On Oversight, Checks and Balances, and the County Budget

Our system of government imposes an arrangement of checks and balances, so no person or group can acquire unchecked power.

When it comes to the county budget, Florida statutes clearly designate the legislative body – the county commission, to have the authority and responsibility to set priorities for spending and taxation. The administrator and his staff prepare a detailed budget, following whatever guidelines they have been given, and the commission meets in the sunshine for two workshops and two public hearings to discuss and adopt a budget before the fiscal year begins on October 1.

WIth $4B at stake, a bureaucracy exceeding 11,000 people, and limited time available, the commissioners themselves cannot physically evaluate every line item in this very complex budget, so they focus on insuring adequate funding for their own public policy priorities while much of the budget travels on automatic. Lower level line items like specific road projects, nature centers, or other items with a constituency, only get discusssed if the staff recommends a substantial change to the item.

What does get discussed every year is the Sheriff’s budget, since it is the major consumer of tax dollars, and outside the control of county staff.

Most everyone will agree that the function of PBSO – law enforcement, the county jails and courtroom protection, is necessary and should be adequately funded. The agency should have modern equipment suitable to the mission, and deputies and staff should be adequately compensated in line with peer agencies around the state and in the rest of the country, and it is the Sheriff’s responsibility to request a budget that delivers what he needs.

But what if his request is excessive?

In the county departments, managers submit budget requests that are a mixture of needs and wish list items. It is the nature of organizations to want to grow. The Administrator and his staff must adjust the requests of his departments in creating the overall budget, so that spending growth (if any) fits within the revenue expectations of the organization as a whole. If the priorities are not in line with the Commission’s expectations, they are free to make adjustments as a part of the process. Not all wish list items are funded. Although the other Constitutional Officers have a similar autonomy to the Sheriff, they usually “play nice” with staff and their budgets are rarely controversial. They are also relatively small.

The Sheriff’s budget is different. It is very large and complex, and very little detail is available to staff or Commissioners, and certainly not the public without a chapter 119 (open Records) request. The attitude is one of arrogance – “this is what I need and I am not willing to discuss it further.” Since the PBSO request must fit within the overall county budget, big increases there crowd out other county spending and severely limit the ability of staff or Commission to be fiscally responsible. Since they are charged with approving the budget, the public typically blames them for the excessive tax increases that result.

This year, many of the Commissioners told us privately that they agreed the Sheriff’s budget is out of control. They know they are responsible for approving his spending, but see no effective way to challenge him. This has been true for many years, as Commissioners have come and gone. While it is true that they have the statutory authority to reduce his spending (subject to appeal to the Florida Cabinet), they do not feel they have the political basis to do so.

This year, only Vice Mayor Paulette Burdick and Mayor Priscilla Taylor have publically questioned the Sheriff’s spending. This takes courage and we appreciate what they have said and done.

As for the others, they are hostage to an impressive political machine that can bring enormous pressure on wavering commissioners from the districts where the Sheriff provides most of the law enforcement. Just witness the array of speakers at the September 8 hearing – HOA Presidents, concerned citizens, even PBSO employees – all came out to speak the Sheriff’s praises and remind the Commissioners what the price of resistance would be. One particular Commissioner went so far as to admit that without the support of the Sheriff, their re-election would be in doubt.

There are about 1.3 million citizens of Palm Beach County. Almost 900,000 are voters. Yet only a small number of people follow what happens at the county, and fewer still participate in the process. We believe that most of the county residents would be surprised at the size and growth rate of the Sheriff’s budget, but they are not organized, and lack the time and assistance to provide sufficient cover to those commissioners who would act if they could. By carefully limiting the size of his increases, the Sheriff assures that we never reach that tipping point that would so outrage the citizens that they would spontaneously rise in opposition.

Some Commissioners have suggested that next year can be different, but we doubt it. As long as the status quo goes unchallenged, or the funding mechanism for the Sheriff’s office is modified through statute or charter, the Sheriff will continue to claim whatever portion of the county budget he desires.

First Public Hearing on 2015 County Budget

The first Public Hearing on the 2015 County Budget is Monday evening, September 8th, at 6:00PM at 301 N Olive, WPB, 6th floor.

Unchanged from June, the county proposes to keep the county-wide tax rate at last year’s 4.7815 despite a 7% increase in valuations, which will result in a tax increase of about $44M over the 2014 adopted tax. This follows a $23M increase last year.

These additional funds will mostly go to the Sheriff (67%), and BCC operations (driven by salary increases).

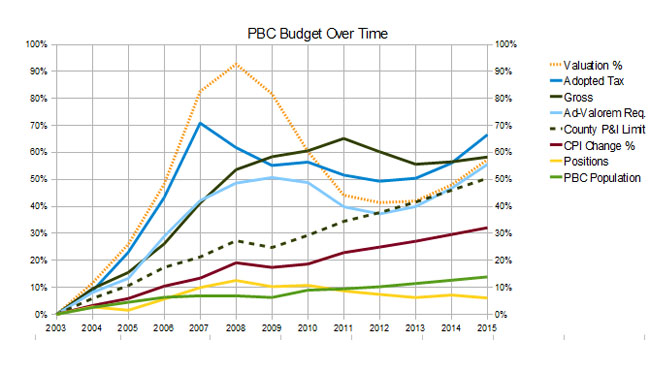

Note the growth in the Sheriff’s budget relative to other county departments. Those departments under control of the Administrator have tracked the valuation changes while the Sheriff showed no such restraint.

When the real estate bubble was expanding prior to 2007, the county budget grew by leaps and bounds, because a flat or mildly decreasing millage was easier to execute than raising it during the downturn. We are about to experience something similar. Back to back increases of $23M and now $44M is our warning. If not opposed now, the county spending will climb unrestrained. Some Commissioners (Burdick, Abrams, Valeche) see this. Others (Taylor, Vana) have embraced it. Returning even a small portion of the 2015 windfall to the taxpayer would set a precedent for the future.

The county is not alone in claiming all the valuation increase for more spending – most of the municipalities are following suit.

If you have a homestead exemption, it may appear that the tax increase on your TRIM notice is smaller than the 7% that the budget would project. This is because valuation increases in a single year are capped at the inflation rate (1.5% this year). Rest assured that your taxes will climb every year hence until you are “caught up”, even if valuations fall. This year, the difference is made up with higher taxes on commercial property and residences without the homestead exemption, for which the cap is 10%.

If you find all this troubling, let the Commissioners know you care about the growth in the county tax burden and spending. Attend the meeting on Monday if you can, or send them an email to BCC-AllCommissioners@pbcgov.org.

Let them know that we don’t want to return to the spending excesses of the last real estate bubble. A decrease of millage this year, sharing the windfall with the taxpayers, would be a tangible signal of responsible governance.

For some details of the 2015 budget, see: “2015 Budget – Flat Millage, what’s not to like? PLENTY!“

Maximum Millage Adopted

Yesterday, the County Commission set the county-wide maximum millage at 4.7815, unchanged in four years. Reduced payments on county debt have very slightly reduced another line item called the “voted debt” millage, and they are trying to claim a slight reduction by combining the two rates, but I am sure you are not fooled. (See: Rate to ensure tax hikes for many in the Palm Beach Post, and Palm Beach County holds the line again on property tax rates in the Sun Sentinel.)

At this millage, rising valuations will generate an additional $44M windfall for the county over last years take, a hefty increase. It is not enough for some commissioners though – Shelley Vana and Mayor Priscilla Taylor argued strongly that there are so many additional things they would like to spend money on, that we should actually increase the tax rate. Commissioner Berger joined them in supporting Vana’s motion, but it failed 3-3 with commissioner Burdick absent. Hal Valeche and Steven Abrams argued against any increase, and Jess Santamaria joined them to defeat it.

We were surprised by this attempt to raise the rate, given the hefty tax increase already planned, and expected a pro-forma vote, coming as it did at the end of a long and involved commission agenda. As such, we did not participate in the meeting, nor call for others to do so. Only two members of the public spoke against the tax rate, Anne Kuhl and Alex Larson.

The $44M tax increase (more than $63M in aggregate, when Fire/Rescue’s $14M hike is included), is too much, coming as it did after last year’s $22M hike. The September public hearings on the budget (September 8 and 22) are the time to make our voice heard on that subject. Although the maximum millage has been set (required to generate initial TRIM notices), the rate can be reduced in those meetings. Reductions in the rate of growth of some programs, particularly the Sheriff, are warranted.

Maximum Millage to be Set on July 22

Tomorrow, July 22, the County Commission will set the maximum millage rate for FY2015. Staff is proposing the countwide rate stay at 4.7815 – which would be the fourth consecutive year at that rate. Judging by its position in an otherwise crowded agenda (Item 5-I-1), they do not expect much public comment on the action.

The maximum rate is the do-not-exceed rate, and the final millage can be set lower than that in September (as it has been on occasion). As adoption of the maximum rate is all but assured, we do not think opposing it at this time is an efficient use of resources. The September public hearings are a more appropriate time to bring arguments for sharing the valuation windfall with the taxpayers.

Since the property appraiser’s office is projecting that the taxable value will increase for 86% of owners, at this millage, most of these will see an increase in their property tax bill at the end of the year, whether homesteaded or otherwise. (See: Taxable value up for 86% of Palm Beach County properties )

Most of the increase is going into employee compensation increases – 3% for most, better than 6% for the Sheriff’s office, on average. We will soon have an article which compares the compenstation trends in county government – PBSO and otherwise, to the growth in private sector county median income. You will see that it has been a good time indeed to work for the government.

We believe that a $44M increase in taxes this year, returning none of the windfall in valuations to the taxpayer, needs more justification than has been forthcoming, particularly from the Sheriff. Sheriff Bradshaw has refused the Mayor’s request for a workshop on the subject however. The commissioners, who are required to hold public meetings on the budget, must defend the Sheriff’s request as if it was their own, even when many have questioned his numbers.

It is an act of political courage for a commissioner to oppose the Sheriff’s budget, as he can organize large numbers of supporters to flood the chamber and demand that his request be filled. Nevertheless, some commissioners have raised the question. But it would take the votes of 4 commissioners to challenge the Sheriff, and under our system of constitutional officers, all they may do is reduce his overall number, not specify from where the cuts would come. If refused, the Sheriff could appeal the decision to the state level, something he has threatened in the past, and the commission could be overturned by the Governor after the budget period ends, leaving them with a hole to be filled from reserves – a daunting prospect.

Unless the Sheriff is challenged though, we are on a trajectory where all the other county functions will be starved for funds, or much larger increases in taxes are in our future.

The commissioners are there to serve their constituents, and for the most part they do that well. If enough constituents ask for a challenge to the Sheriff’s budget, most commissioners will at least ask the question. Between now and the September public hearings on the budget (9/8 and 9/22), we would like to hear from interested parties. Send us an email at info@pbctab.org and let us know if you would be willing to help organize support for those commissioners who would be willing to challenge the Sheriff’s budget.

2015 Budget – Flat Millage, what’s not to like? PLENTY!

The Palm Beach County budget proposal, published this week, is quite remarkable. Not since the bubble years, when inflated valuations drove out of control spending, has there been a budget proposal of this size. Rising valuations should allow a modest return to the taxpayer through lowering the millage. This proposal, while holding millage flat, clearly notes that there are areas whose levels of funding they think are “unacceptably low”.

By almost any measure – the tax amount, ad-valorem equivalent spending, population and inflation (TABOR), the county apparently believes we have returned to the good old days.

While valuations have improved by over 6% this year, at $138.6B we are only at 82% of the peak year of 2008. Yet this year’s budget proposes to spend more than the all time record (on an ad-valorem equivalent basis) that occured in 2009, and collect within 2% of the record tax dollars levied in 2007.

When taking population and inflation into account, this year’s tax increase is more than DOUBLE the 3% that would be expected under TABOR.

What is driving this inflated budget? It is not hiring, as the overall staffing levels have declined slightly. It is not really the FRS contribution rate (less than 7% of the increase), or Palm Tran Connection changes (about 10%). A lot of it is pay increases for employees (3% across the board, on top of step and longevity raises in PBSO) which account for about $21M or half of the increase.

The big gorilla in the room of course is the Sheriff’s budget (as it usually is).

Sheriff Bradshaw seeks to spend $531M next year, supported by $467M from ad-valorem taxes. (The county budget proposal contains $5M less than this but the Sheriff has not agreed to the reduction). This is up from $499M (+6.4%) and $434M (+7.6%) last year. Since 82% of the Sheriff’s budget is personal service costs (salary and benefits), and staff growth is minimal (30 out of almost 4000), we can conclude that most of this increase is headed into the pockets of employees, as they will receive the same 3% that all county employees are scheduled to receive, plus contracted step and longevity raises.

Since 2003, PBSO spending has almost doubled (97%) while other county departments have only increased by a third – well within inflation and population measures. As measured by spending per capita, the Sheriff’s budget has increased by 73% from $195 per county resident in 2003, to $336 today. In 2003, the Sheriff spent 36% of county tax dollars and today that figure has grown to 48%.

Every year, adminstrator Weisman warns the commissioners that this growth of the Sheriff’s budget is unsustainable and at some point will crowd out all other county spending, yet as a group they never do anything about it. Some commissioners have pushed back – particularly Paulette Burdick and sometimes Mayor Taylor and Commissioner Abrams, but there have never been 4 votes to roll back his spending to a sustainable level.

There are a number of reasons for this. A cut to the budget for a constitutional officer (such as the Sheriff) can be appealed to the Governor. If an appeal is brought and the county loses, the budget goes into the next fiscal year with a large hole that needs to come from reserves. While the commission can cut the Sheriff’s appropriation, they are not allowed to say what specific items he should cut. He can therefore use his discretionary power to target areas of maximum political leverage. We have seen for example, how the threat to close the West Boynton substation will turn out COBWRA and others in force to pressure the BCC to restore the funds. We have also seen the PBA fill the commission chambers with red-shirted union members in solidarity with the Sheriff.

Unless there is a concerted effort by the public to raise their voices in opposition to the spending of this leviathan that is PBSO, we can expect no action again this year.

What can you do:

Attend the budget workshop on Tuesday June 10 and / or email, write or call your commissioner. Ask them:

1. Why has county spending returned to levels not seen since the real estate bubble.

2. To reject the Sheriff’s budget as submitted and return a portion of the valuation increase to the taxpayer in the from of a reduction in millage.

3. To consider providing raises to employees based on merit, rather than across-the-board or COLA increases

The bottom line is this – rising property valuations are not correlated with rising incomes among county residents. The growth of government spending should be “reasonable” – perhaps in line with population growth and inflation. There is no justification for a $40M tax increase in a single year.

Dodging a Bullet – No Sales Tax Referendum

In a 4-3 vote, the County Commission yesterday rejected a staff proposal to place a half penny “infrastructure” sales tax on the November ballot.

Criticism of the proposal, from TAB, the Economic Council and others pointed out the “grab bag” nature of the projects, the size of the increase ($110M) in relation to the current budget for Engineering and Public Works ($55M), ballot competition with the School System and the Children’s Services Council re-authorization, and the multi-year decision by the Commission to defer road and bridge maintenance in favor of other priorities.

In December, four of the Commissioners voted to proceed with the referendum and asked staff to bring back a more complete proposal. This time, Jess Santamaria changed his mind after hearing input from the public, and joined Steven Abrams, Paulette Burdick and Hal Valeche to kill the measure.

Shelley Vana, who complained about the state of roads in her district, declared “there is no free lunch” and wanted the “people to decide”. Mary Lou Berger, who sees a public safety issue in deteriorating roads, wanted to proceed with the option of re-thinking it in July. Mayor Priscilla Taylor, who considers the sales tax hike an “investment”, declared that our voters are smart enough to decide for themselves and we shouldn’t worry about what other taxing districts are doing.

Hal Valeche thinks that road and bridge maintenance should be prioritized in the normal budget cycle, and Paulette Burdick didn’t think the public would see this as higher priority than the School’s needs or the CSC. Steven Abrams thought it was a “tax in search of a topic” and captured the situation clearly when he said he couldn’t see people standing on the sidewalk with signs saying “Vote for Drainage, Vote for Road Repair.”

As this is the third try since 2012, we can’t be sure it will not come back, but for now it looks like the proposal is dead for 2014.

Thanks to those who spoke against the measure, including Alex Larson, Anne Kuhl, Daniel Martel of the Economic Council, Realtor Christina Pearce, and Fred Scheibl of TAB. There were no speakers in favor of the referendum.

For the Palm Beach Post Story, see County rejects sales tax ballot bid

Another Go at the Sales Tax on Tuesday

The proposal for a county sales tax increase is back on the agenda, Tuesday March 11, postponed from the December 17 meeting by a 4-3 vote. (See Item 5G1.)

In December, there was consensus that the proposal was a “potpourri” or grab-bag of small projects lumped togther to utilize the $110M a year that a .5% increase would bring. It’s reincarnation is still a grab-bag of small projects, but they are limited to infrastructure and spending for Parks and Recreation was removed. Since the total hasn’t changed, the net effect is to add MORE road projects to the proposal. The largest of these is a line item for “resurfacing – 7 years @ $12M/year” for $84M.

A noteworthy aspect of this proposal coming out of George Webb’s Engineering and Public Works Department, is the condition that 40% ($44M per year) is to be shared with the municipalities for wherever they would like to spend it. However allocated, this would represent a sizeable amount relative to most city, town and village budgets. (Note- this sharing is required by the authorizing statute for sales tax surcharges).

As for Engineering and Public Works itself, the $66M / year retained in this proposal would more than double their $53M current budget.

It should be said that road projects have gotten more of their share of cuts over the last few budget cycles, as the enormous half a $Billion (with a “B”) Sheriff’s budget gobbles up an ever larger percentage of the county tax revenues. Adding $66M to E&PW from a different revenue source would seem to be a questionable action.

The December proposal was allocated differently – $44M for the School District, $40M for the county (including Parks and Recreation), and $26M for the municipalities. The school district did not want to play in this though – rumor has it that a separate sales tax increase will be brought forward by those folks. In the revamped proposal, E&PW decided to just keep all the money for themselves.

This proposal should be considered within the overall background of county finances, not in isolation. Property Appraiser Gary Nikolits is projecting a 6-7% increase in taxable valuations this year. Even with some reduction in millage (which we think is justified), there should be sufficient property tax revenue to start addressing infrastructure maintenance that has been deferred over the last few years. When you build a road, you should plan to maintain it – this is one of the natural and expected functions of government. That spending was diverted to other priorities is a management failing – not a justification for a new tax.

A serious proposal for a sales tax hike could be justified if it was revenue neutral – ie. offset the $110M in new revenue with an equal reduction in ad-valorem tax. That is not what is being proposed. Instead, it is still George Webb’s “wish list” of work he’d like to do but was unable to justify in the normal budget process.

If this were actually to get on the ballot in November, particularly next to a School System increase (“it’s for the children!”) and the re-authorization of the taxing district for the Children’s Services Council (“It’s also for the children!”), then a betting man would wager that it will go down in flames. Perhaps they all will, as the taxpayers do not sense that their money is spent wisely today.

PBG Candidate Forum Synopsis

TAB Co-hosts Forum for PBG Council Race

Overlooking the Obvious? Observations from the Palm Tran Connection Workshop

Good summaries of the 2/28/14 BCC workshop to discuss the future direction of Palm Tran Connection were written by Joe Capozzi in the Palm Beach Post and Andy Reid in the Sun-Sentinel.

We are generally in support of the direction given by the Commission to:

- Pursue multiple contracts in lieu of a single-source vendor, since competition will enhance responsiveness and flexibility.

- Bring dispatch in-house – this may not be quite the salvation for which BCC voted….see below.

- Purchase the vehicles for lease back to the vendors. We see the opportunity for flexibility cited as well as cost savings.

- Free rides on fixed route service for ADA/TD qualified.

- Explore the future use of vouchers and taxis to enhance/expand capability.

But something appears to be lacking in the conclusions drawn in much of the coverage and discussion of Palm Tran Connection and the poor performance by the current vendor, Metro Mobility. That ‘something’ which seemed apparent throughout the workshop was ‘county oversight and accountability‘. The various reasons for perceived unacceptable service were listed dispassionately and without any chagrin or admission of responsibility. Many of these ‘issues’ did not require BCC direction but could or should have been accompanied by firm action plans .

A few examples:

Chaotic dispatching and adherence to schedules was impacted by several issues

- Drivers unable to locate the rider – going to wrong location or lost in a community

- Riders without appropriate ‘personal care attendants” thus driver leaving the vehicle to assist the rider into the appointment location

- Driver waiting for a facility to open (eg rider can’t get in)

- Riders who can’t be left alone due to their disability

Only Commissioner Berger seemed to question the lack of required personal care attendants. Everyone else seemed to take for granted that these were missteps by Metro Mobility. If an ADA or TD qualified rider needs a personal care attendant then the County, who handles the qualification process, should have confirmed that such an attendant accompanies the rider. To have a driver take on 1) liability 2) leave the vehicle unattended 3) abandon schedule in order to perform personal care functions is certain to impact all of the other riders. Is there something in the regulations that absolves the rider (or the County in the qualification process) from responsibility for their part of the bargain?

There is a difference between door to door service and a driver replacing the companion role. As was pointed out in the meeting – if the rider were able to take fixed route service – they would be dropped off and that’s it. Even a taxi doing door to door would not wait for place to open etc. So perhaps the biggest issue to the level of service is that the drivers are going beyond what can reasonably be expected.

Taking vehicles out of service to accommodate school trip requests (primarily Charter schools)

Commissioner Abrams rightly questioned that the PBC School system isn’t involved in this. And is it not obvious that if vehicles are taken out of a route that service and schedules will suffer? Once again – these are decisions that were made by the County and not Metro Mobility.

It was perceived that bringing dispatch in-house (recommended by staff, consultant and voted unanimously by commission) would solve the above issues. But one could ask – what will change? The County staff was responsible for oversight in any case – so if policy changes are not made to solve these problems, in-house dispatch will not alleviate the problems.

Poor state of equipment

Commissioner Vana did her own investigative work to confirm the poor state of equipment and raised the alarm over conditions. But why was that necessary? Was not the administration responsible for oversight and inspections? Purchase of the vehicles by the county may result in savings, which is great! But this does nothing to solve the vehicle maintenance issues. Periodic inspections by the County will (and should have been) vital to assessing compliance with legal and contractual obligations for vehicle maintenance.

Need for a strong and specific contract

Several times during the workshop the need for a strong contract (or contracts) was mentioned by staff. OK – whose fault is it if there wasn’t one in place already? Surely not the vendor’s….

Administration has made management changes and they clearly may have been warranted. But until the County takes full responsibility for the current state of affairs – dramatic improvement in Palm Tran Connection performance may be a long time in coming.