PBSO Budget – A TAB Update

Introduction

During the preparation of this article, TAB members Fred and Iris Scheibl, and Meg Shannon met with PBSO Chief Deputy Mike Gauger and COO George Forman to discuss the PBSO budget history, the challenges they are facing, and the most fair way to present what seems at first glance to be a budget that has grown at a very rapid pace since the 2003 base year of our analysis.

Prior to the meeting, our earlier open records request for spending data from 2003-2011 was fulfilled, and we were able to get a picture of where the money was spent and where the fastest growth has occurred.

At the meeting, we asked them to consider disclosing their budget line item detail as part of the normal process (rather than requiring citizens to jump through the open records request hoops). Both the Martin and Broward Sheriffs do this to varying degrees – Martin even makes the data available on their website. PBSO on the other hand, provides their budget input to the County Administrator only in the minimum form specified by Florida statute. We were told that more transparency was a possibility, and they would have to discuss it among the PBSO executives.

We also asked them for two other things – for the Sheriff to voluntarily come under the jurisdiction of the Inspector General and Ethics Commission, and for there to be a public audit of the Mobile Data Project, which we have been told has suffered some significant setbacks. On the former, the answer was absolutely not – internal controls and audit functions within PBSO are sufficient and there is no chance that PBSO will voluntarily do any such thing. The answer to the second was also an emphatic no.

Since that meeting, we were sent some additional information, including a 2010 Resource Guide (which contains useful information and metrics about the jurisdictions in the county), and a list of links to publicly available information about county operations and the Florida statutes that concern Career Service Protections, FRS and collective bargaining. Although useful, these sources did not help us with the specific information we were after, namely:

- The number of residents in the operating area, and the average number of jail inmates 2003-2011 (The other year resource guides would suffice)

- Call rate by year 2003-2011

- Staffing at the department level: sworn / civilian / part time for 2003-2011

- Years that major new jurisdictions were added and how that changed the revenue/expense/staffing

- Any extraordinary events/challenges that caused a spike in spending, and what costs were incurred (eg. Homeland Security mandates, trends in crime statistics, etc.)

In response to this query, Budget Director Kathy Cochrane forwarded our questions to Central Records Division for action and redaction, and on Tuesday 11/23 we were assigned a tracking number. When the information becomes available, we will refine the presentation in this article to incorporate (hopefully), a more nuanced view of the PBSO budget over the last 8 years, and likely a better justification for the rapid growth in spending.

Budget Summary

TAB has obtained additional data about historical spending in PBSO, specifically a year by year spending comparison from FY2003 to FY2011. This is more detail than provided to county staff during the budget preparation, and is useful to determine trends. (For a TAB summary of the yearly data provided by PBSO, click HERE) During that time:

- Personal Service costs rose 92%

- Operation costs rose 27%

- Per employee compensation rose 49.4%

- Benefit costs (pension + insurance) rose 154%

This time period saw inflation of 21% and the county population grew 6%.

In the latest budget year, personal service costs (pay and benefits) represents 83% of the total PBSO budget. This compares to 62% for Fire/Rescue. Any future cuts to this budget will necessarily involve staff reductions or reductions to pay and benefits.

Likely Future Budget Scenarios

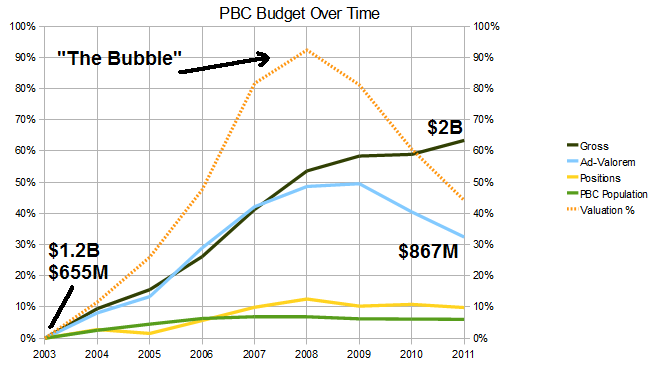

TAB has proposed that the county consider a spending level rollback, perhaps to the levels of 2006. That year is significant because the property valuations of 2011 have fallen to about what they were in 2006, and that level of spending would be sustainable with 2006 pre-bubble levels of taxation (See chart).

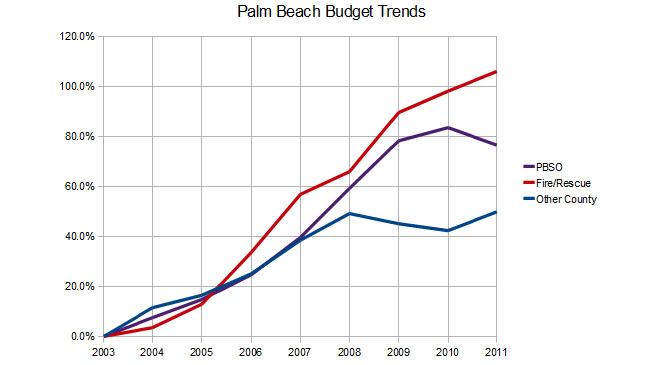

The Sheriff now accounts for 23% of the county appropriations, up from 21% in 2003. By contrast, Fire/Rescue is now 18%, up from 14%. The other county spending though, has been relatively flat since the “bubble” burst in 2008, while both PBSO and F/R continued upwards. The Sheriff did reduce his budget for FY2011 and held positions flat, but is still about 10% above 2008. To roll back to 2006 spending for PBSO would require a reduction of 28% from current levels.

Outlook

TAB believes that the coming years will be particularly challenging for Palm Beach County as property valuations continue their slide and the federal and state “stimulus” money that has been propping up the budget is no longer available. Either significant spending reduction (we would say to 2006 levels or earlier) or equally significant tax hikes will be necessary, and PBSO will not be immune to the challenge. That said, TAB also believes that the Sheriff’s core missions of Law Enforcement, Corrections, and Court Services are a necessary function of county government. Is everything being done today inside PBSO part of those core missions? We don’t yet know the answer to that, and the lack of transparency to the public makes the analysis difficult.

We would like to know if the rapid growth of the PBSO budget was justified by conditions in the community, and how the 4011 employees (1734 of them civilian) are allocated today. We have no reason to believe that there is anything inappropriate being done, but we have no way to tell. Therefore, we would request that PBSO participate more fully in the county budget setting process and implement a public records improvement in keeping with the spirit of the Florida Open Records Law (Statutes chapter 119) that says (among many other things):

“119.01(2)(e): Providing access to public records by remote electronic means is an additional method of access that agencies should strive to provide to the extent feasible. If an agency provides access to public records by remote electronic means, such access should be provided in the most cost-effective and efficient manner available to the agency providing the information.”

We believe the “most cost-effective means” for budget information is either the county or PBSO websites. The county staff does a world class job of this and would be able to assist PBSO in the transition. Martin County Sheriff’s Office provides another example as the Martin equivalent of the information we need from PBSO is available on the MSO website today.

Additional things that would greatly improve the public access to PBSO would be:

- Better cooperation with county staff and commissioners in providing detail to the budget process, even when not mandated by statute.

- Executing an inter-local agreement to voluntarily place PBSO under the juridiction of the Office of Inspector General and subject to the Code of Ethics and Ethics Commission.

- Allow an outside audit of activities that have raised questions in the community – specifically the status of the Mobile Data project and the issues with Intergraph, Inc.

With or without TAB actions, we believe progress is possible in these areas. During the recent election, both candidates for District 2 called for more transparency from the Sheriff, and we are hopeful that the winner – Paulette Burdick, will pursue this. In Broward County, 72% of the voters supported the Charter Amendment that places BSO under the Code of Ethics. There may be a court challenge to this, but it is clear that the citizenry would prefer it. Lastly, questions were raised about Mobile Data during the last budget cycle, and there are members of the community that have begun to probe this program. TAB also expects to investigate this further.

Pension rules are stacked in favor of the unions

This weekend, Randy Schultz of the Palm Beach Post Editorial Board has cast a bright light on the time bomb of public employee pensions in Florida, and shown them for what they are – an unsustainable boon to the unions at taxpayer expense, enabled by the Tallahassee legislators at the urging of the unions, in many cases tying the hands of local officials when they attempt to bargain in good faith.

Read the editorial HERE

In the editorial, Mr. Schultz describes the showdown that is coming and gets at the root of the problem:

…”Politics explains much of this financial problem. Police and firefighter unions have much clout at the local level and in Tallahassee. State fire and police pension laws are stacked in favor of the unions. One example: Governments don’t just have to meet an overall standard for benefits; governments must meet all of nearly two dozen standards. Twice in the past 11 years, at the unions’ urging, the Legislature has ordered cities and counties to sweeten police and fire pensions. This year, the Legislature rejected a request to exclude overtime in pension calculations. A state law that applies only to Palm Beach County gives sheriff’s deputies annual “step-up” pay raises.” …

He points out that many of the cities in Palm Beach county are seeking innovative ways to get control of a critical problem and end some of the worst practices. It is time for the Legislature to back the cities.

TAB believes that public employee pensions, along with other attributes of the lucrative contracts for the Police and Fire unions have arranged for themselves are the most harmful aspects of the county budget. While the cities struggle with their unions, what is the county doing to reign in the excessive compensation paid to Fire/Rescue and PBSO? Not much that we can see.

Responding to the statement by a former head of the PBA who said that West Palm Beach cannot “..ram something down (the unions) throat …”, Mr. Schultz ended his editorial with:

In fact, public safety unions have been ramming a lot down the throats of Florida’s cities. And now the cities are choking.

Well said!

Libertarian Party of Palm Beach County Supports TAB

At it’s annual meeting on Tuesday in West Palm Beach, the Libertarian Party of Palm Beach County decided to officially support TAB, and hopes to be an integral part of the coalition to effect serious change in the 2012 county budget.

Read the story in the Examiner HERE

Town of Palm Beach County Budget Task Force Joins TAB Coalition

After review by the Town Council, the Town of Palm Beach County Budget Task Force has joined TAB as a coalition partner. (See related story HERE).

In June of 2010, in response to the general impression that the projected county tax increases are economically and politically unsustainable, the Town Council formed the task force chaired by Mayor Jack McDonald. Its mission is to build a coalition of like-minded voters, taxpayers, and elected officials throughout the county to monitor and positively impact the county’s budgetary and taxation policies.

Like TAB’s other partners, the Task Force seeks to study the county budget proposals, and attempt to influence policy in a constructive direction, and their expertise and efforts will be a welcome addition to TAB’s growing project portfolio.

Term Limits Unconstitutional?

There has been very little media coverage of a possibly very significant court ruling in Broward County. Lost in the coverage on election day last week, was the story that Broward Circuit Judge Carol-Lisa Phillips, the wife of former Ft. Lauderdale Mayor Jim Naugle, who was term limited in 2009, ruled that Broward County Commission term limits are unconstitutional.

Read about it in the Sun-Sentinel, Miami Herald, and New Times.

The judge cited a 2002 ruling by the Florida Supreme Court that invalidated term limit provisions in the charters of Duval and Pinellas counties. Since Palm Beach is a constitutionally created Charter County as well, it is likely that a similar lawsuit is in the works to clear the way for Karen Marcus (likely) and Burt Aaronson (maybe) to run again in 2012, even though the current Charter would prohibit it.

It should be noted that the Broward voters passed their term limit charter amendment with 80% of the vote, and in Palm Beach it was 70%. Once again, the judiciary steps in to thwart the will of the voters. Since part of the TAB strategy is to seek out like minded candidates to run for these thought-to-be-open seats in 2012, we will be following this closely.

TAB Discusses Partnership with Town of Palm Beach

Update: The Town of Palm Beach Council has decided that it would be inappropriate for the Town to become a TAB partner, but that it would be beneficial and satisfactory if the Budget Task Force did so in its own right. Councilman Richard Kleid, noting that the coalition included tea party groups, said “I don’t want to get in bed with people that I may not agree with on other matters.” Council members also said they were “… concerned about affiliating with a group that may endorse political candidates who may take positions on non-budget issues that the town could be at odds with …”

For the record, TAB does not intend to endorse or directly support candidates for public office, but other coalition partners may. That said, TAB is always on the lookout for like-minded individuals of any political party who would be willing to run for the commission seats that may be open in 2012 and we would encourage them to do so.

For description of the meeting, read William Kelly’s piece in the Palm Beach Daily News HERE

Earlier this year, the Town of Palm Beach established a County Budget Task Force, led by Mayor Jack McDonald, to study the county budget in detail, determine its impact on the town, and make recommendations to the Council regarding possible action. The Mayor and other members have spoken at the county budget hearings and opposed increasing the millage rate.

Since TAB is doing similar analysis and holds similar views of county spending, we were asked to make a presentation to the group on 10/25, and the possibilty of the task force (and possibly the town itself) becoming a TAB coalition partner was introduced. Discussion of the matter will continue at the upcoming 11/9 council meeting.

For background, see the article on the subject by William Kelly in the Palm Beach Daily News. (CLICK HERE).

As the FY2012 Budget discussions begin, TAB intends to reach out to like-minded groups concerned with excessive spending by the county, and propose similar partnerships. In general, TAB coalition partners:

- Identify with TAB premise that county spending is excessive at current levels and should be reduced

- Confine their non-partisan involvement to County Budget issues

- Are Identified by organization logo on the TAB website banner

- May join or leave coalition at any time

- Have access to TAB research and resources

- Provide representatives to participate in TAB activities and events

- Participate in “calls to action” – speaking, writing to newspapers and commissioners, networking, generally supporting the TAB agenda

If you or your organization see benefit in becoming a TAB coalition partner, please contact us at info@pbctab.org

New County Commission for 2011

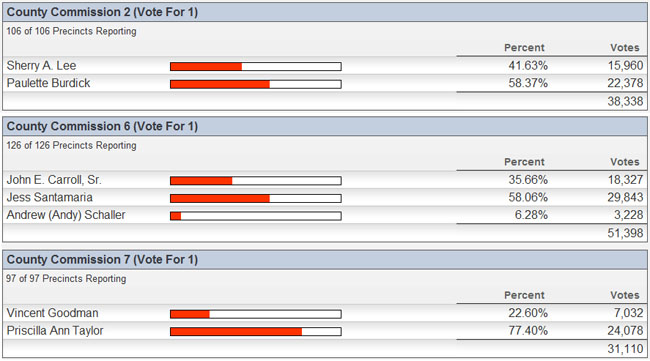

The people have spoken. On November 2, 2010, the three County Commission seats that were disputed (Steven Abrams in District 4 was uncontested) were decided for the incumbents in districts 6 and 7 by large margins, and the open seat (vacated by Jeff Koons earlier in the year) went to Democrat Paulette Burdick over Republican Sherry Lee, 58% to 42%.

The incumbent’s positions on the budget are known. Jess Santamaria voted against the current budget and has been open to at least small cuts. Priscilla Taylor, although opposed to layoffs of county employees, is open to discussion on the budget, has called for more transparency from PBSO, and has asked for a charter review to discuss the structure of county government.

Paulette Burdick, in the later part of the campaign has said encouraging things about controlling county spending and has also called for more disclosure of the PBSO budget detail. TAB hopes to begin a dialog with Ms. Burdick on budget issues in the near future.

Below is the election results for County Commission as reported by the Supervisor of Elections:

Both Candidates for District 2 Call for Sheriff to Open his Books

TAB has been vocal about the lack of transparency in the PBSO budget. Every year, the Sheriff delivers to county staff, the bare minimum of information specifically required by statute. This is not enough detail to understand where the money is spent, rather it is just the top line amounts for the main areas of Law Enforcement, Corrections, and Court Services. We have been stressing to the Commissioners that they have the right under statute (some would say the responsibility) to demand a full accounting of both the historical and projected spending detail.

District 2 candidate Sherry Lee has been a TAB supporter and a party to our call for PBSO transparency. Her opponent, School Board member Paulette Burdick, has now joined the call for opening the Sheriff’s books. From a Palm Beach Post article by Jennifer Sorentrue yesterday:

Burdick also wants commissioners to force Sheriff Ric Bradshaw to explain his budget to the public every year. Bradshaw’s spending plan makes up the largest portion of the county’s operations budget.

“I believe the sheriff should present his budget line item by line item at an evening meeting.” Burdick said. “The public doesn’t see it or hear it.”

The sheriff could do more to cut overtime and cap salaries and perks, Burdick added.

Lee also criticized Bradshaw, for what she called a “lack of transparency” in discussing the office’s budget. The sheriff should look at cutting civilian employees, as oppposed to deputies, she said.”

For the full article, CLICK HERE.

TAB Request for PBSO Budget Detail

As many are aware, we submitted a records request to PBSO in July for line item budget detail. As of 10/15, this request had not been filled (but is now -see below). We have begun a dialog with budget manager Kathryn Cochrane, in conjunction with COO George Forman who offered his assistance after the 9/28 budget meeting. Our request to Ms. Cochrane was for “bureau level detail for the years 2003 to the present”, so we can do an analysis of PBSO to the same level as we have done for the county.

Update: Today (10/18), we received the information request. Consisting of 9 pages, one each for the years 2003 through 2011 budget years, it contains more detail than we have seen before, with line items for about 50 appropriations categories, split into the 3 main functional groups of Law Enforcement, Corrections, and Court Services. It does not contain the department level detail that we will need to analyse the trends, but it is a start. We are learning about how PBSO works internally and will try to be more specific in framing our next request. Our goal is to get to the point where the information that is readily available online for the other county departments does not require the assistance of the open records laws to obtain from PBSO. We do appreciate that (after first being denied an electronic form of the document) we were at last able to get central records to send us the 9 page pdf file in an email.

County Commission Hikes Taxes Yet Again

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

On Tuesday evening, the Palm Beach County Commission voted 4-2 to raise county tax rates 9.3%, on top of a 15% increase last year. TAB had proposed specific cuts of $50M (2.5% of the $4B adopted budget) that would have prevented the hike. We also asked the commissioners to defer the Fire/Rescue raises (4% increase on a $140,000 average compensation – costing $14M in this budget), and to defer some capital spending. Fire/Rescue cuts would not have affected the county-wide millage (it is a separate line item) but would have been an acknowledgement that the public sector union employees are not completely isolated from economic conditions affecting those who pay their salaries.

The commissioners, in a not-very-serious discussion of additional cuts of up to $10M, and a contemptuous disregard for Commissioner Santamaria’s proposal to reduce the county car allowance, moved to a vote with very little discussion. There was consensus that any cuts that would not have a major effect on the taxes paid by for the mythical $200,000 house would be no more than pocket change and beneath their consideration. The fact that more than 60% of taxpayers will be paying more (click here for the Sun-Sentinel analysis) was glossed over by the commissioners – “the people want the services more than they want a tiny tax cut” – to paraphase Commissioner Aaronsen.

We at TAB are not surprised at the outcome, having discussed it with individual commissioners over the last week:

- Commissioner Marcus told us she was pursuing additional cuts of up to $10M, including some from the Sheriff, but did no more than mention it in passing at the hearing.

- Commissioner Abrams explained to us that while he would like to see the deeper TAB cuts implemented, the votes were not there for it and smaller cuts were not worth the pain they would cause.

- Commissioner Santamaria thought some token cuts would be good but did not support anything substantive.

- Commissioner Taylor would not even consider a cut that resulted in a single employee layoff.

- Commissioner Vana is all for reviewing programs next year (she is calling for “contingency audits”), but would also draw the line at layoffs and is vehemently opposed to outsourcing.

- We did not speak with commissioner Aaronson – what would be the point? He made it clear that he thinks the 2.5% TAB cuts would “destroy the county”.

A curious thing occurred at the hearing. While the Sheriff did not attend the 9/14 hearing and there was little participation or discussion regarding PBSO, at this hearing his organization was well represented, with over 20 employees coming to the microphone in support of the Sheriff’s budget.

We believe this was a consequence of TAB discussions with individual commissioners over the last week regarding the BCC rights under Florida statutes to request line item detail from the Sheriff. The reason for this line of inquiry was in response to Bob Weisman’s statement on several occasions that the county can not cut any more from their budget unless the Sheriff makes equivalent reductions. If this were to be asked of the Sheriff, having the line item detail would allow a public analysis of whether additional cuts would indeed compromise public safety. The PBSO budget has grown 80% in 8 years – about 12 times the population growth and 3.5 times the rate of inflation. The Sheriff provides to the county only the detail required by statute – which is not enough to understand the PBSO spending. Both Broward and Martin county Sheriff’s provide much more detail, and TAB believes the BCC should require it of PBSO as well.

At the hearing, John Kazanjian, president of Palm Beach County PBA (the police union) made the following statement:

“I hadn’t planned on being here, neither had my members and fellow employees.” … “But it’s our understanding that the commission and its staff are listening and catering to professional and semi-professional anti-tax groups, little circles of characters who would complain even if they were paying next to nothing in taxes. But these are the same characters who march into government offices demanding services and call 911 when trash gets thrown on their yard”. “I’m here… because We’re tired of them bashing the Sheriff.”

Let’s set the record straight: TAB is neither a professional nor semi-professional anti-tax group. We are a coalition of concerned citizen-taxpayers, worried that excessive spending at all levels of government has begun to compromise our way of life and the American Dream for future generations. We have no sources of funding other than our own pockets, and all our work is a volunteer effort. The 15 or so citizens who spoke on behalf of the TAB proposal were at the meeting on their own dime, paid for their own parking, and took time out of their lives because they are concerned about the future of Palm Beach County.

We appreciate the feelings of the PBA and the non-union PBSO employees who spoke at the meeting, and we congratulate Sheriff Bradshaw and his team for their enthusiasm and commitment to the organization. They are however, all employees of the county, and representing their self interest. That is their right – the first amendment doesn’t stop when you put on a uniform or draw a public paycheck. What everyone needs to consider though, is that it is the private sector that provides the source of wealth from which government draws its funding. It is a bargain that works best when it is balanced. At the current time, the alliance of public officials, their employees, and the public sector unions that provide their funding and political support have distorted the private/public compact. This phenomenon has destroyed California and is wreaking havoc in many other states. In Florida we have not yet reached the tipping point, but the pension time bomb is ticking. The situation can be brought back to balance, but only if all parties are willing to cooperate.

For an excellent article on the subject, see The Trouble with Public Sector Unions in the fall issue of National Affairs.

We in TAB are not “bashing the Sheriff”. Rather, we have a lot of respect for PBSO and the work they do. We are asking only for transparency in the budget process, and an appropriate level of spending. The Sheriff, the Chief Deputy, and the COO have all offered to meet with TAB and discuss the PBSO budget. We thank them and will take them up on the offer in the very near future.

As a closing remark, I would remind the Commissioners that TAB is focused on SPENDING rather than taxes. Now that the tax rate is set until next year, the ad-valorem discussion is over, but the spending discussion will continue. We at TAB plan to continue our look at the budget line items, perhaps drilling down to the next level. We also hope to look beyond the county to the other taxing districts and the cities. Our mission is unchanged – “We are paying the TAB and we are keeping TABs on you.”

Synopsis of 9/14 Budget Hearing

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

Palm Beach County held the first of two public hearings on the 2011 Fiscal Budget on 9/14. The county chambers were filled to capacity and many people either watched on monitors in the anterooms on the 6th and 5th floors or in the lobby to the building. People were turned away and those who arrived after discussion had begun were unable to submit cards to speak or have their positions read into the record.

Note for future reference: At all PBC Commission meetings, once discussion has begun on a topic, no further cards may be submitted. This meeting was no exception. The topic for the county budget was IV E 1 and for Fire/Rescue – IV E 4. Many people arrived late and thus were unable to participate.

Most of those who spoke represented groups unhappy about cuts in the budget – primarily cuts to the Cultural Council, Palm Tran, the Drug Farm and the Eagle Academy. Even after the Commissioners made it clear that the Drug Farm and Eagle Academy were the Sheriff’s decision, speakers continued to come forward on it.

Thanks to those on the Palm Beach County Taxpayer Action Board work groups who spoke: Shannon Armstrong, Ed Fulop, Jim Donahue, Karl Dickey, John Parsons, Christina Pearce, Michele Kirk, Sherry Lee and Fred and Iris Scheibl. Carol Hurst also spoke on behalf of the TAB proposal. Also speaking – although not specifically on the TAB proposal was Dionna Hall. There were several other people who did not speak but submitted cards stating that they were in support of the TAB proposal. I’m sorry if I missed anyone who also spoke – I was not taking notes. It was unclear whether the Commissioners had received any phone calls or emails; if they had, they did not acknowledge them.

Many speakers left the long meeting after their 3 minutes, so by the time the Commissioners got to discussion of the budget the chambers were almost empty. To view the commission debate – advance to the 3 hr 8 minute point in the video accessed by clicking: ![]() HERE

HERE

Discussion lasted over an hour. The Commission voted 5:1 (Steven Abrams opposed) to keep the 4.75 millage rate as a maximum (as it appeared on the trim notices received by all property owners). Attempts would be made to bring the number down – potentially to 4.72 or 4.70. But the majority of the commissioners out right rejected the TAB proposal of roughly $30M in cuts plus an additional $20M which would be required by PBSO to retain flat millage. The target they gave County Administration was anywhere in the range of $4M ($2M from both PBSO and County) to $15M – all predicated on steep cuts by the Sheriff. It was totally unclear whether any further spending cuts whatsoever would be presented at the next hearing on September 28.

Following is a rough outline of the discussion and questions asked by the Commissioners:

Chairman Aaronson started the debate with a motion that 4.75 millage be made the ceiling. It was seconded and then discussion began.

Commissioner Marcus started going through the TAB proposal, exploring various aspects with Administrator Weisman responding:

- Blue vs Green pages: All Green pages done; none of the Blue cuts were made.

- Fire/Rescue: union approached on postponing increases – outright rejection

- Maintain PBSO cut: PBSO cut or returned revenue in amount of $28M

- HR programs: outright rejection of any of the Clerk’s suggestions of $1M

- Cut almost $10M in ad-valorem capital – rejected as necessary

- Stop or defer $91M in non-ad-valorem capital – rejected since it didn’t affect ad-valorem

Commissioner Marcus pursued capital some more – wasn’t a drop-off expected this year? Response was no – actually this coming year was going to be pretty bad with Max Planck debt coming in.

Commissioner Marcus raised the topic of the PBSO Mobile Data Project debt service on $35 million in bonds – raised by TAB members Iris Scheibl and Jim Donahue in their talks. Joe Doucette confirmed that the capital had not been drawn down as would be expected and discussion ensued around paying off the debt to eliminate around $6M in debt service. Marcus wanted a status on the project.

PBSO Budget – Commissioner Marcus and PBSO COO George Forman discussed civilian longevity and step raises and whether or not a Florida Statute would allow them to cancel or defer up to $11M in increases from occurring. While Mr. Forman stated that the $11M applied across the board (uniformed and non-uniformed staff) – Marcus replied that if 40% of staff wasn’t sworn – then wouldn’t it be true that about 40% of the $11M applied to civilians. Back and forth on the statute written to apply specifically to PBC and no other counties. Discussion on whether or not Fire/Rescue or PBSO contracts could be opened due to ‘exigent operational necessity, eg: financial catastrophe. It was unclear what kind of status report or response from PBSO would result from the querying other than direct response requested on the status of the Mobile Data Project.

Chairman Aaronson brought the conversation back to overall budget discussion. Aaronson favored cutting CCRT (Countywide Community Revitalization Team) and management of environmentally sensitive land $$ for a modest cut of $2-3M. He was absolutely against blue pages cuts or layoffs of ANY COUNTY EMPLOYEES. Ridiculous discussion then ensued stating that to cut $30M (TAB proposal) would result in a 750 person lay-off (when TAB proposal was actually 268). Aaronson said that any lay-off would hurt the Palm Beach County economy, result in further defaults on homes, so OUT OF THE QUESTION. After much discussion they concluded that they were only talking savings to the taxpayer of $8 if cut the spending.

Commissioner Abrams didn’t agree with the whole approach. Felt that we needed to do large scale reductions (eg the blue pages without closing the pools). That the county should do outsourcing. He rejected comparison to cities that have kept their millage rate flat, however – stating that the County doesn’t control PBSO and that Fire/Rescue isn’t in the county base millage rate.

Commissioner Santamaria was looking for a target; he would accept the motion of 4.75 millage if a $$ target were set. None ever was.

Commissioner Aaronson said that no way would $36M ever be cut and no matter how many people groups like TAB brought in, more could be brought in to say they want continued services and $$ spent. He could fill the chambers with them.

Commissioner Marcus would support the motion if the $6M in the Mobile Data project was pursued for a total range of $5-$15M in cuts.

Commissioner Vana was willing to postpone some capital (eg Mobile Data) and referred to a discussion from another meeting on jails vs ankle bracelets. She also suggested looking into contingency audits for the next budget to find low-hanging fruit – but absolutely no lay-offs or privatization. Looked directly to the TAB folks and said you won’t get to 4.34 millage this year – but maybe some of these actions would get us closer in the future.

Commissioner Taylor spoke against any attempt to outsource, citing an issue of Government Magazine. She also stated that one can’t compare cities to counties and that the Commission only does what the people want. And the people wanted Scripps and Max Planck. There was a lot of discussion with Commissioner Aaronson and Administrator Weisman on the history of the jails, Scripps and Max Planck – after which Commissioner Taylor said that the people want these things and then they have to pay for them.

There was a small amount of additional discussion on targets and then the Commissioners had their 5:1 vote on the Aaronson motion. The remainder of the meeting was to go through approval of all the other MSTU millage rates and transfers. Fire/Rescue was not touched. The meeing was adjourned.