County Tax Trends – Some Perspective

After several years of calling for flat millage, it is time to shift our attention to the tax dollars themselves.

Budget Hearings

Monday, 9/9 at 6:00pm

Monday 9/23 at 6:00pm

There is an old saying that “nobody washes a rental car”. When you own, it is more in your interest to maintain the value of your asset. Similarly, if a third party is paying for something that benefits you, you may not think about the “value proposition” or how much it costs because it is not your purchase decision. This is why health care inflation is high for procedures where a third party (government or insurance company) pays, but low for out of pocket items like plastic surgery or laser vision correction where you can choose the best value from competing practitioners.

When a government spends money, if it is directly tied to your tax bill you pay attention, but when the money comes from somebody else, “what difference does it make?”.

Spending at the federal level has been disassociated with individual income taxes for some time. With almost 40% of the federal budget coming from borrowed money, and less than half of the citizens paying federal income tax, it is hard to get too upset over another $10B for this or that, as it isn’t going to come out of your pocket any time soon. Even if it does concern you, federal taxation is difficult for a citizen to impact, given the way our Congress works.

Similarly, at the state level in Florida, with no income tax, a sales tax that is not out of line with other states, and much of state revenues coming from tourist taxes, state spending has little impact on the average citizen.

At the county and city level though, we are all aware of our property taxes (or our rent if we don’t own property). Over the years this link has been weakened at the county level as much spending is supported by user fees and “intergovernmental” revenue, which includes federal and state grants, and revenue sharing from sales tax, gas tax, and other sources. Currently only about 35% of county revenues (excluding fund balance) come from property taxes.

It is the changes in tax rates or taxes collected from you that you notice, not necessarily the level of county spending.

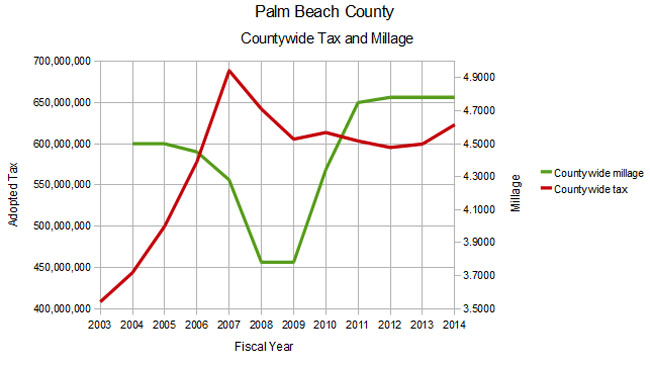

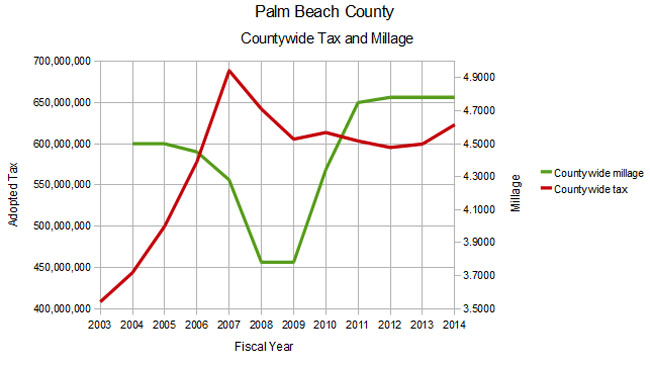

As the property valuations accelerated and hit their peak in 2007, tax rates were stable or declining, and the “wealth effect” associated with rapidly appreciating property masked the fact that taxes collected were skyrocketing. The adopted countywide tax in 2003 was $408M, but climbed to $689M by 2007. This was an increase of 13%, 16%, and 19% in the years 2005, 2006 and 2007 respectively, in a time when the millage or tax rate was decreasing.

The millage rate is widely reported. You see it on your TRIM notice as well as in the press coverage of the budget process. It wasn’t until this rate started soaring that people’s attention was drawn to it.

For the 2010 budget, adopted in September 2009, the millage increased by 15%. Many thought this outrageous, as our neighboring counties were booking much smaller increases, yet the countywide adopted tax dollars only increased by a tiny 1.3%. This outrage was widespread however, affecting the business community, realtors, grassroots groups and others, and led to the formation of TAB by the following year.

In 2011, in spite of some public opposition, the commissioners raised the millage yet again by 9%, but for 2012 – 2014 it was essentially flat. Taxes collected in those three years declined slightly until this year when a 3.9% increase (a $23M increase, most going to the Sheriff). TAB argued for flat millage during this period, and accepted another year of 4.7815, in spite of the increase in dollar amount. It is expected that this rate will be adopted during the budget hearings this month.

Governments do not typically throttle their spending voluntarily. Taxes and spending need to be scrutinized by the public, and objections raised when they get out of line. In a downturn (both in property valuation and lately in federal grants), it is in the nature of government to try to maintain spending levels rather than adjust them to match economic conditions if possible. Otherwise, programs have to be cut, layoffs are possible, and the recipients of government spending begin to organize.

We are now at a turning point. Next year, if valuations continue to rise, we will focus on tax dollars rather than millage, and argue that increases in spending should not exceed population growth and inflation measures. A millage reduction would be justified under that scenario. If valuations stay flat or decline, then we shall also oppose any millage increase.

County Proposes No Change to Millage, $23M Tax Increase

The July budget line item is included in the next scheduled BCC Meeting on Tuesday, July 16, which starts at 9:30am. It is item 5G-1 on the agenda and will likely be the last item of the morning session.

The first county budget proposal for fiscal year 2014, presented at the June 11 meeting, called for a millage increase to 4.8164 (up from the current 4.7815) and $25M in new ad valorem tax revenue – mostly to fund new spending proposed by the Sheriff.

While not definitive, the drift from the dais was that they would like to see flat millage (Abrams, Burdick, Valeche) and more spending on priorities like road repair and less of an increase to PBSO. Some commissioners, particularly Shelley Vana, didn’t want to be “penny wise and pound foolish” and thought that flat millage should “no longer be the holy grail”.

So we were pleasantly surprised to see that the July Budget Package is introduced under separate cover by Administrator Bob Weisman with

down to the current year 4.7815.

During the month interim, Mr. Weisman and staff were able to achieve this by:

- Seeing an additional $2.6M from increased property valuations

- Allocating an additional $2M from the proceeds of the $26M Mecca Farms sale into 2014

- Gaining $859,000 in concessions from the Sheriff – which is half of the remaining shortfall with flat millage.

He was also able to increase funding for some priorities, including:

- $1.6M for neighborhood road repaving

- $270K for the Palm Beach sand transfer plant

- $100K in additional funds for the Business Development Board

With the new assumptions, the flat millage proposal will generate a countywide tax of $623M, up $23M from the 2013 fiscal year, slightly less than the June proposal. As seen in the chart, this is a visible uptick from previous years, and is the highest tax collected since 2008, when the millage was at a low point of 3.7811.

Assuming that the valuation increase this year is a start of a trend, flat millage will no longer be acceptable going forward and we will be expecting substantial reductions. That said, the current proposal of flat millage appears to be a genuine attempt to satisfy the pent up spending demand, particularly for salary increases for county staff while not overly gouging the taxpayer. Historically, overall county spending is approaching a “TABOR” (population and inflation) projection from a 2003 baseline. (See Determining County Budget Growth – Why the Baseline Year Matters )

Assuming the BCC accepts the flat millage proposal, we do not expect to be calling for any taxpayer actions during this budget cycle.

Determining County Budget Growth – Why the Baseline Year Matters

For the last few years, whenever the county budget has been presented, growth has been charted based on the year 2003. Numerical comparisons were made to 2007 though, and this year even the charts are based on 2007. Does this make a difference? What do the two baseline years tell us about the growth in spending and how the county staff wants you to look at it?

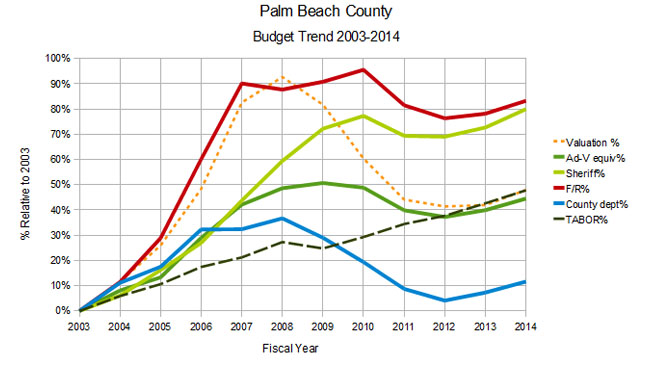

As you may remember, the middle of the last decade saw a real estate “bubble”, where average properties in the county became greatly inflated – sometimes doubling in only a few years. The year 2007 represented a leveling off of the valuation increases, with values 83% higher than they were in 2003. Valuations climbed a little more in 2008 (to 93% of 2003), and then began a rapid decline to the bottom in 2012 at 43% of 2003. Today’s levels are about 48% of the 2003 values.

Since county property tax follows property valuations, as you would expect, the county’s revenue and spending exploded during this runup period. In the four years from 2003 to 2007, the overall county-wide “ad valorem equivalent” (a measure of spending) rose 42%, led by Fire/Rescue which saw its spending almost double (90% increase). By adopting 2007 as their “base year”, the county would like you to overlook this rapid growth prior to that, and imply that the relatively flat spending since 2007 is “normal”.

Consider the following chart, based on 2003:

Chart 1 – 2003 Baseline

Chart 1 – 2003 BaselineThe dashed orange line shows the real estate “bubble”. Note that the Fire / Rescue spending climbed the “bubble”, but then stayed at the higner level as the bubble burst. The Sheriff’s budget did a similar thing, although their spending lagged a little. Both are up over 80% since 2003. Spending on the “rest of the county” (blue line) – including engineering, Palm Tran, community services, information systems, parks and recreation, and the other constitutional officers was the big loser, as the “total ad-valorem equivalent” (the dark green line) – which includes all county functions stayed as high as the taxpayers would accept, up 45% and ending at about where the valuations did. The dashed green line represents “TABOR”1, or the increase in spending that would be justified by changing population and inflation. Interestingly, the “total ad-valorem equivalent” ends about on the TABOR line, even though spending greatly exceeded it in the middle years.

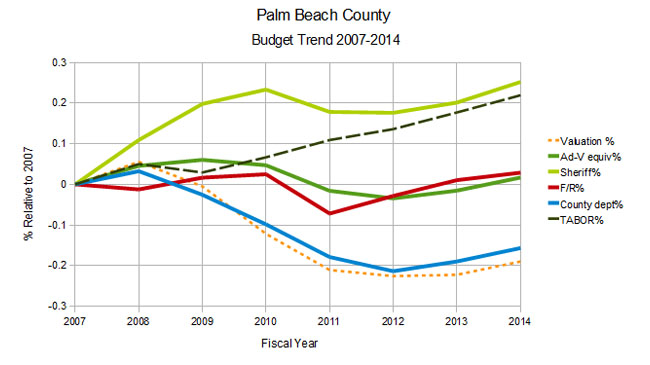

Now consider the next chart which uses 2007 as the baseline year:

Chart 2 – 2007 Baseline

Chart 2 – 2007 BaselineUsing the “bubble” spending levels as a reference, it appears that “total ad-valorem equivalent” is flat – exceeding the 2007 level by only 2%, and well below “TABOR”, and the county department spending has actually declined by 16%. Even the grossly inflated PBSO budget looks like it is converging on the “TABOR” line.

If you were the county administrator and you wanted to make the best case for fiscal responsibility, which chart would you use?

Baselines do matter.

There are many external factors that should determine the “appropriate” level of spending of tax dollars, such as the health of the overall economy, the declining average income in the county, the “artifacts” in the valuation numbers from foreclosure dynamics and demand for real estate by third party investors. From a strictly historical perspective however, most would agree that the spending growth in the years leading up to the bubble were wild and crazy. The great recession has brought some of the spending back down to earth as measured by inflation and population growth as shown on chart 1, with the notable exceptions of PBSO and Fire/Rescue.

With a 2003 baseline, county spending today looks almost responsible, and the case can be made without changing the baseline to obscure the rapid growth of government leading to the bubble. We hope that county staff does not plan to rewrite history.

1. TABOR is an acronym for “Taxpayer Bill of Rights”, a legislative approach tried is some states to control spending growth by limiting it to the inflation rate and population growth.

Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

This is the second in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

A recent article in the Sun-Sentinel found Orlando to be tops in the US for meetings July 2011-June 2012. “After Orlando, the company found the next most popular cities for meetings and events are in order: Washington DC, Las Vegas, Miami, Chicago, San Diego, Phoenix, Atlanta, Dallas and New Orleans.” “Miami is No. 4, Fort Lauderdale No. 30 and Boca Raton No. 43”.

So – let’s look at how some cities’ convention centers or HQ hotels are faring by looking at some recent 2010-2012 headlines…

Miami: Voters on Tuesday supported a Miami Beach bed tax increase to fund convention center improvements. But if and when a tax increase happens depends on city commissioners and a public corruption investigation. – August 2012

“The commission voted in December to bid out a $1 billion convention center district project that aims to have developers renovate the convention center, build an adjacent hotel and redesign and lease the surrounding publicly owned acres into an iconic complex. That project, however, remains in the early stages due largely to a public corruption investigation into whether the city’s then-purchasing director tainted the bidding process.”

Washington D.C: The sorry saga of the D.C. convention center hotel – Feb 2010

“I understand there may be reasons to subsidize a convention center hotel that agrees to set aside 80 percent of its rooms during peak season for low-margin convention business. But if the hotel really requires this much of a subsidy, then it raises a serious question about the economics of a project that, at best, is expected to increase convention spending in the city by $100 million a year. Right now, it looks as though the benefit of all those subsidies will be fully captured by convention attendees, the convention hotel’s developers and perhaps the owners of the city’s other hotels. If all goes well, the taxpayers will get their money back, but not much more.”

Ft. Lauderdale: Fort Lauderdale to take $13 million hit as it loses its biggest convention – July 2012

“Leaders at the Greater Fort Lauderdale Convention and Visitors Bureau said it’s unlikely that a single convention can replace the business lost from ARVO. So the bureau is working to bring in several smaller events that might fill as many rooms as ARVO: about 24,000 room nights a year.

But competition for groups is stiff because big convention center destinations such as Orlando and Las Vegas no longer wait for mega-events. They go after smaller conventions that pieced together can fill up their space — events that would more typically go to smaller venues.

“Fort Lauderdale competes with everyone in the United States, just as we do, as it relates to small and medium shows,” said Gary Sain, president of Visit Orlando.”

Daytona Beach, FL: If We Build More Will They Come? – June 2012

Raleigh, NC: Raleigh Convention Center: Throwing Good Money after Bad – February 2012

Boston, MA: Panel Proposes Convention Center Hotel – March 2011

Pittsburgh, PA: New Convention Center Hotel is Stalled – March 2012

Salt Lake City, UT: Salt Lake City officials Balk at subsidy for Megahotel – August 2011

Portland, OR: Oregon Convention Center Hotel Gets Another Chance at Life – August 2012

Virginia Beach, VA: Virginia Beach convention center hotel deal killed – February, 2012

There are many more articles for many more cities – but each story just confirms the speciousness of the arguments and the lack of metrics or proof of economic impact.

Some Background to the Mecca Farms Proposal

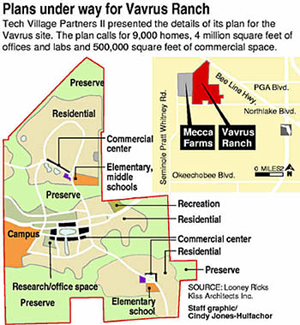

As the BCC considers the possible sale of the Mecca Farms property to the South Florida Water Management District, it is useful to consider the history of this site, and its relationship to the Vavrus Ranch which is just now being considered for development. (See: Blockbuster deal for Vavrus Ranch in the works)

The 1919 acre Mecca Farms, initially the preferred site for the Scripps Biotech industrial park, was to be accompanied by a residential development on the adjacent Vavrus ranch, presumably a “science ghetto” where the Scripps employees and their families would buy houses. Pushed by then Governor Jeb Bush and Commissioner Mary McCarty, the Business Development Board signed options for both parcels in 2003, prior to a final decision by Scripps. Scripps ultimately moved to their current Abacoa location when environmental lawsuits became a significant obstacle and a judge reversed the Corps of Engineers approval of the project.

According to Randy Schultz in the Post on May 25 (The best deal they’ll get):

Source:Sun Sentinel, 2/2005

As reported in the South Florida Business Journal in February of 2005, a division of Lennar held a joint option with Centex to buy Vavrus and planned 9-10,000 homes. The option was held by EDRI (Economic Development Research Institute), a nonprofit established by the BDB, who later transferred it to Lennar/Centex for $1.5M up front plus $51M on closing.

As reported in the Boca News on 8/3/2004, Mecca Farms itself was purchased by the county after a hastily convened meeting of four of the seven Commissioners voted 3-1 to proceed. Voting yes were Burt Aaronson, Karen Marcus and Mary McCarty, with Addie Greene voting no. The reason for the haste was that then Clerk Dorothy Wilkin was holding $1.4M of funds intended to clear the citrus trees off the site and the commissioners wanted to proceed.

Development got started early too, with Catalfumo Construction hired to build the roads on the site, and AKA services to build a 9 mile water pipe extension along SR7, 40th Street, 140th Street North and Grapeview Blvd. In total, the county spent $40M on planning and site prep and $51M for the pipeline, in addition to the $60M for the land.

The 2009 Grand Jury Report on public corruption in the county had this to say:

“The county eventually purchased the 2,000 acre Mecca Farms grove site for approximately $60 million dollars. Palm Beach County paid $30,000 per acre for land that credible evidence indicated was worth a maximum $10,000 to $15,000 per acre. With improvements to the site and area, the county expended approximately $100 million dollars to acquire and improve the Mecca site. Ultimately, Mecca Farms was never approved for development and the Scripps project was sited and built near Abacoa in Jupiter. Palm Beach County now owns and maintains at taxpayer’s expense the 2,000 acres of unimproved and undeveloped property known as the Mecca site.”

“The Mecca site transaction and other transactions lend credence to the perception of cronyism, unfair access and corruption of the land acquisition process. The Grand Jury repeatedly heard testimony of intense political pressure put on local government in land deals. Witnesses referred to the political atmosphere surrounding land deals as being a feeding frenzy.”

“The Grand Jury finds that a glaring deficiency in how land deals are handled by Palm Beach County is the overvaluation of property for purchase and undervaluation of property for sale or trade. A number of witnesses testified that when the county buys property, it overpays, and when the county sells property, it sells too cheaply. The Grand Jury examined a number of documents, received testimony and reviewed reports that support this buy high and sell low charge.”

The current offer for Mecca is $30M in cash plus about 1700 acres of land puported to be worth $25M. Mecca is appraised in the PAPA database at about $50M. The $30M cash is not sufficient to pay off the remaining $45M in debt incurred in the Mecca purchase (with $6.5M / year in debt service), nor will it recoup the $91M investment in infrastructure.

Vavrus is carried on the PAPA books as owned by WIFL, LLC. It is split into 11 parcels with a total 2011 appraisal of $68.5M and a taxable value of less than $1M.

With a Vavrus development now being considered, it would be helpful to know if the pipeline costs can be recovered by supplying the new development, and what affect (if any) a large development next to Mecca would have on its appraisal, and intended use by SFWMD for water storage.

The then ill-advised purchase of Mecca was rushed into without due diligence. Let’s not make the same mistake on its sale. In particular, let not a future grand jury say “..when the county buys property, it overpays, and when the county sells property, it sells too cheaply”.

A County Funded Hotel – Who Wins?

Today the County Commission voted 6-1 to allocate $57M ($27M direct subsidy plus $20M loan guarantee plus $10M cost of the land) toward a 400 room hotel next to the Convention Center. The county would actually own both the land and the building.

Who are the winners and losers in this “public / private partnership”?

First, let’s stipulate that the convention center needs a “headquarters hotel” to make it viable for more than the occasional home show or local meeting. It really wasn’t necessary for the hordes of dark suited businessmen to assure the commissioners of that fact, or that a viable convention center would be good for businesses in the vicinity. Even the Scuba Association and Lion Country Safari came to make that point. People who spend time at conventions can vouch for the fact that needing a 10 minute shuttle ride to and from an event is not conducive to networking or making the most of the convention experience.

Second, lets also stipulate that some amount of public money or other incentive is probably necessary to launch the project, given that nothing is happening without it.

Third, lets acknowledge the fact (that Commissioners Aaronson and Santamaria have done in some detail) that as a business deal, the current proposal is a perfectly awful investment that no sane person would make willingly. On a monetary basis, the county will not see returns for a long time (if ever), and neither the county nor the city of West Palm Beach stand to receive ad-valorem tax revenue on the hotel property.

The winners in this deal are the developer and operator, who have much of their risk assumed by the taxpayers, the businesses in the immediate vicinity that will see increased revenues from conventions (Kravis Center, City Place, Clematis Street, perhaps the Palm Beach restaurants), and the Town of West Palm Beach which would experience growth and an increased tax base from rising valuations associated with new business (even if they get no taxes from the hotel itself). The county commission is also a winner in a moral sense as there would be vindication for hatching a white elephant if it can be made successful,

The losers are the taxpayers who assume the risk of failure (what if they don’t come?), and default on the development loan, and the several million dollars a year of general fund interest payments on the bonds. Bed tax revenue, which can be expected to increase, is restricted in use and cannot offset the drain on the general fund.

Some specific problems we have with the funding plan:

1. Regarding the $20M loan guarantee, think Solyndra. It is similar in two ways – taxpayers take the fall on failure, and the deal pays the taxpayers last as the county sees no revenue until the operator has recouped 10% of their investment or $7M. Solyndra was heralded as a great investment – until it wasn’t.

2. The benefits accrue in geographic proximity to the hotel and flow mostly to West Palm Beach. Yet the citizens of Boca Raton, Jupiter, Wellington and others are asked to pay for it through their property taxes.

3. The existing hotels in the area have large meeting rooms and can support “small” conventions, perhaps to the 500-600 range. The Convention Center is designed to handle up to 6000 according to its website. It is difficult to see how a 400 room headquarters hotel would be make a dent in meeting a need of that size. At some point we expect we will be asked for more money because “the center needs a BIGGER hotel to make it viable”, and the developer does not have the business plan to expand.

4. The data presented to support the project assumptions seem optimistic. The 75% occupancy, the percentage of public investment in convention center projects, the estimates of convention business, the effect on the surrounding area – none of this feels right. Is convention activity nationwide growing? Some studies suggest not. If not, are we poaching from Fort Lauderdale? From Boca Raton? Only public/private projects were included in the averages for amount of public investment for convention center projects. Are there some success stories without public investment? If so where and why? Since the county taxpayers are shouldering the lion’s share of the risk, have the risks been understated? We will be examining these “projections” in a future article.

Today it was wishful thinkers 6, taxpayers 1. Thank you Commissioner Abrams for not drinking the kool-aid.

The July Budget Package – What Has Changed?

On Tuesday, July 10, the Commissioners will set the proposed maximum millage rate based on the July budget package prepared by staff, which recommends keeping the county-wide millage flat at 4.7815.

The agenda item will be discussed on Tuesday, July 10, at 2:15pm (time certain) in the county building at 301 N. Olive, WPB.

This rate is an improvement over the small increase in millage that was proposed in June, reflecting increased valuation estimates from the Property Appraiser.

Is this really an improvement over the June package as a whole? What about compared to last year?

We have opposed millage increases in the past as the valuations were decreasing, with the goal of seeing county spending return to levels that are sustainable as measured by population and inflation. Compared to 2003, the ad-valorem equivalent budget has approached the so-called “TABOR” line, but with valuations bottoming out, we begin a new phase where rising valuations should be accompanied by declining millage rates.

The following table compares millage, proposed tax and ad-valorem equivalent spending between the 2012 budget, the June package and this July package:

| 2012 Budget | June Package | July Package | Net Change from 2012 | |

|---|---|---|---|---|

| County-Wide | ||||

| Millage | 4.7815 | 4.7984 | 4.7815 | 0 |

| Proposed Tax | $595,388,733 | $599,257,607 | $599,618,457 | + $4.2M (0.7%) |

| Fire Rescue | ||||

| Millage | 3.4581 | 3.4581 | 3.4581 | 0 |

| Proposed Tax | $175,610,575 | $176,358,065 | $177,006,499 | + $1.4M (0.8%) |

| Ad-Valorem Equivalent | ||||

| County Wide | $280M | $283M | $284M | + $3.9M (+1.4%) |

| Library & F/R | $228M | $229M | $230M | + $1.8M (0.8%) |

| Judicial & Other | $5.1M | $4.8M | $4.9M | – .2M (-4%) |

| Sheriff & Const. | $439M | $444M | $444M | + $5M (1.2%) |

| Total | $952.1M | $960.7M | $962.6M | + $10.5M (1.1%) |

As you can see from the table, compared to June, the millage is less but the proposed tax is slightly higher. Compared to 2012, the proposed tax is $4.2M higher county-wide and $1.4M in Fire Rescue. But the biggest difference is on the spending side of the equation, with Ad Valorem Equivalent rising $10.5M over 2012, half of that at PBSO.

So here is our net:

Palm Beach County is not Wisconsin

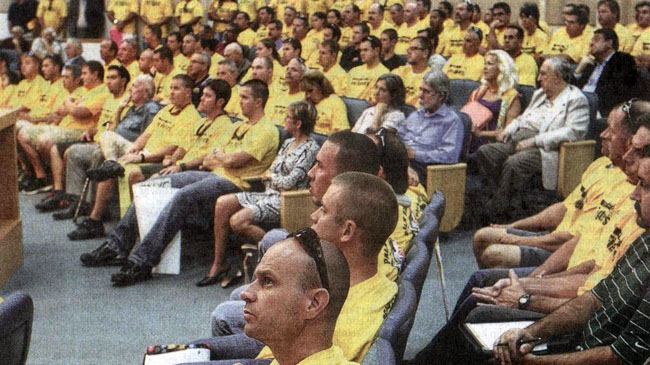

On Tuesday, a sea of yellow shirts packed the commission chambers. None of the shirt wearers, who are members of IAFF local 2928 as well as employees of County Fire Rescue, took the podium to speak. That wasn’t why they were there. As acting union President Ricky Grau spoke in favor of “three men on a truck” and accused the county of understating the amount of reserves they have to spend, the sea of yellow shirts were there to send a not so subtle message to the commissioners.

What was the issue that brought out the troops? They objected to the action taken by Chief Steve Jerauld and Fire Rescue leadership in April to reduce the staffing on some EMS vehicles from three to two under some circumstances. This has reduced the amount of paid overtime. The Chief has assured the Commissioners and the public that in no way had public safety been compromised by this move. The savings are estimated to be $7.8M per year. Although no vote was taken, and only Karen Marcus and Burt Aaronson spoke strongly in favor of restoring the three man crews, staff took that as marching orders and agreed to spend the extra money.

None of this discussion involves any increase in millage or other revenue enhancement, and we believe that drawing down “excessive” reserves – stipulated by all sides to be “at least” $50M is the right thing to do. We also agree with Commissioner Marcus that IF the county policy is indeed “three men/women on a truck”, then it makes more operational and fiscal sense to fully staff the positions rather than paying overtime to a reduced staff. But should a bona fide attempt by the Chief to save taxpayer money by increasing efficiency at no risk to public safety be so quickly rebuffed?

The IAFF is a political force in the county and elected officials cross them at their own risk. The Fire Rescue collective bargaining agreement expired last September and they are currently working without a contract after a year of “negotiations” that led nowhere. Both sides (to their credit) were not suggesting pay increases in this economy, yet a county proposal for a 22% reduction in starting salary for new hires was never even acknowledged by the union. To see the Commissioners buckle over a truck staffing rule before the yellow shirted troops does not bode well for any substantive discussions in the future.

Fire Rescue funding is headed for a showdown when the reserves can no longer be tapped. As some cities are near their millage caps, the Fire Rescue millage has been flat since 2010 and revenue has trended down with property valuations. Spending on the other hand, mostly driven by escalating personal service costs built into the existing contract, contines to rise. Something has to give. We think the overly generous pay and benefits (compared to Fire Rescue national averages) need to be addressed. That is not likely in the game plan though and it would not surprise us to hear more talk of sales tax surcharges in the years to come.

Wisconsin was a wake up call to the public employee unions. Perhaps some of Governor Walker’s courage will rub off on our elected officals too.

For the Palm Beach Post editorial on the subject by Andrew Marra, see: Fire-Rescue headed for a financial emergency

County Commission Forum – District 1 Primary Candidates

On June 18, eight grassroots, civic and political clubs came together to sponsor a candidate debate for the County Commission District 1 primary on August 14. Moderated by local radio personality Tom Boyhan, the three candidates were asked six questions of county-wide interest, chosen from a list of twelve that had been given to the candidates in advance. They were also asked for a brief opening and closing statement. Below you will find a summary of the event, with the questions, their answers, and a link to a video of that section of the forum.

Click on the candidate’s picture for a short biography.

The event was well attended, and quite a few elected officials joined us, including: District 1 Commissioner Karen Marcus, from Palm Beach Gardens Mayor David Levy, Vice Mayor Bert Premuroso, and council members Joe Russo and Marcie Tinsley, Juno Beach Vice Mayor Bill Greene, Tequesta Mayor Tom Paterno, Lake Worth Vice Mayor Scott Maxwell, Jupiter Inlet District Commissioner Patricia Walker, Republican State Committewoman Fran Hancock, and PBCGOP Chair Sid Dinerstein.

Sponsors of the event were the PBC Taxpayer Action Board and their coalition partners South Florida 912, Palm Beach County Tea Party, and Singer Island Civic Association, along with the Republican clubs of Palm Beach, Northern Palm Beaches, the Palm Beaches, and the Jupiter/Tequesta Repbublican Organization.

Dan Amero |

Harry Gaboian |

Hal Valeche |

Some pictures from the event.

TAB View of 2013 County Budget Proposal

In preparation for the first budget workshop of the 2013 cycle next week, the county has published their proposal. The workshop will be held on Tuesday, June 12 at 6:00pm in the county building at 301 N. Olive, WPB.

Unlike the last few years which Administrator Weisman has called “the most difficult budget year the county has faced”, bottoming valuations have created a less austere outlook. With the expectation of a barely perceptible 0.39% drop in property values reported by Property Appraiser Gary Nikolits, (See: Has free-falling Palm Beach County real estate finally hit bottom? ) the days of trying to save programs and spending levels by big hikes in the tax rate may be coming to an end.

The county proposal is therefore modest – a 0.4% hike in the county-wide millage rate to 4.7984 (up from 4.7815 last year), and a 0.6% or $3.9M hike of taxes collected. There are no projected cuts to “vocal constituent” programs like the nature centers, lifeguards or Palm Tran Connection, and even though the Sheriff is asking for an increase of $4.7M in ad-valorem revenue and $8.8M in appropriation, it is mitigated somewhat from a “return of excess fees” of $10M.

What had been expected to be a $15-30M problem this year, was positively affected by smaller than expected costs associated with FRS, and the use of “one-time” sources such as sweeping funds from Risk Management, capital project and Fleet Management reserves. Given TAB’s emphasis last year on using reserves to cover shortfalls in the difficult times, we are glad to see this development.

The entire proposal is good news, considering how hard everyone worked last year to bring the initial proposal (3.6% increase in rates) down to the final 0.6%. Although we think that it would be an appropriate gesture for the board to keep the millage flat (at a cost of the $3.9M hike), as they are doing with the Library and Fire/Rescue MSTUs, if this proposal was approved as submitted we would not object.

That said, there are some cautionary statements in the proposal. It is mentioned that 35 positions (half of them filled) will be eliminated without a service impact, by various good management practices and the expiration of grant funding of temporary positions. It is also stated that general county employees have not received a raise since 2008. There is also interest in some quarters to increase spending on some programs.

We ask that the commissioners not try to address these things in this budget year. The private economy has not yet fully recovered, even if property values are leveling off. Consequently, we call on TAB partners and supporters to stay vigilant, attend the budget meetings, and let your commissioners know you don’t support any increases above the submitted proposal.

For the Post’s view of the proposal, see: County budget proposal: less gloom and doom