Proposed Palm Beach County Charter Review Process

At the Tuesday, January 25, 2011 BCC Workshop, at 11:15a.m., county administration will present their proposal for the Charter Review requested by the Commissioners a couple of months ago.

The Board of County Commissioners (BCC) directed staff, a couple of months ago, to come up with a proposal for a Charter Review. Palm Beach County’s charter, while modified, has not previously undergone a formal review. Many ‘home rule’ charter counties require a periodic review as part of their charter.

Prior to 1968, Florida counties were administrative subdivisons of the state. In 1968, the Florida Constitution authorized home rule charters, which allows modifications to be made to county charters via decisions by their elected Commissioners or via votes by its citizens in a general election. (If one likens a county’s charter to its constitution, then think of the review like a ‘constitutional convention’). Palm Beach County voted to became a home rule charter county in 1984. Twenty of the state’s 67 counties have charters – comprising 75-85% of the population – but most have not modified their base organizations significantly.

Palm Beach County’s charter can be found here.

The Charter Review proposal states that in many charter counties a citizen charter committee is typically appointed to prepare the suggested charter amendments. Palm Beach County staff is proposing that an alternate approach be used instead. Details of the proposal can be found here, along with a timeline to get changes on the ballot in time for the 2012 November elections.

If you are interested in understanding the proposed process and hearing the BCC discussion and direction to staff, then please attend the workshop on Tuesday or watch on Channel 20.

TAB Legislative Wish List

- Modify the “PBSO Career Service Protection” Act

- Repeal the Fire/Rescue Sales Tax provision in FS 212.055

- Modify FRS to provide more flexibility

- Enact the “Local Government Accountability” bills (HB107/SB224)

Since its inception, TAB has focused on the spending side of the ledger, rather than taxes or other revenue, because the appropriations within the control of local officials are the levers on the “size of government” that we need to maintain the public/private sector balance.

A healthy local economy depends on a government that encourages and supports local business development, not one that creates disincentives through heavy taxation, stifles innovation through heavy regulation, or competes for employees and resources by using taxpayer dollars to overly compensate public employees.

When County Commissioners or others exceed the threshold of reasonableness on spending, we intend to firmly take them to task. There are instances though, where state statutes have tied the hands of local officials who are trying to do the right things. Many of these laws were passed at the urging of local special interests, such as the public employee unions, by legislators who they supported.

The County Government has a Legislative Affairs Department whose job it is to lobby for new laws and changes to existing laws that affect Palm Beach County. Each year they publish a “Legislative Issues” document that lays out the agenda.

In this year’s version, many of the items concern obtaining state funds for local projects. While many of these projects are desirable, we should not be treating state grants as “free money”. The test of any spending should be whether it is for an accepted public purpose, and whether it is affordable in the current economic climate. We also find items that support renewable energy standards, drilling bans and “climate change” legislation to be misguided, as are more subsidies for rail projects such as providing Amtrak protections on the FEC Corridor similar to the CSX indemnification for Sunrail.

That said, we find several items in this year’s agenda that we wholeheartedly support, and two that we oppose. Specifically:

FRS Reform

We STRONGLY SUPPORT the county’s proposed FRS reforms (Page 21), which:

- Require FRS participants to contribute to the plan

- Index by COLA rather than fixed increases

- Lengthen the re-hire time after DROP participation

- Offer incentives to voluntary moves to “investment option” plans (eg. 401K)

- Cap the number of overtime hours used in calculating “Average Final Compensation”

However, we feel the list of things to avoid are too limiting – all things should be on the table, including altering benefits for current employees (but not retirees), at least for future accruals, ending defined benefit plans for new hires and raising the retirement age.

Career Service Protection Amendments

We STRONGLY SUPPORT the county proposal to revise the “Palm Beach County Sheriff Career Service Legislation” (page 37). HB601 at the time of passage in 2004, this legislation essentially prevents any reduction in pay or benefits to most employees of PBSO, even during collective bargaining. It states:

“no existing employer-paid benefits and emoluments to all certified and non-certified employees of the Sheriff with regard to the pay plan, longevity plan, tuition-reimbursement plan, career-path program, health insurance, life insurance, and disability benefits may be reduced except in the case of exigent operation necessity.”

As we found out in the last round of budget talks, there can be no “exigent operation necessity” until the county has exhausted all its reserves and is essentially out of money. This means that neither the County Commission nor the Sheriff himself may reduce a benefit currently received or promised in the future, including the very lucrative PBSO longevity raise plan.

Fire/Rescue Surtax

We STRONGLY OPPOSE the county’s proposal to amend the changes brought by the “Emergency Fire Rescue Services and Facilities Surtax Act” (Page 32) so as to make it more workable and permit the return of the sales tax surcharge ballot initiative in 2012. TAB urges repeal of this act. Fire/Rescue should be required to justify its budget every year, just like any county agency, and not be funded by sales tax revenue with no oversight.

Floors for Library Grants

We also OPPOSE the county proposal to set funding floors for state library grants (page 33). All programs should be subject to adjustment in economic downturns. Mandatory funding floors, much like the provisions of the Career Service Protection Act, should not be enacted to prevent state or local governments from acting during times of fiscal challenge. It is hypocritical for the county to want to amend one and enact the other.

Local Government Accountability

Not on the county agenda, but on the TAB radar is a set of bills currently in committee (HB107/SB224 – Local Government Accountablility) that specifies (among other things) the amount of detail the Sheriff would be required to include in his annual budget proposal, specifically:

The sheriff shall furnish to the board of county commissioners or the budget commission, if there is a budget commission in the county, all relevant and pertinent information concerning expenditures made in previous fiscal years and to the proposed expenditures which the board or commission deems necessary, including expenditures at the subobject code level in accordance with the uniform accounting system prescribed by the Department of Financial Services. The board or commission may not amend, modify, increase, or reduce any expenditure at the subobject code level. The board or commission may not require confidential information concerning details of investigations which is exempt from the provisions of s.119.07(1).

Since transparency of the Sheriff’s budget is a Palm Beach County issue, we STRONGLY SUPPORT passage of these bills.

Tax Collector VOIP Project – Necessity or Re-inventing the Wheel?

During TAB’s initial look at the county spending, many people mentioned to us the apparent inefficient duplication of services that exists. Each of the Constitutional Officers, to varying degrees, manage their own infrastructure for things like Human Resources, Purchasing, and Information Technology. The arguments in favor of such an arrangement are sometimes compelling – such as the unique needs of the Sheriff. In other areas it is less clear that an established (and much larger) organization within the county structure could not do the job at lower cost and with better results.

This week, an example of further infrastructure divergence was brought to our attention. The Tax Collector, having assumed the responsibility for the county-wide motor vehicle offices from the state, has decided to upgrade the phone service within that function. Currently, Tax Collector network and telephone infrastructure is provided by county ISS.

Late last year, according to County ISS Director Steve Bordelon, ISS was asked to quote the work, and did so. It came as a surpise when they learned later that the Tax Collector had signed an agreement with an outside vendor (itpointe) for the purchase and installation of the new phone system in the Lantana and Palm Beach Gardens facilities, using a Cisco VOIP solution. ISS had previously adopted an Avaya solution (Cisco and Avaya are battling each other for dominance in the business communications market) and have over 1000 VOIP handsets installed throughout the county, a good track record of performance and reliability, and a trained staff ready to support the Avaya system 24×7.

When informed of this decision, Steve Bordelon wrote a memo to Jean-Luc Caous, the “Innovative Technology Captain” for the Tax Collector’s “Technovative Services” group (titles in the Tax Collector’s office are interesting – they even have a “Goddess of Excellence and Opportunity Leadership Centre”). In it, he explained the advantages of staying with the Avaya solution and further pointed out that the Cisco system cost of $49,041 compares to an equivalent cost of $30,822 for the Avaya, with the additional advantage of leveraging the existing VOIP infrastructure.

Additionally, he said this:

Proceeding with the installation of a Cisco VOIP telephone system will result in a duplication of resources and increased expenditure of taxpayer funds. Further, we are concerned that this decision could be a precursor to converting all of the remaining Tax Collector Offices to a separate phone system and perhaps, even a separate network, which would further increase the costs of government services to the taxpayers.

In his response, Mr. Caous said:

As part of transitioning the Driver’s License functions to the Tax Collector, the state advised us that we were responsible for obtaining the equipment and services required for our operations. As such, we have contracted with various vendors to implement solutions that are aligned with the organization’s strategies. We appreciate your recommendations that were put forward at our last meeting, however we feel that the CISCO VOIP solution better fits our requirements surrounding our new Driver’s License functions. Under our established project timeline, the PGA office is scheduled to be completed January 24th, 2011. Our office is too far along in the process at this point, and we do not want to deviate from the plan, which could jeopardize the project completion dates.

In addition, as mentioned in our previous discussion, the majority of the equipment to be installed would not be replicated. The new locations we are taking over require cabling work, switches, phones, etc., to bring them into our environment. These costs would have to be paid by taxpayers, regardless of whether the costs are paid by the state or the county.

Finally, it is not our intent to acquire a separate network but to leverage the county’s network infrastructure to run the technology that best meets our needs.

So is this decision in the interests of the taxpayer and the citizens of Palm Beach County? We called each of the memo-writers for their comments.

Steve Bordelon was gracious with his time, and explained some of the history of ISS support for the Constitutional officers and how it varies depending on who was elected to the post. He believes the decision is a mistake, but acknowledges that the Tax Collector is an independent entity and is free to make their own IT decisions. However Other Charter Counties in our peer group that he has studied (eg. Orange) make better use of centralized facilities.

Jean-Luc Caous declined to speak with us and instead referred the question to Tax Collector Anne Gannon herself. She told us that they will provide documentation that makes their case, but it will take some time to do so. She indicated that part of what drove the decision was difficulty working with ISS on the concept. On the goal to move to the VOIP system, they at first were told it could not be done in an off-site building, then that it would be too expensive. Finally, although asked to quote, ISS did not provide one to their satisfaction. The project was driven by the details of the handover from the state – the Tax Collector has signed a 50 year lease on the space in the state buildings, and acquired the computer equipment, but the phone systems were to be removed and used by the state elsewhere. Having to move quickly for a January 24 opening date, they bid the project to third party vendors and were satisfied with the price and capablilty of the vendor selected to provide the phones and connect them to the county system. ISS will do the cable installation. Ms. Gannon said she will provide further background on the project later and we agreed to report on it here.

In TAB’s view, the Constitutional’s operate through sub-optimization. Each makes their own decisions about what is best for their organization and proceeds accordingly, irrespective of the investments that have already been made in county infrastructure. (There are exceptions – Gary Nikolits contracts the development and operation of the EXCELLENT and specialized PAPA database system and the printing or TRIM notices to ISS).

There have not been strong incentives to do otherwise, and bureaucracies being what they are, people at all levels would rather control their own destiny by spending their budget dollars in a way that gives them the most control over their resources.

From a taxpayer perspective – this decision sounds like a bad deal – an example of “re-inventing the wheel”. Can Cisco and Avaya systems coexist on the same network? Probably, but it has been my experience (30 years in the IT business) that it is asking for trouble. Minor incompatiblities can result in finger pointing by vendor support staffs, particularly when a rivalry as fierce as Cisco/Avaya is involved. When that happens, support costs go up and reliablility goes down. It makes sense only in the scenario that the Tax Collector is planning to totally disconnect from the rest of the county and go her own way.

That said, it is clear that the working relationship between ISS and the Tax Collector’s office needs some work. While ISS thinks the decision is wrong and the solution too expensive, the Tax Collector believes they were not getting the service they required from ISS. Perhaps avoiding sub-optimization in the future requires mediation.

We think this is an excellent example of what needs to be discussed in the upcoming Charter Review. With the enormous fiscal challenges facing state and local governments this kind of thing is out of step. Many are making the case that the smaller Constitutional Offices should really be county dependent departments (and thus use county support services). While a case can be made for the independence of the Property Appraiser and Supervisor of elections (objectivity) and the Clerk (independent audit), the case for the Tax Collector was given as “not wanting the people sending the bill to also collect the money”. (The independence of the Sheriff is more complicated and will be addressed in a later post.) Perhaps there is a middleground that can provide independence, yet still have incentives to optimize common resources at the county level. Every little bit helps.

Fire/Rescue Sales Tax Surcharge to Make a Comeback

If you thought the Fire/Rescue Sales Tax surcharge was off the table, think again. Earlier this year, against significant opposition from the business and grassroots communities, the County Commission voted to place the measure on the ballot in 2010, only to withdraw it a day later on the advice of counsel. The stated reason was that the authorizing statute (which came into being primarily through the lobbying efforts of The Palm Beach Fire/Rescue Union) had significant flaws. The statute in question is Chapter 212.055 FS, Section 1 Subsection 8, entitled “EMERGENCY FIRE RESCUE SERVICES AND FACILITIES SURTAX”. This was added by SB1000 and HB365 of 2009.

In June, 33 of the 34 speakers were vehemently opposed to the measure and represented business groups, realtors, chambers of commerce, at least one city (the Mayor of Palm Beach spoke against it), grassroots

organizations, and political clubs. The lone voice speaking in favor simply delivered a statement from the Village of Wellington that they supported it. (Wellington is part of the county MSTU and is not one of the 12 municipalities that get a “vote” on the issue.)

The correct course in our view would be to REPEAL the statute– Fire/Rescue should have to justify its budget every year, just like other county departments, not have a multi-year slush fund in which to fund even more exorbitant compensation packages. (The AVERAGE compensation for Fire/Rescue employees under the current budget is $146,000 / year!).

The 2010 Legislative priorities of the current Commissioners however contains a line item “Fire Rescue Sales Tax Surcharge Glitch” on page 32. It says:

FIRE RESCUE SALES SURTAX GLITCH

During the 2009 Session, the Emergency Fire Rescue Services and Facilities Surtax Act was passed by the Legislature. In order to implement the provisions of the Act, several clarifications are needed. Support legislation that would provide the following changes to current law:

- The addition of a sentence that specifies that the term “emergency fire rescue services” as used in the surtax statute does not include volunteer fire department services.

- A statement that any surtax (all of which are subject to original approval by referendum) must be

reauthorized by referendum at least once every 10 years.- Clarification that a Municipal Services Taxing Unit is eligible to receive surtax proceeds under the

distribution formulas in the act.- Clarify provisions requiring that participating jurisdictions reduce either taxes or other revenues by

the amount of the surtax.- Include provisions that protect community redevelopment agencies from loss of revenue as

a result of imposition of the surtax.- Change in the date surtax collections will be initiated after approval from January 1 to October 1 to

ensure the surtax will not provide a windfall to participating governments.

Now is the time to contact your state representatives and ask them to REPEAL, not fix the Fire/Rescue surcharge addition to FS 212.055.

Commissioner Burdick Off to a Good Start

New County Commissioner Paulette Burdick is off to a promising start. TAB was impressed with her challenge to several Consent Agenda items at the December 7th meeting. Among them:

- She raised concerns with increasing fuel flowage fees at local airports, siding with the Aviation and Airports Advisory Board, which voted 4 to 3 against establishing the fees for the North County and Pahokee Airports and raising them at the Lantana Airport at its October 8, 2010 meeting. The other commissioners had no qualms about over-riding the board in search of revenue. They voted 6:1 for the fees with Ms. Burdick in sole opposition

- Ms. Burdick had an item moved to the 12/21 BCC meeting in order to explore local sources.

- She questioned the rationale for library warehouse leasing.

- She sought measurable performance standards in PBSO Law Enforcement Trust Fund (LETF) grants. Ms. Burdick noted that perhaps legislative relief was in order to allow these grants to be used in other circumstances, pointing out that the sums being considered could have otherwise been used for the Drug Farm or Eagle Academy if the statute were amended. Administrator Weisman deflected her questions to PBSO. (NOTE: For TAB’s view of the LETF, see below.)

- Most encouraging was Ms. Burdick’s opposition to the acceptance of a US Justice Department Community Oriented Policing Services (COPS), Hiring Program Grant award in the amount of $2,634,400 for the period of September 1, 2010, through August 31, 2013. While no matching funds are required during the grant period, there is a retention period of 12 months after the grant ends. The ongoing cost, assuming these ten officers are retained would be almost $1 million/year. The other Commissioners and Administrator Weisman expressed minimal concern – basically saying ‘what’s a million dollars in a four hundred million dollar plus budget?’ or ‘why worry about something 4 years down the road? Another grant will come up.’ The item was passed 6:1 with Commissioner Burdick opposed.

Kudos go to our newest Commissioner for considering the economy, the tax-payer and the long-term implications of ‘free money’. Keep it up!

NOTE: TAB considers the current operation of the LETF to be the Sheriff’s equivalent of the Commissioner’s “slush funds” from a few years back. The statute states clearly that the funds can only be spent on a narrow list of items, but PBSO spends the money on whatever they choose, with minimal justification. In September, the LETF was used to fund Cultural Council items that had been cut by the BCC. Today’s line item had funds for local charities. To see how much of a stretch this is – read the justifications: HERE

Florida Statute 932.7055 lists these as the only approved uses of LETF funds:

“… the support or operation of any drug treatment, drug abuse education, drug prevention, crime prevention, safe neighborhood, or school resource officer program(s). The local law enforcement agency has the discretion to determine which program(s) will receive the designated proceeds …”

Should Ethics Director Johnson Get a Raise?

A pay raise for the Ethics Director? This question has recently entered the public sphere.

Shortly after the Palm Beach County Ethics Commission was formed this year, Alan Johnson was hired in April as the Commission’s Executive Director. ( Press Release ) Mr. Johnson had been senior counsel for the Public Integrity Unit of the State Attorney’s Office.

At the time, the ethics ordinances had been in place for a few months, and discussion had already begun on the ballot initiative to bring the cities under the Ethics Commission’s jurisdiction, so it should be a surprise to no one that the measure passed and the scope of the Commission will be expanded, subject to the charter amendments that are to be written.

With expanded scope, larger budget and staff, Mr. Johnson has made it known that he would like a larger salary than the $118,000 plus benefits that was offered and accepted in April. Several Commissioners support this concept, suggesting that it was their plan all along. Commissioner Fiore went so far as to say they knew they were “underpaying” Johnson.

See the article on the subject by Andy Reid in the Sun Sentinel HERE

With the exception of the Fire/Rescue and PBSO employees who are compensated under a union contract, few if any county employees have had a raise in quite some time. Is it fair then to give Mr. Johnson a raise after only a few months on the job?

Let’s examine the facts.

In the database of county salaries (PBSO is excluded), Mr. Johnson’s $118,000 salary places him at number 328 in the total pay hierarchy when all county employees are considered. (Of course most of that list are firefighters – remember that their average compensation is currently about $140K. As a matter of fact, 69% of those earning more than Mr. Johnson are the 225 Captains and Chiefs and the like in Fire/Rescue). When only the county staff are considered, he would be number 103.

If PBSO were included in the comparison, there are an addtional 209 employees with total pay above $118K, so that would put Mr. Johnson at number 537 in the hierarchy.

Just above that level are the Assistant Director of Roads and Bridges, and the Assistant Director of Libraries. Just below that level is the Director of HCD and a title called “Fiscal Manager II”.

If you were to compare Mr. Johnson’s salary to the private sector, for an advise and consent, administrative job with 2 employees reporting to him, $118,000 is a lot. For the county though, where the compensation is plush and comfortable, maybe it is an outlier.

As a taxpayer, I believe that all the county salaries and benefits have reached levels that are unjustifiable and there should be a public outcry – particularly about Fire/Rescue. For Director Johnson though, I do believe he should make more than the Assistant Director of Libraries, and it is unfair to single him out for scrutiny when the rest of the county coasts by out of the public eye.

So yes – Alan Johnson should get a raise when the scope of the job expands to cover the cities. It would be premature for the Commission to act prior to that time however, since the job was offered and accepted at the current level, and the scope has not yet changed.

Volunteers Wanted for TAB “Shovel-Ready” Projects

As more volunteers come forward to work on TAB Research, and we have begun considering paid studies, the time has come for a “to do” list of projects that are “shovel ready”. The objective of these projects is to increase our understanding of the trends in county spending and taxation, and to bring to light areas of excess, or unsustainable trends that bode ill for the future.

Many of these projects can be undertaken purely from publicly available materials, others may require staff contact and/or public records requests. All will be useful as we make our case for a rollback of county spending to pre-boom levels.

If you would like to volunteer for any of these projects, or have more projects to add to the list, add a comment to the post or mail us at info@pbctab.org

If you decide to participate, you will not be working alone. The TAB team can provide the tools, technology, contacts, analysis techniques, and moral support. Join us today!

Project List

GB:General Budget

SS: School System

SO: PBSO

FR: Fire/Rescue

CS: Core Services

GS: Govt. Structure

CD: Capital/Debt

| Project Title | Tasks |

|---|---|

| GB1: Pension Cost Projection | Prepare a spreadsheet of the county pension costs by year since 2003, then project it 10 years into the future. List all the categories of pensions by type of position or bargaining unit, projecting them individually |

| GB2: Health Insurance Projection | Prepare a spreadsheet of the county employee health care costs by year since 2003, then project it 10 years into the future. List all the categories of plans by type of position or bargaining unit, projecting them individually |

| GB3: Peer County Comparisons | For the 5 largest Florida Counties (Palm Beach, Broward, Dade, Hillsborough, Orange), show the percentage budget growth (spending and ad-valorem taxes) for the years 2003-2011. In years that Palm Beach has exceeded the growth of the peer counties, examine which components grew the most (eg. PBSO, county staff, etc.) |

| GB4: Payers and Payees | Build a list of the municipalities and unincorporated areas of the county and for each, estimate their county tax burden (based on valuation). Based on population of each, determine per-capita tax burden. If possible, estimate “tax dollars returned” to those communities. |

| GB5: Allocation of ARRA Funds | Of the more than $500M in inter-govermental transfer funds, much in the last 2 years came from federal ARRA money. Track down where the money was spent and estimate whether it provided a general benefit to the county or was spent on special interests. |

| SS1: School Budget Trends | Develop a budget trend chart (spending and ad-valorem taxes) for the school system for the years 2003-2011, in a format for comparison with other county spending. |

| SS2: School System Salary Skew | Using a salary chart for all school system employees, analyze compensation for teachers versus administrators. Show growth in salaries for both groups from 2003-2011, as well as the number of teachers versus administrators. |

| SO1: PBSO Salary Skew | Using a salary chart for all PBSO employees, analyze compensation for sworn deputies versus civilian employees. Show growth in salaries for both groups from 2003-2011, as well as the number of each. |

| SO2: PBSO Spending History | Using information gleaned from pending open records requests, adjust the TAB PBSO trend data to reflect the population of the service areas by year, new jurisdictions added, and special mandates (eg. Homeland Security requirements). Build a chart of spending per capita (in the service area) and spending per call. |

| FR1: Fire Rescue Salary Skew | Using a salary chart for all Fire/Rescue employees, analyze compensation for union represented firefighters vesus other employees. Show growth in salaries for both groups from 2003-2011, as well as the number of each. |

| GS1: State Mandates | Build a list of Florida statutes that are impediments to substantive budget reduction in the county. Determine how much of the county budget growth can be attributed to state or federal mandates, and develop legislative proposals that could be used to restore local control. |

| CD1: Surplus Holdings | Develop a list of surplus buildings, land, and equipment (eg. Mecca Farms). Investigate the carrying costs and develop proposals for divesting assets to save money over the long term. |

| CS1: Appropriation Constituencies | Break down the county departments into “general benefit” (eg. parks, law enforcement) and “special benefit” (eg. Community Revitalization, Charity). Determine the size of the constituency of “special benefit” spending and examine the justification for that spending. |

| CS2: Program List | Build a list of all county programs and separate them into those that are clearly the function of government, those that are clearly not, and those in a gray area. Build a case to terminate the second category and create a plan to evaluate those in the gray area. |

Will Aaronson and Marcus run again?

Since the Broward term limits charter amendment has been trashed, what will happen in Palm Beach? If Judge Carol-Lisa Philipp’s ruling stands on appeal to the Fourth District, it will be controlling on our county as well.

So what will our two (currently) term-limited commissioners do? Burt Aaronson has not closed the door on a primary run against Anne Gannon in District 5. Karen Marcus on the other hand is in “wait and see” mode.

Chances are, if either of these incumbents is legally able to run and chooses to do so, the “power of incumbency” will make it very hard for a challenger to compete against them.

Read all about it in George Bennett’s Post article HERE.

PBSO Budget – A TAB Update

Introduction

During the preparation of this article, TAB members Fred and Iris Scheibl, and Meg Shannon met with PBSO Chief Deputy Mike Gauger and COO George Forman to discuss the PBSO budget history, the challenges they are facing, and the most fair way to present what seems at first glance to be a budget that has grown at a very rapid pace since the 2003 base year of our analysis.

Prior to the meeting, our earlier open records request for spending data from 2003-2011 was fulfilled, and we were able to get a picture of where the money was spent and where the fastest growth has occurred.

At the meeting, we asked them to consider disclosing their budget line item detail as part of the normal process (rather than requiring citizens to jump through the open records request hoops). Both the Martin and Broward Sheriffs do this to varying degrees – Martin even makes the data available on their website. PBSO on the other hand, provides their budget input to the County Administrator only in the minimum form specified by Florida statute. We were told that more transparency was a possibility, and they would have to discuss it among the PBSO executives.

We also asked them for two other things – for the Sheriff to voluntarily come under the jurisdiction of the Inspector General and Ethics Commission, and for there to be a public audit of the Mobile Data Project, which we have been told has suffered some significant setbacks. On the former, the answer was absolutely not – internal controls and audit functions within PBSO are sufficient and there is no chance that PBSO will voluntarily do any such thing. The answer to the second was also an emphatic no.

Since that meeting, we were sent some additional information, including a 2010 Resource Guide (which contains useful information and metrics about the jurisdictions in the county), and a list of links to publicly available information about county operations and the Florida statutes that concern Career Service Protections, FRS and collective bargaining. Although useful, these sources did not help us with the specific information we were after, namely:

- The number of residents in the operating area, and the average number of jail inmates 2003-2011 (The other year resource guides would suffice)

- Call rate by year 2003-2011

- Staffing at the department level: sworn / civilian / part time for 2003-2011

- Years that major new jurisdictions were added and how that changed the revenue/expense/staffing

- Any extraordinary events/challenges that caused a spike in spending, and what costs were incurred (eg. Homeland Security mandates, trends in crime statistics, etc.)

In response to this query, Budget Director Kathy Cochrane forwarded our questions to Central Records Division for action and redaction, and on Tuesday 11/23 we were assigned a tracking number. When the information becomes available, we will refine the presentation in this article to incorporate (hopefully), a more nuanced view of the PBSO budget over the last 8 years, and likely a better justification for the rapid growth in spending.

Budget Summary

TAB has obtained additional data about historical spending in PBSO, specifically a year by year spending comparison from FY2003 to FY2011. This is more detail than provided to county staff during the budget preparation, and is useful to determine trends. (For a TAB summary of the yearly data provided by PBSO, click HERE) During that time:

- Personal Service costs rose 92%

- Operation costs rose 27%

- Per employee compensation rose 49.4%

- Benefit costs (pension + insurance) rose 154%

This time period saw inflation of 21% and the county population grew 6%.

In the latest budget year, personal service costs (pay and benefits) represents 83% of the total PBSO budget. This compares to 62% for Fire/Rescue. Any future cuts to this budget will necessarily involve staff reductions or reductions to pay and benefits.

Likely Future Budget Scenarios

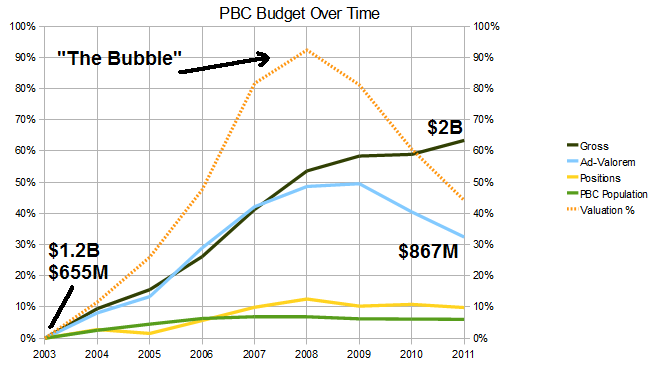

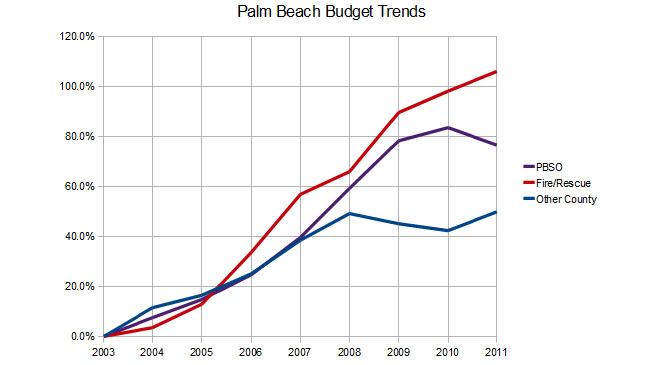

TAB has proposed that the county consider a spending level rollback, perhaps to the levels of 2006. That year is significant because the property valuations of 2011 have fallen to about what they were in 2006, and that level of spending would be sustainable with 2006 pre-bubble levels of taxation (See chart).

The Sheriff now accounts for 23% of the county appropriations, up from 21% in 2003. By contrast, Fire/Rescue is now 18%, up from 14%. The other county spending though, has been relatively flat since the “bubble” burst in 2008, while both PBSO and F/R continued upwards. The Sheriff did reduce his budget for FY2011 and held positions flat, but is still about 10% above 2008. To roll back to 2006 spending for PBSO would require a reduction of 28% from current levels.

Outlook

TAB believes that the coming years will be particularly challenging for Palm Beach County as property valuations continue their slide and the federal and state “stimulus” money that has been propping up the budget is no longer available. Either significant spending reduction (we would say to 2006 levels or earlier) or equally significant tax hikes will be necessary, and PBSO will not be immune to the challenge. That said, TAB also believes that the Sheriff’s core missions of Law Enforcement, Corrections, and Court Services are a necessary function of county government. Is everything being done today inside PBSO part of those core missions? We don’t yet know the answer to that, and the lack of transparency to the public makes the analysis difficult.

We would like to know if the rapid growth of the PBSO budget was justified by conditions in the community, and how the 4011 employees (1734 of them civilian) are allocated today. We have no reason to believe that there is anything inappropriate being done, but we have no way to tell. Therefore, we would request that PBSO participate more fully in the county budget setting process and implement a public records improvement in keeping with the spirit of the Florida Open Records Law (Statutes chapter 119) that says (among many other things):

“119.01(2)(e): Providing access to public records by remote electronic means is an additional method of access that agencies should strive to provide to the extent feasible. If an agency provides access to public records by remote electronic means, such access should be provided in the most cost-effective and efficient manner available to the agency providing the information.”

We believe the “most cost-effective means” for budget information is either the county or PBSO websites. The county staff does a world class job of this and would be able to assist PBSO in the transition. Martin County Sheriff’s Office provides another example as the Martin equivalent of the information we need from PBSO is available on the MSO website today.

Additional things that would greatly improve the public access to PBSO would be:

- Better cooperation with county staff and commissioners in providing detail to the budget process, even when not mandated by statute.

- Executing an inter-local agreement to voluntarily place PBSO under the juridiction of the Office of Inspector General and subject to the Code of Ethics and Ethics Commission.

- Allow an outside audit of activities that have raised questions in the community – specifically the status of the Mobile Data project and the issues with Intergraph, Inc.

With or without TAB actions, we believe progress is possible in these areas. During the recent election, both candidates for District 2 called for more transparency from the Sheriff, and we are hopeful that the winner – Paulette Burdick, will pursue this. In Broward County, 72% of the voters supported the Charter Amendment that places BSO under the Code of Ethics. There may be a court challenge to this, but it is clear that the citizenry would prefer it. Lastly, questions were raised about Mobile Data during the last budget cycle, and there are members of the community that have begun to probe this program. TAB also expects to investigate this further.

Pension rules are stacked in favor of the unions

This weekend, Randy Schultz of the Palm Beach Post Editorial Board has cast a bright light on the time bomb of public employee pensions in Florida, and shown them for what they are – an unsustainable boon to the unions at taxpayer expense, enabled by the Tallahassee legislators at the urging of the unions, in many cases tying the hands of local officials when they attempt to bargain in good faith.

Read the editorial HERE

In the editorial, Mr. Schultz describes the showdown that is coming and gets at the root of the problem:

…”Politics explains much of this financial problem. Police and firefighter unions have much clout at the local level and in Tallahassee. State fire and police pension laws are stacked in favor of the unions. One example: Governments don’t just have to meet an overall standard for benefits; governments must meet all of nearly two dozen standards. Twice in the past 11 years, at the unions’ urging, the Legislature has ordered cities and counties to sweeten police and fire pensions. This year, the Legislature rejected a request to exclude overtime in pension calculations. A state law that applies only to Palm Beach County gives sheriff’s deputies annual “step-up” pay raises.” …

He points out that many of the cities in Palm Beach county are seeking innovative ways to get control of a critical problem and end some of the worst practices. It is time for the Legislature to back the cities.

TAB believes that public employee pensions, along with other attributes of the lucrative contracts for the Police and Fire unions have arranged for themselves are the most harmful aspects of the county budget. While the cities struggle with their unions, what is the county doing to reign in the excessive compensation paid to Fire/Rescue and PBSO? Not much that we can see.

Responding to the statement by a former head of the PBA who said that West Palm Beach cannot “..ram something down (the unions) throat …”, Mr. Schultz ended his editorial with:

In fact, public safety unions have been ramming a lot down the throats of Florida’s cities. And now the cities are choking.

Well said!