Palm Beach Civic Association Sponsors TaxWatch Study

The Palm Beach Civic Association, in conjunction with the Town of Palm Beach County Budget Task Force (CBTF), is engaging Florida TaxWatch to perform a study of Palm Beach County capital expenditures, debt and reserves, and inventory of underutilized land and buildings. Funded half by the Civic Association with the other half being raised by task force member Jere Zenko, the project is scheduled to start shortly and be completed in time for use in the budget workshops during the summer.

TAB participated with TaxWatch and the task force (a TAB Coalition Partner) in defining the project scope.

Read the article on the subject in the Palm Beach Daily News: Civic Association helping town task force fund Florida TaxWatch study of Palm Beach County budget

The Florida TaxWatch Center for Local Government Studies conducts research projects and performs contract research of Florida City and County Governments and is located in Tallahassee. They performed a similar study under the auspices of the PBC Economic Council in 2006 which is available from their website HERE.

Smart Cap – Good for the State, Good for the County

The Florida Legislature is moving forward on a constitutional amendment for the 2012 ballot to limit state spending to a “growth factor” tied to inflation and population growth. A previous attempt in 2009 had included county and municpal governments in its scope, but that has been omitted this time.

We think it is still a good idea however, and could be implemented for Palm Beach County as a Charter Amendment. TAB plans to argue both for and against the various proposals coming forward during the charter review process. Since a Smart Cap is not likely to be proposed by the Board themselves, we want to raise this proposal now so it can be discussed and perhaps gather momentum.

This article examines the effect a smart cap would have had on the county if it were in place since 2003. The conclusions are:

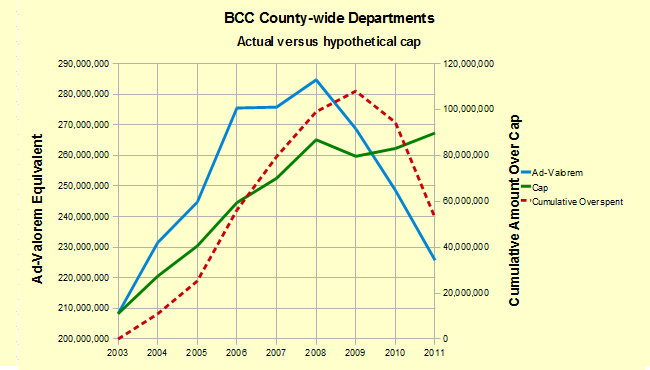

- The FY2011 ad-valorem equivalent for the county-wide departments is 15% less than a cap would have allowed. This is good and reasonable. It was achieved however, by significant reductions over the last three budget cycles, coming off a peak in 2008 that was 7% over cap, and a record of exceeding the cap in all but the last two years.

- It would have greatly restrained the growth in PBSO and Fire/Rescue, as their FY2011 ad-valorem equivalent exceeds what the cap would have allowed by 32% and 19% respectively. Since both of those organization’s budgets are primarily personal service costs, the existence of a cap would have limited the salary and benefit enhancements that were granted in the lucrative collective bargaining agreements that are now such a drag on the county budget.

- If a cap were to be imposed, it could be crafted in such a way that emergency overrides are possible.

- Although we are not enthusiastic about the overuse of federal grants for local projects, a county “Smart Cap” would not interfere with the use of such funds.

- There is precedent – both Duval and Brevard counties (and possibly others) have caps in place today.

For these reasons, we would very much like to see a county version of Smart Cap on the 2012 budget as a result of the Charter Review.

What is Smart Cap?

Senate Joint Resolution 958, introduced by Senator Ellyn Bogdanoff and approved by the Florida Senate on March 15, would place a constitutional amendment on the 2012 ballot to limit the growth in spending at the state level. House Joint Resolution 7221, an identical bill, has passed out of committee and is pending a floor vote.

Unlike a previous attempt at a Florida “Smart Cap” (SJR1906), introduced by now Senate President Mike Haridopolis in 2009 and applying to county and municipal governments as well, the current iteration would apply only to the state budget. It’s provisions (summarized in the staff analysis) are:

- Replaces the existing state revenue limitation based on Florida personal income growth with a new state revenue limitation based on changes in population and inflation

- Requires excess revenues to be deposited into the Budget Stabilization Fund, used to support public education, or returned to the taxpayers

- Adds fines and revenues used to pay debt service on bonds issued after July 1, 2012 to the state revenues subject to the limitation

- Authorizes the Legislature to increase the revenue limitation by a supermajority vote

- Authorizes the Legislature to place a proposed increase before the voters, requiring approval by 60 percent of the voters

It should be noted that the “revenue” that is capped is subject to some exclusions. It does not apply to Medicaid funds, revenue necessary to meet bond requirements, federal grants and some other revenues. The amendment would replace the current cap which is based on personal income. Currently, 32 states have some kind of statutory cap on spending.

Palm Beach County Smart Cap

On the county level, a “Smart Cap” could be instituted through a Charter Change amendment on the 2012 ballot. Would this have much effect on the budget?

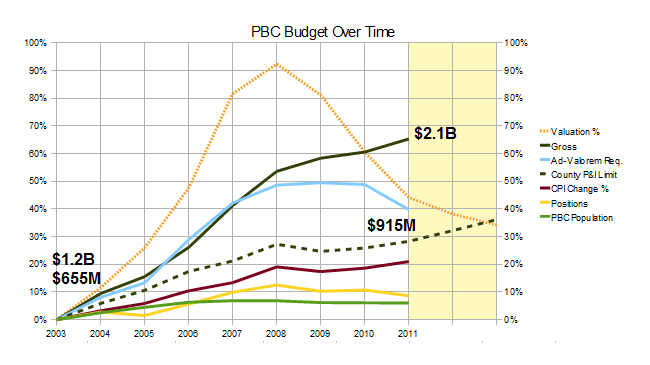

TAB has pointed out that the county budget overall has grown “11 times population growth and 3 times the rate of inflation” from $1.2B in 2003 to $2.1B in 2011. This tracks spending growth though, and is partly funded by revenue that under the state rules would be exempt such as federal grants. It also includes “fee for service” revenue that varies with the services requested, and other revenue that is department specific. For simplicity, we have chosen to look at the effects of a “Smart Cap” by analysing the “ad-valorem equivalent” amount at the department level. This number is the difference between the spending proposed by a department (appropriations), and the revenue it receives from specific sources like grants or fees, and is paid for by a combination of ad-valorem taxes and other “ad-valorem equivalent” revenues such as the sales tax.

The revenue cap at the state level is based on a “population and inflation” model, and sets the cap at last year’s revenue limit plus a growth factor. The growth factor is computed by combining inflation represented by the consumer price index (CPI) and the state population as used in other measures. In other states, most notably Colorado’s “TABOR”, the Taxpayer Bill of Rights, the cap was applied to the previous year’s revenue. Since revenue declines during a recession, this caused the cap to “ratchet” down and caused more spending reduction than was anticipated or desired. It was suspended for a period of time by the legislature to allow the economy to equilibrate. The Florida proposal does not have this problem since the growth factor is applied to the previous year’s cap – not the revenue collected (after a multi-year startup phase).

To see the effect had Smart Cap been in effect in 2003, we can compute the growth factor from that year’s budget forward to 2011, and compare it to the actual budget growth that occurred. The results show that while PBSO, Fire/Rescue, and the Supervisor of Elections all grew much faster than a cap would have allowed, the countywide departments are now comfortably 15% under what the cap would require. Bob Weisman has always maintained that his growth was “less than TABOR”, – and it was, if you only look at the endpoints. You just have to separate his budget from the others to see it clearly. The 8 year trend is shown in the following chart. Unfortunately, the overspending in the early years resulted in a cumulative overspend of about $50M.

County-wide Departments ad-valorem equivalent compared to a “smart cap”

The following table illustrates what the FY2011 budget (ad-valorem equivalent) would have been had Smart Cap been in place since 2003. The “Growth Factor” is computed by combining the change in CPI and the change in service population for the period 2003-2011, and is 28.4% countywide. Fire / Rescue has expanded their service area during the period from 641,000 to 807,727 by taking over municipal departments, so their growth factor of 52.5% reflects that change. Likewise, the Library system has grown their population by about 13% during the period, now providing service to 28 of the 38 municipalities for a growth factor of 37.2%.

The Sheriff has also grown the PBSO service area during the period by taking over law enforcement duties in Pahokee, South Bay, Belle Glade, Royal Palm Beach, Wellington, Lake Worth, Mangonia Park and Loxahatchee Groves. We did not adjust the PBSO growth factor however, because unlike Fire/Rescue, they are funded from county-wide ad-valorem taxes and the change in service area is offset by specific contract revenue from the towns and cities that have been absorbed. Corrections, court protection and law enforcement infrastructure (crime lab, SWAT, etc.) are funded by all county taxpayers.

| 2003 Ad-valorem Equivalent | Growth Factor | 2011 Cap | 2011 Ad-valorem Equivalent | Exceeded Cap By | |

|---|---|---|---|---|---|

| County-Wide Departments | $208M | 28.4% | $267M | $226M | -15.4% |

| Fire / Rescue | $113M | 52.5% | $172M | $205M | 19.2% |

| Library System | $26M | 37.2% | $36M | $38M | 6.4% |

| Constitutional Officers | |||||

| Sheriff | $236M | 28.4% | $303M | $400M | 32.0% |

| Clerk * | $31M | 28.4% | $39M | $12M | -69.2% |

| Property Appraiser | $14M | 28.4% | $18M | $18M | 0.0% |

| Supervisor of Elections | $5M | 28.4% | $6M | $11M | 83.3% |

| Tax Collector | $4M | 28.4% | $5M | $4M | -20.0% |

Note: The large reduction in the Clerk’s budget is a result of conversion of some ad-valorem items to a fee basis in 2005.

The eight year growth in spending has shown that portions of the county, including the county-wide departments and the constitutional officers (except the Sheriff and SOE) have been responsible in adjusting their budget appropriate to the size of the county population and consistent with price inflation. It should be noted however, that until the valuations began to decline after 2008 there was not much evidence of restraint.

We will examine the relationship of spending to the cap on a year by year basis in an upcoming article.

PBSO and Fire/Rescue on the other hand have grown way out of proportion, and most of the increase has gone into salaries and benefits for those covered under collective bargaining agreements. It is time to rein this in, and a Smart Cap Charter amendment is a way to do it.

Put Smart Cap on the ballot in 2012 and let the people decide.

The 2012 Budget – a Very Preliminary Analysis.

Although the first budget workshop is a couple of months away, and the department rollups won’t be done until next month, there are some inferences that can be drawn from the environment in which the budget is being prepared.

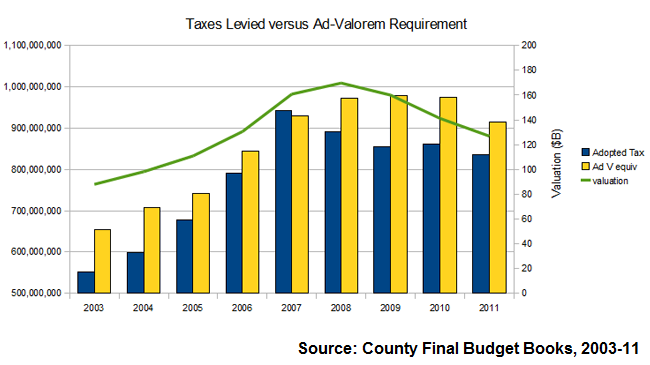

- Property values are expected to decline by 6%, but some new construction will offset that and the county is using a 5% decline as a working number. Since the 2011 valuation was approximately $127B, the 2012 number would then be $120.7B.

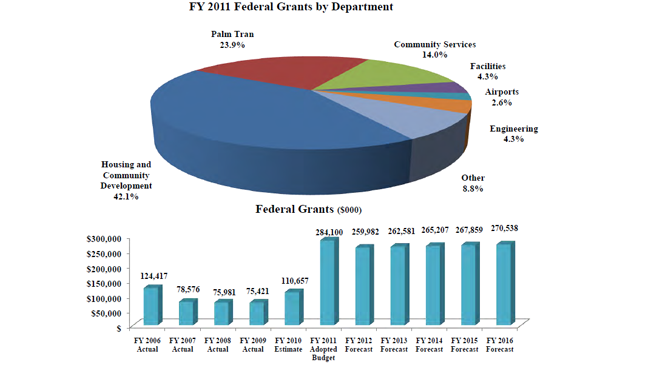

- The record $522M of intergovernmental (federal and state) revenue in the 2011 budget will likely be less this year – grants to local governments are under pressure both in Washington and Tallahassee.

- Expenses are rising in some areas – particularly in personal service costs. Step raises, longevity bonuses and other aspects of the existing collective bargaining contracts will add to the budget this year, even if most staff do not get raises.

- Revenue from non-ad valorem sources (eg. sales, bed, gas taxes) could also decline given the level of economic activity.

County staff expects to see about a $60M shortfall from these factors if the millage is not raised. Currently, county-wide millage is 4.75, yielding $603M, and the Fire/Rescue MSTU millage is 3.4581, yielding $179M. County Administrator Bob Weisman has signaled on several occasions (at the commissioners “off-site” retreat, and again at the 4/12 BCC meeting) that he would like to see rollback millage adopted, which by our calculation would be about 5.00 county-wide, a 5.3% increase. Achieving rollback would require about a $30M cut from the expected rollup. No millage increase, as previously noted, requires $60M in cuts.

At the off-site retreat, a majority of the commissioners requested that the first pass at the budget have no millage increase and directed staff to provide the list of cuts that are necessary to achieve it. TAB has some ideas in this area.

What is “realistic growth” in spending?

First, it is necessary to say that we believe holding the countywide millage at 4.75 (and the Fire/Rescue MSTU to 3.4581) this year is the proper decision. We have tracked county spending and tax collections from 2003 through the current year, and compared it to changes in county population and inflation – an objective measure of “appropriate” spending growth. During that time, gross spending (appropriations) has grown 11 times the population rate and 3 times the rate of inflation, and it continues to rise – an unsustainable trend. Ad-valorem requirements on the other hand, declined slightly in FY2010 and fell by about 6% in FY2011. This spending increase at a time of decining tax collection was possible because the spending was propped up by large infusions of intergovernmental revenue, including the federal “stimulus” known as the “American Recovery and Reinvestment Act” (ARRA). The $522M infusion in FY2011 compares to $239M in FY2009, a 218% increase in 2 years!

Note that we expect a reduction in intergovermental revenue this year – reflecting new realities in Washington and Tallahassee. County estimates of these amounts are overly optimistic however (see graph below taken from the Final FY2011 County Budget assumptions).

From 2003 to 2011, inflation measured by the consumer price index was about 21%. Population growth was about 6% overall. Combining those numbers would imply that a “realistic growth” figure for the county budget would have been 28.4%, not the 65% that spending grew, or the 40% increase in ad-valorem requirements. These numbers are the combined requirements of the county-wide, fire/rescue, and library taxing units, and aren’t completely fair since Fire/Rescue in particular serves only about 63% of the county and saw its service population grow 26% over the 8 year period. The Sheriff provides primary law enforcement to about 56% of the county, but any variations in PBSO service area is accounted for in the revenue received from those areas, and the entire county foots the bill for the Sheriff’s ad-valorem requirement. We are refining our P&I model and will have a better analysis as the budgets are developed.

It should be noted that for most of the last 8 years, the adopted tax (millage x valuation) was considerably less than ad-valorem requirement (see graph below). This reflects a spending down of reserves. As this is a management action divorced from either spending or taxation, we are using ad-valorem requirements for analysis, except where millage is discussed.

So from where would the $60M in cuts come? Much would come from Tallahassee in the form of FRS reform, courtesy of Governor Scott. Although the legislature has fallen short of where the governor wanted to go, the bills (HB1405 and SB2100) require an average of 3% contribution by participants in the FRS pension system (which includes all county employees). Pension reform is a complex area, and there are many differences in the bills (see Pension Bills Ready for Conference), but each bill contains the 2011 employer contribution as a percent of salary, which allows an estimate of the potential savings to the county. By our calculations, using employee salary data, this reform will save between $23M to $40M for the county ($16M – $30M against county-wide ad-valorem requirements alone). It also will save $28M-$39M for the school system.

| Group | Number of employees | Average Salary | Scott Proposal Savings | SB2100 Savings | HB1405 Savings |

|---|---|---|---|---|---|

| County Staff | 5,731 | $45.9K | $13.2M | $11.9M | $8.5M |

| PBSO (general risk) | 1,808 | $53.0K | $4.8M | $4.4M | $3.1M |

| Fire/Rescue (general risk) | 208 | $85.0K | $0.9M | $0.8M | $0.6M |

| Schools | 20,986 | $41.3K | $43.3M | $39.3M | $27.9M |

| TOTAL (contr.) | 28,733 | $62.2M | $56.4M | $40.1M | |

| Governor 2% accrual | |||||

| PBSO special risk | 2111 | $77.7K | $20.3M | $13.6M | $6.5M |

| F/R special risk | 1303 | $88.6M | 14.3M | $9.6 | $4.6M |

| TOTAL (accr.) | 3414 | $34.6M | $23.2 | $11.1M | |

| TOTAL (both) | 32,147 | $96.8M | $79.6 | $51.2M | |

| Schools Only | 20,986 | $43.3M | $39.3M | $27.9M | |

| County Only | 11,161 | $53.5M | $40.3M | $23.3M | |

| Copyright 2011, Palm Beach County Taxpayer Action Board | |||||

Further cuts could come from the areas identified last year in the “blue pages”. TAB had identified approximately $31M in cuts that could have been taken in these programs. Since PBSO is a larger (and growing larger) part of the county-wide budget, we believe that the Sheriff should match any cuts taken by county staff, perhaps even exceeding them as our preliminary calculations of population and inflation measurements show PBSO has grown much faster than the growth of their service population would require.

As the budget develops, we will be refining the TAB position.

SWA Board Selects Babcock and Wilcox

The Taxpayers won again – just barely.

After a 9 1/2 hour marathon meeting at the Solid Waste Authority auditorium on Jog Road, the SWA board upheld their selection committee’s choice of Babcock and Wilcox to build and operate the $600M waste-to-energy plant that is the biggest taxpayer-funded project ever undertaken in the county.

This was good news for the taxpayer since on the “future value” method of comparison by SWA consultant Malcom Pirnie, Inc., the $500M B&W bid was considerably lower than Wheelabrator ($626M or 25% more) and Covanta ($779M or 56% more).

But the day was not without drama, ending as it did with a 4-3 squeaker that had Commissioners Marcus, Vana and Burdick seemingly acting counter to the evidence presented, to spurn the low bidder in an attempt to “renegotiate” a price with their preference – Wheelabrator – currently at $126M (25%) over the B&W price.

This curious move by the three would have repudiated the unanimous decision of the selection committee that was led by County Administrator Bob Weisman, their high priced consultant Malcom Pirney, Inc., and the entire SWA staff – all of which worked for months to evaluate the very complex proposals. Why would they do this? Some in the audience seemed dumbfounded as what seemed a clear decision was suddenly thrown into chaos. It came down to a union issue for Vana and Marcus – they made it clear that they didn’t like Babcock and Wilcox partner BE&K very much, having been unsuccessful in the past in trying to force the company into signing a collective bargaining agreement with a local union. It was not clear why Paulette Burdick voted this way and she offered no comment or explanation. Their motion was quickly questioned by Commissioner Aaronson who did not see the wisdom of rejecting advice of consultant and staff.

The day began with a sizeable protest on Jog Road in front of the facility, and the road was parked in for a mile from the site. The red-shirted protesters, banging on drums and waving signs in front of the facility entrance, all wore identical shirts indicating that they didn’t like B&W partner BE&K, and they “wanted jobs”. When asked which of the bidders they wanted to win, some of the protesters told us they didn’t know or care – just wanted jobs with as much pay as possible. They couldn’t tell us who the bidders were – even though their shirts clearly had the letters BE&K in a circle with a slash through it. They would not tell us if they belonged to a union – they just “wanted jobs”. Another with whom we waited in line to enter the facility, an experienced pipefitter, was more knowledgeable. He was protesting the BE&K practice of hiring skilled labor from out of state. “They are owned by Haliburton” he said – “and you know what they are like”. (Editor’s note – this was repeated by several speakers at the meeting but to our knowledge was never true. B&W was spun off last year from parent McDermott International, which has participated in some joint ventures with Haliburton.)

In the meeting, the morning was consumed by a challenge to the B&W selection raised by Wheelabrator. The Wheelabrator legal consultant presented a polished, well argued accusation of B&W bid process violations, largely a repeat of the points made (and rejected) in the selection committee meeting in March (Today, the Taxpayer Won), followed by B&W rebuttal and an hour long exposition of the finer points by SWA attorney. This was resolved after much discussion on a 5-2 vote for Commissioner Abrams motion to deny the challenge.

In the afternoon, the public comment session heard from about 50 speakers at 2 minutes each. There would have been more but word spread that the deputies at the entrance to the facility were turning people away, saying the meeting and parking lot were full. Chairman Vana asked the SWA staff to get that stopped and allowed latecomers to talk, even if they had not submitted a card. The speakers fell in several main groups – 16% wanted to stop the project altogether, 18% opposed BE&K, 29% supported BE&K, and 37% “just wanted jobs”, without indicating a preference for bidder.

Each vendor was then given 15 minutes to present, followed by questions by the board members. Some of the morning’s session was rehashed, but much time was spent on the local hiring issue, and the amount of skilled and unskilled positions each company had committed to fill with local labor. Commissioner Aaronson pressed them all for much higher numbers, much to the delight of the crowd. Commissioners Vana and Marcus challenged the BE&K representative to confirm or deny that their “business model” precluded them from hiring union labor, and referred to discussions relevant to another project. The answer was that they will hire anyone with the requisite skills, they just will not sign a collective bargaining agreement that prevents them from hiring non-union from the same trade. Commissioners Marcus and Vana did not feel that was sufficient and implied that failure to sign a bargaining agreement was equivalent to rejecting union workers. (There is clearly more to this story but a fuller explanation could not be discerned from the public statements.)

Commissioner Aaronson found the concept of renegotiating the price (the only attribute that can be discussed under the terms of the RFP) as unfair as it allows another trip to the well. He questioned Covanta on why their bid was $279M higher than B&W and received “we made a mistake” for an answer. Indeed. Commissioner Taylor drilled in on some of the issues raised earlier in the challenge, particularly the partnership relationship between B&W and BE&K, and their insurance arrangements. Commissioner Santamaria pointed out that very few environmental organizations were objecting to the plant, including some he had specifically contacted. Commissioner Abrams on several occasions brought perspective to the discussion, reminding the others that the technical differences between the proposals were slight, the costs differences vast, and the local hiring percentages in the bids actually favored B&W over Wheelabrator.

It was a thorough and long session, and when it came time for a vote, Commissioner Taylor moved that B&W be “conditionally” awarded the bid, subject to firmer statement on local hiring. SWA Attorney pointed out that the terms could not be renegotiated, so Commissioner Abrams introduced a motion for outright award and Taylor seconded. It was at this point that commissioners Vana and Marcus said they could not support that motion and introduced their own – to award Wheelabrator and renegotiate the price. There was some surprise at this, both on the board as well as in the audience. After some additional arguments on all sides, Commissioners Aaronson and Santamaria joined Abrams and Taylor and voted to adopt staff recommendation for Babcock and Wilcox and the deed was done.

Another win for the Taxpayer.

County Votes to pay 35% of cost of Convention Center Hotel

This morning, the Board of County Commissioners voted 4-2 (Marcus/Aaronson/Vana/Burdick in favor, Abrams/Taylor against, Santamaria absent) to “conceptually approve” a county subsidy of $27 Million to The Related Companies to build a 400 room Hilton next to the convention center. They also approved $200,000 from the General Fund Contingency Reserves to fund consultant and legal services to further develop the proposal.

While most would agree that a hotel is needed to support the viability of the county-owned convention center (The Marriott across the street is considered too small to support large gatherings), the fact that no private entity was willing to take on the project without this large subsidy should be a red flag. The $27M is in addition to another $8M that the planners hope to get in the form of federal “New Market” funds (which may have to come from the county also) which together make up about 35% of the total cost of the $101M project.

So what does the county get for putting up 35% of the cost of the project and the use of the county owned land?

An ownership stake or revenue sharing? NO.

Jobs? – Yes, 350 construction jobs for 2 years and 300 permanent, low-wage hospitality sector jobs. (In other words, $35M buys 300 jobs at $117K per job – and those jobs will pay about a quarter of that.)

Ongoing tax revenue? – Yes and no. The annual $2.2M bond interest on the $27M ($2.7M if on the hook for $35M) is to be a recurring expense drawn from the ad-valorem funded General Fund, while bed tax revenue from the hotel would be restricted to non-ad valorem TDC programs.

Commissioner’s Aaronson and Marcus raised the issue that they were not able to bring the Florida Association of Counties convention to PBC because the convention center support infrastructure is lacking. This may be true, but Commissioner Abrams pointed out that the much larger Florida League of Cities has come to the county many times – although to Boca Raton instead of West Palm Beach. Both Commissioner Abrams and Taylor raised issues with adding this additional burden on the budget every year at a time we are striving to reduce spending, and pointed to the drain that the Scripps subsidy is to our current budget. Of course they were not on the commission when the convention center decisions were made. Commissioners Aaronson and Marcus on the other hand (who were) have invested their reputations in those decisions and of course want to spend more money to vindicate the original move.

Many people came forward to speak in favor of this project, particulary those in West Palm Beach who will clearly benefit. The Mayor was absent, but it was said she “supports the project”. I would hope so – having all the county taxpayers fund what will mostly benefit her city is quite a boon.

The decision is for “conceptual approval” and commits only the continuance of the planning, yet it is a clear ‘GO’ signal for the project.

We believe that for the county to have a successful convention center, a nearby hotel large enough to service a capacity convention is necessary. That said, for the county to contribute 35% of the construction costs and get no direct return on investment sounds like compounding an error. You may recall that the original proposal for the convention center never projected a county subsidy for a hotel, assuming that it would be a profitable project for the private sector. We would have preferred a smaller subsidy by the county, some contribution from the City of West Palm Beach, and a return to the General Fund of some of the subsidy, perhaps by converting a portion into a loan. Although some of the $1M in annual subsidy for the convention center itself could be reduced by an improvement in business, there are no guarantees.

The Taxpayer did not win today. Thank you Commissioners Abrams and Taylor for having the courage to try to stop this train.

Pension Bills Ready for Conference

Much has happened to the two pension reform bills winding their way through the Legislature this week. Both Senate Bill SB2100 (replacing SB1130) and House Bill HB1405 have survived a vote (mostly along party lines) in their respective chambers. As there are differences between the bills, a conference committee will attempt to resolve them, probably starting next week. Although they do not go as far as the Governor’s original proposal (no change to special risk accrual for example), the changes are significant and it is expected that Governor Scott will support the result.

HB1405 requires an across the board 3% contribution from plan participants, increases the retirement age (for those entering the system after July) from 62 (or 30 years service) to 65 (or 33 years service), and terminates the DROP program starting in July. Special risk classes would see the retirement age go from 55 or 25 years of service, to 60 or 30 years. It does not change the 3% COLA. Employer contribution rates are set for 2012 at 6.16% for regular class and 16.95% for special risk, with a “surcharge” of .25% and 1.17% respecively to address the unfunded actuarial liability. Click HERE for the details of HB1405.

SB2100 requires an employee contribution that is tiered, starting with 2% for income under $25,000, 4% for income between $25,000 and $50,000, and 6% above that. Cost of living adjustments (COLA) are eliminated on a pro-rata basis, eliminating any COLA for accruals after July of this year. Like the house bill it ends the DROP program, but not until 2016. Retirement age is increased as in the house bill for all except the special risk class which is unchanged. The Senate bill also addresses the calculation of “Average Final Compensation” (AFC), excluding all but 300 hours of overtime from consideration, and allows only 500 hours of accumulated leave time that was earned prior to July of this year. Employer contribution rates are set for 2012 at 5.09% for regular class and 13.8% for special risk, with no “surcharge” for unfunded liabilities, although there is a section in the bill that allows for this to be added. Click HERE for details of SB2100.

From a Palm Beach County Perspective, both of these bills will result in significant savings. By using the stated employer contribution rates (compared to the current 9.63% and 22.11% special risk), we calculate savings between $23M and $40M in the county budget, and $28M to $39M to the school system.

The county is facing a significant budget hole this year with rising costs and decreasing revenue from non-ad valorem sources (including state and federal grants) and a projected 5% decline in property values. These FRS savings could go a long way to offsetting the need for a millage increase in the 2012 budget year.

For some analysis and political perspective on these bills see House Backs State Employees’ Pension Reform on Party Lines Vote and Florida Senate moderates public employee pension bill

The following table illustrates the differences between the Original Scott proposal and SB2100 / HB1405 in their current state.

| Current FRS | Rick Scott Proposal | SB2100 | HB1405 | |

|---|---|---|---|---|

| Accrual Rates | 3% special risk 1.6% general + 3 others |

2.0% special risk 1.6% all others |

NO CHANGES to current plan | NO CHANGES to current plan |

| Participant Contributions | None | 5% across the board | Tiered 0-$25K, 2% $25-$50K, 4% $50K+, 6% |

3% across the board |

| Defined Contribution Plan | Offered, with few takers | Only option for new hires | Only option for new hires after July except special risk class | NO CHANGES |

| COLA | fixed 3% / year | Eliminated for accruals past July 2011 (protects current retirees and accumulated benefits) | Eliminated for accruals past July 2011 (protects current retirees and accumulated benefits) | NO CHANGES to current plan |

| DROP Program | Continue working for 5 years while pension accumulates, then lump sum | Eliminated after July, 2011 | Eliminated after July, 2016 | Eliminated after July, 2011 |

| Retirement Age | age 62 / 30 years age 55 / 25 years (special risk) |

age 65 / 35 years age 55 / 25 years (special risk) |

age 65 / 35 years age 60 / 30 years (special risk) |

|

| Copyright 2011, Palm Beach County Taxpayer Action Board | ||||

The following chart illustrates the effect the Scott proposal would have on the county budget, compareed to the Senate and House bills. Maybe it is time for the taxpayers to remind our legislators why they were elected.

| Group | Number of employees | Average Salary | Scott Proposal Savings | SB2100 Savings | HB1405 Savings |

|---|---|---|---|---|---|

| County Staff | 5,731 | $45.9K | $13.2M | $11.9M | $8.5M |

| PBSO (general risk) | 1,808 | $53.0K | $4.8M | $4.4M | $3.1M |

| Fire/Rescue (general risk) | 208 | $85.0K | $0.9M | $0.8M | $0.6M |

| Schools | 20,986 | $41.3K | $43.3M | $39.3M | $27.9M |

| TOTAL (contr.) | 28,733 | $62.2M | $56.4M | $40.1M | |

| Governor 2% accrual | |||||

| PBSO special risk | 2111 | $77.7K | $20.3M | $13.6M | $6.5M |

| F/R special risk | 1303 | $88.6M | 14.3M | $9.6 | $4.6M |

| TOTAL (accr.) | 3414 | $34.6M | $23.2 | $11.1M | |

| TOTAL (both) | 32,147 | $96.8M | $79.6 | $51.2M | |

| Schools Only | 20,986 | $43.3M | $39.3M | $27.9M | |

| County Only | 11,161 | $53.5M | $40.3M | $23.3M | |

| Copyright 2011, Palm Beach County Taxpayer Action Board | |||||

NOTE: Assumptions are: 1) contribution savings = total payroll x contribution rate, 2) special risk accrual going from 3% to 2% would drop employer contribution from 23.25% to 15.5% over time (2/3). 3. Payroll is projected from 2009 data. Employer contribution rates from bill text used if available.