Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

This is the second in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

A recent article in the Sun-Sentinel found Orlando to be tops in the US for meetings July 2011-June 2012. “After Orlando, the company found the next most popular cities for meetings and events are in order: Washington DC, Las Vegas, Miami, Chicago, San Diego, Phoenix, Atlanta, Dallas and New Orleans.” “Miami is No. 4, Fort Lauderdale No. 30 and Boca Raton No. 43”.

So – let’s look at how some cities’ convention centers or HQ hotels are faring by looking at some recent 2010-2012 headlines…

Miami: Voters on Tuesday supported a Miami Beach bed tax increase to fund convention center improvements. But if and when a tax increase happens depends on city commissioners and a public corruption investigation. – August 2012

“The commission voted in December to bid out a $1 billion convention center district project that aims to have developers renovate the convention center, build an adjacent hotel and redesign and lease the surrounding publicly owned acres into an iconic complex. That project, however, remains in the early stages due largely to a public corruption investigation into whether the city’s then-purchasing director tainted the bidding process.”

Washington D.C: The sorry saga of the D.C. convention center hotel – Feb 2010

“I understand there may be reasons to subsidize a convention center hotel that agrees to set aside 80 percent of its rooms during peak season for low-margin convention business. But if the hotel really requires this much of a subsidy, then it raises a serious question about the economics of a project that, at best, is expected to increase convention spending in the city by $100 million a year. Right now, it looks as though the benefit of all those subsidies will be fully captured by convention attendees, the convention hotel’s developers and perhaps the owners of the city’s other hotels. If all goes well, the taxpayers will get their money back, but not much more.”

Ft. Lauderdale: Fort Lauderdale to take $13 million hit as it loses its biggest convention – July 2012

“Leaders at the Greater Fort Lauderdale Convention and Visitors Bureau said it’s unlikely that a single convention can replace the business lost from ARVO. So the bureau is working to bring in several smaller events that might fill as many rooms as ARVO: about 24,000 room nights a year.

But competition for groups is stiff because big convention center destinations such as Orlando and Las Vegas no longer wait for mega-events. They go after smaller conventions that pieced together can fill up their space — events that would more typically go to smaller venues.

“Fort Lauderdale competes with everyone in the United States, just as we do, as it relates to small and medium shows,” said Gary Sain, president of Visit Orlando.”

Daytona Beach, FL: If We Build More Will They Come? – June 2012

Raleigh, NC: Raleigh Convention Center: Throwing Good Money after Bad – February 2012

Boston, MA: Panel Proposes Convention Center Hotel – March 2011

Pittsburgh, PA: New Convention Center Hotel is Stalled – March 2012

Salt Lake City, UT: Salt Lake City officials Balk at subsidy for Megahotel – August 2011

Portland, OR: Oregon Convention Center Hotel Gets Another Chance at Life – August 2012

Virginia Beach, VA: Virginia Beach convention center hotel deal killed – February, 2012

There are many more articles for many more cities – but each story just confirms the speciousness of the arguments and the lack of metrics or proof of economic impact.

Some Background to the Mecca Farms Proposal

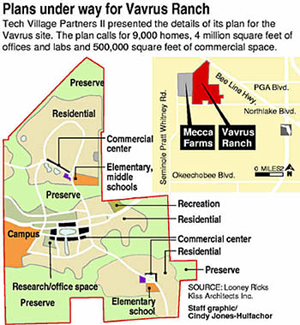

As the BCC considers the possible sale of the Mecca Farms property to the South Florida Water Management District, it is useful to consider the history of this site, and its relationship to the Vavrus Ranch which is just now being considered for development. (See: Blockbuster deal for Vavrus Ranch in the works)

The 1919 acre Mecca Farms, initially the preferred site for the Scripps Biotech industrial park, was to be accompanied by a residential development on the adjacent Vavrus ranch, presumably a “science ghetto” where the Scripps employees and their families would buy houses. Pushed by then Governor Jeb Bush and Commissioner Mary McCarty, the Business Development Board signed options for both parcels in 2003, prior to a final decision by Scripps. Scripps ultimately moved to their current Abacoa location when environmental lawsuits became a significant obstacle and a judge reversed the Corps of Engineers approval of the project.

According to Randy Schultz in the Post on May 25 (The best deal they’ll get):

Source:Sun Sentinel, 2/2005

As reported in the South Florida Business Journal in February of 2005, a division of Lennar held a joint option with Centex to buy Vavrus and planned 9-10,000 homes. The option was held by EDRI (Economic Development Research Institute), a nonprofit established by the BDB, who later transferred it to Lennar/Centex for $1.5M up front plus $51M on closing.

As reported in the Boca News on 8/3/2004, Mecca Farms itself was purchased by the county after a hastily convened meeting of four of the seven Commissioners voted 3-1 to proceed. Voting yes were Burt Aaronson, Karen Marcus and Mary McCarty, with Addie Greene voting no. The reason for the haste was that then Clerk Dorothy Wilkin was holding $1.4M of funds intended to clear the citrus trees off the site and the commissioners wanted to proceed.

Development got started early too, with Catalfumo Construction hired to build the roads on the site, and AKA services to build a 9 mile water pipe extension along SR7, 40th Street, 140th Street North and Grapeview Blvd. In total, the county spent $40M on planning and site prep and $51M for the pipeline, in addition to the $60M for the land.

The 2009 Grand Jury Report on public corruption in the county had this to say:

“The county eventually purchased the 2,000 acre Mecca Farms grove site for approximately $60 million dollars. Palm Beach County paid $30,000 per acre for land that credible evidence indicated was worth a maximum $10,000 to $15,000 per acre. With improvements to the site and area, the county expended approximately $100 million dollars to acquire and improve the Mecca site. Ultimately, Mecca Farms was never approved for development and the Scripps project was sited and built near Abacoa in Jupiter. Palm Beach County now owns and maintains at taxpayer’s expense the 2,000 acres of unimproved and undeveloped property known as the Mecca site.”

“The Mecca site transaction and other transactions lend credence to the perception of cronyism, unfair access and corruption of the land acquisition process. The Grand Jury repeatedly heard testimony of intense political pressure put on local government in land deals. Witnesses referred to the political atmosphere surrounding land deals as being a feeding frenzy.”

“The Grand Jury finds that a glaring deficiency in how land deals are handled by Palm Beach County is the overvaluation of property for purchase and undervaluation of property for sale or trade. A number of witnesses testified that when the county buys property, it overpays, and when the county sells property, it sells too cheaply. The Grand Jury examined a number of documents, received testimony and reviewed reports that support this buy high and sell low charge.”

The current offer for Mecca is $30M in cash plus about 1700 acres of land puported to be worth $25M. Mecca is appraised in the PAPA database at about $50M. The $30M cash is not sufficient to pay off the remaining $45M in debt incurred in the Mecca purchase (with $6.5M / year in debt service), nor will it recoup the $91M investment in infrastructure.

Vavrus is carried on the PAPA books as owned by WIFL, LLC. It is split into 11 parcels with a total 2011 appraisal of $68.5M and a taxable value of less than $1M.

With a Vavrus development now being considered, it would be helpful to know if the pipeline costs can be recovered by supplying the new development, and what affect (if any) a large development next to Mecca would have on its appraisal, and intended use by SFWMD for water storage.

The then ill-advised purchase of Mecca was rushed into without due diligence. Let’s not make the same mistake on its sale. In particular, let not a future grand jury say “..when the county buys property, it overpays, and when the county sells property, it sells too cheaply”.

A County Funded Hotel – Who Wins?

Today the County Commission voted 6-1 to allocate $57M ($27M direct subsidy plus $20M loan guarantee plus $10M cost of the land) toward a 400 room hotel next to the Convention Center. The county would actually own both the land and the building.

Who are the winners and losers in this “public / private partnership”?

First, let’s stipulate that the convention center needs a “headquarters hotel” to make it viable for more than the occasional home show or local meeting. It really wasn’t necessary for the hordes of dark suited businessmen to assure the commissioners of that fact, or that a viable convention center would be good for businesses in the vicinity. Even the Scuba Association and Lion Country Safari came to make that point. People who spend time at conventions can vouch for the fact that needing a 10 minute shuttle ride to and from an event is not conducive to networking or making the most of the convention experience.

Second, lets also stipulate that some amount of public money or other incentive is probably necessary to launch the project, given that nothing is happening without it.

Third, lets acknowledge the fact (that Commissioners Aaronson and Santamaria have done in some detail) that as a business deal, the current proposal is a perfectly awful investment that no sane person would make willingly. On a monetary basis, the county will not see returns for a long time (if ever), and neither the county nor the city of West Palm Beach stand to receive ad-valorem tax revenue on the hotel property.

The winners in this deal are the developer and operator, who have much of their risk assumed by the taxpayers, the businesses in the immediate vicinity that will see increased revenues from conventions (Kravis Center, City Place, Clematis Street, perhaps the Palm Beach restaurants), and the Town of West Palm Beach which would experience growth and an increased tax base from rising valuations associated with new business (even if they get no taxes from the hotel itself). The county commission is also a winner in a moral sense as there would be vindication for hatching a white elephant if it can be made successful,

The losers are the taxpayers who assume the risk of failure (what if they don’t come?), and default on the development loan, and the several million dollars a year of general fund interest payments on the bonds. Bed tax revenue, which can be expected to increase, is restricted in use and cannot offset the drain on the general fund.

Some specific problems we have with the funding plan:

1. Regarding the $20M loan guarantee, think Solyndra. It is similar in two ways – taxpayers take the fall on failure, and the deal pays the taxpayers last as the county sees no revenue until the operator has recouped 10% of their investment or $7M. Solyndra was heralded as a great investment – until it wasn’t.

2. The benefits accrue in geographic proximity to the hotel and flow mostly to West Palm Beach. Yet the citizens of Boca Raton, Jupiter, Wellington and others are asked to pay for it through their property taxes.

3. The existing hotels in the area have large meeting rooms and can support “small” conventions, perhaps to the 500-600 range. The Convention Center is designed to handle up to 6000 according to its website. It is difficult to see how a 400 room headquarters hotel would be make a dent in meeting a need of that size. At some point we expect we will be asked for more money because “the center needs a BIGGER hotel to make it viable”, and the developer does not have the business plan to expand.

4. The data presented to support the project assumptions seem optimistic. The 75% occupancy, the percentage of public investment in convention center projects, the estimates of convention business, the effect on the surrounding area – none of this feels right. Is convention activity nationwide growing? Some studies suggest not. If not, are we poaching from Fort Lauderdale? From Boca Raton? Only public/private projects were included in the averages for amount of public investment for convention center projects. Are there some success stories without public investment? If so where and why? Since the county taxpayers are shouldering the lion’s share of the risk, have the risks been understated? We will be examining these “projections” in a future article.

Today it was wishful thinkers 6, taxpayers 1. Thank you Commissioner Abrams for not drinking the kool-aid.

County Adopts New Financial Standards

The county commission today discussed and approved new accounting standards for the next budget year that will adopt a more standard accounting methodology, making comparisons with peer counties possible (perhaps). For a full description, CLICK HERE.

Highlights included:

- Adoption of GASB 54, reporting spendable fund balances in 4 categories, possibly providing more transparency. During the discussion it was stated that since Hillsborough is already using this standard, it was not possible for TaxWatch (or anyone else apparently) to compare the currently reported Palm Beach County reserves to theirs. John Wilson mentioned they have had numerous discussions with TaxWatch on the subject since the budget hearings and that TaxWatch now “understands” their reserves, but the county is going back and looking at each capital project balance in more detail.

- Adoption of a “target” debt limit of $1200 per capita (which we are very close to at the present time). This is county only, not including SWA bonds. Additionally, debt service payments, exclusive of general obligation and self-supporting debts, will be no more than 5% of governmental expenditures.

- A policy proposal to consider voted General Obligation bonds over non-voted revenue bonds for future borrowing. As you might expect, this was not very popular but Steve Abrams suggested that projects could be “bundled” to make them more attractive to the voters. Karen Marcus indicated that was done in the past for Parks and Recreation.

- A non-specific proposal for departmental “Performance Measures” that could be used to compare to outsourcing alternatives and aid in evaluating department requests for increased funding. Bob Weisman suggested that there already were measurements in place but several commissioners were outright skeptical. Commissioner Vana thought that we can only take “baby steps” in this direction, but that measurements could also be used to consider “in-sourcing” tasks where the county can do it much better than a vendor. No examples were given.

Bob Weisman’s Response to TaxWatch Study

NOTE: The TaxWatch study was made available to commissioners and staff prior to their press release. This is the initial response from County Adminstrator Weisman.

From: Robert Weisman

Sent: Wednesday, September 07, 2011 9:01 AM

To: BCC-All Commissioners

Cc: Lisa DeLaRionda; John Wilson; Audrey Wolf; Ross Hering; Robert Weisman; Brad Merriman; Denise Nieman; George Webb; Joe Bergeron F.; Jon Van Arnam; Liz Bloeser; Shannon LaRocque; Steve Bordelon; Steve Jerauld; Verdenia Baker; Vince Bonvento

Subject: TaxWatch Report on Reserves and Property

You have been provided with a “draft” copy of a TaxWatch report on Palm Beach County that concentrates on our financial reserves and property. We have been able to give this only a cursory review since we were given access to it last night. The following are some brief comments in case you are asked about the report.

The financial reserve discussion appears very similar in opinion to the report that was issued 5 years ago. There does not appear to be anything in the reserve discussion that would affect our proposed budget. The funds they speak about are from multiple sources (impact fees, special revenues, bonds, general fund, etc) which are allocated to multiple projects. The only way funds could be made available to help balance the budget would be to eliminate and de-fund general fund projects that we have deemed necessary. We routinely examine project status and one of the ways we have balanced our budgets over the past few years is by taking money from completed or other projects whenever justifiable.

There would not appear to be anything new in the property portion of the report. Mecca is by far the largest asset we have, which it appears makes up 1/3 of the property they are talking about. The practicality and wisdom of selling our limited marketable property at this time is questionable. The numbers sound big, the reality is different.

We will evaluate and respond more fully after the final report is issued and we can review it in detail. If it discloses anything that can be useful in our budget balancing efforts, I can assure you that we will so inform you.

Florida TaxWatch Report on County Reserves, Debt, and Property Utilization

At the request of the Palm Beach Civic Association, the Palm Beach County Taxpayer Action Board, and the Town of Palm Beach County Budget Task Force, Florida TaxWatch conducted a study of several aspects of Palm Beach County Finances.

In addition to an analysis of the county debt and reserves compared to our “peer” counties – Miami/Dade, Broward, Hillsborough and Orange, updated from their similar 2006 report, they also investigated the quantity and status of unneeded or underutilized property owned by the county.

The complete report is available HERE. What follows is a summary of the major findings.

Major Findings

1. County Fund Balance (“money in the bank”) is excessive

- The commonly accepted fund balance levels (unreserved) as a percent of expenditures for a government entity is 15%. Locally, 25% is considered prudent for hurricane preparedness. Palm Beach County has maintained a balance exceeding 50% over the last six years. Bringing this level down to even 40% would free up $188M of “excess reserves” that could be used for current spending, thus avoiding a tax rate increase through several cycles to come.

- Peer counties retain AAA bond rating with considerably less reserves

NOTE: This finding supports point 4 of the TAB Proposal – Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties.

2. The County owns vast amounts of “Vacant” Property

- Of 2500 parcels owned, 353 parcels totaling 6200 acres are “vacant” – either unused or used for something other than their intended purpose

- Selling 25% of this vacant property would generate $54M in revenue and return $270K/year (unimproved) to the tax rolls

- Property record-keeping is unreliable and formal definitions and classification procedures are needed

NOTE: This finding supports point 3 of the TAB proposal – Take action to reduce the inventory of county property and reduce the debt.

3. County Office Space Allocation is overly generous

- Office size for executives and supervisors greatly exceeds state standards

- Reducing to standard could save $400K / year

In addition to these (and other findings), the TaxWatch team also made specific recommendations. Six were carried over from the 2006 study and are still relevant in 2011. The others are new and relate to the land and buildings aspects of the study.

Florida TaxWatch Recommendations

Recommendations from 2006 study that were not implemented:

- Establish a fixed cap on reserve funds as done elsewhere

- Implement a priority based budget process with performance metrics

- Adopt a budget reporting system that follows accepted standards and can be understood by the public

- Implement a Sunset Review process with automatic repealers

- Periodically rank all unstarted capital projects (partially implemented)

- Centralize services for constitutional officers

New Recommendations regarding property and buildings

Property

- Work with commercial realtor to plan and execute marketing plan to sell surplus properting over the next 18 months

- Institute formal definitions and procedures to identify “vacant”, “improved”, and “surplus” property

- Dispose of “strips” of land to adjacent property owners or bundle for sale

- Fully implement County Owned Real Estate (CORE) database and make available to the public

- Implement online marketplace to dispose of surplus property

- Apply full sunshine to property acquisition, exchange and sale process and separate from consent agenda

- Engage consultant to suggest utilization of surplus “right of way” property

- Incorporate vacant land disposition as part of County Comprehensive Plan

Buildings

- Require occupancy and vacancy rates of county assets be tracked

- Revise office space guidelines to align with Florida space allocation standards

- Make list of county owned buildings easily accessible to the public

Conclusion

TAB has argued that in this time of economic distress, tax hikes of any kind are counter productive. As the real estate bubble has deflated, the county has been increasing the tax rates in an attempt to prevent a decline in tax revenue. An alternative (in addition to the obvious – cut spending) is to buffer the shortfall with reserves accumulated during the “good” times. Not all government entities have that option as their reserves have been depleted.

The TaxWatch study points out that Palm Beach County is flush with reserves. Additionally, the county is carrying a significant quantity of unused or underutilized property that could be sold off over the next year or two, and the proceeds used to replace reserves spent to cover current spending.

It is our hope that the commissioners will agree and use this information to reject a tax rate increase for 2012.

Palm Beach Civic Association Sponsors TaxWatch Study

The Palm Beach Civic Association, in conjunction with the Town of Palm Beach County Budget Task Force (CBTF), is engaging Florida TaxWatch to perform a study of Palm Beach County capital expenditures, debt and reserves, and inventory of underutilized land and buildings. Funded half by the Civic Association with the other half being raised by task force member Jere Zenko, the project is scheduled to start shortly and be completed in time for use in the budget workshops during the summer.

TAB participated with TaxWatch and the task force (a TAB Coalition Partner) in defining the project scope.

Read the article on the subject in the Palm Beach Daily News: Civic Association helping town task force fund Florida TaxWatch study of Palm Beach County budget

The Florida TaxWatch Center for Local Government Studies conducts research projects and performs contract research of Florida City and County Governments and is located in Tallahassee. They performed a similar study under the auspices of the PBC Economic Council in 2006 which is available from their website HERE.

SWA Board Selects Babcock and Wilcox

The Taxpayers won again – just barely.

After a 9 1/2 hour marathon meeting at the Solid Waste Authority auditorium on Jog Road, the SWA board upheld their selection committee’s choice of Babcock and Wilcox to build and operate the $600M waste-to-energy plant that is the biggest taxpayer-funded project ever undertaken in the county.

This was good news for the taxpayer since on the “future value” method of comparison by SWA consultant Malcom Pirnie, Inc., the $500M B&W bid was considerably lower than Wheelabrator ($626M or 25% more) and Covanta ($779M or 56% more).

But the day was not without drama, ending as it did with a 4-3 squeaker that had Commissioners Marcus, Vana and Burdick seemingly acting counter to the evidence presented, to spurn the low bidder in an attempt to “renegotiate” a price with their preference – Wheelabrator – currently at $126M (25%) over the B&W price.

This curious move by the three would have repudiated the unanimous decision of the selection committee that was led by County Administrator Bob Weisman, their high priced consultant Malcom Pirney, Inc., and the entire SWA staff – all of which worked for months to evaluate the very complex proposals. Why would they do this? Some in the audience seemed dumbfounded as what seemed a clear decision was suddenly thrown into chaos. It came down to a union issue for Vana and Marcus – they made it clear that they didn’t like Babcock and Wilcox partner BE&K very much, having been unsuccessful in the past in trying to force the company into signing a collective bargaining agreement with a local union. It was not clear why Paulette Burdick voted this way and she offered no comment or explanation. Their motion was quickly questioned by Commissioner Aaronson who did not see the wisdom of rejecting advice of consultant and staff.

The day began with a sizeable protest on Jog Road in front of the facility, and the road was parked in for a mile from the site. The red-shirted protesters, banging on drums and waving signs in front of the facility entrance, all wore identical shirts indicating that they didn’t like B&W partner BE&K, and they “wanted jobs”. When asked which of the bidders they wanted to win, some of the protesters told us they didn’t know or care – just wanted jobs with as much pay as possible. They couldn’t tell us who the bidders were – even though their shirts clearly had the letters BE&K in a circle with a slash through it. They would not tell us if they belonged to a union – they just “wanted jobs”. Another with whom we waited in line to enter the facility, an experienced pipefitter, was more knowledgeable. He was protesting the BE&K practice of hiring skilled labor from out of state. “They are owned by Haliburton” he said – “and you know what they are like”. (Editor’s note – this was repeated by several speakers at the meeting but to our knowledge was never true. B&W was spun off last year from parent McDermott International, which has participated in some joint ventures with Haliburton.)

In the meeting, the morning was consumed by a challenge to the B&W selection raised by Wheelabrator. The Wheelabrator legal consultant presented a polished, well argued accusation of B&W bid process violations, largely a repeat of the points made (and rejected) in the selection committee meeting in March (Today, the Taxpayer Won), followed by B&W rebuttal and an hour long exposition of the finer points by SWA attorney. This was resolved after much discussion on a 5-2 vote for Commissioner Abrams motion to deny the challenge.

In the afternoon, the public comment session heard from about 50 speakers at 2 minutes each. There would have been more but word spread that the deputies at the entrance to the facility were turning people away, saying the meeting and parking lot were full. Chairman Vana asked the SWA staff to get that stopped and allowed latecomers to talk, even if they had not submitted a card. The speakers fell in several main groups – 16% wanted to stop the project altogether, 18% opposed BE&K, 29% supported BE&K, and 37% “just wanted jobs”, without indicating a preference for bidder.

Each vendor was then given 15 minutes to present, followed by questions by the board members. Some of the morning’s session was rehashed, but much time was spent on the local hiring issue, and the amount of skilled and unskilled positions each company had committed to fill with local labor. Commissioner Aaronson pressed them all for much higher numbers, much to the delight of the crowd. Commissioners Vana and Marcus challenged the BE&K representative to confirm or deny that their “business model” precluded them from hiring union labor, and referred to discussions relevant to another project. The answer was that they will hire anyone with the requisite skills, they just will not sign a collective bargaining agreement that prevents them from hiring non-union from the same trade. Commissioners Marcus and Vana did not feel that was sufficient and implied that failure to sign a bargaining agreement was equivalent to rejecting union workers. (There is clearly more to this story but a fuller explanation could not be discerned from the public statements.)

Commissioner Aaronson found the concept of renegotiating the price (the only attribute that can be discussed under the terms of the RFP) as unfair as it allows another trip to the well. He questioned Covanta on why their bid was $279M higher than B&W and received “we made a mistake” for an answer. Indeed. Commissioner Taylor drilled in on some of the issues raised earlier in the challenge, particularly the partnership relationship between B&W and BE&K, and their insurance arrangements. Commissioner Santamaria pointed out that very few environmental organizations were objecting to the plant, including some he had specifically contacted. Commissioner Abrams on several occasions brought perspective to the discussion, reminding the others that the technical differences between the proposals were slight, the costs differences vast, and the local hiring percentages in the bids actually favored B&W over Wheelabrator.

It was a thorough and long session, and when it came time for a vote, Commissioner Taylor moved that B&W be “conditionally” awarded the bid, subject to firmer statement on local hiring. SWA Attorney pointed out that the terms could not be renegotiated, so Commissioner Abrams introduced a motion for outright award and Taylor seconded. It was at this point that commissioners Vana and Marcus said they could not support that motion and introduced their own – to award Wheelabrator and renegotiate the price. There was some surprise at this, both on the board as well as in the audience. After some additional arguments on all sides, Commissioners Aaronson and Santamaria joined Abrams and Taylor and voted to adopt staff recommendation for Babcock and Wilcox and the deed was done.

Another win for the Taxpayer.

County Votes to pay 35% of cost of Convention Center Hotel

This morning, the Board of County Commissioners voted 4-2 (Marcus/Aaronson/Vana/Burdick in favor, Abrams/Taylor against, Santamaria absent) to “conceptually approve” a county subsidy of $27 Million to The Related Companies to build a 400 room Hilton next to the convention center. They also approved $200,000 from the General Fund Contingency Reserves to fund consultant and legal services to further develop the proposal.

While most would agree that a hotel is needed to support the viability of the county-owned convention center (The Marriott across the street is considered too small to support large gatherings), the fact that no private entity was willing to take on the project without this large subsidy should be a red flag. The $27M is in addition to another $8M that the planners hope to get in the form of federal “New Market” funds (which may have to come from the county also) which together make up about 35% of the total cost of the $101M project.

So what does the county get for putting up 35% of the cost of the project and the use of the county owned land?

An ownership stake or revenue sharing? NO.

Jobs? – Yes, 350 construction jobs for 2 years and 300 permanent, low-wage hospitality sector jobs. (In other words, $35M buys 300 jobs at $117K per job – and those jobs will pay about a quarter of that.)

Ongoing tax revenue? – Yes and no. The annual $2.2M bond interest on the $27M ($2.7M if on the hook for $35M) is to be a recurring expense drawn from the ad-valorem funded General Fund, while bed tax revenue from the hotel would be restricted to non-ad valorem TDC programs.

Commissioner’s Aaronson and Marcus raised the issue that they were not able to bring the Florida Association of Counties convention to PBC because the convention center support infrastructure is lacking. This may be true, but Commissioner Abrams pointed out that the much larger Florida League of Cities has come to the county many times – although to Boca Raton instead of West Palm Beach. Both Commissioner Abrams and Taylor raised issues with adding this additional burden on the budget every year at a time we are striving to reduce spending, and pointed to the drain that the Scripps subsidy is to our current budget. Of course they were not on the commission when the convention center decisions were made. Commissioners Aaronson and Marcus on the other hand (who were) have invested their reputations in those decisions and of course want to spend more money to vindicate the original move.

Many people came forward to speak in favor of this project, particulary those in West Palm Beach who will clearly benefit. The Mayor was absent, but it was said she “supports the project”. I would hope so – having all the county taxpayers fund what will mostly benefit her city is quite a boon.

The decision is for “conceptual approval” and commits only the continuance of the planning, yet it is a clear ‘GO’ signal for the project.

We believe that for the county to have a successful convention center, a nearby hotel large enough to service a capacity convention is necessary. That said, for the county to contribute 35% of the construction costs and get no direct return on investment sounds like compounding an error. You may recall that the original proposal for the convention center never projected a county subsidy for a hotel, assuming that it would be a profitable project for the private sector. We would have preferred a smaller subsidy by the county, some contribution from the City of West Palm Beach, and a return to the General Fund of some of the subsidy, perhaps by converting a portion into a loan. Although some of the $1M in annual subsidy for the convention center itself could be reduced by an improvement in business, there are no guarantees.

The Taxpayer did not win today. Thank you Commissioners Abrams and Taylor for having the courage to try to stop this train.

Today, the Taxpayer Won

4/1/11 Update: Wheelabrator has decided to protest the bid and will be heard at the SWA Board meeting on 4/13 at 9:00. They will have 45 minutes to make their case and B&W will have an equal time to rebut. See Agenda for more information.

Low-cost bidder Babcock and Wilcox recommended by committee for SWA mass burn plant.

This afternoon at the Solid Waste Authority Visitor’s Center on Jog Road, the committee tasked with selecting one of the three responders to the Waste-to-Energy plant RFP met to pick a winner to recommend to the board. The three potential vendors are Babcock and Wilcox Power Generation Group (Barberton, Ohio), Covanta Energy (Spring Hill, Florida), and Wheelabrator Technologies (Hampton, New Hampshire). B&W team member BE&K operates the existing county burn plant and Wheelabrator operates one in Broward.

TAB has not been actively following the SWA budget, but when one of the teams representing a responder suggested we take a look at how the county was about to spend $800M (the bonds having been already sold), we decided to do a little research and attended the meeting.

Last month, the 7 member committee, which includes County Adminstrator Bob Weisman and Gardens City Manager Ron Ferris, scored the proposals on their technical merits, and today heard the cost side of things. Technical scoring evaluated 10 attributes and assigned scores out of 100, and considered the design, aesthetics, energy efficiency, operations and maintenance, as well as the amount of local hiring projected. Three members selected Covanta as their top choice, 2 for Wheelabrator, and one for Babcock and Wilcox, but it needs to be said that all vendors scored better than 90% in aggregate and there were no disqualifiers.

The financial attributes were analysed by a computer model created by SWA Consulting Engineer Malcom Pirnie, Inc., and used a net present value measurement to take into account energy production revenue and maintenance costs over 20 years as well as the costs of construction. Construction costs varied from a high of $830M (Covanta) to a low of $606M (Wheelabrator) – a wide spread given the closeness of the technical evaluations. On the NPV measurement though, Babcock and Wilcox was the clear winner as they actually showed a positive cash flow of $171M from energy sales and yielded a $20M/year operating cost versus $28M for Wheelabrator and $24M for Covanta. The calcuated NPV was: B&W: $500M, Covanta: $779M, and Wheelabrator: $626M.

Fifteen minute presentations by the three vendors were given prior to discussion, and both Joseph Threshler of Covanta and Jack Ristau of Wheelabrator spent their time arguing that B&W should be disqualified for violating the procurement rules. They accused their competitor with changing the corporate makeup of their team after the original Statement of Qualifications (SOQ) was decided, and that their performance bond did not meet the requirements of the RFP. They also brought up design differences where they thought B&W was inferior – namely the location of the plant’s superheater and the cladding in the lower level of the furnace. One even suggested that B&W’s own engineering handbook “Steam” suggested their design was flawed.

John Kitto of B&W put the matter to rest, stating matter of factly that each of the procedural issues had been resolved with the evaluation team. He also pointed out that if they had used the 2005 version of “Steam” instead of the 1992 edition, they would know that the thinking about the issues had changed.

Discussion and analysis by the Malcom Pirnie team supported Mr. Kitto’s contentions, and in their opinion, the proposals were so close in technical merit that the cost estimate made the choice of Babcock and Wilcox clear. The seven members of the committee agreed and voted unanimously to recommend Babcock and Wilcox to the SWA board at their April meeting. If the board (which is made up of the seven county commissioners) agrees, the contract could be signed as early as May 1.

TAB has not researched the arguments that led the board to proceed with acquisition of the burn plant, but it is supposed to greatly extend the life of the county landfill and generate significant energy as well. Picking the clearly lowest cost of the alternatives would seem to be the logical choice and if the board follows the committee’s advice the Taxpayers will win.

It would defy logic for the board to decide against the unanimous opinion of their committee, but of course that will be a political decision. The board has the ability to reopen the cost question with the vendors and re-negotiate (something the committee could not do under the procurement rules). There were a large number of IBEW union members in the audience but since there was no public comment it was not clear which vendor they preferred. We do know that other unions (carpenters and ironworkers) have protested the current plant operator (BE&K – part of the B&W bid team) because they had brought workers from out of state.

We look forward to following the board’s actions at their meeting on April 13.