Increasing Sales Taxes a Bad Idea

A little shy of two years ago, the County Commission voted 4-3 to reject a staff proposal for a ballot initiative for a half penny sales tax increase. This was the third sales tax attempt since 2012, and we are about to see the fourth attempt unveiled at the February 9th BCC meeting (Items 5D2, 5D3).

County Administrator Verdenia Baker has been shopping around her proposal for a half cent increase to fund “infrastructure” – roughly defined as roads, bridges, drainage, parks, and other physical items. The increase would last at least 10 years, and bring in more than $110M per year of new revenue for each 1/2 cent increase. The plan was defeated last time around partly because it was perceived as funding a “grab bag” of small unrelated projects, with nothing that would capture the imagination as a critical need. As one of the Commissioners put it – what is the constituency for road striping and drainage ditches?

Complicating matters this year is the “feeding frenzy” that is surrounding the whiff of new revenue. The School System, with infrastructure needs of their own, are also considering a half cent increase, and since “for the children” is more compelling than “for the drainage ditches”, the county would like to combine their request into a full cent that would be split with the District. So far the district isn’t buying it, figuring (rightly) that their chances are better alone. Not to be muscled aside, County Fire/Rescue, which is funded by its own taxing districts (county and Jupiter), has wanted since 2010 to convert some of its revenue flow from property taxes to sales taxes, and would like at least a half cent of their own. The 2010 proposal was turned down by the BCC over the complexity of dividing it up among the county and cities. And outside of the process (but perhaps thinking they can bring marketing skill to the ballot proposal), the PBC Cultural Council would like a piece of the action. The CC is funded today by the “tourist” bed tax on hotel stays and rental cars.

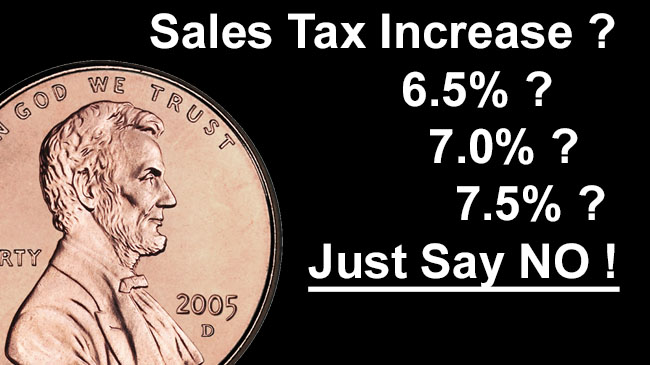

So is this potential 1-1/2 cent increase in the sales tax (to 7.5% if everyone gets theirs) justified?

Please consider:

- For the current fiscal year, the county-wide property taxes levied reached an all-time high of $730M, up 9.4% over the previous year, and up 23% in just 4 years, far exceeding inflation and population growth.

- Although the Sheriff’s portion of the budget increased by almost $30M, he deferred some capital spending into the next fiscal year and we expect an even larger increase in the 2017 budget – therefore the county will be considering another big property tax hike as well.

- Maintaining the infrastructure is one of the basic things we expect from government, and it should not need its own special revenue source – it should be given priority in the normal budget process.

- Sales taxes, by their nature generate revenue untied to specific spending needs and outside of the public budgeting process. This leads to a lack of oversight and wasteful spending.

- A portion of sales taxes (40%) by statute must go to the cities. Some cities are actively opposed to a sales tax increase, and others have budgeted responsibly and do not need additional revenue sources. This is a wasteful and inefficient way to generate county level revenue.

- For the county, the designated infrastructure “needs” are still a grab-bag of small unrelated projects, and not a compelling list of urgent priorities justifying up to $2.5B in new taxes over 10 years.

- The schools budget proposed at the state level by the governor will provide significantly more money for the school system next year, easing any need they have for more sales tax revenue.

- While a case could be made to shift some revenue from property to sales tax to capture more from non-residents (there is some of this in the Fire/Rescue proposal), neither the county nor the School District is considering a reduction of ad-valorem taxes.

We think raising the sales tax for any of the stated purposes is a bad idea, and if any of these do get on the November ballot, we think it will very likely be defeated by the already overburdened taxpayers.

If you agree, let the Commissioners know at BCC-AllCommissioners@pbcgov.org or speak at the meeting.

For TAB Articles concerning the various sales tax schemes of the last few years see:

- Mar 12 2014: Dodging a Bullet – No Sales Tax Referendum

- Mar 7, 2014: Another Go at the Sales Tax on Tuesday

- Dec 18, 2013: Dark Cloud of Sales Tax Referendum Hangs over the County

- Dec 11, 2013: Another Attempt to Raise the County Sales Tax

- May 11, 2012: “Half Baked” Tax Proposal put back in the oven for another year

- Apr 27, 2012: TAB Opposes Sales Tax Increase

- Dec 8, 2010: Fire/Rescue Sales Tax Surcharge to Make a Comeback

I am very much against any raising of the sales tax in PBC.

The county and the school board take enough of our money with very poor results. They will take the money raised from the proposed tax increase and spend it quite foolishly on themselves in raises, bonuses and useless “programs” and grants to their cronies. We should know by now that more money is not the solution to better education for our children.

The fellow that has proposed this new tax increase, the new superintendent, can’t even make the school buses run correctly and yet he wants more money for him and his overpaid under-worked cohorts to waste trying to make our schools better.

Enough already let’s get some people in to run the government that have a clue!!