Maximum Millage Adopted

Yesterday, the County Commission set the county-wide maximum millage at 4.7815, unchanged in four years. Reduced payments on county debt have very slightly reduced another line item called the “voted debt” millage, and they are trying to claim a slight reduction by combining the two rates, but I am sure you are not fooled. (See: Rate to ensure tax hikes for many in the Palm Beach Post, and Palm Beach County holds the line again on property tax rates in the Sun Sentinel.)

At this millage, rising valuations will generate an additional $44M windfall for the county over last years take, a hefty increase. It is not enough for some commissioners though – Shelley Vana and Mayor Priscilla Taylor argued strongly that there are so many additional things they would like to spend money on, that we should actually increase the tax rate. Commissioner Berger joined them in supporting Vana’s motion, but it failed 3-3 with commissioner Burdick absent. Hal Valeche and Steven Abrams argued against any increase, and Jess Santamaria joined them to defeat it.

We were surprised by this attempt to raise the rate, given the hefty tax increase already planned, and expected a pro-forma vote, coming as it did at the end of a long and involved commission agenda. As such, we did not participate in the meeting, nor call for others to do so. Only two members of the public spoke against the tax rate, Anne Kuhl and Alex Larson.

The $44M tax increase (more than $63M in aggregate, when Fire/Rescue’s $14M hike is included), is too much, coming as it did after last year’s $22M hike. The September public hearings on the budget (September 8 and 22) are the time to make our voice heard on that subject. Although the maximum millage has been set (required to generate initial TRIM notices), the rate can be reduced in those meetings. Reductions in the rate of growth of some programs, particularly the Sheriff, are warranted.

Maximum Millage to be Set on July 22

Tomorrow, July 22, the County Commission will set the maximum millage rate for FY2015. Staff is proposing the countwide rate stay at 4.7815 – which would be the fourth consecutive year at that rate. Judging by its position in an otherwise crowded agenda (Item 5-I-1), they do not expect much public comment on the action.

The maximum rate is the do-not-exceed rate, and the final millage can be set lower than that in September (as it has been on occasion). As adoption of the maximum rate is all but assured, we do not think opposing it at this time is an efficient use of resources. The September public hearings are a more appropriate time to bring arguments for sharing the valuation windfall with the taxpayers.

Since the property appraiser’s office is projecting that the taxable value will increase for 86% of owners, at this millage, most of these will see an increase in their property tax bill at the end of the year, whether homesteaded or otherwise. (See: Taxable value up for 86% of Palm Beach County properties )

Most of the increase is going into employee compensation increases – 3% for most, better than 6% for the Sheriff’s office, on average. We will soon have an article which compares the compenstation trends in county government – PBSO and otherwise, to the growth in private sector county median income. You will see that it has been a good time indeed to work for the government.

We believe that a $44M increase in taxes this year, returning none of the windfall in valuations to the taxpayer, needs more justification than has been forthcoming, particularly from the Sheriff. Sheriff Bradshaw has refused the Mayor’s request for a workshop on the subject however. The commissioners, who are required to hold public meetings on the budget, must defend the Sheriff’s request as if it was their own, even when many have questioned his numbers.

It is an act of political courage for a commissioner to oppose the Sheriff’s budget, as he can organize large numbers of supporters to flood the chamber and demand that his request be filled. Nevertheless, some commissioners have raised the question. But it would take the votes of 4 commissioners to challenge the Sheriff, and under our system of constitutional officers, all they may do is reduce his overall number, not specify from where the cuts would come. If refused, the Sheriff could appeal the decision to the state level, something he has threatened in the past, and the commission could be overturned by the Governor after the budget period ends, leaving them with a hole to be filled from reserves – a daunting prospect.

Unless the Sheriff is challenged though, we are on a trajectory where all the other county functions will be starved for funds, or much larger increases in taxes are in our future.

The commissioners are there to serve their constituents, and for the most part they do that well. If enough constituents ask for a challenge to the Sheriff’s budget, most commissioners will at least ask the question. Between now and the September public hearings on the budget (9/8 and 9/22), we would like to hear from interested parties. Send us an email at info@pbctab.org and let us know if you would be willing to help organize support for those commissioners who would be willing to challenge the Sheriff’s budget.

2015 Budget – Flat Millage, what’s not to like? PLENTY!

The Palm Beach County budget proposal, published this week, is quite remarkable. Not since the bubble years, when inflated valuations drove out of control spending, has there been a budget proposal of this size. Rising valuations should allow a modest return to the taxpayer through lowering the millage. This proposal, while holding millage flat, clearly notes that there are areas whose levels of funding they think are “unacceptably low”.

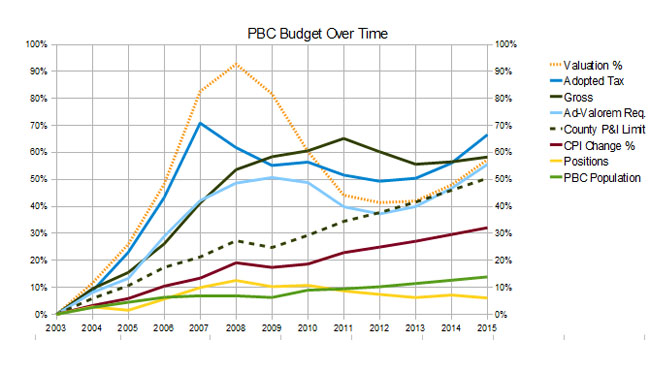

By almost any measure – the tax amount, ad-valorem equivalent spending, population and inflation (TABOR), the county apparently believes we have returned to the good old days.

While valuations have improved by over 6% this year, at $138.6B we are only at 82% of the peak year of 2008. Yet this year’s budget proposes to spend more than the all time record (on an ad-valorem equivalent basis) that occured in 2009, and collect within 2% of the record tax dollars levied in 2007.

When taking population and inflation into account, this year’s tax increase is more than DOUBLE the 3% that would be expected under TABOR.

What is driving this inflated budget? It is not hiring, as the overall staffing levels have declined slightly. It is not really the FRS contribution rate (less than 7% of the increase), or Palm Tran Connection changes (about 10%). A lot of it is pay increases for employees (3% across the board, on top of step and longevity raises in PBSO) which account for about $21M or half of the increase.

The big gorilla in the room of course is the Sheriff’s budget (as it usually is).

Sheriff Bradshaw seeks to spend $531M next year, supported by $467M from ad-valorem taxes. (The county budget proposal contains $5M less than this but the Sheriff has not agreed to the reduction). This is up from $499M (+6.4%) and $434M (+7.6%) last year. Since 82% of the Sheriff’s budget is personal service costs (salary and benefits), and staff growth is minimal (30 out of almost 4000), we can conclude that most of this increase is headed into the pockets of employees, as they will receive the same 3% that all county employees are scheduled to receive, plus contracted step and longevity raises.

Since 2003, PBSO spending has almost doubled (97%) while other county departments have only increased by a third – well within inflation and population measures. As measured by spending per capita, the Sheriff’s budget has increased by 73% from $195 per county resident in 2003, to $336 today. In 2003, the Sheriff spent 36% of county tax dollars and today that figure has grown to 48%.

Every year, adminstrator Weisman warns the commissioners that this growth of the Sheriff’s budget is unsustainable and at some point will crowd out all other county spending, yet as a group they never do anything about it. Some commissioners have pushed back – particularly Paulette Burdick and sometimes Mayor Taylor and Commissioner Abrams, but there have never been 4 votes to roll back his spending to a sustainable level.

There are a number of reasons for this. A cut to the budget for a constitutional officer (such as the Sheriff) can be appealed to the Governor. If an appeal is brought and the county loses, the budget goes into the next fiscal year with a large hole that needs to come from reserves. While the commission can cut the Sheriff’s appropriation, they are not allowed to say what specific items he should cut. He can therefore use his discretionary power to target areas of maximum political leverage. We have seen for example, how the threat to close the West Boynton substation will turn out COBWRA and others in force to pressure the BCC to restore the funds. We have also seen the PBA fill the commission chambers with red-shirted union members in solidarity with the Sheriff.

Unless there is a concerted effort by the public to raise their voices in opposition to the spending of this leviathan that is PBSO, we can expect no action again this year.

What can you do:

Attend the budget workshop on Tuesday June 10 and / or email, write or call your commissioner. Ask them:

1. Why has county spending returned to levels not seen since the real estate bubble.

2. To reject the Sheriff’s budget as submitted and return a portion of the valuation increase to the taxpayer in the from of a reduction in millage.

3. To consider providing raises to employees based on merit, rather than across-the-board or COLA increases

The bottom line is this – rising property valuations are not correlated with rising incomes among county residents. The growth of government spending should be “reasonable” – perhaps in line with population growth and inflation. There is no justification for a $40M tax increase in a single year.

Another Go at the Sales Tax on Tuesday

The proposal for a county sales tax increase is back on the agenda, Tuesday March 11, postponed from the December 17 meeting by a 4-3 vote. (See Item 5G1.)

In December, there was consensus that the proposal was a “potpourri” or grab-bag of small projects lumped togther to utilize the $110M a year that a .5% increase would bring. It’s reincarnation is still a grab-bag of small projects, but they are limited to infrastructure and spending for Parks and Recreation was removed. Since the total hasn’t changed, the net effect is to add MORE road projects to the proposal. The largest of these is a line item for “resurfacing – 7 years @ $12M/year” for $84M.

A noteworthy aspect of this proposal coming out of George Webb’s Engineering and Public Works Department, is the condition that 40% ($44M per year) is to be shared with the municipalities for wherever they would like to spend it. However allocated, this would represent a sizeable amount relative to most city, town and village budgets. (Note- this sharing is required by the authorizing statute for sales tax surcharges).

As for Engineering and Public Works itself, the $66M / year retained in this proposal would more than double their $53M current budget.

It should be said that road projects have gotten more of their share of cuts over the last few budget cycles, as the enormous half a $Billion (with a “B”) Sheriff’s budget gobbles up an ever larger percentage of the county tax revenues. Adding $66M to E&PW from a different revenue source would seem to be a questionable action.

The December proposal was allocated differently – $44M for the School District, $40M for the county (including Parks and Recreation), and $26M for the municipalities. The school district did not want to play in this though – rumor has it that a separate sales tax increase will be brought forward by those folks. In the revamped proposal, E&PW decided to just keep all the money for themselves.

This proposal should be considered within the overall background of county finances, not in isolation. Property Appraiser Gary Nikolits is projecting a 6-7% increase in taxable valuations this year. Even with some reduction in millage (which we think is justified), there should be sufficient property tax revenue to start addressing infrastructure maintenance that has been deferred over the last few years. When you build a road, you should plan to maintain it – this is one of the natural and expected functions of government. That spending was diverted to other priorities is a management failing – not a justification for a new tax.

A serious proposal for a sales tax hike could be justified if it was revenue neutral – ie. offset the $110M in new revenue with an equal reduction in ad-valorem tax. That is not what is being proposed. Instead, it is still George Webb’s “wish list” of work he’d like to do but was unable to justify in the normal budget process.

If this were actually to get on the ballot in November, particularly next to a School System increase (“it’s for the children!”) and the re-authorization of the taxing district for the Children’s Services Council (“It’s also for the children!”), then a betting man would wager that it will go down in flames. Perhaps they all will, as the taxpayers do not sense that their money is spent wisely today.

Another Attempt to Raise the County Sales Tax

We have not taken any formal action; however, from the discussion on this matter during informal Board Workshops, it appears unlikely that the School Board would support a joint referendum.

To the extent that the attached County Board Item suggests otherwise may place the School Board in an awkward position.

Please take appropriate steps to delete any reference to the School Board in the item.

As a result, the Tuesday agenda item has been revised: See Item 5A2-Revised The Palm Beach Post reports that many of the Commissioners are skeptical of the proposal, and the business community and watchdog groups (including TAB) are organizing to oppose it. See Schools want out of sales tax hike

At next Tuesday’s 12/17 BCC Meeting (time certain 10:30), staff will propose raising the sales tax to 6.5%, projected to raise $110M per year starting in 2015 and running until the end of 2020. Unlike a preliminary proposal that would have competed with the School District which also seeks higher taxes, this revenue would be shared. 40% ($44M/year) would flow to the Schools, 36% ($40M/year) to the county, and 24% ($26M/year) to be divided up among the 38 municipalities. The tax would generate $660M over the six years it would be effective, if approved by the voters next fall.

What is the stated need for this additional revenue? The proposal states “County, School Board and municipal staffs have identified significant facility and infrastructure needs to maintain and enhance our public quality of life.”

The county alone has identified $197M in wish-list projects, divided equitably among the seven districts so everyone gets some of the “goodies”. These are mainly road projects and new spending for Parks and Recreation.

It should be noted that both of these areas are funded in the current county budget at the level of $53M/year for Public Works and Engineering, and $64M/year for Parks & Rec, so the county windfall that this represents would be an increase to that spending by 34% in the first year alone.

Some would say that sales taxes are preferable to property taxes because the burden is shared by all, including visitors, and that is true as far as it goes. But keep in mind that this proposal is NOT revenue neutral – it is net additional taxation. The county ad-valorem taxes rose over $23M this year and the county forecasts overall property taxes to go up over 20% in the next four years. They have plans to spend every penny.

Historically, sales tax hikes have not gone down easy. In 2010, a Fire/Rescue sales tax was defeated before it got on the ballot. The predecessor to this proposal that was brought to the commission in 2012 was rejected as “half baked”. This time, there is an attempt to “sweeten” the deal by distributing some money to the cities and spreading the largess around the commission districts. Presumably an orchestrated collection of speakers will come forward to talk about the “need” for these projects. We will be told that our sales tax is “too low” as other counties have higher.

Don’t be fooled. This is an attempt to significantly increase government spending in Palm Beach County, at a time when valuations (and likely ad-valorem taxes) are expected to climb. It should be rejected before it gets to the November ballot, and now is the time to voice your opposition.

If you oppose raising the sales tax, make your voice heard. Call or email your commissioners prior to next Tuesday’s meeting, and attend the meeting if you can. And let us know your thoughts.

Some talking points:

- The proposal is a net increase in taxation of $110M/year – about $100 per resident.

- Parks&Rec and Engineering / Public Works are already funded at $117M – the sales tax would support a 34% increase in spending every year for the next six years.

- Sales taxes have a negative effect on business, driving sales to lower tax counties or the internet and stopping incoming business from counties with higher taxes.

- Neither of our neighboring counties (Martin, Broward) have a discretionary sales tax.

- The county has shown restraint in recent years regarding increases in ad-valorem taxes – this proposal is an end-run around the scrutiny that the millage rate gets on a yearly basis.

- A sales tax is a fixed rate that grows automatically with rising prices and economic recovery and is not subject to yearly adjustment like property taxes.

County Commission votes to penalize West Palm Beach and Riviera Beach over Inspector General Lawsuit

In a clever but unusual move, County Administrator Bob Weisman last night proposed $916K in additional spending over the July budget package that specifically excluded amounts requested for West Palm Beach and Riviera Beach by $70K and $50K respectively. This was a direct response to those city’s refusal to pay their share of the Inspector General budget. The proposal included additional spending of $916K – $400K for the YECs, $175K for the Pahokee Recreation center, and $341K for the Inspector General.

The additional $346K to cover the IG shortfall will come from the Solid Waste Authority ($100K), funds from the non-suing cities released by the Clerk ($262K), and $16K from other county departments.

Since the maximum millage was set in the July workshop to 4.7815 (unchanged from last year), the additional funding will come from reserves and tapping an additional $800K from the proceeds of the Mecca Farms sale to South Florida Water Management.

A motion by Commissioner Priscilla Taylor to restore the funds for the West Palm and Riviera YECs and provide an additional $40K for the Belle Glade YEC (requested by Commissioner Shelley Vana) was defeated 4-3 and the Weisman proposal was passed without change. Commissioners Valeche, Burdick, Santamaria and Berger rejected the change for a variety of reasons.

Hal Valeche said “The cities are taking us for a ride..”, and “By restoring this funding they are taking us for a further ride.” Commissioner Santamaria explained to the many children and instructors from the YEC who turned out to support their programs that “Unfortunately the YECs and the IG are connected”. He said that the cities could have opted to spend the IG money they are keeping on the YECs but declined to do so. Commissioner Vana, seeing her request for additional Belle Glade money “for the children” going down to defeat, said “It is disgraceful what we are doing here today”. “I am ashamed to be part of this board at this point.”

It should be noted that the 14 cities participating in the IG lawsuit owe $1.9M to the county – 90% of it from the 5 cities of West Palm Beach ($657K), Boca Raton ($406K), Delray Beach ($348K), Riviera Beach ($169K) and Jupiter ($142K). It is a positive step that the county should withhold grants and assistance to these cities while they are declining to pay for the IG services. The $120K at issue here is a drop in the bucket and it would be appropriate to raise the ante by challenging other grants to these five, in areas such as community development, environmental resource projects within their boundaries and social services. Money is fungible and amounts could be held in escrow while the litigation continues.

The final budget hearing will be held on September 23 at 6:00 PM.

County Tax Trends – Some Perspective

After several years of calling for flat millage, it is time to shift our attention to the tax dollars themselves.

Budget Hearings

Monday, 9/9 at 6:00pm

Monday 9/23 at 6:00pm

There is an old saying that “nobody washes a rental car”. When you own, it is more in your interest to maintain the value of your asset. Similarly, if a third party is paying for something that benefits you, you may not think about the “value proposition” or how much it costs because it is not your purchase decision. This is why health care inflation is high for procedures where a third party (government or insurance company) pays, but low for out of pocket items like plastic surgery or laser vision correction where you can choose the best value from competing practitioners.

When a government spends money, if it is directly tied to your tax bill you pay attention, but when the money comes from somebody else, “what difference does it make?”.

Spending at the federal level has been disassociated with individual income taxes for some time. With almost 40% of the federal budget coming from borrowed money, and less than half of the citizens paying federal income tax, it is hard to get too upset over another $10B for this or that, as it isn’t going to come out of your pocket any time soon. Even if it does concern you, federal taxation is difficult for a citizen to impact, given the way our Congress works.

Similarly, at the state level in Florida, with no income tax, a sales tax that is not out of line with other states, and much of state revenues coming from tourist taxes, state spending has little impact on the average citizen.

At the county and city level though, we are all aware of our property taxes (or our rent if we don’t own property). Over the years this link has been weakened at the county level as much spending is supported by user fees and “intergovernmental” revenue, which includes federal and state grants, and revenue sharing from sales tax, gas tax, and other sources. Currently only about 35% of county revenues (excluding fund balance) come from property taxes.

It is the changes in tax rates or taxes collected from you that you notice, not necessarily the level of county spending.

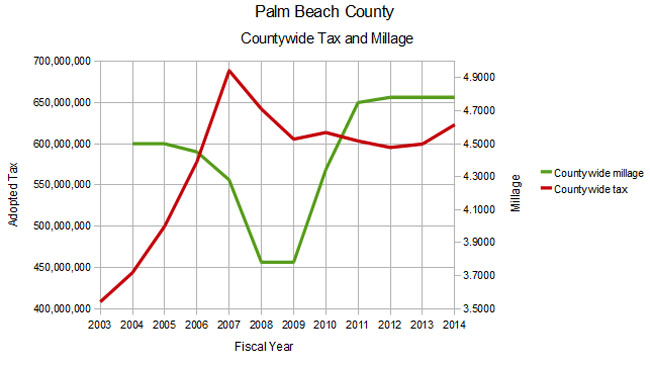

As the property valuations accelerated and hit their peak in 2007, tax rates were stable or declining, and the “wealth effect” associated with rapidly appreciating property masked the fact that taxes collected were skyrocketing. The adopted countywide tax in 2003 was $408M, but climbed to $689M by 2007. This was an increase of 13%, 16%, and 19% in the years 2005, 2006 and 2007 respectively, in a time when the millage or tax rate was decreasing.

The millage rate is widely reported. You see it on your TRIM notice as well as in the press coverage of the budget process. It wasn’t until this rate started soaring that people’s attention was drawn to it.

For the 2010 budget, adopted in September 2009, the millage increased by 15%. Many thought this outrageous, as our neighboring counties were booking much smaller increases, yet the countywide adopted tax dollars only increased by a tiny 1.3%. This outrage was widespread however, affecting the business community, realtors, grassroots groups and others, and led to the formation of TAB by the following year.

In 2011, in spite of some public opposition, the commissioners raised the millage yet again by 9%, but for 2012 – 2014 it was essentially flat. Taxes collected in those three years declined slightly until this year when a 3.9% increase (a $23M increase, most going to the Sheriff). TAB argued for flat millage during this period, and accepted another year of 4.7815, in spite of the increase in dollar amount. It is expected that this rate will be adopted during the budget hearings this month.

Governments do not typically throttle their spending voluntarily. Taxes and spending need to be scrutinized by the public, and objections raised when they get out of line. In a downturn (both in property valuation and lately in federal grants), it is in the nature of government to try to maintain spending levels rather than adjust them to match economic conditions if possible. Otherwise, programs have to be cut, layoffs are possible, and the recipients of government spending begin to organize.

We are now at a turning point. Next year, if valuations continue to rise, we will focus on tax dollars rather than millage, and argue that increases in spending should not exceed population growth and inflation measures. A millage reduction would be justified under that scenario. If valuations stay flat or decline, then we shall also oppose any millage increase.

County Proposes No Change to Millage, $23M Tax Increase

The July budget line item is included in the next scheduled BCC Meeting on Tuesday, July 16, which starts at 9:30am. It is item 5G-1 on the agenda and will likely be the last item of the morning session.

The first county budget proposal for fiscal year 2014, presented at the June 11 meeting, called for a millage increase to 4.8164 (up from the current 4.7815) and $25M in new ad valorem tax revenue – mostly to fund new spending proposed by the Sheriff.

While not definitive, the drift from the dais was that they would like to see flat millage (Abrams, Burdick, Valeche) and more spending on priorities like road repair and less of an increase to PBSO. Some commissioners, particularly Shelley Vana, didn’t want to be “penny wise and pound foolish” and thought that flat millage should “no longer be the holy grail”.

So we were pleasantly surprised to see that the July Budget Package is introduced under separate cover by Administrator Bob Weisman with

down to the current year 4.7815.

During the month interim, Mr. Weisman and staff were able to achieve this by:

- Seeing an additional $2.6M from increased property valuations

- Allocating an additional $2M from the proceeds of the $26M Mecca Farms sale into 2014

- Gaining $859,000 in concessions from the Sheriff – which is half of the remaining shortfall with flat millage.

He was also able to increase funding for some priorities, including:

- $1.6M for neighborhood road repaving

- $270K for the Palm Beach sand transfer plant

- $100K in additional funds for the Business Development Board

With the new assumptions, the flat millage proposal will generate a countywide tax of $623M, up $23M from the 2013 fiscal year, slightly less than the June proposal. As seen in the chart, this is a visible uptick from previous years, and is the highest tax collected since 2008, when the millage was at a low point of 3.7811.

Assuming that the valuation increase this year is a start of a trend, flat millage will no longer be acceptable going forward and we will be expecting substantial reductions. That said, the current proposal of flat millage appears to be a genuine attempt to satisfy the pent up spending demand, particularly for salary increases for county staff while not overly gouging the taxpayer. Historically, overall county spending is approaching a “TABOR” (population and inflation) projection from a 2003 baseline. (See Determining County Budget Growth – Why the Baseline Year Matters )

Assuming the BCC accepts the flat millage proposal, we do not expect to be calling for any taxpayer actions during this budget cycle.

Determining County Budget Growth – Why the Baseline Year Matters

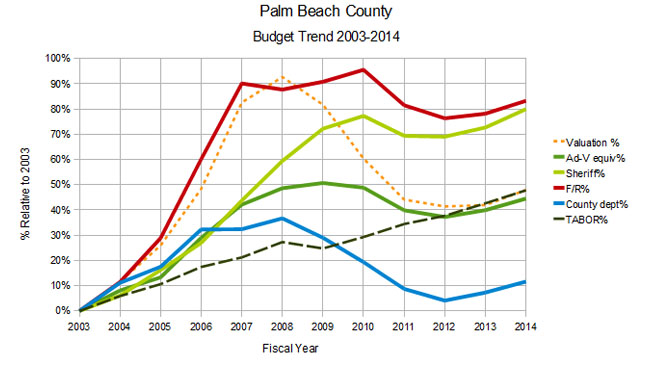

For the last few years, whenever the county budget has been presented, growth has been charted based on the year 2003. Numerical comparisons were made to 2007 though, and this year even the charts are based on 2007. Does this make a difference? What do the two baseline years tell us about the growth in spending and how the county staff wants you to look at it?

As you may remember, the middle of the last decade saw a real estate “bubble”, where average properties in the county became greatly inflated – sometimes doubling in only a few years. The year 2007 represented a leveling off of the valuation increases, with values 83% higher than they were in 2003. Valuations climbed a little more in 2008 (to 93% of 2003), and then began a rapid decline to the bottom in 2012 at 43% of 2003. Today’s levels are about 48% of the 2003 values.

Since county property tax follows property valuations, as you would expect, the county’s revenue and spending exploded during this runup period. In the four years from 2003 to 2007, the overall county-wide “ad valorem equivalent” (a measure of spending) rose 42%, led by Fire/Rescue which saw its spending almost double (90% increase). By adopting 2007 as their “base year”, the county would like you to overlook this rapid growth prior to that, and imply that the relatively flat spending since 2007 is “normal”.

Consider the following chart, based on 2003:

Chart 1 – 2003 Baseline

Chart 1 – 2003 BaselineThe dashed orange line shows the real estate “bubble”. Note that the Fire / Rescue spending climbed the “bubble”, but then stayed at the higner level as the bubble burst. The Sheriff’s budget did a similar thing, although their spending lagged a little. Both are up over 80% since 2003. Spending on the “rest of the county” (blue line) – including engineering, Palm Tran, community services, information systems, parks and recreation, and the other constitutional officers was the big loser, as the “total ad-valorem equivalent” (the dark green line) – which includes all county functions stayed as high as the taxpayers would accept, up 45% and ending at about where the valuations did. The dashed green line represents “TABOR”1, or the increase in spending that would be justified by changing population and inflation. Interestingly, the “total ad-valorem equivalent” ends about on the TABOR line, even though spending greatly exceeded it in the middle years.

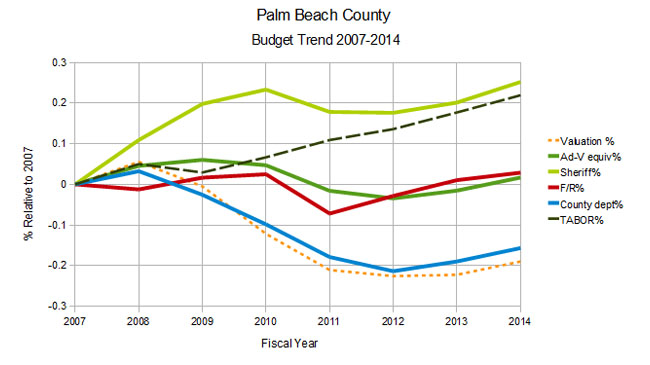

Now consider the next chart which uses 2007 as the baseline year:

Chart 2 – 2007 Baseline

Chart 2 – 2007 BaselineUsing the “bubble” spending levels as a reference, it appears that “total ad-valorem equivalent” is flat – exceeding the 2007 level by only 2%, and well below “TABOR”, and the county department spending has actually declined by 16%. Even the grossly inflated PBSO budget looks like it is converging on the “TABOR” line.

If you were the county administrator and you wanted to make the best case for fiscal responsibility, which chart would you use?

Baselines do matter.

There are many external factors that should determine the “appropriate” level of spending of tax dollars, such as the health of the overall economy, the declining average income in the county, the “artifacts” in the valuation numbers from foreclosure dynamics and demand for real estate by third party investors. From a strictly historical perspective however, most would agree that the spending growth in the years leading up to the bubble were wild and crazy. The great recession has brought some of the spending back down to earth as measured by inflation and population growth as shown on chart 1, with the notable exceptions of PBSO and Fire/Rescue.

With a 2003 baseline, county spending today looks almost responsible, and the case can be made without changing the baseline to obscure the rapid growth of government leading to the bubble. We hope that county staff does not plan to rewrite history.

1. TABOR is an acronym for “Taxpayer Bill of Rights”, a legislative approach tried is some states to control spending growth by limiting it to the inflation rate and population growth.

County Proposes $25.3M tax increase

After leveling off last year following 4 years of decline, property values seem to have turned a corner and have ticked up 3.7% this year, easing pressure on county and municipal budgets. As the county has cranked up the millage rate as the valuations fell, will they now start to decrease them? Apparently not.

The June budget package, to be discussed at the first hearing next Tuesday at 6:00pm, proposes an increase in the millage from 4.7815 to 4.8164. This would generate $624.9 million – $25.3M or 4.2% more than last years adopted tax of about $600M.

The additional funds are allocated about $19.5M to the Sheriff (see note below regarding Sheriff’s budget), and $7.3M to the countywide BCC departments. (note: these add up to $26.8M not $25.3M, but that is how it is described in the Weisman cover letter). Much of this will go to pay increases for employees (3% to county workers, 2% to PBSO in addition to their contracted longevity and step raises). The “personal services” (ie. employee) budget for the Sheriff increases by over 6%.

Many commission priorities were NOT addressed in the new spending, including $300K additional funding for the homeless resource center, $5M for road resurfacing, $2.7M for Palm Tran service enhancements and $547K for Youth Empowerment Centers. It will be interesting to see if a constituency emerges to fund these things and raise taxes even further.

Library and Fire/Rescue millage is expected to be unchanged.

We think that raising the millage this year in the face of improving valuations and economic conditions would be a mistake. Yes, there is pent-up demand for additional spending (isn’t that always true in government?), and some growth is justified, but flat millage would already provide some $20M in new revenue. Raising the millage now is a slap at the county property owners, many of whom are still struggling along with the economy. The incremental revenue to be had with the proposed hike is small – surely a way can be found to defer that much until next year and keep faith with the taxpayer.

Come to the meeting next Tuesday and let the commissioners hear what you think of this proposal. The special interests who want spending increases for their programs will be there. Don’t let them be the only voices.

The meeting will start at 6:00pm in the commission chambers, 301 N. Olive, 6th floor.

NOTE: The Sheriff requested a gross budget of $510.1 million or 8.2% ($38M) over the FY 2013 gross budget. The net ad valorem funded budget is up $19.5 million (4.8%). Subsequent to his budget submission, the proposed budget was revised to assume his capital request of $10.6 million will be financed in FY 2014. The estimated debt service has been included in the proposed budget.