Reduce Govt Overhead, Not Essential Services: BOC, Constitutional Officers and particularly the Sheriff

Editor’s note: This post was sent as an email to the County Commissioners and Constitutional Officers by Dale Gregory on June 13, 2011.

PALM BEACH TAB PROPOSALS:

I support in concept the proposals of the Palm Beach TAB advocated at the June 13, 2011 Budget Workshop.

REDUCE GOVERNMENT OVERHEAD, NOT ESSENTIAL SERVICES

I am appalled at the County Administrator’s appeal to emotion by proposing to increase Palm Tran rates, reduce life guards, and the like. I pray that you will vote “NO” on any increase in taxes or reduction in essential services! This applies to the Sheriff’s response that he is going to reduce essential staff if the BOC doesn’t approve his budget demands.

In 2010 Martin County implemented a one day per month furlough (unpaid day off) as a means to balance their budget. The County has also reduced staff levels. Has Palm Beach County used this as a tool to balance the budget?

I have volunteered on a number of initiatives in Palm Beach County and learned early on: If the County Administrator doesn’t take a personal interest, forget the initiative no matter how much it may benefit the community.

If the County Administrator could effectively collaborate with the Constitutional Officers we could dramatically improve the efficiency of government operations. Examples include sharing information technology, telecommunication services, purchasing, human resource administration, real estate planning, logistics, and other back office functions.

There are similar collaboration and shared services opportunities between the County, Palm Beach School District, South Florida Water Management District, Children’s Services Council, Palm Beach County Health Care District, Library District, Port of Palm Beach District, municipalities, and nonprofit organizations. Trust me, it works. Take a trip to Martin County to learn more.

Collaboration is happening elsewhere in the United States, and taxpayers are benefiting immensely. Unfortunately Palm Beach County’s reputation of corruption and insider deals impedes such collaboration. County Administrative leadership is not a “poster child” for advocating trust, shared values, and change.

Elected officials need to leave their ego’s at home and start thinking about being better stewards of the combined “spend” of taxpayers – state, county, schools, municipal, and other taxing authorities. This includes Constitutional Officers.

COUNTY ADMINISTRATIVE LEADERSHIP

Most private sector and nonprofit organizations would not tolerate strategies that have been proposed by the County Administrator. The most successful organizations would make changes at the top to transform their culture and develop a winning strategy to achieve organizational objectives. Early 20th century thinking simply doesn’t work in today’s world.

If the Administrator cannot develop a strategy to balance the budget without increasing taxes while maintaining all essential services, the BOC should find someone who will.

SHERIFF:

I recently talked to a Commissioner from another Florida county. I explained how the Palm Beach Sheriff appears to ignore the Palm Beach BOC, operating without sufficient checks and balances. I was told that this would never happen in their county….. that the BOC would force the issue.

You were elected to serve the residents of Palm Beach County. This includes a fiduciary responsibility to manage the use of all of our tax dollars. It is time to put the Sheriff on notice: Cut expenditures and maintain service levels. This includes freezing compensation of all who are not part of collective bargaining agreements. If the Sheriff has the option to appeal his issue on funding to Tallahassee, go for it. It is time to break the mold.

Marathon Session for First Budget Workshop

Last evening, starting at 6:00pm, the first steps in the annual county budget dance were performed before a large audience. The meeting did not end until around 11:00pm

County Administrator Bob Weisman, along with OFMB chief Liz Bloeser and Budget Director John Wilson, explained the high points of the 4.75 millage $588M tax proposal, and explained why he’d really like to see it raised to “rollback” millage of 4.922.

While Weisman maintained there were no “Washington Monument” cuts and all were feasible, several commissioners pointed out that many of the “green page” cuts were in areas that were both visible to the public and in areas that would raise significant objections from the public. Commissioner Abrams went so far as to point out that the “green pages” even contained service impact notes listing the dire consequences that were about to befall the county as a result of taking the cut. If the expectations were so dire, then why take these particular cuts? He referred to the comments in the budget document as “advocacy” and we couldn’t agree more.

After a brief pitch by Supervisor of Elections Susan Bucher, requesting more money to “compensate” for the new law limiting the length of early voting (shorter time means she needs more facilities, equipment and overtime – who knew?), Sheriff Bradshaw went through his budget presentation.

The Sheriff made some interesting claims.

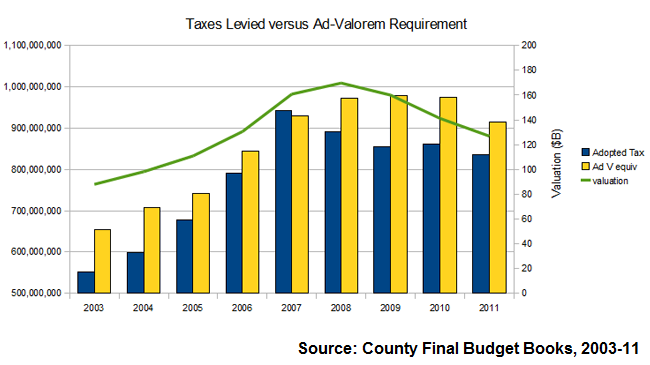

Much has been made of the growing percentage of the county budget that goes to PBSO – we estimate their portion the ad-valorem equivalent county-wide budget is now 59%, up from 46% in 2003. Not so fast, says Sheriff Bradshaw. If you look at the core operation of the agency, removing the aspects that are state mandated or are county responsibilities (the jail, crossing guards, etc) – his spending is only 25% of the county budget. We find this argument interesting but not very relevant.

Another claim has to do with the way the county is accounting for the “savings” from the retirement system (FRS) changes passed by the Legislature. (TAB estimates the savings to be about $20M for PBSO, $15M for the county departments and other constitutionals, and $11.6M for Fire/Rescue). Don’t call them “savings” he says – it is simply a change in rates that he will now use to calculate his budget. The change in rate from last year amounts to $18M by his calculation and he takes it directly off his budget. The county contends that this amount should be “shared” with the county departments – it is a windfall from the state that needs to be used to fill their overall budget hole. Since the Sheriff, with many “special risk” employees gets a much bigger “savings” than the county with “regular risk” classes, he should “share the wealth”. In this one, we believe the Sheriff occupies the moral high ground, and the FRS “savings” that occur in PBSO should stay in PBSO. After all – it is a net budget reduction.

This is a serious dispute that will need to be resolved before a clear view of the flat millage budget can emerge, and it appears that both sides have dug in their heels. There are other issues as well, including the $5M credit the Sheriff wants to take for FRS savings he will realize in the period before the new budget year on October 1.

The way the county allocates their FRS “savings” is much more convoluted. Complicating things is that the county staff is divided up between departments that are not funded by ad-valorem taxes (eg. airports) and those that are fully or only partially funded by tax dollars. Our estimate of $15.4M savings is reduced to a little less than $8M that can be used to offset the ad-valorem levy according to Budget Director John Wilson.

Even so, this $8M plus the Sheriff’s $18M in “savings” ($26M total) should be more than enough to plug the “hole” between the $603M adopted tax of FY2011 and the $588M that flat millage will collect in 2012. John points out that there are other “holes”, like decreased interest earnings that make the actual “hole” $45M, so cuts are necessary. Unfortunately for us TAB analysts, none of the budget materials provided to the public provide the documentation necessary to see the whole picture, but John has promised to provide us with what we need shortly. Watch this space.

With the conclusion of the Sheriff’s budget, public comment began. As with most budget meetings, we saw a parade of supporters of the various programs on the chopping block. By our count, there were about 40 speakers. Three spoke to keep the rates low for Palm Tran Connection, one to restore manatee protection, 5 for the nature centers, a couple for community revitalization, four for Small Business Assistance, and ten for victims’s services. The support for the latter was quite moving as victims of rape, shootings and other mayhem came forward to tell their stories. Given that the amount of the cuts to Victims services is a relatively minor $320K or so and 4 positions we would guess they may get restored. All of these areas amount to a couple of million out of $25M in cuts, so we will see if their advocacy will prevail. Other constituencies in jeopardy (eg. lifeguards, FAA) did not turn out at this meeting.

Fifteen spoke in favor of the submitted, flat millage budget. These included Fred and Iris Scheibl of TAB, Meg Shannon of Tea Party in Action, Shannon and Doug Armstrong, Ed Fulop, Victoria Thiel and Dr. Richard Raborn of South Florida 912, Phil Blumel of RCCPBC, Mayor Gail Coniglio of the Town of Palm Beach County Budget Task Force, Pat Cooper of the PBCA, Dick Clyde of the PB City Council, Dionna Hall of RAPB and several others. Other TAB coalition partners who could not attend the meeting but sent emails to the commissioners included Hal Valeche of Taxpayer Action Network, Mayor Dan Comerford and Councilman Chip Block of Jupiter Inlet Colony.

At the end of the meeting the commissioners discussed what they had heard. Although they did not vote or take positions on the budget proposal, by their comments we would assess commissioners Abrams, Marcus and Burdick as leaning towards accepting the flat millage budget, and commissioner Aaronson as wanting to raise the millage. Commissioners Santamaria, Vana and Taylor seem to be hedging their bets at this time.

For media coverage of the meeting see: Palm Beach County Commission balks at cuts — or raising taxes in the Post, and Palm Beach County’s proposed spending cuts prompt citizen backlash in the Sun Sentinel.

The next step in the budget process is the workshop on July 11 at 9:30am. There is also an off-site retreat for the commissioners where budget strategy and objectives will be discussed. That will be held on Thursday June 30 at 10:00AM at the Lake Okeechobee Outpost in Pahokee.

BIZPAC Review:County budget a Weisman trick-expect tax increase

The Kabuki Budget

Yesterday, the county released the budget package for the June 13 workshop. While this preliminary document is lacking in detail (it doesn’t show the department rollups or make it possible to assess what the FRS savings were), it is predictive of the course of debate.

To their credit, the Board of County Commissioners directed Administrator Weisman and staff to prepare a budget this year with no tax increases. The submited budget meets that requirement. However, Mr. Weisman states in his cover letter that he wants them to approve a tax increase “to reinstate some of the less desirable budget cuts”.

Let the dance begin. Anyone who follows the county budget hearings knows how this works. The administrator wants to spend more. Some board members agree, some don’t, but they first need to listen to “the people”. Within the county, there are well organized special interest groups that are reliable and can be expected to come out and argue passionately for their slice of the pie. These groups include riders of Palm Tran and the Palm Tran Connection, the county lifeguards, directors of charitable organizations that get handouts from the county (Financially Assisted Agencies), the Cultural Council, and (when the Sheriff’s budget is threatened), lots of folks in PBA shirts and PBSO boosters from the Sheriff’s neighborhood programs. It used to include former Drug Farm residents, but they lost the fight last year.

Guess where the cuts come in the submitted budget. From these groups of course! Does anyone expect that the board will listen to groups of people in wheelchairs and not restore funding for Palm Tran Connection? Or turn away 150 young lifeguards who feel their way of life is threatened by closing pools? My guess is that these funds will be restored and the only reason they were offered up is to perpetuate “the dance”.

Of the $21.5M of specified county department cuts in the cover letter, the bulk comes from social service (including FAA), Palm Tran, ERM – including manatee protection, pavement and traffic signal repair (EPW), parks and recreation (pools and lifeguards), animal control, youth affairs and victim services. These are designed to sound “draconian”. Strangely enough, the detail provided shows actual increases in two of the areas – Palm Tran sees an actual ad-valorem increase of 25% ($3.9M) in its subsidy due to declining revenue, and Engineering & Public Works (EPW) grows by 10%. Nowhere in the submission can you find the amount saved by FRS reform (we estimate it to be $15.4M).

Likewise, the Sheriff (who asked for a 4% increase in his budget) is being told he will get a $22M cut. On Monday we will probably hear that this will result in the removal of patrols around the largest senior centers and other “constituent sensitive” areas, resulting in catastrophe if the money is not restored.

We could try to second guess the Administrator on where the cuts “should” be taken (we all have our anecdotes about waste and inefficiency), but that is hard to do without an insider’s knowledge. Instead, we say – go ahead and restore the funding to the squeeky wheels – but do it in a budget neutral manner. For every dollar restored, there needs to be a dollar cut somewhere else. The millage needs to stay at 4.75.

Do the right thing.

The TAB Proposal and the County Budget

The county has published their initial budget package for the June 13 workshop. It is a flat millage budget, with cuts of $13.6M from county departments and $22M from PBSO over FY2011, and would seem at first reading to be in line with the first two points of the TAB Proposal, “Don’t raise the millage” and “take more of the cuts from the Sheriff”.

Upon further reading, it is clear that many of the cuts are intended to provoke a response from the user community. If you remember the horde of lifeguards and community recipients of FAA (charity) funds that showed up last year to protest, you can expect the same from the proposed $4.8M cut to Parks and Recreation which will close pools and reduce lifeguards, and the $1M cut to the FAA funds. Not to mention who will turn out to protest the $2.4M increase in Palm Tran fares.

In his cover letter, Administrator Weisman says: “I recommend the Board set a millage rate at rollback, which is currently estimated to be 4.922 mills. This would allow the Board to reinstate some of the less desirable budget cuts.”

Rollback represents a 3.6% increase in tax rates. Unless TAB partners and like minded citizens turn out to support the TAB proposal and ask the board to accept the submitted flat millage budget as stated, we can surely expect the special interests to push it to the rollback rate or beyond.

To recap, the TAB proposal is:

- Maintain the county-wide millage at 4.75

- Take the majority of cuts from PBSO, not the county departments

- Take action to reduce the inventory of county property and reduce the debt

We also want to see a charter amendment for a county version of “Smart Cap” placed on the 2012 ballot. Detailed arguments for each of these can be found later in this article.

Background

Last year, TAB was formed in July, after the county budget process was well underway.

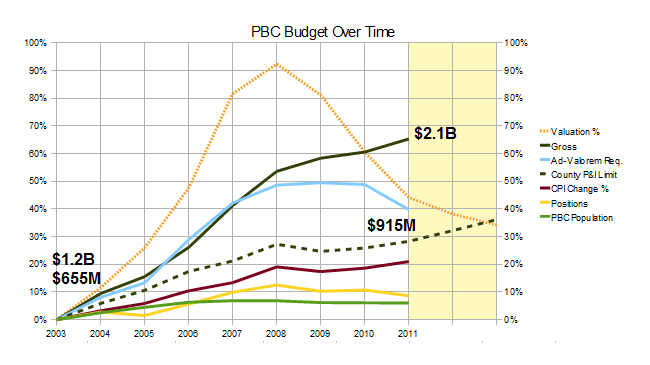

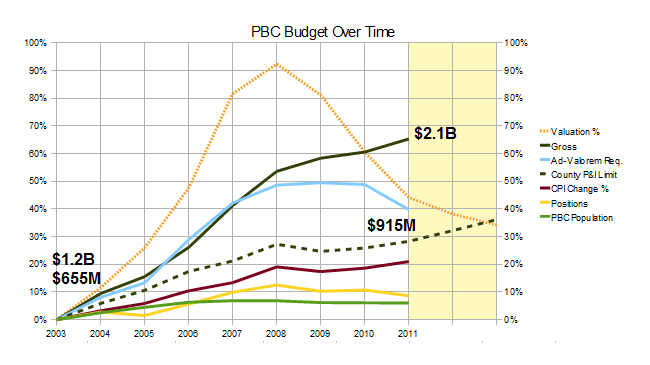

After researching the growth in county spending for the period 2003-2011, we concluded that it had grown 11 times the population growth and 3 times the rate of inflation. For FY2011, the proposed budget raised the millage by more than 9% on top of an increase of more than 15% in the previous year. Although the ad-valorem equivalent (and the total amount of collected taxes) declined in the 2011 fiscal year with the steep decline in property valuations, those with homestead properties saw their taxes go up. Overall spending, propped up by state and federal stimulus funds, continued to increase in 2011. (See chart below).

With the weak economy and double digit unemployment in the county, we thought another tax rate increase was wrong, and argued for keeping the millage flat at 4.344. As part of the proposal, we went through the staff’s “green” and “blue” pages, and made specific spending cut proposals totalling over $50M, argued for deferring raises in Fire/Rescue and PBSO, and listed $100M in capital projects that could have been deferred.

In meetings with the individual commissioners, we made our case and had a productive dialogue, but were not persuasive enough to carry the day against the hordes of special interests (including PBA members supporting the Sheriff’s budget) that flooded the meetings and lobbied the commissioners to keep the taxpayer money flowing. The final budget passed with a 9.3% rate hike on a 4-2 vote, with commissioners Abrams and Santamaria voting against, and the district 2 seat vacant after the resignation of Jeff Koons.

This year we are starting earlier and have focused on educating community groups about the budget history, preparing them to join the discussion armed with the proper facts. The actual budget has just been released to the public and we are just beginning our analysis. These are some aspects of the environment in which it is being created:

- The county administrator submitted a 4.75 flat millage budget as directed by the BCC, yet he is really asking for a rollback rate of 4.922 which would be a 3.6% increase over 2011, “to reinstate some of the less desirable budget cuts.”

- The Sheriff submitted a budget request with spending that is 4% higher than last year, mostly to cover raises under the collective bargaining agreements in place until 9/2012. In the flat millage budget, he is being asked to cut 5% more than he saves with FRS.

- The property appraiser, who had been projecting a 6% decline in valuations this year, has softened his outlook to a 2.3% decline.

- FRS reform, passed by the legislature and signed by the Governor, will result in savings to the county departments, PBSO and Fire/Rescue of $15.4M, $20.6M, and $11.6M respectively (by our calculations). Note: The county shows the PBSO savings to be $18M.

- Adam Playford’s article in the Palm Beach Post on May 21 gives some indication of the direction various players would like to go. Administrator Bob Weisman would like to see rollback millage to prevent any cuts in service. Commissioner Shelly Vana suggests we have not properly determined our priorities. The county is “saddled with debt”. The interest payments take 14% of what the county collects in property taxes according to Budget Director John Wilson. “Some of the county’s current fiscal squeeze is because it didn’t save enough earlier in the decade when tax money was flooding in” (during the boom) according to Clerk and Comptroller Sharon Bock.

The following is an outline of the “TAB Proposal” for 2012:

The 2012 TAB Proposal – preliminary

- Maintain the county-wide millage at 4.75

- County-wide property tax rates have risen 25.6% in the last two years alone

- Although the total taxes collected have declined over the same period, those with homestead properties saw double digit increase in their county taxes

- This year, the reduction in valuations has slowed from an expectation of -6% to a more modest -2.8%, reducing the pressure on the budget and millage rate

- TAB estimates that reforms to the Florida Retirement System (FRS), passed by the Legislature, will result in a $48M savings to the county this year ($20.6M in PBSO, $15.4 in county departments, and $11.6M in Fire/Rescue). This should be used to hold or reduce the millage, not for new spending on programs or salary increases.

- The commissioners directed the County Administrator to submit an initial budget with no change to the millage rate and he did. Bob Weisman’s request for rollback at 4.922 (a 3.6% increase) would seem to exceed his guidance.

- The county is still experiencing double digit unemployment and slow economic growth. This is not the time to be raising taxes.

- We expect the Fire / Rescue and Library MSTUs to also avoid a rate increase, but that has already been included in the submitted budget and so far no one has asked to exceed it.

- Take the majority of cuts from PBSO, not the county departments

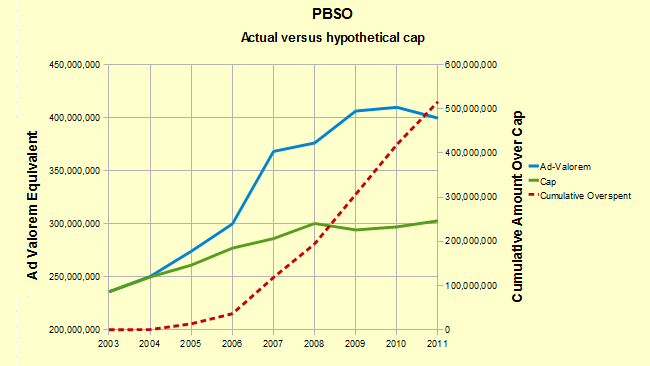

- County-wide ad-valorem taxes pay for the county departments and the constitutional officers, including the Sheriff. In the last 8 years, PBSO has grown from 46% of the budget to 59%.

- Most of the growth in the PBSO budget has been in personal services costs (salary and benefits), and PBSO deputies are now compensated more than 30% above the national average for similar positions.

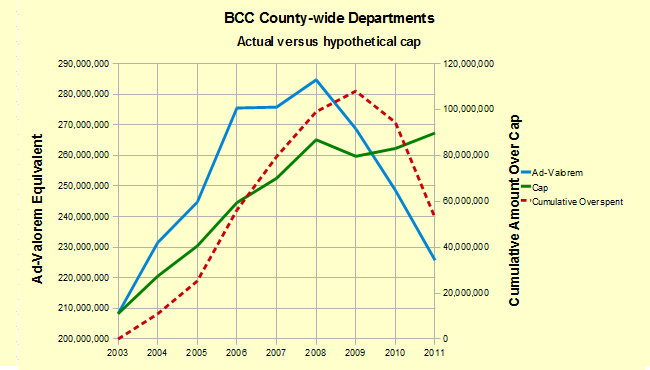

- Measured against a hypothetical population+inflation cap since 2003, county departments are now comfortably under the cap (although they exceeded it in the boom years by a cumulative amount of $50M). PBSO has greatly exceeded the cap in each year, with a cumulative overspending (versus the cap) of $500M in the 8 years. (See charts below)

- The Sheriff provides only the statutory minimum of budget data to the county (and the public) so it is difficult to see where the money is being spent. Through Chapter 119 (open records law) requests, TAB has determined that almost all the spending growth has been in salaries and benefits for employees covered by collective bargaining agreements, not in operating costs.

- The reduction to PBSO from $470M to $448M in the submitted budget would meet our criteria if allowed to stand.

- Take action to reduce the inventory of county property and reduce the debt

- Florida TaxWatch is conducting a study funded by the PBCA and others, that will inventory underutilized land and other property owned by the county, and compare our debt and capital programs to our peer counties. This study can be used as a blueprint for action to reduce the debt (currently $1600 per county resident with interest costs estimated at 14% of taxes collected) and make plans to sell off assets like Mecca Farms.

- The Clerk and Comptroller has identified the debt as being significant already, and it is about to be increased even further with the building of the waste to energy facility by the Solid Waste Authority and the convention center hotel.

- During the boom, windfall tax receipts were used to start projects that committed the county to long term debt that is difficult to justify now that the boom has ended. We need a plan to correct the problems caused by earlier bad decisions.

- TAB has obtained a list of vacant properties owned by the county and has begun comparing the current value of these parcels to what was paid for them. As long as these properties remain on the books it is a double liablility – there is a carrying cost associated with them and they are held off the tax rolls. Many of the over 2400 properties listed in the PAPA database as belonging to the county should be sold, even at a loss.

Separate from the TAB Proposal for the FY2012 budget cycle, but important for long term budget restraint is a charter amendment to bring the state level “Smart Cap” proposal (SJR958) to the county. This will be a separate track, aligned with the charter review process, but if you agree with it, please mention it in the context of the budget discussion.

Adopt a “Smart Cap” charter amendment for county government

- The state-wide “Smart Cap” (SJR958) will be on the ballot in 2012. What is good for the state is good for the county.

- “Smart Cap” limits the revenue that can be collected to last year’s cap plus an adjustment factor that reflects inflation (change in Consumer Price Index) and population growth – an objective measure of “appropriate spending”.

- Although the decline in valuations has currently dampened the large increases in county spending that occurred during the boom, spending has continued to rise, even last year. When “normal” returns to the real estate market, a cap could prevent the out of control spending that occurred during the bubble.

- Unlike Colorado’s Taxpayer Bill of Rights (TABOR), a smart cap is based on last year’s cap, not on last year’s revenue. That prevents the “ratcheting down” of the cap that caused problems in that state during a recession.

- A well designed Smart Cap can provide emergency override (Supermajority BCC vote) and exemptions for unfunded mandates and other areas identified by the League of Cities as as problematic.

This year’s TAB Proposal is really not asking that much. With the smaller decline in valuations and the large savings from FRS reform, there should be very little difficulty in making the modest cuts that will be necessary to avoid an increase in the tax rates.

Growth in ad-valorem equivalents compared to hypothetical “Smart Cap”

Pension Reform – the Final Bill

On Friday May 6, the conference committee put the final touches on FRS Reform and sent SB2100 to the Governor. Although it is not as far-reaching as the Governor wanted, it is significant, both in the precedent it sets (employees must now contribute to their pensions) and in the budget savings for both the state and the counties that participate in FRS.

The conference staff analysis summarizes the highlights of the bill as:

- All FRS members must now contribute 3% of their earnings to the system.

- For pension dollars accrued after July 1, 2011, the Cost of Living Allowance (COLA) of 3% is eliminated. (This is grandfathered in the bill in 2016, which leaves it up to a future legislature whether it will be restored. Sort of like the “Bush Tax Cuts”.)

- For participants who enter DROP after July 1, interest accrues at 1.3% instead of 6.5%.

Additionally, for those who enroll in FRS after July 1, 2011:

- “Average Final Compensation” (AFC) is the average of the highest earning 8 years (not 5).

- Vesting occurs after 8 years (not 5).

- Age and service requirements change to age 65 / 33 years (not 62/30) for regular class and to age 60 / 30 years (not 55/25) for special risk class.

To calculate the budget impact to the county, we must refer to the “employer contribution” section of the bill that starts on page 180 of the final conference amendment. The contributions are 3.28% of gross compensation for regular class, and 10.21% for special risk. (This compares with 9.63% and 22.11% this year).

That’s not the end of it though – the final amendment adds a section to “address the unfunded actuarial liabilities of the system” with an additional employer contribution of 0.49% and 2.75%, starting July 1 for regular and special risk, respectively. This amount then bumps up to 2.16% and 8.21% in 2012.

Taking these figures and applying them to our database of county employee compensation, finds that the county-wide savings in the first year would be $48M ($98M including the schools) and $26M in the next year. The first year savings breaks down as follows: $15.4M in county staff, $20.6M in PBSO, and $11.6M in Fire/Rescue.

The Florida Association of Counties has done a similar analysis state-wide and calculated that the savings for all counties would be $615M in the first year.

Legislative Update – 5/5/11

As the Legislature winds down the session, there has been much progress on the bills we have been tracking that relate to county budget issues. The following is a status:

Pension Reform

SB2100/HB1405 having emerged from conference on Friday May 6, has been sent to the governor. From the House bill, the plan adopts the 3% employee contribution and retirement eligibility of age 65 / 33 years for general class and age 60 / 30 years for special risk. From the Senate bill it eliminates cost-of-living adjustments for accruals accumulated after July of this year. The DROP program, eliminated in both underlyihg bills, was retained in the compromise, but the interest rate was reduced from 6% to 1.3%. One feature that appears to be new is the redefinition of “average final compensation” from 5 years to 8 years, which will reduce the base upon which a pension amount is calculated. The provision in the House bill to restrict new hires to a defined contribution plan only did not survive.

We estimate the savings for the county to be about $48M in the first year, based on the “employer contribution” section of the bill. See Pension Reform – the Final Bill for the details of the analysis.

Smart Cap

CS/JSR958 State Revenue Limitation, also known as “Smart Cap”, was sent to the Governor on May 4. Placed on the 2012 ballot will be a constitutional amendment that replaces the state’s current cap based on personal income growth, to one based on population and inflation, similar to Colorado’s TABOR. It differs from TABOR in one important respect however – the cap is based on the previous year’s cap, not on revenue. This has the effect of preventing the “ratcheting down” effect that can happen when revenue declines in a recession, and prevents unanticipated or undesired reductions. The cap can decline though, if inflation is negative or population shrinks.

Smart Cap applies only to state revenue, but we think it is time to examine a potential Smart Cap for the county budget – implemented as a charter change and also on the 2012 ballot.

Local Government Accountability

One bill that has been under the radar for most people is CS/SB224 – Local Government Accountability. The bill does several different things, but most notably for Palm Beach County, it will require the Sheriff to disclose more of the PBSO budget to public scrutiny, and give the County Commissioners more authority to obtain line item detail for this and previous budget years. Currently, only a Chapter 119 (open records) request has been able to obtain this level of detail on the Sheriff’s budget. Among other things, the bill says:

“The sheriff shall furnish to the board of county commissioners or the budget commission, if there is a budget commission in the county, all relevant and pertinent information concerning expenditures made in previous fiscal years and to the proposed expenditures which the such board or commission deems necessary, including expenditures at the subobject code level in accordance with the uniform accounting system prescribed by the Department of Financial Services.”

This bill was sent to the Governor on May 4.

Additional Homestead Exemption

HJR381, “Additional Homestead Exemption; Property Value Decline; Reduction for Nonhomestead Assessment Increases; Abrogation of Scheduled Repeal”, was sent to the Governor on May 4. This bill places a constitutional amendment on the 2012 ballot that will have several effects if approved by the voters, including eliminating the unfortunate circumstance that can cause your assessed valuation to increase while your actual market value is decreasing on a homesteaded property. It also caps the increase for non-homestead property to 5%.

Labor and Employment

SB830, “Labor and Employment”, also know as the “Thrasher Bill”, would prohibit state or local governments from deducting from wages, funds for political activity, primarly union dues. It also prohibits labor organizations from collecting dues, assessments, fines or penalties for the purposes of political activity without written authorization from the collectee. This is similar to measures being pursued in other states this year.

This bill was never brought up on the floor before the session ended and therefore died from inaction.

As things change with these bills, we will update this post to reflect the current status.

Palm Beach Civic Association Sponsors TaxWatch Study

The Palm Beach Civic Association, in conjunction with the Town of Palm Beach County Budget Task Force (CBTF), is engaging Florida TaxWatch to perform a study of Palm Beach County capital expenditures, debt and reserves, and inventory of underutilized land and buildings. Funded half by the Civic Association with the other half being raised by task force member Jere Zenko, the project is scheduled to start shortly and be completed in time for use in the budget workshops during the summer.

TAB participated with TaxWatch and the task force (a TAB Coalition Partner) in defining the project scope.

Read the article on the subject in the Palm Beach Daily News: Civic Association helping town task force fund Florida TaxWatch study of Palm Beach County budget

The Florida TaxWatch Center for Local Government Studies conducts research projects and performs contract research of Florida City and County Governments and is located in Tallahassee. They performed a similar study under the auspices of the PBC Economic Council in 2006 which is available from their website HERE.

Smart Cap – Good for the State, Good for the County

The Florida Legislature is moving forward on a constitutional amendment for the 2012 ballot to limit state spending to a “growth factor” tied to inflation and population growth. A previous attempt in 2009 had included county and municpal governments in its scope, but that has been omitted this time.

We think it is still a good idea however, and could be implemented for Palm Beach County as a Charter Amendment. TAB plans to argue both for and against the various proposals coming forward during the charter review process. Since a Smart Cap is not likely to be proposed by the Board themselves, we want to raise this proposal now so it can be discussed and perhaps gather momentum.

This article examines the effect a smart cap would have had on the county if it were in place since 2003. The conclusions are:

- The FY2011 ad-valorem equivalent for the county-wide departments is 15% less than a cap would have allowed. This is good and reasonable. It was achieved however, by significant reductions over the last three budget cycles, coming off a peak in 2008 that was 7% over cap, and a record of exceeding the cap in all but the last two years.

- It would have greatly restrained the growth in PBSO and Fire/Rescue, as their FY2011 ad-valorem equivalent exceeds what the cap would have allowed by 32% and 19% respectively. Since both of those organization’s budgets are primarily personal service costs, the existence of a cap would have limited the salary and benefit enhancements that were granted in the lucrative collective bargaining agreements that are now such a drag on the county budget.

- If a cap were to be imposed, it could be crafted in such a way that emergency overrides are possible.

- Although we are not enthusiastic about the overuse of federal grants for local projects, a county “Smart Cap” would not interfere with the use of such funds.

- There is precedent – both Duval and Brevard counties (and possibly others) have caps in place today.

For these reasons, we would very much like to see a county version of Smart Cap on the 2012 budget as a result of the Charter Review.

What is Smart Cap?

Senate Joint Resolution 958, introduced by Senator Ellyn Bogdanoff and approved by the Florida Senate on March 15, would place a constitutional amendment on the 2012 ballot to limit the growth in spending at the state level. House Joint Resolution 7221, an identical bill, has passed out of committee and is pending a floor vote.

Unlike a previous attempt at a Florida “Smart Cap” (SJR1906), introduced by now Senate President Mike Haridopolis in 2009 and applying to county and municipal governments as well, the current iteration would apply only to the state budget. It’s provisions (summarized in the staff analysis) are:

- Replaces the existing state revenue limitation based on Florida personal income growth with a new state revenue limitation based on changes in population and inflation

- Requires excess revenues to be deposited into the Budget Stabilization Fund, used to support public education, or returned to the taxpayers

- Adds fines and revenues used to pay debt service on bonds issued after July 1, 2012 to the state revenues subject to the limitation

- Authorizes the Legislature to increase the revenue limitation by a supermajority vote

- Authorizes the Legislature to place a proposed increase before the voters, requiring approval by 60 percent of the voters

It should be noted that the “revenue” that is capped is subject to some exclusions. It does not apply to Medicaid funds, revenue necessary to meet bond requirements, federal grants and some other revenues. The amendment would replace the current cap which is based on personal income. Currently, 32 states have some kind of statutory cap on spending.

Palm Beach County Smart Cap

On the county level, a “Smart Cap” could be instituted through a Charter Change amendment on the 2012 ballot. Would this have much effect on the budget?

TAB has pointed out that the county budget overall has grown “11 times population growth and 3 times the rate of inflation” from $1.2B in 2003 to $2.1B in 2011. This tracks spending growth though, and is partly funded by revenue that under the state rules would be exempt such as federal grants. It also includes “fee for service” revenue that varies with the services requested, and other revenue that is department specific. For simplicity, we have chosen to look at the effects of a “Smart Cap” by analysing the “ad-valorem equivalent” amount at the department level. This number is the difference between the spending proposed by a department (appropriations), and the revenue it receives from specific sources like grants or fees, and is paid for by a combination of ad-valorem taxes and other “ad-valorem equivalent” revenues such as the sales tax.

The revenue cap at the state level is based on a “population and inflation” model, and sets the cap at last year’s revenue limit plus a growth factor. The growth factor is computed by combining inflation represented by the consumer price index (CPI) and the state population as used in other measures. In other states, most notably Colorado’s “TABOR”, the Taxpayer Bill of Rights, the cap was applied to the previous year’s revenue. Since revenue declines during a recession, this caused the cap to “ratchet” down and caused more spending reduction than was anticipated or desired. It was suspended for a period of time by the legislature to allow the economy to equilibrate. The Florida proposal does not have this problem since the growth factor is applied to the previous year’s cap – not the revenue collected (after a multi-year startup phase).

To see the effect had Smart Cap been in effect in 2003, we can compute the growth factor from that year’s budget forward to 2011, and compare it to the actual budget growth that occurred. The results show that while PBSO, Fire/Rescue, and the Supervisor of Elections all grew much faster than a cap would have allowed, the countywide departments are now comfortably 15% under what the cap would require. Bob Weisman has always maintained that his growth was “less than TABOR”, – and it was, if you only look at the endpoints. You just have to separate his budget from the others to see it clearly. The 8 year trend is shown in the following chart. Unfortunately, the overspending in the early years resulted in a cumulative overspend of about $50M.

County-wide Departments ad-valorem equivalent compared to a “smart cap”

The following table illustrates what the FY2011 budget (ad-valorem equivalent) would have been had Smart Cap been in place since 2003. The “Growth Factor” is computed by combining the change in CPI and the change in service population for the period 2003-2011, and is 28.4% countywide. Fire / Rescue has expanded their service area during the period from 641,000 to 807,727 by taking over municipal departments, so their growth factor of 52.5% reflects that change. Likewise, the Library system has grown their population by about 13% during the period, now providing service to 28 of the 38 municipalities for a growth factor of 37.2%.

The Sheriff has also grown the PBSO service area during the period by taking over law enforcement duties in Pahokee, South Bay, Belle Glade, Royal Palm Beach, Wellington, Lake Worth, Mangonia Park and Loxahatchee Groves. We did not adjust the PBSO growth factor however, because unlike Fire/Rescue, they are funded from county-wide ad-valorem taxes and the change in service area is offset by specific contract revenue from the towns and cities that have been absorbed. Corrections, court protection and law enforcement infrastructure (crime lab, SWAT, etc.) are funded by all county taxpayers.

| 2003 Ad-valorem Equivalent | Growth Factor | 2011 Cap | 2011 Ad-valorem Equivalent | Exceeded Cap By | |

|---|---|---|---|---|---|

| County-Wide Departments | $208M | 28.4% | $267M | $226M | -15.4% |

| Fire / Rescue | $113M | 52.5% | $172M | $205M | 19.2% |

| Library System | $26M | 37.2% | $36M | $38M | 6.4% |

| Constitutional Officers | |||||

| Sheriff | $236M | 28.4% | $303M | $400M | 32.0% |

| Clerk * | $31M | 28.4% | $39M | $12M | -69.2% |

| Property Appraiser | $14M | 28.4% | $18M | $18M | 0.0% |

| Supervisor of Elections | $5M | 28.4% | $6M | $11M | 83.3% |

| Tax Collector | $4M | 28.4% | $5M | $4M | -20.0% |

Note: The large reduction in the Clerk’s budget is a result of conversion of some ad-valorem items to a fee basis in 2005.

The eight year growth in spending has shown that portions of the county, including the county-wide departments and the constitutional officers (except the Sheriff and SOE) have been responsible in adjusting their budget appropriate to the size of the county population and consistent with price inflation. It should be noted however, that until the valuations began to decline after 2008 there was not much evidence of restraint.

We will examine the relationship of spending to the cap on a year by year basis in an upcoming article.

PBSO and Fire/Rescue on the other hand have grown way out of proportion, and most of the increase has gone into salaries and benefits for those covered under collective bargaining agreements. It is time to rein this in, and a Smart Cap Charter amendment is a way to do it.

Put Smart Cap on the ballot in 2012 and let the people decide.

The 2012 Budget – a Very Preliminary Analysis.

Although the first budget workshop is a couple of months away, and the department rollups won’t be done until next month, there are some inferences that can be drawn from the environment in which the budget is being prepared.

- Property values are expected to decline by 6%, but some new construction will offset that and the county is using a 5% decline as a working number. Since the 2011 valuation was approximately $127B, the 2012 number would then be $120.7B.

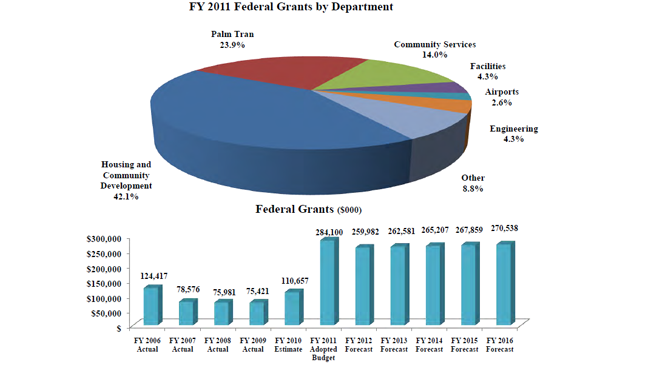

- The record $522M of intergovernmental (federal and state) revenue in the 2011 budget will likely be less this year – grants to local governments are under pressure both in Washington and Tallahassee.

- Expenses are rising in some areas – particularly in personal service costs. Step raises, longevity bonuses and other aspects of the existing collective bargaining contracts will add to the budget this year, even if most staff do not get raises.

- Revenue from non-ad valorem sources (eg. sales, bed, gas taxes) could also decline given the level of economic activity.

County staff expects to see about a $60M shortfall from these factors if the millage is not raised. Currently, county-wide millage is 4.75, yielding $603M, and the Fire/Rescue MSTU millage is 3.4581, yielding $179M. County Administrator Bob Weisman has signaled on several occasions (at the commissioners “off-site” retreat, and again at the 4/12 BCC meeting) that he would like to see rollback millage adopted, which by our calculation would be about 5.00 county-wide, a 5.3% increase. Achieving rollback would require about a $30M cut from the expected rollup. No millage increase, as previously noted, requires $60M in cuts.

At the off-site retreat, a majority of the commissioners requested that the first pass at the budget have no millage increase and directed staff to provide the list of cuts that are necessary to achieve it. TAB has some ideas in this area.

What is “realistic growth” in spending?

First, it is necessary to say that we believe holding the countywide millage at 4.75 (and the Fire/Rescue MSTU to 3.4581) this year is the proper decision. We have tracked county spending and tax collections from 2003 through the current year, and compared it to changes in county population and inflation – an objective measure of “appropriate” spending growth. During that time, gross spending (appropriations) has grown 11 times the population rate and 3 times the rate of inflation, and it continues to rise – an unsustainable trend. Ad-valorem requirements on the other hand, declined slightly in FY2010 and fell by about 6% in FY2011. This spending increase at a time of decining tax collection was possible because the spending was propped up by large infusions of intergovernmental revenue, including the federal “stimulus” known as the “American Recovery and Reinvestment Act” (ARRA). The $522M infusion in FY2011 compares to $239M in FY2009, a 218% increase in 2 years!

Note that we expect a reduction in intergovermental revenue this year – reflecting new realities in Washington and Tallahassee. County estimates of these amounts are overly optimistic however (see graph below taken from the Final FY2011 County Budget assumptions).

From 2003 to 2011, inflation measured by the consumer price index was about 21%. Population growth was about 6% overall. Combining those numbers would imply that a “realistic growth” figure for the county budget would have been 28.4%, not the 65% that spending grew, or the 40% increase in ad-valorem requirements. These numbers are the combined requirements of the county-wide, fire/rescue, and library taxing units, and aren’t completely fair since Fire/Rescue in particular serves only about 63% of the county and saw its service population grow 26% over the 8 year period. The Sheriff provides primary law enforcement to about 56% of the county, but any variations in PBSO service area is accounted for in the revenue received from those areas, and the entire county foots the bill for the Sheriff’s ad-valorem requirement. We are refining our P&I model and will have a better analysis as the budgets are developed.

It should be noted that for most of the last 8 years, the adopted tax (millage x valuation) was considerably less than ad-valorem requirement (see graph below). This reflects a spending down of reserves. As this is a management action divorced from either spending or taxation, we are using ad-valorem requirements for analysis, except where millage is discussed.

So from where would the $60M in cuts come? Much would come from Tallahassee in the form of FRS reform, courtesy of Governor Scott. Although the legislature has fallen short of where the governor wanted to go, the bills (HB1405 and SB2100) require an average of 3% contribution by participants in the FRS pension system (which includes all county employees). Pension reform is a complex area, and there are many differences in the bills (see Pension Bills Ready for Conference), but each bill contains the 2011 employer contribution as a percent of salary, which allows an estimate of the potential savings to the county. By our calculations, using employee salary data, this reform will save between $23M to $40M for the county ($16M – $30M against county-wide ad-valorem requirements alone). It also will save $28M-$39M for the school system.

| Group | Number of employees | Average Salary | Scott Proposal Savings | SB2100 Savings | HB1405 Savings |

|---|---|---|---|---|---|

| County Staff | 5,731 | $45.9K | $13.2M | $11.9M | $8.5M |

| PBSO (general risk) | 1,808 | $53.0K | $4.8M | $4.4M | $3.1M |

| Fire/Rescue (general risk) | 208 | $85.0K | $0.9M | $0.8M | $0.6M |

| Schools | 20,986 | $41.3K | $43.3M | $39.3M | $27.9M |

| TOTAL (contr.) | 28,733 | $62.2M | $56.4M | $40.1M | |

| Governor 2% accrual | |||||

| PBSO special risk | 2111 | $77.7K | $20.3M | $13.6M | $6.5M |

| F/R special risk | 1303 | $88.6M | 14.3M | $9.6 | $4.6M |

| TOTAL (accr.) | 3414 | $34.6M | $23.2 | $11.1M | |

| TOTAL (both) | 32,147 | $96.8M | $79.6 | $51.2M | |

| Schools Only | 20,986 | $43.3M | $39.3M | $27.9M | |

| County Only | 11,161 | $53.5M | $40.3M | $23.3M | |

| Copyright 2011, Palm Beach County Taxpayer Action Board | |||||

Further cuts could come from the areas identified last year in the “blue pages”. TAB had identified approximately $31M in cuts that could have been taken in these programs. Since PBSO is a larger (and growing larger) part of the county-wide budget, we believe that the Sheriff should match any cuts taken by county staff, perhaps even exceeding them as our preliminary calculations of population and inflation measurements show PBSO has grown much faster than the growth of their service population would require.

As the budget develops, we will be refining the TAB position.