County Tax Trends – Some Perspective

Posted by PBCTAB on September 7, 2013 · Leave a Comment

After several years of calling for flat millage, it is time to shift our attention to the tax dollars themselves.

Budget Hearings

Monday, 9/9 at 6:00pm

Monday 9/23 at 6:00pm

There is an old saying that “nobody washes a rental car”. When you own, it is more in your interest to maintain the value of your asset. Similarly, if a third party is paying for something that benefits you, you may not think about the “value proposition” or how much it costs because it is not your purchase decision. This is why health care inflation is high for procedures where a third party (government or insurance company) pays, but low for out of pocket items like plastic surgery or laser vision correction where you can choose the best value from competing practitioners.

When a government spends money, if it is directly tied to your tax bill you pay attention, but when the money comes from somebody else, “what difference does it make?”.

Spending at the federal level has been disassociated with individual income taxes for some time. With almost 40% of the federal budget coming from borrowed money, and less than half of the citizens paying federal income tax, it is hard to get too upset over another $10B for this or that, as it isn’t going to come out of your pocket any time soon. Even if it does concern you, federal taxation is difficult for a citizen to impact, given the way our Congress works.

Similarly, at the state level in Florida, with no income tax, a sales tax that is not out of line with other states, and much of state revenues coming from tourist taxes, state spending has little impact on the average citizen.

At the county and city level though, we are all aware of our property taxes (or our rent if we don’t own property). Over the years this link has been weakened at the county level as much spending is supported by user fees and “intergovernmental” revenue, which includes federal and state grants, and revenue sharing from sales tax, gas tax, and other sources. Currently only about 35% of county revenues (excluding fund balance) come from property taxes.

It is the changes in tax rates or taxes collected from you that you notice, not necessarily the level of county spending.

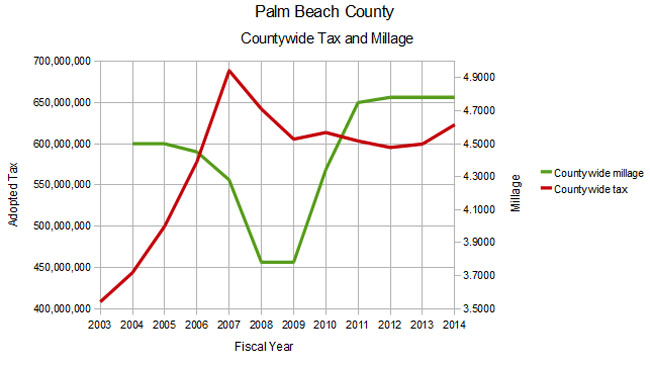

As the property valuations accelerated and hit their peak in 2007, tax rates were stable or declining, and the “wealth effect” associated with rapidly appreciating property masked the fact that taxes collected were skyrocketing. The adopted countywide tax in 2003 was $408M, but climbed to $689M by 2007. This was an increase of 13%, 16%, and 19% in the years 2005, 2006 and 2007 respectively, in a time when the millage or tax rate was decreasing.

The millage rate is widely reported. You see it on your TRIM notice as well as in the press coverage of the budget process. It wasn’t until this rate started soaring that people’s attention was drawn to it.

For the 2010 budget, adopted in September 2009, the millage increased by 15%. Many thought this outrageous, as our neighboring counties were booking much smaller increases, yet the countywide adopted tax dollars only increased by a tiny 1.3%. This outrage was widespread however, affecting the business community, realtors, grassroots groups and others, and led to the formation of TAB by the following year.

In 2011, in spite of some public opposition, the commissioners raised the millage yet again by 9%, but for 2012 – 2014 it was essentially flat. Taxes collected in those three years declined slightly until this year when a 3.9% increase (a $23M increase, most going to the Sheriff). TAB argued for flat millage during this period, and accepted another year of 4.7815, in spite of the increase in dollar amount. It is expected that this rate will be adopted during the budget hearings this month.

Governments do not typically throttle their spending voluntarily. Taxes and spending need to be scrutinized by the public, and objections raised when they get out of line. In a downturn (both in property valuation and lately in federal grants), it is in the nature of government to try to maintain spending levels rather than adjust them to match economic conditions if possible. Otherwise, programs have to be cut, layoffs are possible, and the recipients of government spending begin to organize.

We are now at a turning point. Next year, if valuations continue to rise, we will focus on tax dollars rather than millage, and argue that increases in spending should not exceed population growth and inflation measures. A millage reduction would be justified under that scenario. If valuations stay flat or decline, then we shall also oppose any millage increase.