Maximum Millage to be set Tuesday, 7/21

The county commission will act to set the maximum millage for fiscal year 2016 on Tuesday, 7/21, as part of a regular agenda. Staff recommends holding the county-wide millage flat at 4.7815.

Since the June budget workshop, where the flat millage would have generated $724.8M in taxes on $151.6B in valuation, the property values have been adjusted upward to $152.7B. With flat millage, that will provide another $5.1M in taxes, or $729.9M.

Compared to last year’s adopted tax of $667M, this represents a 9% tax increase, and the largest proposed tax in county history.

The $5.1M windfall since June could have been used to reduce the tax rate, but only Commissioners Steven Abrams and Paulette Burdick have even suggested that as a course of action. Other Commissioners scoffed as they have plans for that money.

Most disappointing was Commissioner Hal Valeche. A founding member of TAB (see: BCC 7/20/10), his interest in restraining the growth in the budget seems to have vanished, showing that once elected to office, one’s priorities change. Commissioner Valeche favors taking all the windfall and (since all is never enough) later floating a bond issue for “infrastructure” spending. Quoted in the Palm Beach Post as the countywide spending soars above $1B, he remarked: “Government has to eventually spend some money on some basic things. This isn’t fluff.”

It should be noted that the area of “infrastructure” – roads and bridges, where it has been repeatedly claimed that more money is needed, saw no significant increase in the budget. The Engineering and Public Works department actually saw a decrease of $1.2M. Remember this when later in the year there is a discussion of the bonds and/or raising the sales tax to pay for basic maintenance of roads, bridges and parks.

As previously noted, the taxable value increase on homestead property is limited this year by the Save Our Homes statute to about 0.8%, so this increase will be mostly borne by non-homesteaders – businesses and second home properties. As a result, homestead owners may feel they have no dog in this fight, but they are wrong. As we saw throughout the downturn, Save Our Homes just delays the tax hikes. Eventually, taxable valuations will catch up – even if market values decline.

The agenda item on 7/21 is not expected to generate much discussion – they will set the maximum millage and go on. In the September public hearings (9/8 and 9/21) though, the Commission will have the opportunity to adopt a lower number – but don’t hold your breath.

Let’s Be Honest about the “Biotech Cluster”

Yesterday, the Board of County Commissioners voted unanimously to void their interest in the deed restriction that would have prevented “Project Diamond”, the UTC techonology showcase proposed within the “biotech campus” on the Briger tract. The other government players – Palm Beach Gardens and the state (represented strangely enough by FDEP), concur. Scripps, while disagreeing that this is an appropriate use, is not strongly objecting. Kolter (of course), the NPBC Chamber and the Economic Council are all strong supporters.

As part of the complex and expensive (to the taxpayer) deal that brought Scripps to Jupiter, 100 acres adjacent to I-95 was set aside for use only by biotech related enterprises, all part of the vision for a “biotech cluster” in Northern Palm Beach County.

It would seem the deed restriction standing in the way of the UTC project has been cleverly sidestepped by the BCC and the other government players. They are not “ending the Biotech era” and blowing up the restriction you see, just making a one-time exception in a way in which Scripps cannot object. In Commissioner Hal Valeche’s words: “You get a bird in the hand like this, it doesn’t come along that often.”

UTC, being an excessively green “smart building”, that “fits the vision of high tech enterprise” may end up being similar to a biotech campus in meeting the 2003 goals, but avoiding the restriction is tacit agreement that the whole vision of the Scripps Project was flawed. “We’re not giving up on bioscience or biotechnology,” said Commissioner Melissa McKinlay. Surely not.

The Scripps Project, by most measures, has been a failure. Although Scripps itself has met their committment in terms of jobs created, the 40,000 related jobs promised when the deal was done have not materialized. The amount of public money that was spent to bring Scripps to Jupiter exceeded $1M for each job actually created.

The UTC HQ project will be a fine addition the county and the city, although the amount of cash and tax avoidance they are being given is distasteful to one who believes in free markets and fiscal responsibility. Clearing the way for them with a deed “exception” though is not being honest. Let’s just acknowledge that the Biotech vision was a failure and move on.

Maybe when Kolter brings their next non-biotech project forward they will finally admit it.

See: County OKs UTC HQ near Scripps

First Public Hearing on 2015 County Budget

The first Public Hearing on the 2015 County Budget is Monday evening, September 8th, at 6:00PM at 301 N Olive, WPB, 6th floor.

Unchanged from June, the county proposes to keep the county-wide tax rate at last year’s 4.7815 despite a 7% increase in valuations, which will result in a tax increase of about $44M over the 2014 adopted tax. This follows a $23M increase last year.

These additional funds will mostly go to the Sheriff (67%), and BCC operations (driven by salary increases).

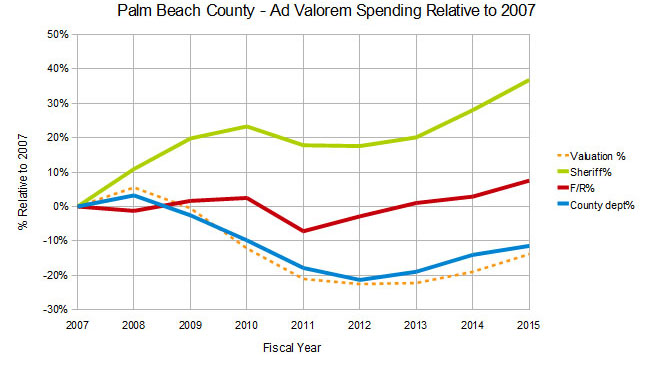

Note the growth in the Sheriff’s budget relative to other county departments. Those departments under control of the Administrator have tracked the valuation changes while the Sheriff showed no such restraint.

When the real estate bubble was expanding prior to 2007, the county budget grew by leaps and bounds, because a flat or mildly decreasing millage was easier to execute than raising it during the downturn. We are about to experience something similar. Back to back increases of $23M and now $44M is our warning. If not opposed now, the county spending will climb unrestrained. Some Commissioners (Burdick, Abrams, Valeche) see this. Others (Taylor, Vana) have embraced it. Returning even a small portion of the 2015 windfall to the taxpayer would set a precedent for the future.

The county is not alone in claiming all the valuation increase for more spending – most of the municipalities are following suit.

If you have a homestead exemption, it may appear that the tax increase on your TRIM notice is smaller than the 7% that the budget would project. This is because valuation increases in a single year are capped at the inflation rate (1.5% this year). Rest assured that your taxes will climb every year hence until you are “caught up”, even if valuations fall. This year, the difference is made up with higher taxes on commercial property and residences without the homestead exemption, for which the cap is 10%.

If you find all this troubling, let the Commissioners know you care about the growth in the county tax burden and spending. Attend the meeting on Monday if you can, or send them an email to BCC-AllCommissioners@pbcgov.org.

Let them know that we don’t want to return to the spending excesses of the last real estate bubble. A decrease of millage this year, sharing the windfall with the taxpayers, would be a tangible signal of responsible governance.

For some details of the 2015 budget, see: “2015 Budget – Flat Millage, what’s not to like? PLENTY!“

Another Go at the Sales Tax on Tuesday

The proposal for a county sales tax increase is back on the agenda, Tuesday March 11, postponed from the December 17 meeting by a 4-3 vote. (See Item 5G1.)

In December, there was consensus that the proposal was a “potpourri” or grab-bag of small projects lumped togther to utilize the $110M a year that a .5% increase would bring. It’s reincarnation is still a grab-bag of small projects, but they are limited to infrastructure and spending for Parks and Recreation was removed. Since the total hasn’t changed, the net effect is to add MORE road projects to the proposal. The largest of these is a line item for “resurfacing – 7 years @ $12M/year” for $84M.

A noteworthy aspect of this proposal coming out of George Webb’s Engineering and Public Works Department, is the condition that 40% ($44M per year) is to be shared with the municipalities for wherever they would like to spend it. However allocated, this would represent a sizeable amount relative to most city, town and village budgets. (Note- this sharing is required by the authorizing statute for sales tax surcharges).

As for Engineering and Public Works itself, the $66M / year retained in this proposal would more than double their $53M current budget.

It should be said that road projects have gotten more of their share of cuts over the last few budget cycles, as the enormous half a $Billion (with a “B”) Sheriff’s budget gobbles up an ever larger percentage of the county tax revenues. Adding $66M to E&PW from a different revenue source would seem to be a questionable action.

The December proposal was allocated differently – $44M for the School District, $40M for the county (including Parks and Recreation), and $26M for the municipalities. The school district did not want to play in this though – rumor has it that a separate sales tax increase will be brought forward by those folks. In the revamped proposal, E&PW decided to just keep all the money for themselves.

This proposal should be considered within the overall background of county finances, not in isolation. Property Appraiser Gary Nikolits is projecting a 6-7% increase in taxable valuations this year. Even with some reduction in millage (which we think is justified), there should be sufficient property tax revenue to start addressing infrastructure maintenance that has been deferred over the last few years. When you build a road, you should plan to maintain it – this is one of the natural and expected functions of government. That spending was diverted to other priorities is a management failing – not a justification for a new tax.

A serious proposal for a sales tax hike could be justified if it was revenue neutral – ie. offset the $110M in new revenue with an equal reduction in ad-valorem tax. That is not what is being proposed. Instead, it is still George Webb’s “wish list” of work he’d like to do but was unable to justify in the normal budget process.

If this were actually to get on the ballot in November, particularly next to a School System increase (“it’s for the children!”) and the re-authorization of the taxing district for the Children’s Services Council (“It’s also for the children!”), then a betting man would wager that it will go down in flames. Perhaps they all will, as the taxpayers do not sense that their money is spent wisely today.

Overlooking the Obvious? Observations from the Palm Tran Connection Workshop

Good summaries of the 2/28/14 BCC workshop to discuss the future direction of Palm Tran Connection were written by Joe Capozzi in the Palm Beach Post and Andy Reid in the Sun-Sentinel.

We are generally in support of the direction given by the Commission to:

- Pursue multiple contracts in lieu of a single-source vendor, since competition will enhance responsiveness and flexibility.

- Bring dispatch in-house – this may not be quite the salvation for which BCC voted….see below.

- Purchase the vehicles for lease back to the vendors. We see the opportunity for flexibility cited as well as cost savings.

- Free rides on fixed route service for ADA/TD qualified.

- Explore the future use of vouchers and taxis to enhance/expand capability.

But something appears to be lacking in the conclusions drawn in much of the coverage and discussion of Palm Tran Connection and the poor performance by the current vendor, Metro Mobility. That ‘something’ which seemed apparent throughout the workshop was ‘county oversight and accountability‘. The various reasons for perceived unacceptable service were listed dispassionately and without any chagrin or admission of responsibility. Many of these ‘issues’ did not require BCC direction but could or should have been accompanied by firm action plans .

A few examples:

Chaotic dispatching and adherence to schedules was impacted by several issues

- Drivers unable to locate the rider – going to wrong location or lost in a community

- Riders without appropriate ‘personal care attendants” thus driver leaving the vehicle to assist the rider into the appointment location

- Driver waiting for a facility to open (eg rider can’t get in)

- Riders who can’t be left alone due to their disability

Only Commissioner Berger seemed to question the lack of required personal care attendants. Everyone else seemed to take for granted that these were missteps by Metro Mobility. If an ADA or TD qualified rider needs a personal care attendant then the County, who handles the qualification process, should have confirmed that such an attendant accompanies the rider. To have a driver take on 1) liability 2) leave the vehicle unattended 3) abandon schedule in order to perform personal care functions is certain to impact all of the other riders. Is there something in the regulations that absolves the rider (or the County in the qualification process) from responsibility for their part of the bargain?

There is a difference between door to door service and a driver replacing the companion role. As was pointed out in the meeting – if the rider were able to take fixed route service – they would be dropped off and that’s it. Even a taxi doing door to door would not wait for place to open etc. So perhaps the biggest issue to the level of service is that the drivers are going beyond what can reasonably be expected.

Taking vehicles out of service to accommodate school trip requests (primarily Charter schools)

Commissioner Abrams rightly questioned that the PBC School system isn’t involved in this. And is it not obvious that if vehicles are taken out of a route that service and schedules will suffer? Once again – these are decisions that were made by the County and not Metro Mobility.

It was perceived that bringing dispatch in-house (recommended by staff, consultant and voted unanimously by commission) would solve the above issues. But one could ask – what will change? The County staff was responsible for oversight in any case – so if policy changes are not made to solve these problems, in-house dispatch will not alleviate the problems.

Poor state of equipment

Commissioner Vana did her own investigative work to confirm the poor state of equipment and raised the alarm over conditions. But why was that necessary? Was not the administration responsible for oversight and inspections? Purchase of the vehicles by the county may result in savings, which is great! But this does nothing to solve the vehicle maintenance issues. Periodic inspections by the County will (and should have been) vital to assessing compliance with legal and contractual obligations for vehicle maintenance.

Need for a strong and specific contract

Several times during the workshop the need for a strong contract (or contracts) was mentioned by staff. OK – whose fault is it if there wasn’t one in place already? Surely not the vendor’s….

Administration has made management changes and they clearly may have been warranted. But until the County takes full responsibility for the current state of affairs – dramatic improvement in Palm Tran Connection performance may be a long time in coming.

Dark Cloud of Sales Tax Referendum Hangs over the County

A “half-baked” proposal with a “half-hearted” sales pitch. That could describe what was brought before the commission yesterday. After the initial plan of a 6 year tax hike divided up among the School District, County and Municipalities fell apart when the School Board declined, a reduced proposal for 3 years and a 60/40 split between the county and cities was floated.

It was clear that Administrator Bob Weisman’s heart was not in it. We can only assume he was given direction to dust off the shaky proposal from May 2012 and make another try for the 2014 election window. There are some on the Commission, most prominently Mayor Taylor, who are not happy that our sales tax burden is not as high as some other Florida counties. We are leaving money on the table after all. After some modest pushback by the board, Mr. Weisman wisely suggested tabling it (unsuccessfully) for another two years.

About a dozen members of the public spoke on the issue, most against. In favor were a few folks who wanted some of the money directed at beach maintenance and Mayor Wilson of Belle Glade, who wants more tax dollars sent to the Glades cities. Others, including the Palm Beach Civic Association, the Economic Council, and TAB, objected to the unfocused wish list of non-urgent minor projects presented as the reason for the tax. In the words of one speaker: “..parking lots and drainage ditches, guardrails and other anonymous improvements, spread around the districts and the cities presumably to spread the wealth around..”.

With the exception of Mayor Taylor, who was enthusiastic for the prospect of more tax dollars, the rest of the commissioners found fault with the proposal. Commissioner Santamaria thought it wasn’t needed if we could restore the impact fee cuts. Commissioner Valeche was against it from the start but defended the impact fee cuts as pro-growth. Commissioner Vana agreed with the speaker’s view of the unfocused list, calling it a potpourri, and worried that an ill-formed proposal that would fail at the polls could poison the new tax well. Commissioner Abrams, calling it a “grab-bag” thought it too broad and that it would not pass. Commissioners Burdick and Berger both opposed the current proposal but would support more spending on roads and infrastucture.

An Abrams attempt to kill it outright (“don’t come back, regroup”) gained some support, but a Vana proposal to seek input from the business community and others for an acceptable plan in six months or so gained some traction (although Commissioner Berger would not focus only on a sales tax hike). The Mayor still wants it on the ballot this year though, so the motion that finally passed has staff coming back in a shorter time with a new proposal. The motion passed 4-3, with Valeche, Burdick and Abrams voting no.

Unfortunately, the dynamic that seems to be operating here is that a sales tax hike is good – just find an important enough project on which to market it. The “potpourri”, “grab-bag” and “wish-list” are clearly not up to snuff.

We would not oppose a sales tax increase that was accompanied by an equal reduction in ad-valorem taxes (ie. “revenue neutral”). We would not oppose a temporary hike for an urgent need such as relief after a major storm or other catastrophe. In this case however, it appears they are now “on the hunt” to find or create a project that could be used to justify the tax increase. That is putting the cart before the horse. Hopefully, if such a measure were to get on the November ballot, the county voters will not be fooled.

County Commission votes to penalize West Palm Beach and Riviera Beach over Inspector General Lawsuit

In a clever but unusual move, County Administrator Bob Weisman last night proposed $916K in additional spending over the July budget package that specifically excluded amounts requested for West Palm Beach and Riviera Beach by $70K and $50K respectively. This was a direct response to those city’s refusal to pay their share of the Inspector General budget. The proposal included additional spending of $916K – $400K for the YECs, $175K for the Pahokee Recreation center, and $341K for the Inspector General.

The additional $346K to cover the IG shortfall will come from the Solid Waste Authority ($100K), funds from the non-suing cities released by the Clerk ($262K), and $16K from other county departments.

Since the maximum millage was set in the July workshop to 4.7815 (unchanged from last year), the additional funding will come from reserves and tapping an additional $800K from the proceeds of the Mecca Farms sale to South Florida Water Management.

A motion by Commissioner Priscilla Taylor to restore the funds for the West Palm and Riviera YECs and provide an additional $40K for the Belle Glade YEC (requested by Commissioner Shelley Vana) was defeated 4-3 and the Weisman proposal was passed without change. Commissioners Valeche, Burdick, Santamaria and Berger rejected the change for a variety of reasons.

Hal Valeche said “The cities are taking us for a ride..”, and “By restoring this funding they are taking us for a further ride.” Commissioner Santamaria explained to the many children and instructors from the YEC who turned out to support their programs that “Unfortunately the YECs and the IG are connected”. He said that the cities could have opted to spend the IG money they are keeping on the YECs but declined to do so. Commissioner Vana, seeing her request for additional Belle Glade money “for the children” going down to defeat, said “It is disgraceful what we are doing here today”. “I am ashamed to be part of this board at this point.”

It should be noted that the 14 cities participating in the IG lawsuit owe $1.9M to the county – 90% of it from the 5 cities of West Palm Beach ($657K), Boca Raton ($406K), Delray Beach ($348K), Riviera Beach ($169K) and Jupiter ($142K). It is a positive step that the county should withhold grants and assistance to these cities while they are declining to pay for the IG services. The $120K at issue here is a drop in the bucket and it would be appropriate to raise the ante by challenging other grants to these five, in areas such as community development, environmental resource projects within their boundaries and social services. Money is fungible and amounts could be held in escrow while the litigation continues.

The final budget hearing will be held on September 23 at 6:00 PM.

County Proposes $25.3M tax increase

After leveling off last year following 4 years of decline, property values seem to have turned a corner and have ticked up 3.7% this year, easing pressure on county and municipal budgets. As the county has cranked up the millage rate as the valuations fell, will they now start to decrease them? Apparently not.

The June budget package, to be discussed at the first hearing next Tuesday at 6:00pm, proposes an increase in the millage from 4.7815 to 4.8164. This would generate $624.9 million – $25.3M or 4.2% more than last years adopted tax of about $600M.

The additional funds are allocated about $19.5M to the Sheriff (see note below regarding Sheriff’s budget), and $7.3M to the countywide BCC departments. (note: these add up to $26.8M not $25.3M, but that is how it is described in the Weisman cover letter). Much of this will go to pay increases for employees (3% to county workers, 2% to PBSO in addition to their contracted longevity and step raises). The “personal services” (ie. employee) budget for the Sheriff increases by over 6%.

Many commission priorities were NOT addressed in the new spending, including $300K additional funding for the homeless resource center, $5M for road resurfacing, $2.7M for Palm Tran service enhancements and $547K for Youth Empowerment Centers. It will be interesting to see if a constituency emerges to fund these things and raise taxes even further.

Library and Fire/Rescue millage is expected to be unchanged.

We think that raising the millage this year in the face of improving valuations and economic conditions would be a mistake. Yes, there is pent-up demand for additional spending (isn’t that always true in government?), and some growth is justified, but flat millage would already provide some $20M in new revenue. Raising the millage now is a slap at the county property owners, many of whom are still struggling along with the economy. The incremental revenue to be had with the proposed hike is small – surely a way can be found to defer that much until next year and keep faith with the taxpayer.

Come to the meeting next Tuesday and let the commissioners hear what you think of this proposal. The special interests who want spending increases for their programs will be there. Don’t let them be the only voices.

The meeting will start at 6:00pm in the commission chambers, 301 N. Olive, 6th floor.

NOTE: The Sheriff requested a gross budget of $510.1 million or 8.2% ($38M) over the FY 2013 gross budget. The net ad valorem funded budget is up $19.5 million (4.8%). Subsequent to his budget submission, the proposed budget was revised to assume his capital request of $10.6 million will be financed in FY 2014. The estimated debt service has been included in the proposed budget.

BCC to Discuss $29M in Spending Reductions

At the Tuesday, May 15 Commission Meeting, agenda items 5a2 and 5a3 deal with an “efficiency audit” performed by consultants Gerstle, Rosen & Goldenberg at the request of county administration.

The audit found areas of significant savings, both in county operations and in the constitutional offices (except the Sheriff who evidently refused to answer any of their questions), estimated in the range of $29M. They looked in four areas: operating efficiencies, outsourcing, staff reductions, and additional sources of revenue. (It appears that only the outsourcing will be discussed in 5a2, and 5a3 addresses efficiencies regarding the constitutional offices).

These savings involve the elimination of 921 positions, mostly through outsourcing, and the bulk of the savings comes from reduction in benefit obligations.

With the county facing a potential $15M shortfall in the 2013 budget to be discussed at the first workshop on June 12, searching for areas to reduce spending is sorely needed and this study is an excellent move in that direction. Staff should be commended for both commissioning the study and for bringing it to the board for direction.

We are not overly optimistic that this initiative will be warmly embraced however. Already, the counter-arguments have begun. Chairman Vana says “My goal was never to try to get rid of a million people”. OFMB Director Bloesser warns that “it was unlikely that many of the findings could be put into effect before the budget year begins on Oct. 1”. Clerk Bock says that the proposed savings in her office are “incorrect and irresponsible”.

Nevertheless, this is the kind of direction that TAB has been calling for for several years, and we ask partners and supporters of TAB to attend the Tuesday session in support of the consultants proposals, or communicate your views to your commissioner.

The full content of the report can be found in the attachment for item 5a2 and the initial reactions are captured in the Palm Beach Post: Consultant: Palm Beach County can save $32M with 1,000 job cuts, add $3M with rate hike.