Trends in the County Budget

The first public hearing on the FY2019 county budget is scheduled for Tuesday, September 4 at 6PM.

As laid out in June, the county intends to keep the millage flat at 4.7815. With the updated valuations at around $188B, up 6% over last year’s $176.8B, that will give them another 6.2% to allocate to new spending and to reserves.

301 N. Olive Street, 6th floor.

Links:

The increased tax collections for 2019 will go primarily to salary and benefit increases (another 3% COLA across the board – for the fifth year in a row), a $31M increase for the Sheriff, 81 new positions being created, and the addition of about $20M to reserves. The reserve funding will bring the total unrestricted reserves up to about 9.2% of the gross General Fund budget.

As this is the seventh year of flat millage, it should be noted that the county-wide taxes collected in those years (FY2012-2019) increased from $595M to $898M, a 51% increase due solely to increased property valuations. That is an average of 7% per year.

The county implies in their budget package that the increases have been less than TABOR (population growth and inflation), but is that really true? It all depends on the base year you pick.

We at TAB have been following the trends in the county budget using data starting in 2003 – a 16 year stretch to the current 2019 Fiscal year.

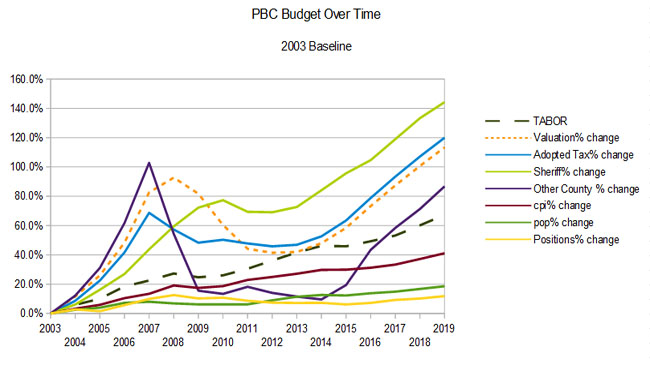

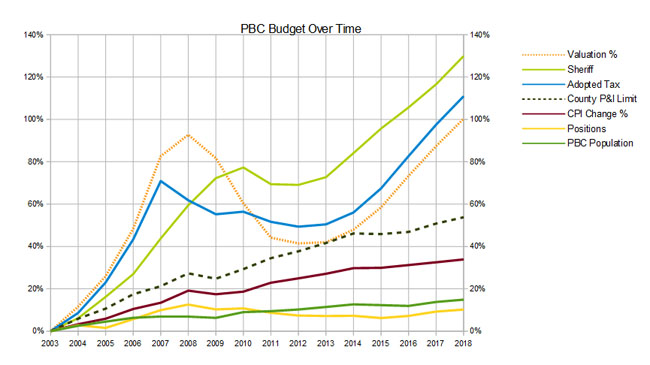

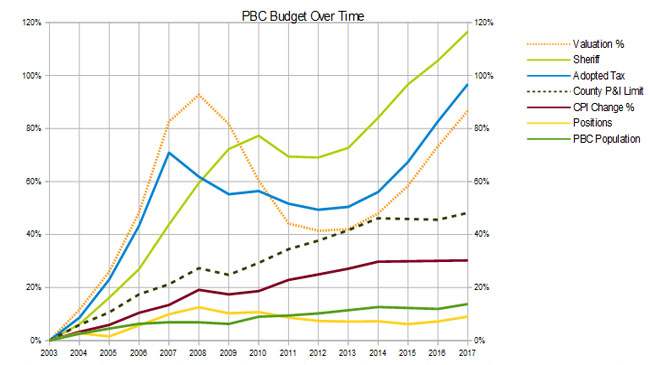

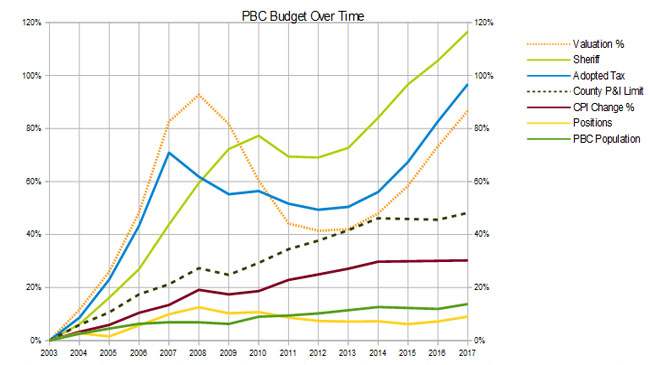

As the following chart 1 indicates, county tax collections significantly declined in 2008 and 2009, and did not really start to recover until 2013. This was due to a number of factors – real estate prices collapsed leading to the financial collapse of 2008, but a major effect on local governments was the legislative changes that made “save our homes” portable, an increase in the homestead exemption and the addition of more classes of property subject to caps.

Chart 1 – 2003 Base

Following the peak of 2007 (prior to which county taxes were expanding at an unsustainable rate), county-wide ad-valorem taxes, excluding the Sheriff, fell 43% in two years – a decline of $150M. This was accompanied by a drastic reduction in capital spending, and a gradual decline in staffing. As of today, we still have not exceeded the 2007 peak of non-Sheriff taxation. (The total ad-valorem tax level passed the peak last year). Referring to chart 2, you will see that until recently, although the Sheriff has always exceeded TABOR by a large margin, other county spending did not.

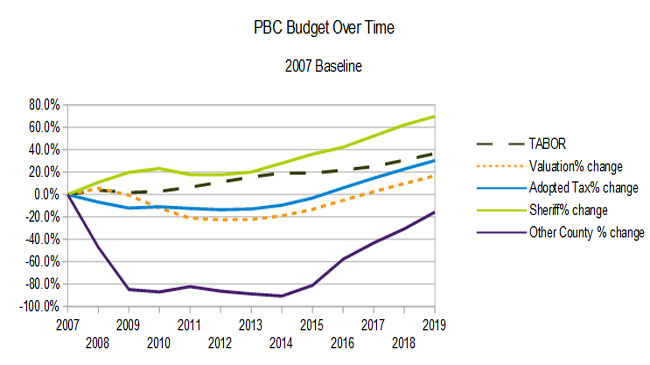

So, in order to make the current level of taxation not look so bad, the county uses the peak year 2007 as its baseline for comparisons. In the second chart below, you will see that using a 2007 base keeps total ad-valorem spending under the TABOR line, even when including the Sheriff’s budget, which now accounts for 64% of the total, down from a peak of about 70% in 2014.

Chart 2 – 2007 Base

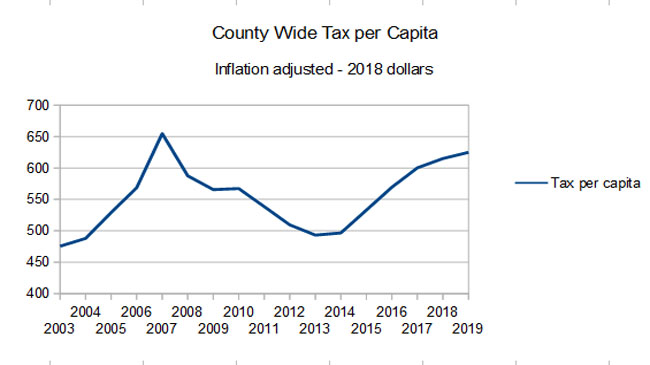

On a per-capita basis (inflation adjusted), the county taxes have increased from $475 to $625 since 2003 (in 2018 dollars). Since 2007 they have actually fallen from $655 to $625. (See chart 3).

Chart 3 – Per Capita Taxes

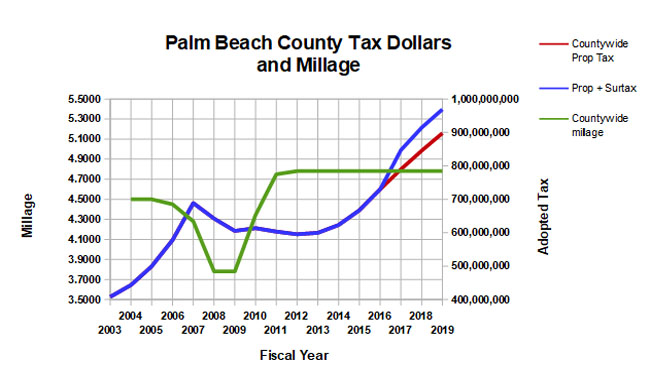

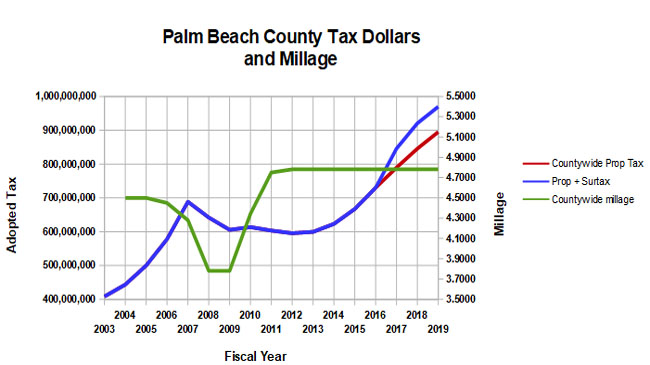

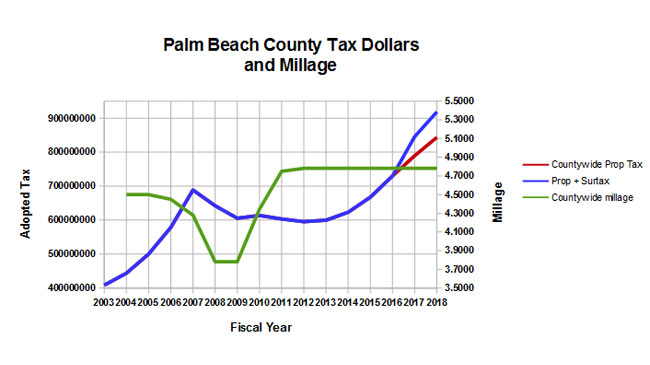

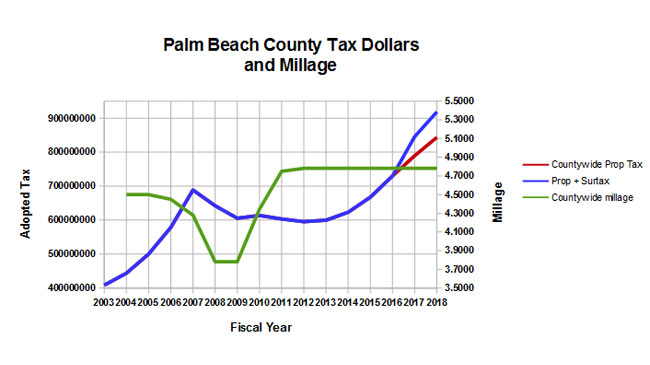

Chart 4 shows the millage and ad-valorem taxes over time. We also show the effect of the revenue from the sales tax surcharge passed by referendum. The 2019 surcharge will amount to about $71M.

Chart 4 – Millage and Taxation

2019 Budget Season Kicks off with June 12 Workshop

The proposed county budget for FY 2019 will be presented at the June 12 BCC workshop at 6:00PM.

Usually, the powerpoint presentation for the meeting is available along with the budget package a week before the meeting, but this year it is not, so we will have to wait for additional details.

301 N. Olive Street, 6th floor.

Links:

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year just shy of 6%.

Some items of interest:

- Valuations are estimated at about $187B, up about 5.7% over a year ago.

- With flat millage (4.7815), this valuation will generate $894.8M in ad-valorem taxes, up $49.2M (5.8%) over last year.

- There will be 81 new BCC funded positions.

- General Fund reserves are being increased to $128M, 9.2% of general fund revenues (was $107M, so up 19% over last year)

- A 3% COLA for all BCC employees will cost $6.5M. This is the fifth year in a row – a 16% across-the-board raise over 5 years.

- The Sheriff will see a $31M increase, which is a net $25.8M (+4.7%) considering carry-forwards and increased revenue.

- The Inspector General will see an increase of 4 positions next year, with 6 more over the following two years. The IG is funded now about 2/3 by the county – municipalities and others kick in about $1M.

- Library and Fire/Rescue will also see flat millage, yielding increases of $2.7M and $13.4M respectively.

Two fairly unusual things jumped out at us from the department level detail, that are not explained in the meeting package or anywhere on the county website. A call to the Budget Office cleared them up:

The supervisor of elections, which has had a flat budget in the $10M range over the last 5 years is jumping up to $22M – a $142% increase. There is not any noticeable increase is staff, so we assumed it must be for equipment or other needs. Robyn Lawrence, Assistant Budget Director explained that the $12M is for scanners, modems and other equipment upgrades.

Likewise, an unexplained change is occurring in the Tax Collector’s budget – a $5.5M decrease from $14.5M down to $9M. This reflects money allocated for a facility being recast as capital spending.

First of two Public Hearings on 2018 Budget on Tuesday 9/5

On Tuesday evening 9/5 at 6:00PM, the County Commission will hold the first of the two required public hearings on the budget for the 2018 fiscal year.

Links:

There are no surprises, as the budget presented in the June and July workshops is essentially the same. At the July meeting, the maximum millage was set at 4.7815, unchanged since 2011. The county staff again proposes to take full advantage of another rise in property values by continuing the 4.7815 millage rate and reaping a tax increase of $56M, up 7.1% over last year, for a total ad-valorem tax levy of $846M. (NOTE: For comparison, we use the stated spending levels in the adopted budget from the previous year, not rollback. General fund ad-valorem taxes in the last budget year were $789.6M, hence the current budget is up 7.1%.)

There is no discussion of reducing millage in recognition of the $75M windfall from the sales tax surcharge. When property tax is combined with the yearly surcharge revenue, the total take of $921M is up 54% over the last 5 years.

This is the fifth year in a row of a 3% across the board pay increase for all employees, representing a raise of 16% since 2013. The Sheriff, as usual, gets a 5% increase and at $542M, now represents about 53% of the total countywide net ad-valorem spending (exclusive of the dependent districts – Fire/Rescue and Library).

The graph below shows the trend in ad-valorem taxes and millage since 2003, with the sales tax surcharge added to put it in perspective.

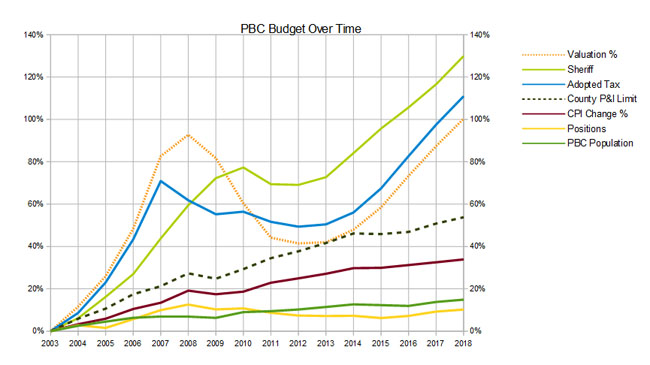

The next graph shows the budget over time compared to the valuation curve and the “TABOR” line. The orange dotted line is valuation which has just doubled since 2003 and is at a new peak for the first time following the 2008 “crash”. Note that the Sheriff’s budget has shown little restraint and has only declined once in 15 years – it is now up about 130% since 2003.

The “TABOR” line (green dotted “County P&I limit”) reflects the combination of inflation and population growth over time and is a model for what responsible budget growth would look like. TABOR would suggest a growth in taxes of about 54% for the period. Although not shown on this graph, if the Sheriff’s budget is subtracted from the total, the budget for the rest of the county departments has not exceeded the TABOR line, clearly indicating where the problem lies.

For more information, see the First Public Hearing Package.

New Budget up 6.9% with Flat Millage

On Tuesday evening 6/13 at 6:00PM, the County Commission will hold the first budget workshop for the 2018 fiscal year.

Links:

There are no surprises. As they have done for the last 5 years, the county staff proposes to take full advantage of another rise in property values by continuing the 4.7815 millage rate and reaping a tax increase of $54M, up 6.9% over last year, for a total ad-valorem tax levy of $844M.

There is no discussion of reducing millage in recognition of the $75M windfall from the sales tax surcharge. When property tax is combined with the yearly surcharge revenue, the total take of $919M is up 53% over the last 5 years.

This is the fifth year in a row of a 3% across the board pay increase for all employees, representing a raise of 16% since 2013. The Sheriff, as usual, gets a 5% increase and at $542M, now represents about half of the total countywide net spending from property taxes.

The graph below shows the trend in ad-valorem taxes and millage since 2003, with the sales tax surcharge added to put it in perspective.

The next graph shows the budget over time compared to the valuation curve and the “TABOR” line. The orange dotted line is valuation which has just doubled since 2003 and is at a new peak for the first time following the 2008 “crash”. Note that the Sheriff’s budget has shown little restraint and has only declined once in 15 years – it is now up about 130% since 2003.

The “TABOR” line (green dotted “County P&I limit”) reflects the combination of inflation and population growth over time and is a model for what responsible budget growth would look like. TABOR would suggest a growth in taxes of about 54% for the period. Although not shown on this graph, if the Sheriff’s budget is subtracted from the total, the budget for the rest of the county departments has not exceeded the TABOR line, clearly indicating where the problem lies.

For more information, see the Budget Presentation and the Budget Package.

Proposed sales tax hike raises discourse at Palm Beach political forum

Tab Point of View Presented at PBCA Candidate Event

VOTE NO on the SALES TAX

Shortly, the Economic Council and others will be spending over $200,000 to convince you that the county sales tax should be raised to 7%. You will hear that the infrastructure is crumbling, that the children are sweating in their classrooms with broken air conditioners, that the roads have potholes and the bridges are falling down. You will hear that a sales tax is good because 25% of it will come from tourists, and that tens of thousands of jobs will be created to rebuild those roads and bridges, county buildings, the jail and the parks.

Don’t be fooled. This 17% increase in the sales tax will generate much more revenue than is arguably needed to repair the infrastructure that was neglected by conscious choices of county staff and commission. Over the last 5 years, the ad-valorem budget has grown 33%, yet Engineering and Public Works only saw a 3% growth. At the same time, the Sheriff’s budget grew by 28% and county employees saw 12% in across the board raises (3% / year for 4 years). These conscious choices indicate that those running our county and school system were willing to defer maintenance until a pitch could be made for a new source of revenue.

A bond issue could have funded the critical needs. Instead, they want a sales tax that will generate $2.7B over 10 years whether it is needed or not. Do not doubt that they will spend every penny.

1. A 17% increase in the sales tax is a net tax increase of $270M per year, with no offsets to property taxes.

2. It is regressive and will affect low income residents the hardest.

3. It is not subject to the scrutiny applied to the annual ad-valorem budget.

4. It creates an incentive to purchase outside the county (Both Broward and Martin are at 6%, many internet retailers do not collect sales tax).

5. It is not an “infrastructure maintenance tax” but includes many new capital projects.

6. Unlike an infrastructure bond that would raise just enough money for critical needs, this granular tax generates a specific amount of money, and low priority projects will have to be funded in order to spend it all. Like previous proposals, it is a grab-bag of projects, many of which would never be done without a “must spend” windfall.

7. Charter schools get nothing.

8. Many of the municipalities (PBG, Boca) didn’t want the money.

9. It comes on top of the largest ad-valorem tax haul at the county level in history, up 8.2% over last year and up 33% since 2012. If passed, the 2017 equivalent tax hike would be 18%.

10. Over the last 5 years, the county has consistently underfunded engineering and public works (+3%), while increasing the Sheriff’s budget by 28% and giving across the board raises to employees of 12% (3%/year for 4 years). When the overall ad-valorem budget increased by 33%, engineering saw a total of 3% in 5 years. This was a conscious choice.

Don’t be an enabler!

Final County Budget Hearing This Evening 9/19

At the first September budget hearing, the Commission unanimously adopted the 4.7815 millage – unchanged for 6 years, and tonight they will make it official.

When this tax rate was first set for the 2012 fiscal year, the countywide ad valorem tax was $595M against a valuation of $124.6B. This year, property valuations have greatly recovered and now total $165.1B. At that level, this millage will generate $790M – up 33% in 6 years, 8.2% in this year alone.

OVer those 6 years, there has only been about 4% inflation and population has grown about 3%. The average household income throughout Palm Beach County grew about 6%.

The government did much better. County employees saw across the board raises of 3% for 4 years in a row (12.6%), and taxes went up 33%.

Remember this growth in taxes – far in excess of inflation and population growth, as you consider whether a 7% sales tax makes sense. If passed, the tax will provide another $70M per year to the county government – larger than the $60M increase in this year’s ad-valorem.

Public Hearing Tuesday on 2017 County Budget

Links:

On Tuesday 9/6 at 6:00 PM, the County Commission will most likely vote to leave the millage unchanged for a sixth year in a row, accepting the tax windfall from rising valuations.

The numbers are slightly higher than the June package as the valuations have been adjusted up slightly to $165.1B – 97% of the all time peak that occurred in 2008. This year’s tax take of $790M is up 8.2% over last year and up 33% in the 5 years since 2012.

Highlights of the budget include:

- a 3% across-the-board salary increase for all employees (on top of 3% in each of the last 3 years). Note that this 12.5% increase for county employees came during the 4 year period when the county average household income only went up about 4%.

- 62 new positions. County staffing has grown by 286 in the last 4 years to a total of 11,202.

- A $28M increase for the Sheriff. The Sheriff now accounts for about 48% of the general fund total appropriation budget.

- A 4.7% decrease in the budget for Engineering and Public Works.

Note that there is nothing in the budget for revenue and appropriations associated with infrastructure projects that would be funded by the proposed 1 cent sales tax surcharge. If the tax were to pass, the county would receive about $70M per year – about $10M more than the amount of the increase in this year’s property tax. When added together, the total tax increase would be 18% in 2017.

First 2017 Budget Hearing on June 14 at 6pm

In an unrelenting desire for ever more taxpayer money, the county Administrator has proposed a $57M tax increase for the next fiscal year, which will be in addition to about $75M per year that the county will get from the sales tax if approved by the voters.

This is just greedy.

Links:

At $787M, up 7.9% over last year’s county-wide operating tax haul (which was the highest in county history), this budget will surpass the peak tax during the real estate bubble by almost $100M and is up 32% from the post-bubble low of 5 years ago.

During these last 5 years, inflation (measured by the consumer price index) is up only 4%, and the population has grown by only 3%. So why do they need to increase taxes by 32%?

One reason is employee raises – cost of living raises across the board of 3% each of the last 4 years (did you get a 12.6% raise over the last 4 years?).

Another is the insatiable appetite of the Sheriff. The current budget of $511M is up from $394M in 2012 – an increase of $117M (30%) in 5 years. Maybe PBSO needs it to pay for all those use-of-force lawsuits they have been losing lately.

Not part of the county-wide budget, but paid by those in their service area, county Fire/Rescue is also up 30% in those 5 years.

By keeping millage constant since 2012, they have been able to ride the increase in property valuation that has almost (but not quite) returned to its 2008 peak, at $164.5B.

We think the millage should be reduced this year. If they really expect the sales tax increase to pass in this interesting “anti-establishment” year, then show some confidence by reducing the ad-valorem burden.

In the above chart, the dotted orange line shows what has happened to property valuations – peaking in 2008, dropping to a low in 2012, and then climbing almost back to the peak. The dotted green line is a combination of population growth and inflation – a measure of “reasonable” tax growth. Comparing this to the blue adopted tax line, you can see how much more our taxes have risen over what is reasonable. And of course the green “Sheriff” line is a tale unto itself.