2025 Budget Raises $125M in New County Taxes

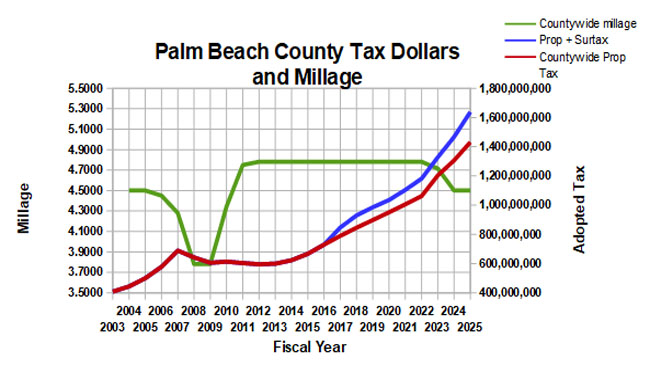

At the first public hearing on the 2025 PBC County budget on 9/10, the Board of County Commissioners (BCC) voted 6-1 to maintain a flat millage of 4.5. Commissioner Baxter was the sole holdout and argued that everything costs more now and with the large runup in property values, the taxpayers could have used a break by reducing the millage slightly. Last year, the rate was reduced about 5% from 4.715 to the current 4.5. There was no support for this position from the other board members as Commissioner Marino (who pushed for last year’s reduction) was not on board, and Mayor Sachs pointed out that the county expenses were higher too, and paying higher taxes is just an indication that your property is worth more.

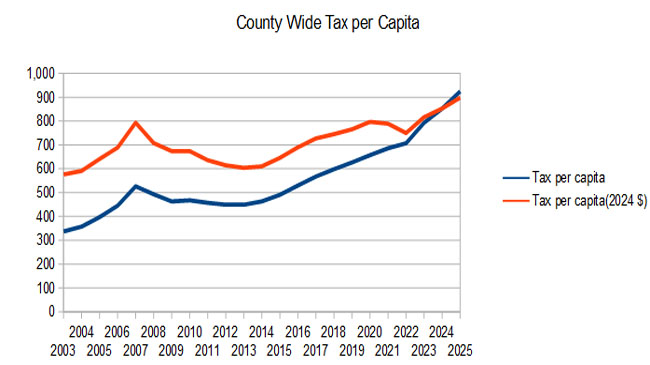

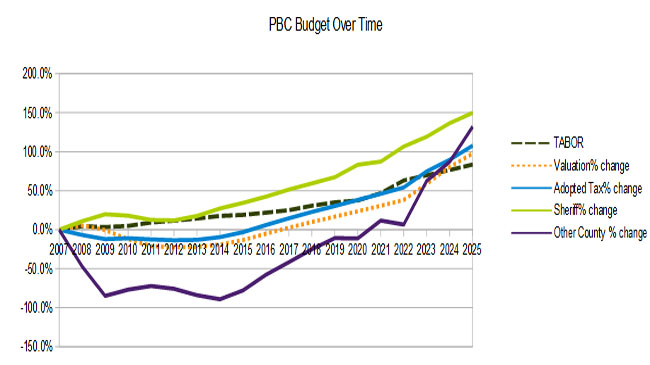

Flat millage is far enough above the roll-back rate so as to require a super majority vote. It represents an increase in collected ad-valorem taxes of about $125M, up 9.6% since last year. On an inflation adjusted per capita basis, each of our 1.5 million residents is responsible for $898 (2024 dollars). This is up from $646 just 10 years ago in FY 2015.

This year sees another 6% across the board salary increase (worth $18M) on top of 6% last year. County employees never have to worry about inflation.

Some other increases in Ad-Valorem expenses in this budget:

+ $70M for the Sheriff – this is a 8.0% increase, yet the PBSO share of the total budget has declined to 59.0% from a peak of 66.4% in 2020 given large increases in other county areas

+ $39M for Housing and Economic Development (+26%)

+ $97M for Palm Tran (+50%)

+ $39M in capital projects

+ $50M for budgeted reserves, to $1.9B (22% of planned expenditures).

+ $53M for Fire/Rescue operations

The supervisor of elections budget request has declined by $8M (-26%) as 2025 is an off year.

Total staffing is increasing by 110 to 12,536, with the biggest increases in Fire-Rescue (+27 to 1882) and PBSO (+16 to 4505).

The final public hearing will be held on September 17th at 5:05pm.