Best Practices in Transportation for the Mobility Impaired

While researching our article “Growing Government in Giant Steps: A County Takeover of Palm Tran Connection?”, we encountered an excellent reference for best practices in ADA compliance for public transportation.

See “Innovative Approaches for Increasing Transportation Options for People with Disabilities in Florida” – published by Center for Urban Transportation Research and sponsored by the United States Department of Health and Human Services, Administration on Developmental Disabilities, the Florida Developmental Disabilities Council, Inc. and The Able Trust, in 2010.

The above paper analyzed approaches throughout the country – and Chapter 3 highlighted Best Practices. Many communities used a combination of fixed route incentives, door to bus-stop (ADA required), vouchers with approved taxi and transportation companies, and volunteer drivers – all incorporated to provide maximum flexibility, improved access and lower cost per trip and allowing for increased ridership as well. Customer satisfaction was also improved by 24/7 access that taxis provided and ability to make same-day reservations.

Amongst those best practices highlighted in Chapter 3:

Vouchers: Implementing voucher and volunteer programs – especially in rural areas where there is limited public transportation; allowing vouchers to be used to pay mileage reimbursement to volunteer drivers; using taxi or volunteer vouchers for return trips from dialysis treatment to reduce wait times

Provider selection: Contract with multiple providers – annually conducting reviews and requiring participating transportation companies trained in ADA requirements, first aid/CPR, background checks etc.

Trip Rate/Rider Selection: negotiated fixed price trip rates with local taxi operators; Reduce or require no co-payments for dialysis transport; allow participants to schedule directly with participating providers

Billing Oversight: Focal point/administrator for the entire network; smart cards or close monitoring of voucher budget – enhanced by fixed flat rate negotiated w taxi/transportation companies; have driver and rider sign vouchers to document that trip was actually made

Funding: Use FTA funds for mobility management services, technology. Use savings from voucher program to expand service areas. Actively pursue support from charitable organization, non-profit and community groups and foundations.

Growing Government in Giant Steps: A County Takeover of Palm Tran Connection?

Now that the county has decided to end the relationship with Metro Mobility Management Group a year from now, a serious proposal has surfaced to bring the operation into the government – with county-owned vans and equipment, and with county employees with their higher salaries and generous benefits.

If executed as described, it would require the hiring of 416 new county employees, a 7% growth in total staff and a 72% growth in the Palm Tran Organization.

By staff’s estimate, the county would need to purchase 241 new vehicles, and build new facilities for administration, fleet storage and maintenance. In addition to $43M in capital investment, the annual costs for labor and operations would be $34M – 23% higher than today’s $28M with the Metro contract.

How could this possibly make sense?

To understand the thinking, you first have to acknowledge that operations under the Metro contract over the last year have not been smooth. Vehicles in service are older and more worn-out than promised, customer service problems have persisted, and the experience of the elderly and disabled riders has not met expectations. Commissioner Shelly Vana, to her credit, has pushed for changes after going out and experiencing using the service herself. The promise of the Metro contract was for acceptable service levels at lower cost than the previous vendor – a bar that has been difficult for the vendor to achieve.

What is Palm Tran Connection?

Palm Tran Connection delivers about 820K trips a year to a ridership of approximately 13K individuals who are eligible through either the federal Americans with Disabilities Act (ADA) – an unfunded mandate affecting entities that otherwise provide public transportation (700K trips and 11K riders) or the state’s Transportation Disadvantaged program (123K trips and about 2K riders). TD riders are 90% subsidized by state funds. Using the current year’s $28M budget, the cost per rider is over $2000 per rider, and the average cost per trip is $34 (calculated by dividing the $28M budget by 820K trips/year).

Although there are federally defined requirements for eligibility (ie. what qualifies as “disabled”), it is not strictly a welfare program as riders must pay a fare to use the system, currently $3.50 per trip (about 10% of the cost). If you work the same numbers for the Palm Tran fixed route system, it is not too much different. ($87M fixed route budget divided by 12M trips is $7.25/trip – making the $1.25 average fare with discounts about 17% of the cost).

So what are the real issues?

We will stipulate that Connection provides a needed service to the county’s disabled population, and as long as the county is in the public transportation business, the service is required under the ADA (although the county does exceed requirements by providing service beyond the “3/4 mile from fixed route” demanded by ADA.) The problem is to provide a reasonable level of service at a reasonable price.

Privatization of county functions where it makes sense has been a long-term goal of TAB, as there is body of evidence that suggests that the private sector, particularly when operating in a competitive environment with an incentive to maximize customer satisfaction at the lowest cost, is best suited to delivering a needed service. A government agency, by its nature, is often hampered by other conflicting considerations (eg. politics, union demands, special interests, etc.)

The current Connection system is a hybrid. The contract is sole-sourced, and part of the function (customer service, scheduling) is performed by the government as the county places itself in between the riders and the provider. The vendor’s customer is the county, not the riders.

How much different would it be if multiple vendors could provide the service, perhaps in smaller service areas than the county as a whole. Companies and drivers could be regulated much the way taxi and limousine services are today. By introducing customer choice into the mix, with the county subsidy delivered through a voucher system, the customer service levels would improve – much as they do in any competitive area.

Private sector competitive based solutions for service delivery versus government run enterprise is an age-old question, usually decided along ideological lines. Given the political makeup of Palm Beach County and those who represent their districts, I would expect the “government run” position to have an edge in this discussion. Before taking that step though, we would hope that the Commissioners consider that de-privatizing Palm Tran Connection is most likely an irrevocable step. Regardless of future changes in ridership level (2014 is projected to be 9% less than 2013) or customer needs, a new 416 person county organization with significant capital assets would be here to stay.

Some Alternatives

Some alternatives to a total government-run Connection provided by staff include partial moves such as in-house dispatch, in-house takeover of service in Belle Glade only, and having the county own the vehicles and leasing them to the vendor.

We think allowing competitive service delivery, a voucher system, expediting the growth of existing transportation companies who wish to enter this space would be a rationale alternative as well. In areas that need to be served for which there is little competitive interest, a sole-source vendor should be sought, much like the existing model. Providing incentives for the mobility impaired to utilize the fixed route system is also desirable.

Many government entities face similar challenges, and a number of best practices have emerged. Please see “Best Practices in Transportation for the mobility impaired.”

Dark Cloud of Sales Tax Referendum Hangs over the County

A “half-baked” proposal with a “half-hearted” sales pitch. That could describe what was brought before the commission yesterday. After the initial plan of a 6 year tax hike divided up among the School District, County and Municipalities fell apart when the School Board declined, a reduced proposal for 3 years and a 60/40 split between the county and cities was floated.

It was clear that Administrator Bob Weisman’s heart was not in it. We can only assume he was given direction to dust off the shaky proposal from May 2012 and make another try for the 2014 election window. There are some on the Commission, most prominently Mayor Taylor, who are not happy that our sales tax burden is not as high as some other Florida counties. We are leaving money on the table after all. After some modest pushback by the board, Mr. Weisman wisely suggested tabling it (unsuccessfully) for another two years.

About a dozen members of the public spoke on the issue, most against. In favor were a few folks who wanted some of the money directed at beach maintenance and Mayor Wilson of Belle Glade, who wants more tax dollars sent to the Glades cities. Others, including the Palm Beach Civic Association, the Economic Council, and TAB, objected to the unfocused wish list of non-urgent minor projects presented as the reason for the tax. In the words of one speaker: “..parking lots and drainage ditches, guardrails and other anonymous improvements, spread around the districts and the cities presumably to spread the wealth around..”.

With the exception of Mayor Taylor, who was enthusiastic for the prospect of more tax dollars, the rest of the commissioners found fault with the proposal. Commissioner Santamaria thought it wasn’t needed if we could restore the impact fee cuts. Commissioner Valeche was against it from the start but defended the impact fee cuts as pro-growth. Commissioner Vana agreed with the speaker’s view of the unfocused list, calling it a potpourri, and worried that an ill-formed proposal that would fail at the polls could poison the new tax well. Commissioner Abrams, calling it a “grab-bag” thought it too broad and that it would not pass. Commissioners Burdick and Berger both opposed the current proposal but would support more spending on roads and infrastucture.

An Abrams attempt to kill it outright (“don’t come back, regroup”) gained some support, but a Vana proposal to seek input from the business community and others for an acceptable plan in six months or so gained some traction (although Commissioner Berger would not focus only on a sales tax hike). The Mayor still wants it on the ballot this year though, so the motion that finally passed has staff coming back in a shorter time with a new proposal. The motion passed 4-3, with Valeche, Burdick and Abrams voting no.

Unfortunately, the dynamic that seems to be operating here is that a sales tax hike is good – just find an important enough project on which to market it. The “potpourri”, “grab-bag” and “wish-list” are clearly not up to snuff.

We would not oppose a sales tax increase that was accompanied by an equal reduction in ad-valorem taxes (ie. “revenue neutral”). We would not oppose a temporary hike for an urgent need such as relief after a major storm or other catastrophe. In this case however, it appears they are now “on the hunt” to find or create a project that could be used to justify the tax increase. That is putting the cart before the horse. Hopefully, if such a measure were to get on the November ballot, the county voters will not be fooled.

Another Attempt to Raise the County Sales Tax

We have not taken any formal action; however, from the discussion on this matter during informal Board Workshops, it appears unlikely that the School Board would support a joint referendum.

To the extent that the attached County Board Item suggests otherwise may place the School Board in an awkward position.

Please take appropriate steps to delete any reference to the School Board in the item.

As a result, the Tuesday agenda item has been revised: See Item 5A2-Revised The Palm Beach Post reports that many of the Commissioners are skeptical of the proposal, and the business community and watchdog groups (including TAB) are organizing to oppose it. See Schools want out of sales tax hike

At next Tuesday’s 12/17 BCC Meeting (time certain 10:30), staff will propose raising the sales tax to 6.5%, projected to raise $110M per year starting in 2015 and running until the end of 2020. Unlike a preliminary proposal that would have competed with the School District which also seeks higher taxes, this revenue would be shared. 40% ($44M/year) would flow to the Schools, 36% ($40M/year) to the county, and 24% ($26M/year) to be divided up among the 38 municipalities. The tax would generate $660M over the six years it would be effective, if approved by the voters next fall.

What is the stated need for this additional revenue? The proposal states “County, School Board and municipal staffs have identified significant facility and infrastructure needs to maintain and enhance our public quality of life.”

The county alone has identified $197M in wish-list projects, divided equitably among the seven districts so everyone gets some of the “goodies”. These are mainly road projects and new spending for Parks and Recreation.

It should be noted that both of these areas are funded in the current county budget at the level of $53M/year for Public Works and Engineering, and $64M/year for Parks & Rec, so the county windfall that this represents would be an increase to that spending by 34% in the first year alone.

Some would say that sales taxes are preferable to property taxes because the burden is shared by all, including visitors, and that is true as far as it goes. But keep in mind that this proposal is NOT revenue neutral – it is net additional taxation. The county ad-valorem taxes rose over $23M this year and the county forecasts overall property taxes to go up over 20% in the next four years. They have plans to spend every penny.

Historically, sales tax hikes have not gone down easy. In 2010, a Fire/Rescue sales tax was defeated before it got on the ballot. The predecessor to this proposal that was brought to the commission in 2012 was rejected as “half baked”. This time, there is an attempt to “sweeten” the deal by distributing some money to the cities and spreading the largess around the commission districts. Presumably an orchestrated collection of speakers will come forward to talk about the “need” for these projects. We will be told that our sales tax is “too low” as other counties have higher.

Don’t be fooled. This is an attempt to significantly increase government spending in Palm Beach County, at a time when valuations (and likely ad-valorem taxes) are expected to climb. It should be rejected before it gets to the November ballot, and now is the time to voice your opposition.

If you oppose raising the sales tax, make your voice heard. Call or email your commissioners prior to next Tuesday’s meeting, and attend the meeting if you can. And let us know your thoughts.

Some talking points:

- The proposal is a net increase in taxation of $110M/year – about $100 per resident.

- Parks&Rec and Engineering / Public Works are already funded at $117M – the sales tax would support a 34% increase in spending every year for the next six years.

- Sales taxes have a negative effect on business, driving sales to lower tax counties or the internet and stopping incoming business from counties with higher taxes.

- Neither of our neighboring counties (Martin, Broward) have a discretionary sales tax.

- The county has shown restraint in recent years regarding increases in ad-valorem taxes – this proposal is an end-run around the scrutiny that the millage rate gets on a yearly basis.

- A sales tax is a fixed rate that grows automatically with rising prices and economic recovery and is not subject to yearly adjustment like property taxes.

County Commission votes to penalize West Palm Beach and Riviera Beach over Inspector General Lawsuit

In a clever but unusual move, County Administrator Bob Weisman last night proposed $916K in additional spending over the July budget package that specifically excluded amounts requested for West Palm Beach and Riviera Beach by $70K and $50K respectively. This was a direct response to those city’s refusal to pay their share of the Inspector General budget. The proposal included additional spending of $916K – $400K for the YECs, $175K for the Pahokee Recreation center, and $341K for the Inspector General.

The additional $346K to cover the IG shortfall will come from the Solid Waste Authority ($100K), funds from the non-suing cities released by the Clerk ($262K), and $16K from other county departments.

Since the maximum millage was set in the July workshop to 4.7815 (unchanged from last year), the additional funding will come from reserves and tapping an additional $800K from the proceeds of the Mecca Farms sale to South Florida Water Management.

A motion by Commissioner Priscilla Taylor to restore the funds for the West Palm and Riviera YECs and provide an additional $40K for the Belle Glade YEC (requested by Commissioner Shelley Vana) was defeated 4-3 and the Weisman proposal was passed without change. Commissioners Valeche, Burdick, Santamaria and Berger rejected the change for a variety of reasons.

Hal Valeche said “The cities are taking us for a ride..”, and “By restoring this funding they are taking us for a further ride.” Commissioner Santamaria explained to the many children and instructors from the YEC who turned out to support their programs that “Unfortunately the YECs and the IG are connected”. He said that the cities could have opted to spend the IG money they are keeping on the YECs but declined to do so. Commissioner Vana, seeing her request for additional Belle Glade money “for the children” going down to defeat, said “It is disgraceful what we are doing here today”. “I am ashamed to be part of this board at this point.”

It should be noted that the 14 cities participating in the IG lawsuit owe $1.9M to the county – 90% of it from the 5 cities of West Palm Beach ($657K), Boca Raton ($406K), Delray Beach ($348K), Riviera Beach ($169K) and Jupiter ($142K). It is a positive step that the county should withhold grants and assistance to these cities while they are declining to pay for the IG services. The $120K at issue here is a drop in the bucket and it would be appropriate to raise the ante by challenging other grants to these five, in areas such as community development, environmental resource projects within their boundaries and social services. Money is fungible and amounts could be held in escrow while the litigation continues.

The final budget hearing will be held on September 23 at 6:00 PM.

County Tax Trends – Some Perspective

After several years of calling for flat millage, it is time to shift our attention to the tax dollars themselves.

Budget Hearings

Monday, 9/9 at 6:00pm

Monday 9/23 at 6:00pm

There is an old saying that “nobody washes a rental car”. When you own, it is more in your interest to maintain the value of your asset. Similarly, if a third party is paying for something that benefits you, you may not think about the “value proposition” or how much it costs because it is not your purchase decision. This is why health care inflation is high for procedures where a third party (government or insurance company) pays, but low for out of pocket items like plastic surgery or laser vision correction where you can choose the best value from competing practitioners.

When a government spends money, if it is directly tied to your tax bill you pay attention, but when the money comes from somebody else, “what difference does it make?”.

Spending at the federal level has been disassociated with individual income taxes for some time. With almost 40% of the federal budget coming from borrowed money, and less than half of the citizens paying federal income tax, it is hard to get too upset over another $10B for this or that, as it isn’t going to come out of your pocket any time soon. Even if it does concern you, federal taxation is difficult for a citizen to impact, given the way our Congress works.

Similarly, at the state level in Florida, with no income tax, a sales tax that is not out of line with other states, and much of state revenues coming from tourist taxes, state spending has little impact on the average citizen.

At the county and city level though, we are all aware of our property taxes (or our rent if we don’t own property). Over the years this link has been weakened at the county level as much spending is supported by user fees and “intergovernmental” revenue, which includes federal and state grants, and revenue sharing from sales tax, gas tax, and other sources. Currently only about 35% of county revenues (excluding fund balance) come from property taxes.

It is the changes in tax rates or taxes collected from you that you notice, not necessarily the level of county spending.

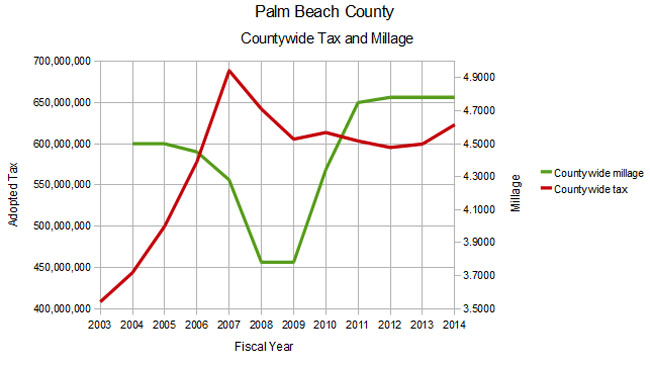

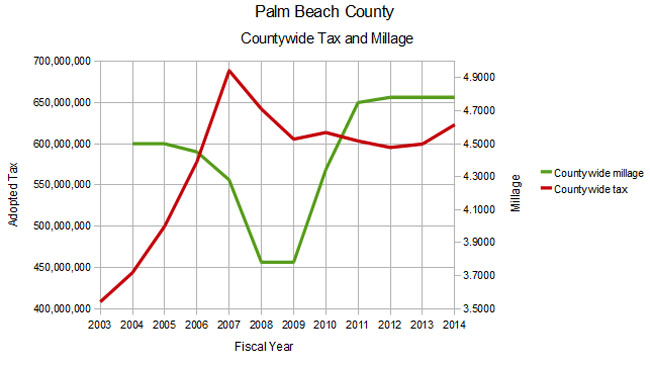

As the property valuations accelerated and hit their peak in 2007, tax rates were stable or declining, and the “wealth effect” associated with rapidly appreciating property masked the fact that taxes collected were skyrocketing. The adopted countywide tax in 2003 was $408M, but climbed to $689M by 2007. This was an increase of 13%, 16%, and 19% in the years 2005, 2006 and 2007 respectively, in a time when the millage or tax rate was decreasing.

The millage rate is widely reported. You see it on your TRIM notice as well as in the press coverage of the budget process. It wasn’t until this rate started soaring that people’s attention was drawn to it.

For the 2010 budget, adopted in September 2009, the millage increased by 15%. Many thought this outrageous, as our neighboring counties were booking much smaller increases, yet the countywide adopted tax dollars only increased by a tiny 1.3%. This outrage was widespread however, affecting the business community, realtors, grassroots groups and others, and led to the formation of TAB by the following year.

In 2011, in spite of some public opposition, the commissioners raised the millage yet again by 9%, but for 2012 – 2014 it was essentially flat. Taxes collected in those three years declined slightly until this year when a 3.9% increase (a $23M increase, most going to the Sheriff). TAB argued for flat millage during this period, and accepted another year of 4.7815, in spite of the increase in dollar amount. It is expected that this rate will be adopted during the budget hearings this month.

Governments do not typically throttle their spending voluntarily. Taxes and spending need to be scrutinized by the public, and objections raised when they get out of line. In a downturn (both in property valuation and lately in federal grants), it is in the nature of government to try to maintain spending levels rather than adjust them to match economic conditions if possible. Otherwise, programs have to be cut, layoffs are possible, and the recipients of government spending begin to organize.

We are now at a turning point. Next year, if valuations continue to rise, we will focus on tax dollars rather than millage, and argue that increases in spending should not exceed population growth and inflation measures. A millage reduction would be justified under that scenario. If valuations stay flat or decline, then we shall also oppose any millage increase.

County Proposes No Change to Millage, $23M Tax Increase

The July budget line item is included in the next scheduled BCC Meeting on Tuesday, July 16, which starts at 9:30am. It is item 5G-1 on the agenda and will likely be the last item of the morning session.

The first county budget proposal for fiscal year 2014, presented at the June 11 meeting, called for a millage increase to 4.8164 (up from the current 4.7815) and $25M in new ad valorem tax revenue – mostly to fund new spending proposed by the Sheriff.

While not definitive, the drift from the dais was that they would like to see flat millage (Abrams, Burdick, Valeche) and more spending on priorities like road repair and less of an increase to PBSO. Some commissioners, particularly Shelley Vana, didn’t want to be “penny wise and pound foolish” and thought that flat millage should “no longer be the holy grail”.

So we were pleasantly surprised to see that the July Budget Package is introduced under separate cover by Administrator Bob Weisman with

down to the current year 4.7815.

During the month interim, Mr. Weisman and staff were able to achieve this by:

- Seeing an additional $2.6M from increased property valuations

- Allocating an additional $2M from the proceeds of the $26M Mecca Farms sale into 2014

- Gaining $859,000 in concessions from the Sheriff – which is half of the remaining shortfall with flat millage.

He was also able to increase funding for some priorities, including:

- $1.6M for neighborhood road repaving

- $270K for the Palm Beach sand transfer plant

- $100K in additional funds for the Business Development Board

With the new assumptions, the flat millage proposal will generate a countywide tax of $623M, up $23M from the 2013 fiscal year, slightly less than the June proposal. As seen in the chart, this is a visible uptick from previous years, and is the highest tax collected since 2008, when the millage was at a low point of 3.7811.

Assuming that the valuation increase this year is a start of a trend, flat millage will no longer be acceptable going forward and we will be expecting substantial reductions. That said, the current proposal of flat millage appears to be a genuine attempt to satisfy the pent up spending demand, particularly for salary increases for county staff while not overly gouging the taxpayer. Historically, overall county spending is approaching a “TABOR” (population and inflation) projection from a 2003 baseline. (See Determining County Budget Growth – Why the Baseline Year Matters )

Assuming the BCC accepts the flat millage proposal, we do not expect to be calling for any taxpayer actions during this budget cycle.

Determining County Budget Growth – Why the Baseline Year Matters

For the last few years, whenever the county budget has been presented, growth has been charted based on the year 2003. Numerical comparisons were made to 2007 though, and this year even the charts are based on 2007. Does this make a difference? What do the two baseline years tell us about the growth in spending and how the county staff wants you to look at it?

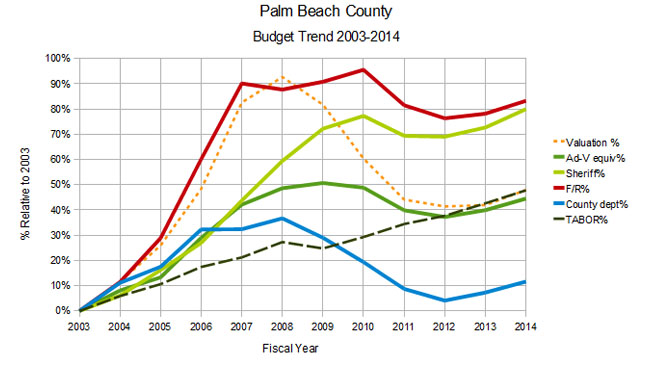

As you may remember, the middle of the last decade saw a real estate “bubble”, where average properties in the county became greatly inflated – sometimes doubling in only a few years. The year 2007 represented a leveling off of the valuation increases, with values 83% higher than they were in 2003. Valuations climbed a little more in 2008 (to 93% of 2003), and then began a rapid decline to the bottom in 2012 at 43% of 2003. Today’s levels are about 48% of the 2003 values.

Since county property tax follows property valuations, as you would expect, the county’s revenue and spending exploded during this runup period. In the four years from 2003 to 2007, the overall county-wide “ad valorem equivalent” (a measure of spending) rose 42%, led by Fire/Rescue which saw its spending almost double (90% increase). By adopting 2007 as their “base year”, the county would like you to overlook this rapid growth prior to that, and imply that the relatively flat spending since 2007 is “normal”.

Consider the following chart, based on 2003:

Chart 1 – 2003 Baseline

Chart 1 – 2003 BaselineThe dashed orange line shows the real estate “bubble”. Note that the Fire / Rescue spending climbed the “bubble”, but then stayed at the higner level as the bubble burst. The Sheriff’s budget did a similar thing, although their spending lagged a little. Both are up over 80% since 2003. Spending on the “rest of the county” (blue line) – including engineering, Palm Tran, community services, information systems, parks and recreation, and the other constitutional officers was the big loser, as the “total ad-valorem equivalent” (the dark green line) – which includes all county functions stayed as high as the taxpayers would accept, up 45% and ending at about where the valuations did. The dashed green line represents “TABOR”1, or the increase in spending that would be justified by changing population and inflation. Interestingly, the “total ad-valorem equivalent” ends about on the TABOR line, even though spending greatly exceeded it in the middle years.

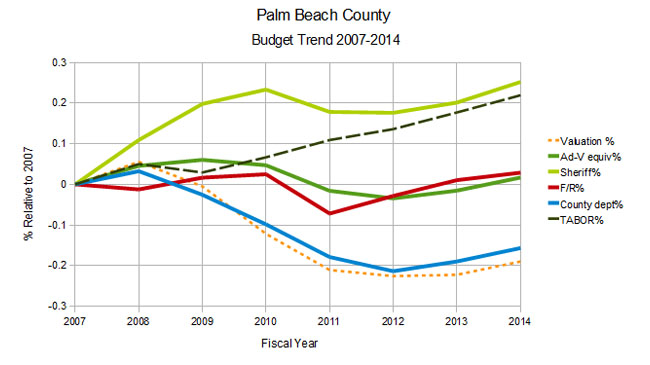

Now consider the next chart which uses 2007 as the baseline year:

Chart 2 – 2007 Baseline

Chart 2 – 2007 BaselineUsing the “bubble” spending levels as a reference, it appears that “total ad-valorem equivalent” is flat – exceeding the 2007 level by only 2%, and well below “TABOR”, and the county department spending has actually declined by 16%. Even the grossly inflated PBSO budget looks like it is converging on the “TABOR” line.

If you were the county administrator and you wanted to make the best case for fiscal responsibility, which chart would you use?

Baselines do matter.

There are many external factors that should determine the “appropriate” level of spending of tax dollars, such as the health of the overall economy, the declining average income in the county, the “artifacts” in the valuation numbers from foreclosure dynamics and demand for real estate by third party investors. From a strictly historical perspective however, most would agree that the spending growth in the years leading up to the bubble were wild and crazy. The great recession has brought some of the spending back down to earth as measured by inflation and population growth as shown on chart 1, with the notable exceptions of PBSO and Fire/Rescue.

With a 2003 baseline, county spending today looks almost responsible, and the case can be made without changing the baseline to obscure the rapid growth of government leading to the bubble. We hope that county staff does not plan to rewrite history.

1. TABOR is an acronym for “Taxpayer Bill of Rights”, a legislative approach tried is some states to control spending growth by limiting it to the inflation rate and population growth.

County Proposes $25.3M tax increase

After leveling off last year following 4 years of decline, property values seem to have turned a corner and have ticked up 3.7% this year, easing pressure on county and municipal budgets. As the county has cranked up the millage rate as the valuations fell, will they now start to decrease them? Apparently not.

The June budget package, to be discussed at the first hearing next Tuesday at 6:00pm, proposes an increase in the millage from 4.7815 to 4.8164. This would generate $624.9 million – $25.3M or 4.2% more than last years adopted tax of about $600M.

The additional funds are allocated about $19.5M to the Sheriff (see note below regarding Sheriff’s budget), and $7.3M to the countywide BCC departments. (note: these add up to $26.8M not $25.3M, but that is how it is described in the Weisman cover letter). Much of this will go to pay increases for employees (3% to county workers, 2% to PBSO in addition to their contracted longevity and step raises). The “personal services” (ie. employee) budget for the Sheriff increases by over 6%.

Many commission priorities were NOT addressed in the new spending, including $300K additional funding for the homeless resource center, $5M for road resurfacing, $2.7M for Palm Tran service enhancements and $547K for Youth Empowerment Centers. It will be interesting to see if a constituency emerges to fund these things and raise taxes even further.

Library and Fire/Rescue millage is expected to be unchanged.

We think that raising the millage this year in the face of improving valuations and economic conditions would be a mistake. Yes, there is pent-up demand for additional spending (isn’t that always true in government?), and some growth is justified, but flat millage would already provide some $20M in new revenue. Raising the millage now is a slap at the county property owners, many of whom are still struggling along with the economy. The incremental revenue to be had with the proposed hike is small – surely a way can be found to defer that much until next year and keep faith with the taxpayer.

Come to the meeting next Tuesday and let the commissioners hear what you think of this proposal. The special interests who want spending increases for their programs will be there. Don’t let them be the only voices.

The meeting will start at 6:00pm in the commission chambers, 301 N. Olive, 6th floor.

NOTE: The Sheriff requested a gross budget of $510.1 million or 8.2% ($38M) over the FY 2013 gross budget. The net ad valorem funded budget is up $19.5 million (4.8%). Subsequent to his budget submission, the proposed budget was revised to assume his capital request of $10.6 million will be financed in FY 2014. The estimated debt service has been included in the proposed budget.

2014 County Budget – What To Expect

Next week, county staff will be unveiling their 2014 budget proposal to be discussed at the June 11 budget workshop at 6pm in the Commission Chambers. TAB will analyse the proposal when it is published, but what do we know now and what can we surmise?

- Property valuations are up this year by 3.7%, from $125.1B to $129.7B, according to Property Appraiser Gary Nikolits. See Tax base grows in Palm Beach County, 34 of its 38 cities.

- Using last year’s millage rate of 4.7815, this would produce approximately $620M in county-wide ad-valorem revenue, up about $20M over last year’s budget.

- The Sheriff’s Budget Proposal is requesting $510M – up $38M or 8.3% over last year. This request includes a 2% across the board “cost of living” increase for all employees, in addition to raises already included via contract. (The personal services budget is up over 6%). It also includes $3M targeted for mandated expenses associated with Obamacare.

- Interest from the county’s investments are down about $10M.

- The Solid Waste Authority (whose governing board is made up of the current county commissioners), gave their employees a 3% increase already (pre-budget), as have some municipalities. (See: Raises approved for Solid Waste Authority employees, after three years of frozen pay) It would seem likely that Administrator Weisman would like to do the same for his employees.

- Reserves have been spent down slightly in recent budget years and both county staff and county Comptroller Sharon Bock would like to begin rebuilding these reserves.

- Infrastructure spending, particularly on roads and bridges, has been deferred in recent years and is a priority for some commissioners.

So what can we gather from all this?

Although many would suggest that rising valuations present an opportunity to lower millage (much as millage has been raised as valuations declined), the combination of upward pressure on spending for raises and infrastructure and reserve replenishment, combined with lower revenue from investments, would seem to suggest the opposite. The Sheriff’s request alone will swamp the additional revenue expected from higher valuations.

We have turned a corner, and the valuation declines that have driven the budget since 2008 have bottomed and are now rising. This suggests a different dynamic. Besides the points already mentioned, you should expect that many special interest groups will come forward to claim a piece of the “windfall”, making for a possible feeding frenzy.

TAB believes that in recent years, the county has done a reasonable job in facing economic reality, and the additional revenue this year at flat millage could be used to relieve some of the pressure. Raising the millage rate in the face of improving conditions would be unwise however. If we have truly turned a corner, there will be revenue available in the coming years and some gratification should be deferred.