Bob Weisman’s Response to TaxWatch Study

NOTE: The TaxWatch study was made available to commissioners and staff prior to their press release. This is the initial response from County Adminstrator Weisman.

From: Robert Weisman

Sent: Wednesday, September 07, 2011 9:01 AM

To: BCC-All Commissioners

Cc: Lisa DeLaRionda; John Wilson; Audrey Wolf; Ross Hering; Robert Weisman; Brad Merriman; Denise Nieman; George Webb; Joe Bergeron F.; Jon Van Arnam; Liz Bloeser; Shannon LaRocque; Steve Bordelon; Steve Jerauld; Verdenia Baker; Vince Bonvento

Subject: TaxWatch Report on Reserves and Property

You have been provided with a “draft” copy of a TaxWatch report on Palm Beach County that concentrates on our financial reserves and property. We have been able to give this only a cursory review since we were given access to it last night. The following are some brief comments in case you are asked about the report.

The financial reserve discussion appears very similar in opinion to the report that was issued 5 years ago. There does not appear to be anything in the reserve discussion that would affect our proposed budget. The funds they speak about are from multiple sources (impact fees, special revenues, bonds, general fund, etc) which are allocated to multiple projects. The only way funds could be made available to help balance the budget would be to eliminate and de-fund general fund projects that we have deemed necessary. We routinely examine project status and one of the ways we have balanced our budgets over the past few years is by taking money from completed or other projects whenever justifiable.

There would not appear to be anything new in the property portion of the report. Mecca is by far the largest asset we have, which it appears makes up 1/3 of the property they are talking about. The practicality and wisdom of selling our limited marketable property at this time is questionable. The numbers sound big, the reality is different.

We will evaluate and respond more fully after the final report is issued and we can review it in detail. If it discloses anything that can be useful in our budget balancing efforts, I can assure you that we will so inform you.

The 2012 TAB Proposal – September Update

The county has published their First Public Hearing package for the September 13 budget meeting. It presents a budget at the “rollback rate”, a 2.6% increase for the county-wide portion, generating $607M in ad-valorem revenue, and retains the current 2011 tax rate for Fire/Rescue and the Library System.

“Rollback rate” is a misleading term. While it is supposed to mean a rate that generates the same amount of tax revenue as the previous year, this one actually adds $4M to the county-wide tax burden. The 2.6% increase will likely understate the change to a homestead property held for some time, since the valuation may still not have caught up to the market value under the “Save our Homes” statute. Check the “TRIM Notice” that you should have received by now and look at the county tax line to see what it means to you.

Since Fire/Rescue and the Library system are not changing rates (and therefore collecting less revenue), the increase in county-wide taxes is offset by enough to hold the combined taxes to within $1M of the current budget. If adopted as proposed, this budget would collect a total of $835,144,556 in the 2012 fiscal year.

In July, the commission voted to set the “maximum millage” to the “rollback rate” of 4.8751. This means that in September they can adopt a lower rate but cannot exceed this maximum. Three of the four commissioners have indicated a desire to avoid raising the rates, and they could prevail. Therefore, to facilitate discussion, the budget proposal “bridges” the two rates by listing the programs that would have to be cut if the millage rate were kept at this year’s 4.75, but would be “restored” if the commissioners go with the higher “rollback rate”. Six separate proposals are provided, representing “steps” that add up to the $16.8M difference between the two rates (4.7500 vs. 4.8751). Controversial programs that are “restored” under the 4.8751 proposal include Palm Tran fares, lifeguard funding, nature centers, some financialy assisted agencies and about $12M in PBSO appropriations (less $5M in “excess fees”).

The first three points of our TAB proposal for this budget year are unchanged from July, but we have added a fourth point which reflects a conclusion drawn by Florida TaxWatch in their recently published study – namely that county fund balances are excessive compared to either our peer counties or objective measures of “prudent reserves”.

The TAB Proposal

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

- Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties.

We also want to see a charter amendment for a county version of “Smart Cap” placed on the 2012 ballot. Detailed arguments for each of these can be found later in this article.

Background

Last year, TAB was formed in July, after the county budget process was well underway.

After researching the growth in county spending for the period 2003-2011, we concluded that it had grown 11 times the population growth and 3 times the rate of inflation. For FY2011, the proposed budget raised the millage by more than 9% on top of an increase of more than 15% in the previous year. Although the ad-valorem equivalent (and the total amount of collected taxes) declined in the 2011 fiscal year with the steep decline in property valuations, those with homestead properties saw their taxes go up.

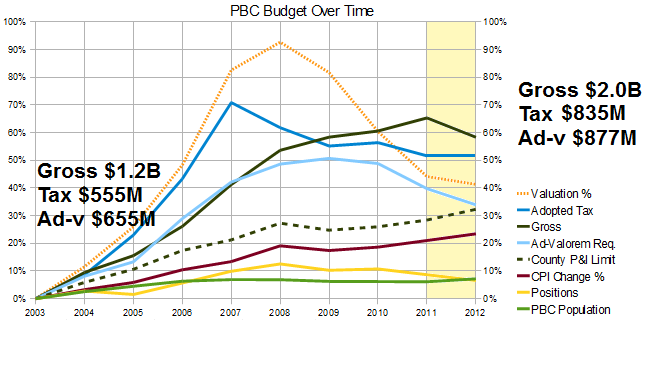

Overall spending, propped up by state and federal stimulus funds, continued to increase in 2011 and only now is declining a bit. (See % changes from a 2003 baseline in the chart below). Adopted tax followed the valuation curve upwards until 2007 where after a slight decline as excessive reserves were burned off, it has been relatively flat, even as the economy has been in decline and valuations have plummeted. Ad-valorem equivalent (which is spending minus non ad-valorem revenue) has declined since 2010, while spending has been supported by intergovernmental grants.

With the weak economy and double digit unemployment in the county, we thought another tax rate increase was wrong, and argued for keeping the millage flat at 4.344. As part of the proposal, we went through the staff’s “green” and “blue” pages, and made specific spending cut proposals totalling over $50M, argued for deferring raises in Fire/Rescue and PBSO, and listed $100M in capital projects that could have been deferred.

In meetings with the individual commissioners, we made our case and had a productive dialogue, but were not persuasive enough to carry the day against the hordes of special interests (including PBA members supporting the Sheriff’s budget) that flooded the meetings and lobbied the commissioners to keep the taxpayer money flowing. The final budget passed with a 9.3% rate hike on a 4-2 vote, with commissioners Abrams and Santamaria voting against, and the district 2 seat vacant after the resignation of Jeff Koons.

This year we started earlier and have focused on educating community groups about the budget history, preparing them to join the discussion armed with the proper facts.

- The Sheriff submitted a budget request with spending that is 4% higher than last year, mostly to cover raises under the collective bargaining agreements in place until 9/2012. In the flat millage budget, he is being asked to cut 5% more than he saves with FRS, but so far has been unwilling cut any deeper.

- The property appraiser, who had been projecting a 6% decline in valuations this year, has softened his outlook to a 2.3% decline.

- FRS reform, passed by the legislature and signed by the Governor, will result in savings to the county departments, PBSO and Fire/Rescue of $15.4M, $20.6M, and $11.6M respectively (by our calculations). Note: The county shows the PBSO savings to be $18M.

- Although the difference between last year’s adopted tax ($603M) and the tax generated by flat millage this year ($591M) is only $12M, cuts are necessary because the “hole” is really $45M. This is explained (although not to our satisfaction) by “decrease in one time funding sources”, “increases in general fund transfers”, and other matters. See: County Budget Update – July 8

The following is an outline of the “TAB Proposal” for 2012:

The 2012 TAB Proposal

- Maintain the county-wide millage at 4.75

- County-wide property tax rates have risen 25.6% in the last two years alone

- Although the total taxes collected have declined over the same period, those with homestead properties saw double digit increase in their county taxes

- This year, the reduction in valuations has slowed from an expectation of -6% to a more modest -2.8%, reducing the pressure on the budget and millage rate

- TAB estimates that reforms to the Florida Retirement System (FRS), passed by the Legislature, will result in a $48M savings to the county this year ($20.6M in PBSO, $15.4 in county departments, and $11.6M in Fire/Rescue). This should be used to hold or reduce the millage, not for new spending on programs or salary increases.

- The county is still experiencing double digit unemployment and slow economic growth. This is not the time to be raising taxes.

- Thankfully, the Fire / Rescue and Library MSTUs are not projecting an increase in tax rate.

- Take the majority of cuts from PBSO, not the county departments

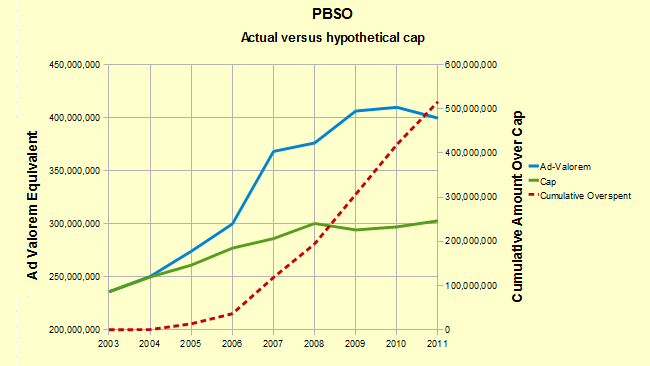

- County-wide ad-valorem taxes pay for the county departments and the constitutional officers, including the Sheriff. In the last 8 years, PBSO has grown from 46% of the budget to 58%.

- Most of the growth in the PBSO budget has been in personal services costs (salary and benefits), and PBSO deputies are now compensated more than 30% above the national average for similar positions.

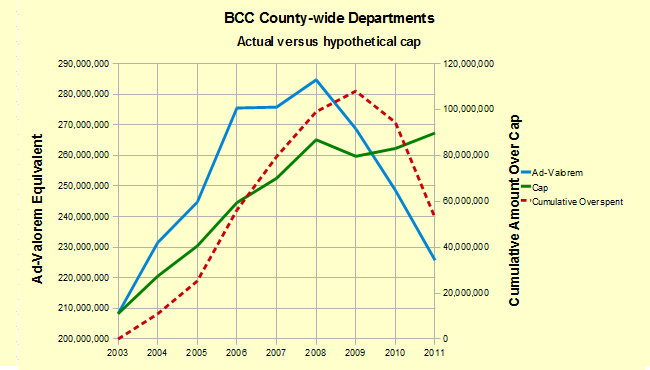

- Measured against a hypothetical population+inflation cap since 2003, county departments are now comfortably under the cap (although they exceeded it in the boom years by a cumulative amount of $50M). PBSO has greatly exceeded the cap in each year, with a cumulative overspending (versus the cap) of $500M in the 8 years. (See charts below)

- The Sheriff provides only the statutory minimum of budget data to the county (and the public) so it is difficult to see where the money is being spent. Through Chapter 119 (open records law) requests, TAB has determined that almost all the spending growth has been in salaries and benefits for employees covered by collective bargaining agreements, not in operating costs.

- The reduction to PBSO from $470M to $448M in the submitted budget would meet our criteria if allowed to stand.

- Take action to reduce the inventory of county property and reduce the debt

- Florida TaxWatch has conducted a Palm Beach County Study funded by the PBCA and others, that created an inventory of underutilized land and other property owned by the county, and compares our debt and capital programs to our peer counties. This study can be used as a blueprint for action to reduce the debt (currently $1600 per county resident with interest costs estimated at 14% of taxes collected) and make plans to sell off assets like Mecca Farms.

- The Clerk and Comptroller has identified the county-wide debt (including the Solid Waste Authority) as being significant already, and it is about to be increased even further with the building of the waste to energy facility and the convention center hotel.

- During the boom, windfall tax receipts were used to start projects that committed the county to long term debt that is difficult to justify now that the boom has ended. We need a plan to correct the problems caused by earlier bad decisions.

- TaxWatch obtained a list of vacant properties owned by the county and has assembled a table of current value. As long as these properties remain on the books it is a double liablility – there is a carrying cost associated with them and they are held off the tax rolls. Many of the over 2400 properties listed in the PAPA database as belonging to the county should be sold, even at a loss.

- Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties

- The TaxWatch Study analyzed unreserved fund balances against peer counties as well as against an objective measure of “prudent reserves” for a government entity, even one within a hurricane zone.

- They concluded that the Palm Beach County fund balances are way in excess of what is needed and should be utilized to fund current spending until the balances fall at least below 40%.

- Sufficent fund balances exist in excess of a 40% cap to fund any shortfall this year and can be used in lieu of raising the tax rate.

It should be noted that items 3 and 4 can be used together. Property can be sold over the next 1-2 years and the proceeds can be used to replace fund balances used to fund current expenses. Asset sales can also be used to retire debt.

This year’s TAB Proposal is really not asking that much. With the smaller decline in valuations and the large savings from FRS reform, there should be very little difficulty in making the modest cuts that will be necessary to avoid an increase in the tax rates.

Smart Cap

Separate from the TAB Proposal for the FY2012 budget cycle, but important for long term budget restraint is a charter amendment to bring the state level “Smart Cap” proposal (SJR958) to the county. This will be a separate track, aligned with the charter review process, but if you agree with it, please mention it in the context of the budget discussion.

Adopt a “Smart Cap” charter amendment for county government

- The state-wide “Smart Cap” (SJR958) will be on the ballot in 2012. What is good for the state is good for the county.

- “Smart Cap” limits the revenue that can be collected to last year’s cap plus an adjustment factor that reflects inflation (change in Consumer Price Index) and population growth – an objective measure of “appropriate spending”.

- Although the decline in valuations has currently dampened the large increases in county spending that occurred during the boom, spending has continued to rise, even last year. When “normal” returns to the real estate market, a cap could prevent the out of control spending that occurred during the bubble.

- Unlike Colorado’s Taxpayer Bill of Rights (TABOR), a smart cap is based on last year’s cap, not on last year’s revenue. That prevents the “ratcheting down” of the cap that caused problems in that state during a recession.

- A well designed Smart Cap can provide emergency override (Supermajority BCC vote) and exemptions for unfunded mandates and other areas identified by the League of Cities as as problematic.

Growth in ad-valorem equivalents compared to hypothetical “Smart Cap”

Florida TaxWatch Report on County Reserves, Debt, and Property Utilization

At the request of the Palm Beach Civic Association, the Palm Beach County Taxpayer Action Board, and the Town of Palm Beach County Budget Task Force, Florida TaxWatch conducted a study of several aspects of Palm Beach County Finances.

In addition to an analysis of the county debt and reserves compared to our “peer” counties – Miami/Dade, Broward, Hillsborough and Orange, updated from their similar 2006 report, they also investigated the quantity and status of unneeded or underutilized property owned by the county.

The complete report is available HERE. What follows is a summary of the major findings.

Major Findings

1. County Fund Balance (“money in the bank”) is excessive

- The commonly accepted fund balance levels (unreserved) as a percent of expenditures for a government entity is 15%. Locally, 25% is considered prudent for hurricane preparedness. Palm Beach County has maintained a balance exceeding 50% over the last six years. Bringing this level down to even 40% would free up $188M of “excess reserves” that could be used for current spending, thus avoiding a tax rate increase through several cycles to come.

- Peer counties retain AAA bond rating with considerably less reserves

NOTE: This finding supports point 4 of the TAB Proposal – Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties.

2. The County owns vast amounts of “Vacant” Property

- Of 2500 parcels owned, 353 parcels totaling 6200 acres are “vacant” – either unused or used for something other than their intended purpose

- Selling 25% of this vacant property would generate $54M in revenue and return $270K/year (unimproved) to the tax rolls

- Property record-keeping is unreliable and formal definitions and classification procedures are needed

NOTE: This finding supports point 3 of the TAB proposal – Take action to reduce the inventory of county property and reduce the debt.

3. County Office Space Allocation is overly generous

- Office size for executives and supervisors greatly exceeds state standards

- Reducing to standard could save $400K / year

In addition to these (and other findings), the TaxWatch team also made specific recommendations. Six were carried over from the 2006 study and are still relevant in 2011. The others are new and relate to the land and buildings aspects of the study.

Florida TaxWatch Recommendations

Recommendations from 2006 study that were not implemented:

- Establish a fixed cap on reserve funds as done elsewhere

- Implement a priority based budget process with performance metrics

- Adopt a budget reporting system that follows accepted standards and can be understood by the public

- Implement a Sunset Review process with automatic repealers

- Periodically rank all unstarted capital projects (partially implemented)

- Centralize services for constitutional officers

New Recommendations regarding property and buildings

Property

- Work with commercial realtor to plan and execute marketing plan to sell surplus properting over the next 18 months

- Institute formal definitions and procedures to identify “vacant”, “improved”, and “surplus” property

- Dispose of “strips” of land to adjacent property owners or bundle for sale

- Fully implement County Owned Real Estate (CORE) database and make available to the public

- Implement online marketplace to dispose of surplus property

- Apply full sunshine to property acquisition, exchange and sale process and separate from consent agenda

- Engage consultant to suggest utilization of surplus “right of way” property

- Incorporate vacant land disposition as part of County Comprehensive Plan

Buildings

- Require occupancy and vacancy rates of county assets be tracked

- Revise office space guidelines to align with Florida space allocation standards

- Make list of county owned buildings easily accessible to the public

Conclusion

TAB has argued that in this time of economic distress, tax hikes of any kind are counter productive. As the real estate bubble has deflated, the county has been increasing the tax rates in an attempt to prevent a decline in tax revenue. An alternative (in addition to the obvious – cut spending) is to buffer the shortfall with reserves accumulated during the “good” times. Not all government entities have that option as their reserves have been depleted.

The TaxWatch study points out that Palm Beach County is flush with reserves. Additionally, the county is carrying a significant quantity of unused or underutilized property that could be sold off over the next year or two, and the proceeds used to replace reserves spent to cover current spending.

It is our hope that the commissioners will agree and use this information to reject a tax rate increase for 2012.

September Budget Hearings – Some Background

At the end of September, the 2012 budget will be in place.

In spite of 4 years of decline in real estate values, the county keeps raising the tax rates to prevent any decline in tax revenue. If the private sector worked like government, all you would need to do to maintain your standard of living as a business owner would be to raise your prices. Everyone would have to pay it, whether they could afford it or not. Of course in the real world your customers would leave.

According to a national research group, tax-rates.org, Palm Beach County is in the top 8% of all the counties in the country for the tax on the median priced property. When measured compared to the median income in the county we are in the top 6%. It wasn’t always this way, but as the housing bubble inflated, local governments (including the county) collected more and more taxes, and now are trying to maintain that high level after the bubble has burst.

The total tax burden varies with the municipality (or unincorporated area) in which you live, but is typically about 2.2% of the value of your property each year when you include school taxes, municipal taxes, and a variety of special taxing districts. On top of that, there are non ad-valorem taxes on utilities, communications, gasoline, etc. It may be worse in New York or California, but few would say the taxes in Palm Beach County are low.

So what can you do about it?

First we have to stop the increases. The county commission voted 4-3 in July to set the “maximum millage” at “rollback”. This means the most that they can levy this year will collect about the same revenue as last year. Even though valuations have declined again, many properties are under water, and the county unemployment rate is in double digits, the county would like to continue collecting what it did last year.

TAB believes that county spending in some areas continues to be excessive, and the first step in turning things around is to refrain from raising the tax rate again this year.

The Legislature has done its part by passing pension reform, estimated to save the county between $26M and $35M depending on how you calculate it. Upwards pressure on costs though, including contracted pay raises for employees of the Sheriff’s Office make it hard to restrain the spending. It should be noted that during the time the county departments have trimmed back substantially, PBSO has not. The Sheriff’s budget now consumes 58% of the county-wide ad-valorem tax revenue, up from only 36% in 2003. Clearly that agency should be doing more to help the county balance their books at flat millage.

TAB proposes a plan with four actions:

- Maintain the county-wide millage at 4.75

- Take any further cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

- Cover any remaining shortfall from current fund balances (reserves) which are excessive compared to peer counties.

The 9/13 meeting will be well attended by those who benefit from county programs and oppose any budget cuts. Typically, those who oppose tax increases are fewer and less vocal. You can help change the equation this year if you show up at the meeting and let the commissioners know you oppose a rate increase. TAB will provide specific arguments you can use on the website after we review the coming budget package. In the meantime, here are some references that may help prepare you to support the TAB proposal at the September 13 budget hearing:

- Higher Tax Rates in our Future – a synopsis of the July budget workshop

- County Budget Update – July 8 – Published prior to the July meeting and covering the origin of the $45M “budget hole”

- The TAB proposal and the County Budget – published in June prior to the first budget workshop

- Powerpoint Charts for the latest version of the TAB presentation

- Synopsis of last year’s budget hearings:

Two TAB Coalition Partners Organize Phonebank to oppose Tax Rate Increase

Is there really a swing vote who will decide if our tax rates are increased this year? It is possible.

During the July budget workshop, the vote to raise the maximum millage to rollback (4.8751) was 4-3. Commissioners Abrams, Marcus and Burdick voted no to the increase and all had good reasons to avoid a third hike in so many years. Commissioners Aaronson, Santamaria, and Taylor voted for the hike. They also gave reasons that are not likely to change in September.

Which leaves District 3 Commissioner Shelley Vana. Her votes on tax increases have been mixed, voting against the 14.9% hike in 2009 but supporting the 9.4% increase in 2010. This year, she voted to raise the maximum millage to keep “options open”, but suggested that there were more savings to be had and she would like to keep the tax rate unchanged when it comes up for the final vote in September.

After the July budget hearing, TAB sent the following in an email to Commissioner Vana:

It is not sufficient to say that it is a “starting point”. I’ve been watching this process for enough years to know how September will go. If you really think that another $12M (the difference between 2011 adopted tax and 2012 rollback) could be extracted from a $4B budget, and you intended to pursue it, then you would have voted for 4.75 to force the issue. For $12M you have poked a stick in the eye of the taxpayer. Actions speak louder than words.

If we are misreading your intentions, we would be glad to meet with you and correct our analysis.”

In response, and to her credit, she got in touch with us and made a convincing case that there was another $12M to be had and she just might “.. be the fourth vote ..” for flat millage in September.

We found this encouraging, but we also know that there are powerful interest groups in the county for continuing programs and taxes that speak very loudly to the commissioners. Those who do not want to see a tax rate increase are rarely heard. More to the point, it is the citizens of District 3 that should matter the most to the Commissioner, not any of the special interests, or even TAB.

Along these lines, two of TAB’s coalition partners have decided to reach out to the constituents of District 3 and educate them on the 2012 budget, and their Commissioner’s role as the potential “swing vote”.

The recently formed Palm Beach County Tea Party, with chapters in Jupiter, Wellington and Boca Raton will join forces with the South Florida 912 which meets in Palm Beach Gardens, Wellington and Lantana. Each of these groups is organizing a phone bank to contact District 3 citizens and ask them to make their wishes known to Commissioner Vana. They believe that many of the citizens would oppose a third year of tax rate hikes. If so, perhaps they can help the Commissioner find the additional $12M in cuts it will take to not raise our taxes again.

TAB applauds this effort and believes it is a new approach to broadening the county budget discussion beyond the commission chambers and the pages of the Palm Beach Post. It may turn out more attendees at the budget hearings who oppose another tax increase. At a minimum, it will have educated a larger group of county residents about the way their taxes are set.

If you would like to assist one of these organizations in their effort, you can contact them as follows:

Palm Beach County Tea Party: action@palmbeachcountyteaparty.org

South Florida 912: action@southflorida912.org

Higher Tax Rates in our Future

On Monday, the county commission voted 4-3 to set the maximum millage at 4.8751, which would be a 2.6% increase over 2011. Maximum millage is the number that may not be exceeded when public hearings on the budget resume on September 13.

Following back-to-back increases totaling over 25% in the last 2 years, the commissioners had directed staff in February to create a budget that did not include a tax increase. This would have resulted in $12M less tax revenue collected because of still declining property values, but was offset by cost savings of $25M from reform of the Florida Retirement System (FRS) by the legislature. Other factors however, including reduced interest income and fund balance issues, resulted in a shortfall estimated at $40M and led to a proposal of cuts to popular programs.

Commissioner Aaronson, who is known for ongoing support for raising taxes on others to pay for services in his district, assured us that “it is only a starting point”.

Like Groundhog Day (the movie), the budget discussion plays out in a similar fashion year after year. A low or minimal rate increase is presented, combined with cuts sure to bring out the supporters (Palm Tran Connection, Nature Centers, Financially Assisted Agencies). A “reasonable alternative” that raises tax rates “just a little” for “pennies a day” is offered by Administrator Weisman, and after several hours of public comment, mostly by beneficiaries of those programs, the commissioners vote in July to set the “maximum millage” to the larger figure. Then, in September, after 8 weeks of “trying” to find additional savings, the commissioners decide they have no choice but to adopt the maximum as the final tax rate. Then the cycle begins again. Any guess as to how this will end this year?

To their credit, Commissioners Marcus, Abrams and Burdick voted against the higher tax rate. Paulette Burdick, in her first budget season as a commissioner, attempted to actually set priorities – facing down PBSO CIO George Forman over further cuts to the Sheriff’s budget, yet supporting continued funding for the financially assisted agencies.

Accepting the higher rate were commissioners Aaronson (no surprise), Taylor (who didn’t think 2.6% was significant), and Santamaria. None of these were surprises as they had made no moves toward the lower rate in the June workshop.

The more curious vote was by Shelley Vana, who at first seemed to be seeking additional savings (efficiency, etc) to prevent the tax hike, but voted for it anyway. Like Aaronson, she said it was a starting point and they can “try” to find additional savings before the September sessions. Actions speak louder than words commissioner. Don’t expect any credit for rhetoric.

From a TAB perspective, those of us who spoke against the tax hike were outnumbered by those seeking program dollars. While it is difficult to get working people to attend a morning meeting, we hope those of you who did not attend were able to send email or other communication to let your voice be heard.

Those who did speak for the lower tax rate, included Jack Borland, Francisco Rodriguez, Mel Grossman, Pam Wohlschlegel, Carol Hurst, Victoria Thiel, Dionna Hall, and Fred and Iris Scheibl.

For the next 8 weeks, TAB will be refining the argument against the higher rate and attempting to increase citizen awareness and involvement in the budget process.

County Budget Update – July 8

The next county budget workshop is Monday, July 11, at 9:30AM at 301 N. Olive, WPB in the 6th Floor Commission Chambers. Because of a scheduling issue, the BCC action to set the maximum millage rate that was scheduled for July 19 has been moved up to the 7/11 meeting. We expect the County Administrator to ask that this be set to rollback, currently estimated at 4.8751 (about a 2.6% increase in tax rate), or higher. The majority of homestead property owners would see a larger increase of course, because their valuations are still catching up.

TAB opposes a tax rate increase of any size and is calling for the millage to remain at 4.75.

Public comment begins at 10:00 but you should be there at 9:30am for the start of the meeting if you plan to speak. Please consider making your thoughts known to the commissioners, either in person at the meeting, or by email or phone prior to next Monday.

Since the June 13 meeting:

1. New estimates of property valuation show a smaller decline that Administrator Weisman sees as $3M more in tax revenue than expected. Consequently, he now calculates “rollback rate” at 4.8751. There is also an expectation for $2M more in revenue from other sources (sales tax and revenue sharing).

2. The Sheriff, who is expected to see a reduction in FRS pension costs of $18M, has objected to the county trying to “share the wealth” and take some of that savings for the county department budget. Bob Weisman has conceded the point and estimates that his shortfall will increase by $12M as a result.

The June budget package at flat (4.75) millage, had a $45M gap versus 2011. $15M of this was from valuation decline ($588M in taxes versus $603M), and $30M from declines “elsewhere”. The Revenue chart on page A-2 only identifies $14M of the “elsewhere” – notably $4M less in interest income, $10M in “other BCC revenue”, and a little more than $1M less from the Sheriff, offset by some small revenue increases in other areas.

Where is the rest of the “budget hole’? We asked Budget Director John Wilson to clarify the $45M, and he gave us this data:

- $15.470M – loss of tax revenue at current millage rate of 4.75

- $9.066M – decrease in one-time funding sources (available funding from existing capital project funds)

- $4.902M – decrease in other revenues (primarily interest income)

- $6.953M – reduction in beginning balances brought forward in Palm Tran, County Transportation Trust Fund & Court Tech. Fund.

- $2.687M – increase in new capital project funding

- $5.184M – increase in General Fund transfer to D/S Funds (additional issue and loss of one-time funding)

- $.781M – increase in non-department operations – primarily due to reduction in indirect cost allocation

We are still a little fuzzy on the fund transfers and one-time funding sources, but he assured us that it would be explained in the July budget package.

Now that the package is available, we are still trying to understand it. We are also having some difficulty in bridging our analysis of the 2003-2011 period with 2012, since the budget package is in a different format than last year, and the section “Comparison of Revenues, Appropriations, Net Ad Valorem Requirement and Positions by Department” has been omitted. This section was important to us because it has appeared mostly unmodified in all the budgets since 2003. Now we are dealing with apples and oranges. The OFMB folks assure us the data is there, just spread around between different sections, and (in some cases) between the June and July packages. If we can unravel this Chinese puzzle, we will update our multi-year tracking charts in a future article.

We are adding another point to the TAB proposal. Since the “$45M gap” (now closer to $40M) is related to starting fund balances and interfund transfers, we think it is appropriate to consider using some small amount of reserves to avoid a tax rate increase. In 2006, Florida TaxWatch pointed out that our unreserved fund balances (then 71% of revenue) far exceeded our peer counties and were remarkably high. Today, the levels have come down some but we are still far above Orange, Hillsborough and Miami-Dade, and slightly below Broward. The balances are a significant multiple of a “prudent miminum” of 15-20% of revenue. Consequently, we are adding “Utilize undesignated reserves to fill a one-time budget hole”.

The TAB Proposal:

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

- Utilize undesignated reserves to fill a one-time budget hole.

*Note: The TaxWatch study that relates to item #3 is in draft. We hope to share some of its findings in the near future.

Notes and Feedback From June 30 Commission Workshop in Pahokee

I was not able to attend the entire Commissioner Workshop on Thursday in Pahokee, but the following are my notes from the discussion:

Programs identified as potential areas for budget cuts by Robert Weisman and the Commissioners:

- 4-H

- Children’s programs

- Park services

- Drug & alcohol treatment / recovery

- Consumer Affairs

- Pools

- Life guards at the beach

- No increase in funds for economic development

- Events at County amphitheatres

The Commissioners expressed concern and would prefer not to reduce these services.

Feedback to Mr. Weisman and the Commissioners: Drop the political jargon and start cutting overhead. Rather than considering a “small” tax increase, your strategy should be to create a budget surplus. The economic issues we are facing will not go away in a year or two. A budget surplus is not a pipe dream. It is possible if you have the will…. And you do not need to reduce services that are valued by your constituents. Just eliminate waste: Insist that Mr. Weisman increase productivity, eliminate positions that do not create direct value for constituents, and find synergies between Mr. Weisman’s responsibility functions.

You should also make peace with the Constitutional Officers. They are the Commissions peers, not Mr. Weisman’s peers. The Chair of the Commission should take the lead to open communications and build trust. There are massive synergies that can be achieved through shared services of information technology, fleet management, real estate management, procurement of commodities, logistics, telecommunications, and other support functions.

Cruzan Amphitheater losses – If you have not attended concerts at Cruzan you should:

- Great entertainment which is often sold out…. Hmm…. Maybe we should raise the ticket price?

- The prices of concessions are similar to that charged at a Dolphins game. The quality of the product and service is substandard. Needs quality and price gouging oversight by the County + check to make sure that the County is receiving a fair share of the concession revenue.

- Alcohol sales are incredible, with literally wheel barrels full of beer carted throughout the venue. Sounds like fun for boomers…. But at what cost on the road after the event? Checking ID’s: right! Interestingly, I’ve never seen a sobriety check point on Southern Blvd after an event. I guess we want to make sure that the vendors don’t get in trouble.

Mr. Weisman:

- We are not going to reduce staff. Layoffs will be avoided.

- Cut the Sheriff’s budget….. no further cuts in his budget

- Questions value of drug and alcohol program, given low success rate

Feedback to Mr. Weisman:

- The County Administrator and Commissioners have a fiduciary responsibility to reduce staff when work volumes decline. There is also a fiduciary responsibility to establish best in class processes, training, and technology to advance productivity while at least maintaining current levels of service to the public. You should ask an unemployed homeowner whether he/she believes their tax payments should be used to retain County employees that are not required or could be laid off without a significant change in the quality of service delivered to the public.

- Any position that is not directly involved in meeting the needs of the public should be subject to elimination. The County Administrator should be a role model by taking a voluntary salary reduction, requiring all employees (and encouraging constitutional officers to do the same) to take one unpaid furlough day per month for the entire budget cycle. Martin County instituted such a program some time ago: Reduced operating expenses by between $1 and 2 million during the fiscal year (approximately 900 employees). Feedback from their employees was mixed, but I understand that most agreed that they would rather reduce their compensation than layoff massive numbers of employees. By the way, Martin County also reduced their staff levels during this same period.

- Drug and alcohol programs: Mr. Weisman should talk to the people that manage these programs to learn that relapse is the norm. Many people relapse more than 10 times before recovery. Of course, he should review the effectiveness of the County program and consider alternative means of delivery (private sector) to insure that cost and quality is effective.

Commissioner Taylor:

- Inspector General is spending $3.4 million even now that we have ethics policies

- Need to replace break walls

- Need to rebuild bridges

- A tax increase to balance the budget is insignificant: $.04 per taxpayer per day….. Most will accept it rather than reduce service levels.

Feedback to Commissioner Taylor:

- Palm Beach County has a national reputation that will not easily be overcome. Our reputation is a significant disadvantage for job creation and economic development. I am thankful that we have an Inspector General. It is up to elected officials to demonstrate that they can be trusted.

- If increasing taxes is “not that big a deal”, then reducing the expenditures to balance the budget is “not that big of a deal?”

- I understand you have a survey at your website asking people if they would rather reduce services than increase tax rates. There should be a third option: Don’t increase taxes and maintain current service levels.

- I agree that infrastructure like aging bridges and break walls are important. This should also be taken into consideration when the County evaluates new infrastructure, including parks, community centers, and the beaches. A question that needs to be addressed: Can we afford the upkeep cost of infrastructure?

Performance Measurement

This is a great topic. I have reviewed Mr. Weisman’s recent performance measurement report provided to Commissioner Marcus. The information included in the report is solely units of activity, not performance. Performance measurement should track productivity, cost per unit, and quality of work (error free work flow – rework is very expensive) of the most important aspects of a person, department and/or organization. In the private sector such measures are called key performance indicators (KPI’s).

The Commissioner discussion included comparing groups like to Sheriff’s Office to other municipalities. Benchmarking should only be based on best in class, and it should not be limited to government comparisons.

Prepared by Dale Gregory

Boca Raton, Florida

July 1, 2011

County Budget Update – July 5

The next county budget workshop is Monday, July 11, at 9:30AM. Because of a “scheduling issue”, the BCC action to set the maximum millage rate that was scheduled for July 19 has been moved up to the 7/11 meeting. We expect the County Administrator to ask that this be set to rollback, currently estimated at 4.89 (about a 3% increase in tax rate). The majority of homestead property owners would see a larger increase of course, because their valuations are still catching up.

TAB opposes a tax rate increase of any size and is calling for the millage to remain at 4.75.

Public comment begins at 10:00 but you should be there at the start of the meeting if you plan to speak. Later in the week we will publish a call to action for TAB coalition partners. Please consider making your thoughts known to the commissioners, either in person at the meeting, or by email or phone prior to next Monday.

Since the June 13 meeting:

1. New estimates of property valuation show a smaller decline that Administrator Weisman sees as $3M more in tax revenue than expected. Consequently, he now calculates “rollback rate” at 4.89. There is also an expectation for $2M more in revenue from other sources (sales tax and revenue sharing).

2. The Sheriff, who is expected to see a reduction in FRS pension costs of $18M, has objected to the county trying to “share the wealth” and take some of that savings for the county department budget. Bob Weisman has conceded the point and estimates that his shortfall will increase by $12M as a result.

The June budget package at flat (4.75) millage, had a $45M gap versus 2011. $15M of this was from valuation decline ($588M in taxes versus $603M), and $30M from declines “elsewhere”. The Revenue chart on page A-2 only identifies $14M of the “elsewhere” – notably $4M less in interest income, $10M in “other BCC revenue”, and a little more than $1M less from the Sheriff, offset by some small revenue increases in other areas.

Where is the rest of the “budget hole’? We asked Budget Director John Wilson to clarify the $45M, and he gave us this data:

- $15.470M – loss of tax revenue at current millage rate of 4.75

- $9.066M – decrease in one-time funding sources (available funding from existing capital project funds)

- $4.902M – decrease in other revenues (primarily interest income)

- $6.953M – reduction in beginning balances brought forward in Palm Tran, County Transportation Trust Fund & Court Tech. Fund.

- $2.687M – increase in new capital project funding

- $5.184M – increase in General Fund transfer to D/S Funds (additional issue and loss of one-time funding)

- $.781M – increase in non-department operations – primarily due to reduction in indirect cost allocation

We are still a little fuzzy on the fund transfers and one-time funding sources, but he assured us that it would be explained in the July budget package which will be available prior to the 7/11 meeting. The new package is not available on the county website as of this writing, but has been delivered to the commissioners. We will publish our analysis of it shortly, and make any adjustments to the TAB proposal that would be called for.

As of now, the TAB Proposal remains:

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

*Note: The TaxWatch study that relates to item #3 is in draft. We hope to share some of its findings in the near future.

Scare Tactics

Once again, the Post’s Rhonda Swan takes on the silly games that permeate the annual county budget process. In First, cut the scare tactics, she highlights the yearly practice of proposing cuts to popular programs, simply to turn out the interest groups to oppose the cuts, knowing full well that the Commissioners will restore them.

TAB explored this game last month in The Kabuki Budget. We believe the practice is cynical, and one of the reasons that people have lost respect for government at all levels.

Ms. Swan ends her editorial with this thought: If county commissioners want to dispel public misconceptions about the budget, they should direct staff to present proposals that are realistic.”

Indeed.