2025 Budget Raises $125M in New County Taxes

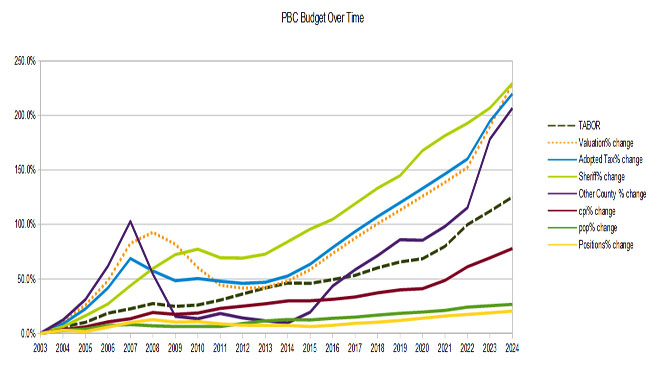

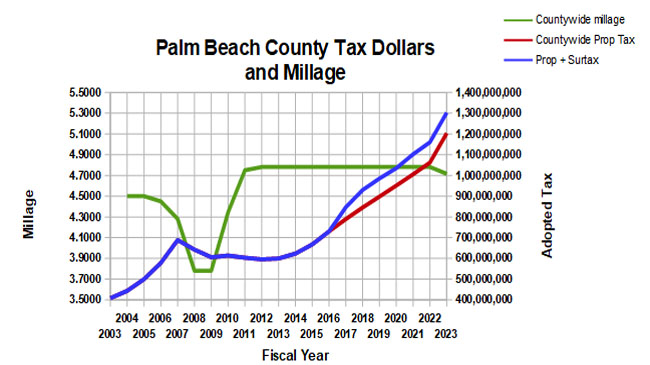

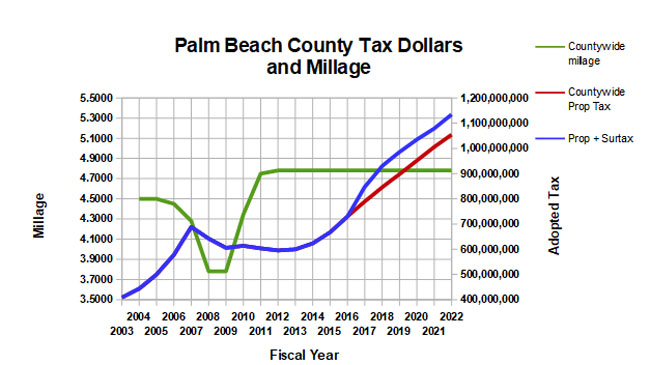

At the first public hearing on the 2025 PBC County budget on 9/10, the Board of County Commissioners (BCC) voted 6-1 to maintain a flat millage of 4.5. Commissioner Baxter was the sole holdout and argued that everything costs more now and with the large runup in property values, the taxpayers could have used a break by reducing the millage slightly. Last year, the rate was reduced about 5% from 4.715 to the current 4.5. There was no support for this position from the other board members as Commissioner Marino (who pushed for last year’s reduction) was not on board, and Mayor Sachs pointed out that the county expenses were higher too, and paying higher taxes is just an indication that your property is worth more.

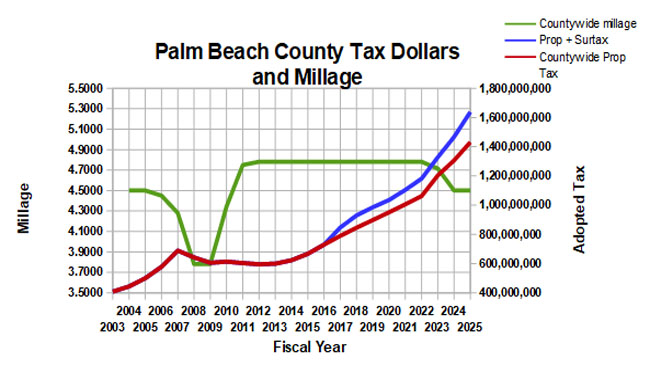

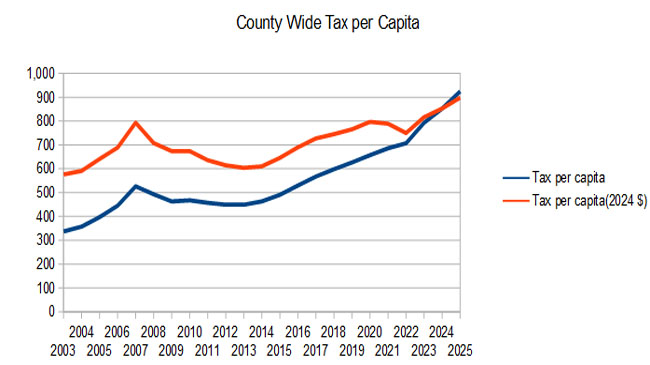

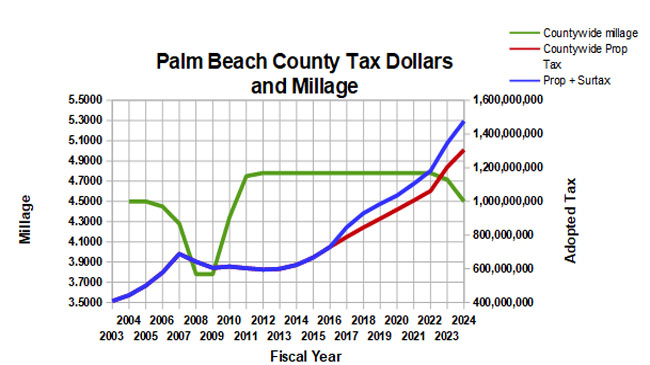

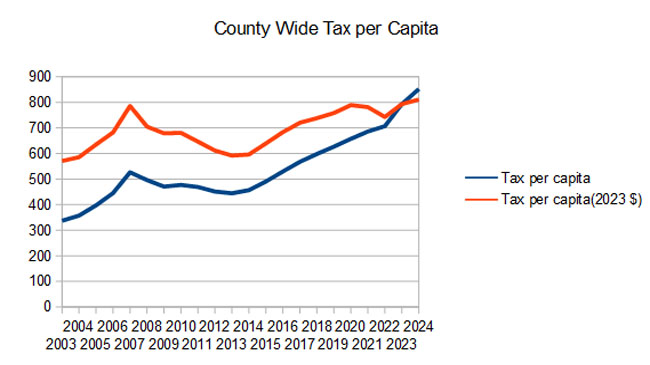

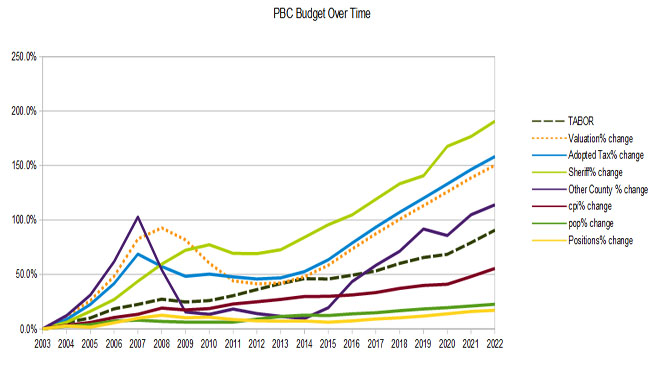

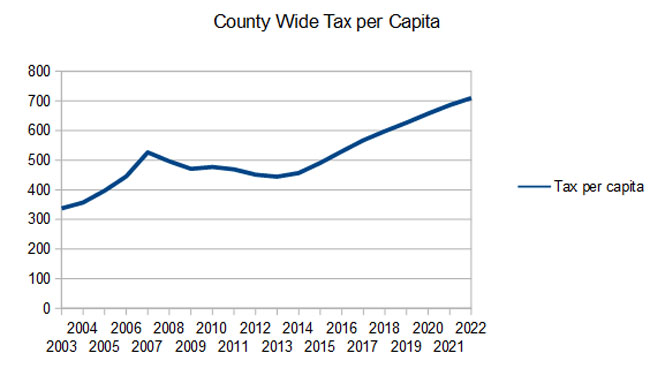

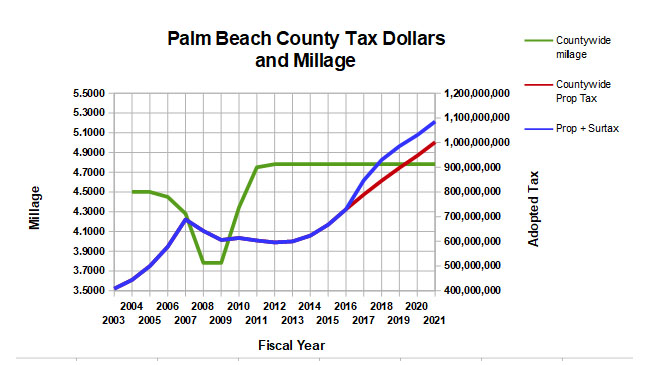

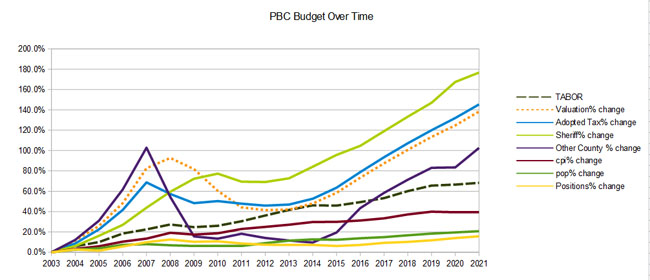

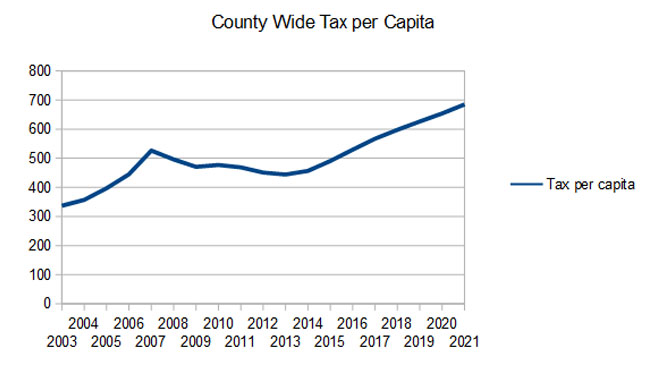

Flat millage is far enough above the roll-back rate so as to require a super majority vote. It represents an increase in collected ad-valorem taxes of about $125M, up 9.6% since last year. On an inflation adjusted per capita basis, each of our 1.5 million residents is responsible for $898 (2024 dollars). This is up from $646 just 10 years ago in FY 2015.

This year sees another 6% across the board salary increase (worth $18M) on top of 6% last year. County employees never have to worry about inflation.

Some other increases in Ad-Valorem expenses in this budget:

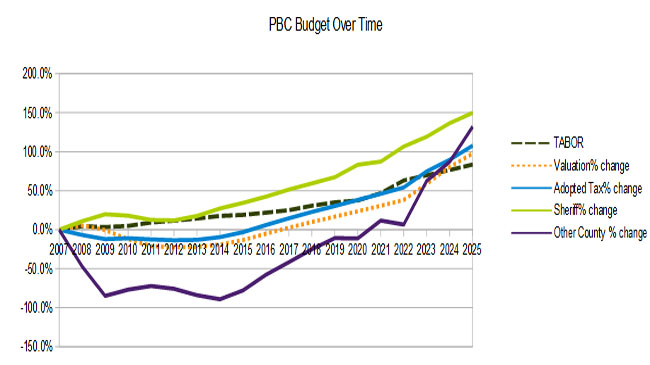

+ $70M for the Sheriff – this is a 8.0% increase, yet the PBSO share of the total budget has declined to 59.0% from a peak of 66.4% in 2020 given large increases in other county areas

+ $39M for Housing and Economic Development (+26%)

+ $97M for Palm Tran (+50%)

+ $39M in capital projects

+ $50M for budgeted reserves, to $1.9B (22% of planned expenditures).

+ $53M for Fire/Rescue operations

The supervisor of elections budget request has declined by $8M (-26%) as 2025 is an off year.

Total staffing is increasing by 110 to 12,536, with the biggest increases in Fire-Rescue (+27 to 1882) and PBSO (+16 to 4505).

The final public hearing will be held on September 17th at 5:05pm.

2024 Budget Raises $100M in New Property Taxes

At the first public hearing on the 2024 PBC County budget on 9/7, the Board of County Commissioners (BCC) followed through with their intention to reduce the millage by about 5% from 4.715 to 4.500. As in July, the vote was unanimous.

A reduction in the millage of that much was a bit of a surprise in June as staff had recommended keeping it flat, and the change reduces the original county-wide ad-valorem tax proposal by $62M. Kudos to Commissioner Marino for suggesting the change and getting the rest of the board to follow her lead.

That said, the county-wide property tax burden is still going up by 8.5% since taxable valuations have climbed almost 15% since last year. That is an increase of $102M. Where is the new money going you ask? Much of it goes to a 6% across the board increase for every employee. This is on top of 3% a year, every year for the last nine (34% from 2014).

Some other increases:

- $54M more for the Sheriff – this is a 7.5% increase, yet the PBSO share of the total budget has declined to 59.5% from a peak of 66.4% in 2020

- $105M increase in reserves. The $1.6B in reserves are now 32% of budgeted expenditures, up from 28% one year ago.

- $29M increase in BCC operations net of revenues

- $85M in capital projects

- $12M increase for the Supervisor of elections, now at $34M (55% increase). Next year is a Presidential election year, but the budget in 2020 was only $16M so it is more than doubled. At the hearing, the majority of speakers addressed this line item and there appears to be an upswell of angst about the conduct of elections in Palm Beach County. This budget increase does not help that much.

The Fire / Rescue budget (separate taxing district, paid only if your town does not have its own F/R) has increased over 10% to $529M.

Total staffing is increasing by 66 to 12,369.

The final public hearing will be held on September 26th at 5:05pm.

2023 County Budget – 13% Tax Increase in Spite of Small Millage Drop

The final proposed county budget for FY 2023 will be voted on at the September 20th BCC Public Hearing at 5:05PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

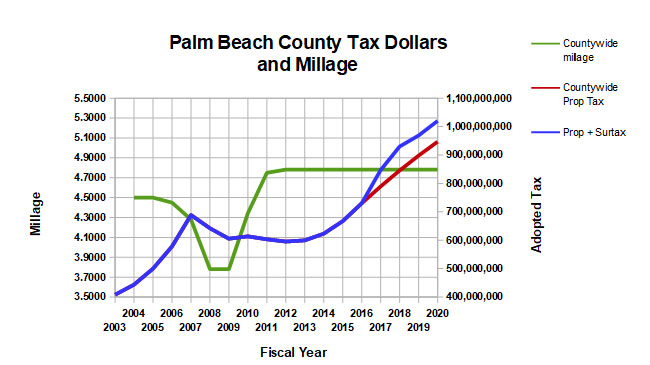

In the summer workshops, the BCC voted to reduce the millage by about 1.6% to 4.7150. This is the first millage change since 2012 when it was increased during the depths of the real estate valuation slump. Even with this minor reduction, the tax burden is up 13.4%. This is so much over the rollback rate that it will take a super majority of the Commission to enact.

It is a budget unlike the last few years in that it is presented in a time of uncontrolled inflation. When prices for everything are rising at an average 8.6% rate, governments just like people must find a way to increase their revenue or cut their spending. Having the power to tax of course, means governments can do just fine while the rest of us suffer.

With close to flat millage (with rising valuations), 6% salary increases for staff across the board and a tax increase over the previous year of about 13.4%, the county’s budget proposal doesn’t appear to subscribe to the “cut the spending” response to inflation.

Total County-wide tax is up $141M to $1.2B, on top of the penny sales tax (infrastructure surcharge) of another $94M (estimated). After many years of small budget increases, the BCC ad-valorem funded departments are going to town. Inside the overall 13% increase, the Sheriff is only asking for 5.5%, while the rest of the departments’ growth is an astounding 27%!

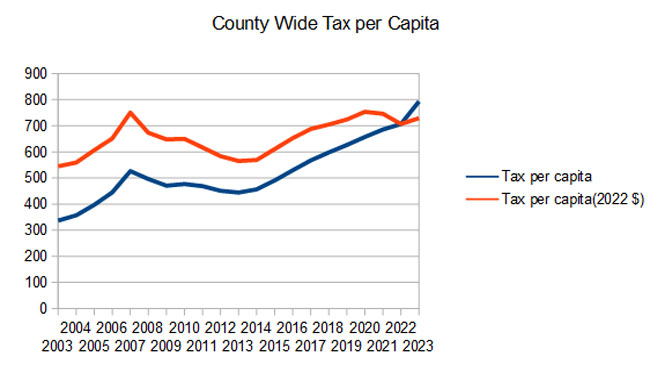

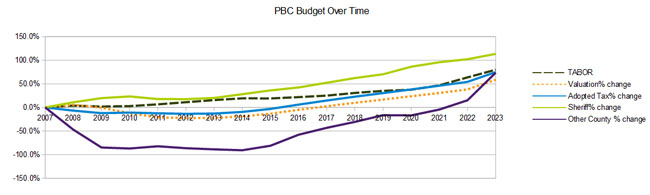

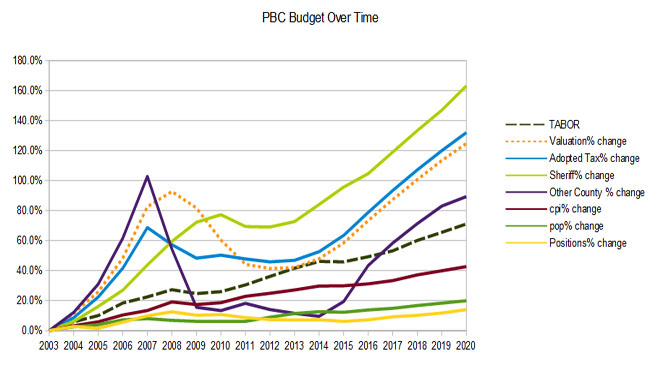

To be fair, with the Federal Reserve printing money to accommodate the Biden Administration’s excessive spending (the $2 Trillion “rescue plan” went right into the M2 money supply), it is prudent for the county to expect much higher costs going forward and padding the budget a little. I expect we will see that on the municipal level as well during the summer. If you look at the “County Wide Tax Per Capita” chart below, when shown in 2022 dollars taxation in flattening out.

For some perspective, during the last 11 years of flat millage (2012-2023), the ad-valorem tax per capita in Palm Beach County rose from $451 to $793, a 73% increase during a time of a 41% change in the consumer price index (much of that in the last year).

Here are some items in the budget of note:

- $3.4M is allocated for “Compensation Study Phase III”, the third and final installment “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” Since this year’s 6% increase comes on top of 3% a year for the last 8 (30% in total), we wonder if the study will find that county staffers are overpaid. No, I didn’t think so.

- As mentioned, after eight years of 3% cost of living (COLA) increases across the board, adding an ongoing $7.3M per year, this year’s 6% makes it 34% over the 9 years – a period when inflation was about 19%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $188K

- Sheriff (including part time crossing guards, etc.): $168K

- Information Technology: $124K

- Office of Management and Budget: $120K

- Parks and Recreation: $94K

- Palm Tran: $98K

- Engineering and Public Works: $87K

- The budget for the Supervisor of Elections is growing about 9% to $21.8M on top of 28% last year.. This includes a net gain of 5 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $255 billion, up about 15% over a year ago.

- With slightly smaller millage (4.7150), this valuation will generate more than $1.2 Billion in ad-valorem taxes, up $141M (13.3%) over last year.

- There will be 97 new BCC funded positions, 16 of them ad-valorem funded.

- General Fund reserves are being increased to $262M, 14% of general fund revenues (was $189M, so up 39% over last year)

- The Sheriff will see a $38M ad-valorem increase (5.5%). This includes money for 16 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $8.1M and $44.2M respectively.

2022 Budget Workshop on Tuesday, June 15

The proposed county budget for FY 2022 will be presented at the June 15 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

Watch the meeting on Channel 20.

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year of about 4.8%.

Total County-wide tax is up $49M to $1.05B, on top of the penny sales tax (infrastructure surcharge) of another $80M (estimated).

For some perspective, during the last 10 years of flat millage (2012-2022), the ad-valorem tax per capita in Palm Beach County rose from $451 to $710, a 57% increase during a time of a 25% change in the consumer price index (much of that in the last few months).

Some items in the budget that should raise a few eyebrows:

- $3.2M is allocated for “Compensation Study Phase II”. The fall budget workshop estimated an additional $10M would be needed to fully complete phase II. Although not described in the package, we believe this is a continuation from the study by Evergreen Solutions back in 2018 and 19, whose purpose was: “… to review and compare the local employment market to determine the competitiveness of the County’s salary ranges, obtain valuable employee feedback relating to their perception of the County as an employer, and to review each and every job classification to ensure it reflects the actual work being performed and that the associated class structure is appropriate.” See: Evergreen Study

- This is the eighth year of a 3% cost of living (COLA) increase across the board, adding an ongoing $7.3M per year. This amounts to 27% over the 8 years – a period when inflation was about 16%. County employees are doing pretty well as a result. For example, the average total compensation (salary plus benefits) for an employee in a sampling of departments looks like:

- Fire / Rescue: $177K

- Sheriff (including part time crossing guards, etc.): $145K

- Information Technology: $117K

- Office of Management and Budget: $113K

- Parks and Recreation: $89K

- Palm Tran: $92K

- Engineering and Public Works: $82K

- The budget for the Supervisor of Elections is growing 28% to $19.9M. This includes a net gain of 4 staff. During the 2020 election season, our Supervisor accepted $6.8M from the foundation funded by Mark Zuckerberg, The Center for Technology and Civic Life (CTCL). (“Zuck Bucks”) According to Breitbart, $1.3M remains unspent. See: Palm Beach County, Florida, Supervisor of Elections Claims ‘No Legal Obligation to Immediately Return’ $1.3 Million to Zuckerberg-Funded CTCL

Some other items of interest:

- Valuations are estimated at about $221 billion, up about 4.9% over a year ago.

- With flat millage (4.7815), this valuation will generate more than $1 Billion in ad-valorem taxes, up $49M (4.8%) over last year.

- There will be 83 new BCC funded positions, 8 of them ad-valorem funded.

- General Fund reserves are being increased to $194M, 11.6% of general fund revenues (was $176M, so up 12% over last year)

- The Sheriff will see a $33M ad-valorem increase (5.1%). This includes money for 35 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $2.1M and $11.4M respectively.

2021 Budget Workshop on June 16

The proposed county budget for FY 2021 will be presented at the June 16 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year about 5.8%.

Total County-wide tax is up $54.7M to $1.0B, on top of the penny sales tax (infrastructure surcharge) of another $84M (estimated).

For some perspective, during the last 9 years of flat millage (2012-2021), the ad-valorem tax per capita in Palm Beach County rose from $451 to $685, a 52% increase during a time of a 12% change in the consumer price index.

Some items of interest:

- Valuations are estimated at about $210 billion, up about 4.9% over a year ago.

- With flat millage (4.7815), this valuation will generate more than $1 Billion in ad-valorem taxes for the first time, up $54.7M (5.1%) over last year.

- There will be 146 new BCC funded positions, 26 of them ad-valorem funded.

- General Fund reserves are being increased to $177M, 11.2% of general fund revenues (was $154M, so up 15% over last year)

- A 3% COLA for all BCC employees will cost $7.0M. This is the seventh year in a row – a 22% across-the-board raise over 7 years. During the same period, inflation was about 7.4%.

- The Sheriff will see a $21.7M ad-valorem increase, which is a net $31.8M (+5.1%) considering carry-forwards and increased revenue. This includes money for 27 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $3.1M and $16.3M respectively.

- Palm Tran is seeing a big boost of $14.1M (11%), 4.8M of that from ad-valorem.

The BCC priorities were funded, with $3.4M for business incentives, $89.2M for infrastructure (including Palm Tran vehicles), $17.6M for Housing/Homelessness (including “non-congregate” shelters), and $2.5M for substance use and behavior disorders.

2020 Budget Workshop on June 10

The proposed county budget for FY 2020 will be presented at the June 10 BCC workshop at 6:00PM.

301 N. Olive Street, 6th floor.

Links:

It is a budget not unlike the last few years, with flat millage (with rising valuations), 3% COLA increases across the board and a tax increase over the previous year about 5.5%.

Total County-wide tax is up $49.1M to $947M, on top of the penny sales tax (infrastructure surcharge) of another $73M.

For some perspective, during the time of flat millage (2012-2020), the ad-valorem tax per capita in Palm Beach County rose from $505 to $652, a 29% increase during a time of 10% inflation.

Some items of interest:

- Valuations are estimated at about $198 billion, up about 5.3% over a year ago.

- With flat millage (4.7815), this valuation will generate $947 Million in ad-valorem taxes, up $49.1M (5.5%) over last year.

- There will be 170 new BCC funded positions, 32 of them ad-valorem funded.

- General Fund reserves are being increased to $154M, 10.4% of general fund revenues (was $131M, so up 18% over last year)

- A 3% COLA for all BCC employees will cost $6.7M. This is the sixth year in a row – a 19% across-the-board raise over 6 years. During the same period, inflation was just shy of 10%.

- The Sheriff will see a $38.2M ad-valorem increase, which is a net $47.7M (+4.7%) considering carry-forwards and increased revenue. This includes money for 10 new deputies

- Library and Fire/Rescue will also see flat millage, yielding increases of $3.0M and $14.8M respectively.

- Palm Tran is seeing a big boost of $15M (11%), 9.9M of that from ad-valorem.

The BCC priorities were funded, with $52M for Housing/Homelessness, and $2.6M for substance use and behavior disorders.

Last year the supervisor of elections, which has had a flat budget in the $10M range over the 5 years saw a 142% increase to $22M. This was for equipment upgrades getting ready for the 2020 election, and this year’s budget has been decreased by about $4M to $17M – still high by historical standards.

Commission and School Board Candidate Forum

On October 1, TAB, along with the South Florida 912 and the Palm Beach County Tea Party, hosted a candidate forum for County Commission district 1 and School Board district 1. Moderated by Steve Rosenblum of the blogTalkRadio show “CRF Radio with Steve and Daria”, the candidates were asked a set of questions about current issues facing their respective bodies, some of which proved to offer a real choice between the candidates. Present for the forum (and keeping them honest) was outgoing Commissioner Karen Marcus, who we thank for her service, and several of Mayor Levy’s councilmen, Bert Premuroso and Eric Jablin.

The School Board event matched former Minnesota Commissioner of Education Christine Jax against long term PBC teacher and principal Mike Murgio.

When asked about how to fix the general perception that the quality of local schools are poor and an impediment to attracting new businesses or hiring from out of the state, Mr. Murgio was defensive about it and claimed that the schools were “better than you think”, and that what we need is better marketing. Ms. Jax agreed that marketing was needed, but also pointed out areas of weakness, particularly at the high school level, that need action. On “high stakes testing”, Christine was firmly in favor of measurements and against “social promotion” while Mike narrowly defined it in terms of the vocational certifications achieved by students at Inlet Grove when he was its principal. Whether graduates can pass their nursing certification is important, but he did not address the wider measurement of academic performance. On school choice, Christine favors private for-profit charter schools where Mike does not. On the subject of the School System Inspector General (as opposed to the independent county OIG), Mike was hopeful that the current IG relationship can work, but would have accepted OIG oversight. Ms. Jax was emphatic – “having an IG on your payroll is just silly – you have to have someone from the outside.”

Moving on to the County Commission race, Democrat Palm Beach Gardens Mayor David Levy, a geologist, contended with past PBG Councilman and Republican Hal Valeche, a financial consultant.

On the budget, Hal gave a vote of support for TABOR measurements that constrain spending to match inflation and population growth. David favors improving efficiency while still providing core services, streamlining the organization chart and reorganizing the IT department. Neither were proponents of the counties giving tax dollars to private charities. On the issue of public safety unions, Hal (who has their support), doesn’t want to “whack anyone over the head”, but believes we need a glide path for pay and benefits to approach the norm. David was more direct – “The fire union was going to bankrupt the city”, he said, “they told me they’re coming after me, but I’m always going to do what’s right.” Neither was particulary supportive of large county cash infusions into the convention center hotel project, and Hal pointed to the Digital Domain fiasco as a reason to avoid such investments in the future, where the private company gets the reward and the taxpayer takes the risk. On the issue of the Inspector General lawsuit, Mayor Levy defended his role in bringing PBG into the lawsuit and said it was all about how the funding was calculated. Hal retorted that if he really wanted to end the lawsuit he should propose that to his council and we should let the IG get on with her business.

Below you will find a summary of the event, with the questions that were asked, and a link to a video of that section of the forum.

For the Palm Beach Post story on the event, see: Candidates for northern Palm Beach County commission seat spar at forum

County Commission Forum – District 1 Primary Candidates

On June 18, eight grassroots, civic and political clubs came together to sponsor a candidate debate for the County Commission District 1 primary on August 14. Moderated by local radio personality Tom Boyhan, the three candidates were asked six questions of county-wide interest, chosen from a list of twelve that had been given to the candidates in advance. They were also asked for a brief opening and closing statement. Below you will find a summary of the event, with the questions, their answers, and a link to a video of that section of the forum.

Click on the candidate’s picture for a short biography.

The event was well attended, and quite a few elected officials joined us, including: District 1 Commissioner Karen Marcus, from Palm Beach Gardens Mayor David Levy, Vice Mayor Bert Premuroso, and council members Joe Russo and Marcie Tinsley, Juno Beach Vice Mayor Bill Greene, Tequesta Mayor Tom Paterno, Lake Worth Vice Mayor Scott Maxwell, Jupiter Inlet District Commissioner Patricia Walker, Republican State Committewoman Fran Hancock, and PBCGOP Chair Sid Dinerstein.

Sponsors of the event were the PBC Taxpayer Action Board and their coalition partners South Florida 912, Palm Beach County Tea Party, and Singer Island Civic Association, along with the Republican clubs of Palm Beach, Northern Palm Beaches, the Palm Beaches, and the Jupiter/Tequesta Repbublican Organization.

Dan Amero |

Harry Gaboian |

Hal Valeche |

Some pictures from the event.

Why TAB – Why Now?

County taxes and spending have been a concern for a number of groups and individuals over the years. Many have taken action and tried to slow the growth of spending, pointing out that it was dishonest and irresponsible to take advantage of inflated real estate valuations and homestead caps to run up double digit increases year after year. On balance, these efforts went nowhere. Those who benefit from county spending, whether they are richly funded special interests with something to gain, or loosely organized “user communities” of taxpayer funded programs, have pretty much controlled the agenda. No one who attempted to speak for the taxpayer has gained much traction.

In the most recent past though, conditions have begun to change. In four years, four county commissioners have been arrested and punished. An ethics commission and an office of Inspector General has been established. The community has begun to take notice of what happens in county government, just as they have awakened to the serious challenges we face from the unchecked growth of the federal government.

We are at a tipping point – almost half of Americans don’t pay income tax, but receive benefits from the other half who do. Government employees at all levels receive much higher salaries and benefits than those doing similar work in the private sector, and they are almost totally immune to layoffs when the economy turns sour for the rest of us. This is a trend that will not end well.

There is something in the air – something afoot. People are taking an interest, going to meetings, getting involved in political campaigns. There is a feeling that we are on a precipice and that if we don’t move quickly we will be swept into the void, that the country, the communities in which we live, are about to be irrecoverably changed. And some of us are resisting.

The tea party movement, which is a generic term, encompassing many different groups, large and small, has raised the banner of fiscal responsibilty, smaller government, and free markets. At the local level, we believe that this energy can be directed at righting the ship – at raising the awareness that something is wrong, and convincing the elected leaders of the community that the time has come when we must look at things differently.

It is against this backdrop that TAB has formed to try yet again to get some traction on county spending that has grown much faster than the local economy. The real estate bubble raised valuations so high that the temptation to follow them with government spending was irresistable, though foolish in hindsight.

This is a starting point. We are well aware of the budget issues that exist with the School Board, the Children’s Services Council, the Health Care District, the myriad other taxing authorities that for years have had a free hand. They are all on the TAB radar. For now though, we must focus on the budget under the control of the County Commission.

It must be emphasized that we are concerned with SPENDING, not taxes, fees, transfers, grants, or other sources on the revenue side. It is excessive SPENDING that is the problem – SPENDING within our means – solve that and the revenue side will take care of itself.

Our approach has 4 components:

- QUESTION – assumptions, staff, program recipients, other jurisdictions

- PUBLISH – our findings, analysis, speculation, conclusions

- ENGAGE – staffs, commission, constitutionals

- SUPPORT – provide cover and support for leaders who share our goals

WE WANT TO BE AN INDEPENDENT RESOURCE FOR LEADERS WILLING TO CHALLENGE THE STATUS QUO

WILL YOU JOIN US?