Volunteers Wanted for TAB “Shovel-Ready” Projects

As more volunteers come forward to work on TAB Research, and we have begun considering paid studies, the time has come for a “to do” list of projects that are “shovel ready”. The objective of these projects is to increase our understanding of the trends in county spending and taxation, and to bring to light areas of excess, or unsustainable trends that bode ill for the future.

Many of these projects can be undertaken purely from publicly available materials, others may require staff contact and/or public records requests. All will be useful as we make our case for a rollback of county spending to pre-boom levels.

If you would like to volunteer for any of these projects, or have more projects to add to the list, add a comment to the post or mail us at info@pbctab.org

If you decide to participate, you will not be working alone. The TAB team can provide the tools, technology, contacts, analysis techniques, and moral support. Join us today!

Project List

GB:General Budget

SS: School System

SO: PBSO

FR: Fire/Rescue

CS: Core Services

GS: Govt. Structure

CD: Capital/Debt

| Project Title | Tasks |

|---|---|

| GB1: Pension Cost Projection | Prepare a spreadsheet of the county pension costs by year since 2003, then project it 10 years into the future. List all the categories of pensions by type of position or bargaining unit, projecting them individually |

| GB2: Health Insurance Projection | Prepare a spreadsheet of the county employee health care costs by year since 2003, then project it 10 years into the future. List all the categories of plans by type of position or bargaining unit, projecting them individually |

| GB3: Peer County Comparisons | For the 5 largest Florida Counties (Palm Beach, Broward, Dade, Hillsborough, Orange), show the percentage budget growth (spending and ad-valorem taxes) for the years 2003-2011. In years that Palm Beach has exceeded the growth of the peer counties, examine which components grew the most (eg. PBSO, county staff, etc.) |

| GB4: Payers and Payees | Build a list of the municipalities and unincorporated areas of the county and for each, estimate their county tax burden (based on valuation). Based on population of each, determine per-capita tax burden. If possible, estimate “tax dollars returned” to those communities. |

| GB5: Allocation of ARRA Funds | Of the more than $500M in inter-govermental transfer funds, much in the last 2 years came from federal ARRA money. Track down where the money was spent and estimate whether it provided a general benefit to the county or was spent on special interests. |

| SS1: School Budget Trends | Develop a budget trend chart (spending and ad-valorem taxes) for the school system for the years 2003-2011, in a format for comparison with other county spending. |

| SS2: School System Salary Skew | Using a salary chart for all school system employees, analyze compensation for teachers versus administrators. Show growth in salaries for both groups from 2003-2011, as well as the number of teachers versus administrators. |

| SO1: PBSO Salary Skew | Using a salary chart for all PBSO employees, analyze compensation for sworn deputies versus civilian employees. Show growth in salaries for both groups from 2003-2011, as well as the number of each. |

| SO2: PBSO Spending History | Using information gleaned from pending open records requests, adjust the TAB PBSO trend data to reflect the population of the service areas by year, new jurisdictions added, and special mandates (eg. Homeland Security requirements). Build a chart of spending per capita (in the service area) and spending per call. |

| FR1: Fire Rescue Salary Skew | Using a salary chart for all Fire/Rescue employees, analyze compensation for union represented firefighters vesus other employees. Show growth in salaries for both groups from 2003-2011, as well as the number of each. |

| GS1: State Mandates | Build a list of Florida statutes that are impediments to substantive budget reduction in the county. Determine how much of the county budget growth can be attributed to state or federal mandates, and develop legislative proposals that could be used to restore local control. |

| CD1: Surplus Holdings | Develop a list of surplus buildings, land, and equipment (eg. Mecca Farms). Investigate the carrying costs and develop proposals for divesting assets to save money over the long term. |

| CS1: Appropriation Constituencies | Break down the county departments into “general benefit” (eg. parks, law enforcement) and “special benefit” (eg. Community Revitalization, Charity). Determine the size of the constituency of “special benefit” spending and examine the justification for that spending. |

| CS2: Program List | Build a list of all county programs and separate them into those that are clearly the function of government, those that are clearly not, and those in a gray area. Build a case to terminate the second category and create a plan to evaluate those in the gray area. |

PBSO Budget – A TAB Update

Introduction

During the preparation of this article, TAB members Fred and Iris Scheibl, and Meg Shannon met with PBSO Chief Deputy Mike Gauger and COO George Forman to discuss the PBSO budget history, the challenges they are facing, and the most fair way to present what seems at first glance to be a budget that has grown at a very rapid pace since the 2003 base year of our analysis.

Prior to the meeting, our earlier open records request for spending data from 2003-2011 was fulfilled, and we were able to get a picture of where the money was spent and where the fastest growth has occurred.

At the meeting, we asked them to consider disclosing their budget line item detail as part of the normal process (rather than requiring citizens to jump through the open records request hoops). Both the Martin and Broward Sheriffs do this to varying degrees – Martin even makes the data available on their website. PBSO on the other hand, provides their budget input to the County Administrator only in the minimum form specified by Florida statute. We were told that more transparency was a possibility, and they would have to discuss it among the PBSO executives.

We also asked them for two other things – for the Sheriff to voluntarily come under the jurisdiction of the Inspector General and Ethics Commission, and for there to be a public audit of the Mobile Data Project, which we have been told has suffered some significant setbacks. On the former, the answer was absolutely not – internal controls and audit functions within PBSO are sufficient and there is no chance that PBSO will voluntarily do any such thing. The answer to the second was also an emphatic no.

Since that meeting, we were sent some additional information, including a 2010 Resource Guide (which contains useful information and metrics about the jurisdictions in the county), and a list of links to publicly available information about county operations and the Florida statutes that concern Career Service Protections, FRS and collective bargaining. Although useful, these sources did not help us with the specific information we were after, namely:

- The number of residents in the operating area, and the average number of jail inmates 2003-2011 (The other year resource guides would suffice)

- Call rate by year 2003-2011

- Staffing at the department level: sworn / civilian / part time for 2003-2011

- Years that major new jurisdictions were added and how that changed the revenue/expense/staffing

- Any extraordinary events/challenges that caused a spike in spending, and what costs were incurred (eg. Homeland Security mandates, trends in crime statistics, etc.)

In response to this query, Budget Director Kathy Cochrane forwarded our questions to Central Records Division for action and redaction, and on Tuesday 11/23 we were assigned a tracking number. When the information becomes available, we will refine the presentation in this article to incorporate (hopefully), a more nuanced view of the PBSO budget over the last 8 years, and likely a better justification for the rapid growth in spending.

Budget Summary

TAB has obtained additional data about historical spending in PBSO, specifically a year by year spending comparison from FY2003 to FY2011. This is more detail than provided to county staff during the budget preparation, and is useful to determine trends. (For a TAB summary of the yearly data provided by PBSO, click HERE) During that time:

- Personal Service costs rose 92%

- Operation costs rose 27%

- Per employee compensation rose 49.4%

- Benefit costs (pension + insurance) rose 154%

This time period saw inflation of 21% and the county population grew 6%.

In the latest budget year, personal service costs (pay and benefits) represents 83% of the total PBSO budget. This compares to 62% for Fire/Rescue. Any future cuts to this budget will necessarily involve staff reductions or reductions to pay and benefits.

Likely Future Budget Scenarios

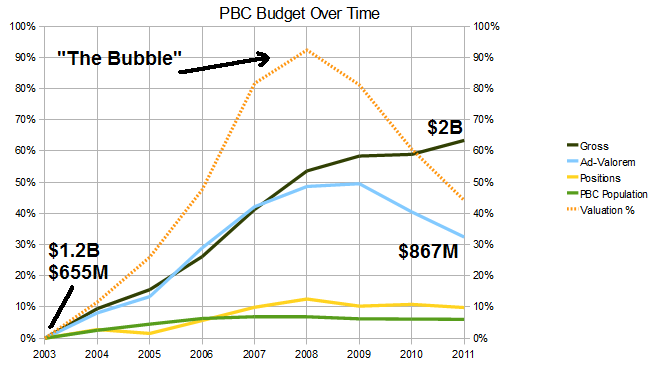

TAB has proposed that the county consider a spending level rollback, perhaps to the levels of 2006. That year is significant because the property valuations of 2011 have fallen to about what they were in 2006, and that level of spending would be sustainable with 2006 pre-bubble levels of taxation (See chart).

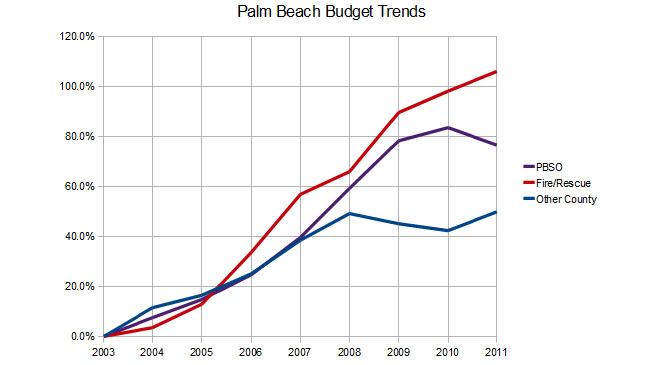

The Sheriff now accounts for 23% of the county appropriations, up from 21% in 2003. By contrast, Fire/Rescue is now 18%, up from 14%. The other county spending though, has been relatively flat since the “bubble” burst in 2008, while both PBSO and F/R continued upwards. The Sheriff did reduce his budget for FY2011 and held positions flat, but is still about 10% above 2008. To roll back to 2006 spending for PBSO would require a reduction of 28% from current levels.

Outlook

TAB believes that the coming years will be particularly challenging for Palm Beach County as property valuations continue their slide and the federal and state “stimulus” money that has been propping up the budget is no longer available. Either significant spending reduction (we would say to 2006 levels or earlier) or equally significant tax hikes will be necessary, and PBSO will not be immune to the challenge. That said, TAB also believes that the Sheriff’s core missions of Law Enforcement, Corrections, and Court Services are a necessary function of county government. Is everything being done today inside PBSO part of those core missions? We don’t yet know the answer to that, and the lack of transparency to the public makes the analysis difficult.

We would like to know if the rapid growth of the PBSO budget was justified by conditions in the community, and how the 4011 employees (1734 of them civilian) are allocated today. We have no reason to believe that there is anything inappropriate being done, but we have no way to tell. Therefore, we would request that PBSO participate more fully in the county budget setting process and implement a public records improvement in keeping with the spirit of the Florida Open Records Law (Statutes chapter 119) that says (among many other things):

“119.01(2)(e): Providing access to public records by remote electronic means is an additional method of access that agencies should strive to provide to the extent feasible. If an agency provides access to public records by remote electronic means, such access should be provided in the most cost-effective and efficient manner available to the agency providing the information.”

We believe the “most cost-effective means” for budget information is either the county or PBSO websites. The county staff does a world class job of this and would be able to assist PBSO in the transition. Martin County Sheriff’s Office provides another example as the Martin equivalent of the information we need from PBSO is available on the MSO website today.

Additional things that would greatly improve the public access to PBSO would be:

- Better cooperation with county staff and commissioners in providing detail to the budget process, even when not mandated by statute.

- Executing an inter-local agreement to voluntarily place PBSO under the juridiction of the Office of Inspector General and subject to the Code of Ethics and Ethics Commission.

- Allow an outside audit of activities that have raised questions in the community – specifically the status of the Mobile Data project and the issues with Intergraph, Inc.

With or without TAB actions, we believe progress is possible in these areas. During the recent election, both candidates for District 2 called for more transparency from the Sheriff, and we are hopeful that the winner – Paulette Burdick, will pursue this. In Broward County, 72% of the voters supported the Charter Amendment that places BSO under the Code of Ethics. There may be a court challenge to this, but it is clear that the citizenry would prefer it. Lastly, questions were raised about Mobile Data during the last budget cycle, and there are members of the community that have begun to probe this program. TAB also expects to investigate this further.

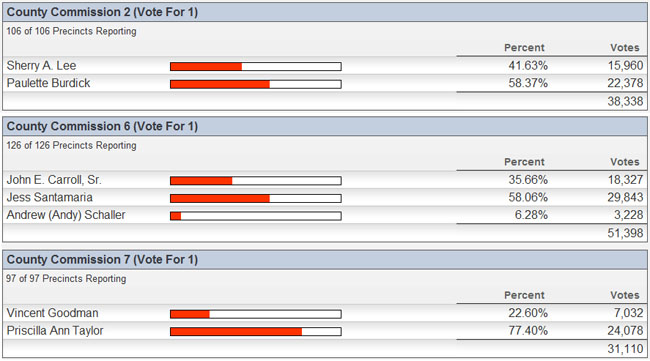

New County Commission for 2011

The people have spoken. On November 2, 2010, the three County Commission seats that were disputed (Steven Abrams in District 4 was uncontested) were decided for the incumbents in districts 6 and 7 by large margins, and the open seat (vacated by Jeff Koons earlier in the year) went to Democrat Paulette Burdick over Republican Sherry Lee, 58% to 42%.

The incumbent’s positions on the budget are known. Jess Santamaria voted against the current budget and has been open to at least small cuts. Priscilla Taylor, although opposed to layoffs of county employees, is open to discussion on the budget, has called for more transparency from PBSO, and has asked for a charter review to discuss the structure of county government.

Paulette Burdick, in the later part of the campaign has said encouraging things about controlling county spending and has also called for more disclosure of the PBSO budget detail. TAB hopes to begin a dialog with Ms. Burdick on budget issues in the near future.

Below is the election results for County Commission as reported by the Supervisor of Elections:

County Commission Hikes Taxes Yet Again

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

On Tuesday evening, the Palm Beach County Commission voted 4-2 to raise county tax rates 9.3%, on top of a 15% increase last year. TAB had proposed specific cuts of $50M (2.5% of the $4B adopted budget) that would have prevented the hike. We also asked the commissioners to defer the Fire/Rescue raises (4% increase on a $140,000 average compensation – costing $14M in this budget), and to defer some capital spending. Fire/Rescue cuts would not have affected the county-wide millage (it is a separate line item) but would have been an acknowledgement that the public sector union employees are not completely isolated from economic conditions affecting those who pay their salaries.

The commissioners, in a not-very-serious discussion of additional cuts of up to $10M, and a contemptuous disregard for Commissioner Santamaria’s proposal to reduce the county car allowance, moved to a vote with very little discussion. There was consensus that any cuts that would not have a major effect on the taxes paid by for the mythical $200,000 house would be no more than pocket change and beneath their consideration. The fact that more than 60% of taxpayers will be paying more (click here for the Sun-Sentinel analysis) was glossed over by the commissioners – “the people want the services more than they want a tiny tax cut” – to paraphase Commissioner Aaronsen.

We at TAB are not surprised at the outcome, having discussed it with individual commissioners over the last week:

- Commissioner Marcus told us she was pursuing additional cuts of up to $10M, including some from the Sheriff, but did no more than mention it in passing at the hearing.

- Commissioner Abrams explained to us that while he would like to see the deeper TAB cuts implemented, the votes were not there for it and smaller cuts were not worth the pain they would cause.

- Commissioner Santamaria thought some token cuts would be good but did not support anything substantive.

- Commissioner Taylor would not even consider a cut that resulted in a single employee layoff.

- Commissioner Vana is all for reviewing programs next year (she is calling for “contingency audits”), but would also draw the line at layoffs and is vehemently opposed to outsourcing.

- We did not speak with commissioner Aaronson – what would be the point? He made it clear that he thinks the 2.5% TAB cuts would “destroy the county”.

A curious thing occurred at the hearing. While the Sheriff did not attend the 9/14 hearing and there was little participation or discussion regarding PBSO, at this hearing his organization was well represented, with over 20 employees coming to the microphone in support of the Sheriff’s budget.

We believe this was a consequence of TAB discussions with individual commissioners over the last week regarding the BCC rights under Florida statutes to request line item detail from the Sheriff. The reason for this line of inquiry was in response to Bob Weisman’s statement on several occasions that the county can not cut any more from their budget unless the Sheriff makes equivalent reductions. If this were to be asked of the Sheriff, having the line item detail would allow a public analysis of whether additional cuts would indeed compromise public safety. The PBSO budget has grown 80% in 8 years – about 12 times the population growth and 3.5 times the rate of inflation. The Sheriff provides to the county only the detail required by statute – which is not enough to understand the PBSO spending. Both Broward and Martin county Sheriff’s provide much more detail, and TAB believes the BCC should require it of PBSO as well.

At the hearing, John Kazanjian, president of Palm Beach County PBA (the police union) made the following statement:

“I hadn’t planned on being here, neither had my members and fellow employees.” … “But it’s our understanding that the commission and its staff are listening and catering to professional and semi-professional anti-tax groups, little circles of characters who would complain even if they were paying next to nothing in taxes. But these are the same characters who march into government offices demanding services and call 911 when trash gets thrown on their yard”. “I’m here… because We’re tired of them bashing the Sheriff.”

Let’s set the record straight: TAB is neither a professional nor semi-professional anti-tax group. We are a coalition of concerned citizen-taxpayers, worried that excessive spending at all levels of government has begun to compromise our way of life and the American Dream for future generations. We have no sources of funding other than our own pockets, and all our work is a volunteer effort. The 15 or so citizens who spoke on behalf of the TAB proposal were at the meeting on their own dime, paid for their own parking, and took time out of their lives because they are concerned about the future of Palm Beach County.

We appreciate the feelings of the PBA and the non-union PBSO employees who spoke at the meeting, and we congratulate Sheriff Bradshaw and his team for their enthusiasm and commitment to the organization. They are however, all employees of the county, and representing their self interest. That is their right – the first amendment doesn’t stop when you put on a uniform or draw a public paycheck. What everyone needs to consider though, is that it is the private sector that provides the source of wealth from which government draws its funding. It is a bargain that works best when it is balanced. At the current time, the alliance of public officials, their employees, and the public sector unions that provide their funding and political support have distorted the private/public compact. This phenomenon has destroyed California and is wreaking havoc in many other states. In Florida we have not yet reached the tipping point, but the pension time bomb is ticking. The situation can be brought back to balance, but only if all parties are willing to cooperate.

For an excellent article on the subject, see The Trouble with Public Sector Unions in the fall issue of National Affairs.

We in TAB are not “bashing the Sheriff”. Rather, we have a lot of respect for PBSO and the work they do. We are asking only for transparency in the budget process, and an appropriate level of spending. The Sheriff, the Chief Deputy, and the COO have all offered to meet with TAB and discuss the PBSO budget. We thank them and will take them up on the offer in the very near future.

As a closing remark, I would remind the Commissioners that TAB is focused on SPENDING rather than taxes. Now that the tax rate is set until next year, the ad-valorem discussion is over, but the spending discussion will continue. We at TAB plan to continue our look at the budget line items, perhaps drilling down to the next level. We also hope to look beyond the county to the other taxing districts and the cities. Our mission is unchanged – “We are paying the TAB and we are keeping TABs on you.”

Synopsis of 9/14 Budget Hearing

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

Palm Beach County held the first of two public hearings on the 2011 Fiscal Budget on 9/14. The county chambers were filled to capacity and many people either watched on monitors in the anterooms on the 6th and 5th floors or in the lobby to the building. People were turned away and those who arrived after discussion had begun were unable to submit cards to speak or have their positions read into the record.

Note for future reference: At all PBC Commission meetings, once discussion has begun on a topic, no further cards may be submitted. This meeting was no exception. The topic for the county budget was IV E 1 and for Fire/Rescue – IV E 4. Many people arrived late and thus were unable to participate.

Most of those who spoke represented groups unhappy about cuts in the budget – primarily cuts to the Cultural Council, Palm Tran, the Drug Farm and the Eagle Academy. Even after the Commissioners made it clear that the Drug Farm and Eagle Academy were the Sheriff’s decision, speakers continued to come forward on it.

Thanks to those on the Palm Beach County Taxpayer Action Board work groups who spoke: Shannon Armstrong, Ed Fulop, Jim Donahue, Karl Dickey, John Parsons, Christina Pearce, Michele Kirk, Sherry Lee and Fred and Iris Scheibl. Carol Hurst also spoke on behalf of the TAB proposal. Also speaking – although not specifically on the TAB proposal was Dionna Hall. There were several other people who did not speak but submitted cards stating that they were in support of the TAB proposal. I’m sorry if I missed anyone who also spoke – I was not taking notes. It was unclear whether the Commissioners had received any phone calls or emails; if they had, they did not acknowledge them.

Many speakers left the long meeting after their 3 minutes, so by the time the Commissioners got to discussion of the budget the chambers were almost empty. To view the commission debate – advance to the 3 hr 8 minute point in the video accessed by clicking: ![]() HERE

HERE

Discussion lasted over an hour. The Commission voted 5:1 (Steven Abrams opposed) to keep the 4.75 millage rate as a maximum (as it appeared on the trim notices received by all property owners). Attempts would be made to bring the number down – potentially to 4.72 or 4.70. But the majority of the commissioners out right rejected the TAB proposal of roughly $30M in cuts plus an additional $20M which would be required by PBSO to retain flat millage. The target they gave County Administration was anywhere in the range of $4M ($2M from both PBSO and County) to $15M – all predicated on steep cuts by the Sheriff. It was totally unclear whether any further spending cuts whatsoever would be presented at the next hearing on September 28.

Following is a rough outline of the discussion and questions asked by the Commissioners:

Chairman Aaronson started the debate with a motion that 4.75 millage be made the ceiling. It was seconded and then discussion began.

Commissioner Marcus started going through the TAB proposal, exploring various aspects with Administrator Weisman responding:

- Blue vs Green pages: All Green pages done; none of the Blue cuts were made.

- Fire/Rescue: union approached on postponing increases – outright rejection

- Maintain PBSO cut: PBSO cut or returned revenue in amount of $28M

- HR programs: outright rejection of any of the Clerk’s suggestions of $1M

- Cut almost $10M in ad-valorem capital – rejected as necessary

- Stop or defer $91M in non-ad-valorem capital – rejected since it didn’t affect ad-valorem

Commissioner Marcus pursued capital some more – wasn’t a drop-off expected this year? Response was no – actually this coming year was going to be pretty bad with Max Planck debt coming in.

Commissioner Marcus raised the topic of the PBSO Mobile Data Project debt service on $35 million in bonds – raised by TAB members Iris Scheibl and Jim Donahue in their talks. Joe Doucette confirmed that the capital had not been drawn down as would be expected and discussion ensued around paying off the debt to eliminate around $6M in debt service. Marcus wanted a status on the project.

PBSO Budget – Commissioner Marcus and PBSO COO George Forman discussed civilian longevity and step raises and whether or not a Florida Statute would allow them to cancel or defer up to $11M in increases from occurring. While Mr. Forman stated that the $11M applied across the board (uniformed and non-uniformed staff) – Marcus replied that if 40% of staff wasn’t sworn – then wouldn’t it be true that about 40% of the $11M applied to civilians. Back and forth on the statute written to apply specifically to PBC and no other counties. Discussion on whether or not Fire/Rescue or PBSO contracts could be opened due to ‘exigent operational necessity, eg: financial catastrophe. It was unclear what kind of status report or response from PBSO would result from the querying other than direct response requested on the status of the Mobile Data Project.

Chairman Aaronson brought the conversation back to overall budget discussion. Aaronson favored cutting CCRT (Countywide Community Revitalization Team) and management of environmentally sensitive land $$ for a modest cut of $2-3M. He was absolutely against blue pages cuts or layoffs of ANY COUNTY EMPLOYEES. Ridiculous discussion then ensued stating that to cut $30M (TAB proposal) would result in a 750 person lay-off (when TAB proposal was actually 268). Aaronson said that any lay-off would hurt the Palm Beach County economy, result in further defaults on homes, so OUT OF THE QUESTION. After much discussion they concluded that they were only talking savings to the taxpayer of $8 if cut the spending.

Commissioner Abrams didn’t agree with the whole approach. Felt that we needed to do large scale reductions (eg the blue pages without closing the pools). That the county should do outsourcing. He rejected comparison to cities that have kept their millage rate flat, however – stating that the County doesn’t control PBSO and that Fire/Rescue isn’t in the county base millage rate.

Commissioner Santamaria was looking for a target; he would accept the motion of 4.75 millage if a $$ target were set. None ever was.

Commissioner Aaronson said that no way would $36M ever be cut and no matter how many people groups like TAB brought in, more could be brought in to say they want continued services and $$ spent. He could fill the chambers with them.

Commissioner Marcus would support the motion if the $6M in the Mobile Data project was pursued for a total range of $5-$15M in cuts.

Commissioner Vana was willing to postpone some capital (eg Mobile Data) and referred to a discussion from another meeting on jails vs ankle bracelets. She also suggested looking into contingency audits for the next budget to find low-hanging fruit – but absolutely no lay-offs or privatization. Looked directly to the TAB folks and said you won’t get to 4.34 millage this year – but maybe some of these actions would get us closer in the future.

Commissioner Taylor spoke against any attempt to outsource, citing an issue of Government Magazine. She also stated that one can’t compare cities to counties and that the Commission only does what the people want. And the people wanted Scripps and Max Planck. There was a lot of discussion with Commissioner Aaronson and Administrator Weisman on the history of the jails, Scripps and Max Planck – after which Commissioner Taylor said that the people want these things and then they have to pay for them.

There was a small amount of additional discussion on targets and then the Commissioners had their 5:1 vote on the Aaronson motion. The remainder of the meeting was to go through approval of all the other MSTU millage rates and transfers. Fire/Rescue was not touched. The meeing was adjourned.

TAB Holds Public Meeting on County Budget

Last evening, September 2, in the county library on Lantana road, 60-70 interested citizens turned out to listen to a presentation by TAB on the county budget. (CLICK HERE to view the presentations).

Many people were surprised to see that even in these tough economic times, with 12.2% unemployment in the county and plunging real estate values, the county spending is projected to increase yet again, by $56M in fact.

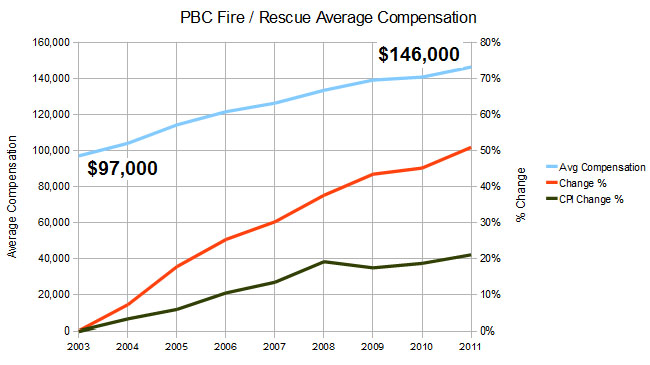

The county firefighters, already paid an extremely generous average compensation of $140,000 / year – are going to get another raise – to an average of $146,000, at a time when pay for other county employees has been frozen. Their level of pay has risen 50% since 2003, while inflation has only been about 20%. The feeling of outrage in the room was palpable as this was explained by Realtor and TAB member Christina Pearce.

Federal stimulus money (also know as ARRA – the American Recovery and Reinvestment Act) has been flowing into the county at a prodigous rate – over $100M this year, allowing the county to increase spending while ad-valorem taxes are (modestly) declining. One of the items on this spending list is $50M for “Neighborhood Stabilization” grants – basically money to give or loan to people who are buying up foreclosed properties and fixing them up. Would the county be spending this without the federal funds? Hard to say, but if this spending level was done without the ARRA money, our taxes would have to rise by 31% according to calculations by SF 912 and TAB organizer Fred Scheibl.

The county has assumed too much debt for questionable reasons and much of the requested new borrowing for capital projects in the FY2011 budget should be deferred or canceled, explained Lower Taxes Now and TAB member Sherry Lee (who is also a candidate for county commission district 2). Sherry described almost $100M in potential deferrals, including money being allocated for airport expansion, even though the whole project is tied up in a lawsuit, and the FAA has not approved the project.

The time has come for defining our “core services”, explained former PBG councilman Hal Valeche, also a member of SF Tea Party and TAB. Citing examples from around the country where progress has been made in trimming outdated or extraneous items from budgets, Hal called on the county commission to require a thorough categorization of all county spending to determine what is “core” and what is “discretionary”.

The whole structure of our county government should be subject to scrutiny, argued SF912 member and TAB member Iris Scheibl. She applauded the county commission for calling for a charter review next year and proposed that TAB be a part of that effort. The relationship between the commission and the constitutional officers, particularly the sheriff need to be examined, for example, to bring more transparency to the internal workings and spending priorities of the PBSO.

After a summary of the “TAB Proposal” to cut $171M from the 2011 budget, moderator and SF 912 founder Shannon Armstrong took questions from the audience. Many pointed out areas that TAB has not so far examined and should (like the School Board), and others added valuable insights into areas like the Fire-Rescue “Kelly Day” concept.

Commissioner Jess Santamaria attended the meeting and spoke briefly at the end, suggesting that we are only addressing half of the problem – that there is still a lot of corruption surrounding the way the county spends its money and he gave some examples where the grass roots have been effective in stopping it, as well as other areas where they could.

It should be noted that all the commissioners were invited, along with the constitutional officers and the county Administrator. Commissioner Shelly Vana said she would attend but did not. Property Appraiser Gary Nikolits was in the audience, as was Budget Director Joe Doucette, and Communications Director Linda Culbertson from the Clerk and Comptroller organization, representing Sharon Bock.

TAB wishes to thank those who participated in the meeting and asks that everyone who is concerned with the excessive levels of spending in the county attend the budget hearings on 9/14 and 9/28, and to ask their commissioners to “Adopt the TAB Proposal”. CLICK HERE for the “Call to Action” containing contact information for the Commission.

Here’s a few pictures of the event:

A TAB Look at Fire / Rescue

What do we know about the Fire / Rescue Budget?

The most important thing to note about Palm Beach County Fire / Rescue is that the average compensation (all employees) is currently $140,000 per year and they are about to get another 4% added to that. This is with other county salaries frozen and private sector county unemployment at 12.1%.

For some perspective, see the Sun Sentinel article “Some government workers get generous raises despite dismal economy”

TAB believes that the raises should be deferred (saving $14M) or other spending reductions be put in place to achieve equivalent savings. Furthermore, the county should perform a comparison with other counties in the state and explain to the citizens why Firefighters in Palm Beach are so expensive.

The current 2011 budget has this line item for Fire / Rescue:

| 2010 | 2011 | Change | % | |

|---|---|---|---|---|

| Revenues | 126,617,751 | 152,101,082 | 25,483,331 | 20.1% |

| Appropriations | 346,986,345 | 360,758,193 | 13,771,848 | 4.0% |

| Countywide | 8,964,411 | 9,423,026 | 458,615 | (5.1%) |

| Net Ad Valorem | 211,404,183 | 199,234,085 | (12,170,098) | (5.8%) |

| Positions | 1542 | 1542 | 0 | (0.0%) |

| In FY 2011, Fire Rescue’s revenue increased by $26.9 million due to a $21.5 million increase in the balance brought forward, an increase in interest income, and an increase in the Main MSTU charges for services (primarily transport revenue). The increase in appropriations is due to to increases in personal services costs (Florida retirement rate, collective bargaining agreement across the board increases and long term disability rates). | ||||

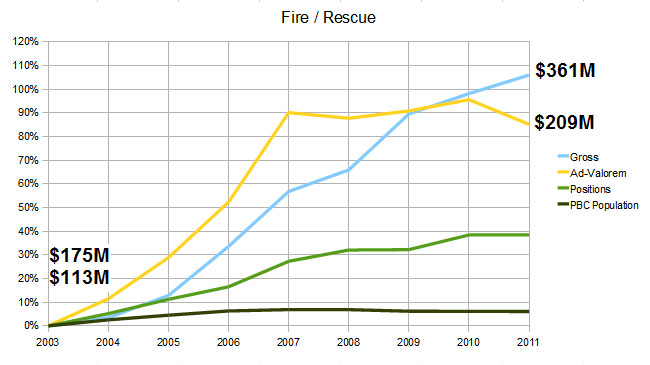

So the budget is being increased by about 4.0% and staffing is unchanged. Is that a good thing or not? To find out, we need to put several things in context. If I go back to previous budgets and plot the “Net Ad Valorem” and staffing from 2003 up to the current year, and place the Palm Beach Population growth line on the same graph it looks like this:

Note that while population stayed relatively flat (we now have only 6% more people in the county than we did in 2003, and it’s been declining since 2007), Fire Rescue staffing went up about 38% and spending went up 106%.

To put that another way, in 2003 there was one Fire Rescue employee for every 1087 residents and Fire Rescue charged an average of $145 per person, while in 2011 it will be one for every 833 residents and cost $281 per person (a 94% increase). Does this make us safer? We’ll look at that question a little later.

2011 Proposed Fire Rescue Budget Cuts

There are none. In fact, the collective bargaining agreement is giving employees an across the board raise of 1% in 4Q10, and 2% next year – with benefits, that is a 4% increase in personal service costs at a time that the rest of the county government is tightening their belts, and civilian unemployment is at 12.2%. Is that prudent?

Project Goals

Palm Beach County Fire & Rescue department is by far one of the most advanced and sophisticated in the Country. The department in it’s current form is not financially sustainable. Small and large changes should be considered to bring this budget back to a realistic working formula. The opportunity to investigate what can be changed is before us right now, for a short window of time. The collective bargaining contract with the Union will be up for renewal in the Spring of 2011. In order for any significant budget and organizational changes to be made, this negotiation must be handled by strong leaders that have the public interest in mind. We intend to . . .

- Search with great scrutiny the collective bargaining contract, review other contracts in Counties that are more fiscally responsible, identify wasteful and excessive items to eliminate. ( Click HERE to view the current contract. )

- Study comparable Fire & Rescue departments in other areas of the Country that are more fiscally responsible to highlight what they are doing differently. Palm Beach County is above the National average. Benefits and pay for the average PBC Fire & Rescue worker is over $140,000 per year.

- Change the new hire policies to reflect the growing need for a more reasonable retirement and benefits package. This should include age of retirement, as well as a change in benefits ( any that can be done on a local level).

- Work on policies that take advantage of the influx of military personnel that will be returning from duty in the near future. These men and women are already well trained in many useful skills and they have VA benefits that could reduce the need for many of their healthcare costs.

- Make proposals in common sense cost cutting areas, such as combining the fleet service with county fleet service, utilizing county communications and dispatch services in a more unified way, eliminating uneccessary vehicles, and replacing 3 full time videographers and photographers with interns from a local film school.

- Explore privatization of services. Provide case studies, and possibly propose a trial area for a test of these services.

- Propose the elimination of Kelly days and review the policy concerning scheduling to reflect the needs of the public, not the needs of Fire & Rescue workers to maintain other jobs.

- Review and eliminate the proposed capital projects that would replace or improve 10 fire stations that are currently not necessary.

- Look into costly and questionable policies concerning lobbying while on duty, including overtime pay in the final retirement formula, accumulating and getting paid for extra sick days, and taking advantage of “double dipping”.

We have a lot of work and research to do in this committee, and we will need to accomplish it before the bargaining agreement begins. Our team is committed to presenting all of our research to the Commissioners and staff and we expect a full review and consideration of all of these suggestions.We will provide the research necessary for this review.

An Analysis of the County Budget Proposal – I

TAB has a goal for this budget year to see the millage unchanged at 4.344. Since the staff proposals (green/blue pages) have been “vetted” and impact analysis performed, we have analysed those line items with an eye towards what would be reasonable and acceptable. As the green page reductions are achieved mostly through elimination of unfilled positions, they would seem to be a clear target. The blue pages (after some line items that would have strong public support are restored) are also acceptable and we believe would have little observable effect by MOST of the public. Therefore, TAB recommends the adoption of spending cuts totalling $56M as defined below, and the related elimination of 268 positions (2% of the county workforce) that could be accomplished through attrition. This does not quite achieve the flat millage, but we are continuing to seek the remaining $5M.

Introduction

The county budget is often analysed from the perspective of the “rollback rate”. This is the millage that would generate the same ad-valorem revenue as the previous budget year, given the current year’s estimate of property valuations. It is useful only in that whatever becomes the actual millage for that year can be compared to the “rollback rate” to see at a glance if the tax burden is growing or shrinking. It says nothing about the spending levels at all though, as other sources of revenue (eg. fees) offset spending across departments, and the budget can be actually growing while the tax burden (ad valorem) is shrinking. By the way – that is actually what is occuring this year – the budget appears to be growing.

It is difficult to see this clearly, because much of the budget documents focus on the ad-valorem numbers, and department level rollups in the documents don’t always match the top line figures because of the real-time nature of the process. That said, the July 6, 2010 workshop document shows the following county rollup on page A-17: (Click HERE to view the document.)

| Grand Total BCC Departments/Agencies, Judicial and Constitutional Officers | ||||

|---|---|---|---|---|

| 2010 | 2011 | Change | % | |

| Revenues | 1,061,922,162 | 1,170,404,859 | 108,482,697 | 10.2% |

| Appropriations | 1,981,557,651 | 2,037,313,337 | 55,755,686 | 2.8% |

| Net Ad Valorem Requirement | 919,635,489 | 866,908,478 | (52,727,011) | (5.7%) |

| Positions | 11,389 | 11,284 | (105) | (0.9%) |

TAB will attempt to look at spending in real terms, including such things as grants and particularly this year – the ARRA stimulus funds that the county received. (ARRA = American Recovery and Reinvestment Act). Our share of ARRA funds is in the vicinity of $110M and it has quite an effect on the budget (as you may expect). For this article though, we will analyse the budget using the information provided in the workshop documents and stick to the Ad Valorem measurements.

The Budget Proposal

As of the last budget meeting, at which time the maximum millage was set at 4.75 for county-wide taxes, the rollback rate was 4.8223, producing county-wide taxes of $612,486,522. Simple arithmetic tells us that this assumes a property valuation of about $127B. Therefore, a millage of 4.75 implies a reduction in ad-valorem equivalent from last year of $9.2M. To achieve the TAB goal of keeping the millage unchanged (4.334) would require a reduction of

$60.7M (coincidently – that is only $5M more than the budget was expected to GROW this year). So how would we get there?

County staff prepared a series of proposals for budget cuts, known by their colors – the “green” and “blue” pages. The green pages are relatively easy to apply – most savings can be had without cutting occupied positions or adversely affecting services delivery. They account for $22.5M in cuts.

The “blue” pages are harder, and are split into “level 1” ($10.4M and the elimination of 91 occupied positions), and “level 2” ($25.7M and 241 positions). Blue page cuts will result in some reduction of county services, some visible and needed.

Again, if we take up our calculator, we see that the sum of all these cuts is $58.6M – pretty close to what we need to keep the millage flat. Since the Sheriff has already been asked for another $3M, just to achieve the 4.75 millage – if that were to happen we would be over the top and have reached our goal. All without needing to look at capital projects or the details of the PBSO internals, or by trading up into the aggregate millage by seeking reductions in Fire / Rescue. Wow – how about that?

So what’s wrong with this picture?

The sticking point is that the “blue” pages require an actual reduction in staff – not just the cutting of “unfilled positions”. Real people will lose their jobs and have to enter the job market at a bad time for the economy. Of course that challenge is faced every day by businesses who can’t just maintain their staffing by raising taxes. Also, cutting staff means delivering fewer services. Some would say that the $400M that was trimmed from the budget over the last few years was not really noticed by anyone. Would this be noticed? Let’s analyse the green and blue pages by line item and see what is being proposed, and judge for ourselves if these are indeed “critical functions” that are part of the core mission of county government, or just some things that are not essential.

So let’s go through the staff proposals by area, and consider the effect of the cuts.

The Green Pages

The $22.5M spending reductions listed in the “Green Pages” are almost completely achieved by eliminating unfilled positions. Where an impact is noted, it would be because some growth in service level was anticipated in the area, or an attempt was being made to reduce workload on current staff. By definition, if the the positions are unfilled, then it is not likely that a service impact will be felt at current service levels. TAB recommends adoption of ALL Green Page proposals.

| Department/Program | Description | Savings | Positions | TAB Analysis |

|---|---|---|---|---|

| Financially Assisted Agencies | Reduce 5%, Eliminate funding for Culture Council | $1.6M | 0 | Not essential services. |

| Office of Community Revitalization | Reduce street light maintenance | $131,232 | 0 | No impact |

| Community Services | Adjustments with grant funded projects | $1,231,950 | 4 | Not essential or absorbed. |

| Cooperative Extension Service | Eliminate unfilled positions | $207,432 | 0 | No impact – positions were unfilled |

| Criminal Justice Commission | Reduce ad-valorem portion of staffing | $514,261 | 4 | Redundant or not essential services. |

| Economic Development | Reduce scale of programs | $309,105 | 0 | Questionable value – what are the metrics? |

| Engineering | Eliminate unfilled positions | $2,853,280 | 0 | No impact – positions were unfilled. |

| Environmental Resources Management | Reduce program scale | $1,692,707 | 0 | Work slowdown – positions were unfilled |

| Facilities Development and Ops | Eliminate unfilled positions, some procedure changes | $1,073,778 | 2 | Minor or no service level impact. |

| Financial Management and Budget | Eliminate unfilled positions | $99,936 | 0 | No impact – positions were unfilled. |

| Human Resources | Eliminate unfilled positions | $166,548 | 0 | No impact – positions were unfilled. |

| Information Systems | Eliminate unfilled positions | $2,772,681 | 0 | No impact – positions were unfilled. |

| Judicial | Various efficiencies | $1,446,985 | 0 | Little or no impact |

| Legislative Affairs | Eliminate unfilled position | $58,961 | 0 | No impact – position was unfilled. |

| Palm Tran | Change in fees and eligibility | $3,075,000 | 0 | Not essential service. |

| Parks and Recreation | Eliminate unfilled positions | $2,688,895 | 0 | None – postitions were unfilled. |

| Planning, Zoning, Building | Eliminate unfilled positions | $907,472 | 0 | No impact – positions were unfilled. |

| Public Affairs | Eliminate unfilled positions | $387,068 | 1 | No impact – positions were unfilled or moved. |

| Public Safety | Eliminate unfilled positions and juggle workload | $1,174,404 | 2 | Little impact – positions were unfilled or can be handled elsewhere. |

| Risk Management | Eliminate unfilled positions | $121,824 | 0 | None – duties absorbed. |

| Small Business Assistance | Reduce mission. | $21,533 | 0 | Not essential service. |

| GRAND TOTAL – GREEN PAGES | $22,531,056 | 13 |

The Blue Pages – Level 1

The level 1 blue pages contain $10M in spending reductions that require staff reduction of filled positions.

With the exception of the Parks & Recreation line item that would result in the closing of pools, parks and nature centers, most of the effect would be to spread work around or ask remaining staff to pick up the load – perhaps with longer delays for service, but in no way is public safety, gross customer satisfaction, or critical mission requirements compromised. In most cases, the reductions are not in what TAB would consider core county missions. TAB recommends adoption of all blue level 1 cuts (except those noted) for a reduction of $8M and 53 positions.

| Department/Program | Description | Savings | Positions | TAB Analysis |

|---|---|---|---|---|

| Financially Assisted Agencies | Reduce 5%, Eliminate funding for Culture Council | $1.6M | 0 | Not essential servcies |

| Financially Assisted Agencies | Reduce additional 5% over green pages | $569,000 | 0 | Not essential services |

| Community Services | Reduce veteran’s service 25% | $48,204 | 1 | Redundant or not essential services |

| Facilities Development and Ops | Eliminate 1 auto tech and reduce window washing | $101,000 | 1 | Slight increase in time to repair – ACCEPTABLE |

| Information Systems | Reduce staff by 5 positions (<3% of department) | $526,000 | 5 | Spread workload – ACCEPTABLE |

| Office of Community Revitalization | Sweep funds | $1,150,551 | 2 | No current impact – ACCEPTABLE |

| Office of Equal Opportunity | 25% cut without violating mandates | $60,000 | 1 | Reduces scope – ACCEPTABLE |

| Palm Tran | Raise Fees | $2,650,000 | 0 | Higher fees and lower subsidy – ACCEPTABLE |

| Parks and Recreation | Reduce staff and close facilities, defer maintenance, reduce public relations | $3,937,581 | 53 | TAB believes the beachs, pools, and nature centers are widely utilized by the public and should be kept open. Some ancillary and seasonal cuts are acceptable. TAB recommends restoring $2,426,000 and 38 positions from this line item. |

| Planning, Zoning, Building | Reduce planning functions to mandated levels | $218,560 | 3 | Planning function only – ACCEPTABLE |

| Public Affairs | Consolidate office services, reduce coverage of channel 20. | $400,000 | 13 | With major meetings still on channel 20, other cuts are ACCEPTABLE |

| Public Safety | Reduce hours in animal control, reassign work, reduce staff | $605,819 | 11 | Reduction is 3% of Public safety area – ACCEPTABLE |

| Small Business Assistance | Eliminate 1 specialist | $155,625 | 1 | 14% staff cut to non-essential service – ACCEPTABLE |

| GRAND TOTAL – BLUE PAGES LEVEL 1 | $10,422,340 | 91 | With TAB Restores: $7,996,340 and 53 positions. |

The Blue Pages – Level 2

The level 2 blue pages contain cuts that are more visible and significant than the level 1 cuts. That said, most of them are in areas that we do not consider “core county mission” and are acceptable spending reductions, except as noted. Cutting maintenance for traffic signal loops or curtailing mosquito control would seem to be silly, and closing the parks and pools is not acceptable to most residents. Therefore, TAB recommends adopting these cuts except where noted, for a total of $23M and 215 positions.

| Department/Program | Description | Savings | Positions | TAB Analysis |

|---|---|---|---|---|

| Financially Assisted Agencies | Reduce another 5% | $540,000 | 0 | Not essential services – agencies that receive FAA funds have other sources and can adjust their service delivery appropriately. | Community Services | Reduction of county overmatch on grant programs | $4,398,000 | 14 | These programs appear to get funding from grants and county contribution is not essential – ACCEPTABLE |

| County Commission | Decrease Commission Support Staff | 0 | 0 | A 33% cut in commissioner staff with no claimed savings would seem to be not helpful. |

| Engineering | Eliminate funding for signal loop maintenance | $285,000 | 0 | Would seem to be unwise. KEEP |

| Environmental Resources Management | Cutbacks in Mosquito Control | $200,000 | 2 | Would seem to be unwise. KEEP |

| Facilities Development and Ops | Eliminate various postions (3%) and outsource Electronic Security Services | $1,018,648 | 35 | Phase in outsourcing (50%) and keep receptionist. Restore $377990 and 16 positions. |

| Information Systems | Eliminate 9 positions (~5% of IT) | $1,192,000 | 9 | 5% can be absorbed in any IT organization by increasing exempt overtime. |

| Palm Tran | Eliminate unfilled positions, change fees | $2,863,225 | 2 | Fixed route Sunday service positions were unfilled. Other service cuts would need to be evaluated in larger context but they seem ACCEPTABLE. |

| Parks and Recreation | Further cuts that would result in closing of many visible facilities and programs and deferring maintenance. | $11,572,331 | 126 | As with the Parks and recreation cuts in level 1, TAB supports restoring the visible facilities that are open to all county residents. Of the 15 line items in this section, we would maintain funding for items 1 (rangers), 2 (nature centers), and 5 (pools), for a total of $2,217,073 and 24 positions. |

| Planning, Zoning, Building | Reduce code enforcement budget by 25% | $795,072 | 11 | Staff cuts will result in delays but not ommission of enforcement functions – ACCEPTABLE |

| Public Safety | Elimination of some ancillary services (youth affairs, victim services) and reduction in hours of animal control | $2,522,400 | 40 | Core functions remain operational and programs that are not “essential services” are curtailed – ACCEPTABLE |

| Small Business Assistance | Further staff cuts to SBA resulting in about half current level. | $275,000 | 2 | Providing assistance to small business, while helpful to those using it, is not a essential to county government – ACCEPTABLE |

| GRAND TOTAL – BLUE PAGES LEVEL 2 | $25,659,882 | 241 | With TAB restores, $22,579,819 and 215 positions. |

Summary

So, based on an analysis of the county staff proposed cuts, we believe that a serious reduction in county spending is possible, without drastically curtailing county services that the majority of the public has come to expect. Taking into account the cuts we would restore, TAB sees one possible scenario as follows:

| Rollback tax revenue | $612,486,522 |

| Green cuts | ($22,531,056) |

| Blue-1 (TAB version) | ($7,996,340) |

| Blue-2 (TAB version) | ($22,579,819) |

| Sheriff’s Challenge | ($3,000,000) |

| Resulting Revenue | $556,379,307 |

| Equivalent Millage | 4.381 |

So, we are close but not quite at flat millage. In part 2, we will examine where else we can find cuts.

Where does the $56M Budget Increase Go?

Did you know that the County budget is growing by $56M this year? Most of the attention has been on the ad-valorem amount (property taxes) decreasing, but the $107M in federal stimulus money is flooding the system (in the first quarter alone: CLICK HERE), causing the county to hire new staff and grow the overall appropriations by $56M. What happens to our budget when the stimulus ends??

First, here’s the budget at a glance:

| Grand Total BCC Departments/Agencies, Judicial and Constitutional Officers | ||||

|---|---|---|---|---|

| 2010 | 2011 | Change | % | |

| Revenues | 1,061,922,162 | 1,170,404,859 | 108,482,697 | 10.2% |

| Appropriations | 1,981,557,651 | 2,037,313,337 | 55,755,686 | 2.8% |

| Net Ad Valorem Requirement | 919,635,489 | 866,908,478 | (52,727,011) | (5.7%) |

| Positions | 11,389 | 11,284 | (105) | (0.9%) |

Now look at where much of the growth is occurring: (source is 7/6/2010 workshop package)

| 2011 Increase | % | Explanation | |

|---|---|---|---|

| Community Services | +$2M | +2.4% | Head Start ARRA Expansion grant – Net +11 positions |

| Environmental Resource Mgt | +$8M | +16% | ?? |

| Housing and Comm. Development | +$48M | +61% | $58M “Neighborhood stabilization grant” – net +8 positions |

| Palm Tran | +$10M | +8.5% | increase in federal grants |

| Econonmic Development | +$9M | +42.8% | Block grants |

| Fire Rescue | +$14M | +4% | increase in compensation – salary and pension from union contract |

| Tourist Development | +$3M | +7.5% | how spent? |

| Water Utilities | +$7M | +6.3% | “uncontrollable operating costs” and new services |

| +$101M |

It should be noted that some consider the federal stimulus funds as “free money” – that is, if we didn’t get it someone else would. There is truth to that given the current management of the federal government. On a local level, a prudent use of these dollars would be to smooth over the budget shortfall until economic conditions improve. Instead, (possibly because of the rules surrounding the grants), the funds are being used to grow the county budget, even adding staff in some areas that will have to be paid out of local dollars when the stimulus ends. Is that the right thing to do?

TAB Plan, Projects, and Timeline

TAB was formed to find ways to reduce county spending. Notice that we are not trying to “reduce the millage rate”, or even “reduce taxes”. The complexity of county revenue sources and the various adjustments to property tax bills such as the homestead exemption and appraisal caps make tax comparison a game of “who wins, who loses”. Millage, likewise, is more a game of trends and estimates in property appraisal. To really get a handle on the affordability of the county spending it must be compared to an objective measure of economic activity, population, inflation, or some other external yardstick. That sort of measure could then be used to see how we stack up against other Florida counties, or government entities around the country.

Palm Beach is a “rich” county. Our per capita income is high for the state and for the country. This should imply that we could spend more per capita, and have a richer infrastructure and nicer amenities, parks, and facilities than the average, but it does not mean that county spending per capita can continue to increase without negative economic consequences to both consumers and businesses.

From a high level, the county budget has parts that are contracting in line with revenue and others that appear have grown without restraint – PBSO and Fire/Rescue for example. Both are complicated by absorption of municipal areas over the survey period, and capital projects for needed service enablement. Most of the growth though, appears to be in the area of employee compensation, driven by union contracts. This is a problem shared by governments at all levels and in all parts of the country. At its core, it is a failure of leadership by elected officials and it is not fair to blame the unions or the employees for requesting and winning a compensation package that is ultimately unaffordable. Just as failures of leadership from the executives of the Detroit auto companies led to federal bailouts, bad negotiating by county (and state and local) officials are leading us towards unpleasant consequences. Public employees deserve good pay and benefits, but it must be in line with the private sector where the wealth is created and which ultimately pays the bills. This is an area for long term focus by TAB.

A look at the chart prepared by Property Appraiser Gary Nikolits indicates that PBSO is the largest component of the county budget and has been growing much faster than the parts controlled by Administrator Weisman (which is shrinking, although modestly so). About $15M in cuts have been proposed by the Sheriff, mainly by cutting 3 entire programs. These are the Eagle Academy, the Drug Farm, and the Parks Police. We will look at these in another article and consider how they fit in the scheme of things. Beyond that it is difficult to analyse the PBSO budget as it is not published with the rest of the county. TAB has submitted a records request with PBSO for the “budget package” and have been assigned a tracking number, but as of yesterday, the Records Division could not say when it would be available.

Short term, TAB wants to see the millage unchanged at 4.344 versus the proposed 4.75 maximum. This would require another $52M in cuts (which is about 8.4% of ad valorem revenue, or about 1.3% of the overall county budget of $4B). Fire/Rescue, which has its own millage rate, is proposing no change for 2011, but it does plan to spend down reserves, so we will be looking at their spending as well.

TAB Timeline

With the next County Commission meeting on the budget set for September 14, we have established a schedule that will produce some solid proposals against our short term goals by that time. The timeline includes a September 2 public meeting, tentatively to be held in the Lantana branch of the County Library system when we will roll out the proposal. Commissioners, staff, and Constitutional Officers will be invited to this meeting. To meet this objective we have divided the TAB team up into work groups to delve into the following areas:

- Core County Mission (ie. “What business are we in?”)

- Capital Projects and the Debt Process

- PBSO Budget

- Fire / Rescue

- Government Structure

In the coming days, we will be organizing this website to display interim findings in these areas. We welcome comments and assistance. If you would like to work with us on these projects, or would like to propose additional areas of focus, please contact us at info@pbctab.org