties today:

Stephen Acquario, executive director of the New York State Association of Counties, said the writing has been on the wall for some time warning elected officials that a financial reckoning was just around the corner. The politicians, he said, have reflexively indulged what Acquario described as a “compulsion or a need to respond to constituent requests.” “But unfortunately the well has run dry,” he said. “Going forward we’re projecting the worst of all possible worlds, which is cutting services, layoffs and raising taxes.”

If there is a silver lining to all of this, and Acquario believes there is, it’s that governments are now being forced to look at the roles they play in the lives of the constituents they serve and to tailor those roles to fit the new economic reality. “We’re starting to ask ourselves at the county government level just what are the core services that county government should be providing. We can’t be all things to all people,” he said.

This is the new reality that faces the Palm Beach County Board of Commissioners. It must decide what role county government should play in the lives of Palm Beach County residents and identify the core services that the county government should be providing and which non-core services should be discontinued. These decisions need to be made without bowing to the insatiable desires of constituents or public employee unions. Times have changed and it is no longer for the Commissioners to make judgments based on what services and amenities they or the citizens would like to have. Instead, decisions must be based on what the county is required by law to provide, and no more.

Palm Beach County is not the only Florida county facing these financial pressures. The Hillsborough County Administrator’s Budget Message noted that he had undertaken “to seek new directions in service delivery and the County’s role in delivering these services.” He also noted that “use of one-time revenue necessitates action over the next twelve months to implement long-term solutions by identifying our priorities and determining how they can be met with recurring resources. Therein lies our greatest singular opportunity as a community to clarify the role and mission of local government in providing service to our residents.” He proposed consolidating functions across departments, and initiated an organizational restructuring process to reduce costs and improve service. This included merging three departments into one department. Other changes he proposed were to merge and integrate administrative, financial and human resources functions into a single Management Support Unit for the Aging Services, Children’s Services, and Health & Social Services Departments. Similar consolidation was implemented for Planning & Growth Management, Public Works and Real Estate Departments and for the Water Resource Services and Solid Waste Management Departments. The Debt Management Department was eliminated through a joint agreement with the Clerk of the Circuit Court. A variety of other programs are being studied over the next year to identify other ways to provide service at a lower cost to the County. (For more detail CLICK HERE )

County Executive, Pete Kremen of Whatcom County, Washington said the following in his State of the County Message this year:

“…the harsh reality is we can no longer operate as we have in the past. We know that for our families and businesses to survive, let alone thrive, they must be able to adapt and reinvent. Government cannot be exempt from this creative approach, no matter how difficult the task or how unpopular the decisions. We must take a long, hard look at the core operations of County government, enhance those services that work and serve our residents, and divest our government of those services that are simply no longer cost-effective or possible.”

TAB PROPOSALS

The first step for the Board of Commissioners is to identify those core services that the county should provide based on a defined set of characteristics to distinguish them from discretionary services and funding so that funding priorities can be established. Look at what the County is currently doing now versus what the original purpose of county government was thought to be.

What TAB proposes is adoption of an approach similar to the one currently used by San Mateo County in California to define Core Services:

The three categories of Core Services are the following:

- Services mandated by federal, state, or local law, including the County Charter and County Code of Ordinances

- Services essential to the health and safety of county residents for which there are no other organizations or institutions able to provide such services

- Services which provide infrastructure to support core services, i.e. administrative and support services

All other functions and programs constitute a discretionary service, not a Core Service, and all spending that is not required to deliver a Core Service is a discretionary expenditure and is subject to reduction or elimination. Additionally, even those services which are considered Core Services need to be examined to determine if they are being delivered in the most efficient and cost effective manner, and whether they are services which should be provided by county employees or whether they can be provided through outside sources at a lower cost while maintaining an acceptable level of quality. For more information on the San Mateo County approach, see San Mateo – Guidelines, San Mateo – Contracts, and San Mateo – Span of Control.

Alternative ways of identifying core services have been used by other county governments. For example, Core Services is a document developed by Buncombe County, NC in which each county service is listed along with the statutory or other mandate requiring it to be provided if such a mandate exists. This approach could be a template also for an analysis by Palm Beach County. Many other examples exist throughout the United States.

ADDITIONAL STRATEGIES TO CONSIDER

Additional strategies to consider, some of which are discussed in more detail elsewhere in the TAB materials, include the following:

- As an alternative to cutting a non-Core Service, identify any fee options which could allow the service to continue or alternative ways the service could be delivered through a different source.

- As an alternative to cutting a non-Core Service, identify ways to reduce the costs through outside contracting, partnerships with others, combining departments or services, or other arrangements.

- Review the comparability of compensation packages between county employees and outside resources capable of providing the same service.

- Consideration should be given to the long term impact on pension obligations imposed on Palm Beach County when comparing compensation packages offered to county employees versus compensation to outside sources and in the determination whether certain county programs are financially self-sustaining.

- Policies that could be adopted by the County Commission to increase revenue by prohibiting the waiver of certain fees, such as impact fees.

- All federal and state mandates should be reviewed and political and advocacy pressure should be used to reduce or eliminate them where appropriate.

- Determine where cooperation with local governments can eliminate duplicate services such as code enforcement, licensing, etc.

- Determine whether budget planning and development should be done biennially rather than annually.

- Develop a long range plan with which budget decisions must be consistent.

All services currently provided by the county should be identified and analyzed to determine where there are discretionary costs specific to each function or program operated by each county department which is funded by the county. The analysis should identify each budget unit, its functions, programs and services, and whether the services are mandatory or discretionary. Each budget unit should provide a description of each function or program, the approximate cost and authorized staffing at the current service level, the revenues the function or program generated, any required subsidies, and the amount of county discretionary funding.

Each budget unit should also list the discretionary functions and programs in priority order, from most important to least important, based on the mission of each department and identify the amount of funding flexibility it involves, e.g. some, most, or no flexibility. Flexibility would be defined as the ability to accept expenditure reductions for a particular function or program and still meet the minimum mandates associated with the function or program. Programs with no flexibility are those which cannot absorb any additional reductions and still meet mandated requirements. Finally, budget units must supply any negotiated requirements, such as collective bargaining agreements, existing leases, bond requirements, etc., that would reduce the ability to absorb reductions in expenditures. Finally, to the extent a budget unit provides services to another unit of government, any costs incurred in excess of the amount reimbursed by the other county unit should be identified so that the County is not subsidizing other government entities.

With regard to the resources required to offset the cost for each function or program, each budget unit must provide the amount of any required match or maintenance of effort requirement imposed to receive non-county revenues, or matches required for state or federal welfare funds.

Discretionary funding would be identified by subtracting any revenues and required match from the gross cost of the function or the program. The difference would constitute the maximum amount of county funding that could be eliminated without risking loss of other funding sources.

The county attorney’s office should make the determination whether each of the services is mandatory or discretionary. It will also be necessary to identity administrative and support service functions. For each function or program, the amount of discretionary funding must be identified.

SUMMARY

TAB recognizes that there is insufficient time in the remaining process for the 2011 Palm Beach County budget to develop and apply this type of analysis to identify possible expenditure reductions to any significant degree. However, even without this level of analysis and to the extent such discretionary expenditures are obvious, TAB urges the County Commissioners to cut expenditures wherever they can be readily identified as discretionary in the 2011 budget. TAB also requests that the Board of County Commissioners adopt a motion to direct County staff to conduct such a detailed analysis to give them the data necessary for the development of the 2012 budget.

Why TAB – Why Now?

County taxes and spending have been a concern for a number of groups and individuals over the years. Many have taken action and tried to slow the growth of spending, pointing out that it was dishonest and irresponsible to take advantage of inflated real estate valuations and homestead caps to run up double digit increases year after year. On balance, these efforts went nowhere. Those who benefit from county spending, whether they are richly funded special interests with something to gain, or loosely organized “user communities” of taxpayer funded programs, have pretty much controlled the agenda. No one who attempted to speak for the taxpayer has gained much traction.

In the most recent past though, conditions have begun to change. In four years, four county commissioners have been arrested and punished. An ethics commission and an office of Inspector General has been established. The community has begun to take notice of what happens in county government, just as they have awakened to the serious challenges we face from the unchecked growth of the federal government.

We are at a tipping point – almost half of Americans don’t pay income tax, but receive benefits from the other half who do. Government employees at all levels receive much higher salaries and benefits than those doing similar work in the private sector, and they are almost totally immune to layoffs when the economy turns sour for the rest of us. This is a trend that will not end well.

There is something in the air – something afoot. People are taking an interest, going to meetings, getting involved in political campaigns. There is a feeling that we are on a precipice and that if we don’t move quickly we will be swept into the void, that the country, the communities in which we live, are about to be irrecoverably changed. And some of us are resisting.

The tea party movement, which is a generic term, encompassing many different groups, large and small, has raised the banner of fiscal responsibilty, smaller government, and free markets. At the local level, we believe that this energy can be directed at righting the ship – at raising the awareness that something is wrong, and convincing the elected leaders of the community that the time has come when we must look at things differently.

It is against this backdrop that TAB has formed to try yet again to get some traction on county spending that has grown much faster than the local economy. The real estate bubble raised valuations so high that the temptation to follow them with government spending was irresistable, though foolish in hindsight.

This is a starting point. We are well aware of the budget issues that exist with the School Board, the Children’s Services Council, the Health Care District, the myriad other taxing authorities that for years have had a free hand. They are all on the TAB radar. For now though, we must focus on the budget under the control of the County Commission.

It must be emphasized that we are concerned with SPENDING, not taxes, fees, transfers, grants, or other sources on the revenue side. It is excessive SPENDING that is the problem – SPENDING within our means – solve that and the revenue side will take care of itself.

Our approach has 4 components:

- QUESTION – assumptions, staff, program recipients, other jurisdictions

- PUBLISH – our findings, analysis, speculation, conclusions

- ENGAGE – staffs, commission, constitutionals

- SUPPORT – provide cover and support for leaders who share our goals

WE WANT TO BE AN INDEPENDENT RESOURCE FOR LEADERS WILLING TO CHALLENGE THE STATUS QUO

WILL YOU JOIN US?

TAB Proposal Summary – A Work in Progress

TAB is working towards a proposal for specific cuts to the 2011 budget as well as broader measures in future years. The county Property Appraiser is projecting a further decline in property values of 6% or so next year and a somewhat smaller decline after that. We are also being artificially propped up by large amounts of federal stimulus (ARRA) spending, which will end shortly. The time has come to reverse all the years of double digit spending increases and better match the size of local government to the needs and resources of the community.

This page is a current look at the specific cuts we propose – both from the “green” and “blue” pages prepared by staff, and from ideas picked up as we make the rounds of the county and constitutional offices.

This page is a work in progress and will be updated regularly until we have a proposal package following the 9/2 public meeting.

Blue/Green Cuts

Note see the post “An Analysis of the County Budget Proposal – Part 1” for details on the Green/Blue pages.

| Rollback tax revenue | $612,486,522 |

| Green cuts | ($22,531,056) |

| Blue-1 (TAB version) | ($7,996,340) |

| Blue-2 (TAB version) | ($22,579,819) |

| Sheriff’s Challenge | ($3,000,000) |

| Resulting Revenue | $556,379,307 |

| Equivalent Millage | 4.381 |

Other Ideas

- Resist restoring Drug Farm, Eagle Academy, Park Police w/o equal PBSO cut

- Move water and SWA collections to Tax Collector ($?)

- Adopt Clerk suggestions for HR:

- Implement county-wide paperless payroll ($200K)

- Eliminate comp time for exempt staff ($600K)

- Eliminate Golden Palm awards ($177K)

- Eliminate or reduce Tuition Reimbursement ($350K)

- Eliminate incentive leave awards ($50K)

- Eliminate 4 day work week for exempt staff

- Eliminate car allowance for BCC staff ($250K/year)

- Stop PBSO take-home cruisers for out-of-county residence

- Adopt zero-based budgeting process

- Fire/Rescue choice – forgo 2011 raise or take furlough or staff reduction

- Separate Fire and EMS / take bids to outsource

- Eliminate COPS program in gated communities or where need is unjustified

Editor’s Note: An earlier version of this page incorrectly attributed some cost saving ideas to the Clerk’s office. This has been corrected, and TAB regrets any misunderstanding.

TAB Opposes Referendum for Continued Levy of 0.25 mills for School Board

PRESS RELEASE

Date: Mon, 16 Aug 2010

For your information:

The following email was sent to the PBC Commissioners. PBC TAB (https://pbctab.org) is against the extension of the .25 mills tax. We are for decreasing government spending in all aspects of Palm Beach County government. Three of the PBC School Board members voted against the referendum – so this was by no means a unanimous position on behalf of the School Board. The BCC’s role in this, other than passing it through to the Supervisor of Elections, is unclear.

To: PBC Commissioners

Subject: Palm Beach County BCC Agenda Item 6A-1 Resolution regarding Referendum for continued levy of 0.25 mills for School Board of Palm Beach County

Date: Mon, 16 Aug 2010

Commissioners:

PBC TAB strongly objects to the actions of the Palm Beach County School Board in voting for the continuation of an annual levy of 0.25 mills for school operational purposes for the next four fiscal years beginning July 1, 2011 and ending June 30, 2015.

The annual levy of .25 mill was a tax scheduled to lapse next year, unless put to a referendum. The tax, if continued, would be expected to generate around $32 million per year for the next four years.

Palm Beach County School officials already expect to get $38 million from last week’s $26 billion jobs bill, which they plan to apply to the 2011-2012 school year.

These are difficult economic times for Palm Beach County taxpayers. The next few years are expected to be equally difficult. Government needs to be cutting deeply and the Palm Beach County School Board is no exception. If it is possible for you, the Board of County Commissioners, to stop the referendum from going on the ballot, please vote NO.

Let this tax expire.

References:

Palm Beach County School Board Tentative Budget

Sun-Sentinel Article on Florida Federal Aid

An Analysis of the County Budget Proposal – I

TAB has a goal for this budget year to see the millage unchanged at 4.344. Since the staff proposals (green/blue pages) have been “vetted” and impact analysis performed, we have analysed those line items with an eye towards what would be reasonable and acceptable. As the green page reductions are achieved mostly through elimination of unfilled positions, they would seem to be a clear target. The blue pages (after some line items that would have strong public support are restored) are also acceptable and we believe would have little observable effect by MOST of the public. Therefore, TAB recommends the adoption of spending cuts totalling $56M as defined below, and the related elimination of 268 positions (2% of the county workforce) that could be accomplished through attrition. This does not quite achieve the flat millage, but we are continuing to seek the remaining $5M.

Introduction

The county budget is often analysed from the perspective of the “rollback rate”. This is the millage that would generate the same ad-valorem revenue as the previous budget year, given the current year’s estimate of property valuations. It is useful only in that whatever becomes the actual millage for that year can be compared to the “rollback rate” to see at a glance if the tax burden is growing or shrinking. It says nothing about the spending levels at all though, as other sources of revenue (eg. fees) offset spending across departments, and the budget can be actually growing while the tax burden (ad valorem) is shrinking. By the way – that is actually what is occuring this year – the budget appears to be growing.

It is difficult to see this clearly, because much of the budget documents focus on the ad-valorem numbers, and department level rollups in the documents don’t always match the top line figures because of the real-time nature of the process. That said, the July 6, 2010 workshop document shows the following county rollup on page A-17: (Click HERE to view the document.)

| Grand Total BCC Departments/Agencies, Judicial and Constitutional Officers | ||||

|---|---|---|---|---|

| 2010 | 2011 | Change | % | |

| Revenues | 1,061,922,162 | 1,170,404,859 | 108,482,697 | 10.2% |

| Appropriations | 1,981,557,651 | 2,037,313,337 | 55,755,686 | 2.8% |

| Net Ad Valorem Requirement | 919,635,489 | 866,908,478 | (52,727,011) | (5.7%) |

| Positions | 11,389 | 11,284 | (105) | (0.9%) |

TAB will attempt to look at spending in real terms, including such things as grants and particularly this year – the ARRA stimulus funds that the county received. (ARRA = American Recovery and Reinvestment Act). Our share of ARRA funds is in the vicinity of $110M and it has quite an effect on the budget (as you may expect). For this article though, we will analyse the budget using the information provided in the workshop documents and stick to the Ad Valorem measurements.

The Budget Proposal

As of the last budget meeting, at which time the maximum millage was set at 4.75 for county-wide taxes, the rollback rate was 4.8223, producing county-wide taxes of $612,486,522. Simple arithmetic tells us that this assumes a property valuation of about $127B. Therefore, a millage of 4.75 implies a reduction in ad-valorem equivalent from last year of $9.2M. To achieve the TAB goal of keeping the millage unchanged (4.334) would require a reduction of

$60.7M (coincidently – that is only $5M more than the budget was expected to GROW this year). So how would we get there?

County staff prepared a series of proposals for budget cuts, known by their colors – the “green” and “blue” pages. The green pages are relatively easy to apply – most savings can be had without cutting occupied positions or adversely affecting services delivery. They account for $22.5M in cuts.

The “blue” pages are harder, and are split into “level 1” ($10.4M and the elimination of 91 occupied positions), and “level 2” ($25.7M and 241 positions). Blue page cuts will result in some reduction of county services, some visible and needed.

Again, if we take up our calculator, we see that the sum of all these cuts is $58.6M – pretty close to what we need to keep the millage flat. Since the Sheriff has already been asked for another $3M, just to achieve the 4.75 millage – if that were to happen we would be over the top and have reached our goal. All without needing to look at capital projects or the details of the PBSO internals, or by trading up into the aggregate millage by seeking reductions in Fire / Rescue. Wow – how about that?

So what’s wrong with this picture?

The sticking point is that the “blue” pages require an actual reduction in staff – not just the cutting of “unfilled positions”. Real people will lose their jobs and have to enter the job market at a bad time for the economy. Of course that challenge is faced every day by businesses who can’t just maintain their staffing by raising taxes. Also, cutting staff means delivering fewer services. Some would say that the $400M that was trimmed from the budget over the last few years was not really noticed by anyone. Would this be noticed? Let’s analyse the green and blue pages by line item and see what is being proposed, and judge for ourselves if these are indeed “critical functions” that are part of the core mission of county government, or just some things that are not essential.

So let’s go through the staff proposals by area, and consider the effect of the cuts.

The Green Pages

The $22.5M spending reductions listed in the “Green Pages” are almost completely achieved by eliminating unfilled positions. Where an impact is noted, it would be because some growth in service level was anticipated in the area, or an attempt was being made to reduce workload on current staff. By definition, if the the positions are unfilled, then it is not likely that a service impact will be felt at current service levels. TAB recommends adoption of ALL Green Page proposals.

| Department/Program | Description | Savings | Positions | TAB Analysis |

|---|---|---|---|---|

| Financially Assisted Agencies | Reduce 5%, Eliminate funding for Culture Council | $1.6M | 0 | Not essential services. |

| Office of Community Revitalization | Reduce street light maintenance | $131,232 | 0 | No impact |

| Community Services | Adjustments with grant funded projects | $1,231,950 | 4 | Not essential or absorbed. |

| Cooperative Extension Service | Eliminate unfilled positions | $207,432 | 0 | No impact – positions were unfilled |

| Criminal Justice Commission | Reduce ad-valorem portion of staffing | $514,261 | 4 | Redundant or not essential services. |

| Economic Development | Reduce scale of programs | $309,105 | 0 | Questionable value – what are the metrics? |

| Engineering | Eliminate unfilled positions | $2,853,280 | 0 | No impact – positions were unfilled. |

| Environmental Resources Management | Reduce program scale | $1,692,707 | 0 | Work slowdown – positions were unfilled |

| Facilities Development and Ops | Eliminate unfilled positions, some procedure changes | $1,073,778 | 2 | Minor or no service level impact. |

| Financial Management and Budget | Eliminate unfilled positions | $99,936 | 0 | No impact – positions were unfilled. |

| Human Resources | Eliminate unfilled positions | $166,548 | 0 | No impact – positions were unfilled. |

| Information Systems | Eliminate unfilled positions | $2,772,681 | 0 | No impact – positions were unfilled. |

| Judicial | Various efficiencies | $1,446,985 | 0 | Little or no impact |

| Legislative Affairs | Eliminate unfilled position | $58,961 | 0 | No impact – position was unfilled. |

| Palm Tran | Change in fees and eligibility | $3,075,000 | 0 | Not essential service. |

| Parks and Recreation | Eliminate unfilled positions | $2,688,895 | 0 | None – postitions were unfilled. |

| Planning, Zoning, Building | Eliminate unfilled positions | $907,472 | 0 | No impact – positions were unfilled. |

| Public Affairs | Eliminate unfilled positions | $387,068 | 1 | No impact – positions were unfilled or moved. |

| Public Safety | Eliminate unfilled positions and juggle workload | $1,174,404 | 2 | Little impact – positions were unfilled or can be handled elsewhere. |

| Risk Management | Eliminate unfilled positions | $121,824 | 0 | None – duties absorbed. |

| Small Business Assistance | Reduce mission. | $21,533 | 0 | Not essential service. |

| GRAND TOTAL – GREEN PAGES | $22,531,056 | 13 |

The Blue Pages – Level 1

The level 1 blue pages contain $10M in spending reductions that require staff reduction of filled positions.

With the exception of the Parks & Recreation line item that would result in the closing of pools, parks and nature centers, most of the effect would be to spread work around or ask remaining staff to pick up the load – perhaps with longer delays for service, but in no way is public safety, gross customer satisfaction, or critical mission requirements compromised. In most cases, the reductions are not in what TAB would consider core county missions. TAB recommends adoption of all blue level 1 cuts (except those noted) for a reduction of $8M and 53 positions.

| Department/Program | Description | Savings | Positions | TAB Analysis |

|---|---|---|---|---|

| Financially Assisted Agencies | Reduce 5%, Eliminate funding for Culture Council | $1.6M | 0 | Not essential servcies |

| Financially Assisted Agencies | Reduce additional 5% over green pages | $569,000 | 0 | Not essential services |

| Community Services | Reduce veteran’s service 25% | $48,204 | 1 | Redundant or not essential services |

| Facilities Development and Ops | Eliminate 1 auto tech and reduce window washing | $101,000 | 1 | Slight increase in time to repair – ACCEPTABLE |

| Information Systems | Reduce staff by 5 positions (<3% of department) | $526,000 | 5 | Spread workload – ACCEPTABLE |

| Office of Community Revitalization | Sweep funds | $1,150,551 | 2 | No current impact – ACCEPTABLE |

| Office of Equal Opportunity | 25% cut without violating mandates | $60,000 | 1 | Reduces scope – ACCEPTABLE |

| Palm Tran | Raise Fees | $2,650,000 | 0 | Higher fees and lower subsidy – ACCEPTABLE |

| Parks and Recreation | Reduce staff and close facilities, defer maintenance, reduce public relations | $3,937,581 | 53 | TAB believes the beachs, pools, and nature centers are widely utilized by the public and should be kept open. Some ancillary and seasonal cuts are acceptable. TAB recommends restoring $2,426,000 and 38 positions from this line item. |

| Planning, Zoning, Building | Reduce planning functions to mandated levels | $218,560 | 3 | Planning function only – ACCEPTABLE |

| Public Affairs | Consolidate office services, reduce coverage of channel 20. | $400,000 | 13 | With major meetings still on channel 20, other cuts are ACCEPTABLE |

| Public Safety | Reduce hours in animal control, reassign work, reduce staff | $605,819 | 11 | Reduction is 3% of Public safety area – ACCEPTABLE |

| Small Business Assistance | Eliminate 1 specialist | $155,625 | 1 | 14% staff cut to non-essential service – ACCEPTABLE |

| GRAND TOTAL – BLUE PAGES LEVEL 1 | $10,422,340 | 91 | With TAB Restores: $7,996,340 and 53 positions. |

The Blue Pages – Level 2

The level 2 blue pages contain cuts that are more visible and significant than the level 1 cuts. That said, most of them are in areas that we do not consider “core county mission” and are acceptable spending reductions, except as noted. Cutting maintenance for traffic signal loops or curtailing mosquito control would seem to be silly, and closing the parks and pools is not acceptable to most residents. Therefore, TAB recommends adopting these cuts except where noted, for a total of $23M and 215 positions.

| Department/Program | Description | Savings | Positions | TAB Analysis |

|---|---|---|---|---|

| Financially Assisted Agencies | Reduce another 5% | $540,000 | 0 | Not essential services – agencies that receive FAA funds have other sources and can adjust their service delivery appropriately. | Community Services | Reduction of county overmatch on grant programs | $4,398,000 | 14 | These programs appear to get funding from grants and county contribution is not essential – ACCEPTABLE |

| County Commission | Decrease Commission Support Staff | 0 | 0 | A 33% cut in commissioner staff with no claimed savings would seem to be not helpful. |

| Engineering | Eliminate funding for signal loop maintenance | $285,000 | 0 | Would seem to be unwise. KEEP |

| Environmental Resources Management | Cutbacks in Mosquito Control | $200,000 | 2 | Would seem to be unwise. KEEP |

| Facilities Development and Ops | Eliminate various postions (3%) and outsource Electronic Security Services | $1,018,648 | 35 | Phase in outsourcing (50%) and keep receptionist. Restore $377990 and 16 positions. |

| Information Systems | Eliminate 9 positions (~5% of IT) | $1,192,000 | 9 | 5% can be absorbed in any IT organization by increasing exempt overtime. |

| Palm Tran | Eliminate unfilled positions, change fees | $2,863,225 | 2 | Fixed route Sunday service positions were unfilled. Other service cuts would need to be evaluated in larger context but they seem ACCEPTABLE. |

| Parks and Recreation | Further cuts that would result in closing of many visible facilities and programs and deferring maintenance. | $11,572,331 | 126 | As with the Parks and recreation cuts in level 1, TAB supports restoring the visible facilities that are open to all county residents. Of the 15 line items in this section, we would maintain funding for items 1 (rangers), 2 (nature centers), and 5 (pools), for a total of $2,217,073 and 24 positions. |

| Planning, Zoning, Building | Reduce code enforcement budget by 25% | $795,072 | 11 | Staff cuts will result in delays but not ommission of enforcement functions – ACCEPTABLE |

| Public Safety | Elimination of some ancillary services (youth affairs, victim services) and reduction in hours of animal control | $2,522,400 | 40 | Core functions remain operational and programs that are not “essential services” are curtailed – ACCEPTABLE |

| Small Business Assistance | Further staff cuts to SBA resulting in about half current level. | $275,000 | 2 | Providing assistance to small business, while helpful to those using it, is not a essential to county government – ACCEPTABLE |

| GRAND TOTAL – BLUE PAGES LEVEL 2 | $25,659,882 | 241 | With TAB restores, $22,579,819 and 215 positions. |

Summary

So, based on an analysis of the county staff proposed cuts, we believe that a serious reduction in county spending is possible, without drastically curtailing county services that the majority of the public has come to expect. Taking into account the cuts we would restore, TAB sees one possible scenario as follows:

| Rollback tax revenue | $612,486,522 |

| Green cuts | ($22,531,056) |

| Blue-1 (TAB version) | ($7,996,340) |

| Blue-2 (TAB version) | ($22,579,819) |

| Sheriff’s Challenge | ($3,000,000) |

| Resulting Revenue | $556,379,307 |

| Equivalent Millage | 4.381 |

So, we are close but not quite at flat millage. In part 2, we will examine where else we can find cuts.

Where does the $56M Budget Increase Go?

Did you know that the County budget is growing by $56M this year? Most of the attention has been on the ad-valorem amount (property taxes) decreasing, but the $107M in federal stimulus money is flooding the system (in the first quarter alone: CLICK HERE), causing the county to hire new staff and grow the overall appropriations by $56M. What happens to our budget when the stimulus ends??

First, here’s the budget at a glance:

| Grand Total BCC Departments/Agencies, Judicial and Constitutional Officers | ||||

|---|---|---|---|---|

| 2010 | 2011 | Change | % | |

| Revenues | 1,061,922,162 | 1,170,404,859 | 108,482,697 | 10.2% |

| Appropriations | 1,981,557,651 | 2,037,313,337 | 55,755,686 | 2.8% |

| Net Ad Valorem Requirement | 919,635,489 | 866,908,478 | (52,727,011) | (5.7%) |

| Positions | 11,389 | 11,284 | (105) | (0.9%) |

Now look at where much of the growth is occurring: (source is 7/6/2010 workshop package)

| 2011 Increase | % | Explanation | |

|---|---|---|---|

| Community Services | +$2M | +2.4% | Head Start ARRA Expansion grant – Net +11 positions |

| Environmental Resource Mgt | +$8M | +16% | ?? |

| Housing and Comm. Development | +$48M | +61% | $58M “Neighborhood stabilization grant” – net +8 positions |

| Palm Tran | +$10M | +8.5% | increase in federal grants |

| Econonmic Development | +$9M | +42.8% | Block grants |

| Fire Rescue | +$14M | +4% | increase in compensation – salary and pension from union contract |

| Tourist Development | +$3M | +7.5% | how spent? |

| Water Utilities | +$7M | +6.3% | “uncontrollable operating costs” and new services |

| +$101M |

It should be noted that some consider the federal stimulus funds as “free money” – that is, if we didn’t get it someone else would. There is truth to that given the current management of the federal government. On a local level, a prudent use of these dollars would be to smooth over the budget shortfall until economic conditions improve. Instead, (possibly because of the rules surrounding the grants), the funds are being used to grow the county budget, even adding staff in some areas that will have to be paid out of local dollars when the stimulus ends. Is that the right thing to do?

Notice of Public Meeting