Volunteers Wanted for TAB “Shovel-Ready” Projects

As more volunteers come forward to work on TAB Research, and we have begun considering paid studies, the time has come for a “to do” list of projects that are “shovel ready”. The objective of these projects is to increase our understanding of the trends in county spending and taxation, and to bring to light areas of excess, or unsustainable trends that bode ill for the future.

Many of these projects can be undertaken purely from publicly available materials, others may require staff contact and/or public records requests. All will be useful as we make our case for a rollback of county spending to pre-boom levels.

If you would like to volunteer for any of these projects, or have more projects to add to the list, add a comment to the post or mail us at info@pbctab.org

If you decide to participate, you will not be working alone. The TAB team can provide the tools, technology, contacts, analysis techniques, and moral support. Join us today!

Project List

GB:General Budget

SS: School System

SO: PBSO

FR: Fire/Rescue

CS: Core Services

GS: Govt. Structure

CD: Capital/Debt

| Project Title | Tasks |

|---|---|

| GB1: Pension Cost Projection | Prepare a spreadsheet of the county pension costs by year since 2003, then project it 10 years into the future. List all the categories of pensions by type of position or bargaining unit, projecting them individually |

| GB2: Health Insurance Projection | Prepare a spreadsheet of the county employee health care costs by year since 2003, then project it 10 years into the future. List all the categories of plans by type of position or bargaining unit, projecting them individually |

| GB3: Peer County Comparisons | For the 5 largest Florida Counties (Palm Beach, Broward, Dade, Hillsborough, Orange), show the percentage budget growth (spending and ad-valorem taxes) for the years 2003-2011. In years that Palm Beach has exceeded the growth of the peer counties, examine which components grew the most (eg. PBSO, county staff, etc.) |

| GB4: Payers and Payees | Build a list of the municipalities and unincorporated areas of the county and for each, estimate their county tax burden (based on valuation). Based on population of each, determine per-capita tax burden. If possible, estimate “tax dollars returned” to those communities. |

| GB5: Allocation of ARRA Funds | Of the more than $500M in inter-govermental transfer funds, much in the last 2 years came from federal ARRA money. Track down where the money was spent and estimate whether it provided a general benefit to the county or was spent on special interests. |

| SS1: School Budget Trends | Develop a budget trend chart (spending and ad-valorem taxes) for the school system for the years 2003-2011, in a format for comparison with other county spending. |

| SS2: School System Salary Skew | Using a salary chart for all school system employees, analyze compensation for teachers versus administrators. Show growth in salaries for both groups from 2003-2011, as well as the number of teachers versus administrators. |

| SO1: PBSO Salary Skew | Using a salary chart for all PBSO employees, analyze compensation for sworn deputies versus civilian employees. Show growth in salaries for both groups from 2003-2011, as well as the number of each. |

| SO2: PBSO Spending History | Using information gleaned from pending open records requests, adjust the TAB PBSO trend data to reflect the population of the service areas by year, new jurisdictions added, and special mandates (eg. Homeland Security requirements). Build a chart of spending per capita (in the service area) and spending per call. |

| FR1: Fire Rescue Salary Skew | Using a salary chart for all Fire/Rescue employees, analyze compensation for union represented firefighters vesus other employees. Show growth in salaries for both groups from 2003-2011, as well as the number of each. |

| GS1: State Mandates | Build a list of Florida statutes that are impediments to substantive budget reduction in the county. Determine how much of the county budget growth can be attributed to state or federal mandates, and develop legislative proposals that could be used to restore local control. |

| CD1: Surplus Holdings | Develop a list of surplus buildings, land, and equipment (eg. Mecca Farms). Investigate the carrying costs and develop proposals for divesting assets to save money over the long term. |

| CS1: Appropriation Constituencies | Break down the county departments into “general benefit” (eg. parks, law enforcement) and “special benefit” (eg. Community Revitalization, Charity). Determine the size of the constituency of “special benefit” spending and examine the justification for that spending. |

| CS2: Program List | Build a list of all county programs and separate them into those that are clearly the function of government, those that are clearly not, and those in a gray area. Build a case to terminate the second category and create a plan to evaluate those in the gray area. |

Will Aaronson and Marcus run again?

Since the Broward term limits charter amendment has been trashed, what will happen in Palm Beach? If Judge Carol-Lisa Philipp’s ruling stands on appeal to the Fourth District, it will be controlling on our county as well.

So what will our two (currently) term-limited commissioners do? Burt Aaronson has not closed the door on a primary run against Anne Gannon in District 5. Karen Marcus on the other hand is in “wait and see” mode.

Chances are, if either of these incumbents is legally able to run and chooses to do so, the “power of incumbency” will make it very hard for a challenger to compete against them.

Read all about it in George Bennett’s Post article HERE.

PBSO Budget – A TAB Update

Introduction

During the preparation of this article, TAB members Fred and Iris Scheibl, and Meg Shannon met with PBSO Chief Deputy Mike Gauger and COO George Forman to discuss the PBSO budget history, the challenges they are facing, and the most fair way to present what seems at first glance to be a budget that has grown at a very rapid pace since the 2003 base year of our analysis.

Prior to the meeting, our earlier open records request for spending data from 2003-2011 was fulfilled, and we were able to get a picture of where the money was spent and where the fastest growth has occurred.

At the meeting, we asked them to consider disclosing their budget line item detail as part of the normal process (rather than requiring citizens to jump through the open records request hoops). Both the Martin and Broward Sheriffs do this to varying degrees – Martin even makes the data available on their website. PBSO on the other hand, provides their budget input to the County Administrator only in the minimum form specified by Florida statute. We were told that more transparency was a possibility, and they would have to discuss it among the PBSO executives.

We also asked them for two other things – for the Sheriff to voluntarily come under the jurisdiction of the Inspector General and Ethics Commission, and for there to be a public audit of the Mobile Data Project, which we have been told has suffered some significant setbacks. On the former, the answer was absolutely not – internal controls and audit functions within PBSO are sufficient and there is no chance that PBSO will voluntarily do any such thing. The answer to the second was also an emphatic no.

Since that meeting, we were sent some additional information, including a 2010 Resource Guide (which contains useful information and metrics about the jurisdictions in the county), and a list of links to publicly available information about county operations and the Florida statutes that concern Career Service Protections, FRS and collective bargaining. Although useful, these sources did not help us with the specific information we were after, namely:

- The number of residents in the operating area, and the average number of jail inmates 2003-2011 (The other year resource guides would suffice)

- Call rate by year 2003-2011

- Staffing at the department level: sworn / civilian / part time for 2003-2011

- Years that major new jurisdictions were added and how that changed the revenue/expense/staffing

- Any extraordinary events/challenges that caused a spike in spending, and what costs were incurred (eg. Homeland Security mandates, trends in crime statistics, etc.)

In response to this query, Budget Director Kathy Cochrane forwarded our questions to Central Records Division for action and redaction, and on Tuesday 11/23 we were assigned a tracking number. When the information becomes available, we will refine the presentation in this article to incorporate (hopefully), a more nuanced view of the PBSO budget over the last 8 years, and likely a better justification for the rapid growth in spending.

Budget Summary

TAB has obtained additional data about historical spending in PBSO, specifically a year by year spending comparison from FY2003 to FY2011. This is more detail than provided to county staff during the budget preparation, and is useful to determine trends. (For a TAB summary of the yearly data provided by PBSO, click HERE) During that time:

- Personal Service costs rose 92%

- Operation costs rose 27%

- Per employee compensation rose 49.4%

- Benefit costs (pension + insurance) rose 154%

This time period saw inflation of 21% and the county population grew 6%.

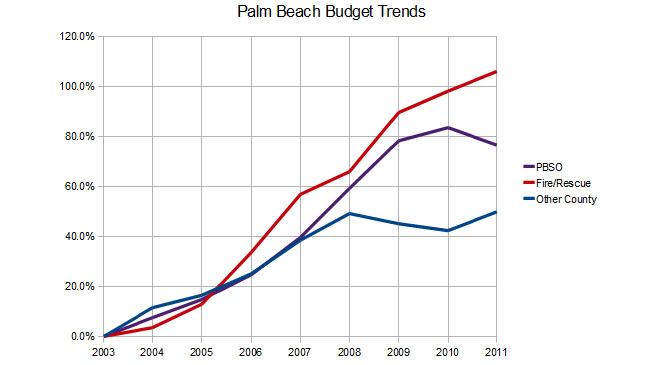

In the latest budget year, personal service costs (pay and benefits) represents 83% of the total PBSO budget. This compares to 62% for Fire/Rescue. Any future cuts to this budget will necessarily involve staff reductions or reductions to pay and benefits.

Likely Future Budget Scenarios

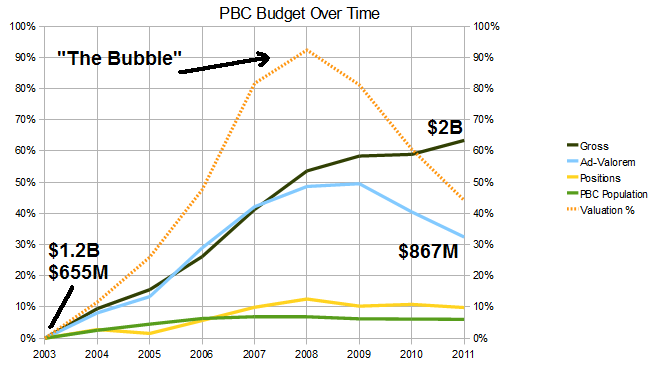

TAB has proposed that the county consider a spending level rollback, perhaps to the levels of 2006. That year is significant because the property valuations of 2011 have fallen to about what they were in 2006, and that level of spending would be sustainable with 2006 pre-bubble levels of taxation (See chart).

The Sheriff now accounts for 23% of the county appropriations, up from 21% in 2003. By contrast, Fire/Rescue is now 18%, up from 14%. The other county spending though, has been relatively flat since the “bubble” burst in 2008, while both PBSO and F/R continued upwards. The Sheriff did reduce his budget for FY2011 and held positions flat, but is still about 10% above 2008. To roll back to 2006 spending for PBSO would require a reduction of 28% from current levels.

Outlook

TAB believes that the coming years will be particularly challenging for Palm Beach County as property valuations continue their slide and the federal and state “stimulus” money that has been propping up the budget is no longer available. Either significant spending reduction (we would say to 2006 levels or earlier) or equally significant tax hikes will be necessary, and PBSO will not be immune to the challenge. That said, TAB also believes that the Sheriff’s core missions of Law Enforcement, Corrections, and Court Services are a necessary function of county government. Is everything being done today inside PBSO part of those core missions? We don’t yet know the answer to that, and the lack of transparency to the public makes the analysis difficult.

We would like to know if the rapid growth of the PBSO budget was justified by conditions in the community, and how the 4011 employees (1734 of them civilian) are allocated today. We have no reason to believe that there is anything inappropriate being done, but we have no way to tell. Therefore, we would request that PBSO participate more fully in the county budget setting process and implement a public records improvement in keeping with the spirit of the Florida Open Records Law (Statutes chapter 119) that says (among many other things):

“119.01(2)(e): Providing access to public records by remote electronic means is an additional method of access that agencies should strive to provide to the extent feasible. If an agency provides access to public records by remote electronic means, such access should be provided in the most cost-effective and efficient manner available to the agency providing the information.”

We believe the “most cost-effective means” for budget information is either the county or PBSO websites. The county staff does a world class job of this and would be able to assist PBSO in the transition. Martin County Sheriff’s Office provides another example as the Martin equivalent of the information we need from PBSO is available on the MSO website today.

Additional things that would greatly improve the public access to PBSO would be:

- Better cooperation with county staff and commissioners in providing detail to the budget process, even when not mandated by statute.

- Executing an inter-local agreement to voluntarily place PBSO under the juridiction of the Office of Inspector General and subject to the Code of Ethics and Ethics Commission.

- Allow an outside audit of activities that have raised questions in the community – specifically the status of the Mobile Data project and the issues with Intergraph, Inc.

With or without TAB actions, we believe progress is possible in these areas. During the recent election, both candidates for District 2 called for more transparency from the Sheriff, and we are hopeful that the winner – Paulette Burdick, will pursue this. In Broward County, 72% of the voters supported the Charter Amendment that places BSO under the Code of Ethics. There may be a court challenge to this, but it is clear that the citizenry would prefer it. Lastly, questions were raised about Mobile Data during the last budget cycle, and there are members of the community that have begun to probe this program. TAB also expects to investigate this further.

Pension rules are stacked in favor of the unions

This weekend, Randy Schultz of the Palm Beach Post Editorial Board has cast a bright light on the time bomb of public employee pensions in Florida, and shown them for what they are – an unsustainable boon to the unions at taxpayer expense, enabled by the Tallahassee legislators at the urging of the unions, in many cases tying the hands of local officials when they attempt to bargain in good faith.

Read the editorial HERE

In the editorial, Mr. Schultz describes the showdown that is coming and gets at the root of the problem:

…”Politics explains much of this financial problem. Police and firefighter unions have much clout at the local level and in Tallahassee. State fire and police pension laws are stacked in favor of the unions. One example: Governments don’t just have to meet an overall standard for benefits; governments must meet all of nearly two dozen standards. Twice in the past 11 years, at the unions’ urging, the Legislature has ordered cities and counties to sweeten police and fire pensions. This year, the Legislature rejected a request to exclude overtime in pension calculations. A state law that applies only to Palm Beach County gives sheriff’s deputies annual “step-up” pay raises.” …

He points out that many of the cities in Palm Beach county are seeking innovative ways to get control of a critical problem and end some of the worst practices. It is time for the Legislature to back the cities.

TAB believes that public employee pensions, along with other attributes of the lucrative contracts for the Police and Fire unions have arranged for themselves are the most harmful aspects of the county budget. While the cities struggle with their unions, what is the county doing to reign in the excessive compensation paid to Fire/Rescue and PBSO? Not much that we can see.

Responding to the statement by a former head of the PBA who said that West Palm Beach cannot “..ram something down (the unions) throat …”, Mr. Schultz ended his editorial with:

In fact, public safety unions have been ramming a lot down the throats of Florida’s cities. And now the cities are choking.

Well said!

Libertarian Party of Palm Beach County Supports TAB

At it’s annual meeting on Tuesday in West Palm Beach, the Libertarian Party of Palm Beach County decided to officially support TAB, and hopes to be an integral part of the coalition to effect serious change in the 2012 county budget.

Read the story in the Examiner HERE

Town of Palm Beach County Budget Task Force Joins TAB Coalition

After review by the Town Council, the Town of Palm Beach County Budget Task Force has joined TAB as a coalition partner. (See related story HERE).

In June of 2010, in response to the general impression that the projected county tax increases are economically and politically unsustainable, the Town Council formed the task force chaired by Mayor Jack McDonald. Its mission is to build a coalition of like-minded voters, taxpayers, and elected officials throughout the county to monitor and positively impact the county’s budgetary and taxation policies.

Like TAB’s other partners, the Task Force seeks to study the county budget proposals, and attempt to influence policy in a constructive direction, and their expertise and efforts will be a welcome addition to TAB’s growing project portfolio.

Term Limits Unconstitutional?

There has been very little media coverage of a possibly very significant court ruling in Broward County. Lost in the coverage on election day last week, was the story that Broward Circuit Judge Carol-Lisa Phillips, the wife of former Ft. Lauderdale Mayor Jim Naugle, who was term limited in 2009, ruled that Broward County Commission term limits are unconstitutional.

Read about it in the Sun-Sentinel, Miami Herald, and New Times.

The judge cited a 2002 ruling by the Florida Supreme Court that invalidated term limit provisions in the charters of Duval and Pinellas counties. Since Palm Beach is a constitutionally created Charter County as well, it is likely that a similar lawsuit is in the works to clear the way for Karen Marcus (likely) and Burt Aaronson (maybe) to run again in 2012, even though the current Charter would prohibit it.

It should be noted that the Broward voters passed their term limit charter amendment with 80% of the vote, and in Palm Beach it was 70%. Once again, the judiciary steps in to thwart the will of the voters. Since part of the TAB strategy is to seek out like minded candidates to run for these thought-to-be-open seats in 2012, we will be following this closely.

TAB Discusses Partnership with Town of Palm Beach

Update: The Town of Palm Beach Council has decided that it would be inappropriate for the Town to become a TAB partner, but that it would be beneficial and satisfactory if the Budget Task Force did so in its own right. Councilman Richard Kleid, noting that the coalition included tea party groups, said “I don’t want to get in bed with people that I may not agree with on other matters.” Council members also said they were “… concerned about affiliating with a group that may endorse political candidates who may take positions on non-budget issues that the town could be at odds with …”

For the record, TAB does not intend to endorse or directly support candidates for public office, but other coalition partners may. That said, TAB is always on the lookout for like-minded individuals of any political party who would be willing to run for the commission seats that may be open in 2012 and we would encourage them to do so.

For description of the meeting, read William Kelly’s piece in the Palm Beach Daily News HERE

Earlier this year, the Town of Palm Beach established a County Budget Task Force, led by Mayor Jack McDonald, to study the county budget in detail, determine its impact on the town, and make recommendations to the Council regarding possible action. The Mayor and other members have spoken at the county budget hearings and opposed increasing the millage rate.

Since TAB is doing similar analysis and holds similar views of county spending, we were asked to make a presentation to the group on 10/25, and the possibilty of the task force (and possibly the town itself) becoming a TAB coalition partner was introduced. Discussion of the matter will continue at the upcoming 11/9 council meeting.

For background, see the article on the subject by William Kelly in the Palm Beach Daily News. (CLICK HERE).

As the FY2012 Budget discussions begin, TAB intends to reach out to like-minded groups concerned with excessive spending by the county, and propose similar partnerships. In general, TAB coalition partners:

- Identify with TAB premise that county spending is excessive at current levels and should be reduced

- Confine their non-partisan involvement to County Budget issues

- Are Identified by organization logo on the TAB website banner

- May join or leave coalition at any time

- Have access to TAB research and resources

- Provide representatives to participate in TAB activities and events

- Participate in “calls to action” – speaking, writing to newspapers and commissioners, networking, generally supporting the TAB agenda

If you or your organization see benefit in becoming a TAB coalition partner, please contact us at info@pbctab.org

New County Commission for 2011

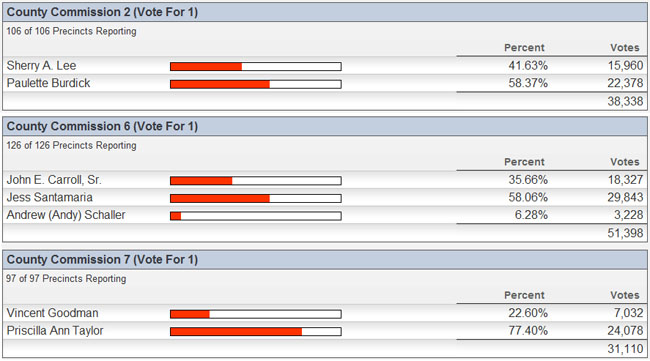

The people have spoken. On November 2, 2010, the three County Commission seats that were disputed (Steven Abrams in District 4 was uncontested) were decided for the incumbents in districts 6 and 7 by large margins, and the open seat (vacated by Jeff Koons earlier in the year) went to Democrat Paulette Burdick over Republican Sherry Lee, 58% to 42%.

The incumbent’s positions on the budget are known. Jess Santamaria voted against the current budget and has been open to at least small cuts. Priscilla Taylor, although opposed to layoffs of county employees, is open to discussion on the budget, has called for more transparency from PBSO, and has asked for a charter review to discuss the structure of county government.

Paulette Burdick, in the later part of the campaign has said encouraging things about controlling county spending and has also called for more disclosure of the PBSO budget detail. TAB hopes to begin a dialog with Ms. Burdick on budget issues in the near future.

Below is the election results for County Commission as reported by the Supervisor of Elections:

Both Candidates for District 2 Call for Sheriff to Open his Books

TAB has been vocal about the lack of transparency in the PBSO budget. Every year, the Sheriff delivers to county staff, the bare minimum of information specifically required by statute. This is not enough detail to understand where the money is spent, rather it is just the top line amounts for the main areas of Law Enforcement, Corrections, and Court Services. We have been stressing to the Commissioners that they have the right under statute (some would say the responsibility) to demand a full accounting of both the historical and projected spending detail.

District 2 candidate Sherry Lee has been a TAB supporter and a party to our call for PBSO transparency. Her opponent, School Board member Paulette Burdick, has now joined the call for opening the Sheriff’s books. From a Palm Beach Post article by Jennifer Sorentrue yesterday:

Burdick also wants commissioners to force Sheriff Ric Bradshaw to explain his budget to the public every year. Bradshaw’s spending plan makes up the largest portion of the county’s operations budget.

“I believe the sheriff should present his budget line item by line item at an evening meeting.” Burdick said. “The public doesn’t see it or hear it.”

The sheriff could do more to cut overtime and cap salaries and perks, Burdick added.

Lee also criticized Bradshaw, for what she called a “lack of transparency” in discussing the office’s budget. The sheriff should look at cutting civilian employees, as oppposed to deputies, she said.”

For the full article, CLICK HERE.

TAB Request for PBSO Budget Detail

As many are aware, we submitted a records request to PBSO in July for line item budget detail. As of 10/15, this request had not been filled (but is now -see below). We have begun a dialog with budget manager Kathryn Cochrane, in conjunction with COO George Forman who offered his assistance after the 9/28 budget meeting. Our request to Ms. Cochrane was for “bureau level detail for the years 2003 to the present”, so we can do an analysis of PBSO to the same level as we have done for the county.

Update: Today (10/18), we received the information request. Consisting of 9 pages, one each for the years 2003 through 2011 budget years, it contains more detail than we have seen before, with line items for about 50 appropriations categories, split into the 3 main functional groups of Law Enforcement, Corrections, and Court Services. It does not contain the department level detail that we will need to analyse the trends, but it is a start. We are learning about how PBSO works internally and will try to be more specific in framing our next request. Our goal is to get to the point where the information that is readily available online for the other county departments does not require the assistance of the open records laws to obtain from PBSO. We do appreciate that (after first being denied an electronic form of the document) we were at last able to get central records to send us the 9 page pdf file in an email.