“Half Baked” Tax Proposal put back in the oven for another year

“Half baked” – that is how Commissioner Steve Abrams described Bob Weisman’s proposal to put a $100M, half percent sales tax surcharge on the November ballot.

We agree. Even Commissioner Taylor, who seems to believe our money belongs to her (“We’re not exercising our RIGHT” to raise these taxes) thought the proposal needed a little more development.

Normally, county staff does a good job on budget proposals. We don’t always agree with their priorities, but they do offer justifications and complete analysis. This proposal seemed to drop out of thin air a week ago and postulated $100M more in revenues for unspecified “transportation” projects with no sunset. A vague suggestion of possible offsets to property taxes was contained in the agenda item, but there was no Powerpoint presentation, no forward projections, no discussion of the trends in existing transportation funding like the gas tax.

The commmissioners, to their credit, recognized the difficulty in selling such an open ended proposal and all wanted to table the issue until the staff could come back with a more thought-out package. Those that were OK with raising the sales tax (Taylor, Vana, Aaronson), wanted staff to return in a month so there would still be time to put it on the November ballot. Those not so keen on the idea (Burdick, Abrams, Marcus), preferred to table it until next year or indefinitely. Karen Marcus suggested that when the TriRail expansion occurs, we may need the money more than we do now. (Ouch !).

It is clear that if the proposal were to come back in a month, a lot of time and resources would have to be spent by TAB and others in order to develop counter arguments. With the budget workshops coming up in June, that would be a considerable distraction. It was starting to look at one point that we would have another 4-3 vote in that direction, but Commissioner Santamaria joined with the taxpayer-friendly commissioners to table the issue until next year.

Thank you to all who came to the meeting and spoke against the proposal, including Alex Larson, Pat Cooper, Fred and Iris Scheibl, Janet Campbell, Nancy Hogan, and Rick Roth.

TAB Note: The discussion of transportation funding has shined a light on the budget dynamics of Palm Tran, which we were astounded to learn is more than 90% subsidized. Since only a small part is ad-valorem funded, TAB has not paid it much mind in the past, but now it will get some scrutiny for sure.

Yet Another Taxing District?

Palm Beach County property owners are taxed in many ways. We pay separate tax rates for our cities, for our schools, and for the county government. We also pay for the county libraries, the Health Care District, the Children’s Services Council, and a variety of inlet and water management districts. If we live in the unincorporated areas we pay separately for Fire/Rescue.

Now there is a proposal to create yet another tax district – for the Office of Inspector General. Why this and why now?

It is raw politics.

Some Background

The Office of Inspector General was established in 2009 by the County Commission in response to the grand jury report investigating “Corruption County”. With many commissioners and lobbyists serving jail terms for abuse of the public trust, it was a correct response, and much effort went in to making the office “independent”. Hiring was performed by an independent selection board. Removal required the votes of the entire selection board plus 5 of the 7 commissioners. The budget was floored at an amount .25% of the contracts that vendors have with the county, and could not be reduced without 5 votes of the commission.

In 2010, a ballot initiative asked the voters if the IG jurisdiction should be extended to the 38 municipalities, with a proportional increase in funding to come from those entities. 72% of the voters agreed and the result was codified in the county charter after a six month effort by an ordinance drafting committee. The committee was composed of representatives of the county, the League of Cities, and the public, but much of the discussion was contentious. The cities objected mainly on two grounds – that the scope was too broad and that the purview of “waste, fraud, abuse and mismanagement” needed to be narrowly defined to limit what the IG could investigate, and that the funding formula based on a LOGER estimate of contract activity constituted an illegal tax. The ordinance draft did pass by a majority vote.

In 2011, after the IG began her work with the cities, the opposition began. Many cities passed local ordinances adding the definitions that were rejected by the drafting committee. A narrative was established that complying with the IG would be prohibitively expensive to answer their questions and fix any problems found. “The people did not know what they were voting for” became the operative justification for the opposition. Finally, in a major strike, 15 of the 38 municipalities filed a lawsuit claiming that the funding mechanism is illegal under Florida law, and refused to remit their obligated funding. Funds already provided by the municipalities that were not party to the lawsuit were sequestered by the County Clerk. A crisis in funding was at hand.

Recent Developments

On Tuesday, 3/20, a lawsuit “settlement proposal” negotiated by County Attorney staff was brought to the Commissioners. Under its terms, the cities would collect a contract fee of .25% levied by the county on their contracts, to be used for IG oversight of only those contracts. Contracts that predated 6/12 would be excluded, as would a long list of exempted contracts including large ones like FPL, waste collection and all federal grants. The IG office estimated that acceptance of this settlement would gut 60% of their budget, effectively limiting their oversight of the municipalities. After a large number of members of the public came forward urging rejection of the settlement, the commission voted 7-0 to reject it and move on to mediation.

On Monday 3/26, a joint meeting was held in the West Palm Beach City Hall between the County Commission and the representative of the municipal litigants. It was an august collection of the most senior public officials at the local level. While all professed to “support the IG”, and that the lawsuit was “just about the funding”, an objective observer could conclude that an independent Inspector General with free rein to investigate in the cities was not universally embraced.

Commission Chairman Shelley Vana correctly summarized that the intention of the ordinance is to provide for IG independence by having the governing body NOT control the IG budget. Mayor Muoio and the others see that as the crux of the problem – how can you be responsible for a budget if you can’t set the level of spending on a line item. Why, if the economy is bad, we may just decide not to fund the IG at all in a given year! Control of the IG budget is control of the office – just what the ordinance is intended to prevent.

During this meeting, West Palm Beach attorney Glen Torciva suggested an independent taxing district as the way out of the dilemma. Let both the county and the municipalities wash their hands of the funding issue and let the people decide. Of course a new taxing district would have to go on the ballot – perhaps this November. This is perfect for those who believe “the voters didn’t know what they were voting for” in extending the IG to the cities. Instead of asking “.. should we have an IG?” as in the 2010 question, we will ask ” .. should we pay more taxes so we can have an IG?” Maybe then the 72% of the voters who wanted to meddle in the affairs of our elected officials will think twice.

If you have any doubts about the motive here, consider Mr. Torciva’s statement to the Palm Beach Post:

Commissioner Burt Aaronson, a supporter of the concept, added (with a smile):

The creation of the Office of Inspector General and the Ethics Commission has gone a long way to correct our reputation as “Corruption County”. This latest attempt to neuter or eliminate the office proves that we still have a lot of work to do. The roughly $3.5M OIG budget would be equivalent to a 0.03 millage rate on our $120B property valuation – hardly worth the effort it would take to collect it. The current LOGER system is an accurate, reliable way of measuring local economic activity and establishing a fee for IG services. Whether a fee is actually charged to a contract or not, it is a reasonable way to both estimate and bill.

We think the county and cities should find a way to make it work and drop any attempt at forming a new taxing district.

Commission and Staff Hold Off-site Retreat

The County Commissioners and senior staff assembled today in Boynton Beach at the Intracoastal Park Clubhouse, for an off-site “retreat”.

In January of last year, a similar meeting was held at the Riviera Beach Marina, and a wide variety of strategic topics were discussed (energy and water costs, Glades restoration, Biotech investments) as well as the upcoming budget outlook. The most significant result of that meeting was the setting of clear board direction to staff to return a flat millage budget. This benchmark was the driving force for the budget workshops and resulted in a final budget in September that was very nearly flat. The meeting was successful largely as a result of then Chairman Karen Marcus’ efficient management style, which kept the discussion focused and moving.

This year’s meeting was different. Instead of herself leading the discussion, current Chairman Shelley Vana turned the meeting over to a professional “facilitator”, David Rabiner. Mr Rabiner’s website lists as one of his services “Retreat Facilitation for Governing Boards and Managing Teams”. As a leadership trainer, he was compelling and entertaining, and one could easily see him in a corporate setting. However, for this group, his techiques to “facilitate trust and an effective working relationship” between commissioners and staff were off the mark.

Last year’s meeting was effective because the commissioners spoke freely to each other and related their views on the budget and strategic topics in depth. In this year’s meeting, much of the content consisted of Mr. Rabiner talking about his views on process and how things work in his native Oregon. Perhaps the commissioners found it useful but I suspect not. Many people who attended the meeting to hear some discussion of the budget outlook left before lunch and did not return.

After lunch, Mr Rabiner attempted to extract from the group a clear direction to staff for this year’s budget assumptions. He failed. When the meeting ended at the appointed time, a conficting set of requirements were laid on Bob Weisman and staff.

Steven Abrams and Paulette Burdick want a flat millage budget like last year.

Shelley Vana wants a budget proposal that delivers a “consistent service level”, even if a millage hike is necessary. Priscilla Taylor seemed to concur.

Jess Santamaria wants a “flat taxation” proposal – ie. a rollback budget, regardless of millage rate.

Burt Aaronson wants to reverse the cuts that have been made in ad valorem spending over the few years and “enhance the product” with either a 3% or 5% increase in millage.

Karen Marcus does not want to see any layoffs this year, but wants to start with a “consistent service level” proposal and have the board make cuts to approach flat millage from the high side.

When the meeting ended, these conflicting positions were on the table. Hardly a “clear direction to staff”.

Commissioner Marcus’ proposal deserves further comment however, as it represents a new approach. Mr. Rabiner made the point that there are two ways to achieve budget cuts. The first is to cut “line items” – which are portions of programs similar to what is presented on the “green pages” and “blue pages” prepared by staff in the last two years, sized by dollar and people impact. The second is to cut programs entirely (presumably those that are not needed anymore or no longer appropriate to the current environment).

With the “line item” approach, the priorities are driven by the County Administrator and staff since they present to the board their list of potential cuts from which to choose. Typically, these are sprinkled with items with vocal constituencies, leading to the yearly “Kabuki Dance” of the colored tee shirts.

With the “program” approach, the priorities are driven by the board itself, and have the possibility of being strategic in nature, or at least policy driven.

Karen Marcus seems to be proposing the latter approach, with a consistent service level starting point. Criticism of her proposal pointed out that only the staffs have the inside knowledge of how the pieces fit together and without the green/blue pages, intelligent choice is impossible. This misses the point – the commissioners, particularly long serving ones like Marcus, do have the knowledge and experience to make informed choices for program elimination or even adjustment of sub items. We think they should give this a try.

Transparency at PBSO – the Challenger’s View

At various times over the last two years, we at TAB have raised the issue of transparency regarding the Sheriff’s half billion dollar budget. Much of what goes on at PBSO is hidden from public view, and the budget is no exception. The only way to see how the agency spends the taxpayer’s money within the three “silos” of Law Enforcement, Corrections, and Court Services, is to file a chapter 119 (open records law) request and wait months for a partial answer. By contrast, the Martin County Sheriff puts all of his budget data right on his website for all to see. (see MSO Budget and Finance ).

Sheriff Candidate Joe Talley

Ethics also are not transparent at PBSO, and we believe that the Sheriff should voluntarily execute an interlocal agreement with the Office of Inspector General for oversight services equivalent to what we have for the county departments, the Solid Waste Authority, and the municipal governments. Commissioner Marcus pursued this avenue last year and was rebuffed. (See Should the Sheriff be Subject to the Ethics Ordinances and the Inspector General? ) “No way, no how” was the answer.

The County Commission created the Office of Inspector General in part to address our reputation as “corruption county”. The voters overwhelmingly voted to place the municipalities under her jurisdiction, and the SWA, Children’s Services Counsel and Health Care District came voluntarily. The Sheriff however, continues to resist.

Since Ric Bradshaw must stand for re-election to a third term this year, we wondered what his challenger Joe Talley had to say on these issues. Joe has recently announced his bid to lead PBSO, and brings a full career of law enforcement experience to the race, including 22 years in the Baltimore County Police Department where he attained the rank of major, and 5 years with the PBSO reserves. With this background he speaks from a position of authority on these matters. Here is what he had to say to us (emphasis is ours):

“… it is my view that the Sheriff is elected by the people. The Sheriff’s budget is money from the people. He is to administer that budget and the Office of the Sheriff as directed by the people…..the laws and the expressed wishes are from the people.

If the majority of the people vote to create an Inspector General, it is for a very good reason. To resist is like saying: “I am here now and you cannot touch me…I don’t care about the wishes of the people and I sure am not going to let the people see how I am spending their money”. What part of that kind of attitude works for a thinking citizen/taxpayer?

Is not the average taxpayer now thinking that perhaps there may be some very good reasons (or bad reasons) why they are being kept in the dark and the Sheriff is being defiant?

Perhaps, if we could see all the documents that have been requested over many months (and few have surfaced and then wrong ones or partial ones) the public would be less than pleased at the reckless and undisciplined spending inside the PBSO..

If elected, I will shine the bright light of day on the PBSO budget and answer all concerns of the public or the County Commission or special interest groups or students or anyone – because the citizens deserve answers. The budget will get a review by the County Commission and I will invite the Inspector General into PBSO warmly. I will have nothing to be afraid of and nothing to hide.

There is so much dysfunction inside PBSO and the employees are so distracted by the need to keep looking behind them, the citizens are getting short-changed at the moment.”

We think this is a refreshing attitude from one seeking the job of County Sheriff, and we hope his candidacy begins a public dialogue on these issues. A Sheriff should cooperate with the County Commission and the other constitutional officers and be a responsible steward of the public trust. Maybe the dialog of the 2012 elections can move us in that direction.

Another decrease in valuations in 2012?

As you may recall from last year, county property valuation fell 1.8%. This put pressure on the commissioners to raise the millage in order to avoid cutting spending. As it turned out, the final millage did result in a budget reduction of $7.9M or about 1%, helped enormously by the Legislature’s passage of pension reform that provided a county windfall.

This year, Legislative action will again impact county budgets. One way is through HB251/SB928, which changes the rules under which county property appraisers operate. Specifically, this bill would require consideration of “open market transactions..”, “.. including, but not limited to, a distress sale, short sale, bank sale, or sale at public auction.”

Although the proposed statue would give the local PA some discretion, it is likely to depress valuations. Palm Beach County Property Appraiser Gary Nikolits estimates this could be as much a 2% reduction in valuaion – good for the homeowner, but not so good for city and county governments. (See the Palm Beach Post Story by Jennifer Sorentrue: “Property values stable in Palm Beach County, but bills leave tax revenue uncertain” )

The 2012 adopted budget which is now available on the county website, states on page 2, “Following four years of decline, property values have begun to stabilize and are projected to be level for FY 2013.” More optimistically, on page 58 they estimate a 2013 valuation forecast of $125.8 B, a 1% increase. Maybe not.

In any case, expect another difficult budget year.

Fire/Rescue Contract Negotiations – Back to the BCC

TAB members have been attending these, mostly once/monthly, negotiations since mid-June. It was clear that little or no progress had been made in six months, and we of TAB wondered how many more billable hours would be spent for attorneys from both sides, sans resolution to anything.

Well – apparently, the County management team’s patience has been exhausted. The County expected the Union to appear with a wage proposal, or at least an analysis of the County’s 22% across the board cut for new employees. The Union said ‘No – the person who was doing the analysis had surgery and so we don’t have a response for you”. County asked “Any movement on any of the proposals made by the County’? “No” to that as well. In fact, the Union said that it was very difficult to respond to 45 changes that the County wanted to make to the contract and although there has been probably some resolutions to 5-10 of these 45, that there are still 35 issues to work out. The County attorney said he wasn’t going to get into exactly how many issues there were or remain.

County then went through 2 minor (one to two word changes) in articles 20 and 28. County called them clarifications. Union said these were changes, not clarifications.

Robert Norton (attorney for the county) then probed if there could be any meetings in January. Matthew Mierzwa (union attorney) gave reasons why he was unavailable. Mr. Norton said that “It’s clear that no progress is going to be made today” and went on to say that he doesn’t recall any time in his career, making so little progress on a contract, and if there was a time, he doesn’t remember it. While he wasn’t quite ready to call an “impasse”, he said that it was time to go back to the elected officials (Board of County Commissioners), to get guidance from them. Depending on their decision, he’ll either work to get new bargaining dates or do whatever the next step is.

As a citizen and tax payer, watching twelve men waste their own (and our) time for six months, to achieve nothing, highlights why trust in government is at an all time low.

Note: the current contract expired in September.

County Adopts New Financial Standards

The county commission today discussed and approved new accounting standards for the next budget year that will adopt a more standard accounting methodology, making comparisons with peer counties possible (perhaps). For a full description, CLICK HERE.

Highlights included:

- Adoption of GASB 54, reporting spendable fund balances in 4 categories, possibly providing more transparency. During the discussion it was stated that since Hillsborough is already using this standard, it was not possible for TaxWatch (or anyone else apparently) to compare the currently reported Palm Beach County reserves to theirs. John Wilson mentioned they have had numerous discussions with TaxWatch on the subject since the budget hearings and that TaxWatch now “understands” their reserves, but the county is going back and looking at each capital project balance in more detail.

- Adoption of a “target” debt limit of $1200 per capita (which we are very close to at the present time). This is county only, not including SWA bonds. Additionally, debt service payments, exclusive of general obligation and self-supporting debts, will be no more than 5% of governmental expenditures.

- A policy proposal to consider voted General Obligation bonds over non-voted revenue bonds for future borrowing. As you might expect, this was not very popular but Steve Abrams suggested that projects could be “bundled” to make them more attractive to the voters. Karen Marcus indicated that was done in the past for Parks and Recreation.

- A non-specific proposal for departmental “Performance Measures” that could be used to compare to outsourcing alternatives and aid in evaluating department requests for increased funding. Bob Weisman suggested that there already were measurements in place but several commissioners were outright skeptical. Commissioner Vana thought that we can only take “baby steps” in this direction, but that measurements could also be used to consider “in-sourcing” tasks where the county can do it much better than a vendor. No examples were given.

Fire/Rescue Contract Talks Postponed for Another Month

For the county:

Steven Jerauld

Appointed to the top Fire/Rescue position in 2009, Chief Jerauld came up through the ranks. He participated in the last contract negotiations as Deputy Chief of Operations.

Robert L. Norton

Partner in the firm Allen, Norton & Blue, P.A. which calls themselves “The Management Labor & Employment Firm”, Robert Noyce has 38 years of practice in Labor and Employment law. He holds a JD from the University of Florida Levin College of Law and a BS from U Florida. Mr. Norton negotiated the previous contract for the county in 2009.

For the IAFF

Michael J. Mayo

President Mayo is a longtime leader of IAFF Local 2928 Fire/Rescue union and has negotiated prior contracts with the county as well as municipalities in the area.

Matthew J Mierzwa

Mr. Mierzwa, Local 2928 Legal Council, is the principal of Mierzwa & Assoc. PA. which represents labor organizations, employee benefit plans and union members in the areas of labor law, benefit law, election law, and individual employment rights throughout the State of Florida. He holds a JD from the University of Miami School of Law and undergraduate degrees in Economics from Harvard and studied industrial and labor relations at Cornell.

So – where do we stand? The current contract expired at the end of September. There have been 6 contract negotiation meetings so far – of which 3 were 1/2 day and 3 were purportedly all day – or at least most of a day. Only a handful of the 47 articles (ie. chapters) have been signed-off, although most have at least been mentioned in the course of the 5 months elapsed time.

Observations: The meetings continue to be stylized. These are not negotiations in the common usage of the word. One side’s attorney (typically management) describes the change sought from the current contract. The other side’s attorney (typically the union) says ‘yes’ or more likely ‘no’. Occasionally there will be a few words of correction or acknowledgement from the 6+ representatives on each side. But more often, not. After several articles are discussed, the meeting breaks up in order that the sides (typically the union) can ‘caucus’. They come back and say ‘no’ and do not offer a tangible counter-proposal. There is no real discussion. There don’t seem to be minutes from prior meetings so topics are re-hashed. The difficult topics – eg pay plan, have not yet been broached.

Having come from only the private sector (with professional/white collar, hourly/blue collar, management/non-management) experience, negotiations on anything usually began with a summation of what was/wasn’t agreed to previously, and significant discussion would occur amongst those with the power to negotiate. Points of agreement would be compiled, points of disagreement would be clear and then, if necessary, the meeting would break up briefly to come to closure on a particular point. Perhaps what we’re observing is typical of all public sector negotations, we really don’t know. It does seem to be very inefficient to rehash the same things multiple times without at least noting what points were at issue.

Perhaps the problem is that the process is being observed. When we asked one of those who was present at the last contract talks in 2009 if this was “typical” of the process, it was suggested that our presence may be having an effect on the meetings. As one of the commissioners has told us on several occasions, government works best when it is being observed. Since this is the first time (to our knowledge) that members of the public have attended a Fire/Rescue union contract negotiation, perhaps the normal “give and take” of the sessions is being inhibited by the fact we are reporting what we observe. Think how things would change if these meetings were televised!

Is inefficiency necessary to good government? When not conducted in the sunlight, would a contract negotiated between a union and management that used to belong to the union have the same outcome? The taxpayer does not sit at this table. Neither does any commissioner, the elected taxpayer’s representatives. All we can do is observe and report.

Joking during the last meeting, when the scheduling of the next round was discussed, the union attorney suggested that it be on Thanksgiving Day because all would be paid extra to do so. What they did decide to do was to schedule the next round of meetings for November 22 and 23rd, the Tuesday and Wednesday of Thanksgiving week, a time when many members of the community are traveling or spending time with family. Maybe they expect to have a clear field on those days.

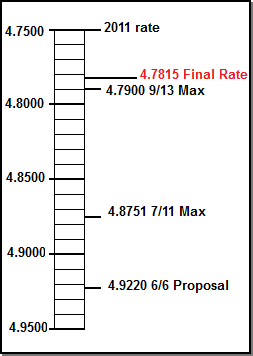

2012 Millage set at 4.7815

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

In a relatively short meeting last night, the County Commission approved a 2012 budget by a 4-3 vote. Setting the county-wide millage at $4.7815 per $1000 valuation, the rate is an increase of 0.66%.

TAB has been working over the last few months to avoid any increase, but this outcome is acceptable, given it is a lot closer to our $4.75 target than the rollback rate proposed in June at $4.922. We would have liked to see more restraint in the Sheriff’s budget (it is actually increasing when pension reform savings are taken into consideration), but four of the seven commissioners were hard over on not cutting his budget at all. The Sheriff did pony up $1M in excess fees that helped them bring the millage down ever so slightly.

This was the closest budget vote in recent years – many thanks to commissioners Abrams, Burdick and Marcus, who kept to their position from the beginning of the process back in March to the final vote not to raise the rate. The others did exhibit some flexibility this year, even Burt Aaronson who has rarely argued for lower tax rates. Commissioner Taylor thought that the result was a compromise that had something for everyone and we would agree.

It can’t be proved whether our efforts in TAB have affected the outcome, but given the starting proposal of 4.922 and the significant progress towards the goal, we would like to think so. Almost all of those who spoke at the meetings in opposition to the tax hike were associated in some way with TAB.

Special thanks to those who spoke at the final meeting: Janet Campbell, Mel Grossman and Laura Henning of PBC Tea Party, Mayor Dan Comerford and Commissioner Chip Block of Jupiter Inlet Colony, Matthew Leger, Dionna Hall and Christina Pearce of RAPB, County Commission candidate Albert Key, State Senate candidate and 912 member Mike Lameyer, South Florida 912 members Dennis Lipp, Victoria Thiel and Nancy Hogan, and Barbara Susco, Mark Dougan, as well as Fred and Iris Scheibl of TAB.

Next year will be particularly challenging for the county budget, with an increase in pension costs expected as well as continued pressure on valuations. Be assured that TAB will continue our watchdog role going forward.

F-bombs Fly at Fire/Rescue Negotiations

TAB has been attending the meetings between County Fire/Rescue management and IAFF Local 2928 since they began four months ago (See Genesis of a Collective Bargaining Agreement, Fire / Rescue Contract Talks Continue, and Little Progress in the IAFF Contract.)

We had been advised that the meetings tended to be raucous and filled with stunts and theatrics on the part of the union, but in three meetings we saw none of that. While very little progress was made, the tone of discussion was professional and cordial.

Apparently, that has all changed now.

The latest meeting was Wednesday, 9/14, starting at 10:00am. After about an hour in which the county proposed that a group of sections that were not particularly controversial be approved as a package, the union began a private caucus that lasted about an hour. Since the caucus is private, members of the public are excluded so we went into the conference room next door. This wasn’t far enough evidently, as one of the negotiators suspected we could hear them through the wall and asked us to go farther away.

We returned at the conclusion of the Caucus for 10 minutes only as they spoke briefly to the county and went back into caucus for the next two hours. We were not able to return at that time, but a member of one of our coalition partners attended the afternoon session and sent us the following report. Evidently, the negotiations are taking a different turn. We are speculating that the union attorney has been restrained in his language up to now because there was always a woman present.

I attended the Palm Beach County Firefighters Union negotiation today. Here’s how it went:

I arrived at the new facility on Pikes road at 1:45 pm, checked in and went upstairs to the room were the negotiation were taking place. The union reps were the only people in the room and they asked me to leave because they were in caucus. I would have used a different word. They finally sent someone down to the lobby to advise me I could attend at 2:45 pm.

When in the room the management side of the bargaining table said I could sit by the wall out of the way. The attorney representing the union started turning pages of the new contract and would say we agree or we don’t agree and so on. (I thought man, I could have gone fishing or maybe the range.) Ah then it started!

But first let me point out how weird they operate the fire department money tree. The management side includes the Fire Chief and other management and administrative members and they are ones who go to the county for money. You know, our tax dollars. The Union representatives on the other hand are asking, pleading and even begging (actually more like demanding) more money and expect management to go get it.

Then it happened – the monster page appeared. It had something to do with an EMS person or Firefighter having to drive maybe fifty miles on occasion, to work at a different location if someone called out or they just needed help. The attorney who represented the union said no; we will not accept any part of this section. A management team member said that they had to because every staff member, no matter the profession is challenged on occasion and must participate in what might be a temporary inconvenience.

The union attorney said no way would they consider it. The management side said it didn’t matter – every one must participate in an inconvenience when the economy is tight. The (union) attorney then said f–k no, we are not accepting this. The management person said he would produce the travel records to show that the long commute didn’t happen very often. The attorney said f–k no, the union would not agree with it and that it was f–king not even going to be considered.

The (union) attorney then said bring it on, bring your f–king records. The management attorney said they were going to bring all the records to the next meeting. Mr. (union) attorney said he didn’t give a f–k, what they brought – this session is over and I’m f–king out of here.

The (union) attorney then packed his stuff and the union reps followed suit.

The Fire Chief was sitting across from this attorney while the the attorney acted like a disrespectful jackass. I won’t mention what would have happened if I were the Chief. I came away thinking that these union people are bunch of spoiled rotten brats sucking on the money nipple and can’t be weaned off the freebies. Of course our tax dollars are the freebies.

I believe it is time to fully investigate privatizing as much of the EMS services as possible and maybe some Firefighter services or at least force changes in the way they operate. Unfortunately I do not believe this is ever going to get better for the taxpayer, and the time to investigate the possibilities of some privatization happens to be right now. You can be assured I will not miss the next session.