A Commissioner Takes on “Exigent Operational Necessity”

The Palm Beach Post is looking out for the taxpayer.

Last week we mentioned that Rhonda Swan raised the issue of the county’s interpretation of “exigent operational necessity” as it applies to the PBSO Career Services Act in an editorial.

This week, Jennifer Sorentrue brings it up in the context of the Sheriff’s budget dispute with the county, and quotes Steven Abrams: “It would seem to boil down to whether our current budget situation qualifies, Commissioner Steven Abrams said recently. “I personally believe it does.”

We know of one, perhaps two other commissioners who also differ with County Attorney Denise Neiman’s interpretation of the statute that “it is not necessity until the county is out of money”. Or, in the words of Ric Bradshaw: ‘The county would have to be “almost insolvent” before he could freeze employees’ pay, in his view. “If I was to freeze the pay plan, the union could come in here and take me to court,” Bradshaw said. “You can’t just violate the law because you want to.”

Will the commissioners push the issue? – we really hope so. The time has come for the Sheriff to tighten his belt like everyone else in the county – including the county staff who haven’t seen raises in quite a while.

For Jennifer’s excellent article, see: Palm Beach County, sheriff at odds over raises

Exigent Operational Necessity?

Writing in the Palm Beach Post on Friday, editorial writer and columnist Rhonda Swan makes the case that salary reductions for government employees in these troubled times are justifiable – even for administrators like Bob Weisman who takes home $251K / year.

She is also the first in the local media (to our knowledge) to raise questions about the Sheriff’s plan to give raises to the newly unionized civilian employees of PBSO. Citing the protection of the “PBSO Career Service Protection Act” – passed in 2004 to prevent a reduction in benefits for sworn law enforcement and corrections officers, Sheriff Bradshaw claims it now applies to the civilians.

The escape clause in the bill, “exigent operational necessity” has in the past been interpreted by County Attorney Denise Neiman as meaning “the county is out of money and the reserves are gone”. Ms Swan suggests an alternate view – that the Sheriff can invoke “necessity” within PBSO in light of county forced budget cuts. An innovative interpretation and we applaud the concept.

For the entire article, see: Administrators not immune

TAB is referenced in the article for our study on county pay and benefits.

Should the Sheriff be Subject to the Ethics Ordinances and the Inspector General?

Over the last few years, Palm Beach County has taken a great leap in establishing ethical standards and implementing a watchdog function that is helping dispel the reputation of “corruption county”. First, by ordinance, the County Commission and staff included themselves under the jurisdiction of a Commission on Ethics, and the Office of Inspector General. Then, in November of 2010, 70% of the voters supported a charter amendment to extend the umbrella to the 38 municipalities of the county, and the Solid Waste Authority brought themselves under it by inter-local agreement. By May of this year, the new ordinances (including a Code of Ethics and Lobbyist rules) were fully implemented.

There are still pockets of county government that are exempt from all this however. The school board is considering the question and may take the plunge at a later time, but the Constitutional Officers (Sheriff, Clerk, Tax Collector, Supervisor of Elections, Property Appraiser, County Attorney and Public Defender) are specifically excluded. The most significant of these of course is the Palm Beach Sheriff’s Office with its 4000 employees and $500M annual budget.

TAB believes if it is good for the county and cities, it should be good for the Sheriff, particularly given the wall that exists between PBSO and the public regarding disclosure of information. Very little financial (or other) information is readily available for scrutiny, and Chapter 119 (Open Records Law) procedures are needed to obtain anything not specifically mandated for disclosure under statute.

Just as the SWA took this step voluntarily, it has been proposed that the Sheriff enter into an inter-local agreement with the county to become part of the county ethics process. To this end, Chairman Karen Marcus formally requested that they do so.

“No Way, No How” was the synopsis of the 9 page response.

Responding for the Sheriff, Colonel Joe Bradshaw in the department of Legal Affairs, explained that they asked for a legal opinion from the General Counsel of the Florida Sheriff’s Association, R.W Evans. In Mr. Evans opinion, the “…County Code of Ethics cannot be applied to the Sheriff under any circumstances, because the investigation of law enforcement and corrections officers is preempted by Florida Law. Further, any oversight of the Sheriff’s Office by the Commission on Ethics and the Inspector General exceeds the County’s authority and improperly encroaches upon the constitutional office of the Sheriff.”

Based on this opinion, Colonel Bradshaw concludes “.. the Sheriff cannot enter into an interagency agreement with the county to extend the jurisdiction of the Palm Beach County Commission on Ethics and the Inspector General to the Palm Beach County Sheriff’s Office.”

In Mr. Evans response, he notes that “This issue is critically important to FLorida Sheriffs..” and that this is “.. the position of the Florida Sheriff’s Association of which I am General Counsel.”

In the opinion, several Florida Statues and case law are cited, pointing out that the Legislature has drawn a protective moat around law enforcement agencies which excludes interference from local elected officials in any way. In a sense, PBSO is “above the law” as far as the county is concerned and no public influence on PBSO is possible without changes in Legislation. We see this time and again – if the county asks the Sheriff for budget cuts he threatens to go to Tallahassee to overturn them. If existing benefits are questioned, the “PBSO Career Service Protection Act” is cited. There is effectively no local control over the Sheriff’s office save the ballot box.

Given the above, is there no other choice but to accept the opinion of the Sheriff’s Association? The voters of Broward County did not think so, and recently passed a charter amendment with 72% of the vote, placing their constitutionals (including the Broward Sheriff) under the County Code of Ethics. To date (to our knowledge), this has not been challenged in court on constitutional or other grounds, although Palm Beach County Attorney Denise Neiman has stated that Broward has crossed the constitutional line and a challenge would succeed. We shall see.

So what can be done about this? There are groups out there that are critical about the way PBSO spends taxpayer money (among other things – see pbsotalk.com). We have no way of knowing if information from those sources are accurate, but much of it appears to come from insiders. In fact, there is currently no outside oversight of PBSO such as the Office of Inspector General brings to other parts of county government, and we think that is a dangerous situation.

We support Chairman Marcus’ call for an inter-local agreement with PBSO. If there are legislative roadblocks then we should work through them with the delegation. We should also have a serious discussion of charter changes which would tear down the constitutional barriers to public oversight of PBSO.

For the full text of Colonel Bradshaw’s response to Karen Marcus, including the opinion of the Florida Sheriff’s Association, click HERE.

New County Grassroots Organization becomes TAB Coalition Partner

TAB welcomes its newest coalition partner, the Palm Beach County Tea Party. The group, formed by past leaders of SFTP that want to go in a new direction, was announced on Tuesday, June 21, and will initially have chapters in Jupiter and Wellington.

Local issues will have a more prominent role with the new group, including the county budget. In a question and answer video, group founder Pam Wohlschlegel said regarding the county budget: “We need to be fiscally responsible and part of that is budget cuts. Our founding group feels very strongly that the TAB proposal has a lot of good things in it and hope that our commissioners will accept it.”

For more information about the newest TAB partner, click HERE.

Genesis of a Collective Bargaining Agreement

On June 16, at the Chief Herman W. Brice Administrative Complex on Pike Road, negotiators for County Fire / Rescue and the International Association of Fire Fighters (IAFF local 2928) met across the table to reach agreement on a new contract which will replace the current agreement expiring in September.

As it was a public meeting, advertised on the county meetings calendar, and we at TAB are interested in how public employee union contracts are negotiated, we decided to attend and observe. There has been very little public participation at these meetings in the past, and when we arrived there were no seats anywhere but at the table, but they very graciously found us some. Chief Jerauld told us later that occasionally, fireman who may not agree with the union position will attend the meetings, but public participation is rare. That was disappointing to hear. Much of the budgets of Fire / Rescue, PBSO and other county agencies are driven by personal service costs, mostly established in these multi-year collective bargaining agreements. If we as citizens want to influence the way our governments spend our money, we should be willing to attend these meetings and understand how the contracts are set.

For our part, we were impressed with the professionalism displayed on both sides of the table, and the respect the sides showed to each other. For the first hour and a half or so, the attorney for management walked through the lengthy contract, pointing out changes from previous versions. A lot of the sections at issue related to work rules and compensation arrangements that need practitioner context to fully understand. Three items that we found particularly noteworthy though were:

- Elimination of employee performance reviews. The implication was that the current system does not achieve anything so it is better to scrap it altogether.

- A 22% reduction in starting salary for new employees. It was said the it was an attractive enough place to work that high starting salaries are not needed to attract recruits.

- A 3% employee contribution for insurance. This compares to 10% in the county departments.

On the latter two there was silence from the union side of the table and it is safe to say that did not mean concurrence. Several times, the phrase “unreasonable in the current times” was used to explain why a benefit was being reduced. From our limited perspective (and not having copies of the document we have not seen the new salary grid), it appears that the Fire / Rescue management is making a good faith attempt at bringing their contracts into line with economic conditions, and we find that encouraging.

When the document review was complete, management and the public (us) left the room so the union could confer privately. After about 10 minutes, word was relayed that the meeting was ending and would continue at a later date to be determined. For whatever reason, they needed more time to consider a response.

TAB is planning to follow the progress of this contract and will attend the followup meeting when it occurs. Stay tuned.

Marathon Session for First Budget Workshop

Last evening, starting at 6:00pm, the first steps in the annual county budget dance were performed before a large audience. The meeting did not end until around 11:00pm

County Administrator Bob Weisman, along with OFMB chief Liz Bloeser and Budget Director John Wilson, explained the high points of the 4.75 millage $588M tax proposal, and explained why he’d really like to see it raised to “rollback” millage of 4.922.

While Weisman maintained there were no “Washington Monument” cuts and all were feasible, several commissioners pointed out that many of the “green page” cuts were in areas that were both visible to the public and in areas that would raise significant objections from the public. Commissioner Abrams went so far as to point out that the “green pages” even contained service impact notes listing the dire consequences that were about to befall the county as a result of taking the cut. If the expectations were so dire, then why take these particular cuts? He referred to the comments in the budget document as “advocacy” and we couldn’t agree more.

After a brief pitch by Supervisor of Elections Susan Bucher, requesting more money to “compensate” for the new law limiting the length of early voting (shorter time means she needs more facilities, equipment and overtime – who knew?), Sheriff Bradshaw went through his budget presentation.

The Sheriff made some interesting claims.

Much has been made of the growing percentage of the county budget that goes to PBSO – we estimate their portion the ad-valorem equivalent county-wide budget is now 59%, up from 46% in 2003. Not so fast, says Sheriff Bradshaw. If you look at the core operation of the agency, removing the aspects that are state mandated or are county responsibilities (the jail, crossing guards, etc) – his spending is only 25% of the county budget. We find this argument interesting but not very relevant.

Another claim has to do with the way the county is accounting for the “savings” from the retirement system (FRS) changes passed by the Legislature. (TAB estimates the savings to be about $20M for PBSO, $15M for the county departments and other constitutionals, and $11.6M for Fire/Rescue). Don’t call them “savings” he says – it is simply a change in rates that he will now use to calculate his budget. The change in rate from last year amounts to $18M by his calculation and he takes it directly off his budget. The county contends that this amount should be “shared” with the county departments – it is a windfall from the state that needs to be used to fill their overall budget hole. Since the Sheriff, with many “special risk” employees gets a much bigger “savings” than the county with “regular risk” classes, he should “share the wealth”. In this one, we believe the Sheriff occupies the moral high ground, and the FRS “savings” that occur in PBSO should stay in PBSO. After all – it is a net budget reduction.

This is a serious dispute that will need to be resolved before a clear view of the flat millage budget can emerge, and it appears that both sides have dug in their heels. There are other issues as well, including the $5M credit the Sheriff wants to take for FRS savings he will realize in the period before the new budget year on October 1.

The way the county allocates their FRS “savings” is much more convoluted. Complicating things is that the county staff is divided up between departments that are not funded by ad-valorem taxes (eg. airports) and those that are fully or only partially funded by tax dollars. Our estimate of $15.4M savings is reduced to a little less than $8M that can be used to offset the ad-valorem levy according to Budget Director John Wilson.

Even so, this $8M plus the Sheriff’s $18M in “savings” ($26M total) should be more than enough to plug the “hole” between the $603M adopted tax of FY2011 and the $588M that flat millage will collect in 2012. John points out that there are other “holes”, like decreased interest earnings that make the actual “hole” $45M, so cuts are necessary. Unfortunately for us TAB analysts, none of the budget materials provided to the public provide the documentation necessary to see the whole picture, but John has promised to provide us with what we need shortly. Watch this space.

With the conclusion of the Sheriff’s budget, public comment began. As with most budget meetings, we saw a parade of supporters of the various programs on the chopping block. By our count, there were about 40 speakers. Three spoke to keep the rates low for Palm Tran Connection, one to restore manatee protection, 5 for the nature centers, a couple for community revitalization, four for Small Business Assistance, and ten for victims’s services. The support for the latter was quite moving as victims of rape, shootings and other mayhem came forward to tell their stories. Given that the amount of the cuts to Victims services is a relatively minor $320K or so and 4 positions we would guess they may get restored. All of these areas amount to a couple of million out of $25M in cuts, so we will see if their advocacy will prevail. Other constituencies in jeopardy (eg. lifeguards, FAA) did not turn out at this meeting.

Fifteen spoke in favor of the submitted, flat millage budget. These included Fred and Iris Scheibl of TAB, Meg Shannon of Tea Party in Action, Shannon and Doug Armstrong, Ed Fulop, Victoria Thiel and Dr. Richard Raborn of South Florida 912, Phil Blumel of RCCPBC, Mayor Gail Coniglio of the Town of Palm Beach County Budget Task Force, Pat Cooper of the PBCA, Dick Clyde of the PB City Council, Dionna Hall of RAPB and several others. Other TAB coalition partners who could not attend the meeting but sent emails to the commissioners included Hal Valeche of Taxpayer Action Network, Mayor Dan Comerford and Councilman Chip Block of Jupiter Inlet Colony.

At the end of the meeting the commissioners discussed what they had heard. Although they did not vote or take positions on the budget proposal, by their comments we would assess commissioners Abrams, Marcus and Burdick as leaning towards accepting the flat millage budget, and commissioner Aaronson as wanting to raise the millage. Commissioners Santamaria, Vana and Taylor seem to be hedging their bets at this time.

For media coverage of the meeting see: Palm Beach County Commission balks at cuts — or raising taxes in the Post, and Palm Beach County’s proposed spending cuts prompt citizen backlash in the Sun Sentinel.

The next step in the budget process is the workshop on July 11 at 9:30am. There is also an off-site retreat for the commissioners where budget strategy and objectives will be discussed. That will be held on Thursday June 30 at 10:00AM at the Lake Okeechobee Outpost in Pahokee.

BIZPAC Review:County budget a Weisman trick-expect tax increase

The Kabuki Budget

Yesterday, the county released the budget package for the June 13 workshop. While this preliminary document is lacking in detail (it doesn’t show the department rollups or make it possible to assess what the FRS savings were), it is predictive of the course of debate.

To their credit, the Board of County Commissioners directed Administrator Weisman and staff to prepare a budget this year with no tax increases. The submited budget meets that requirement. However, Mr. Weisman states in his cover letter that he wants them to approve a tax increase “to reinstate some of the less desirable budget cuts”.

Let the dance begin. Anyone who follows the county budget hearings knows how this works. The administrator wants to spend more. Some board members agree, some don’t, but they first need to listen to “the people”. Within the county, there are well organized special interest groups that are reliable and can be expected to come out and argue passionately for their slice of the pie. These groups include riders of Palm Tran and the Palm Tran Connection, the county lifeguards, directors of charitable organizations that get handouts from the county (Financially Assisted Agencies), the Cultural Council, and (when the Sheriff’s budget is threatened), lots of folks in PBA shirts and PBSO boosters from the Sheriff’s neighborhood programs. It used to include former Drug Farm residents, but they lost the fight last year.

Guess where the cuts come in the submitted budget. From these groups of course! Does anyone expect that the board will listen to groups of people in wheelchairs and not restore funding for Palm Tran Connection? Or turn away 150 young lifeguards who feel their way of life is threatened by closing pools? My guess is that these funds will be restored and the only reason they were offered up is to perpetuate “the dance”.

Of the $21.5M of specified county department cuts in the cover letter, the bulk comes from social service (including FAA), Palm Tran, ERM – including manatee protection, pavement and traffic signal repair (EPW), parks and recreation (pools and lifeguards), animal control, youth affairs and victim services. These are designed to sound “draconian”. Strangely enough, the detail provided shows actual increases in two of the areas – Palm Tran sees an actual ad-valorem increase of 25% ($3.9M) in its subsidy due to declining revenue, and Engineering & Public Works (EPW) grows by 10%. Nowhere in the submission can you find the amount saved by FRS reform (we estimate it to be $15.4M).

Likewise, the Sheriff (who asked for a 4% increase in his budget) is being told he will get a $22M cut. On Monday we will probably hear that this will result in the removal of patrols around the largest senior centers and other “constituent sensitive” areas, resulting in catastrophe if the money is not restored.

We could try to second guess the Administrator on where the cuts “should” be taken (we all have our anecdotes about waste and inefficiency), but that is hard to do without an insider’s knowledge. Instead, we say – go ahead and restore the funding to the squeeky wheels – but do it in a budget neutral manner. For every dollar restored, there needs to be a dollar cut somewhere else. The millage needs to stay at 4.75.

Do the right thing.

The TAB Proposal and the County Budget

The county has published their initial budget package for the June 13 workshop. It is a flat millage budget, with cuts of $13.6M from county departments and $22M from PBSO over FY2011, and would seem at first reading to be in line with the first two points of the TAB Proposal, “Don’t raise the millage” and “take more of the cuts from the Sheriff”.

Upon further reading, it is clear that many of the cuts are intended to provoke a response from the user community. If you remember the horde of lifeguards and community recipients of FAA (charity) funds that showed up last year to protest, you can expect the same from the proposed $4.8M cut to Parks and Recreation which will close pools and reduce lifeguards, and the $1M cut to the FAA funds. Not to mention who will turn out to protest the $2.4M increase in Palm Tran fares.

In his cover letter, Administrator Weisman says: “I recommend the Board set a millage rate at rollback, which is currently estimated to be 4.922 mills. This would allow the Board to reinstate some of the less desirable budget cuts.”

Rollback represents a 3.6% increase in tax rates. Unless TAB partners and like minded citizens turn out to support the TAB proposal and ask the board to accept the submitted flat millage budget as stated, we can surely expect the special interests to push it to the rollback rate or beyond.

To recap, the TAB proposal is:

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

We also want to see a charter amendment for a county version of “Smart Cap” placed on the 2012 ballot. Detailed arguments for each of these can be found later in this article.

Background

Last year, TAB was formed in July, after the county budget process was well underway.

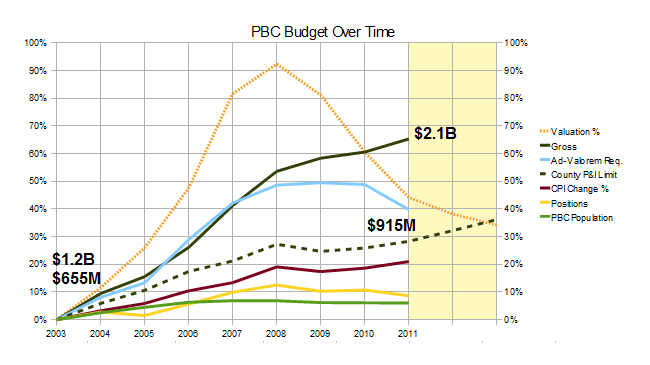

After researching the growth in county spending for the period 2003-2011, we concluded that it had grown 11 times the population growth and 3 times the rate of inflation. For FY2011, the proposed budget raised the millage by more than 9% on top of an increase of more than 15% in the previous year. Although the ad-valorem equivalent (and the total amount of collected taxes) declined in the 2011 fiscal year with the steep decline in property valuations, those with homestead properties saw their taxes go up. Overall spending, propped up by state and federal stimulus funds, continued to increase in 2011. (See chart below).

With the weak economy and double digit unemployment in the county, we thought another tax rate increase was wrong, and argued for keeping the millage flat at 4.344. As part of the proposal, we went through the staff’s “green” and “blue” pages, and made specific spending cut proposals totalling over $50M, argued for deferring raises in Fire/Rescue and PBSO, and listed $100M in capital projects that could have been deferred.

In meetings with the individual commissioners, we made our case and had a productive dialogue, but were not persuasive enough to carry the day against the hordes of special interests (including PBA members supporting the Sheriff’s budget) that flooded the meetings and lobbied the commissioners to keep the taxpayer money flowing. The final budget passed with a 9.3% rate hike on a 4-2 vote, with commissioners Abrams and Santamaria voting against, and the district 2 seat vacant after the resignation of Jeff Koons.

This year we are starting earlier and have focused on educating community groups about the budget history, preparing them to join the discussion armed with the proper facts. The actual budget has just been released to the public and we are just beginning our analysis. These are some aspects of the environment in which it is being created:

- The county administrator submitted a 4.75 flat millage budget as directed by the BCC, yet he is really asking for a rollback rate of 4.922 which would be a 3.6% increase over 2011, “to reinstate some of the less desirable budget cuts.”

- The Sheriff submitted a budget request with spending that is 4% higher than last year, mostly to cover raises under the collective bargaining agreements in place until 9/2012. In the flat millage budget, he is being asked to cut 5% more than he saves with FRS.

- The property appraiser, who had been projecting a 6% decline in valuations this year, has softened his outlook to a 2.3% decline.

- FRS reform, passed by the legislature and signed by the Governor, will result in savings to the county departments, PBSO and Fire/Rescue of $15.4M, $20.6M, and $11.6M respectively (by our calculations). Note: The county shows the PBSO savings to be $18M.

- Adam Playford’s article in the Palm Beach Post on May 21 gives some indication of the direction various players would like to go. Administrator Bob Weisman would like to see rollback millage to prevent any cuts in service. Commissioner Shelly Vana suggests we have not properly determined our priorities. The county is “saddled with debt”. The interest payments take 14% of what the county collects in property taxes according to Budget Director John Wilson. “Some of the county’s current fiscal squeeze is because it didn’t save enough earlier in the decade when tax money was flooding in” (during the boom) according to Clerk and Comptroller Sharon Bock.

The following is an outline of the “TAB Proposal” for 2012:

The 2012 TAB Proposal – preliminary

- Maintain the county-wide millage at 4.75

- County-wide property tax rates have risen 25.6% in the last two years alone

- Although the total taxes collected have declined over the same period, those with homestead properties saw double digit increase in their county taxes

- This year, the reduction in valuations has slowed from an expectation of -6% to a more modest -2.8%, reducing the pressure on the budget and millage rate

- TAB estimates that reforms to the Florida Retirement System (FRS), passed by the Legislature, will result in a $48M savings to the county this year ($20.6M in PBSO, $15.4 in county departments, and $11.6M in Fire/Rescue). This should be used to hold or reduce the millage, not for new spending on programs or salary increases.

- The commissioners directed the County Administrator to submit an initial budget with no change to the millage rate and he did. Bob Weisman’s request for rollback at 4.922 (a 3.6% increase) would seem to exceed his guidance.

- The county is still experiencing double digit unemployment and slow economic growth. This is not the time to be raising taxes.

- We expect the Fire / Rescue and Library MSTUs to also avoid a rate increase, but that has already been included in the submitted budget and so far no one has asked to exceed it.

- Take the majority of cuts from PBSO, not the county departments

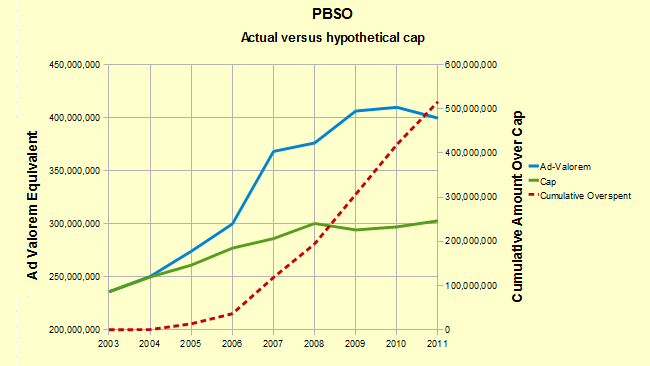

- County-wide ad-valorem taxes pay for the county departments and the constitutional officers, including the Sheriff. In the last 8 years, PBSO has grown from 46% of the budget to 59%.

- Most of the growth in the PBSO budget has been in personal services costs (salary and benefits), and PBSO deputies are now compensated more than 30% above the national average for similar positions.

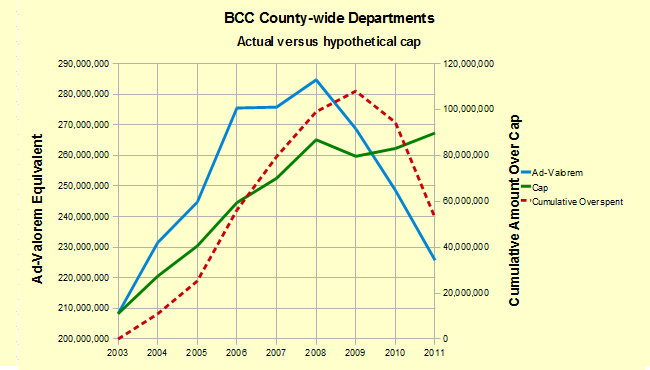

- Measured against a hypothetical population+inflation cap since 2003, county departments are now comfortably under the cap (although they exceeded it in the boom years by a cumulative amount of $50M). PBSO has greatly exceeded the cap in each year, with a cumulative overspending (versus the cap) of $500M in the 8 years. (See charts below)

- The Sheriff provides only the statutory minimum of budget data to the county (and the public) so it is difficult to see where the money is being spent. Through Chapter 119 (open records law) requests, TAB has determined that almost all the spending growth has been in salaries and benefits for employees covered by collective bargaining agreements, not in operating costs.

- The reduction to PBSO from $470M to $448M in the submitted budget would meet our criteria if allowed to stand.

- Take action to reduce the inventory of county property and reduce the debt

- Florida TaxWatch is conducting a study funded by the PBCA and others, that will inventory underutilized land and other property owned by the county, and compare our debt and capital programs to our peer counties. This study can be used as a blueprint for action to reduce the debt (currently $1600 per county resident with interest costs estimated at 14% of taxes collected) and make plans to sell off assets like Mecca Farms.

- The Clerk and Comptroller has identified the debt as being significant already, and it is about to be increased even further with the building of the waste to energy facility by the Solid Waste Authority and the convention center hotel.

- During the boom, windfall tax receipts were used to start projects that committed the county to long term debt that is difficult to justify now that the boom has ended. We need a plan to correct the problems caused by earlier bad decisions.

- TAB has obtained a list of vacant properties owned by the county and has begun comparing the current value of these parcels to what was paid for them. As long as these properties remain on the books it is a double liablility – there is a carrying cost associated with them and they are held off the tax rolls. Many of the over 2400 properties listed in the PAPA database as belonging to the county should be sold, even at a loss.

Separate from the TAB Proposal for the FY2012 budget cycle, but important for long term budget restraint is a charter amendment to bring the state level “Smart Cap” proposal (SJR958) to the county. This will be a separate track, aligned with the charter review process, but if you agree with it, please mention it in the context of the budget discussion.

Adopt a “Smart Cap” charter amendment for county government

- The state-wide “Smart Cap” (SJR958) will be on the ballot in 2012. What is good for the state is good for the county.

- “Smart Cap” limits the revenue that can be collected to last year’s cap plus an adjustment factor that reflects inflation (change in Consumer Price Index) and population growth – an objective measure of “appropriate spending”.

- Although the decline in valuations has currently dampened the large increases in county spending that occurred during the boom, spending has continued to rise, even last year. When “normal” returns to the real estate market, a cap could prevent the out of control spending that occurred during the bubble.

- Unlike Colorado’s Taxpayer Bill of Rights (TABOR), a smart cap is based on last year’s cap, not on last year’s revenue. That prevents the “ratcheting down” of the cap that caused problems in that state during a recession.

- A well designed Smart Cap can provide emergency override (Supermajority BCC vote) and exemptions for unfunded mandates and other areas identified by the League of Cities as as problematic.

This year’s TAB Proposal is really not asking that much. With the smaller decline in valuations and the large savings from FRS reform, there should be very little difficulty in making the modest cuts that will be necessary to avoid an increase in the tax rates.

Growth in ad-valorem equivalents compared to hypothetical “Smart Cap”

Conversation with a Firefighter / Paramedic

Throughout our analysis of the county budgets, we have been somewhat critical of Fire / Rescue. We observed that the growth of their budget (even adjusted for service area size) was significant over the last 8 years, and the firefighters in the county are compensated more than 50% above the national average from the Bureau of Labor Statistics.

How much should we be paying for a well equipped Fire and EMS service though? This and related issues formed the basis of a recent dialog between a county firefighter from south county and TAB in a comment thread attached to one of last year’s postings.

Our correspondent argued that “bringing the emergency room to the patient” is expensive, and successful outcomes require multiple vehicles and staff to respond. Fighting fires or dealing with medical emergencies is skilled and dangerous work, deserving of pay and benefit premiums. Comparisons with the private sector are unfair, given the unique nature of the work, and so much has changed in the last 8 years in both equipment and expectations, that growth in unit costs are justified.

For our part, we considered the dangers inherent in some private sector jobs and how those are compensated, aspects of the 48 hour work week versus private sector expectations, and the studies we have performed comparing PBC Fire/Rescue to peer groups.

Both points of view have compelling aspects, and we thought the TAB readers would find them interesting. The threads are reproduced here – you be the judge. Are we being unfair to PBC Fire/Rescue?

The thread begins with a response to the conclusions in “Palm Beach County Pay and Benefits – How Much is Enough?“.

May 10, 2011 2:10 pm |

Split the two careers (Firefighter / Paramedic) into two separate careers. Paramedic Firefighters are what’s known as “Dual Function” positions. Across the country there are fire rescue agencies that are not Advanced Life Support – Paramedic / Transport capable services. So when doing an analysis / comparison across the country, are you comparing apples to apples?

And for the sake of argument, if your one sided / prejudiced bar graphs and charts are correct, after having digested all of the factors such as the one above: ….. When you’re comparing salaries and benefits in South Florida to the rest of the country and you’re asking “Why are we paying more?” …. Could one also interpret that to mean: “Why are we taking better care of our first responders, than the rest of the country? … They should be following our lead” ???? |

May 11, 2011 12:32 am |

These are all good questions, but comparisons to other jurisdictions can be misleading. For example, the Town of Palm Beach just settled a contract with their firefighters. What was arguably the best pension deal in the county (3.5% accrual compared to 3% in FRS) is now one of the worst. Will that change their level of service? How important is a pension plan in retention and hiring in this economic environment? I guess we will see, but since there are few if any jurisdictions hiring at present it may take a while.

That town took this action because the current plan was not affordable. All around the country are examples of county and municipal contracts that promised more than could be delivered, even with a good economy. Now we have FRS reform, but the deal is still very much better than in the private sector. Palm Beach Gardens is about to renegotiate their Police and Fire contracts. While the outlook is not as severe as in Palm Beach, it will still mean take-aways. How much should a firefighter be paid? Compared to what? Should it be 4 times what a teacher makes and one and a half times a Sheriff’s deputy? Why is that? Is a deputies job less dangerous or less skilled? Are teachers not contributing as much as firefighters? How do you answer questions like these? In the private sector, the worth of a job is easier to determine. An employee contributes to the bottom line of the company in a measureable way and can be compensated directly. Salesmen earn commissions based on sales. Professionals are compensated for the intellectual property they create. If the company gets into trouble the workers are laid off. The company’s earnings depend on the performance of their employees. In the public sector, everything and everyone is a cost center. Public sector employees create no wealth or generate profit. They use resources taken from the private sector to deliver services to the public. In the case of local government, police and fire are important, basic functions, but the proportion of available resources spent on these services are not spent on others (like teachers or bus drivers or accountants). One could argue that we need police more than we need parks or streetlights. Should all the resources be used for public safety? The average compensation (salary and benefits) for a private sector worker in Palm Beach County is somewhere around $60K, and that worker is not likely to have a defined benefit pension. County staffers make a little more than this, teachers a little less, but both have good pension and health plans. In PBSO the average compensation is about $100K, but for Fire/Rescue it is $150K. Either special risk employee can retire at an early age on a high percentage of their salary, and then go start a different career. That private sector worker is paying some of that $60K to fund the salaries of the public sector workers who have better job security, higher pay and benefits, and likely work fewer hours. Is that an equitable arrangement? Will it last? Public sector employees, particularly those in strong unions, have had a pretty good run in the last decade, and it is not likely that they will lose too much in the retrenchment that is coming. It took the current economic crisis to shine light on where the tax dollars are going. Perhaps now there can be an open dialog about pay and compensation. Florida is is much better shape than other states. By looking at states like California or New York (or countries like Greece or Ireland), we can get a glimpse of where this is going if we don’t come to grips with it. |

May 13, 2011 1:01 am |

I’m sorry, I guess I’m just having a hard time digesting the assumption that the Town of Palm Beach is in, or headed towards dire financial straights. And when you’re talking about a “Arguably best pension deal in the county” one has to remember that it was just a few short years ago that the town of Palm Beach pay and benefits for their firefighters was below that of the city of Riviera Beach firefighters. Compare the socio-economic make up, and property values between these two municipalities, and explain how this could happen?

So …… coming from that type of history, then going to what you describe as the best pension deal in the county, for s short period of time, and then they pull the rug out from under them, it’s a hard pill to swallow. Your argument / comparison between Police, Firefighter, Teacher, and asking why aren’t the Teachers and Police making what the Firefighters make, is somewhat pitting two blue collar careers against the one. My answer to that would be that the teachers and the police should be brought up. 10 Police officers in Florida have been killed this year alone, and we’re only 1/2 way into 2011. If you can show me a private sector job in Florida that’s as dangerous, and they’re not making what Police officers and Firefighters are making with pay and benefits, then I’d have to say that that private sector employee is getting screwed. There’s a reason why the two careers – Police Officer and Paramedic Firefighter are called “High Risk” ….. Aside from the obvious high risk as far as physical injury / trauma / death, there’s the long term health – high risk, with regards to disease exposure, hazardous material exposure, and finally physical and mental stress exposure. So, think about that when you find yourself wanting to continuously compare the Private Sector – Low Risk, to the Public Sector – High Risk. The Firefighters work a 48 hour work week. (Town of Palm Beach’s imposed contract, tacks on an additional 8 hours, forcing them to work a 56 hour work week now) …. So when you’re comparing the high risk workers to the private sector, and you’re saying that the high risk workers “Likely work fewer hours” and ask is this “Equitable” ?? ….. I believe that the private sector is still putting in a 40 hour work week, so how does one derive 56 Vs. 40 as “Fewer Hours” ?? ….. If you’re working off the assumption that Paramedic Firefighters work one day on, two days off, you’re mislead. 24 hr shifts mean that you start at 07:00 A.M. on Monday, and at 12 midnight you begin working your final 7 hours on Tuesday. So, you’re working two days on, one day off. And once again, you’re working a 48 hour work week. (8 hours more than the 40 hour worker) The Town of Palm Beach also referred to what you describe above regarding Firefighters retiring at a young age, and can go on to work another job. I will ask you this …… Do you think that it’s fair that you ask your high risk employees to put in 30 years, and pay them a salary and benefits that are built on the premise that they should find themselves another job after they’ve retired from a 30 year career faithfully serving their community in a high risk position? Lets talk about the job a little. Paramedic Firefighters today, are not exposed to what Firefighters were exposed to years ago. Firefighting equipment and procedures have gotten a lot safer and more advanced over the years, but the amount of firefighter fatalities has stayed steady. This is because the materials used in modern day construction, and furnishings, are not made with the “Ordinary Combustibles” of yesteryear. Buildings and furnishings today, burn hotter, faster, and give off more toxic fumes / gases, than ever before. So …. even if we’re fighting fewer fires than yesteryear, reciprocally the decrease in quantity, is made up for in the increase in quality. The town of Palm Beach’s town manager used the 90% Vs. 10% ammunition. (90% Emergency Medical Service Vs. 10% Fires) ….. I forget what point he was trying to make, if in fact he even had a point, but if he was trying to discount the dangers / the risks, think about what I just described above. Also think about the dangers and risks that the Emergency Medical Service part of the equation entail. This is the part where most likely your private sector workers will tell you “You can’t pay me enough to do that !!”. And that includes blood, feces, urine, saliva, vomit, ect. …… Diseases with many syllables. You get the drift right? ….. We deal with this stuff in an uncontrolled / unsterile environment. It’s when we get to the Emergency room at the hospital, that’s where it gets sterile, and de-conned. So …… 25 / 30 years of working on 2 year olds who jump up and down on their bed at night and get caught up in the window shade cord and strangle them self to death, but not right away because we pull out all the stops, and go the extra mile to try and revive them, with the distraught mother bouncing off the walls behind us. Or trying to revive them after they’ve been pulled out of the backyard pool where they were submerged for over 6 minutes and not breathing, or trying to revive someones 90 year old grandmother, pulling people out of twisted car wrecks, out of canals, lakes, ponds …. Pulling people out of landscaping shredding machines after they’ve been torn to pieces, the drug over doses, the psychologically impaired, the suicides, the domestic disputes, the false calls, and on and on and on. Yes, 25 / 30 years of that ……. And then thank them for their service and tell them to go get another job. Nice |

May 14, 2011 11:05 am |

You have several main themes here, so let’s address them one at a time.

First there is risk, comparing public sector “high risk” to private sector “low risk”, and the wage and benefit premium that is “fair”. There is no doubt that being a firefighter involves risk – as a matter of fact, most analysis considers that job as the 13th most dangerous in the nation, with 7 deaths per 100,000, right behind police officers with 16 per 100K. I am not in any way minimizing the risks you mention. However, the most dangerous 11 jobs in the country are all in the private sector, from fishing (#1, 129 deaths per 100K, $30K/year), logging (#2, 116 per 100K, $31K/year), on through farmer/rancher, structural construction worker, sanitation worker, pilot, roofer, coal miner, merchant mariner, miller, and power line installer. If you check the BLS numbers you will see that most of these occupations make considerably less than firefighters in PBC. Then of course there is the military. As a veteran I can tell you that most soldiers and sailors are not in it for the money. The special-risk class in FRS originally had a specific purpose. At inception it was intended to provide an equivalent pension at 25 years that a regular-class employee would get at 30, reflecting the physical demands of the job. This was achieved with the initial special-risk accrual of 2% / year (compared to 1.6% for regular-class). About 10 years ago, this was upped to 3% and made retroactive, and parity was replaced with significant premium. The current system, combined with 3% COLAs and the ability to spike the final earning years with overtime and bonuses allows many in that class to soon make in retirement, more than they made when working. Not a bad deal, wouldn’t you say? From your comments, you are not painting an accurate picture of the “private sector”, where the norm now is a 401(k) plan rather than defined benefit one, if you get a pension at all. If you are one of the 21% who do have a conventional pension, typically you can retire at 65 or after 30 years with about 1/3 of your salary. If the position is salaried (also known as “exempt”), which applies to most management, professional and clerical jobs, you don’t get overtime but are expected to work more than 40 hours a week to stay competitive. Most people in high tech jobs (my experience) routinely work 60 hour + weeks under significant stress and typically need to be available 24×7. There are very few jobs in government (except at very high levels) that expect this of their employees. The private sector is also at a disadvantage in job security, health benefits, sick time, vacation, and other aspects that are routine in government jobs. Regarding the 48 hour workweek – yes, two 24 hour shifts do add up to 48 hours, but having 5 out of every 7 days off provides flexibility that most jobs do not offer. It is not unusual for firefighters to spend their off-shift time working another job or running a business. Nationwide, I think Kelly days are the exception and most shift rotations result in 56 hour work weeks. You raise the issue of the 90% EMS versus 10% Fire. (I think the county number is 87%). What is relevant here is not the risk involved on the call but the economics of how the call is answered. In jurisdictions with separate (and/or private) EMS, a medical call is answered with a single unit with the relevant equipment and trained staff. In the county, it appears that EMS calls are answered by both EMS and Fire equipment. I don’t know if this is policy or not, but I have observered that calls are answered with multiple vehicles. Each has a minimum 3 person crew, including a Lieutenant (EMS) and a Captain (Fire). There may be a valid reason for this, but it is not the way a private EMS company would respond. There is a national debate over the size and scope of government, and the recession has been shining a bright light over the advantages that government employees now have over the rest of us. There was a time that lower salaries were the price of absolute job security and better than average benefits. No longer. Compensation in the public sector has made great advances over the last decade and is now considerably superior to similar work in the private economy, reaching almost double at the federal level for equivalent positions. Where salaries have not advanced, benefits – particularly pension benefits have lept ahead, placing burdens on the future cash flow of state and local governments. This is partly due to the private sector losing ground in the recession while government has stayed the course, but that is about to end, as governments are also going broke. Watch California for a glimpse of what may be the future. Florida and PBC may be in better shape than most, but it is time that these matters were discussed openly. |

May 14, 2011 4:12 pm |

Good information. But I’m still having a problem understanding your point. Let’s start with your first paragraph that lists occupations that you say are more dangerous than the career of a Paramedic Firefighter, and then you list their salaries, as comparatively much lower than a Paramedic Firefighter in Palm Beach County. Once again, your point? …. I’m assuming that you’re suggesting that the salaries for these “Higher Risk” jobs, are fair. That a logging company, or roofing company that turns a pretty good profit, should in turn be able to pay their employees $15.00 an hour? And out of that $15.00 and hour, that employee should be expected to carve out their own pension investment, their own medical insurance, and get small incremental raises that do not keep up with the cost of inflation? …. There is most likely a lot of statistical data that would either skew your numbers, or possibly show that there’s maybe a logical explanation why the number of fatalities in these professions are so high. Like maybe the turnover rate because these workers go on to find better / higher paying jobs, which increases the revolving door – turn over rate, which increases the lack of experienced workers who’ve been on the job longer and the safety value of this, I don’t know. I do know this … I grew up on Long Island, and there’s a Merchant Marine Academy in Kings Point, Nassau County. You make mention of Merchant Marines above, in your list of comparative occupations that are as you infer, more dangerous than that of a Paramedic Firefighter, and are making less. Before I left New York in 1982, Merchant Marines were making somewhere in the area of $90,000.00 a year. Not too shabby, wouldn’t you say? …. I also would say that FP&L linemen are making a pretty good living as well. Just to mention a couple.

I won’t even get into the amount of continuing education credits, and continuous ongoing training required for the Paramedic Firefighter, after the training and education required to get certified in both disciplines, Vs. other private sector occupations that you’re making comparisons to. I have a high respect for veterans. Thank you very much for your service to our country. My father was Army. The Korean theater. After he was released from the service, he was able to buy a nice home for our family with his V.A. loan, and for the rest of his life there were other various benefits that my father was afforded because of his 4 year stint in the military, including V.A. health care benefits. That 4 year stint also included room, board, clothing, and food. I am in no way discounting his commitment, and his service to our country. So there is obviously a little more to a military salary than what some people leave out, when they’d like to pit the military against first responders with regards to pay and benefits. And once again, the argument that first responders should be brought down to military is somewhat backwards. Some would argue that the military should be brought up to what first responders make. And when you do a cost comparison between the two, with regards to all of the other benefit costs aside from just salary, I’d be interested to see how far off the two really are. Your comparison between the private sector and the public sector with regards to hours worked, and that your high tech job requires you to put in 60+ hours, and is high stress. Much respect from me to you. But my question is this, what are the risks of your high stress tech job, putting in that many hours? …. What I mean by that is, what’s the worst that can happen if you fail at any given time in your high tech position because of fatigue or stress? …. (On the job) …. The profession of a Paramedic Firefighter requires getting it right 100% of the time. Failure can mean the difference between living or dying, both for the Paramedic Firefighter, and / or the customer. Surely you can agree. Once again, your reference to 48 hours, and defining that as two days, is misleading. It’s 2 days on, one day off, and a total of 48 hours = 6 – 8 hour days. A Paramedic Firefighter must stay in a government building for 24 hours, subject to an emergency call at any time during that 24 hour period. Yes, some do have side jobs, or teach on the side, or own a business on the side. Is your point that no one in the private sector works another job, or has a business above and beyond their base employment? Your reference to the way a call is answered in Palm Beach County regarding the usage of multiple vehicles and personnel, that you compare to the private sector, as if this is a waste. What you’re failing to understand is that the level of Advanced Life Support service in Palm Beach County dictates that certain procedures are followed, and certain tools, equipment, and supplies are used to provide this advanced service. The modern day Emergency Medical Team is basically bringing the Emergency Room to the patient. This requires man power. Years ago, Paramedic Firefighters were not carrying 12-Lead EKG’s, weren’t carrying Glucometers, or using the advanced airway adjuncts, and various other tools / equipment, or performing the myriad of tests that they’re performing now. And the customer demands this level of service. If the private sector will promise you that they can do it with less, I would venture to say that they’re misleading you. A Cardiac Arrest patient who requires CPR, Electro-Shock therapy, Intraveneous lines, Airway intubation, Medication administration, and someone to document this all, with the time line, along with all other pertinent information needed for the hospital could be handled by one private sector vehicle? …. I guess that might be possible. But their shouid be at least 5 or 6 people on that vehicle, with all the necessary equipment. That would make it a pretty big vehicle. Your statement about supervisors on the different rigs (Lieutenant / EMS – Captain FIRE) ….. And how a private company doesn’t do it this way. I beg to differ. The private provider ambulance companies that operate in Palm Beach County have supervisors on most if not all of their trucks. You’re treading down a slippery slope when you compare “For Profit” against not for profit, regarding emergency services. If you really want to get into a “Waste” discussion, lets talk about municipalities that have borders against each other, and 3 fire stations all within a mile or two of each other. Each fire station covering their municipality only. How many municipalities in Palm Beach County have their own emergency services, separate equipment, separate communications, separate maintenance and supply facilities, separate purchasing contracts with weaker purchasing power, ect ect ect …… And this wouldn’t be the fault of the Emergency Service Providers themselves. This would most likely be more of a league of cities – autonomy – what’s ours is ours – identity thing. Ending question – What percentage of the Florida State Retirement system, is part of the over all state budget ? |

May 14, 2011 5:35 pm |

Comparison of dangerous job categories can be found at various places, including The Daily Beast, Forbes, and Business Insider among others. My rankings came from the first of these which lists the salary of a merchant mariner as $61,960 and a firefighter as $45,700 (which is approximately the Bureau of Labor Statistics national average, and much less than the $71,800 average of Palm Beach Fire/Rescue in 2009). BLS is the source for much of the information, including fatalities per 100K.

The point of this is not to argue which jobs carry more risk, but to suggest that risk alone does not correlate strongly to compensation. You would hope that in a free country where both employers and employees constitute a labor market and can make free choices, that compensation would correlate strongly with the perceived value of the services provided. Risk would be a part perhaps, but not the major driver. Perhaps the PBC Fire/Rescue provides a service that is truly worth the 52% premium it gets over the national average, I don’t know. You make a good case that it is expensive to bring the emergency room to the patient, and if I was having the emergency I would be grateful for the service. In jurisdictions where the equipment and training level is less than this, (many parts of the country, presumably, given their costs), then I assume more people die before receiving treatment. It would be interesting to gather those statistics as a way of bolstering the case. I do know that in the 8 years since 2003, the Fire/Rescue budget has grown 82% when its service population only grew 26% and staff only grew by 36%. Most of the budget growth was in personal service costs, not equipment and infrastructure. The IAFF is a very good bargaining unit and deserves the appreciation of their members. It is both appropriate and expected that the union should negotiate the best deal, that is not the problem. It is the county administration and commission who sit on the other side of the table (and are supposed to represent the taxpayers) that should explain to us why our services cost more than others. This applies to PBSO as well as Fire/Rescue. County staff spending growth has been somewhat restrained in the last few years. The municipalities that still have their own Fire/Rescue services (37% of the county at present), have made their choices for various reasons. Cost would be one – the budget growth in the county Fire/Rescue exceeds that of the cities whose budgets we have examined. At the state level, as at the county, the 2011 employer contributions for FRS were 9.63% of payroll (regular class) and 22.11% (special risk). This falls to 3.77% and 12.96% respectively, for 2012 if the governor signs SB2100. |

May 14, 2011 10:57 pm |

Your comparison of the career “Firefighter” vs. Merchant Mariner as it relates to a national average. Is your BLS data comparing “Paramedic Firefighters” … Or just Firefighters, as you’ve written above? ….. As I’ve said up above, one has to view the service provided as a “Dual Service”. And to get a true value based comparison between salaries of these occupations, you’d need more data than what these website’s you’re using, are providing.

For the last 25 years, the fire rescue budget has been run quite fiscally responsible. Everything’s been basically paid off, without the need for bond issues and the like. This would relate to your equipment and infrastructure data. I don’t know if the municipalities can lay claim to the same. I’m assuming that the municipalities that came into the county system must have come in for a fiscal savings component. The city of Boca Raton has used their fire rescue system as a marketing tool for annexation. They promised the citizens of Boca Raton big increases in level of service, with less taxes. If you’ve read the local newspapers in the last few years, I don’t think their taxes have remained stagnant. Your right about health / life risk data not being the only analysis that should be made. Your numbers regarding population and staff growth, as it relates to this discussion prompts me to ask you, has “Demand” remained stagnant? Has the call volume gone up or down? …… In an area that has a population fluctuation that widely goes up and down as it relates to tourism and snow birds, and the population that travels through the major highway arteries of Palm Beach County, can you get a true picture of how many human beings are physically in this county and need to be protected at any given time, and does your data reflect this? All of the occupations you use as your safety / salary comparison, how many of them require college credit training? ….. I believe the pilot, and merchant marine categories are pretty much the only ones. So yes, there’s more than just the safety factor to consider. Have you done any studies that would show that if the municipalities that represent the 37% which have kept their own fire rescue services, would benefit as a whole by consolidating into one department? ….. Do you have any charts that would possibly show over lapping with regards to fire stations from several different agencies, that are basically on top of each other? Several agencies with their own multi-million dollar communications set ups? Their own multi-million dollar training facilities? …. You say that these municipalities have made these choices for various reasons. You’d probably be best served by examining those reasons first, before going after the lively hood of your first responders and their families. Your last statement didn’t answer my last question above. What is the FRS percentage of the total state budget?. Another question: What is the median price of a home in Palm Beach County at this time? |

May 14, 2011 1:36 pm (Edit) |

So many questions. I sense our world views are so divergent that any agreement on these issues would be improbable.

So here is an offer – make your case that the 52% premium is justified, or that it is misleading or incorrect. Or make the case that the extra spending saves lives and that the PBC EMS performance far exceeds the peer group. We will run your article as a feature story and distribute it to the TAB mailing list. But be forewarned – it is a tough crowd that leans towards the view that county spending has been excessive. But we are rational people and will give it a fair hearing. You can send it to: info@pbctab.org |

May 15, 2011 6:04 pm |

Yes, lots of questions, and lots of factors to be considered before making informed opinions / informed decisions. As far as tough crowds go, there are a few here in Palm Beach County. One of those is a crowd that is probably the biggest demand of the Fire Rescue / E.M.S. system. That would be our elderly population here in Palm Beach County. And the odd thing about these customers, as it relates to your argument here, is that a lot of these people are “Homesteaded Out” …. Which means they pay little to no taxes, yet use the system extensively.

One can almost draw a comparison with your argument of why are we paying the Paramedic Firefighters X amount of dollars, and what are we getting for our money? … With … Why are we paying for this system, yet the people who use it the most, are not? ….. But I seriously doubt you’d wanna go up against that crowd, no matter how tough your crowd is. And the ironic twist here? —> I would venture to say that there’s a strong possibility that a lot of these elderly residents of Palm Beach County, are parents of the tea party people who would attack the first responders as over paid. |

May 16, 2011 5:50 am |

Making my case is easy. Include everything I’ve talked about above, with this …….

In the past 25 years, I can personally assure you that there are at least 4 human beings, 4 tax paying citizens in Palm Beach County, that went into what’s called “Ventricular Fibrillation”, which is a cardiac condition where the heart stops beating and begins to “Fibrillate”, (Which means that the heart that normally has one dominant natural “pacemaker” of it’s own, fails to be the dominant one, and little pacemakers all over the heart begin vying / competing to take over and become the dominant one – Basically.) that the Paramedic Firefighters who immediately applied the EKG monitor and made the diagnosis of this life threatening heart problem, applied the defibrillation paddles to the patients chest, performed the defibrillation, which basically sends a large electric shock and depolarizes all of those little pacemakers in the heart at once, with the hopes that the dominant pacemaker will take back over and lead the heart into beating normally again … worked … and got the heart beating normally again, the Paramedic Firefighters were then able to quickly administer medications through an intravenous line that they initiated / established, and were able to administer medications carried in their box to sooth / relax the heart (It’s gone through a traumatic event here, and is still irritable and could quite possibly go right back into ventricular fibrillation), administer oxygen to the patient for the very same reason, and these 4 human beings regained consciousness before arriving at the Emergency Room, and were released back to their families several weeks later, with no residual, neurological deficits. So there’s at least 4 human beings in Palm Beach County, (That I personally know of) that I would challenge you to ask they and their families: “Are Paramedic Firefighters worth what we pay them?” Now those are just a few examples of people that have been brought back “After” crossing the thresh hold of deaths door step. (That I personally know of) ….. Let’s talk about the hundreds, if not thousands that I personally know of, who have been stopped “Before” crossing the thresh hold of deaths door step, by Paramedic Firefighters in Palm Beach County. A few of these conditions would include, but not limited to ……. The heart conditions that are extremely dangerous, and require other intravenous medications, or electro-shock therapy, to treat the problem and either stabilize it (With Oxygen), or correct it, prior to entering the Emergency Room. The condition known as “Congestive Heart Failure” or simply “C.H.F.” … (This is where the side of the heart that is relied upon for dispensing the oxygenated blood from the lungs, to the rest of the body, begins to slow down / fail, which then causes the blood to back up into the lungs, basically causing the patient to now drown in their own fluid.) where the Paramedic Firefighters quickly apply oxygen, initiate an intravenous line, administer a medication they carry in their box called “Lasix” which works in the kidneys to drain the fluid that is built up in the lungs, thus allowing them to breathe normally again, prior to entering the Emergency Room. The Diabetics who are in what’s called “Insulin Shock”, this is where their blood sugar levels are dangerously low, and the Paramedic Firefighters would know this because they have equipment that immediately tests their blood sugar level, and are able to immediately establish an intravenous line, and administer a medication in their box called “Dextrose” which is a medication that is basically brings their blood sugar level back up to non life threatening levels before entering the Emergency Room. The drug over doses (Accidental or Intentional) where Paramedic Firefighters are able to immediately establish an intravenous line to administer a medication they carry in their box called “Narcan”, which treats Narcotic over dose and brings the heart back to a normal rate / rhythm, brings the blood pressure back up, brings the patients level of consciousness back up, …. once again, before entering the Emergency Room. Just these three examples, which are just three of many other life threatening conditions that Paramedic Firefighters are trained and equipped to handle, are examples of hundreds if not well over a thousand, that I can personally attest to, that your Paramedic Firefighters have saved from crossing over the thresh hold of deaths door step in the last 25 years. So ….. If you were to gather up all of these patients and their families, and ask them if Paramedic Firefighters are worth the money they’re paid, I would venture to say that the majority of them, if not all of them would say yes. Well worth it, and then some. There are just a few examples. Then, as part of your analysis / as part of your information gathering, to make an informed / balanced / non biased opinion, and advice to your elected officials, I would challenge you to ask Paramedic Firefighter peer groups (Both private and Public providers) around the country basically the same question, but slightly modified. ………. “Do you think that Paramedic Firefighters in Palm Beach County Florida, are paid a fair wage that’s equitable to the cost of living / cost of buying a home in Palm Beach County?” …… Sorry …. A lot of questions, a lot of information. But the web page here says: “Speak your mind, tell us what you’re thinking.” ….. Please feel free to share all of this with your tough crowd. Thank you for your time. Over and out. |