County Administrator Bob Weisman’s Outlook for 2014 Budget

On Thursday March 28, the County Budget Task Force of the Town of Palm Beach, a TAB coalition partner, chaired by Mayor Gail Coniglio, hosted County Administrator Bob Weisman, OFMB Director Liz Bloeser and Budget Director John Wilson for some insight into the coming budget cycle.

Robert Weisman

After several years of increasing millage, last year was significant in that the millage was unchanged, and the slight (0.7%) uptick in valuations after 5 years of declines yielded a few million more in revenue. Although it is still early, the departments have not done their budget estimates, and the Sheriff (2/3 of the ad-valorem county-wide budget) will not make his request until May, Mr. Weisman intends to seek flat millage once again. (Note: With the property appraiser’s early forecast at + 1.5%, that could generate an additional $9M in property taxes.)

In a wide-ranging presentation, the Administrator highlighted some situations that have bearing on the 2014 budget:

- The communications workers and transit workers (Palm Tran) unions were offered a small increase for September but are holding out for more. The county does not plan to change their offer.

- The Palm Tran worker’s pensions are in a separate plan from FRS (Florida Retirement System) used by the rest of the county, and are underfunded. The county is on the hook for $9M ($3M per year for three years) to increase its funding level.

- His general instruction to staff departments is to hold the line – no refill of vacant positions again this year.

- The Sheriff (as usual) is the biggest variable, spending $400M (mostly on employee pay and benefits), compared to $270M for the county staffs.

- Fire Rescue is about to conclude a new contract next month, for two years with no increases and 3% in the third year. New hire salaries will be reduced going forward, although there have been no new hires in four years. The contract will be less expensive than the previous period.

- Clerk Sharon Bock, who is in charge of the county investment portfolio has shifted much of the balance from relatively high performing instruments (primarily mortgage backed Frannie Mae securities) to short term bonds. This reflects a changing outlook on the future economy (presumably higher interest rates), but will present a shortfall in portfolio earnings this year.

- The Mecca Farms deal with the South Florida Water Management District appears to be dead. The $30M offered is less than the property is worth, and conditions have changed in two years. With Vavrus likely to be developed next door, Mecca may be worth something closer to the $60M that was paid for it, and several developers have approached the county to discuss options.

- Overall debt levels (and carrying costs) are declining.

- Supervisor of Elections Susan Bucher has under spent her budget and returned a million or so.

- The sequestor will affect the county in two areas – Head Start and Senior Services (meals, etc.) By eliminating bus service for the Head Start students, they can absorb the cuts without reducing the program.

- A relatively new expense going forward is $5M per year for the Homeless Resource Center, off-budget at inception but strongly supported by the Board of Commissioners.

The meeting was upbeat and provided a good snapshot at this point in the cycle, and was much appreciated by the task force members.

Some dates to keep in mind: On May 1, the Sheriff will deliver his budget request. On June 1, the Property Appraisor will have his estimate of valuations. Then on June 11, the first budget workshop will take place at 6:00pm in the commission chambers, 301 North Olive.

TAB co-hosts PBG Council Candidate Forum

On February 28, PBG Watch, along with the South Florida 912 and the Palm Beach County Tea Party, Taxpayer Action Board and the Palm Beach Gardens Residents Coalition hosted a candidate forum for City Council election, featuring former Mayor David Levy and challenger attorney James D’Loughy..

TAB Co-Sponsors PBG City Council Candidate Forum

Candidate Forum

Join us for an evening of in-depth discussion of city issues with the candidates for the March 12th election in Group 4. The seat has been vacant since former Mayor (and current candidate) David Levy resigned to run for the County Commission.

Moderated by Daniel Martell, President and CEO, of the Economic Council of Palm Beach County.

Thursday, February 28, 2013

7:00 PM

Gardens Branch, Palm Beach County Library *

11303 Campus Drive

Palm Beach Gardens, FL 33410

The candidates are:

For information, call 561-972-8789

This event is jointly sponsored by:

Palm Beach County Tea Party

Palm Beach Gardens Residents Coalition

PBGWatch

South Florida 912

* This program is not sponsored/endorsed by the Palm Beach County Library

Candidate Biographies

David Levy

Florida native David Levy was born in 1960 and is the owner of environmental engineering firm Southeast Remediation Technnology, and an adjunct professor in environmental geology at Palm Beach State College. He received a B.S in Geology from Florida State University, and a M.S. in Geological Services from Virginia Polytech.

He is the former Mayor of Palm Beach Gardens, and was a City Councilman from 2004 through 2012. County-wide, he chaired the League of Cities Environmental Committee, the Regional Hazardous Material Oversight Committee and the Water Resources Task Force, as well as participating with Workforce Alliance, the Biotech Land Advisory Board, and the Loxahatchee River Management Coordinating Council.

James D’Loughy

James D’Loughy, is a long-time resident of Palm Beach Gardens. A lawyer of over 17 years, James is the founder of AdvisorLaw PLLC, a legal firm that represents clients in complex business matters. He helps individuals and small businesses alike protect their assets, resolve conflicts, and plan for a rainy day.

James’s knowledge of politics is informed by a degree in political science as well as experience working on Capitol Hill. Having worked on corporate transparency and compliance issues, James seeks to bring a new level of ethical governance to the Palm Beach Gardens City Council.

James lives with his wife, Anne Louise, his two daughters, Fredericka and Wilhelmina, and his newborn son, Maximilian, in Frenchman’s Reserve, where he volunteers his time as a member of the community’s governing body.

Moderator Biography

Daniel Martell

Daniel Martell is President and CEO of the Economic Council of Palm Beach County, a not-for-profit, non-governmental, non- partisan organization established in 1975. Its members come from all geographic areas of the county, represent all major business categories and encompass all sizes of businesses. Its mission statement is simply, “Create an environment to help business prosper.”

Mr. Martell came to the Economic Council of Palm Beach County from local sugar company, Florida Crystals Corporation as Vice President of Real Estate. His responsibilities at Florida Crystals included overseeing local government affairs, corporate land development, and real estate investments.

Beginning his career as the Director of Government and Political Affairs for the Gold Coast Builders Association, he was responsible for the regulatory and political issues confronting the home building industry in Palm Beach and Broward counties. He received his undergraduate degree in Political Science from the University of Florida, Juris Doctor from the Shepard Broad Law Center at Nova Southeastern University, and obtained a Certificate of Corporate Finance from Cornell University in 2011.

Final 2013 Budget Adopted

Last evening, at the final hearing on the 2013 county budget, a 4.7815 millage rate was adopted, unchanged from last year.

Compared to the contentious budgets of the last three years, where rates went up 14.9%, 9.3% and 0.7% respectively, this was a pleasant change. Missing was the Kubuki dance by the program constituents whose perogatives were threatened, the standoffs between the Administrator and the Sheriff, and battles with taxpayer advocates over the millage rate, the use of reserves, and the potential sale of county property to make ends meet. Some funds were even restored to address road maintenance that has been routinely deferred.

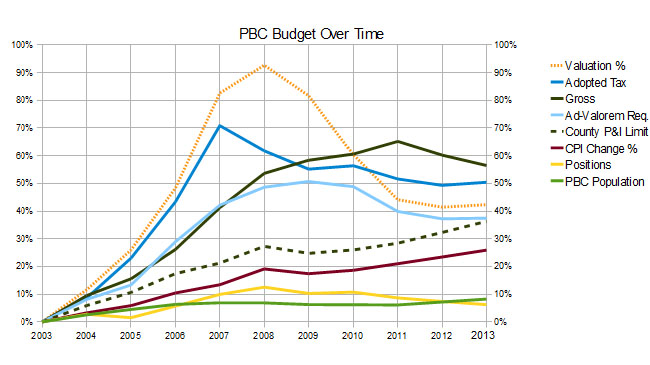

In a presentation by Bob Weisman at the last budget hearing earlier in the month, the trend in ad-valorem equivalent spending was shown to have converged on the “TABOR” line – that measurement of population growth and inflation that is a gauge of “acceptable” spending growth. What that means is that if spending had risen only as fast as inflation and the expanding population since 2003, the spending level would be what it is today. Of course the fact that spending was quite a bit above that line for most of the period indicates that in good times, restraint is hard to find.

Much of this spending restraint came at the expense of the county departments, as the “gorilla in the room” is the PBSO budget which at almost $480M has grown over 70% since 2003. With 83% of that figure tied to salary and benefits, expect much discussion of that figure going forward.

TAB has typically been critical of the budgets of recent years, but this year we are satisfied that flat millage without significant program cuts was appropriate. Going forward though, as housing recovers and valuations start up again (they bottomed this year), we will remain vigilant, and hope that the “TABOR” discipline has caught on. With Commissioner Santamaria already calling for raises for all employees, we shall see.

Here are the Post and Sun-Sentinel accounts of the meeting:

- Palm Beach County approves $3.2 billion budget, holding tax revenues steady

- Palm Beach County avoids property tax increase

In the following graph, the dotted line represents “TABOR” – indicating that population and inflation supported a 36% cumulative growth in spending. As you can see, ad-valorem spending has come down to that line, with valuations and adopted tax leveling off. The decline in gross spending seems to be influenced by a sharp dropoff in “intergovernmental” revenue – federal and state grants and the like. That category fell to $391M from $523M in 2012.

October 1 Forum for County Commission and School Board

Candidate Forum

Join us for an evening of in-depth discussion of county issues with the candidates competing to replace outgoing County Commissioner Karen Marcus and School Board member Monroe Benaim.

Moderated by Steve Rosenblum, former candidate for Florida House and host of the “CRF Radio with Steve and Daria” show on BlogTalkRadio

October 1, 2012

6:00pm buffet ($15), 7:00 Program

Abacoa Golf Club

105 Barbados Drive, Jupiter, Florida 33458

The candidates are:

This event is jointly sponsored by:

Palm Beach County Tea Party

South Florida 912

Candidate Biographies

David Levy

Florida native David Levy was born in 1960 and is the owner of environmental engineering firm Southeast Remediation Technnology, and an adjunct professor in environmental geology at Palm Beach State College. He received a B.S in Geology from Florida State University, and a M.S. in Geological Services from Virginia Polytech.

He is currently Mayor of Palm Beach Gardens, and has been a City Councilman since 2004. County-wide, he chairs the League of Cities Environmental Committee, the Regional Hazardous Material Oversight Committee and the Water Resources Task Force, as well as participating with Workforce Alliance, the Biotech Land Advisory Board, and the Loxahatchee River Management Coordinating Council.

David’s campaign issues are streamlining the county permitting process, creating an attractive environment for new businesses, supporting FAU Research Park and additional biotech startups, and protecting the environment, particularly water resources.

Hal Valeche

Hal Valeche was born in 1948, grew up in New York and received a degree in American Studies from Yale. Joining the Navy flight program during the Vietnam era, he flew 85 combat missions as a fighter pilot off the carrier USS Oriskany. After the Navy, Hal received an MBA in Finance from Wharton and returned to NYC to work as an investment banker for Merrill Lynch. Hal has been a Palm Beach County resident since the early ’90s, and works in venture capital for Carl Domino, Inc.

In 2002 he was elected to the Board of the Northern PBC Improvement District and won a seat on the Palm Beach Gardens City Council in 2004, serving two terms. He also served on the board of the League of Cities, chaired the Consumer Affairs Hearing Board and was active in philanthropic endeavors. In 2008, He ran for Congress in District 16, losing to Tom Rooney in the Republican primary.

Hal is a fiscal conservative and founded the Taxpayer Action Network, a budget watchdog, and has been a participant in the Taxpayer Action Board.

In the 2012 Republican primary, Hal won 67% of the vote, defeating Dan Amero (27%) and Harry Gaboian (6%).

Christina Jax

Christine Jax was born in 1959 and lives in West Palm Beach’s Osprey Isles. She has a PhD in Education policy and Administration from the University of Minnesota, an MA in Public Administration from Hamline University, and a BA in child Psychology, also from U. Minnesota.

She was Minnesota Commissioner of Education under Governor Jesse Ventura and briefly ran for Governor of that state as an Independent Party candidate. She is currently listed on the staff roster of Walden University in Minneapolis, an online university, as Associate Dean, Doctoral Programs.

Ms. Jax has been endorsed by both the PBA and BizPAC. She was the only candidate of the original five to support high stakes testing and believes schools and teachers should be measured.

Her bio is quite extensive, with a significant array of awards won, papers written, and she is nationally known as an education expert.

Mike Murgio

Bio provided by candidate:

Mike Murgio was born in 1950 and has been a Palm Beach county resident for 39 years. He has a Masters Degree in Educational Administration and Supervision from Florida Atlantic University and a BA in Education from William Paterson University in New Jersey. He was a teacher, then a school principal for 20 years. Because of his extensive business expertise as a general and roofing contractor he was called on to solve overcrowding in our Schools in the mid 1990’s. As Principal on Special Assignment he managed the departments of Planning & Real Estate, Architect Services, and Facilities & Construction Management with budgets in excess of $170 million and 120 employees. Mike retired from the School District in 2007.

Mike has been endorsed by Palm Beach County’s most highly respected leaders who have worked closely with him for over three decades. To name a few: County Commissioner Karen Marcus; former principal of Suncoast High School, Kay Carnes; David Talley, former Chairman of the North Palm Beach Chamber of Commerce; former principal of Bak Middle School of the Arts and Dreyfoos School of the Arts, Amelia Ostrosky; and former school superintendents Tom Mills and Bill Malone. They know first hand the expertise, quality and commitment he will bring to the school board. When elected Mike will ensure students are the priority.

What’s Going On with Convention Centers and HQ Hotels? Part 1 of 3

This is the first in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

PBCTAB is late to the game as we first heard about the Convention Center HQ Hotel a year ago, and then had short notice prior to the July 24th, 2012 Workshop where it was decided to proceed with a County subsidized Convention Center HQ Hotel.

While conventional (sic) wisdom says that of course one should have a HQ hotel next to a convention center (A County Funded Hotel – Who Wins?), does the supposed induced demand in conventions due to the proposed HQ hotel justify the spending of taxpayer dollars? West Palm Beach and Palm Beach County are not alone. There are many cities considering, in process or completing HQ hotels. All of these use the same arguments and analyses.

The myriad cities all:

- are told by X, Y, Z trade show associations that they were not picked because of lack of HQ hotel (or their HQ hotel was not adequately sized) and are presented with videos by those associations describing how they would have picked that city otherwise

- use the same 1-3 consultants to justify their proposal to use public funds

- say that they have unique and desirable features that will bring the conventioneer to their city

- estimate a large increase in attendance based upon the addition of the HQ hotel or addition and an associated increase in employment and associated economic impact by those direct jobs and indirect spending by the visitors

- do not put measurements in place to assure that the projections are met

- do not achieve the desired outcome

- then have to ‘update’ their convention center, their HQ Hotel, their ‘City Place’ equivalent or add an arena.

We sent the Commissioners an article entitled “The Convention Center Shell Game” from 2004. But has anything changed since then? Steve Malanga, author of the quoted piece, writes this in a January 2012 piece:

“The convention business has been waning for years. Back in 2007, before the current economic slowdown, a report from Destination Marketing Association International was already calling it a “buyer’s market.” It has only worsened since. In 2010, conventions and meetings drew just 86 million attendees, down from 126 million ten years earlier. Meantime, available convention space has steadily increased to 70 million square feet, up from 40 million 20 years ago.”

Several of the Commissioners have quoted from Governing magazine in the past. The following quotation is from an article from the magazine, entitled “Needed: Better Benchmarks for Convention Investments” in July 2011. The emphasis is ours.

“The national supply of convention exhibit space has increased by more than 70 percent over the last 20 years, but the past decade hasn’t been kind. According to the now-defunct industry publication Tradeshow Week, attendance at conventions, trade and consumer shows decreased from 126 million in 2000 to 86 million in 2010.

Even such industry leaders as Las Vegas, Orlando, Atlanta and Chicago saw business decline after completing expansions in recent years, according to Prof. Heywood Sanders, who tracks the convention industry. Some opened their expanded facilities during a recession, but all saw business drop.

With hotels–particularly the large, moderately priced kind convention planners favor–proving increasingly difficult to finance, many industry insiders are blaming the downturn on a shortage of rooms proximate to convention centers. The response has been a spate of publicly owned or subsidized hotel development.

But that hasn’t cured what ails the industry. Convention hotels in Baltimore, Austin and Phoenix are doing poorly, and St. Louis’ convention headquarters hotel is in foreclosure.

Nonetheless, a 1,167-room headquarters hotel just opened in Washington, D.C., and Philadelphia recently unveiled a $787 million convention-center expansion. Convention and/or hotel expansions are also underway in Dallas, Detroit, Indianapolis, Nashville and Orlando.”

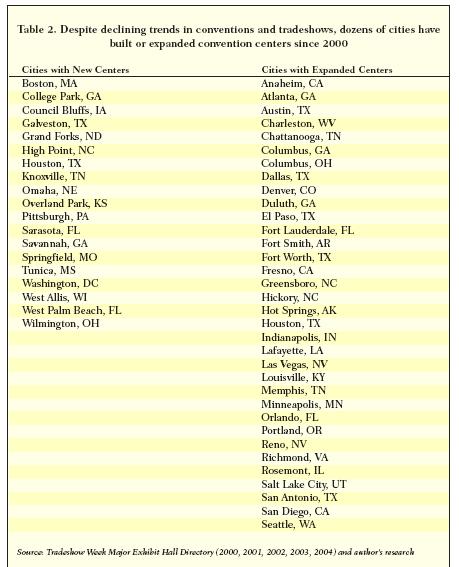

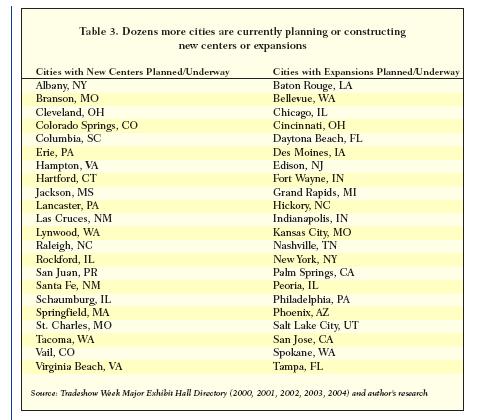

Dr. Heywood Sanders, Professor at University of Texas, San Antonio, wrote a research brief published by the Brookings Institution in 2005, entitled Space Available: The Realities of Convention Centers as Economic Development Strategy. Sanders’ expertise is in Public Policy and he is sought by citizens from cities across the country to testify to the folly of their government’s proposed expenditures. While the professor may have his detractors (primarily cities forging ahead with plans and those consultants used to justify those plans) – the following two charts from his 2005 study show the sheer number of convention center upgrades in the works during the last 10 years:

and

Meanwhile – the studies used by our own Palm Beach County administration shows a chart, Figure 5, of similarly sized, publicly subsidized hotels with the dates they were due to open.

Source: Public Participation in Hotel Development Prepared by HVS Convention, Sport& Entertainment Facilities Consulting, November 3, 2011.

These above are only a list of similarly sized hotels and do not represent all of the additional room nights being added throughout the country. The leading convention centers areas, such as Orlando, and Las Vegas are dealing with the economic realities by packing in multiple simultaneous events into their huge centers – thus taking demand from the second and third tier markets.

This mature and declining industry cannot possibly absorb all of the additional space nor achieve the positive economic impacts and occupancy projections made to the cities by consultants and by the cities to justify expenditure of public monies.

Our next article will examine recent developments related to publicly subsidized Convention Centers and HQ Hotels around the country.

- Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

This is the second in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

A recent article in the Sun-Sentinel found Orlando to be tops in the US for meetings July 2011-June 2012. “After Orlando, the company found the next most popular cities for meetings and events are in order: Washington DC, Las Vegas, Miami, Chicago, San Diego, Phoenix, Atlanta, Dallas and New Orleans.” “Miami is No. 4, Fort Lauderdale No. 30 and Boca Raton No. 43”.

So – let’s look at how some cities’ convention centers or HQ hotels are faring by looking at some recent 2010-2012 headlines…

Miami: Voters on Tuesday supported a Miami Beach bed tax increase to fund convention center improvements. But if and when a tax increase happens depends on city commissioners and a public corruption investigation. – August 2012

“The commission voted in December to bid out a $1 billion convention center district project that aims to have developers renovate the convention center, build an adjacent hotel and redesign and lease the surrounding publicly owned acres into an iconic complex. That project, however, remains in the early stages due largely to a public corruption investigation into whether the city’s then-purchasing director tainted the bidding process.”

Washington D.C: The sorry saga of the D.C. convention center hotel – Feb 2010

“I understand there may be reasons to subsidize a convention center hotel that agrees to set aside 80 percent of its rooms during peak season for low-margin convention business. But if the hotel really requires this much of a subsidy, then it raises a serious question about the economics of a project that, at best, is expected to increase convention spending in the city by $100 million a year. Right now, it looks as though the benefit of all those subsidies will be fully captured by convention attendees, the convention hotel’s developers and perhaps the owners of the city’s other hotels. If all goes well, the taxpayers will get their money back, but not much more.”

Ft. Lauderdale: Fort Lauderdale to take $13 million hit as it loses its biggest convention – July 2012

“Leaders at the Greater Fort Lauderdale Convention and Visitors Bureau said it’s unlikely that a single convention can replace the business lost from ARVO. So the bureau is working to bring in several smaller events that might fill as many rooms as ARVO: about 24,000 room nights a year.

But competition for groups is stiff because big convention center destinations such as Orlando and Las Vegas no longer wait for mega-events. They go after smaller conventions that pieced together can fill up their space — events that would more typically go to smaller venues.

“Fort Lauderdale competes with everyone in the United States, just as we do, as it relates to small and medium shows,” said Gary Sain, president of Visit Orlando.”

Daytona Beach, FL: If We Build More Will They Come? – June 2012

Raleigh, NC: Raleigh Convention Center: Throwing Good Money after Bad – February 2012

Boston, MA: Panel Proposes Convention Center Hotel – March 2011

Pittsburgh, PA: New Convention Center Hotel is Stalled – March 2012

Salt Lake City, UT: Salt Lake City officials Balk at subsidy for Megahotel – August 2011

Portland, OR: Oregon Convention Center Hotel Gets Another Chance at Life – August 2012

Virginia Beach, VA: Virginia Beach convention center hotel deal killed – February, 2012

There are many more articles for many more cities – but each story just confirms the speciousness of the arguments and the lack of metrics or proof of economic impact.

Some Background to the Mecca Farms Proposal

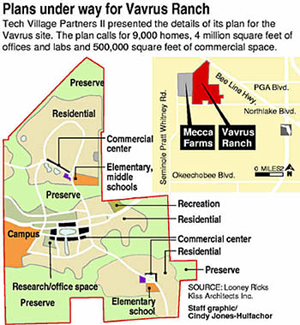

As the BCC considers the possible sale of the Mecca Farms property to the South Florida Water Management District, it is useful to consider the history of this site, and its relationship to the Vavrus Ranch which is just now being considered for development. (See: Blockbuster deal for Vavrus Ranch in the works)

The 1919 acre Mecca Farms, initially the preferred site for the Scripps Biotech industrial park, was to be accompanied by a residential development on the adjacent Vavrus ranch, presumably a “science ghetto” where the Scripps employees and their families would buy houses. Pushed by then Governor Jeb Bush and Commissioner Mary McCarty, the Business Development Board signed options for both parcels in 2003, prior to a final decision by Scripps. Scripps ultimately moved to their current Abacoa location when environmental lawsuits became a significant obstacle and a judge reversed the Corps of Engineers approval of the project.

According to Randy Schultz in the Post on May 25 (The best deal they’ll get):

Source:Sun Sentinel, 2/2005

As reported in the South Florida Business Journal in February of 2005, a division of Lennar held a joint option with Centex to buy Vavrus and planned 9-10,000 homes. The option was held by EDRI (Economic Development Research Institute), a nonprofit established by the BDB, who later transferred it to Lennar/Centex for $1.5M up front plus $51M on closing.

As reported in the Boca News on 8/3/2004, Mecca Farms itself was purchased by the county after a hastily convened meeting of four of the seven Commissioners voted 3-1 to proceed. Voting yes were Burt Aaronson, Karen Marcus and Mary McCarty, with Addie Greene voting no. The reason for the haste was that then Clerk Dorothy Wilkin was holding $1.4M of funds intended to clear the citrus trees off the site and the commissioners wanted to proceed.

Development got started early too, with Catalfumo Construction hired to build the roads on the site, and AKA services to build a 9 mile water pipe extension along SR7, 40th Street, 140th Street North and Grapeview Blvd. In total, the county spent $40M on planning and site prep and $51M for the pipeline, in addition to the $60M for the land.

The 2009 Grand Jury Report on public corruption in the county had this to say:

“The county eventually purchased the 2,000 acre Mecca Farms grove site for approximately $60 million dollars. Palm Beach County paid $30,000 per acre for land that credible evidence indicated was worth a maximum $10,000 to $15,000 per acre. With improvements to the site and area, the county expended approximately $100 million dollars to acquire and improve the Mecca site. Ultimately, Mecca Farms was never approved for development and the Scripps project was sited and built near Abacoa in Jupiter. Palm Beach County now owns and maintains at taxpayer’s expense the 2,000 acres of unimproved and undeveloped property known as the Mecca site.”

“The Mecca site transaction and other transactions lend credence to the perception of cronyism, unfair access and corruption of the land acquisition process. The Grand Jury repeatedly heard testimony of intense political pressure put on local government in land deals. Witnesses referred to the political atmosphere surrounding land deals as being a feeding frenzy.”

“The Grand Jury finds that a glaring deficiency in how land deals are handled by Palm Beach County is the overvaluation of property for purchase and undervaluation of property for sale or trade. A number of witnesses testified that when the county buys property, it overpays, and when the county sells property, it sells too cheaply. The Grand Jury examined a number of documents, received testimony and reviewed reports that support this buy high and sell low charge.”

The current offer for Mecca is $30M in cash plus about 1700 acres of land puported to be worth $25M. Mecca is appraised in the PAPA database at about $50M. The $30M cash is not sufficient to pay off the remaining $45M in debt incurred in the Mecca purchase (with $6.5M / year in debt service), nor will it recoup the $91M investment in infrastructure.

Vavrus is carried on the PAPA books as owned by WIFL, LLC. It is split into 11 parcels with a total 2011 appraisal of $68.5M and a taxable value of less than $1M.

With a Vavrus development now being considered, it would be helpful to know if the pipeline costs can be recovered by supplying the new development, and what affect (if any) a large development next to Mecca would have on its appraisal, and intended use by SFWMD for water storage.

The then ill-advised purchase of Mecca was rushed into without due diligence. Let’s not make the same mistake on its sale. In particular, let not a future grand jury say “..when the county buys property, it overpays, and when the county sells property, it sells too cheaply”.

A County Funded Hotel – Who Wins?

Today the County Commission voted 6-1 to allocate $57M ($27M direct subsidy plus $20M loan guarantee plus $10M cost of the land) toward a 400 room hotel next to the Convention Center. The county would actually own both the land and the building.

Who are the winners and losers in this “public / private partnership”?

First, let’s stipulate that the convention center needs a “headquarters hotel” to make it viable for more than the occasional home show or local meeting. It really wasn’t necessary for the hordes of dark suited businessmen to assure the commissioners of that fact, or that a viable convention center would be good for businesses in the vicinity. Even the Scuba Association and Lion Country Safari came to make that point. People who spend time at conventions can vouch for the fact that needing a 10 minute shuttle ride to and from an event is not conducive to networking or making the most of the convention experience.

Second, lets also stipulate that some amount of public money or other incentive is probably necessary to launch the project, given that nothing is happening without it.

Third, lets acknowledge the fact (that Commissioners Aaronson and Santamaria have done in some detail) that as a business deal, the current proposal is a perfectly awful investment that no sane person would make willingly. On a monetary basis, the county will not see returns for a long time (if ever), and neither the county nor the city of West Palm Beach stand to receive ad-valorem tax revenue on the hotel property.

The winners in this deal are the developer and operator, who have much of their risk assumed by the taxpayers, the businesses in the immediate vicinity that will see increased revenues from conventions (Kravis Center, City Place, Clematis Street, perhaps the Palm Beach restaurants), and the Town of West Palm Beach which would experience growth and an increased tax base from rising valuations associated with new business (even if they get no taxes from the hotel itself). The county commission is also a winner in a moral sense as there would be vindication for hatching a white elephant if it can be made successful,

The losers are the taxpayers who assume the risk of failure (what if they don’t come?), and default on the development loan, and the several million dollars a year of general fund interest payments on the bonds. Bed tax revenue, which can be expected to increase, is restricted in use and cannot offset the drain on the general fund.

Some specific problems we have with the funding plan:

1. Regarding the $20M loan guarantee, think Solyndra. It is similar in two ways – taxpayers take the fall on failure, and the deal pays the taxpayers last as the county sees no revenue until the operator has recouped 10% of their investment or $7M. Solyndra was heralded as a great investment – until it wasn’t.

2. The benefits accrue in geographic proximity to the hotel and flow mostly to West Palm Beach. Yet the citizens of Boca Raton, Jupiter, Wellington and others are asked to pay for it through their property taxes.

3. The existing hotels in the area have large meeting rooms and can support “small” conventions, perhaps to the 500-600 range. The Convention Center is designed to handle up to 6000 according to its website. It is difficult to see how a 400 room headquarters hotel would be make a dent in meeting a need of that size. At some point we expect we will be asked for more money because “the center needs a BIGGER hotel to make it viable”, and the developer does not have the business plan to expand.

4. The data presented to support the project assumptions seem optimistic. The 75% occupancy, the percentage of public investment in convention center projects, the estimates of convention business, the effect on the surrounding area – none of this feels right. Is convention activity nationwide growing? Some studies suggest not. If not, are we poaching from Fort Lauderdale? From Boca Raton? Only public/private projects were included in the averages for amount of public investment for convention center projects. Are there some success stories without public investment? If so where and why? Since the county taxpayers are shouldering the lion’s share of the risk, have the risks been understated? We will be examining these “projections” in a future article.

Today it was wishful thinkers 6, taxpayers 1. Thank you Commissioner Abrams for not drinking the kool-aid.

Commissioners Cap Millage at Last Year’s Levels

The 2:15pm time-certain item 5A3 to set maximum millage for 2013 didn’t get going until well past 3:30 – but it was short and to the point.

County Administrator Weisman made it clear that the only topic that had to be discussed was the setting of maximum millage for the September hearings. No details of the budget need be addressed until then. He confirmed to Commissioner Aaronson that the current millage was 4.7815. Aaronson then made a motion to keep the maximum millage at 4.7815 and Commission Taylor seconded it.

Two members of the public spoke. Stella Jordan of the Town of South Palm Beach and a member of their town council, told the Commission that they were fortunate that valuations went up. She cautioned, however, that spending would be going up with this flat millage and that she would expect next year that millage be reduced. Alex Larson said she was glad that the Commissioners were not going to raise the millage rate. But she said was that what their constituents really needed from the Commission and the School Board and all the governments was to lower tax rates.

Back to the Board – Commissioner Burdick questioned the amount actually available for additional spending – which after some clarification, was $800K. Kudos to Mrs. Burdick for suggesting that perhaps in September the Commission could establish a precedent for taking half of any overage and using it to rollback rates for the taxpayer. There will be pressures on the Commission to spend to the limit. We hope that they decide, instead, to give some, if not all, back to the tax-payers.