County Commission District 1 Candidate Forum

Candidate Forum

Join us for an evening of in-depth discussion of county issues with the three Republican candidates competing to replace term-limited commmissioner Karen Marcus.

Moderated by Tom Boyhan, WJTW FM100.3

June 18, 2012

6:00pm Meet and Greet, 7:00 Program

Abacoa Golf Club

105 Barbados Drive, Jupiter, Florida 33458

Food and Drink Available

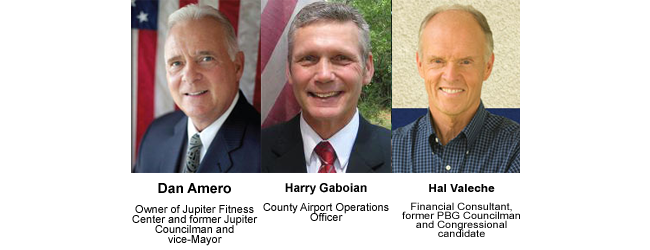

The candidates are:

This event is jointly sponsored by:

Palm Beach County Taxpayer Action Board

Palm Beach County Tea Party

Palm Beach Republican Club

Republican Club of the Northern Palm Beaches

Republican Club of the Palm Beaches

Singer Island Civic Association

South Florida 912

This forum has been organized to feature the district one candidates appearing on the August ballot. Gardens Mayor David Levy, also a candidate for the position, is unopposed on the Democrat ticket and will face the eventual winner of this August contest in November.

BCC to Discuss $29M in Spending Reductions

At the Tuesday, May 15 Commission Meeting, agenda items 5a2 and 5a3 deal with an “efficiency audit” performed by consultants Gerstle, Rosen & Goldenberg at the request of county administration.

The audit found areas of significant savings, both in county operations and in the constitutional offices (except the Sheriff who evidently refused to answer any of their questions), estimated in the range of $29M. They looked in four areas: operating efficiencies, outsourcing, staff reductions, and additional sources of revenue. (It appears that only the outsourcing will be discussed in 5a2, and 5a3 addresses efficiencies regarding the constitutional offices).

These savings involve the elimination of 921 positions, mostly through outsourcing, and the bulk of the savings comes from reduction in benefit obligations.

With the county facing a potential $15M shortfall in the 2013 budget to be discussed at the first workshop on June 12, searching for areas to reduce spending is sorely needed and this study is an excellent move in that direction. Staff should be commended for both commissioning the study and for bringing it to the board for direction.

We are not overly optimistic that this initiative will be warmly embraced however. Already, the counter-arguments have begun. Chairman Vana says “My goal was never to try to get rid of a million people”. OFMB Director Bloesser warns that “it was unlikely that many of the findings could be put into effect before the budget year begins on Oct. 1”. Clerk Bock says that the proposed savings in her office are “incorrect and irresponsible”.

Nevertheless, this is the kind of direction that TAB has been calling for for several years, and we ask partners and supporters of TAB to attend the Tuesday session in support of the consultants proposals, or communicate your views to your commissioner.

The full content of the report can be found in the attachment for item 5a2 and the initial reactions are captured in the Palm Beach Post: Consultant: Palm Beach County can save $32M with 1,000 job cuts, add $3M with rate hike.

A Look at the Candidates for County Office at the Voters Coalition

“Half Baked” Tax Proposal put back in the oven for another year

“Half baked” – that is how Commissioner Steve Abrams described Bob Weisman’s proposal to put a $100M, half percent sales tax surcharge on the November ballot.

We agree. Even Commissioner Taylor, who seems to believe our money belongs to her (“We’re not exercising our RIGHT” to raise these taxes) thought the proposal needed a little more development.

Normally, county staff does a good job on budget proposals. We don’t always agree with their priorities, but they do offer justifications and complete analysis. This proposal seemed to drop out of thin air a week ago and postulated $100M more in revenues for unspecified “transportation” projects with no sunset. A vague suggestion of possible offsets to property taxes was contained in the agenda item, but there was no Powerpoint presentation, no forward projections, no discussion of the trends in existing transportation funding like the gas tax.

The commmissioners, to their credit, recognized the difficulty in selling such an open ended proposal and all wanted to table the issue until the staff could come back with a more thought-out package. Those that were OK with raising the sales tax (Taylor, Vana, Aaronson), wanted staff to return in a month so there would still be time to put it on the November ballot. Those not so keen on the idea (Burdick, Abrams, Marcus), preferred to table it until next year or indefinitely. Karen Marcus suggested that when the TriRail expansion occurs, we may need the money more than we do now. (Ouch !).

It is clear that if the proposal were to come back in a month, a lot of time and resources would have to be spent by TAB and others in order to develop counter arguments. With the budget workshops coming up in June, that would be a considerable distraction. It was starting to look at one point that we would have another 4-3 vote in that direction, but Commissioner Santamaria joined with the taxpayer-friendly commissioners to table the issue until next year.

Thank you to all who came to the meeting and spoke against the proposal, including Alex Larson, Pat Cooper, Fred and Iris Scheibl, Janet Campbell, Nancy Hogan, and Rick Roth.

TAB Note: The discussion of transportation funding has shined a light on the budget dynamics of Palm Tran, which we were astounded to learn is more than 90% subsidized. Since only a small part is ad-valorem funded, TAB has not paid it much mind in the past, but now it will get some scrutiny for sure.

TAB Opposes Sales Tax Increase

Staff requests direction on implementation of a “Charter County and Regional Transportation Tax”

On Tuesday, May 1st, the Palm Beach County Commission will be considering a $100 Million, 1/2% increase (raising existing 6% to 6.5%) in the sales tax to fund transportation related spending. The Administrator is requesting board feedback on putting this proposed tax on the November ballot, and the Commission must give approval prior to the August 10th ballot language deadline. A good description can be found in Jennifer Sorentrue’s article Palm Beach County voters may be asked to increase sales tax by half-cent for roads, transportation.

The agenda item is 4A2 – and it falls early in the morning’s schedule – after special presentations and the Consent Agenda, and an item related to the Supervisor of Elections. The agenda can be found here and the agenda item background here.

The County Administrator’s rationale is as follows:

- The tax will generate over $100 million annually

- It will partially shift transportation funding to ‘tourists’

- State Statute allows for the tax and PBC is one of the few of the 67 counties that don’t charge this sales tax.

Why now? Is it because our economy languishes and home values aren’t increasing significantly so there are revenue pressures? Is it because the price of gas has become so high that we – tourist and resident alike, are driving less or boating less? Is it because the administration doesn’t want to have to account for how they spend – when they have no productivity and performance benchmarks nor measurements against those benchmarks?

TAB has issues with this proposed sales tax increase:

- This is a tax increase. It affects most purchases and services. And unlike the fire/rescue sales surtax proposed to the Commission in 2010, it makes no claims that it will be revenue neutral nor is it accompanied by any decrease in ad valorem

- This tax would be permanent. Unlike the recently expired school sales tax, this tax is not for a specific set of projects nor does it have an end date.

- This will be a revenue windfall for the county. We remain in an economy close to recession. Inflation is already here in our fuel and food prices, and will continue to increase.

- There is no accountability. The spending isn’t subject to any board, nor does the county have any performance or productivity benchmarks.

Background:

Residents, business owners and tourists alike pay ad valorem taxes. The resident or business owner pays it directly. The ‘tourist’ pays it indirectly. Residents, businesses and tourists pay for fuel. The Palm Beach County Revenue Manual lists several taxes that are geared towards transportation already:

- Local option gas tax: 6 cents on every gallon of gas for exactly the same purpose as this proposed except debt service

- The ‘ninth’ cent tax, 1 cent tax on every gallon of gas that lists all the same purpose

- County Gas Tax: 1 cent on every gallon of gas to be used on transportation related areas

In addition – Palm Tran already has fees, and builders have ‘road’ impact fees.

At the April 27, 2012 Commissioners’ workshop on the Internal Audit Department, the Commissioners, whether rhetorically or not, questioned the lack of any kind of productivity or performance measurements in the county. Asking the voters’ to hand over more of their hard-earned money to an open-ended, unspecific, windfall tax is unconscionable.

Voters are unlikely to approve the proposed ballot amendment. Please tell your commissioners to reject this request by the County Administration and not put it on the ballot in November.

Yet Another Taxing District?

Palm Beach County property owners are taxed in many ways. We pay separate tax rates for our cities, for our schools, and for the county government. We also pay for the county libraries, the Health Care District, the Children’s Services Council, and a variety of inlet and water management districts. If we live in the unincorporated areas we pay separately for Fire/Rescue.

Now there is a proposal to create yet another tax district – for the Office of Inspector General. Why this and why now?

It is raw politics.

Some Background

The Office of Inspector General was established in 2009 by the County Commission in response to the grand jury report investigating “Corruption County”. With many commissioners and lobbyists serving jail terms for abuse of the public trust, it was a correct response, and much effort went in to making the office “independent”. Hiring was performed by an independent selection board. Removal required the votes of the entire selection board plus 5 of the 7 commissioners. The budget was floored at an amount .25% of the contracts that vendors have with the county, and could not be reduced without 5 votes of the commission.

In 2010, a ballot initiative asked the voters if the IG jurisdiction should be extended to the 38 municipalities, with a proportional increase in funding to come from those entities. 72% of the voters agreed and the result was codified in the county charter after a six month effort by an ordinance drafting committee. The committee was composed of representatives of the county, the League of Cities, and the public, but much of the discussion was contentious. The cities objected mainly on two grounds – that the scope was too broad and that the purview of “waste, fraud, abuse and mismanagement” needed to be narrowly defined to limit what the IG could investigate, and that the funding formula based on a LOGER estimate of contract activity constituted an illegal tax. The ordinance draft did pass by a majority vote.

In 2011, after the IG began her work with the cities, the opposition began. Many cities passed local ordinances adding the definitions that were rejected by the drafting committee. A narrative was established that complying with the IG would be prohibitively expensive to answer their questions and fix any problems found. “The people did not know what they were voting for” became the operative justification for the opposition. Finally, in a major strike, 15 of the 38 municipalities filed a lawsuit claiming that the funding mechanism is illegal under Florida law, and refused to remit their obligated funding. Funds already provided by the municipalities that were not party to the lawsuit were sequestered by the County Clerk. A crisis in funding was at hand.

Recent Developments

On Tuesday, 3/20, a lawsuit “settlement proposal” negotiated by County Attorney staff was brought to the Commissioners. Under its terms, the cities would collect a contract fee of .25% levied by the county on their contracts, to be used for IG oversight of only those contracts. Contracts that predated 6/12 would be excluded, as would a long list of exempted contracts including large ones like FPL, waste collection and all federal grants. The IG office estimated that acceptance of this settlement would gut 60% of their budget, effectively limiting their oversight of the municipalities. After a large number of members of the public came forward urging rejection of the settlement, the commission voted 7-0 to reject it and move on to mediation.

On Monday 3/26, a joint meeting was held in the West Palm Beach City Hall between the County Commission and the representative of the municipal litigants. It was an august collection of the most senior public officials at the local level. While all professed to “support the IG”, and that the lawsuit was “just about the funding”, an objective observer could conclude that an independent Inspector General with free rein to investigate in the cities was not universally embraced.

Commission Chairman Shelley Vana correctly summarized that the intention of the ordinance is to provide for IG independence by having the governing body NOT control the IG budget. Mayor Muoio and the others see that as the crux of the problem – how can you be responsible for a budget if you can’t set the level of spending on a line item. Why, if the economy is bad, we may just decide not to fund the IG at all in a given year! Control of the IG budget is control of the office – just what the ordinance is intended to prevent.

During this meeting, West Palm Beach attorney Glen Torciva suggested an independent taxing district as the way out of the dilemma. Let both the county and the municipalities wash their hands of the funding issue and let the people decide. Of course a new taxing district would have to go on the ballot – perhaps this November. This is perfect for those who believe “the voters didn’t know what they were voting for” in extending the IG to the cities. Instead of asking “.. should we have an IG?” as in the 2010 question, we will ask ” .. should we pay more taxes so we can have an IG?” Maybe then the 72% of the voters who wanted to meddle in the affairs of our elected officials will think twice.

If you have any doubts about the motive here, consider Mr. Torciva’s statement to the Palm Beach Post:

Commissioner Burt Aaronson, a supporter of the concept, added (with a smile):

The creation of the Office of Inspector General and the Ethics Commission has gone a long way to correct our reputation as “Corruption County”. This latest attempt to neuter or eliminate the office proves that we still have a lot of work to do. The roughly $3.5M OIG budget would be equivalent to a 0.03 millage rate on our $120B property valuation – hardly worth the effort it would take to collect it. The current LOGER system is an accurate, reliable way of measuring local economic activity and establishing a fee for IG services. Whether a fee is actually charged to a contract or not, it is a reasonable way to both estimate and bill.

We think the county and cities should find a way to make it work and drop any attempt at forming a new taxing district.

Commission and Staff Hold Off-site Retreat

The County Commissioners and senior staff assembled today in Boynton Beach at the Intracoastal Park Clubhouse, for an off-site “retreat”.

In January of last year, a similar meeting was held at the Riviera Beach Marina, and a wide variety of strategic topics were discussed (energy and water costs, Glades restoration, Biotech investments) as well as the upcoming budget outlook. The most significant result of that meeting was the setting of clear board direction to staff to return a flat millage budget. This benchmark was the driving force for the budget workshops and resulted in a final budget in September that was very nearly flat. The meeting was successful largely as a result of then Chairman Karen Marcus’ efficient management style, which kept the discussion focused and moving.

This year’s meeting was different. Instead of herself leading the discussion, current Chairman Shelley Vana turned the meeting over to a professional “facilitator”, David Rabiner. Mr Rabiner’s website lists as one of his services “Retreat Facilitation for Governing Boards and Managing Teams”. As a leadership trainer, he was compelling and entertaining, and one could easily see him in a corporate setting. However, for this group, his techiques to “facilitate trust and an effective working relationship” between commissioners and staff were off the mark.

Last year’s meeting was effective because the commissioners spoke freely to each other and related their views on the budget and strategic topics in depth. In this year’s meeting, much of the content consisted of Mr. Rabiner talking about his views on process and how things work in his native Oregon. Perhaps the commissioners found it useful but I suspect not. Many people who attended the meeting to hear some discussion of the budget outlook left before lunch and did not return.

After lunch, Mr Rabiner attempted to extract from the group a clear direction to staff for this year’s budget assumptions. He failed. When the meeting ended at the appointed time, a conficting set of requirements were laid on Bob Weisman and staff.

Steven Abrams and Paulette Burdick want a flat millage budget like last year.

Shelley Vana wants a budget proposal that delivers a “consistent service level”, even if a millage hike is necessary. Priscilla Taylor seemed to concur.

Jess Santamaria wants a “flat taxation” proposal – ie. a rollback budget, regardless of millage rate.

Burt Aaronson wants to reverse the cuts that have been made in ad valorem spending over the few years and “enhance the product” with either a 3% or 5% increase in millage.

Karen Marcus does not want to see any layoffs this year, but wants to start with a “consistent service level” proposal and have the board make cuts to approach flat millage from the high side.

When the meeting ended, these conflicting positions were on the table. Hardly a “clear direction to staff”.

Commissioner Marcus’ proposal deserves further comment however, as it represents a new approach. Mr. Rabiner made the point that there are two ways to achieve budget cuts. The first is to cut “line items” – which are portions of programs similar to what is presented on the “green pages” and “blue pages” prepared by staff in the last two years, sized by dollar and people impact. The second is to cut programs entirely (presumably those that are not needed anymore or no longer appropriate to the current environment).

With the “line item” approach, the priorities are driven by the County Administrator and staff since they present to the board their list of potential cuts from which to choose. Typically, these are sprinkled with items with vocal constituencies, leading to the yearly “Kabuki Dance” of the colored tee shirts.

With the “program” approach, the priorities are driven by the board itself, and have the possibility of being strategic in nature, or at least policy driven.

Karen Marcus seems to be proposing the latter approach, with a consistent service level starting point. Criticism of her proposal pointed out that only the staffs have the inside knowledge of how the pieces fit together and without the green/blue pages, intelligent choice is impossible. This misses the point – the commissioners, particularly long serving ones like Marcus, do have the knowledge and experience to make informed choices for program elimination or even adjustment of sub items. We think they should give this a try.

Transparency at PBSO – the Challenger’s View

At various times over the last two years, we at TAB have raised the issue of transparency regarding the Sheriff’s half billion dollar budget. Much of what goes on at PBSO is hidden from public view, and the budget is no exception. The only way to see how the agency spends the taxpayer’s money within the three “silos” of Law Enforcement, Corrections, and Court Services, is to file a chapter 119 (open records law) request and wait months for a partial answer. By contrast, the Martin County Sheriff puts all of his budget data right on his website for all to see. (see MSO Budget and Finance ).

Sheriff Candidate Joe Talley

Ethics also are not transparent at PBSO, and we believe that the Sheriff should voluntarily execute an interlocal agreement with the Office of Inspector General for oversight services equivalent to what we have for the county departments, the Solid Waste Authority, and the municipal governments. Commissioner Marcus pursued this avenue last year and was rebuffed. (See Should the Sheriff be Subject to the Ethics Ordinances and the Inspector General? ) “No way, no how” was the answer.

The County Commission created the Office of Inspector General in part to address our reputation as “corruption county”. The voters overwhelmingly voted to place the municipalities under her jurisdiction, and the SWA, Children’s Services Counsel and Health Care District came voluntarily. The Sheriff however, continues to resist.

Since Ric Bradshaw must stand for re-election to a third term this year, we wondered what his challenger Joe Talley had to say on these issues. Joe has recently announced his bid to lead PBSO, and brings a full career of law enforcement experience to the race, including 22 years in the Baltimore County Police Department where he attained the rank of major, and 5 years with the PBSO reserves. With this background he speaks from a position of authority on these matters. Here is what he had to say to us (emphasis is ours):

“… it is my view that the Sheriff is elected by the people. The Sheriff’s budget is money from the people. He is to administer that budget and the Office of the Sheriff as directed by the people…..the laws and the expressed wishes are from the people.

If the majority of the people vote to create an Inspector General, it is for a very good reason. To resist is like saying: “I am here now and you cannot touch me…I don’t care about the wishes of the people and I sure am not going to let the people see how I am spending their money”. What part of that kind of attitude works for a thinking citizen/taxpayer?

Is not the average taxpayer now thinking that perhaps there may be some very good reasons (or bad reasons) why they are being kept in the dark and the Sheriff is being defiant?

Perhaps, if we could see all the documents that have been requested over many months (and few have surfaced and then wrong ones or partial ones) the public would be less than pleased at the reckless and undisciplined spending inside the PBSO..

If elected, I will shine the bright light of day on the PBSO budget and answer all concerns of the public or the County Commission or special interest groups or students or anyone – because the citizens deserve answers. The budget will get a review by the County Commission and I will invite the Inspector General into PBSO warmly. I will have nothing to be afraid of and nothing to hide.

There is so much dysfunction inside PBSO and the employees are so distracted by the need to keep looking behind them, the citizens are getting short-changed at the moment.”

We think this is a refreshing attitude from one seeking the job of County Sheriff, and we hope his candidacy begins a public dialogue on these issues. A Sheriff should cooperate with the County Commission and the other constitutional officers and be a responsible steward of the public trust. Maybe the dialog of the 2012 elections can move us in that direction.

Beyond the Local Elections – a Municipal Elections Forum

Another decrease in valuations in 2012?

As you may recall from last year, county property valuation fell 1.8%. This put pressure on the commissioners to raise the millage in order to avoid cutting spending. As it turned out, the final millage did result in a budget reduction of $7.9M or about 1%, helped enormously by the Legislature’s passage of pension reform that provided a county windfall.

This year, Legislative action will again impact county budgets. One way is through HB251/SB928, which changes the rules under which county property appraisers operate. Specifically, this bill would require consideration of “open market transactions..”, “.. including, but not limited to, a distress sale, short sale, bank sale, or sale at public auction.”

Although the proposed statue would give the local PA some discretion, it is likely to depress valuations. Palm Beach County Property Appraiser Gary Nikolits estimates this could be as much a 2% reduction in valuaion – good for the homeowner, but not so good for city and county governments. (See the Palm Beach Post Story by Jennifer Sorentrue: “Property values stable in Palm Beach County, but bills leave tax revenue uncertain” )

The 2012 adopted budget which is now available on the county website, states on page 2, “Following four years of decline, property values have begun to stabilize and are projected to be level for FY 2013.” More optimistically, on page 58 they estimate a 2013 valuation forecast of $125.8 B, a 1% increase. Maybe not.

In any case, expect another difficult budget year.