A Surrealistic Budget Hearing

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

At about 11:00pm Tuesday evening, the County Commission voted to set the county-wide tax rate at $4.79 per $1K valuation. This is up 0.84% over last year – a small increase, but an increase nonetheless.

After the last meeting, the rollback rate of 4.8751 was on the table, intended to collect $607M in countywide taxes, $4M more than last year. The new rate will collect $596M, an $11M difference and $7M less than 2011. That is some progress, but going another $5M to flat millage would have sent a signal that the commission “feels your pain”. Any increase, no matter how small, sends the opposite message and all good will is lost. Thank you to Commissioners Abrams, Marcus and Burdick for trying to do the right thing.

The real story is how the dynamics of the meeting played out and the bizarre behavior of some of the commissioners. What played out was a perfect example of why people are losing confidence in government at all levels. It was sad to watch.

The five and a half hour meeting started with a brief overview presentation by Administrator Weisman that contained a strangely petulant rant against the recent TaxWatch study on county reserves. It was if his integrity was being questioned by a Tallahassee interloper that had no business telling lies about his stewardship of the county purse. TaxWatch claims that Palm Beach County has excessive reserves when compared to objective measures or peer counties. Nyet, says Bob. Move along, nothing to see here.

Next we had “public comment”. By TAB’s count there were about 80 speakers. 75% were very much opposed to any cuts in “their” programs, including all the usual suspects – Palm Tran Connection riders, directors of Financially Assisted Agencies with their hands out, the minions of COBWRA and others from the West Boynton area reacting to the Sheriff’s threat to close their substation, advocates for Victim’s Services, the blind, lifeguards and swimmers, Animal Control, and the eloquent (even poetic!) supporters of the Green Cay Nature Center.

Speaking for the taxpayer and greatly outnumbered were about 20 citizens opposed to the millage increase – almost all associated in some way with TAB. The other 1.3 million residents of the county stayed home last night and get the government they deserve.

When the public portion of the circus was over, the meeting “returned to the board” where the real show began.

In a motion that had jaws dropping throughout the chamber, Commissioner Aaronson proposed funding EVERYTHING on page 8 of the package (the list of programs they would like to restore above a flat millage benchmark). This would be done by adopting a 4.80 tax rate, then funding the additional $7M or so in additional items (Sheriff adders, BDB, Cultural Council, Film Commission) by “taking the money from the roads programs”. If the $7M required would be too difficult for that department (it had been previously discussed with staff), then take the money from “reserves”.

Wow – an admission that we can spend reserves. (TaxWatch?, TAB?) Most striking was the hanging question, finally asked by Commissioner Marcus – how come we are just learning that this $7M is available? Couldn’t we have dispensed with stirring up all the constituent groups by just using this from the get go?

Steve Abrams said this was going in the wrong direction. Instead of funding everything on the page, why not use this “found money” to fund some of the programs while keeping the millage at 4.75?

It has been a long standing tradition that when cuts are made, the county departments and the Sheriff share them dollar for dollar. On the table was an additional restore for the Sheriff of $5M, not matched by the county. Steve Abrams wanted to see the tradition continue and Chairman Marcus polled the board to see if it could be maintained. No. Aaronson, Santamaria, Taylor and Vana will vote to give the Sheriff everything he wants. Case closed. The other three did not like this but there was nothing to be done. Chalk one up for the impressive Ric Bradshaw political operation. This was clearly a done deal before the meeting as there was no discussion on the topic.

The meeting then became a horse trading session – Shelley Vana would delete the mediation program that Priscilla Taylor wanted as well as letting Animal Control close one day a week until it was pointed out that there could be more euthanized cats and dogs (oh my!), prompting Vana to look horrified and say “oh no, we can’t do that!” and Taylor to say “if you restore that then give me back my mediators!” Finally, Vana threw up her hands and said “OK, Just fund EVERTHING!”. Now there is leadership! Karen Marcus around this point made the observation “..we’re not looking too good up here right now..”.

Someone then threw out an arbitrary number – “Why don’t we set the millage at 4.79?” It was after all, getting late. One number is as good as another I guess. Chairman Marcus regained control of the meeting at this point and called a 20 minute “time out” to let staff calculate what 4.79 and “funding everything” would mean.

At the end of the break, staff reported that this would require an additional $7.9M, which would come from the roads program and/or reserves. Since there were not 4 votes to revisit the Sheriff’s share, Mr. Weisman was directed to identify this amount before the final meeting on 9/27, “taken from programs that have no constituency, like engineering or buildings and land”, and the meeting wrapped up with the formal votes on the millage rates.

So what are the take-aways from this meeting?

- The millage was set at 4.79 or below, at most a 0.8% increase over last year.

- The Sheriff got everything he wanted and was not required to match cuts with the county departments, breaking a long-standing tradition.

- About $7M in surplus or deferrable program funds were mysteriously “found” after threatening all the programs with vocal constituencies that could have been satisfied with less.

- After claiming TaxWatch was wrong and our reserves are too low to use, Mr. Weisman reversed course and offered $7M to fund the programs.

In summary, this was not too bad an outcome given where we started, but the cynical way the process was conducted by staff and some commissioners was not government’s finest hour.

The 2012 TAB Proposal – September Update

The county has published their First Public Hearing package for the September 13 budget meeting. It presents a budget at the “rollback rate”, a 2.6% increase for the county-wide portion, generating $607M in ad-valorem revenue, and retains the current 2011 tax rate for Fire/Rescue and the Library System.

“Rollback rate” is a misleading term. While it is supposed to mean a rate that generates the same amount of tax revenue as the previous year, this one actually adds $4M to the county-wide tax burden. The 2.6% increase will likely understate the change to a homestead property held for some time, since the valuation may still not have caught up to the market value under the “Save our Homes” statute. Check the “TRIM Notice” that you should have received by now and look at the county tax line to see what it means to you.

Since Fire/Rescue and the Library system are not changing rates (and therefore collecting less revenue), the increase in county-wide taxes is offset by enough to hold the combined taxes to within $1M of the current budget. If adopted as proposed, this budget would collect a total of $835,144,556 in the 2012 fiscal year.

In July, the commission voted to set the “maximum millage” to the “rollback rate” of 4.8751. This means that in September they can adopt a lower rate but cannot exceed this maximum. Three of the four commissioners have indicated a desire to avoid raising the rates, and they could prevail. Therefore, to facilitate discussion, the budget proposal “bridges” the two rates by listing the programs that would have to be cut if the millage rate were kept at this year’s 4.75, but would be “restored” if the commissioners go with the higher “rollback rate”. Six separate proposals are provided, representing “steps” that add up to the $16.8M difference between the two rates (4.7500 vs. 4.8751). Controversial programs that are “restored” under the 4.8751 proposal include Palm Tran fares, lifeguard funding, nature centers, some financialy assisted agencies and about $12M in PBSO appropriations (less $5M in “excess fees”).

The first three points of our TAB proposal for this budget year are unchanged from July, but we have added a fourth point which reflects a conclusion drawn by Florida TaxWatch in their recently published study – namely that county fund balances are excessive compared to either our peer counties or objective measures of “prudent reserves”.

The TAB Proposal

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

- Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties.

We also want to see a charter amendment for a county version of “Smart Cap” placed on the 2012 ballot. Detailed arguments for each of these can be found later in this article.

Background

Last year, TAB was formed in July, after the county budget process was well underway.

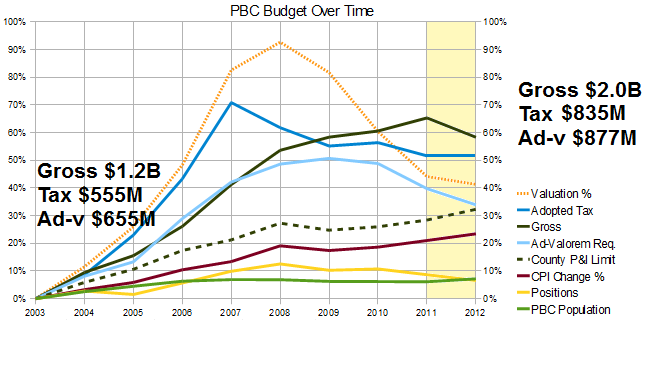

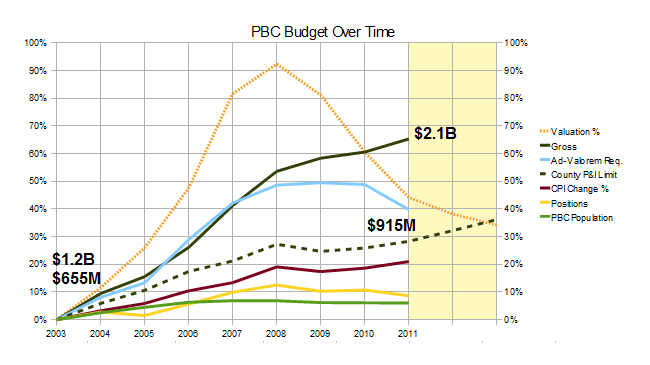

After researching the growth in county spending for the period 2003-2011, we concluded that it had grown 11 times the population growth and 3 times the rate of inflation. For FY2011, the proposed budget raised the millage by more than 9% on top of an increase of more than 15% in the previous year. Although the ad-valorem equivalent (and the total amount of collected taxes) declined in the 2011 fiscal year with the steep decline in property valuations, those with homestead properties saw their taxes go up.

Overall spending, propped up by state and federal stimulus funds, continued to increase in 2011 and only now is declining a bit. (See % changes from a 2003 baseline in the chart below). Adopted tax followed the valuation curve upwards until 2007 where after a slight decline as excessive reserves were burned off, it has been relatively flat, even as the economy has been in decline and valuations have plummeted. Ad-valorem equivalent (which is spending minus non ad-valorem revenue) has declined since 2010, while spending has been supported by intergovernmental grants.

With the weak economy and double digit unemployment in the county, we thought another tax rate increase was wrong, and argued for keeping the millage flat at 4.344. As part of the proposal, we went through the staff’s “green” and “blue” pages, and made specific spending cut proposals totalling over $50M, argued for deferring raises in Fire/Rescue and PBSO, and listed $100M in capital projects that could have been deferred.

In meetings with the individual commissioners, we made our case and had a productive dialogue, but were not persuasive enough to carry the day against the hordes of special interests (including PBA members supporting the Sheriff’s budget) that flooded the meetings and lobbied the commissioners to keep the taxpayer money flowing. The final budget passed with a 9.3% rate hike on a 4-2 vote, with commissioners Abrams and Santamaria voting against, and the district 2 seat vacant after the resignation of Jeff Koons.

This year we started earlier and have focused on educating community groups about the budget history, preparing them to join the discussion armed with the proper facts.

- The Sheriff submitted a budget request with spending that is 4% higher than last year, mostly to cover raises under the collective bargaining agreements in place until 9/2012. In the flat millage budget, he is being asked to cut 5% more than he saves with FRS, but so far has been unwilling cut any deeper.

- The property appraiser, who had been projecting a 6% decline in valuations this year, has softened his outlook to a 2.3% decline.

- FRS reform, passed by the legislature and signed by the Governor, will result in savings to the county departments, PBSO and Fire/Rescue of $15.4M, $20.6M, and $11.6M respectively (by our calculations). Note: The county shows the PBSO savings to be $18M.

- Although the difference between last year’s adopted tax ($603M) and the tax generated by flat millage this year ($591M) is only $12M, cuts are necessary because the “hole” is really $45M. This is explained (although not to our satisfaction) by “decrease in one time funding sources”, “increases in general fund transfers”, and other matters. See: County Budget Update – July 8

The following is an outline of the “TAB Proposal” for 2012:

The 2012 TAB Proposal

- Maintain the county-wide millage at 4.75

- County-wide property tax rates have risen 25.6% in the last two years alone

- Although the total taxes collected have declined over the same period, those with homestead properties saw double digit increase in their county taxes

- This year, the reduction in valuations has slowed from an expectation of -6% to a more modest -2.8%, reducing the pressure on the budget and millage rate

- TAB estimates that reforms to the Florida Retirement System (FRS), passed by the Legislature, will result in a $48M savings to the county this year ($20.6M in PBSO, $15.4 in county departments, and $11.6M in Fire/Rescue). This should be used to hold or reduce the millage, not for new spending on programs or salary increases.

- The county is still experiencing double digit unemployment and slow economic growth. This is not the time to be raising taxes.

- Thankfully, the Fire / Rescue and Library MSTUs are not projecting an increase in tax rate.

- Take the majority of cuts from PBSO, not the county departments

- County-wide ad-valorem taxes pay for the county departments and the constitutional officers, including the Sheriff. In the last 8 years, PBSO has grown from 46% of the budget to 58%.

- Most of the growth in the PBSO budget has been in personal services costs (salary and benefits), and PBSO deputies are now compensated more than 30% above the national average for similar positions.

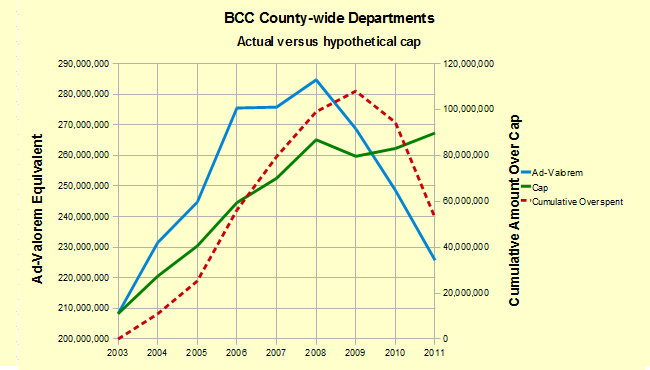

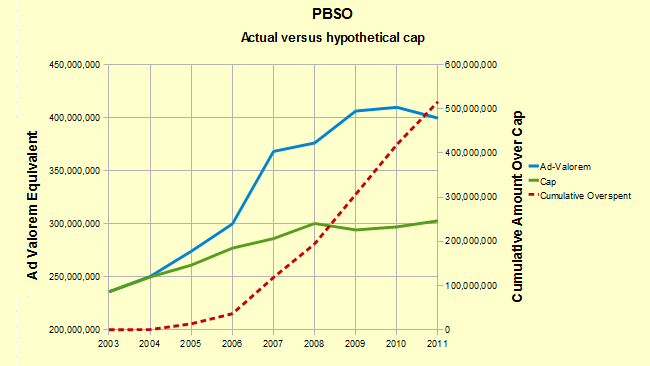

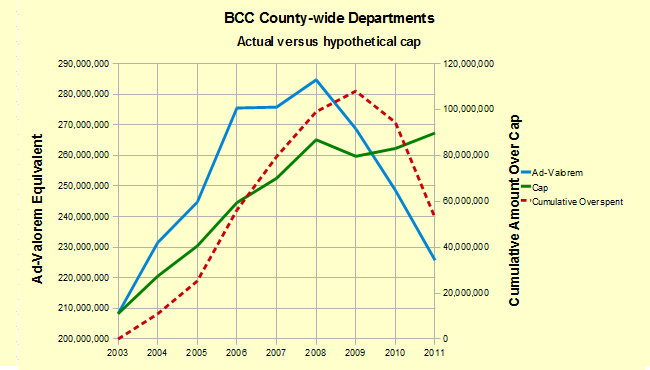

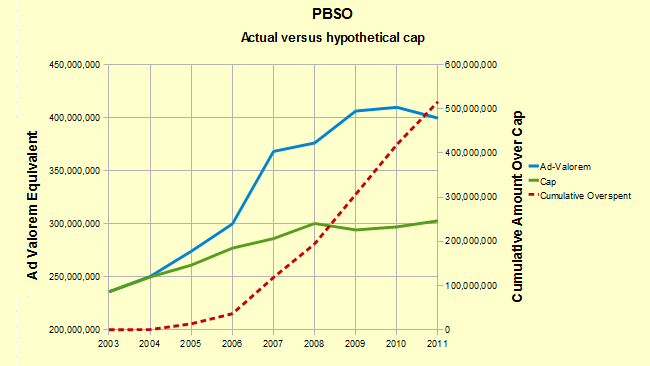

- Measured against a hypothetical population+inflation cap since 2003, county departments are now comfortably under the cap (although they exceeded it in the boom years by a cumulative amount of $50M). PBSO has greatly exceeded the cap in each year, with a cumulative overspending (versus the cap) of $500M in the 8 years. (See charts below)

- The Sheriff provides only the statutory minimum of budget data to the county (and the public) so it is difficult to see where the money is being spent. Through Chapter 119 (open records law) requests, TAB has determined that almost all the spending growth has been in salaries and benefits for employees covered by collective bargaining agreements, not in operating costs.

- The reduction to PBSO from $470M to $448M in the submitted budget would meet our criteria if allowed to stand.

- Take action to reduce the inventory of county property and reduce the debt

- Florida TaxWatch has conducted a Palm Beach County Study funded by the PBCA and others, that created an inventory of underutilized land and other property owned by the county, and compares our debt and capital programs to our peer counties. This study can be used as a blueprint for action to reduce the debt (currently $1600 per county resident with interest costs estimated at 14% of taxes collected) and make plans to sell off assets like Mecca Farms.

- The Clerk and Comptroller has identified the county-wide debt (including the Solid Waste Authority) as being significant already, and it is about to be increased even further with the building of the waste to energy facility and the convention center hotel.

- During the boom, windfall tax receipts were used to start projects that committed the county to long term debt that is difficult to justify now that the boom has ended. We need a plan to correct the problems caused by earlier bad decisions.

- TaxWatch obtained a list of vacant properties owned by the county and has assembled a table of current value. As long as these properties remain on the books it is a double liablility – there is a carrying cost associated with them and they are held off the tax rolls. Many of the over 2400 properties listed in the PAPA database as belonging to the county should be sold, even at a loss.

- Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties

- The TaxWatch Study analyzed unreserved fund balances against peer counties as well as against an objective measure of “prudent reserves” for a government entity, even one within a hurricane zone.

- They concluded that the Palm Beach County fund balances are way in excess of what is needed and should be utilized to fund current spending until the balances fall at least below 40%.

- Sufficent fund balances exist in excess of a 40% cap to fund any shortfall this year and can be used in lieu of raising the tax rate.

It should be noted that items 3 and 4 can be used together. Property can be sold over the next 1-2 years and the proceeds can be used to replace fund balances used to fund current expenses. Asset sales can also be used to retire debt.

This year’s TAB Proposal is really not asking that much. With the smaller decline in valuations and the large savings from FRS reform, there should be very little difficulty in making the modest cuts that will be necessary to avoid an increase in the tax rates.

Smart Cap

Separate from the TAB Proposal for the FY2012 budget cycle, but important for long term budget restraint is a charter amendment to bring the state level “Smart Cap” proposal (SJR958) to the county. This will be a separate track, aligned with the charter review process, but if you agree with it, please mention it in the context of the budget discussion.

Adopt a “Smart Cap” charter amendment for county government

- The state-wide “Smart Cap” (SJR958) will be on the ballot in 2012. What is good for the state is good for the county.

- “Smart Cap” limits the revenue that can be collected to last year’s cap plus an adjustment factor that reflects inflation (change in Consumer Price Index) and population growth – an objective measure of “appropriate spending”.

- Although the decline in valuations has currently dampened the large increases in county spending that occurred during the boom, spending has continued to rise, even last year. When “normal” returns to the real estate market, a cap could prevent the out of control spending that occurred during the bubble.

- Unlike Colorado’s Taxpayer Bill of Rights (TABOR), a smart cap is based on last year’s cap, not on last year’s revenue. That prevents the “ratcheting down” of the cap that caused problems in that state during a recession.

- A well designed Smart Cap can provide emergency override (Supermajority BCC vote) and exemptions for unfunded mandates and other areas identified by the League of Cities as as problematic.

Growth in ad-valorem equivalents compared to hypothetical “Smart Cap”

Florida TaxWatch Report on County Reserves, Debt, and Property Utilization

At the request of the Palm Beach Civic Association, the Palm Beach County Taxpayer Action Board, and the Town of Palm Beach County Budget Task Force, Florida TaxWatch conducted a study of several aspects of Palm Beach County Finances.

In addition to an analysis of the county debt and reserves compared to our “peer” counties – Miami/Dade, Broward, Hillsborough and Orange, updated from their similar 2006 report, they also investigated the quantity and status of unneeded or underutilized property owned by the county.

The complete report is available HERE. What follows is a summary of the major findings.

Major Findings

1. County Fund Balance (“money in the bank”) is excessive

- The commonly accepted fund balance levels (unreserved) as a percent of expenditures for a government entity is 15%. Locally, 25% is considered prudent for hurricane preparedness. Palm Beach County has maintained a balance exceeding 50% over the last six years. Bringing this level down to even 40% would free up $188M of “excess reserves” that could be used for current spending, thus avoiding a tax rate increase through several cycles to come.

- Peer counties retain AAA bond rating with considerably less reserves

NOTE: This finding supports point 4 of the TAB Proposal – Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties.

2. The County owns vast amounts of “Vacant” Property

- Of 2500 parcels owned, 353 parcels totaling 6200 acres are “vacant” – either unused or used for something other than their intended purpose

- Selling 25% of this vacant property would generate $54M in revenue and return $270K/year (unimproved) to the tax rolls

- Property record-keeping is unreliable and formal definitions and classification procedures are needed

NOTE: This finding supports point 3 of the TAB proposal – Take action to reduce the inventory of county property and reduce the debt.

3. County Office Space Allocation is overly generous

- Office size for executives and supervisors greatly exceeds state standards

- Reducing to standard could save $400K / year

In addition to these (and other findings), the TaxWatch team also made specific recommendations. Six were carried over from the 2006 study and are still relevant in 2011. The others are new and relate to the land and buildings aspects of the study.

Florida TaxWatch Recommendations

Recommendations from 2006 study that were not implemented:

- Establish a fixed cap on reserve funds as done elsewhere

- Implement a priority based budget process with performance metrics

- Adopt a budget reporting system that follows accepted standards and can be understood by the public

- Implement a Sunset Review process with automatic repealers

- Periodically rank all unstarted capital projects (partially implemented)

- Centralize services for constitutional officers

New Recommendations regarding property and buildings

Property

- Work with commercial realtor to plan and execute marketing plan to sell surplus properting over the next 18 months

- Institute formal definitions and procedures to identify “vacant”, “improved”, and “surplus” property

- Dispose of “strips” of land to adjacent property owners or bundle for sale

- Fully implement County Owned Real Estate (CORE) database and make available to the public

- Implement online marketplace to dispose of surplus property

- Apply full sunshine to property acquisition, exchange and sale process and separate from consent agenda

- Engage consultant to suggest utilization of surplus “right of way” property

- Incorporate vacant land disposition as part of County Comprehensive Plan

Buildings

- Require occupancy and vacancy rates of county assets be tracked

- Revise office space guidelines to align with Florida space allocation standards

- Make list of county owned buildings easily accessible to the public

Conclusion

TAB has argued that in this time of economic distress, tax hikes of any kind are counter productive. As the real estate bubble has deflated, the county has been increasing the tax rates in an attempt to prevent a decline in tax revenue. An alternative (in addition to the obvious – cut spending) is to buffer the shortfall with reserves accumulated during the “good” times. Not all government entities have that option as their reserves have been depleted.

The TaxWatch study points out that Palm Beach County is flush with reserves. Additionally, the county is carrying a significant quantity of unused or underutilized property that could be sold off over the next year or two, and the proceeds used to replace reserves spent to cover current spending.

It is our hope that the commissioners will agree and use this information to reject a tax rate increase for 2012.

September Budget Hearings – Some Background

At the end of September, the 2012 budget will be in place.

In spite of 4 years of decline in real estate values, the county keeps raising the tax rates to prevent any decline in tax revenue. If the private sector worked like government, all you would need to do to maintain your standard of living as a business owner would be to raise your prices. Everyone would have to pay it, whether they could afford it or not. Of course in the real world your customers would leave.

According to a national research group, tax-rates.org, Palm Beach County is in the top 8% of all the counties in the country for the tax on the median priced property. When measured compared to the median income in the county we are in the top 6%. It wasn’t always this way, but as the housing bubble inflated, local governments (including the county) collected more and more taxes, and now are trying to maintain that high level after the bubble has burst.

The total tax burden varies with the municipality (or unincorporated area) in which you live, but is typically about 2.2% of the value of your property each year when you include school taxes, municipal taxes, and a variety of special taxing districts. On top of that, there are non ad-valorem taxes on utilities, communications, gasoline, etc. It may be worse in New York or California, but few would say the taxes in Palm Beach County are low.

So what can you do about it?

First we have to stop the increases. The county commission voted 4-3 in July to set the “maximum millage” at “rollback”. This means the most that they can levy this year will collect about the same revenue as last year. Even though valuations have declined again, many properties are under water, and the county unemployment rate is in double digits, the county would like to continue collecting what it did last year.

TAB believes that county spending in some areas continues to be excessive, and the first step in turning things around is to refrain from raising the tax rate again this year.

The Legislature has done its part by passing pension reform, estimated to save the county between $26M and $35M depending on how you calculate it. Upwards pressure on costs though, including contracted pay raises for employees of the Sheriff’s Office make it hard to restrain the spending. It should be noted that during the time the county departments have trimmed back substantially, PBSO has not. The Sheriff’s budget now consumes 58% of the county-wide ad-valorem tax revenue, up from only 36% in 2003. Clearly that agency should be doing more to help the county balance their books at flat millage.

TAB proposes a plan with four actions:

- Maintain the county-wide millage at 4.75

- Take any further cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

- Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties.

The 9/13 meeting will be well attended by those who benefit from county programs and oppose any budget cuts. Typically, those who oppose tax increases are fewer and less vocal. You can help change the equation this year if you show up at the meeting and let the commissioners know you oppose a rate increase. TAB will provide specific arguments you can use on the website after we review the coming budget package. In the meantime, here are some references that may help prepare you to support the TAB proposal at the September 13 budget hearing:

- Higher Tax Rates in our Future – a synopsis of the July budget workshop

- County Budget Update – July 8 – Published prior to the July meeting and covering the origin of the $45M “budget hole”

- The TAB proposal and the County Budget – published in June prior to the first budget workshop

- Powerpoint Charts for the latest version of the TAB presentation

- Synopsis of last year’s budget hearings:

Little Progress in the IAFF Contract

The “negotiations” between Palm Beach County and the International Association of Fire Fighters, local 2928 have now been in progress for three months. With the exception of some minor cleanup in the text, there has been no agreement on anything. The major issues of starting salary (the county wants a 22% reduction) or employee contributions toward health insurance (3%) have not even been broached in the public meetings.

Seemingly minor issues, such as posting the seniority list on the intranet rather than on bulletin boards give rise to heated discussion, complete with implausible hypotheticals and the predictions of dire consequences. The county proposal to allow internal raters on promotional boards is treated by the union as if it was a wholesale rejection of a merit system for one of abject cronyism.

Yet with the exception of one heated exchange between attorneys over the “impasse” of qualifying overtime on a weekly rather than daily basis, the discussions have been cordial. The only problem is that they have accomplished absolutely nothing.

TAB volunteers have sat through these meetings, joined at various times by members of the press and a representative of the county Inspector General’s office. While the meetings have been about as exciting as watching paint dry, the way they have been conducted has been instructive in how public sector unions maintain their control over the functions of government.

Why this lack of progress?

The county, for their part, have proceeded in a workmanlike manner. Led by Attorney Robert L. Norton and Chief Steve Jerauld, their 6 member team has put their cards on the table in the form of detailed modifications to the existing contract document and walked through it in painstaking detail for the union representatives. They showed up for the meetings on time, and have been reasonable in the representation of their position. Of course their negotiating position is modest – other than the reduction in starting salary that affects nobody currently represented by the IAFF, there is no attempt to pare down the salaries and luxurious benefits enjoyed by current employees. The county team appears to be serious about completing the negotiations in a timely manner, and have tried multiple times to get additional meetings scheduled to expedite the process.

The union on the other hand, seems content to let the talks drift along. Led by Attorney Matthew J. Mierzwa, they have avoided agreeing to anything, even minor changes in wording. They showed up an hour late for the August session, a public meeting that had been on the county web calendar for quite a while, claiming “miscommunication”. (The county team was there on time, as were the observers). In the first meeting, halfway through the first “caucus”, they abruptly terminated the discussion and did not return until the next month’s meeting. One of their team of nine negotiators made the incredible statement that he had not read major sections of the county proposal because “he knew he wouldn’t agree with it”.

It appears to an outside observer that the county wants to conclude a new contract and the IAFF does not. Why would that be?

The contract expires at the end of September. The new county proposal contains new hire salary reductions, benefit cost sharing, and other things that disadvantage the union. The union version omits the reductions but does agree to forgo across the board salary increases in the new contract, subject to the condition: “Should the assessed value of properties in Palm Beach County or total revenues for Fire Rescue increase during the term of this agreement, the Union may reopen this Article for further negotiations.”

Maybe they want to run out the clock the way Congress does on major legislation. Perhaps they feel an improving economy will strengthen their hand. It is hard to say.

Although it is early to speculate, what if no agreement were to be reached? In that case, resolution would follow the rules of Florida Statutes Chapter 407.403 – “Resolution of Impasse” which involves mediation by a special magistrate. You may recall that this was a step in the resolution of the Fire/Rescue contract in the Town of Palm Beach. Ultimately it fell to the city council to impose what was a significant setback to the IAFF in that town. In this case, it would fall to the County Commission to impose a settlement.

The process continues in a planned all-day session on September 14, unless the proposal for four additional meetings requested by Mr. Norton is accepted. It should be pointed out that all participants in these discussions (6 for the county and 9 for the union) are being paid by the taxpayers. The attorneys of course are generating billable hours.

Higher Tax Rates in our Future

On Monday, the county commission voted 4-3 to set the maximum millage at 4.8751, which would be a 2.6% increase over 2011. Maximum millage is the number that may not be exceeded when public hearings on the budget resume on September 13.

Following back-to-back increases totaling over 25% in the last 2 years, the commissioners had directed staff in February to create a budget that did not include a tax increase. This would have resulted in $12M less tax revenue collected because of still declining property values, but was offset by cost savings of $25M from reform of the Florida Retirement System (FRS) by the legislature. Other factors however, including reduced interest income and fund balance issues, resulted in a shortfall estimated at $40M and led to a proposal of cuts to popular programs.

Commissioner Aaronson, who is known for ongoing support for raising taxes on others to pay for services in his district, assured us that “it is only a starting point”.

Like Groundhog Day (the movie), the budget discussion plays out in a similar fashion year after year. A low or minimal rate increase is presented, combined with cuts sure to bring out the supporters (Palm Tran Connection, Nature Centers, Financially Assisted Agencies). A “reasonable alternative” that raises tax rates “just a little” for “pennies a day” is offered by Administrator Weisman, and after several hours of public comment, mostly by beneficiaries of those programs, the commissioners vote in July to set the “maximum millage” to the larger figure. Then, in September, after 8 weeks of “trying” to find additional savings, the commissioners decide they have no choice but to adopt the maximum as the final tax rate. Then the cycle begins again. Any guess as to how this will end this year?

To their credit, Commissioners Marcus, Abrams and Burdick voted against the higher tax rate. Paulette Burdick, in her first budget season as a commissioner, attempted to actually set priorities – facing down PBSO CIO George Forman over further cuts to the Sheriff’s budget, yet supporting continued funding for the financially assisted agencies.

Accepting the higher rate were commissioners Aaronson (no surprise), Taylor (who didn’t think 2.6% was significant), and Santamaria. None of these were surprises as they had made no moves toward the lower rate in the June workshop.

The more curious vote was by Shelley Vana, who at first seemed to be seeking additional savings (efficiency, etc) to prevent the tax hike, but voted for it anyway. Like Aaronson, she said it was a starting point and they can “try” to find additional savings before the September sessions. Actions speak louder than words commissioner. Don’t expect any credit for rhetoric.

From a TAB perspective, those of us who spoke against the tax hike were outnumbered by those seeking program dollars. While it is difficult to get working people to attend a morning meeting, we hope those of you who did not attend were able to send email or other communication to let your voice be heard.

Those who did speak for the lower tax rate, included Jack Borland, Francisco Rodriguez, Mel Grossman, Pam Wohlschlegel, Carol Hurst, Victoria Thiel, Dionna Hall, and Fred and Iris Scheibl.

For the next 8 weeks, TAB will be refining the argument against the higher rate and attempting to increase citizen awareness and involvement in the budget process.

Should the Sheriff be Subject to the Ethics Ordinances and the Inspector General?

Over the last few years, Palm Beach County has taken a great leap in establishing ethical standards and implementing a watchdog function that is helping dispel the reputation of “corruption county”. First, by ordinance, the County Commission and staff included themselves under the jurisdiction of a Commission on Ethics, and the Office of Inspector General. Then, in November of 2010, 70% of the voters supported a charter amendment to extend the umbrella to the 38 municipalities of the county, and the Solid Waste Authority brought themselves under it by inter-local agreement. By May of this year, the new ordinances (including a Code of Ethics and Lobbyist rules) were fully implemented.

There are still pockets of county government that are exempt from all this however. The school board is considering the question and may take the plunge at a later time, but the Constitutional Officers (Sheriff, Clerk, Tax Collector, Supervisor of Elections, Property Appraiser, County Attorney and Public Defender) are specifically excluded. The most significant of these of course is the Palm Beach Sheriff’s Office with its 4000 employees and $500M annual budget.

TAB believes if it is good for the county and cities, it should be good for the Sheriff, particularly given the wall that exists between PBSO and the public regarding disclosure of information. Very little financial (or other) information is readily available for scrutiny, and Chapter 119 (Open Records Law) procedures are needed to obtain anything not specifically mandated for disclosure under statute.

Just as the SWA took this step voluntarily, it has been proposed that the Sheriff enter into an inter-local agreement with the county to become part of the county ethics process. To this end, Chairman Karen Marcus formally requested that they do so.

“No Way, No How” was the synopsis of the 9 page response.

Responding for the Sheriff, Colonel Joe Bradshaw in the department of Legal Affairs, explained that they asked for a legal opinion from the General Counsel of the Florida Sheriff’s Association, R.W Evans. In Mr. Evans opinion, the “…County Code of Ethics cannot be applied to the Sheriff under any circumstances, because the investigation of law enforcement and corrections officers is preempted by Florida Law. Further, any oversight of the Sheriff’s Office by the Commission on Ethics and the Inspector General exceeds the County’s authority and improperly encroaches upon the constitutional office of the Sheriff.”

Based on this opinion, Colonel Bradshaw concludes “.. the Sheriff cannot enter into an interagency agreement with the county to extend the jurisdiction of the Palm Beach County Commission on Ethics and the Inspector General to the Palm Beach County Sheriff’s Office.”

In Mr. Evans response, he notes that “This issue is critically important to FLorida Sheriffs..” and that this is “.. the position of the Florida Sheriff’s Association of which I am General Counsel.”

In the opinion, several Florida Statues and case law are cited, pointing out that the Legislature has drawn a protective moat around law enforcement agencies which excludes interference from local elected officials in any way. In a sense, PBSO is “above the law” as far as the county is concerned and no public influence on PBSO is possible without changes in Legislation. We see this time and again – if the county asks the Sheriff for budget cuts he threatens to go to Tallahassee to overturn them. If existing benefits are questioned, the “PBSO Career Service Protection Act” is cited. There is effectively no local control over the Sheriff’s office save the ballot box.

Given the above, is there no other choice but to accept the opinion of the Sheriff’s Association? The voters of Broward County did not think so, and recently passed a charter amendment with 72% of the vote, placing their constitutionals (including the Broward Sheriff) under the County Code of Ethics. To date (to our knowledge), this has not been challenged in court on constitutional or other grounds, although Palm Beach County Attorney Denise Neiman has stated that Broward has crossed the constitutional line and a challenge would succeed. We shall see.

So what can be done about this? There are groups out there that are critical about the way PBSO spends taxpayer money (among other things – see pbsotalk.com). We have no way of knowing if information from those sources are accurate, but much of it appears to come from insiders. In fact, there is currently no outside oversight of PBSO such as the Office of Inspector General brings to other parts of county government, and we think that is a dangerous situation.

We support Chairman Marcus’ call for an inter-local agreement with PBSO. If there are legislative roadblocks then we should work through them with the delegation. We should also have a serious discussion of charter changes which would tear down the constitutional barriers to public oversight of PBSO.

For the full text of Colonel Bradshaw’s response to Karen Marcus, including the opinion of the Florida Sheriff’s Association, click HERE.

Marathon Session for First Budget Workshop

Last evening, starting at 6:00pm, the first steps in the annual county budget dance were performed before a large audience. The meeting did not end until around 11:00pm

County Administrator Bob Weisman, along with OFMB chief Liz Bloeser and Budget Director John Wilson, explained the high points of the 4.75 millage $588M tax proposal, and explained why he’d really like to see it raised to “rollback” millage of 4.922.

While Weisman maintained there were no “Washington Monument” cuts and all were feasible, several commissioners pointed out that many of the “green page” cuts were in areas that were both visible to the public and in areas that would raise significant objections from the public. Commissioner Abrams went so far as to point out that the “green pages” even contained service impact notes listing the dire consequences that were about to befall the county as a result of taking the cut. If the expectations were so dire, then why take these particular cuts? He referred to the comments in the budget document as “advocacy” and we couldn’t agree more.

After a brief pitch by Supervisor of Elections Susan Bucher, requesting more money to “compensate” for the new law limiting the length of early voting (shorter time means she needs more facilities, equipment and overtime – who knew?), Sheriff Bradshaw went through his budget presentation.

The Sheriff made some interesting claims.

Much has been made of the growing percentage of the county budget that goes to PBSO – we estimate their portion the ad-valorem equivalent county-wide budget is now 59%, up from 46% in 2003. Not so fast, says Sheriff Bradshaw. If you look at the core operation of the agency, removing the aspects that are state mandated or are county responsibilities (the jail, crossing guards, etc) – his spending is only 25% of the county budget. We find this argument interesting but not very relevant.

Another claim has to do with the way the county is accounting for the “savings” from the retirement system (FRS) changes passed by the Legislature. (TAB estimates the savings to be about $20M for PBSO, $15M for the county departments and other constitutionals, and $11.6M for Fire/Rescue). Don’t call them “savings” he says – it is simply a change in rates that he will now use to calculate his budget. The change in rate from last year amounts to $18M by his calculation and he takes it directly off his budget. The county contends that this amount should be “shared” with the county departments – it is a windfall from the state that needs to be used to fill their overall budget hole. Since the Sheriff, with many “special risk” employees gets a much bigger “savings” than the county with “regular risk” classes, he should “share the wealth”. In this one, we believe the Sheriff occupies the moral high ground, and the FRS “savings” that occur in PBSO should stay in PBSO. After all – it is a net budget reduction.

This is a serious dispute that will need to be resolved before a clear view of the flat millage budget can emerge, and it appears that both sides have dug in their heels. There are other issues as well, including the $5M credit the Sheriff wants to take for FRS savings he will realize in the period before the new budget year on October 1.

The way the county allocates their FRS “savings” is much more convoluted. Complicating things is that the county staff is divided up between departments that are not funded by ad-valorem taxes (eg. airports) and those that are fully or only partially funded by tax dollars. Our estimate of $15.4M savings is reduced to a little less than $8M that can be used to offset the ad-valorem levy according to Budget Director John Wilson.

Even so, this $8M plus the Sheriff’s $18M in “savings” ($26M total) should be more than enough to plug the “hole” between the $603M adopted tax of FY2011 and the $588M that flat millage will collect in 2012. John points out that there are other “holes”, like decreased interest earnings that make the actual “hole” $45M, so cuts are necessary. Unfortunately for us TAB analysts, none of the budget materials provided to the public provide the documentation necessary to see the whole picture, but John has promised to provide us with what we need shortly. Watch this space.

With the conclusion of the Sheriff’s budget, public comment began. As with most budget meetings, we saw a parade of supporters of the various programs on the chopping block. By our count, there were about 40 speakers. Three spoke to keep the rates low for Palm Tran Connection, one to restore manatee protection, 5 for the nature centers, a couple for community revitalization, four for Small Business Assistance, and ten for victims’s services. The support for the latter was quite moving as victims of rape, shootings and other mayhem came forward to tell their stories. Given that the amount of the cuts to Victims services is a relatively minor $320K or so and 4 positions we would guess they may get restored. All of these areas amount to a couple of million out of $25M in cuts, so we will see if their advocacy will prevail. Other constituencies in jeopardy (eg. lifeguards, FAA) did not turn out at this meeting.

Fifteen spoke in favor of the submitted, flat millage budget. These included Fred and Iris Scheibl of TAB, Meg Shannon of Tea Party in Action, Shannon and Doug Armstrong, Ed Fulop, Victoria Thiel and Dr. Richard Raborn of South Florida 912, Phil Blumel of RCCPBC, Mayor Gail Coniglio of the Town of Palm Beach County Budget Task Force, Pat Cooper of the PBCA, Dick Clyde of the PB City Council, Dionna Hall of RAPB and several others. Other TAB coalition partners who could not attend the meeting but sent emails to the commissioners included Hal Valeche of Taxpayer Action Network, Mayor Dan Comerford and Councilman Chip Block of Jupiter Inlet Colony.

At the end of the meeting the commissioners discussed what they had heard. Although they did not vote or take positions on the budget proposal, by their comments we would assess commissioners Abrams, Marcus and Burdick as leaning towards accepting the flat millage budget, and commissioner Aaronson as wanting to raise the millage. Commissioners Santamaria, Vana and Taylor seem to be hedging their bets at this time.

For media coverage of the meeting see: Palm Beach County Commission balks at cuts — or raising taxes in the Post, and Palm Beach County’s proposed spending cuts prompt citizen backlash in the Sun Sentinel.

The next step in the budget process is the workshop on July 11 at 9:30am. There is also an off-site retreat for the commissioners where budget strategy and objectives will be discussed. That will be held on Thursday June 30 at 10:00AM at the Lake Okeechobee Outpost in Pahokee.

The Kabuki Budget

Yesterday, the county released the budget package for the June 13 workshop. While this preliminary document is lacking in detail (it doesn’t show the department rollups or make it possible to assess what the FRS savings were), it is predictive of the course of debate.

To their credit, the Board of County Commissioners directed Administrator Weisman and staff to prepare a budget this year with no tax increases. The submited budget meets that requirement. However, Mr. Weisman states in his cover letter that he wants them to approve a tax increase “to reinstate some of the less desirable budget cuts”.

Let the dance begin. Anyone who follows the county budget hearings knows how this works. The administrator wants to spend more. Some board members agree, some don’t, but they first need to listen to “the people”. Within the county, there are well organized special interest groups that are reliable and can be expected to come out and argue passionately for their slice of the pie. These groups include riders of Palm Tran and the Palm Tran Connection, the county lifeguards, directors of charitable organizations that get handouts from the county (Financially Assisted Agencies), the Cultural Council, and (when the Sheriff’s budget is threatened), lots of folks in PBA shirts and PBSO boosters from the Sheriff’s neighborhood programs. It used to include former Drug Farm residents, but they lost the fight last year.

Guess where the cuts come in the submitted budget. From these groups of course! Does anyone expect that the board will listen to groups of people in wheelchairs and not restore funding for Palm Tran Connection? Or turn away 150 young lifeguards who feel their way of life is threatened by closing pools? My guess is that these funds will be restored and the only reason they were offered up is to perpetuate “the dance”.

Of the $21.5M of specified county department cuts in the cover letter, the bulk comes from social service (including FAA), Palm Tran, ERM – including manatee protection, pavement and traffic signal repair (EPW), parks and recreation (pools and lifeguards), animal control, youth affairs and victim services. These are designed to sound “draconian”. Strangely enough, the detail provided shows actual increases in two of the areas – Palm Tran sees an actual ad-valorem increase of 25% ($3.9M) in its subsidy due to declining revenue, and Engineering & Public Works (EPW) grows by 10%. Nowhere in the submission can you find the amount saved by FRS reform (we estimate it to be $15.4M).

Likewise, the Sheriff (who asked for a 4% increase in his budget) is being told he will get a $22M cut. On Monday we will probably hear that this will result in the removal of patrols around the largest senior centers and other “constituent sensitive” areas, resulting in catastrophe if the money is not restored.

We could try to second guess the Administrator on where the cuts “should” be taken (we all have our anecdotes about waste and inefficiency), but that is hard to do without an insider’s knowledge. Instead, we say – go ahead and restore the funding to the squeeky wheels – but do it in a budget neutral manner. For every dollar restored, there needs to be a dollar cut somewhere else. The millage needs to stay at 4.75.

Do the right thing.

The TAB Proposal and the County Budget

The county has published their initial budget package for the June 13 workshop. It is a flat millage budget, with cuts of $13.6M from county departments and $22M from PBSO over FY2011, and would seem at first reading to be in line with the first two points of the TAB Proposal, “Don’t raise the millage” and “take more of the cuts from the Sheriff”.

Upon further reading, it is clear that many of the cuts are intended to provoke a response from the user community. If you remember the horde of lifeguards and community recipients of FAA (charity) funds that showed up last year to protest, you can expect the same from the proposed $4.8M cut to Parks and Recreation which will close pools and reduce lifeguards, and the $1M cut to the FAA funds. Not to mention who will turn out to protest the $2.4M increase in Palm Tran fares.

In his cover letter, Administrator Weisman says: “I recommend the Board set a millage rate at rollback, which is currently estimated to be 4.922 mills. This would allow the Board to reinstate some of the less desirable budget cuts.”

Rollback represents a 3.6% increase in tax rates. Unless TAB partners and like minded citizens turn out to support the TAB proposal and ask the board to accept the submitted flat millage budget as stated, we can surely expect the special interests to push it to the rollback rate or beyond.

To recap, the TAB proposal is:

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

We also want to see a charter amendment for a county version of “Smart Cap” placed on the 2012 ballot. Detailed arguments for each of these can be found later in this article.

Background

Last year, TAB was formed in July, after the county budget process was well underway.

After researching the growth in county spending for the period 2003-2011, we concluded that it had grown 11 times the population growth and 3 times the rate of inflation. For FY2011, the proposed budget raised the millage by more than 9% on top of an increase of more than 15% in the previous year. Although the ad-valorem equivalent (and the total amount of collected taxes) declined in the 2011 fiscal year with the steep decline in property valuations, those with homestead properties saw their taxes go up. Overall spending, propped up by state and federal stimulus funds, continued to increase in 2011. (See chart below).

With the weak economy and double digit unemployment in the county, we thought another tax rate increase was wrong, and argued for keeping the millage flat at 4.344. As part of the proposal, we went through the staff’s “green” and “blue” pages, and made specific spending cut proposals totalling over $50M, argued for deferring raises in Fire/Rescue and PBSO, and listed $100M in capital projects that could have been deferred.

In meetings with the individual commissioners, we made our case and had a productive dialogue, but were not persuasive enough to carry the day against the hordes of special interests (including PBA members supporting the Sheriff’s budget) that flooded the meetings and lobbied the commissioners to keep the taxpayer money flowing. The final budget passed with a 9.3% rate hike on a 4-2 vote, with commissioners Abrams and Santamaria voting against, and the district 2 seat vacant after the resignation of Jeff Koons.

This year we are starting earlier and have focused on educating community groups about the budget history, preparing them to join the discussion armed with the proper facts. The actual budget has just been released to the public and we are just beginning our analysis. These are some aspects of the environment in which it is being created:

- The county administrator submitted a 4.75 flat millage budget as directed by the BCC, yet he is really asking for a rollback rate of 4.922 which would be a 3.6% increase over 2011, “to reinstate some of the less desirable budget cuts.”

- The Sheriff submitted a budget request with spending that is 4% higher than last year, mostly to cover raises under the collective bargaining agreements in place until 9/2012. In the flat millage budget, he is being asked to cut 5% more than he saves with FRS.

- The property appraiser, who had been projecting a 6% decline in valuations this year, has softened his outlook to a 2.3% decline.

- FRS reform, passed by the legislature and signed by the Governor, will result in savings to the county departments, PBSO and Fire/Rescue of $15.4M, $20.6M, and $11.6M respectively (by our calculations). Note: The county shows the PBSO savings to be $18M.

- Adam Playford’s article in the Palm Beach Post on May 21 gives some indication of the direction various players would like to go. Administrator Bob Weisman would like to see rollback millage to prevent any cuts in service. Commissioner Shelly Vana suggests we have not properly determined our priorities. The county is “saddled with debt”. The interest payments take 14% of what the county collects in property taxes according to Budget Director John Wilson. “Some of the county’s current fiscal squeeze is because it didn’t save enough earlier in the decade when tax money was flooding in” (during the boom) according to Clerk and Comptroller Sharon Bock.

The following is an outline of the “TAB Proposal” for 2012:

The 2012 TAB Proposal – preliminary

- Maintain the county-wide millage at 4.75

- County-wide property tax rates have risen 25.6% in the last two years alone

- Although the total taxes collected have declined over the same period, those with homestead properties saw double digit increase in their county taxes

- This year, the reduction in valuations has slowed from an expectation of -6% to a more modest -2.8%, reducing the pressure on the budget and millage rate

- TAB estimates that reforms to the Florida Retirement System (FRS), passed by the Legislature, will result in a $48M savings to the county this year ($20.6M in PBSO, $15.4 in county departments, and $11.6M in Fire/Rescue). This should be used to hold or reduce the millage, not for new spending on programs or salary increases.

- The commissioners directed the County Administrator to submit an initial budget with no change to the millage rate and he did. Bob Weisman’s request for rollback at 4.922 (a 3.6% increase) would seem to exceed his guidance.

- The county is still experiencing double digit unemployment and slow economic growth. This is not the time to be raising taxes.

- We expect the Fire / Rescue and Library MSTUs to also avoid a rate increase, but that has already been included in the submitted budget and so far no one has asked to exceed it.

- Take the majority of cuts from PBSO, not the county departments

- County-wide ad-valorem taxes pay for the county departments and the constitutional officers, including the Sheriff. In the last 8 years, PBSO has grown from 46% of the budget to 59%.

- Most of the growth in the PBSO budget has been in personal services costs (salary and benefits), and PBSO deputies are now compensated more than 30% above the national average for similar positions.

- Measured against a hypothetical population+inflation cap since 2003, county departments are now comfortably under the cap (although they exceeded it in the boom years by a cumulative amount of $50M). PBSO has greatly exceeded the cap in each year, with a cumulative overspending (versus the cap) of $500M in the 8 years. (See charts below)

- The Sheriff provides only the statutory minimum of budget data to the county (and the public) so it is difficult to see where the money is being spent. Through Chapter 119 (open records law) requests, TAB has determined that almost all the spending growth has been in salaries and benefits for employees covered by collective bargaining agreements, not in operating costs.

- The reduction to PBSO from $470M to $448M in the submitted budget would meet our criteria if allowed to stand.

- Take action to reduce the inventory of county property and reduce the debt

- Florida TaxWatch is conducting a study funded by the PBCA and others, that will inventory underutilized land and other property owned by the county, and compare our debt and capital programs to our peer counties. This study can be used as a blueprint for action to reduce the debt (currently $1600 per county resident with interest costs estimated at 14% of taxes collected) and make plans to sell off assets like Mecca Farms.

- The Clerk and Comptroller has identified the debt as being significant already, and it is about to be increased even further with the building of the waste to energy facility by the Solid Waste Authority and the convention center hotel.

- During the boom, windfall tax receipts were used to start projects that committed the county to long term debt that is difficult to justify now that the boom has ended. We need a plan to correct the problems caused by earlier bad decisions.

- TAB has obtained a list of vacant properties owned by the county and has begun comparing the current value of these parcels to what was paid for them. As long as these properties remain on the books it is a double liablility – there is a carrying cost associated with them and they are held off the tax rolls. Many of the over 2400 properties listed in the PAPA database as belonging to the county should be sold, even at a loss.

Separate from the TAB Proposal for the FY2012 budget cycle, but important for long term budget restraint is a charter amendment to bring the state level “Smart Cap” proposal (SJR958) to the county. This will be a separate track, aligned with the charter review process, but if you agree with it, please mention it in the context of the budget discussion.

Adopt a “Smart Cap” charter amendment for county government

- The state-wide “Smart Cap” (SJR958) will be on the ballot in 2012. What is good for the state is good for the county.

- “Smart Cap” limits the revenue that can be collected to last year’s cap plus an adjustment factor that reflects inflation (change in Consumer Price Index) and population growth – an objective measure of “appropriate spending”.

- Although the decline in valuations has currently dampened the large increases in county spending that occurred during the boom, spending has continued to rise, even last year. When “normal” returns to the real estate market, a cap could prevent the out of control spending that occurred during the bubble.

- Unlike Colorado’s Taxpayer Bill of Rights (TABOR), a smart cap is based on last year’s cap, not on last year’s revenue. That prevents the “ratcheting down” of the cap that caused problems in that state during a recession.

- A well designed Smart Cap can provide emergency override (Supermajority BCC vote) and exemptions for unfunded mandates and other areas identified by the League of Cities as as problematic.

This year’s TAB Proposal is really not asking that much. With the smaller decline in valuations and the large savings from FRS reform, there should be very little difficulty in making the modest cuts that will be necessary to avoid an increase in the tax rates.

Growth in ad-valorem equivalents compared to hypothetical “Smart Cap”