County Commission Hikes Taxes Yet Again

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

On Tuesday evening, the Palm Beach County Commission voted 4-2 to raise county tax rates 9.3%, on top of a 15% increase last year. TAB had proposed specific cuts of $50M (2.5% of the $4B adopted budget) that would have prevented the hike. We also asked the commissioners to defer the Fire/Rescue raises (4% increase on a $140,000 average compensation – costing $14M in this budget), and to defer some capital spending. Fire/Rescue cuts would not have affected the county-wide millage (it is a separate line item) but would have been an acknowledgement that the public sector union employees are not completely isolated from economic conditions affecting those who pay their salaries.

The commissioners, in a not-very-serious discussion of additional cuts of up to $10M, and a contemptuous disregard for Commissioner Santamaria’s proposal to reduce the county car allowance, moved to a vote with very little discussion. There was consensus that any cuts that would not have a major effect on the taxes paid by for the mythical $200,000 house would be no more than pocket change and beneath their consideration. The fact that more than 60% of taxpayers will be paying more (click here for the Sun-Sentinel analysis) was glossed over by the commissioners – “the people want the services more than they want a tiny tax cut” – to paraphase Commissioner Aaronsen.

We at TAB are not surprised at the outcome, having discussed it with individual commissioners over the last week:

- Commissioner Marcus told us she was pursuing additional cuts of up to $10M, including some from the Sheriff, but did no more than mention it in passing at the hearing.

- Commissioner Abrams explained to us that while he would like to see the deeper TAB cuts implemented, the votes were not there for it and smaller cuts were not worth the pain they would cause.

- Commissioner Santamaria thought some token cuts would be good but did not support anything substantive.

- Commissioner Taylor would not even consider a cut that resulted in a single employee layoff.

- Commissioner Vana is all for reviewing programs next year (she is calling for “contingency audits”), but would also draw the line at layoffs and is vehemently opposed to outsourcing.

- We did not speak with commissioner Aaronson – what would be the point? He made it clear that he thinks the 2.5% TAB cuts would “destroy the county”.

A curious thing occurred at the hearing. While the Sheriff did not attend the 9/14 hearing and there was little participation or discussion regarding PBSO, at this hearing his organization was well represented, with over 20 employees coming to the microphone in support of the Sheriff’s budget.

We believe this was a consequence of TAB discussions with individual commissioners over the last week regarding the BCC rights under Florida statutes to request line item detail from the Sheriff. The reason for this line of inquiry was in response to Bob Weisman’s statement on several occasions that the county can not cut any more from their budget unless the Sheriff makes equivalent reductions. If this were to be asked of the Sheriff, having the line item detail would allow a public analysis of whether additional cuts would indeed compromise public safety. The PBSO budget has grown 80% in 8 years – about 12 times the population growth and 3.5 times the rate of inflation. The Sheriff provides to the county only the detail required by statute – which is not enough to understand the PBSO spending. Both Broward and Martin county Sheriff’s provide much more detail, and TAB believes the BCC should require it of PBSO as well.

At the hearing, John Kazanjian, president of Palm Beach County PBA (the police union) made the following statement:

“I hadn’t planned on being here, neither had my members and fellow employees.” … “But it’s our understanding that the commission and its staff are listening and catering to professional and semi-professional anti-tax groups, little circles of characters who would complain even if they were paying next to nothing in taxes. But these are the same characters who march into government offices demanding services and call 911 when trash gets thrown on their yard”. “I’m here… because We’re tired of them bashing the Sheriff.”

Let’s set the record straight: TAB is neither a professional nor semi-professional anti-tax group. We are a coalition of concerned citizen-taxpayers, worried that excessive spending at all levels of government has begun to compromise our way of life and the American Dream for future generations. We have no sources of funding other than our own pockets, and all our work is a volunteer effort. The 15 or so citizens who spoke on behalf of the TAB proposal were at the meeting on their own dime, paid for their own parking, and took time out of their lives because they are concerned about the future of Palm Beach County.

We appreciate the feelings of the PBA and the non-union PBSO employees who spoke at the meeting, and we congratulate Sheriff Bradshaw and his team for their enthusiasm and commitment to the organization. They are however, all employees of the county, and representing their self interest. That is their right – the first amendment doesn’t stop when you put on a uniform or draw a public paycheck. What everyone needs to consider though, is that it is the private sector that provides the source of wealth from which government draws its funding. It is a bargain that works best when it is balanced. At the current time, the alliance of public officials, their employees, and the public sector unions that provide their funding and political support have distorted the private/public compact. This phenomenon has destroyed California and is wreaking havoc in many other states. In Florida we have not yet reached the tipping point, but the pension time bomb is ticking. The situation can be brought back to balance, but only if all parties are willing to cooperate.

For an excellent article on the subject, see The Trouble with Public Sector Unions in the fall issue of National Affairs.

We in TAB are not “bashing the Sheriff”. Rather, we have a lot of respect for PBSO and the work they do. We are asking only for transparency in the budget process, and an appropriate level of spending. The Sheriff, the Chief Deputy, and the COO have all offered to meet with TAB and discuss the PBSO budget. We thank them and will take them up on the offer in the very near future.

As a closing remark, I would remind the Commissioners that TAB is focused on SPENDING rather than taxes. Now that the tax rate is set until next year, the ad-valorem discussion is over, but the spending discussion will continue. We at TAB plan to continue our look at the budget line items, perhaps drilling down to the next level. We also hope to look beyond the county to the other taxing districts and the cities. Our mission is unchanged – “We are paying the TAB and we are keeping TABs on you.”

Synopsis of 9/14 Budget Hearing

![]() Click HERE for Channel 20 Video of the meeting.

Click HERE for Channel 20 Video of the meeting.

Palm Beach County held the first of two public hearings on the 2011 Fiscal Budget on 9/14. The county chambers were filled to capacity and many people either watched on monitors in the anterooms on the 6th and 5th floors or in the lobby to the building. People were turned away and those who arrived after discussion had begun were unable to submit cards to speak or have their positions read into the record.

Note for future reference: At all PBC Commission meetings, once discussion has begun on a topic, no further cards may be submitted. This meeting was no exception. The topic for the county budget was IV E 1 and for Fire/Rescue – IV E 4. Many people arrived late and thus were unable to participate.

Most of those who spoke represented groups unhappy about cuts in the budget – primarily cuts to the Cultural Council, Palm Tran, the Drug Farm and the Eagle Academy. Even after the Commissioners made it clear that the Drug Farm and Eagle Academy were the Sheriff’s decision, speakers continued to come forward on it.

Thanks to those on the Palm Beach County Taxpayer Action Board work groups who spoke: Shannon Armstrong, Ed Fulop, Jim Donahue, Karl Dickey, John Parsons, Christina Pearce, Michele Kirk, Sherry Lee and Fred and Iris Scheibl. Carol Hurst also spoke on behalf of the TAB proposal. Also speaking – although not specifically on the TAB proposal was Dionna Hall. There were several other people who did not speak but submitted cards stating that they were in support of the TAB proposal. I’m sorry if I missed anyone who also spoke – I was not taking notes. It was unclear whether the Commissioners had received any phone calls or emails; if they had, they did not acknowledge them.

Many speakers left the long meeting after their 3 minutes, so by the time the Commissioners got to discussion of the budget the chambers were almost empty. To view the commission debate – advance to the 3 hr 8 minute point in the video accessed by clicking: ![]() HERE

HERE

Discussion lasted over an hour. The Commission voted 5:1 (Steven Abrams opposed) to keep the 4.75 millage rate as a maximum (as it appeared on the trim notices received by all property owners). Attempts would be made to bring the number down – potentially to 4.72 or 4.70. But the majority of the commissioners out right rejected the TAB proposal of roughly $30M in cuts plus an additional $20M which would be required by PBSO to retain flat millage. The target they gave County Administration was anywhere in the range of $4M ($2M from both PBSO and County) to $15M – all predicated on steep cuts by the Sheriff. It was totally unclear whether any further spending cuts whatsoever would be presented at the next hearing on September 28.

Following is a rough outline of the discussion and questions asked by the Commissioners:

Chairman Aaronson started the debate with a motion that 4.75 millage be made the ceiling. It was seconded and then discussion began.

Commissioner Marcus started going through the TAB proposal, exploring various aspects with Administrator Weisman responding:

- Blue vs Green pages: All Green pages done; none of the Blue cuts were made.

- Fire/Rescue: union approached on postponing increases – outright rejection

- Maintain PBSO cut: PBSO cut or returned revenue in amount of $28M

- HR programs: outright rejection of any of the Clerk’s suggestions of $1M

- Cut almost $10M in ad-valorem capital – rejected as necessary

- Stop or defer $91M in non-ad-valorem capital – rejected since it didn’t affect ad-valorem

Commissioner Marcus pursued capital some more – wasn’t a drop-off expected this year? Response was no – actually this coming year was going to be pretty bad with Max Planck debt coming in.

Commissioner Marcus raised the topic of the PBSO Mobile Data Project debt service on $35 million in bonds – raised by TAB members Iris Scheibl and Jim Donahue in their talks. Joe Doucette confirmed that the capital had not been drawn down as would be expected and discussion ensued around paying off the debt to eliminate around $6M in debt service. Marcus wanted a status on the project.

PBSO Budget – Commissioner Marcus and PBSO COO George Forman discussed civilian longevity and step raises and whether or not a Florida Statute would allow them to cancel or defer up to $11M in increases from occurring. While Mr. Forman stated that the $11M applied across the board (uniformed and non-uniformed staff) – Marcus replied that if 40% of staff wasn’t sworn – then wouldn’t it be true that about 40% of the $11M applied to civilians. Back and forth on the statute written to apply specifically to PBC and no other counties. Discussion on whether or not Fire/Rescue or PBSO contracts could be opened due to ‘exigent operational necessity, eg: financial catastrophe. It was unclear what kind of status report or response from PBSO would result from the querying other than direct response requested on the status of the Mobile Data Project.

Chairman Aaronson brought the conversation back to overall budget discussion. Aaronson favored cutting CCRT (Countywide Community Revitalization Team) and management of environmentally sensitive land $$ for a modest cut of $2-3M. He was absolutely against blue pages cuts or layoffs of ANY COUNTY EMPLOYEES. Ridiculous discussion then ensued stating that to cut $30M (TAB proposal) would result in a 750 person lay-off (when TAB proposal was actually 268). Aaronson said that any lay-off would hurt the Palm Beach County economy, result in further defaults on homes, so OUT OF THE QUESTION. After much discussion they concluded that they were only talking savings to the taxpayer of $8 if cut the spending.

Commissioner Abrams didn’t agree with the whole approach. Felt that we needed to do large scale reductions (eg the blue pages without closing the pools). That the county should do outsourcing. He rejected comparison to cities that have kept their millage rate flat, however – stating that the County doesn’t control PBSO and that Fire/Rescue isn’t in the county base millage rate.

Commissioner Santamaria was looking for a target; he would accept the motion of 4.75 millage if a $$ target were set. None ever was.

Commissioner Aaronson said that no way would $36M ever be cut and no matter how many people groups like TAB brought in, more could be brought in to say they want continued services and $$ spent. He could fill the chambers with them.

Commissioner Marcus would support the motion if the $6M in the Mobile Data project was pursued for a total range of $5-$15M in cuts.

Commissioner Vana was willing to postpone some capital (eg Mobile Data) and referred to a discussion from another meeting on jails vs ankle bracelets. She also suggested looking into contingency audits for the next budget to find low-hanging fruit – but absolutely no lay-offs or privatization. Looked directly to the TAB folks and said you won’t get to 4.34 millage this year – but maybe some of these actions would get us closer in the future.

Commissioner Taylor spoke against any attempt to outsource, citing an issue of Government Magazine. She also stated that one can’t compare cities to counties and that the Commission only does what the people want. And the people wanted Scripps and Max Planck. There was a lot of discussion with Commissioner Aaronson and Administrator Weisman on the history of the jails, Scripps and Max Planck – after which Commissioner Taylor said that the people want these things and then they have to pay for them.

There was a small amount of additional discussion on targets and then the Commissioners had their 5:1 vote on the Aaronson motion. The remainder of the meeting was to go through approval of all the other MSTU millage rates and transfers. Fire/Rescue was not touched. The meeing was adjourned.

Correction

At the end of the article “An Analysis of the County Budget Proposal – Part 1”, the TAB cuts were applied against a “starting point” of the rollback county-wide taxes of $612,486,522. To this figure we applied the “green page” cuts ($22.5M), and TAB modified “blue page” cuts ($30.6M), and the “Sheriff’s Challenge” of $3M, totaling $56.1M, and providing for $556M in taxes. We then calculated an effective millage rate of 4.381.

County Budget Director Joe Doucette pointed out to us that this is not a correct computation, since the county adjustments used to compute the 4.75 millage took into account other factors besides spending – specifically the “budget hole” that had to be filled due to lower non-tax revenue in some areas, and the “statutory reserve” requirement that requires $1 of taxes for each $.95 of budgeted requirement.

In the July county calculation for 4.80 millage, all the green pages are assumed ($22.5M) and the tax amount is $609.6M – so in effect, about $3M in tax reduction cost $22.5M in spending reductions due to factors mentioned. To then get to the 4.75 millage, another $6M in cuts were necessary, and that came from the Sheriff ($3M) to be provided by a return of unspent funds, and a county match of ($3M) that Administrator Weisman was able to find revenue to cover.

Joe then calculates the effect of our additional $30.6M cuts (blue pages) as follows:

| Millage | Ad Valorem | |

|---|---|---|

| 4.75 | 603,303,606 | a 9.3% tax rate increase |

| (32,185,431) | Sum of TAB blue cuts net of statutory reserve | |

| 4.4966 | 571,118,175 | a 3.5% tax rate increase |

So, in order to keep the millage flat at 3.44, we would need an addtional $20M in cuts.

This was an interesting discussion and I would like to thank Joe for taking the time to talk me through it. There was one thing that I was still unclear about however – weren’t the blue page cuts designed for flat millage if all were taken? It would seem that we would still be short. Joe explained the missing piece – county staff offered the additional blue page cuts on the condition that PBSO would cut an equivalent amount to “share the pain”. Our calculation did not take that into account.

Therefore – we need to amend the TAB proposal to request that in addition to the $30.6M in blue page cuts that TAB recommends, PBSO should absorb a similar amount (which would be about 6.6% of their budget). Alternatively, a $20M cut by the Sheriff would allow a flat millage under these assumptions.

Call to Action

[ PRINT ]

The TAB Proposal

The first milestone on the TAB agenda was passed on September 2, 2010 with the first public meeting. A package containing the presentations from that meeting, along with supporting material and an executive summary is being delivered to the County Commissioners and Adminstrator on 9/8.

If you would like a copy of that packages, you may print and bind the following files:

NOTE: Budget Director Joe Doucette pointed out an error in my calculation of the millage resulting from the TAB recommended blue page cuts of $30.6M. Please CLICK HERE for the details.

TAB Holds Public Meeting on County Budget

Last evening, September 2, in the county library on Lantana road, 60-70 interested citizens turned out to listen to a presentation by TAB on the county budget. (CLICK HERE to view the presentations).

Many people were surprised to see that even in these tough economic times, with 12.2% unemployment in the county and plunging real estate values, the county spending is projected to increase yet again, by $56M in fact.

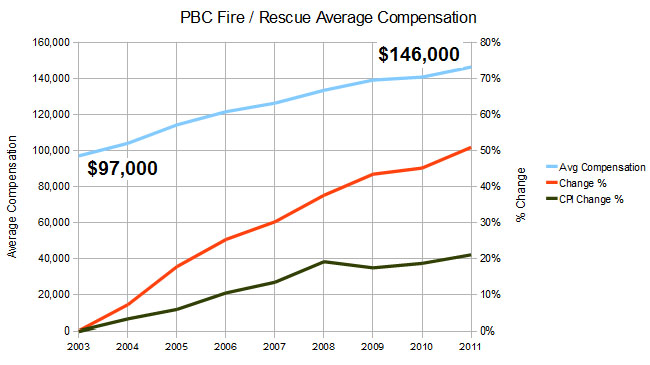

The county firefighters, already paid an extremely generous average compensation of $140,000 / year – are going to get another raise – to an average of $146,000, at a time when pay for other county employees has been frozen. Their level of pay has risen 50% since 2003, while inflation has only been about 20%. The feeling of outrage in the room was palpable as this was explained by Realtor and TAB member Christina Pearce.

Federal stimulus money (also know as ARRA – the American Recovery and Reinvestment Act) has been flowing into the county at a prodigous rate – over $100M this year, allowing the county to increase spending while ad-valorem taxes are (modestly) declining. One of the items on this spending list is $50M for “Neighborhood Stabilization” grants – basically money to give or loan to people who are buying up foreclosed properties and fixing them up. Would the county be spending this without the federal funds? Hard to say, but if this spending level was done without the ARRA money, our taxes would have to rise by 31% according to calculations by SF 912 and TAB organizer Fred Scheibl.

The county has assumed too much debt for questionable reasons and much of the requested new borrowing for capital projects in the FY2011 budget should be deferred or canceled, explained Lower Taxes Now and TAB member Sherry Lee (who is also a candidate for county commission district 2). Sherry described almost $100M in potential deferrals, including money being allocated for airport expansion, even though the whole project is tied up in a lawsuit, and the FAA has not approved the project.

The time has come for defining our “core services”, explained former PBG councilman Hal Valeche, also a member of SF Tea Party and TAB. Citing examples from around the country where progress has been made in trimming outdated or extraneous items from budgets, Hal called on the county commission to require a thorough categorization of all county spending to determine what is “core” and what is “discretionary”.

The whole structure of our county government should be subject to scrutiny, argued SF912 member and TAB member Iris Scheibl. She applauded the county commission for calling for a charter review next year and proposed that TAB be a part of that effort. The relationship between the commission and the constitutional officers, particularly the sheriff need to be examined, for example, to bring more transparency to the internal workings and spending priorities of the PBSO.

After a summary of the “TAB Proposal” to cut $171M from the 2011 budget, moderator and SF 912 founder Shannon Armstrong took questions from the audience. Many pointed out areas that TAB has not so far examined and should (like the School Board), and others added valuable insights into areas like the Fire-Rescue “Kelly Day” concept.

Commissioner Jess Santamaria attended the meeting and spoke briefly at the end, suggesting that we are only addressing half of the problem – that there is still a lot of corruption surrounding the way the county spends its money and he gave some examples where the grass roots have been effective in stopping it, as well as other areas where they could.

It should be noted that all the commissioners were invited, along with the constitutional officers and the county Administrator. Commissioner Shelly Vana said she would attend but did not. Property Appraiser Gary Nikolits was in the audience, as was Budget Director Joe Doucette, and Communications Director Linda Culbertson from the Clerk and Comptroller organization, representing Sharon Bock.

TAB wishes to thank those who participated in the meeting and asks that everyone who is concerned with the excessive levels of spending in the county attend the budget hearings on 9/14 and 9/28, and to ask their commissioners to “Adopt the TAB Proposal”. CLICK HERE for the “Call to Action” containing contact information for the Commission.

Here’s a few pictures of the event:

The Story of Spending

The Cost of the Protected Class

Arnold Schwarzenegger writes in the August 27, Wall Street Journal:

“…..At the same time that government-employee costs have been climbing, the private-sector workers whose taxes pay for them have been hurting. Since 2007, one million private jobs have been lost in California. Median incomes of workers in the state’s private sector have stagnated for more than a decade. To make matters worse, the retirement accounts of those workers in California have declined. The average 401(k) is down nationally nearly 20% since 2007. Meanwhile, the defined benefit retirement plans of government employees—for which private-sector workers are on the hook—have risen in value.

Few Californians in the private sector have $1 million in savings, but that’s effectively the retirement account they guarantee to public employees who opt to retire at age 55 and are entitled to a monthly, inflation-protected check of $3,000 for the rest of their lives. ”

“… I am under no illusion about the difficulty of my task. Government-employee unions are the most powerful political forces in our state and largely control Democratic legislators. But for the future of our state, no task is more important.”

Read the whole story HERE

A TAB Look at Fire / Rescue

What do we know about the Fire / Rescue Budget?

The most important thing to note about Palm Beach County Fire / Rescue is that the average compensation (all employees) is currently $140,000 per year and they are about to get another 4% added to that. This is with other county salaries frozen and private sector county unemployment at 12.1%.

For some perspective, see the Sun Sentinel article “Some government workers get generous raises despite dismal economy”

TAB believes that the raises should be deferred (saving $14M) or other spending reductions be put in place to achieve equivalent savings. Furthermore, the county should perform a comparison with other counties in the state and explain to the citizens why Firefighters in Palm Beach are so expensive.

The current 2011 budget has this line item for Fire / Rescue:

| 2010 | 2011 | Change | % | |

|---|---|---|---|---|

| Revenues | 126,617,751 | 152,101,082 | 25,483,331 | 20.1% |

| Appropriations | 346,986,345 | 360,758,193 | 13,771,848 | 4.0% |

| Countywide | 8,964,411 | 9,423,026 | 458,615 | (5.1%) |

| Net Ad Valorem | 211,404,183 | 199,234,085 | (12,170,098) | (5.8%) |

| Positions | 1542 | 1542 | 0 | (0.0%) |

| In FY 2011, Fire Rescue’s revenue increased by $26.9 million due to a $21.5 million increase in the balance brought forward, an increase in interest income, and an increase in the Main MSTU charges for services (primarily transport revenue). The increase in appropriations is due to to increases in personal services costs (Florida retirement rate, collective bargaining agreement across the board increases and long term disability rates). | ||||

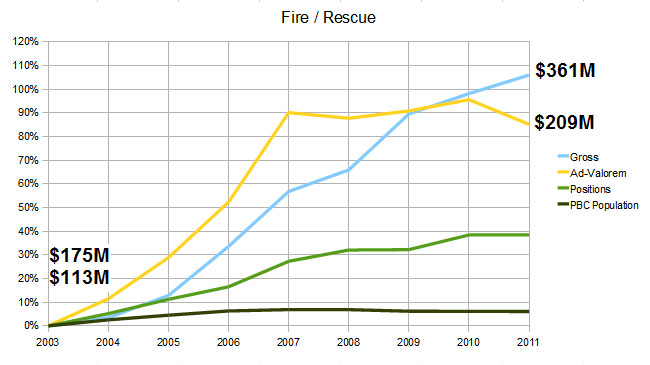

So the budget is being increased by about 4.0% and staffing is unchanged. Is that a good thing or not? To find out, we need to put several things in context. If I go back to previous budgets and plot the “Net Ad Valorem” and staffing from 2003 up to the current year, and place the Palm Beach Population growth line on the same graph it looks like this:

Note that while population stayed relatively flat (we now have only 6% more people in the county than we did in 2003, and it’s been declining since 2007), Fire Rescue staffing went up about 38% and spending went up 106%.

To put that another way, in 2003 there was one Fire Rescue employee for every 1087 residents and Fire Rescue charged an average of $145 per person, while in 2011 it will be one for every 833 residents and cost $281 per person (a 94% increase). Does this make us safer? We’ll look at that question a little later.

2011 Proposed Fire Rescue Budget Cuts

There are none. In fact, the collective bargaining agreement is giving employees an across the board raise of 1% in 4Q10, and 2% next year – with benefits, that is a 4% increase in personal service costs at a time that the rest of the county government is tightening their belts, and civilian unemployment is at 12.2%. Is that prudent?

Project Goals

Palm Beach County Fire & Rescue department is by far one of the most advanced and sophisticated in the Country. The department in it’s current form is not financially sustainable. Small and large changes should be considered to bring this budget back to a realistic working formula. The opportunity to investigate what can be changed is before us right now, for a short window of time. The collective bargaining contract with the Union will be up for renewal in the Spring of 2011. In order for any significant budget and organizational changes to be made, this negotiation must be handled by strong leaders that have the public interest in mind. We intend to . . .

- Search with great scrutiny the collective bargaining contract, review other contracts in Counties that are more fiscally responsible, identify wasteful and excessive items to eliminate. ( Click HERE to view the current contract. )

- Study comparable Fire & Rescue departments in other areas of the Country that are more fiscally responsible to highlight what they are doing differently. Palm Beach County is above the National average. Benefits and pay for the average PBC Fire & Rescue worker is over $140,000 per year.

- Change the new hire policies to reflect the growing need for a more reasonable retirement and benefits package. This should include age of retirement, as well as a change in benefits ( any that can be done on a local level).

- Work on policies that take advantage of the influx of military personnel that will be returning from duty in the near future. These men and women are already well trained in many useful skills and they have VA benefits that could reduce the need for many of their healthcare costs.

- Make proposals in common sense cost cutting areas, such as combining the fleet service with county fleet service, utilizing county communications and dispatch services in a more unified way, eliminating uneccessary vehicles, and replacing 3 full time videographers and photographers with interns from a local film school.

- Explore privatization of services. Provide case studies, and possibly propose a trial area for a test of these services.

- Propose the elimination of Kelly days and review the policy concerning scheduling to reflect the needs of the public, not the needs of Fire & Rescue workers to maintain other jobs.

- Review and eliminate the proposed capital projects that would replace or improve 10 fire stations that are currently not necessary.

- Look into costly and questionable policies concerning lobbying while on duty, including overtime pay in the final retirement formula, accumulating and getting paid for extra sick days, and taking advantage of “double dipping”.

We have a lot of work and research to do in this committee, and we will need to accomplish it before the bargaining agreement begins. Our team is committed to presenting all of our research to the Commissioners and staff and we expect a full review and consideration of all of these suggestions.We will provide the research necessary for this review.

TAB Proposal for Core Services

Proposal for Identifying and Prioritizing Core Services Provided by Palm Beach County

BACKGROUND

Palm Beach County is facing enormous financial pressures causing it to look for ways it can cut its expenditures. Lowering expenditures is necessary in order to avoid increasing, and hopefully decreasing, the rate and amount of taxes levied on taxpayers. Palm Beach County is not alone in facing difficulty in achieving a sustainable budget as counties all over the United States find themselves in similar or worse situations.

A July 16, 2010 Fox Business article described the situation as follows:

“For decades, state and local governments across the U.S. have conceded to the insatiable demands of both their constituents and the public employee unions whose contracts they negotiate and ultimately approve. The result has been unprecedented levels of service delivered through ever-expanding layers of government bureaucracy. Now many of these governments are broke and they find themselves under tremendous pressure to balance their budgets and facing intense heat from their constituents to not raise taxes.”

An elected county official quoted in the Fox Business article noted that his primary obligation as an elected official was to the taxpayers and rate payers of the county. His primary obligation is not to county employees, despite his close relationship with many of them. This is a philosophy that TAB suggests should also apply to Palm Beach County Commissioners when they are making budgetary decisions, as difficult as these decisions may be when they affect county employees.

The article goes on to note another commentary on the new focus of government in view of the economic situation faced by counties today:

Stephen Acquario, executive director of the New York State Association of Counties, said the writing has been on the wall for some time warning elected officials that a financial reckoning was just around the corner. The politicians, he said, have reflexively indulged what Acquario described as a “compulsion or a need to respond to constituent requests.” “But unfortunately the well has run dry,” he said. “Going forward we’re projecting the worst of all possible worlds, which is cutting services, layoffs and raising taxes.”

If there is a silver lining to all of this, and Acquario believes there is, it’s that governments are now being forced to look at the roles they play in the lives of the constituents they serve and to tailor those roles to fit the new economic reality. “We’re starting to ask ourselves at the county government level just what are the core services that county government should be providing. We can’t be all things to all people,” he said.

This is the new reality that faces the Palm Beach County Board of Commissioners. It must decide what role county government should play in the lives of Palm Beach County residents and identify the core services that the county government should be providing and which non-core services should be discontinued. These decisions need to be made without bowing to the insatiable desires of constituents or public employee unions. Times have changed and it is no longer for the Commissioners to make judgments based on what services and amenities they or the citizens would like to have. Instead, decisions must be based on what the county is required by law to provide, and no more.

Palm Beach County is not the only Florida county facing these financial pressures. The Hillsborough County Administrator’s Budget Message noted that he had undertaken “to seek new directions in service delivery and the County’s role in delivering these services.” He also noted that “use of one-time revenue necessitates action over the next twelve months to implement long-term solutions by identifying our priorities and determining how they can be met with recurring resources. Therein lies our greatest singular opportunity as a community to clarify the role and mission of local government in providing service to our residents.” He proposed consolidating functions across departments, and initiated an organizational restructuring process to reduce costs and improve service. This included merging three departments into one department. Other changes he proposed were to merge and integrate administrative, financial and human resources functions into a single Management Support Unit for the Aging Services, Children’s Services, and Health & Social Services Departments. Similar consolidation was implemented for Planning & Growth Management, Public Works and Real Estate Departments and for the Water Resource Services and Solid Waste Management Departments. The Debt Management Department was eliminated through a joint agreement with the Clerk of the Circuit Court. A variety of other programs are being studied over the next year to identify other ways to provide service at a lower cost to the County. (For more detail CLICK HERE )

County Executive, Pete Kremen of Whatcom County, Washington said the following in his State of the County Message this year:

“…the harsh reality is we can no longer operate as we have in the past. We know that for our families and businesses to survive, let alone thrive, they must be able to adapt and reinvent. Government cannot be exempt from this creative approach, no matter how difficult the task or how unpopular the decisions. We must take a long, hard look at the core operations of County government, enhance those services that work and serve our residents, and divest our government of those services that are simply no longer cost-effective or possible.”

TAB PROPOSALS

The first step for the Board of Commissioners is to identify those core services that the county should provide based on a defined set of characteristics to distinguish them from discretionary services and funding so that funding priorities can be established. Look at what the County is currently doing now versus what the original purpose of county government was thought to be.

What TAB proposes is adoption of an approach similar to the one currently used by San Mateo County in California to define Core Services:

The three categories of Core Services are the following:

- Services mandated by federal, state, or local law, including the County Charter and County Code of Ordinances

- Services essential to the health and safety of county residents for which there are no other organizations or institutions able to provide such services

- Services which provide infrastructure to support core services, i.e. administrative and support services

All other functions and programs constitute a discretionary service, not a Core Service, and all spending that is not required to deliver a Core Service is a discretionary expenditure and is subject to reduction or elimination. Additionally, even those services which are considered Core Services need to be examined to determine if they are being delivered in the most efficient and cost effective manner, and whether they are services which should be provided by county employees or whether they can be provided through outside sources at a lower cost while maintaining an acceptable level of quality. For more information on the San Mateo County approach, see San Mateo – Guidelines, San Mateo – Contracts, and San Mateo – Span of Control.

Alternative ways of identifying core services have been used by other county governments. For example, Core Services is a document developed by Buncombe County, NC in which each county service is listed along with the statutory or other mandate requiring it to be provided if such a mandate exists. This approach could be a template also for an analysis by Palm Beach County. Many other examples exist throughout the United States.

ADDITIONAL STRATEGIES TO CONSIDER

Additional strategies to consider, some of which are discussed in more detail elsewhere in the TAB materials, include the following:

- As an alternative to cutting a non-Core Service, identify any fee options which could allow the service to continue or alternative ways the service could be delivered through a different source.

- As an alternative to cutting a non-Core Service, identify ways to reduce the costs through outside contracting, partnerships with others, combining departments or services, or other arrangements.

- Review the comparability of compensation packages between county employees and outside resources capable of providing the same service.

- Consideration should be given to the long term impact on pension obligations imposed on Palm Beach County when comparing compensation packages offered to county employees versus compensation to outside sources and in the determination whether certain county programs are financially self-sustaining.

- Policies that could be adopted by the County Commission to increase revenue by prohibiting the waiver of certain fees, such as impact fees.

- All federal and state mandates should be reviewed and political and advocacy pressure should be used to reduce or eliminate them where appropriate.

- Determine where cooperation with local governments can eliminate duplicate services such as code enforcement, licensing, etc.

- Determine whether budget planning and development should be done biennially rather than annually.

- Develop a long range plan with which budget decisions must be consistent.

All services currently provided by the county should be identified and analyzed to determine where there are discretionary costs specific to each function or program operated by each county department which is funded by the county. The analysis should identify each budget unit, its functions, programs and services, and whether the services are mandatory or discretionary. Each budget unit should provide a description of each function or program, the approximate cost and authorized staffing at the current service level, the revenues the function or program generated, any required subsidies, and the amount of county discretionary funding.

Each budget unit should also list the discretionary functions and programs in priority order, from most important to least important, based on the mission of each department and identify the amount of funding flexibility it involves, e.g. some, most, or no flexibility. Flexibility would be defined as the ability to accept expenditure reductions for a particular function or program and still meet the minimum mandates associated with the function or program. Programs with no flexibility are those which cannot absorb any additional reductions and still meet mandated requirements. Finally, budget units must supply any negotiated requirements, such as collective bargaining agreements, existing leases, bond requirements, etc., that would reduce the ability to absorb reductions in expenditures. Finally, to the extent a budget unit provides services to another unit of government, any costs incurred in excess of the amount reimbursed by the other county unit should be identified so that the County is not subsidizing other government entities.

With regard to the resources required to offset the cost for each function or program, each budget unit must provide the amount of any required match or maintenance of effort requirement imposed to receive non-county revenues, or matches required for state or federal welfare funds.

Discretionary funding would be identified by subtracting any revenues and required match from the gross cost of the function or the program. The difference would constitute the maximum amount of county funding that could be eliminated without risking loss of other funding sources.

The county attorney’s office should make the determination whether each of the services is mandatory or discretionary. It will also be necessary to identity administrative and support service functions. For each function or program, the amount of discretionary funding must be identified.

SUMMARY

TAB recognizes that there is insufficient time in the remaining process for the 2011 Palm Beach County budget to develop and apply this type of analysis to identify possible expenditure reductions to any significant degree. However, even without this level of analysis and to the extent such discretionary expenditures are obvious, TAB urges the County Commissioners to cut expenditures wherever they can be readily identified as discretionary in the 2011 budget. TAB also requests that the Board of County Commissioners adopt a motion to direct County staff to conduct such a detailed analysis to give them the data necessary for the development of the 2012 budget.