Tab Point of View Presented at PBCA Candidate Event

VOTE NO on the SALES TAX

Shortly, the Economic Council and others will be spending over $200,000 to convince you that the county sales tax should be raised to 7%. You will hear that the infrastructure is crumbling, that the children are sweating in their classrooms with broken air conditioners, that the roads have potholes and the bridges are falling down. You will hear that a sales tax is good because 25% of it will come from tourists, and that tens of thousands of jobs will be created to rebuild those roads and bridges, county buildings, the jail and the parks.

Don’t be fooled. This 17% increase in the sales tax will generate much more revenue than is arguably needed to repair the infrastructure that was neglected by conscious choices of county staff and commission. Over the last 5 years, the ad-valorem budget has grown 33%, yet Engineering and Public Works only saw a 3% growth. At the same time, the Sheriff’s budget grew by 28% and county employees saw 12% in across the board raises (3% / year for 4 years). These conscious choices indicate that those running our county and school system were willing to defer maintenance until a pitch could be made for a new source of revenue.

A bond issue could have funded the critical needs. Instead, they want a sales tax that will generate $2.7B over 10 years whether it is needed or not. Do not doubt that they will spend every penny.

1. A 17% increase in the sales tax is a net tax increase of $270M per year, with no offsets to property taxes.

2. It is regressive and will affect low income residents the hardest.

3. It is not subject to the scrutiny applied to the annual ad-valorem budget.

4. It creates an incentive to purchase outside the county (Both Broward and Martin are at 6%, many internet retailers do not collect sales tax).

5. It is not an “infrastructure maintenance tax” but includes many new capital projects.

6. Unlike an infrastructure bond that would raise just enough money for critical needs, this granular tax generates a specific amount of money, and low priority projects will have to be funded in order to spend it all. Like previous proposals, it is a grab-bag of projects, many of which would never be done without a “must spend” windfall.

7. Charter schools get nothing.

8. Many of the municipalities (PBG, Boca) didn’t want the money.

9. It comes on top of the largest ad-valorem tax haul at the county level in history, up 8.2% over last year and up 33% since 2012. If passed, the 2017 equivalent tax hike would be 18%.

10. Over the last 5 years, the county has consistently underfunded engineering and public works (+3%), while increasing the Sheriff’s budget by 28% and giving across the board raises to employees of 12% (3%/year for 4 years). When the overall ad-valorem budget increased by 33%, engineering saw a total of 3% in 5 years. This was a conscious choice.

Don’t be an enabler!

Final County Budget Hearing This Evening 9/19

At the first September budget hearing, the Commission unanimously adopted the 4.7815 millage – unchanged for 6 years, and tonight they will make it official.

When this tax rate was first set for the 2012 fiscal year, the countywide ad valorem tax was $595M against a valuation of $124.6B. This year, property valuations have greatly recovered and now total $165.1B. At that level, this millage will generate $790M – up 33% in 6 years, 8.2% in this year alone.

OVer those 6 years, there has only been about 4% inflation and population has grown about 3%. The average household income throughout Palm Beach County grew about 6%.

The government did much better. County employees saw across the board raises of 3% for 4 years in a row (12.6%), and taxes went up 33%.

Remember this growth in taxes – far in excess of inflation and population growth, as you consider whether a 7% sales tax makes sense. If passed, the tax will provide another $70M per year to the county government – larger than the $60M increase in this year’s ad-valorem.

Public Hearing Tuesday on 2017 County Budget

Links:

On Tuesday 9/6 at 6:00 PM, the County Commission will most likely vote to leave the millage unchanged for a sixth year in a row, accepting the tax windfall from rising valuations.

The numbers are slightly higher than the June package as the valuations have been adjusted up slightly to $165.1B – 97% of the all time peak that occurred in 2008. This year’s tax take of $790M is up 8.2% over last year and up 33% in the 5 years since 2012.

Highlights of the budget include:

- a 3% across-the-board salary increase for all employees (on top of 3% in each of the last 3 years). Note that this 12.5% increase for county employees came during the 4 year period when the county average household income only went up about 4%.

- 62 new positions. County staffing has grown by 286 in the last 4 years to a total of 11,202.

- A $28M increase for the Sheriff. The Sheriff now accounts for about 48% of the general fund total appropriation budget.

- A 4.7% decrease in the budget for Engineering and Public Works.

Note that there is nothing in the budget for revenue and appropriations associated with infrastructure projects that would be funded by the proposed 1 cent sales tax surcharge. If the tax were to pass, the county would receive about $70M per year – about $10M more than the amount of the increase in this year’s property tax. When added together, the total tax increase would be 18% in 2017.

First 2017 Budget Hearing on June 14 at 6pm

In an unrelenting desire for ever more taxpayer money, the county Administrator has proposed a $57M tax increase for the next fiscal year, which will be in addition to about $75M per year that the county will get from the sales tax if approved by the voters.

This is just greedy.

Links:

At $787M, up 7.9% over last year’s county-wide operating tax haul (which was the highest in county history), this budget will surpass the peak tax during the real estate bubble by almost $100M and is up 32% from the post-bubble low of 5 years ago.

During these last 5 years, inflation (measured by the consumer price index) is up only 4%, and the population has grown by only 3%. So why do they need to increase taxes by 32%?

One reason is employee raises – cost of living raises across the board of 3% each of the last 4 years (did you get a 12.6% raise over the last 4 years?).

Another is the insatiable appetite of the Sheriff. The current budget of $511M is up from $394M in 2012 – an increase of $117M (30%) in 5 years. Maybe PBSO needs it to pay for all those use-of-force lawsuits they have been losing lately.

Not part of the county-wide budget, but paid by those in their service area, county Fire/Rescue is also up 30% in those 5 years.

By keeping millage constant since 2012, they have been able to ride the increase in property valuation that has almost (but not quite) returned to its 2008 peak, at $164.5B.

We think the millage should be reduced this year. If they really expect the sales tax increase to pass in this interesting “anti-establishment” year, then show some confidence by reducing the ad-valorem burden.

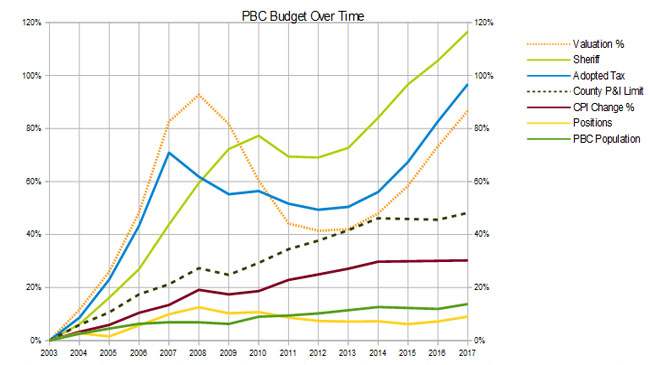

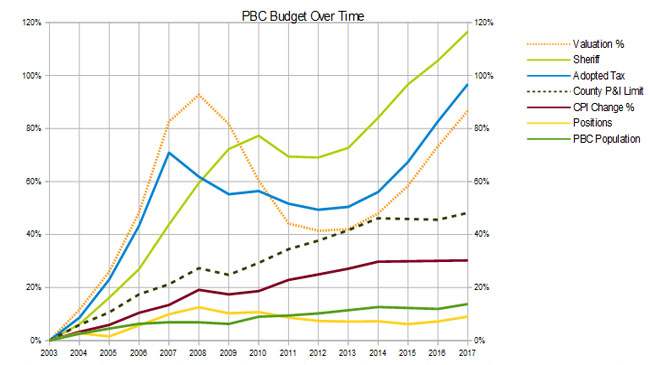

In the above chart, the dotted orange line shows what has happened to property valuations – peaking in 2008, dropping to a low in 2012, and then climbing almost back to the peak. The dotted green line is a combination of population growth and inflation – a measure of “reasonable” tax growth. Comparing this to the blue adopted tax line, you can see how much more our taxes have risen over what is reasonable. And of course the green “Sheriff” line is a tale unto itself.

Sales Tax Increase – Are the intended uses lawful?

As you probably know, the County Commission voted 5-2 to proceed with a 1% sales tax referendum for the November election. Ballot language is expected to be voted on at an upcoming meeting.

Under the terms of the proposal, the $270M annual proceeds are distributed as follows:

| 48.0% | $130M | School District |

|---|---|---|

| 27.5% | $74M | County |

| 18.5% | $50M | Municipalities |

| 4.5% | $12M | Cultural Council Projects |

| 1.5% | $4M | Economic Development |

A sales tax can only be imposed under the rules established by Florida Statutes 212.055 “Discretionary sales surtaxes; legislative intent; authorization and use of proceeds”, which spells out how proceeds may be used.

Specifically, it says in 2(d): “The proceeds …. shall be expended … to finance, plan and construct infrastructure; to acquire land for public recreation, conservation or protection of natural resources ….”

Section 2(d)1 provides a definition of “infrastructure”, which includes construction and improvement of public facilities, acquisition of public safety vehicles and equipment, etc.

Then in 2(d)3, it says “a local government infrastructure surtax … may allocate up to 15 percent of the surtax proceeds for deposit into a trust fund within the county’s accounts created for the purpose of funding economic development projects having a general public purpose of improving local economies, including the funding of operational costs and incentives related to economic development.”

It is probably safe to assume that the school district, county and municipalities can easily identify their intended projects as “infrastructure”. The Cultural Council projects though, as they are privately owned, do not qualify. Therefore, to be able to spend money from the sales tax, the museums, theaters and other entities would have to be considered “economic development” projects.

Are they really? Do they have “a general public purpose of improving local economies”? Is improving the outside appearance of the Norton Museum really in the same category as offering an incentive to a company to move its headquarters to the county?

What about the argument that these projects encourage tourism, and thus bring jobs and economic activity to the county?

On the WPTV show “To the Point” last Sunday, Tourist Development Council Executive Director Glenn Jergensen spoke of the drivers of county tourism – specifically beaches, baseball, and the convention center. He never mentioned theaters, museums or the zoo.

The statute also says that the “economic development” money needs to be put in a trust fund, presumably to be allocated for projects that are prioritized by some process. How can it be lawful to designate a fixed 4.5% of the proceeds to the discretion of the Cultural Council – an unelected board representing private interests?

The Cultural Council itself gets money from the bed tax and provides grants to the museums, theaters and other entities who typically have their own endowments or sources of private funding, and are not totally dependent on public money. Many of the projects intended for sales tax dollars were already in the pipeline and would happen with or without public funds.

It would seem that allocating 4.5% of the proceeds to these cultural projects may violate the letter of FS212.055, making the entire proposal subject to legal challenge. As such, we think the county should seek an opinion from the state Attorney General before proceeding with this ballot initiative.

As the municipalities are in the process of deciding whether to sign an interlocal agreement in support of the package, they too should be concerned. If any of you plan on attending your city or town’s meeting on the subject, consider bringing it up.

Sales Tax Referendum Gathering Steam

The county commission will vote Tuesday whether to ask the voters to raise the county sales tax from 6% to 7%. (Agenda Item 5B1)

After aborted attempts in 2012 and 2014, when a majority of the board thought the proposal was “half baked” and the need not urgent enough to convince the voters to cough up several billion over ten years, this time no one will say that the proposal hasn’t been finely tuned.

To her credit, County Administrator Verdenia Baker has put enormous energy and thought into lining up partners and getting potential opponents on board. She has made countless trips to the District, the League of Cities, business groups, city and town governments, and even homeowners associations to solicit ideas and sell the concept.

The School District has bought in, voting to partner up and accept just 48% of the take – less than they would have received with a go-it-alone half cent increase “for the children”.

The cities have also rallied to grab a piece of the potential windfall, producing a detailed wish list of projects to absorb their 18.5% – many of which would never have been conceived under their own municipal budgets.

And the master stroke was to bring in the Cultural Council as the tip of the spear. Acting in a capacity that can be looked at as “fee for service”, the Cultural Council is the hired gun whose “One County, One Plan, One Penny” campaign is already cranking up. The School District and the County Government are prohibited by law from engaging in political campaigning to pass a measure favorable to them, but the Public/Private Cultural Council is under no such restraint. Their 4.5% of the proceeds (about $122M over 10 years) is payment rendered to convince the public that this tax increase is to their benefit.

If it passes, the county will receive 28.5% of the proceeds, and although it is an “infrastructure surtax”, intended for maintenance of roads, bridges and facilities, much of the money is earmarked for new capital projects. It even contains a $27M “Economic Development Fund” for unspecified projects “to attract, retain, and expand businesses to improve the local economy.”

We think this a bad direction for the county, but there is enough muscle behind the proposal, that keeping it off the ballot would seem unlikely at this point. Only one Commissioner has signaled his opposition (Hal Valeche, to his credit), and the usual folks who oppose tax increases – such as the Economic Council, the Palm Beach Post editorial board, even some TAB partners, are either supporting the proposal or remaining neutral.

If you would like to go on record as opposing this referendum, send an email to the BCC or speak at the meeting on Tuesday.

Here are some things to keep in mind:

- It is a net tax increase of $220M per year – there is no talk of reducing ad-valorem taxes

- It is not subject to the scrutiny applied to items in the annual ad-valorem budget

- It creates an incentive to make purchases outside the county (both Broward and Martin are at 6%)

- It is regressive

- It is not an “infrastructure maintenance” tax, but includes many new capital projects

Sales Tax Proposal Sent Back for More Info

During a long meeting that stretched from before lunch until 5pm, the Board of County Commissioners yesterday deferred action on staff’s sales tax proposal, sending it back for more information.

Commissioners Valeche, Burdick and Abrams all wanted to see things slow down while the proposal is fleshed out. They did not want to see ballot language as of yet, rather the next session should discuss the unknowns of the proposal, including:

– What is the project list from the cities and School District?

– How would funds be distributed among cities, Cultural Council, county, schools?

– What it looks like without the Cultural Council projects included?

– What does the Hospitality Industry think of it?

While no one wanted to shut it down, they are clearly not ready to move on it. Some concerns expressed were that the proposal had expanded way beyond the original infrastructure funding, encompassing new construction projects, equipment for the Sheriff, and other items. Commissioner Abrams worried that the “Christmas tree” could tip over from all the ornaments.

Regarding the proposals from the Cultural Council – illustrated by a procession of over 10 museum directors, zookeepers, theater managers and the like, some of the projects go way beyond what you would expect from public funding, including architectural enhancements to the exterior of existing buildings to make them more trendy.

We will wait and see. We have listed objections to the plan as it is currently known. We expect that the devil is in the details though, specifically:

– Will the cities give up some of their share to fund CC projects?

– What will each of the 39 municipalities do with their share? Will any reduce their ad-valorem?

– What effect will this have on the county Ad-valorem budget process this year?

Regarding the Fire/Rescue sales tax proposal, there were too many questions about the enabling statute to move forward at this time. In particular:

– It is unclear what happens if sales tax revenue exceeds needs – can the surplus be spent on non fire/rescue projects by the county or cities? – It needs a statute change or AG opinion.

– What would be the process for collecting and distributing the cash, and how could ad-valorem be adjusted after trim notices are sent – Tax Collector Anne Gannon came and listed some of her process issues with it.

– What does Fire/Rescue administration (ie. Fire Chief Collins) think of the proposal. (The proposal is being brought forward by the IAFF union, not Fire/Rescue management).

We will keep you posted.

Some of the organizations with whom we have spoken, are also in a “wait and see” mode. Many believe there are real infrastructure needs, but many of the add-on projects give them pause.

For the Post story on the meeting, see: Action on Sales Tax Issue Delayed.

Increasing Sales Taxes a Bad Idea

A little shy of two years ago, the County Commission voted 4-3 to reject a staff proposal for a ballot initiative for a half penny sales tax increase. This was the third sales tax attempt since 2012, and we are about to see the fourth attempt unveiled at the February 9th BCC meeting (Items 5D2, 5D3).

County Administrator Verdenia Baker has been shopping around her proposal for a half cent increase to fund “infrastructure” – roughly defined as roads, bridges, drainage, parks, and other physical items. The increase would last at least 10 years, and bring in more than $110M per year of new revenue for each 1/2 cent increase. The plan was defeated last time around partly because it was perceived as funding a “grab bag” of small unrelated projects, with nothing that would capture the imagination as a critical need. As one of the Commissioners put it – what is the constituency for road striping and drainage ditches?

Complicating matters this year is the “feeding frenzy” that is surrounding the whiff of new revenue. The School System, with infrastructure needs of their own, are also considering a half cent increase, and since “for the children” is more compelling than “for the drainage ditches”, the county would like to combine their request into a full cent that would be split with the District. So far the district isn’t buying it, figuring (rightly) that their chances are better alone. Not to be muscled aside, County Fire/Rescue, which is funded by its own taxing districts (county and Jupiter), has wanted since 2010 to convert some of its revenue flow from property taxes to sales taxes, and would like at least a half cent of their own. The 2010 proposal was turned down by the BCC over the complexity of dividing it up among the county and cities. And outside of the process (but perhaps thinking they can bring marketing skill to the ballot proposal), the PBC Cultural Council would like a piece of the action. The CC is funded today by the “tourist” bed tax on hotel stays and rental cars.

So is this potential 1-1/2 cent increase in the sales tax (to 7.5% if everyone gets theirs) justified?

Please consider:

- For the current fiscal year, the county-wide property taxes levied reached an all-time high of $730M, up 9.4% over the previous year, and up 23% in just 4 years, far exceeding inflation and population growth.

- Although the Sheriff’s portion of the budget increased by almost $30M, he deferred some capital spending into the next fiscal year and we expect an even larger increase in the 2017 budget – therefore the county will be considering another big property tax hike as well.

- Maintaining the infrastructure is one of the basic things we expect from government, and it should not need its own special revenue source – it should be given priority in the normal budget process.

- Sales taxes, by their nature generate revenue untied to specific spending needs and outside of the public budgeting process. This leads to a lack of oversight and wasteful spending.

- A portion of sales taxes (40%) by statute must go to the cities. Some cities are actively opposed to a sales tax increase, and others have budgeted responsibly and do not need additional revenue sources. This is a wasteful and inefficient way to generate county level revenue.

- For the county, the designated infrastructure “needs” are still a grab-bag of small unrelated projects, and not a compelling list of urgent priorities justifying up to $2.5B in new taxes over 10 years.

- The schools budget proposed at the state level by the governor will provide significantly more money for the school system next year, easing any need they have for more sales tax revenue.

- While a case could be made to shift some revenue from property to sales tax to capture more from non-residents (there is some of this in the Fire/Rescue proposal), neither the county nor the School District is considering a reduction of ad-valorem taxes.

We think raising the sales tax for any of the stated purposes is a bad idea, and if any of these do get on the November ballot, we think it will very likely be defeated by the already overburdened taxpayers.

If you agree, let the Commissioners know at BCC-AllCommissioners@pbcgov.org or speak at the meeting.

For TAB Articles concerning the various sales tax schemes of the last few years see:

- Mar 12 2014: Dodging a Bullet – No Sales Tax Referendum

- Mar 7, 2014: Another Go at the Sales Tax on Tuesday

- Dec 18, 2013: Dark Cloud of Sales Tax Referendum Hangs over the County

- Dec 11, 2013: Another Attempt to Raise the County Sales Tax

- May 11, 2012: “Half Baked” Tax Proposal put back in the oven for another year

- Apr 27, 2012: TAB Opposes Sales Tax Increase

- Dec 8, 2010: Fire/Rescue Sales Tax Surcharge to Make a Comeback

Final Hearing on FY2016 Budget, 9/21

Next Monday, the Commission will take their final vote to set the county-wide millage rate at 4.7815, unchanged since 2012.

Out of the $63M tax increase, the $775K that they did not commit to new spending will be rolled into reserves, ready for use to increase the BDB subsidy and other priorities that didn’t make the budget proposal.

This is how the budget compares to last year:

| 2015 | 2016 | Change | |

|---|---|---|---|

| County-wide | $667.3M | 729.9M | + 9.4% |

| Library | $41.5M | 45.0M | + 8.4% |

| County Fire Rescue | $196.6M | 214.8M | + 9.3% |

| Jupiter Fire Rescue | $17.6M | 17.7M | + 0.6% |

Keep these large increases in mind as you contemplate the coming push for raising the sales tax to pay for “infrastucture” projects that should have been addressed in the normal budget process.