$725M County Budget Proposal Largest in History

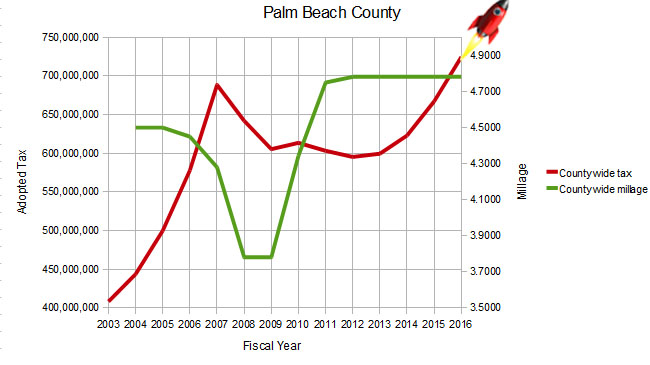

The county budget proposal, to be discussed in the first budget workshop on Tuesday, June 9 at 6pm, proposes flat millage at 4.7815 producing $57.5M in new taxes on rising valuations.

With property values having returned to 89% of the peak seen in 2007, this budget is actually $36M higher than the record set that year, making it the highest dollar value budget in the history of the county.

Coming on top of a $44M tax increase last year, during a time of negligible inflation and little population growth, the county is intent on taking a larger and larger share of taxpayer wealth. Many of the municipalities have already started talking about decreasing their millage – why not the county?

As usual, the Sheriff is claiming a big slice of this largesse, but the county-wide departments are also upping their spending. There is an across the board 3% “cost of living” increase on top of a similar 3% last year. Hiring is being turned on again with 66 new positions to fill. And $19M is targeted for capital projects.

Since the proposed millage is the same as last year, and there is a slight decline in the debt service, this budget will be presented as if it contains a slight tax rate decrease in aggregate. Don’t be fooled – at $725M, the proposed countywide taxes collected is both the largest total amount in history, as well as the largest dollar increase since 2007 at the peak of the bubble.

So what does this mean to the property owner?

Thanks to “Save our Homes”, the most that the taxable value of a homestead property can increase in a single year is 3% or the inflation rate, whichever is lower. This year the state has set the rate to 0.8%. With flat millage then, the homesteader’s tax bill increase is limited to less than 1% and much will be made of the fact that this is only a few dollars at most.

2015 Tax x 39% = homestead share

$667M x .39 = $260M

Allowable increase = 0.8% x $260M = $2.08M

Remainder ($57.5M – $2.08M = $55.4M)

to be paid by non-homesteader

who paid

$667M x 61% = $407M for 2015

and will pay

$407M + $55M = $462M for 2016

or + 13.6%

But what of the non-homesteader?

There are approximately 630K taxable properties in the county, of which 298K are homesteaded (47%), and last year these paid about 39% of the taxes. Using these figures we can calculate that the homesteader’s share of the $57.5M tax increase is about $2M or about $7 per parcel on average (see box). The remaining $55M will be paid by the non-homestead properties (both residential and commercial) and they will see an increase of about 13% over last year, or about $167 per parcel. Since some non-homestead properties are capped at 10%, those not so fortunate will pay even more.

From a historical perspective, the millage has been unchanged since 2012, when the county property valuation was about $125B. As it now sits at $152B, the county has been able to increase its “take” from the $595M in 2012 to this proposal’s $725M, up $130M, without having to increase the tax rate. How much different it was in the years leading up to the bubble bursting after 2007. For the years 2006, 2007 and 2008, as valuations climbed, a different set of Commissioners actually DECREASED the millage rate. Even though tax amounts continued to climb, their action resulted in lower taxes than flat millage would have produced.

It is clearly time to start decreasing the millage rate, even a small amount. Maybe this Commission should study the actions of their predecessors.

Let’s Be Honest about the “Biotech Cluster”

Yesterday, the Board of County Commissioners voted unanimously to void their interest in the deed restriction that would have prevented “Project Diamond”, the UTC techonology showcase proposed within the “biotech campus” on the Briger tract. The other government players – Palm Beach Gardens and the state (represented strangely enough by FDEP), concur. Scripps, while disagreeing that this is an appropriate use, is not strongly objecting. Kolter (of course), the NPBC Chamber and the Economic Council are all strong supporters.

As part of the complex and expensive (to the taxpayer) deal that brought Scripps to Jupiter, 100 acres adjacent to I-95 was set aside for use only by biotech related enterprises, all part of the vision for a “biotech cluster” in Northern Palm Beach County.

It would seem the deed restriction standing in the way of the UTC project has been cleverly sidestepped by the BCC and the other government players. They are not “ending the Biotech era” and blowing up the restriction you see, just making a one-time exception in a way in which Scripps cannot object. In Commissioner Hal Valeche’s words: “You get a bird in the hand like this, it doesn’t come along that often.”

UTC, being an excessively green “smart building”, that “fits the vision of high tech enterprise” may end up being similar to a biotech campus in meeting the 2003 goals, but avoiding the restriction is tacit agreement that the whole vision of the Scripps Project was flawed. “We’re not giving up on bioscience or biotechnology,” said Commissioner Melissa McKinlay. Surely not.

The Scripps Project, by most measures, has been a failure. Although Scripps itself has met their committment in terms of jobs created, the 40,000 related jobs promised when the deal was done have not materialized. The amount of public money that was spent to bring Scripps to Jupiter exceeded $1M for each job actually created.

The UTC HQ project will be a fine addition the county and the city, although the amount of cash and tax avoidance they are being given is distasteful to one who believes in free markets and fiscal responsibility. Clearing the way for them with a deed “exception” though is not being honest. Let’s just acknowledge that the Biotech vision was a failure and move on.

Maybe when Kolter brings their next non-biotech project forward they will finally admit it.

See: County OKs UTC HQ near Scripps

On Oversight, Checks and Balances, and the County Budget

Our system of government imposes an arrangement of checks and balances, so no person or group can acquire unchecked power.

When it comes to the county budget, Florida statutes clearly designate the legislative body – the county commission, to have the authority and responsibility to set priorities for spending and taxation. The administrator and his staff prepare a detailed budget, following whatever guidelines they have been given, and the commission meets in the sunshine for two workshops and two public hearings to discuss and adopt a budget before the fiscal year begins on October 1.

WIth $4B at stake, a bureaucracy exceeding 11,000 people, and limited time available, the commissioners themselves cannot physically evaluate every line item in this very complex budget, so they focus on insuring adequate funding for their own public policy priorities while much of the budget travels on automatic. Lower level line items like specific road projects, nature centers, or other items with a constituency, only get discusssed if the staff recommends a substantial change to the item.

What does get discussed every year is the Sheriff’s budget, since it is the major consumer of tax dollars, and outside the control of county staff.

Most everyone will agree that the function of PBSO – law enforcement, the county jails and courtroom protection, is necessary and should be adequately funded. The agency should have modern equipment suitable to the mission, and deputies and staff should be adequately compensated in line with peer agencies around the state and in the rest of the country, and it is the Sheriff’s responsibility to request a budget that delivers what he needs.

But what if his request is excessive?

In the county departments, managers submit budget requests that are a mixture of needs and wish list items. It is the nature of organizations to want to grow. The Administrator and his staff must adjust the requests of his departments in creating the overall budget, so that spending growth (if any) fits within the revenue expectations of the organization as a whole. If the priorities are not in line with the Commission’s expectations, they are free to make adjustments as a part of the process. Not all wish list items are funded. Although the other Constitutional Officers have a similar autonomy to the Sheriff, they usually “play nice” with staff and their budgets are rarely controversial. They are also relatively small.

The Sheriff’s budget is different. It is very large and complex, and very little detail is available to staff or Commissioners, and certainly not the public without a chapter 119 (open Records) request. The attitude is one of arrogance – “this is what I need and I am not willing to discuss it further.” Since the PBSO request must fit within the overall county budget, big increases there crowd out other county spending and severely limit the ability of staff or Commission to be fiscally responsible. Since they are charged with approving the budget, the public typically blames them for the excessive tax increases that result.

This year, many of the Commissioners told us privately that they agreed the Sheriff’s budget is out of control. They know they are responsible for approving his spending, but see no effective way to challenge him. This has been true for many years, as Commissioners have come and gone. While it is true that they have the statutory authority to reduce his spending (subject to appeal to the Florida Cabinet), they do not feel they have the political basis to do so.

This year, only Vice Mayor Paulette Burdick and Mayor Priscilla Taylor have publically questioned the Sheriff’s spending. This takes courage and we appreciate what they have said and done.

As for the others, they are hostage to an impressive political machine that can bring enormous pressure on wavering commissioners from the districts where the Sheriff provides most of the law enforcement. Just witness the array of speakers at the September 8 hearing – HOA Presidents, concerned citizens, even PBSO employees – all came out to speak the Sheriff’s praises and remind the Commissioners what the price of resistance would be. One particular Commissioner went so far as to admit that without the support of the Sheriff, their re-election would be in doubt.

There are about 1.3 million citizens of Palm Beach County. Almost 900,000 are voters. Yet only a small number of people follow what happens at the county, and fewer still participate in the process. We believe that most of the county residents would be surprised at the size and growth rate of the Sheriff’s budget, but they are not organized, and lack the time and assistance to provide sufficient cover to those commissioners who would act if they could. By carefully limiting the size of his increases, the Sheriff assures that we never reach that tipping point that would so outrage the citizens that they would spontaneously rise in opposition.

Some Commissioners have suggested that next year can be different, but we doubt it. As long as the status quo goes unchallenged, or the funding mechanism for the Sheriff’s office is modified through statute or charter, the Sheriff will continue to claim whatever portion of the county budget he desires.

Maximum Millage Adopted

Yesterday, the County Commission set the county-wide maximum millage at 4.7815, unchanged in four years. Reduced payments on county debt have very slightly reduced another line item called the “voted debt” millage, and they are trying to claim a slight reduction by combining the two rates, but I am sure you are not fooled. (See: Rate to ensure tax hikes for many in the Palm Beach Post, and Palm Beach County holds the line again on property tax rates in the Sun Sentinel.)

At this millage, rising valuations will generate an additional $44M windfall for the county over last years take, a hefty increase. It is not enough for some commissioners though – Shelley Vana and Mayor Priscilla Taylor argued strongly that there are so many additional things they would like to spend money on, that we should actually increase the tax rate. Commissioner Berger joined them in supporting Vana’s motion, but it failed 3-3 with commissioner Burdick absent. Hal Valeche and Steven Abrams argued against any increase, and Jess Santamaria joined them to defeat it.

We were surprised by this attempt to raise the rate, given the hefty tax increase already planned, and expected a pro-forma vote, coming as it did at the end of a long and involved commission agenda. As such, we did not participate in the meeting, nor call for others to do so. Only two members of the public spoke against the tax rate, Anne Kuhl and Alex Larson.

The $44M tax increase (more than $63M in aggregate, when Fire/Rescue’s $14M hike is included), is too much, coming as it did after last year’s $22M hike. The September public hearings on the budget (September 8 and 22) are the time to make our voice heard on that subject. Although the maximum millage has been set (required to generate initial TRIM notices), the rate can be reduced in those meetings. Reductions in the rate of growth of some programs, particularly the Sheriff, are warranted.

2015 Budget – Flat Millage, what’s not to like? PLENTY!

The Palm Beach County budget proposal, published this week, is quite remarkable. Not since the bubble years, when inflated valuations drove out of control spending, has there been a budget proposal of this size. Rising valuations should allow a modest return to the taxpayer through lowering the millage. This proposal, while holding millage flat, clearly notes that there are areas whose levels of funding they think are “unacceptably low”.

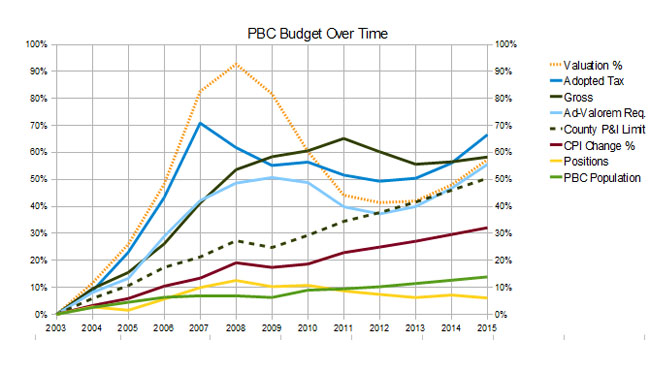

By almost any measure – the tax amount, ad-valorem equivalent spending, population and inflation (TABOR), the county apparently believes we have returned to the good old days.

While valuations have improved by over 6% this year, at $138.6B we are only at 82% of the peak year of 2008. Yet this year’s budget proposes to spend more than the all time record (on an ad-valorem equivalent basis) that occured in 2009, and collect within 2% of the record tax dollars levied in 2007.

When taking population and inflation into account, this year’s tax increase is more than DOUBLE the 3% that would be expected under TABOR.

What is driving this inflated budget? It is not hiring, as the overall staffing levels have declined slightly. It is not really the FRS contribution rate (less than 7% of the increase), or Palm Tran Connection changes (about 10%). A lot of it is pay increases for employees (3% across the board, on top of step and longevity raises in PBSO) which account for about $21M or half of the increase.

The big gorilla in the room of course is the Sheriff’s budget (as it usually is).

Sheriff Bradshaw seeks to spend $531M next year, supported by $467M from ad-valorem taxes. (The county budget proposal contains $5M less than this but the Sheriff has not agreed to the reduction). This is up from $499M (+6.4%) and $434M (+7.6%) last year. Since 82% of the Sheriff’s budget is personal service costs (salary and benefits), and staff growth is minimal (30 out of almost 4000), we can conclude that most of this increase is headed into the pockets of employees, as they will receive the same 3% that all county employees are scheduled to receive, plus contracted step and longevity raises.

Since 2003, PBSO spending has almost doubled (97%) while other county departments have only increased by a third – well within inflation and population measures. As measured by spending per capita, the Sheriff’s budget has increased by 73% from $195 per county resident in 2003, to $336 today. In 2003, the Sheriff spent 36% of county tax dollars and today that figure has grown to 48%.

Every year, adminstrator Weisman warns the commissioners that this growth of the Sheriff’s budget is unsustainable and at some point will crowd out all other county spending, yet as a group they never do anything about it. Some commissioners have pushed back – particularly Paulette Burdick and sometimes Mayor Taylor and Commissioner Abrams, but there have never been 4 votes to roll back his spending to a sustainable level.

There are a number of reasons for this. A cut to the budget for a constitutional officer (such as the Sheriff) can be appealed to the Governor. If an appeal is brought and the county loses, the budget goes into the next fiscal year with a large hole that needs to come from reserves. While the commission can cut the Sheriff’s appropriation, they are not allowed to say what specific items he should cut. He can therefore use his discretionary power to target areas of maximum political leverage. We have seen for example, how the threat to close the West Boynton substation will turn out COBWRA and others in force to pressure the BCC to restore the funds. We have also seen the PBA fill the commission chambers with red-shirted union members in solidarity with the Sheriff.

Unless there is a concerted effort by the public to raise their voices in opposition to the spending of this leviathan that is PBSO, we can expect no action again this year.

What can you do:

Attend the budget workshop on Tuesday June 10 and / or email, write or call your commissioner. Ask them:

1. Why has county spending returned to levels not seen since the real estate bubble.

2. To reject the Sheriff’s budget as submitted and return a portion of the valuation increase to the taxpayer in the from of a reduction in millage.

3. To consider providing raises to employees based on merit, rather than across-the-board or COLA increases

The bottom line is this – rising property valuations are not correlated with rising incomes among county residents. The growth of government spending should be “reasonable” – perhaps in line with population growth and inflation. There is no justification for a $40M tax increase in a single year.

Dodging a Bullet – No Sales Tax Referendum

In a 4-3 vote, the County Commission yesterday rejected a staff proposal to place a half penny “infrastructure” sales tax on the November ballot.

Criticism of the proposal, from TAB, the Economic Council and others pointed out the “grab bag” nature of the projects, the size of the increase ($110M) in relation to the current budget for Engineering and Public Works ($55M), ballot competition with the School System and the Children’s Services Council re-authorization, and the multi-year decision by the Commission to defer road and bridge maintenance in favor of other priorities.

In December, four of the Commissioners voted to proceed with the referendum and asked staff to bring back a more complete proposal. This time, Jess Santamaria changed his mind after hearing input from the public, and joined Steven Abrams, Paulette Burdick and Hal Valeche to kill the measure.

Shelley Vana, who complained about the state of roads in her district, declared “there is no free lunch” and wanted the “people to decide”. Mary Lou Berger, who sees a public safety issue in deteriorating roads, wanted to proceed with the option of re-thinking it in July. Mayor Priscilla Taylor, who considers the sales tax hike an “investment”, declared that our voters are smart enough to decide for themselves and we shouldn’t worry about what other taxing districts are doing.

Hal Valeche thinks that road and bridge maintenance should be prioritized in the normal budget cycle, and Paulette Burdick didn’t think the public would see this as higher priority than the School’s needs or the CSC. Steven Abrams thought it was a “tax in search of a topic” and captured the situation clearly when he said he couldn’t see people standing on the sidewalk with signs saying “Vote for Drainage, Vote for Road Repair.”

As this is the third try since 2012, we can’t be sure it will not come back, but for now it looks like the proposal is dead for 2014.

Thanks to those who spoke against the measure, including Alex Larson, Anne Kuhl, Daniel Martel of the Economic Council, Realtor Christina Pearce, and Fred Scheibl of TAB. There were no speakers in favor of the referendum.

For the Palm Beach Post Story, see County rejects sales tax ballot bid

PBG Candidate Forum Synopsis

Overlooking the Obvious? Observations from the Palm Tran Connection Workshop

Good summaries of the 2/28/14 BCC workshop to discuss the future direction of Palm Tran Connection were written by Joe Capozzi in the Palm Beach Post and Andy Reid in the Sun-Sentinel.

We are generally in support of the direction given by the Commission to:

- Pursue multiple contracts in lieu of a single-source vendor, since competition will enhance responsiveness and flexibility.

- Bring dispatch in-house – this may not be quite the salvation for which BCC voted….see below.

- Purchase the vehicles for lease back to the vendors. We see the opportunity for flexibility cited as well as cost savings.

- Free rides on fixed route service for ADA/TD qualified.

- Explore the future use of vouchers and taxis to enhance/expand capability.

But something appears to be lacking in the conclusions drawn in much of the coverage and discussion of Palm Tran Connection and the poor performance by the current vendor, Metro Mobility. That ‘something’ which seemed apparent throughout the workshop was ‘county oversight and accountability‘. The various reasons for perceived unacceptable service were listed dispassionately and without any chagrin or admission of responsibility. Many of these ‘issues’ did not require BCC direction but could or should have been accompanied by firm action plans .

A few examples:

Chaotic dispatching and adherence to schedules was impacted by several issues

- Drivers unable to locate the rider – going to wrong location or lost in a community

- Riders without appropriate ‘personal care attendants” thus driver leaving the vehicle to assist the rider into the appointment location

- Driver waiting for a facility to open (eg rider can’t get in)

- Riders who can’t be left alone due to their disability

Only Commissioner Berger seemed to question the lack of required personal care attendants. Everyone else seemed to take for granted that these were missteps by Metro Mobility. If an ADA or TD qualified rider needs a personal care attendant then the County, who handles the qualification process, should have confirmed that such an attendant accompanies the rider. To have a driver take on 1) liability 2) leave the vehicle unattended 3) abandon schedule in order to perform personal care functions is certain to impact all of the other riders. Is there something in the regulations that absolves the rider (or the County in the qualification process) from responsibility for their part of the bargain?

There is a difference between door to door service and a driver replacing the companion role. As was pointed out in the meeting – if the rider were able to take fixed route service – they would be dropped off and that’s it. Even a taxi doing door to door would not wait for place to open etc. So perhaps the biggest issue to the level of service is that the drivers are going beyond what can reasonably be expected.

Taking vehicles out of service to accommodate school trip requests (primarily Charter schools)

Commissioner Abrams rightly questioned that the PBC School system isn’t involved in this. And is it not obvious that if vehicles are taken out of a route that service and schedules will suffer? Once again – these are decisions that were made by the County and not Metro Mobility.

It was perceived that bringing dispatch in-house (recommended by staff, consultant and voted unanimously by commission) would solve the above issues. But one could ask – what will change? The County staff was responsible for oversight in any case – so if policy changes are not made to solve these problems, in-house dispatch will not alleviate the problems.

Poor state of equipment

Commissioner Vana did her own investigative work to confirm the poor state of equipment and raised the alarm over conditions. But why was that necessary? Was not the administration responsible for oversight and inspections? Purchase of the vehicles by the county may result in savings, which is great! But this does nothing to solve the vehicle maintenance issues. Periodic inspections by the County will (and should have been) vital to assessing compliance with legal and contractual obligations for vehicle maintenance.

Need for a strong and specific contract

Several times during the workshop the need for a strong contract (or contracts) was mentioned by staff. OK – whose fault is it if there wasn’t one in place already? Surely not the vendor’s….

Administration has made management changes and they clearly may have been warranted. But until the County takes full responsibility for the current state of affairs – dramatic improvement in Palm Tran Connection performance may be a long time in coming.

Dark Cloud of Sales Tax Referendum Hangs over the County

A “half-baked” proposal with a “half-hearted” sales pitch. That could describe what was brought before the commission yesterday. After the initial plan of a 6 year tax hike divided up among the School District, County and Municipalities fell apart when the School Board declined, a reduced proposal for 3 years and a 60/40 split between the county and cities was floated.

It was clear that Administrator Bob Weisman’s heart was not in it. We can only assume he was given direction to dust off the shaky proposal from May 2012 and make another try for the 2014 election window. There are some on the Commission, most prominently Mayor Taylor, who are not happy that our sales tax burden is not as high as some other Florida counties. We are leaving money on the table after all. After some modest pushback by the board, Mr. Weisman wisely suggested tabling it (unsuccessfully) for another two years.

About a dozen members of the public spoke on the issue, most against. In favor were a few folks who wanted some of the money directed at beach maintenance and Mayor Wilson of Belle Glade, who wants more tax dollars sent to the Glades cities. Others, including the Palm Beach Civic Association, the Economic Council, and TAB, objected to the unfocused wish list of non-urgent minor projects presented as the reason for the tax. In the words of one speaker: “..parking lots and drainage ditches, guardrails and other anonymous improvements, spread around the districts and the cities presumably to spread the wealth around..”.

With the exception of Mayor Taylor, who was enthusiastic for the prospect of more tax dollars, the rest of the commissioners found fault with the proposal. Commissioner Santamaria thought it wasn’t needed if we could restore the impact fee cuts. Commissioner Valeche was against it from the start but defended the impact fee cuts as pro-growth. Commissioner Vana agreed with the speaker’s view of the unfocused list, calling it a potpourri, and worried that an ill-formed proposal that would fail at the polls could poison the new tax well. Commissioner Abrams, calling it a “grab-bag” thought it too broad and that it would not pass. Commissioners Burdick and Berger both opposed the current proposal but would support more spending on roads and infrastucture.

An Abrams attempt to kill it outright (“don’t come back, regroup”) gained some support, but a Vana proposal to seek input from the business community and others for an acceptable plan in six months or so gained some traction (although Commissioner Berger would not focus only on a sales tax hike). The Mayor still wants it on the ballot this year though, so the motion that finally passed has staff coming back in a shorter time with a new proposal. The motion passed 4-3, with Valeche, Burdick and Abrams voting no.

Unfortunately, the dynamic that seems to be operating here is that a sales tax hike is good – just find an important enough project on which to market it. The “potpourri”, “grab-bag” and “wish-list” are clearly not up to snuff.

We would not oppose a sales tax increase that was accompanied by an equal reduction in ad-valorem taxes (ie. “revenue neutral”). We would not oppose a temporary hike for an urgent need such as relief after a major storm or other catastrophe. In this case however, it appears they are now “on the hunt” to find or create a project that could be used to justify the tax increase. That is putting the cart before the horse. Hopefully, if such a measure were to get on the November ballot, the county voters will not be fooled.

County Commission votes to penalize West Palm Beach and Riviera Beach over Inspector General Lawsuit

In a clever but unusual move, County Administrator Bob Weisman last night proposed $916K in additional spending over the July budget package that specifically excluded amounts requested for West Palm Beach and Riviera Beach by $70K and $50K respectively. This was a direct response to those city’s refusal to pay their share of the Inspector General budget. The proposal included additional spending of $916K – $400K for the YECs, $175K for the Pahokee Recreation center, and $341K for the Inspector General.

The additional $346K to cover the IG shortfall will come from the Solid Waste Authority ($100K), funds from the non-suing cities released by the Clerk ($262K), and $16K from other county departments.

Since the maximum millage was set in the July workshop to 4.7815 (unchanged from last year), the additional funding will come from reserves and tapping an additional $800K from the proceeds of the Mecca Farms sale to South Florida Water Management.

A motion by Commissioner Priscilla Taylor to restore the funds for the West Palm and Riviera YECs and provide an additional $40K for the Belle Glade YEC (requested by Commissioner Shelley Vana) was defeated 4-3 and the Weisman proposal was passed without change. Commissioners Valeche, Burdick, Santamaria and Berger rejected the change for a variety of reasons.

Hal Valeche said “The cities are taking us for a ride..”, and “By restoring this funding they are taking us for a further ride.” Commissioner Santamaria explained to the many children and instructors from the YEC who turned out to support their programs that “Unfortunately the YECs and the IG are connected”. He said that the cities could have opted to spend the IG money they are keeping on the YECs but declined to do so. Commissioner Vana, seeing her request for additional Belle Glade money “for the children” going down to defeat, said “It is disgraceful what we are doing here today”. “I am ashamed to be part of this board at this point.”

It should be noted that the 14 cities participating in the IG lawsuit owe $1.9M to the county – 90% of it from the 5 cities of West Palm Beach ($657K), Boca Raton ($406K), Delray Beach ($348K), Riviera Beach ($169K) and Jupiter ($142K). It is a positive step that the county should withhold grants and assistance to these cities while they are declining to pay for the IG services. The $120K at issue here is a drop in the bucket and it would be appropriate to raise the ante by challenging other grants to these five, in areas such as community development, environmental resource projects within their boundaries and social services. Money is fungible and amounts could be held in escrow while the litigation continues.

The final budget hearing will be held on September 23 at 6:00 PM.