The July Budget Package – What Has Changed?

On Tuesday, July 10, the Commissioners will set the proposed maximum millage rate based on the July budget package prepared by staff, which recommends keeping the county-wide millage flat at 4.7815.

The agenda item will be discussed on Tuesday, July 10, at 2:15pm (time certain) in the county building at 301 N. Olive, WPB.

This rate is an improvement over the small increase in millage that was proposed in June, reflecting increased valuation estimates from the Property Appraiser.

Is this really an improvement over the June package as a whole? What about compared to last year?

We have opposed millage increases in the past as the valuations were decreasing, with the goal of seeing county spending return to levels that are sustainable as measured by population and inflation. Compared to 2003, the ad-valorem equivalent budget has approached the so-called “TABOR” line, but with valuations bottoming out, we begin a new phase where rising valuations should be accompanied by declining millage rates.

The following table compares millage, proposed tax and ad-valorem equivalent spending between the 2012 budget, the June package and this July package:

| 2012 Budget | June Package | July Package | Net Change from 2012 | |

|---|---|---|---|---|

| County-Wide | ||||

| Millage | 4.7815 | 4.7984 | 4.7815 | 0 |

| Proposed Tax | $595,388,733 | $599,257,607 | $599,618,457 | + $4.2M (0.7%) |

| Fire Rescue | ||||

| Millage | 3.4581 | 3.4581 | 3.4581 | 0 |

| Proposed Tax | $175,610,575 | $176,358,065 | $177,006,499 | + $1.4M (0.8%) |

| Ad-Valorem Equivalent | ||||

| County Wide | $280M | $283M | $284M | + $3.9M (+1.4%) |

| Library & F/R | $228M | $229M | $230M | + $1.8M (0.8%) |

| Judicial & Other | $5.1M | $4.8M | $4.9M | – .2M (-4%) |

| Sheriff & Const. | $439M | $444M | $444M | + $5M (1.2%) |

| Total | $952.1M | $960.7M | $962.6M | + $10.5M (1.1%) |

As you can see from the table, compared to June, the millage is less but the proposed tax is slightly higher. Compared to 2012, the proposed tax is $4.2M higher county-wide and $1.4M in Fire Rescue. But the biggest difference is on the spending side of the equation, with Ad Valorem Equivalent rising $10.5M over 2012, half of that at PBSO.

So here is our net:

Palm Beach County is not Wisconsin

On Tuesday, a sea of yellow shirts packed the commission chambers. None of the shirt wearers, who are members of IAFF local 2928 as well as employees of County Fire Rescue, took the podium to speak. That wasn’t why they were there. As acting union President Ricky Grau spoke in favor of “three men on a truck” and accused the county of understating the amount of reserves they have to spend, the sea of yellow shirts were there to send a not so subtle message to the commissioners.

What was the issue that brought out the troops? They objected to the action taken by Chief Steve Jerauld and Fire Rescue leadership in April to reduce the staffing on some EMS vehicles from three to two under some circumstances. This has reduced the amount of paid overtime. The Chief has assured the Commissioners and the public that in no way had public safety been compromised by this move. The savings are estimated to be $7.8M per year. Although no vote was taken, and only Karen Marcus and Burt Aaronson spoke strongly in favor of restoring the three man crews, staff took that as marching orders and agreed to spend the extra money.

None of this discussion involves any increase in millage or other revenue enhancement, and we believe that drawing down “excessive” reserves – stipulated by all sides to be “at least” $50M is the right thing to do. We also agree with Commissioner Marcus that IF the county policy is indeed “three men/women on a truck”, then it makes more operational and fiscal sense to fully staff the positions rather than paying overtime to a reduced staff. But should a bona fide attempt by the Chief to save taxpayer money by increasing efficiency at no risk to public safety be so quickly rebuffed?

The IAFF is a political force in the county and elected officials cross them at their own risk. The Fire Rescue collective bargaining agreement expired last September and they are currently working without a contract after a year of “negotiations” that led nowhere. Both sides (to their credit) were not suggesting pay increases in this economy, yet a county proposal for a 22% reduction in starting salary for new hires was never even acknowledged by the union. To see the Commissioners buckle over a truck staffing rule before the yellow shirted troops does not bode well for any substantive discussions in the future.

Fire Rescue funding is headed for a showdown when the reserves can no longer be tapped. As some cities are near their millage caps, the Fire Rescue millage has been flat since 2010 and revenue has trended down with property valuations. Spending on the other hand, mostly driven by escalating personal service costs built into the existing contract, contines to rise. Something has to give. We think the overly generous pay and benefits (compared to Fire Rescue national averages) need to be addressed. That is not likely in the game plan though and it would not surprise us to hear more talk of sales tax surcharges in the years to come.

Wisconsin was a wake up call to the public employee unions. Perhaps some of Governor Walker’s courage will rub off on our elected officals too.

For the Palm Beach Post editorial on the subject by Andrew Marra, see: Fire-Rescue headed for a financial emergency

TAB View of 2013 County Budget Proposal

In preparation for the first budget workshop of the 2013 cycle next week, the county has published their proposal. The workshop will be held on Tuesday, June 12 at 6:00pm in the county building at 301 N. Olive, WPB.

Unlike the last few years which Administrator Weisman has called “the most difficult budget year the county has faced”, bottoming valuations have created a less austere outlook. With the expectation of a barely perceptible 0.39% drop in property values reported by Property Appraiser Gary Nikolits, (See: Has free-falling Palm Beach County real estate finally hit bottom? ) the days of trying to save programs and spending levels by big hikes in the tax rate may be coming to an end.

The county proposal is therefore modest – a 0.4% hike in the county-wide millage rate to 4.7984 (up from 4.7815 last year), and a 0.6% or $3.9M hike of taxes collected. There are no projected cuts to “vocal constituent” programs like the nature centers, lifeguards or Palm Tran Connection, and even though the Sheriff is asking for an increase of $4.7M in ad-valorem revenue and $8.8M in appropriation, it is mitigated somewhat from a “return of excess fees” of $10M.

What had been expected to be a $15-30M problem this year, was positively affected by smaller than expected costs associated with FRS, and the use of “one-time” sources such as sweeping funds from Risk Management, capital project and Fleet Management reserves. Given TAB’s emphasis last year on using reserves to cover shortfalls in the difficult times, we are glad to see this development.

The entire proposal is good news, considering how hard everyone worked last year to bring the initial proposal (3.6% increase in rates) down to the final 0.6%. Although we think that it would be an appropriate gesture for the board to keep the millage flat (at a cost of the $3.9M hike), as they are doing with the Library and Fire/Rescue MSTUs, if this proposal was approved as submitted we would not object.

That said, there are some cautionary statements in the proposal. It is mentioned that 35 positions (half of them filled) will be eliminated without a service impact, by various good management practices and the expiration of grant funding of temporary positions. It is also stated that general county employees have not received a raise since 2008. There is also interest in some quarters to increase spending on some programs.

We ask that the commissioners not try to address these things in this budget year. The private economy has not yet fully recovered, even if property values are leveling off. Consequently, we call on TAB partners and supporters to stay vigilant, attend the budget meetings, and let your commissioners know you don’t support any increases above the submitted proposal.

For the Post’s view of the proposal, see: County budget proposal: less gloom and doom

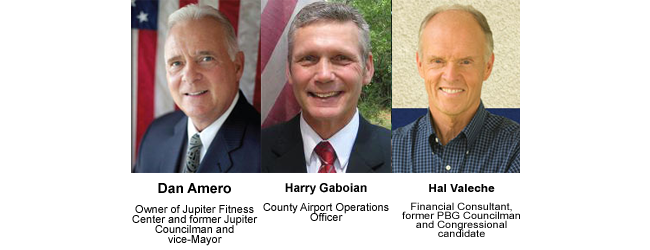

County Commission District 1 Candidate Forum

Candidate Forum

Join us for an evening of in-depth discussion of county issues with the three Republican candidates competing to replace term-limited commmissioner Karen Marcus.

Moderated by Tom Boyhan, WJTW FM100.3

June 18, 2012

6:00pm Meet and Greet, 7:00 Program

Abacoa Golf Club

105 Barbados Drive, Jupiter, Florida 33458

Food and Drink Available

The candidates are:

This event is jointly sponsored by:

Palm Beach County Taxpayer Action Board

Palm Beach County Tea Party

Palm Beach Republican Club

Republican Club of the Northern Palm Beaches

Republican Club of the Palm Beaches

Singer Island Civic Association

South Florida 912

This forum has been organized to feature the district one candidates appearing on the August ballot. Gardens Mayor David Levy, also a candidate for the position, is unopposed on the Democrat ticket and will face the eventual winner of this August contest in November.

BCC to Discuss $29M in Spending Reductions

At the Tuesday, May 15 Commission Meeting, agenda items 5a2 and 5a3 deal with an “efficiency audit” performed by consultants Gerstle, Rosen & Goldenberg at the request of county administration.

The audit found areas of significant savings, both in county operations and in the constitutional offices (except the Sheriff who evidently refused to answer any of their questions), estimated in the range of $29M. They looked in four areas: operating efficiencies, outsourcing, staff reductions, and additional sources of revenue. (It appears that only the outsourcing will be discussed in 5a2, and 5a3 addresses efficiencies regarding the constitutional offices).

These savings involve the elimination of 921 positions, mostly through outsourcing, and the bulk of the savings comes from reduction in benefit obligations.

With the county facing a potential $15M shortfall in the 2013 budget to be discussed at the first workshop on June 12, searching for areas to reduce spending is sorely needed and this study is an excellent move in that direction. Staff should be commended for both commissioning the study and for bringing it to the board for direction.

We are not overly optimistic that this initiative will be warmly embraced however. Already, the counter-arguments have begun. Chairman Vana says “My goal was never to try to get rid of a million people”. OFMB Director Bloesser warns that “it was unlikely that many of the findings could be put into effect before the budget year begins on Oct. 1”. Clerk Bock says that the proposed savings in her office are “incorrect and irresponsible”.

Nevertheless, this is the kind of direction that TAB has been calling for for several years, and we ask partners and supporters of TAB to attend the Tuesday session in support of the consultants proposals, or communicate your views to your commissioner.

The full content of the report can be found in the attachment for item 5a2 and the initial reactions are captured in the Palm Beach Post: Consultant: Palm Beach County can save $32M with 1,000 job cuts, add $3M with rate hike.

A Look at the Candidates for County Office at the Voters Coalition

“Half Baked” Tax Proposal put back in the oven for another year

“Half baked” – that is how Commissioner Steve Abrams described Bob Weisman’s proposal to put a $100M, half percent sales tax surcharge on the November ballot.

We agree. Even Commissioner Taylor, who seems to believe our money belongs to her (“We’re not exercising our RIGHT” to raise these taxes) thought the proposal needed a little more development.

Normally, county staff does a good job on budget proposals. We don’t always agree with their priorities, but they do offer justifications and complete analysis. This proposal seemed to drop out of thin air a week ago and postulated $100M more in revenues for unspecified “transportation” projects with no sunset. A vague suggestion of possible offsets to property taxes was contained in the agenda item, but there was no Powerpoint presentation, no forward projections, no discussion of the trends in existing transportation funding like the gas tax.

The commmissioners, to their credit, recognized the difficulty in selling such an open ended proposal and all wanted to table the issue until the staff could come back with a more thought-out package. Those that were OK with raising the sales tax (Taylor, Vana, Aaronson), wanted staff to return in a month so there would still be time to put it on the November ballot. Those not so keen on the idea (Burdick, Abrams, Marcus), preferred to table it until next year or indefinitely. Karen Marcus suggested that when the TriRail expansion occurs, we may need the money more than we do now. (Ouch !).

It is clear that if the proposal were to come back in a month, a lot of time and resources would have to be spent by TAB and others in order to develop counter arguments. With the budget workshops coming up in June, that would be a considerable distraction. It was starting to look at one point that we would have another 4-3 vote in that direction, but Commissioner Santamaria joined with the taxpayer-friendly commissioners to table the issue until next year.

Thank you to all who came to the meeting and spoke against the proposal, including Alex Larson, Pat Cooper, Fred and Iris Scheibl, Janet Campbell, Nancy Hogan, and Rick Roth.

TAB Note: The discussion of transportation funding has shined a light on the budget dynamics of Palm Tran, which we were astounded to learn is more than 90% subsidized. Since only a small part is ad-valorem funded, TAB has not paid it much mind in the past, but now it will get some scrutiny for sure.

TAB Opposes Sales Tax Increase

Staff requests direction on implementation of a “Charter County and Regional Transportation Tax”

On Tuesday, May 1st, the Palm Beach County Commission will be considering a $100 Million, 1/2% increase (raising existing 6% to 6.5%) in the sales tax to fund transportation related spending. The Administrator is requesting board feedback on putting this proposed tax on the November ballot, and the Commission must give approval prior to the August 10th ballot language deadline. A good description can be found in Jennifer Sorentrue’s article Palm Beach County voters may be asked to increase sales tax by half-cent for roads, transportation.

The agenda item is 4A2 – and it falls early in the morning’s schedule – after special presentations and the Consent Agenda, and an item related to the Supervisor of Elections. The agenda can be found here and the agenda item background here.

The County Administrator’s rationale is as follows:

- The tax will generate over $100 million annually

- It will partially shift transportation funding to ‘tourists’

- State Statute allows for the tax and PBC is one of the few of the 67 counties that don’t charge this sales tax.

Why now? Is it because our economy languishes and home values aren’t increasing significantly so there are revenue pressures? Is it because the price of gas has become so high that we – tourist and resident alike, are driving less or boating less? Is it because the administration doesn’t want to have to account for how they spend – when they have no productivity and performance benchmarks nor measurements against those benchmarks?

TAB has issues with this proposed sales tax increase:

- This is a tax increase. It affects most purchases and services. And unlike the fire/rescue sales surtax proposed to the Commission in 2010, it makes no claims that it will be revenue neutral nor is it accompanied by any decrease in ad valorem

- This tax would be permanent. Unlike the recently expired school sales tax, this tax is not for a specific set of projects nor does it have an end date.

- This will be a revenue windfall for the county. We remain in an economy close to recession. Inflation is already here in our fuel and food prices, and will continue to increase.

- There is no accountability. The spending isn’t subject to any board, nor does the county have any performance or productivity benchmarks.

Background:

Residents, business owners and tourists alike pay ad valorem taxes. The resident or business owner pays it directly. The ‘tourist’ pays it indirectly. Residents, businesses and tourists pay for fuel. The Palm Beach County Revenue Manual lists several taxes that are geared towards transportation already:

- Local option gas tax: 6 cents on every gallon of gas for exactly the same purpose as this proposed except debt service

- The ‘ninth’ cent tax, 1 cent tax on every gallon of gas that lists all the same purpose

- County Gas Tax: 1 cent on every gallon of gas to be used on transportation related areas

In addition – Palm Tran already has fees, and builders have ‘road’ impact fees.

At the April 27, 2012 Commissioners’ workshop on the Internal Audit Department, the Commissioners, whether rhetorically or not, questioned the lack of any kind of productivity or performance measurements in the county. Asking the voters’ to hand over more of their hard-earned money to an open-ended, unspecific, windfall tax is unconscionable.

Voters are unlikely to approve the proposed ballot amendment. Please tell your commissioners to reject this request by the County Administration and not put it on the ballot in November.

BCC Briefs for April 17, 2012

The following was provided by Quianna Gray, Secretary to Shelley Vana:

At the April 17, 2012, Board of County Commissioners meeting, the board took the following action:

Wage theft – discussed a proposed county ordinance establishing a procedure for victims of wage theft to recover back wages. Staff was directed to take 90 days to work on the ordinance language with the Legal Aid Society, business leaders, and members of a workers advocacy group.

Congress Avenue – conceptually approved alignment 2a for the extension of Congress Avenue from Park Lane to Alternate A1A. This allows for the design and right of way acquisition process to begin.

Island Way – discussed a proposed alignment for Jupiter Park Drive/Western Corridor, to be known as Island Way, and agreed to postpone selection to the May 15 board meeting to give staff an opportunity to meet with affected residents.

Water mains – adopted resolutions confirming special assessments for property owners on Raulerson Drive in Greenacres and East Secretariat Drive in Loxahatchee for installation of potable water mains.

Vehicles for hire – approved on preliminary reading and to advertise for public hearing on May 15 a series of amendments to the Palm Beach County Vehicle for Hire Ordinance. Staff was directed to return in six months with specific standards mirroring those in effect at Palm Beach International Airport.

Legislative update – heard a presentation by state Rep. Mark Pafford on the county’s 2012 legislative agenda priorities and appropriations.

Legislative Affairs – received a final report on the 2012 Florida Legislative Session from Legislative Affairs Director Todd Bonlarron.

Housing – approved up to $10 million in Housing Finance Authority multifamily housing revenue bonds for Village at the Park, a 152-unit multifamily rental housing facility in Delray Beach to be rented to qualified individuals; also approved up to $8.4 million in Housing Finance Authority multifamily housing revenue refunding debt obligations for Pinnacle Palms Apartments, a 152-unit facility for the elderly in West Palm Beach. No county funds or its taxing power, faith or credit are involved.

Historic property – adopted a resolution granting a county tax exemption for a historic property known as the Bath and Tennis Club, located at 1170 South Ocean Blvd., in the town of Palm Beach.

Land use – declined to consider at a future meeting whether to require a super-majority vote (five votes) on proposed land-use changes for Peanut Island, environmentally sensitive lands owned by the county, and publicly owned land in the Agricultural Reserve.

Yet Another Taxing District?

Palm Beach County property owners are taxed in many ways. We pay separate tax rates for our cities, for our schools, and for the county government. We also pay for the county libraries, the Health Care District, the Children’s Services Council, and a variety of inlet and water management districts. If we live in the unincorporated areas we pay separately for Fire/Rescue.

Now there is a proposal to create yet another tax district – for the Office of Inspector General. Why this and why now?

It is raw politics.

Some Background

The Office of Inspector General was established in 2009 by the County Commission in response to the grand jury report investigating “Corruption County”. With many commissioners and lobbyists serving jail terms for abuse of the public trust, it was a correct response, and much effort went in to making the office “independent”. Hiring was performed by an independent selection board. Removal required the votes of the entire selection board plus 5 of the 7 commissioners. The budget was floored at an amount .25% of the contracts that vendors have with the county, and could not be reduced without 5 votes of the commission.

In 2010, a ballot initiative asked the voters if the IG jurisdiction should be extended to the 38 municipalities, with a proportional increase in funding to come from those entities. 72% of the voters agreed and the result was codified in the county charter after a six month effort by an ordinance drafting committee. The committee was composed of representatives of the county, the League of Cities, and the public, but much of the discussion was contentious. The cities objected mainly on two grounds – that the scope was too broad and that the purview of “waste, fraud, abuse and mismanagement” needed to be narrowly defined to limit what the IG could investigate, and that the funding formula based on a LOGER estimate of contract activity constituted an illegal tax. The ordinance draft did pass by a majority vote.

In 2011, after the IG began her work with the cities, the opposition began. Many cities passed local ordinances adding the definitions that were rejected by the drafting committee. A narrative was established that complying with the IG would be prohibitively expensive to answer their questions and fix any problems found. “The people did not know what they were voting for” became the operative justification for the opposition. Finally, in a major strike, 15 of the 38 municipalities filed a lawsuit claiming that the funding mechanism is illegal under Florida law, and refused to remit their obligated funding. Funds already provided by the municipalities that were not party to the lawsuit were sequestered by the County Clerk. A crisis in funding was at hand.

Recent Developments

On Tuesday, 3/20, a lawsuit “settlement proposal” negotiated by County Attorney staff was brought to the Commissioners. Under its terms, the cities would collect a contract fee of .25% levied by the county on their contracts, to be used for IG oversight of only those contracts. Contracts that predated 6/12 would be excluded, as would a long list of exempted contracts including large ones like FPL, waste collection and all federal grants. The IG office estimated that acceptance of this settlement would gut 60% of their budget, effectively limiting their oversight of the municipalities. After a large number of members of the public came forward urging rejection of the settlement, the commission voted 7-0 to reject it and move on to mediation.

On Monday 3/26, a joint meeting was held in the West Palm Beach City Hall between the County Commission and the representative of the municipal litigants. It was an august collection of the most senior public officials at the local level. While all professed to “support the IG”, and that the lawsuit was “just about the funding”, an objective observer could conclude that an independent Inspector General with free rein to investigate in the cities was not universally embraced.

Commission Chairman Shelley Vana correctly summarized that the intention of the ordinance is to provide for IG independence by having the governing body NOT control the IG budget. Mayor Muoio and the others see that as the crux of the problem – how can you be responsible for a budget if you can’t set the level of spending on a line item. Why, if the economy is bad, we may just decide not to fund the IG at all in a given year! Control of the IG budget is control of the office – just what the ordinance is intended to prevent.

During this meeting, West Palm Beach attorney Glen Torciva suggested an independent taxing district as the way out of the dilemma. Let both the county and the municipalities wash their hands of the funding issue and let the people decide. Of course a new taxing district would have to go on the ballot – perhaps this November. This is perfect for those who believe “the voters didn’t know what they were voting for” in extending the IG to the cities. Instead of asking “.. should we have an IG?” as in the 2010 question, we will ask ” .. should we pay more taxes so we can have an IG?” Maybe then the 72% of the voters who wanted to meddle in the affairs of our elected officials will think twice.

If you have any doubts about the motive here, consider Mr. Torciva’s statement to the Palm Beach Post:

Commissioner Burt Aaronson, a supporter of the concept, added (with a smile):

The creation of the Office of Inspector General and the Ethics Commission has gone a long way to correct our reputation as “Corruption County”. This latest attempt to neuter or eliminate the office proves that we still have a lot of work to do. The roughly $3.5M OIG budget would be equivalent to a 0.03 millage rate on our $120B property valuation – hardly worth the effort it would take to collect it. The current LOGER system is an accurate, reliable way of measuring local economic activity and establishing a fee for IG services. Whether a fee is actually charged to a contract or not, it is a reasonable way to both estimate and bill.

We think the county and cities should find a way to make it work and drop any attempt at forming a new taxing district.